- TradingFinder

- Education

- Forex Education

- RTM Education

RTM Education

The Read The Market (RTM) methodology is one of the most advanced approaches to price action analysis, emphasizing the interpretation of price behavior without the use of indicators. The foundation of RTM lies in understanding market structure and identifying key supply and demand zones-areas that have previously triggered strong price reversals. In this approach, traders make decisions by evaluating breaks of significant levels and confirming them through price behavior, a process known as Break & Confirmation. RTM relies on precise concepts for trade entry, including FTR (Failure to Return), FL (Flag Limit), and CP (Compression), all of which are defined based on historical price movement. Rather than forecasting with mathematical tools, RTM analyzes the likely future direction of the market by examining price action across multiple timeframes. To learn RTM’s structural and conceptual framework in depth, traders can refer to the educational resources available on the Trading Finder website, which are specifically designed to focus on detailed price analysis and real market behavior.

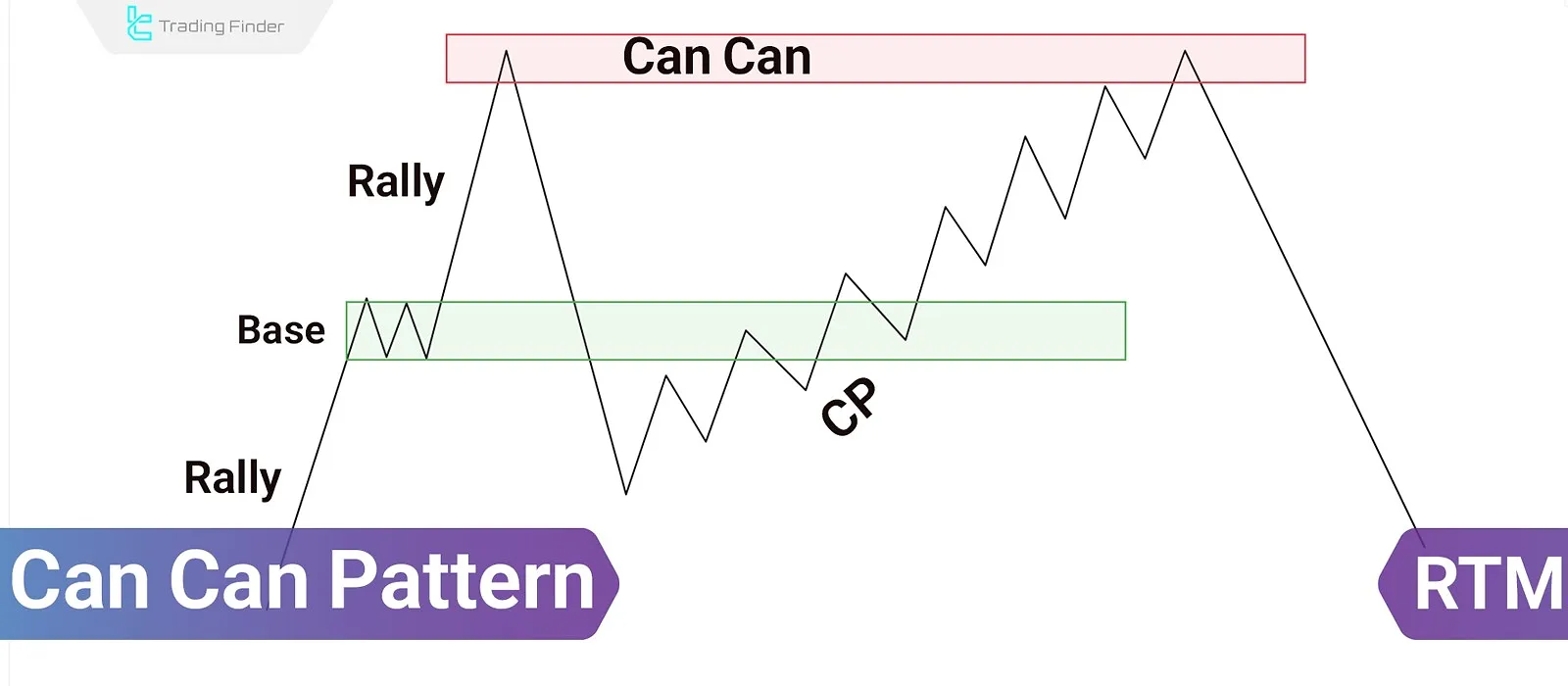

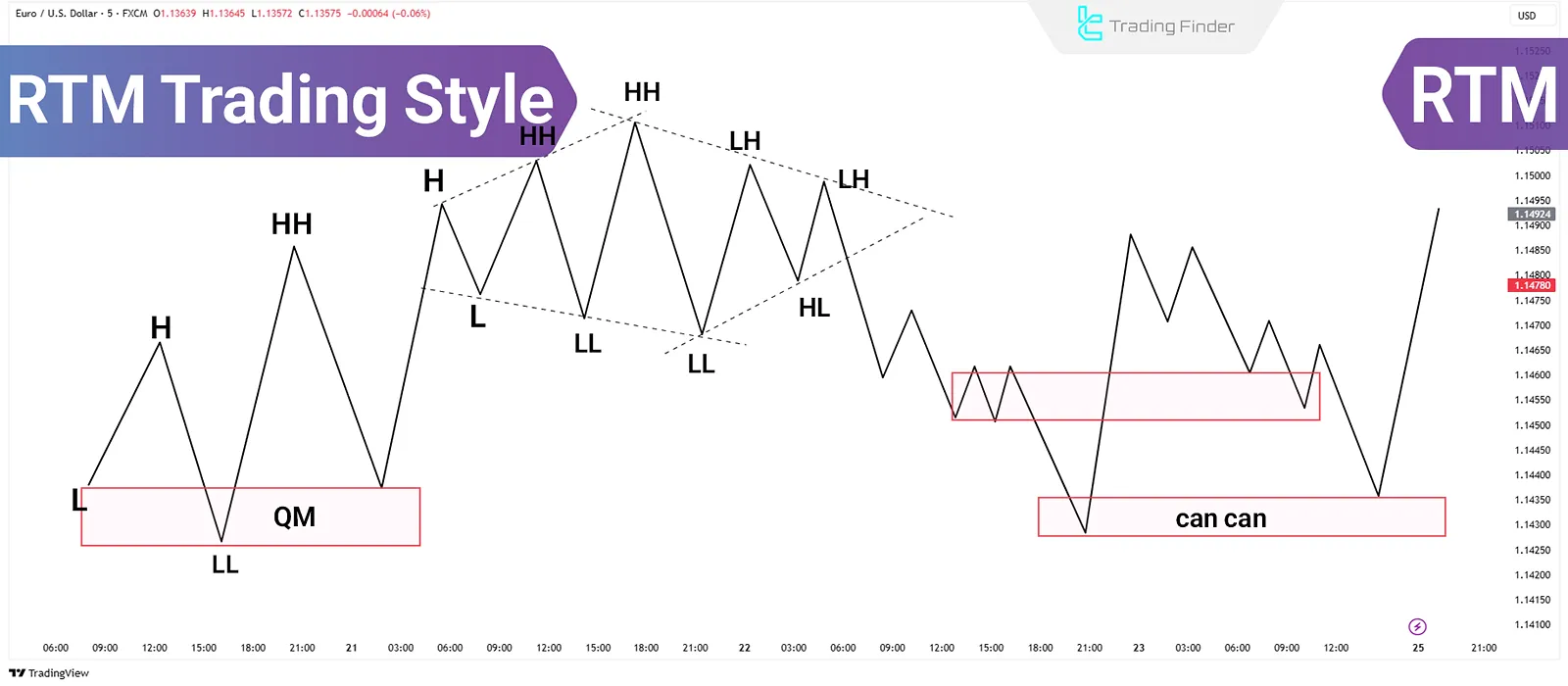

Can Can Pattern in RTM: Compression and Tap to Broken Zone (Caps)

The Can Can pattern in the RTM methodology reflects a smart price behavior designed to trap breakout traders. It is not a...

What Is the RTM Diamond Pattern? Trading the Diamond Pattern in the RTM Style

The RTM Diamond Pattern is one of the main patterns in the RTM style that deceives both buyers and sellers. This pattern appears...

What Is RTM Price Action? Using RBR, DBR, DBD, and RBD Structures in RTM Style

RTM Style, short for "Read The Market" is an analytical method in financial markets that, instead of relying on indicators,...

What is Quasimodo (QM) Pattern in RTM Style?

The Quasimodo (QM) pattern is an advanced concept in technical analysis under the RTM (Read the Market) style. It is used to...