The Tokyo session (Tokyo session), as Asia’s trading hub, begins with the activity of the Bank of Japan, financial institutions, and export companies. The prominent role of the Japanese yen [the third most-traded currency in the world] means this session sets the day’s initial direction.

In the early hours, incoming bank orders and corporate hedging increase liquidity and the Asian range forms; this range becomes the basis for breakout or reversal strategies.

The release of macro data—including interest rates, Bank of Japan (BoJ) policy, and the trade balance—is the primary driver of volatility. Ultimately, this session provides an environment for lower-risk trading, volatility control, and preparation for the London overlap.

Introduction to the Tokyo trading Session (Asian session)

The Tokyo session (Asia) is the first of the three main forex sessions to open and continues as the London session begins.

The Tokyo session time in GMT is 00:00 to 09:00. In other words, this session is active from 12:00 AM to 9:00 AM UTC. Japan does not observe daylight saving time; therefore, the official Tokyo session hours in Japan are fixed.

Contrary to common belief, Asia’s main forex trading center is not only Tokyo. Hong Kong and Singapore, with an approximate 7.6% market share, cover larger volumes; Japan accounts for about 4.5%. Hence, the term “Asian session” is more precise than “Tokyo session”.

For more information about this trading meeting, you can refer to the article on trading sessions at investopedia.com.

Advantages and Disadvantages of the Tokyo session (Asia)

The Tokyo session is better suited to traders seeking moderate volatility, more stable market conditions, and opportunities based on technical analysis.

However, for traders who prefer highly volatile environments with strong price moves, this session presents limitations. Advantages and disadvantages of the Tokyo session (Asia):

Advantages | Disadvantages |

Regular and predictable price movements | Limited volatility for traders seeking strong moves |

Suitable for scalping and short-term trades | Lower liquidity in some pairs such as EUR/USD or GBP/USD |

Least impact from sudden news in this session | Market lethargy in the middle of the session |

Overlap with the Sydney session at the start and with the London session at the end of the Tokyo session | Less influence on the overall market trend |

Focus on specific pairs with high liquidity such as USD/JPY, AUD/USD, and NZD/USD | Possibility of gaps or unexpected moves at the session open (especially on Mondays) |

Introducing the Session Box Indicator for Displaying Forex Trading Sessions

The Session Box indicator on MetaTrader 4 and 5 is an advanced tool for analyzing market behavior based on trading session timing.

By drawing color-coded boxes on the chart, this indicator accurately displays the time ranges of the three main sessions—Asia (Tokyo and Sydney), Europe (London and Frankfurt), and the U.S. (New York)—and enables traders to assess the price conditions of each session at a glance.

A key feature of Session Box is marking the High and Low of each session, which reveals price volatility within a specified window.

This capability is highly valuable for day trading and scalping, as the start of each session is typically accompanied by increased liquidity, false breakouts, and the beginning of powerful trends.

- Display of session open/close times based on UTC or local time;

- Ability to change colors and set session time ranges;

- A dedicated panel to display whether the market is open or closed;

- Support for lower timeframes such as M1, M5, M15, and M30;

- Non-repainting and compatible with ICT Concepts for liquidity and market-structure analysis.

This indicator can be used in markets such as forex, commodities, and indices. For example, a break below the London session low can act as a liquidity grab and signal a bullish reversal. This tool is available for MetaTrader 4 and 5 free of charge:

The Session Box MT4 indicator is a specialized tool for analyzing trading session timing and its impact on market volatility. By displaying time ranges and the High/Low of each session, it increases technical-analysis precision, improves risk management, and makes trading strategies more targeted.

For day traders and scalpers, using Session Box is a notable advantage. For complete training on this indicator, watch the following video:

The Impact of Japanese holidays on the Tokyo Session

On days when Japanese banks and financial institutions are closed, the Tokyo session exhibits a pattern different from normal conditions. The main effects of these holidays can be seen in the following:

- Liquidity reduction: bank and institutional closures in Japan and a shallower market;

- Artificial volatility: lack of institutional liquidity and outsized impact of smaller orders;

- Greater reliance on China and Australia: focus on macro data and impacts on AUD/USD, AUD/JPY, and NZD/JPY;

- Setup for the London session: narrow-range trading and higher odds of false breakouts.

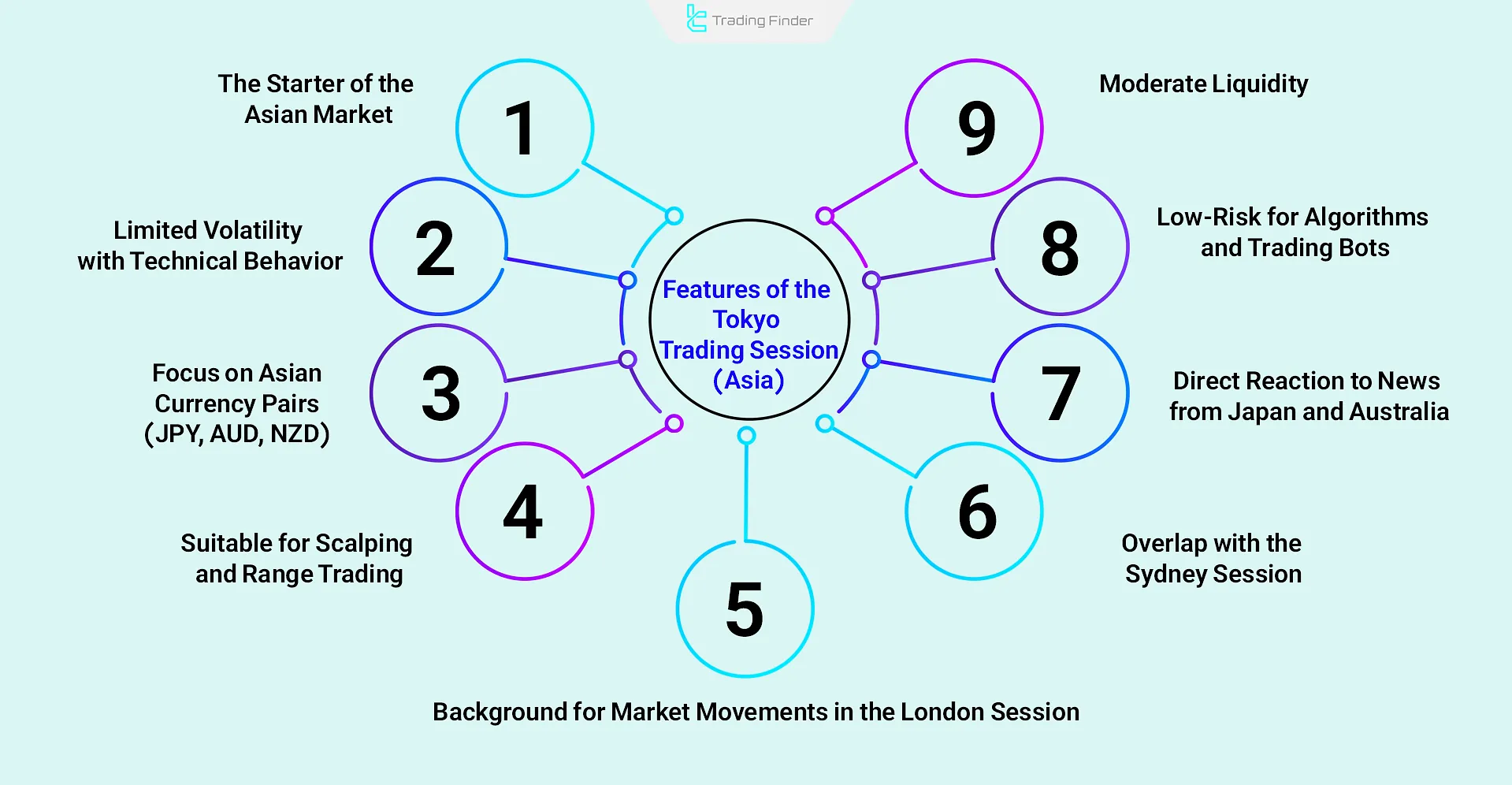

Capabilities of the Tokyo Trading Session

The Tokyo session (Tokyo session) is the primary initiator of liquidity flow in forex, with a focus on Asian currency pairs. The capabilities of the Tokyo trading meeting include:

- Official start of the Asian market

- Limited volatility and technical behavior

- Focus on currency pairs including JPY, AUD, and NZD

- Suitable for scalping and range trading strategies

- Precursor to market moves in the London session

- Initial overlap with the Sydney session

- Direct reaction to Japanese and Australian economic news

- Low-risk environment for algorithms and trading robots

- Medium liquidity with predictable behavior

Peak Volatility Hours in the Tokyo Session

Given session overlaps and the timing of macro releases, the highest price volatility in the Tokyo session is usually observed in the following windows:

- At the market open, coinciding with economic data releases;

- Overlap with Sydney, especially in AUD and NZD pairs;

- Overlap with London, which leads to higher trading volumes in EUR/JPY and GBP/JPY.

Example of Peak Volatility During the Tokyo Session (Asia)–London Overlap

Suppose the EUR/JPY pair fluctuates within a low-volume range during the final hours of the Tokyo session; as the London session begins, order flow increases rapidly, causing a breakout from Tokyo’s range. During this window:

- European economic data (e.g., PMI or inflation) is released;

- European banks enter the market;

- High liquidity creates explosive 40–70-pip moves in pairs like GBP/JPY or EUR/JPY.

Thus, peak volatility in this overlap usually stems from the combination of Europe’s news catalysts and the accumulation of Asian liquidity.

Tradable Currency Pairs In the Tokyo Session

Tokyo trading session pairs can be divided into two groups: highly volatile and low-volatility:

- Highly volatile pairs: EUR/JPY, AUD/JPY, NZD/JPY, GBP/JPY;

- Low-volatility pairs: EUR/USD, GBP/USD, USD/CHF, USD/CAD, EUR/GBP, AUD/NZD.

In the Tokyo session, JPY crosses have the greatest depth and responsiveness, while USD pairs with AUD and NZD are more influenced by macro data from China and Australia. Below are the most important pairs for trading in the Tokyo session:

- USD/JPY: the most active and liquid pair in the Tokyo session, aligned with the opening of Japan’s equity market;

- AUD/JPY: higher volatility due to Australia’s export dependence and RBA policy;

- GBP/JPY: lower liquidity during Asia but suitable for swing traders;

- EUR/JPY: short-term and sudden moves, influenced by changes in USD/JPY.

The Impact of Economic Data on the Tokyo Session

The Tokyo session is directly affected by data from Japan and key Asian economies such as Australia and China. Market reactions in this window are not limited to BoJ rate decisions; a combination of data, liquidity flows, and expectations is decisive.

The impact of economic data on the Tokyo session:

- Japan (Bank of Japan (BoJ) and inflation): CPI, PPI, and BoJ policy decisions—especially YCC—immediately create strong volatility in yen pairs; even minor rate changes can shift global capital flows;

- Australia (Reserve Bank of Australia (RBA) and employment): employment data and RBA statements are the main drivers of AUD. In addition to AUD pairs, these data influence commodity markets;

- China (PMI and trade): China’s macro indicators, especially PMI, directly affect commodity currencies and risk assets. Deviations from expectations typically trigger sharp moves in AUD, NZD, and metals.

Key Trading Notes for the Tokyo Session

In the Tokyo session (Asia), trading volumes are usually lower than in other sessions, but price fluctuations—especially in Asian pairs like the Japanese yen (JPY)—are notable.

For a better understanding of how to trade the Tokyo session (Asia), you can also refer to the full training video on how to trade the Asian session in forex by the tomtrades YouTube channel:

Below are notes on trading in the Tokyo session (Asian session):

- Trading volumes and liquidity: volumes in the Tokyo session are usually lower than in the London and New York sessions; however, there is sufficient liquidity to execute trades;

- Volatility: market volatility in the Tokyo session is usually lower, but during economic releases or overlapping with other sessions, volatility increases;

- Active currencies: the Tokyo session is suitable for trading Asian currency pairs, especially the Japanese yen (JPY) and the U.S. dollar (USD);

- Overlaps with other sessions: the Tokyo–Sydney (early morning) and Tokyo–London (late morning) overlaps increase trading volumes and liquidity;

- Trading strategies: suitable strategies for this session include range breakouts and news-based trading;

- Risk management: appropriate stop loss and position sizing in the Tokyo session can reduce potential risks;

- Economic news and events: before entering the market, review Asia-related economic news—especially Japan—to anticipate volatility and make timely decisions.

Common Trading Strategies in the Tokyo Session

In the Tokyo session (Asian session), due to liquidity conditions and overlaps with Asia’s macro data, several Tokyo session strategies see more use:

- Range breakout (Tokyo breakout): at the start of the Tokyo session time, the market typically fluctuates within a narrow range, and traders define the first hour’s High and Low to prepare for entries on breakouts; high-volume breaks often start the day’s trend;

- News trading: releases from the Bank of Japan (BoJ), Japan’s trade balance, and China’s PMI are primary catalysts; reactions are fast and volatile, which is attractive to scalpers using tight stop losses;

- Yen crosses trading: pairs such as AUD/JPY, NZD/JPY, and EUR/JPY are highly sensitive to the Asian flow; lower liquidity than majors leads to faster swings;

- Scalping with lower liquidity: tighter spreads—especially in USD/JPY—create favorable conditions; using indicators like ATR and RSI enables professionals to exploit small ranges;

- Trend continuation: moves formed in London or New York sometimes consolidate in Tokyo, and traders holding overnight positions seek confirmation or continuation;

- Tokyo–London overlap: in the final two hours of Tokyo, London’s open boosts liquidity, enabling strong moves and valid breakouts.

Risk-management Notes for Trading in the Tokyo Session

Due to its distinct liquidity structure, the Tokyo session creates a different environment from London and New York.

Professional traders should control risk not merely with a numeric stop loss, but via position management, order-flow analysis, and aligning with Asia’s liquidity structure.

Below are the key principles of risk management in the Tokyo session:

- Adaptive position size: set position size based on ATR and the session’s limited volatility;

- Smart stop loss: place stops beyond liquidity pockets or the Asian range rather than using fixed numbers;

- Realistic take-profit: target smaller 10–25-pip moves with a sensible risk-reward ratio of 1:1.2 to 1:1.5;

- Avoid overtrading: control the number of positions in the Tokyo session’s lower-volatility conditions.

Comparison of the Tokyo Session with London and New York

Each session operates with its own characteristics in terms of liquidity, volatility range, and fundamental drivers.

Tokyo is influenced mainly by Asian economic data, London channels the world’s primary liquidity flow, and New York—driven by U.S. data—sets the market’s final course.

Features | Tokyo session | London session | New York session |

Working hours | 00:00 – 09:00 | 07:00 – 16:00 | 12:00 – 21:00 |

Liquidity level | Low to medium | Very high | High |

Volatility range | Limited (Range-bound) | Wide (Volatile) | High, especially during the London overlap |

Dominant pairs | JPY, AUD, NZD | EUR, GBP, CHF | USD, CAD |

Main drivers | Japan, China, Australia data | Europe and UK data | US and Canada data |

Common trading styles | Range trading, low-risk strategies | Scalping, breakouts | News-driven, trend-following |

Overlaps | With Sydney | With Tokyo and New York | With London |

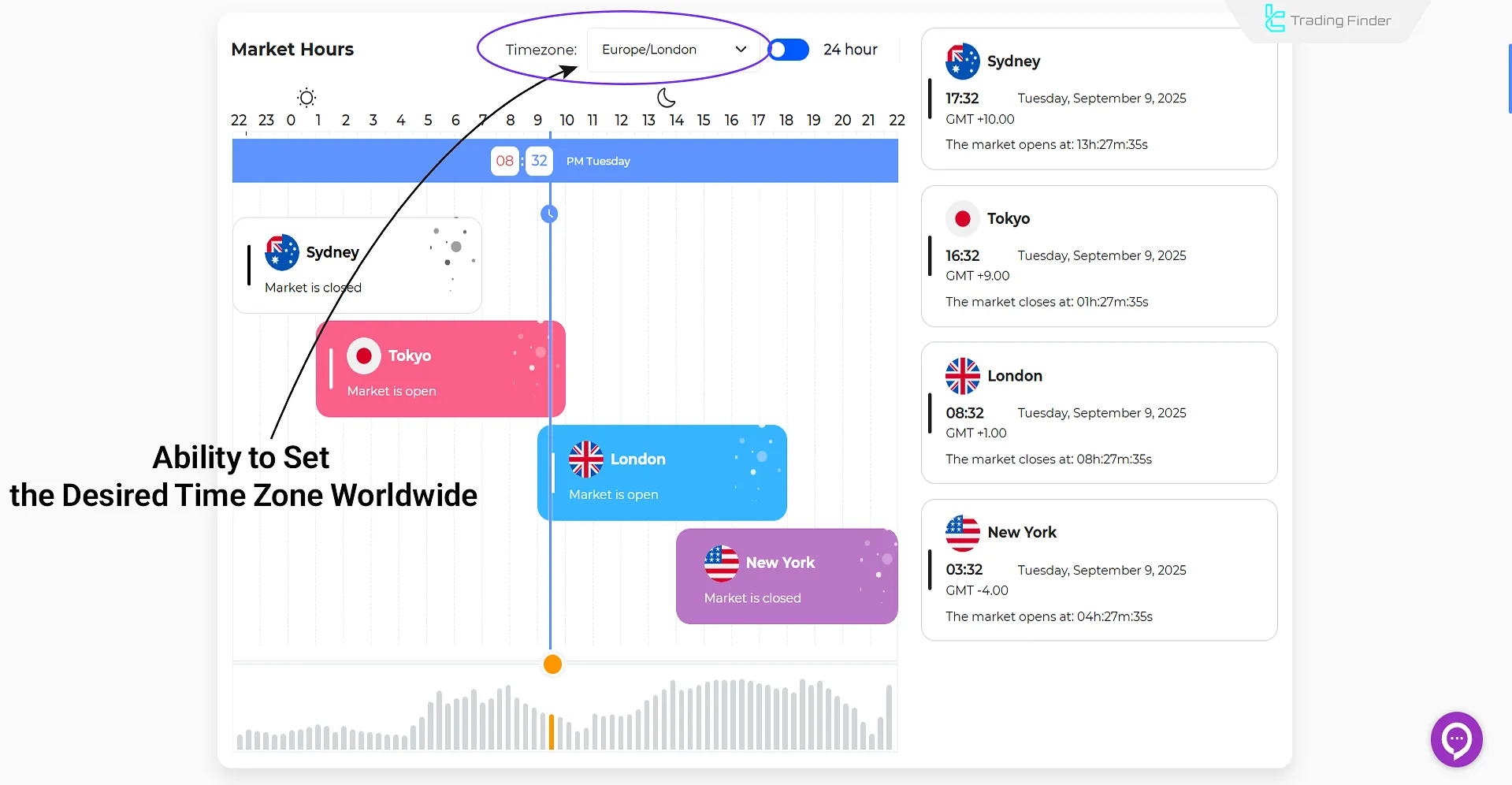

Using the Forex Market Hours & Trading Sessions Tool For Trading The Tokyo Session

TradingFinder’s Market Hours tool displays whether sessions are open or closed, countdowns to the start or end of each market, and peak-volume hours based on the user’s time zone.

By providing a precise table of global market open/close times and overlap windows, this tool simplifies forex trade management. You can also set it for all time zones worldwide:

Stock Market Trading Hours During the Tokyo Session

The Tokyo trading session, as the main representative of Asia’s stock market, begins with the opening of the Tokyo Stock Exchange and other financial markets in Japan.

- Start of trading: 09:00 AM local Tokyo time (01:00 GMT);

- End of trading: 03:00 PM local Tokyo time (07:00 GMT).

During this period, venues such as the Tokyo Stock Exchange (TSE), the Osaka Exchange, and other Japanese financial institutions are active. Overlaps with the Sydney session at the start of the day and with the London session toward the end lead to increased liquidity and greater volatility.

Conclusion

The Tokyo session (Tokyo session) kicks off the forex trading cycle with stable liquidity, controlled volatility, and technical behavior. This trading meeting provides a suitable environment for scalping, algorithmic trading, and day strategies.

Accurate knowledge of timing, active pairs, and the impact of Asia-region news is essential for risk management and decision-making during the Tokyo session time. For an overview of trading sessions, you can also use the free sessions indicator on TradingView.