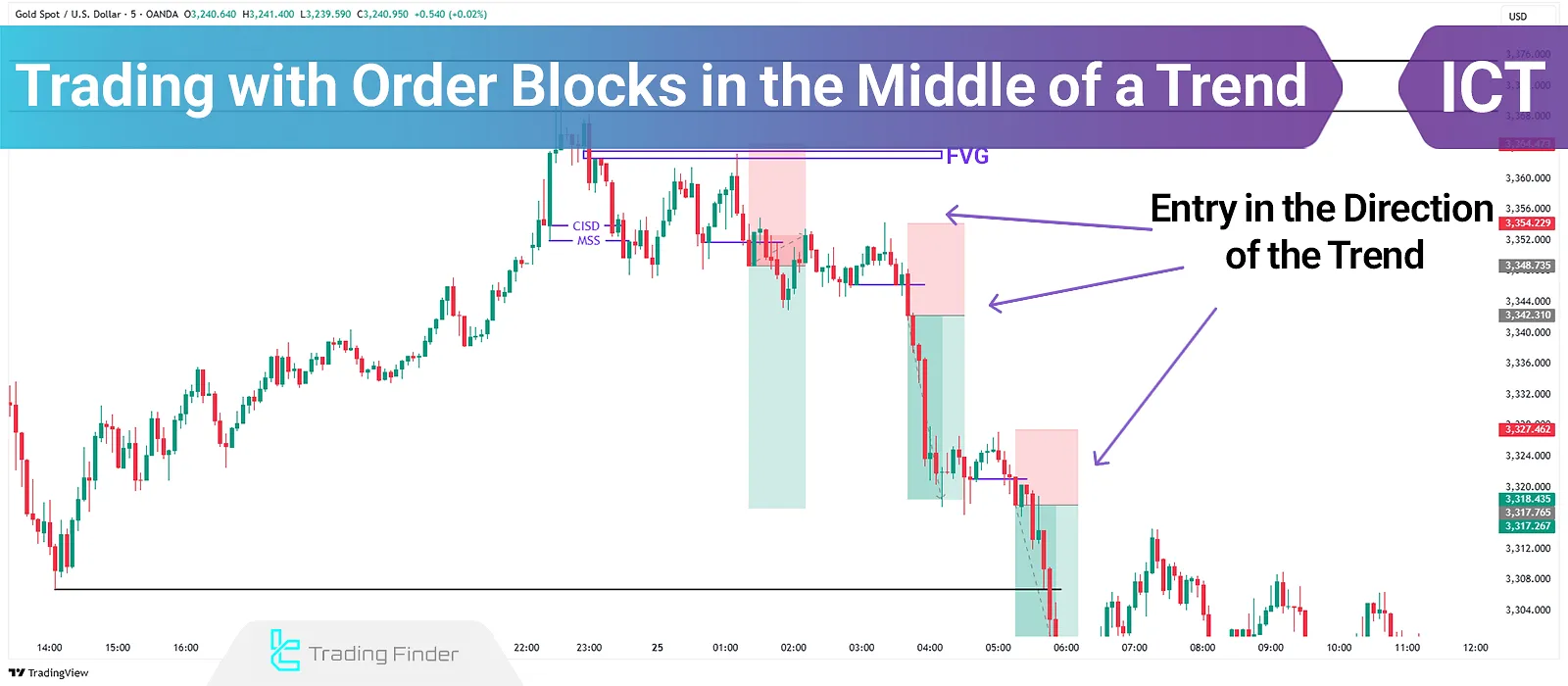

When traders miss the initial entry point and aim to enter in the middle of a trend, the ICT approach recommends re-entry only if confirmation is received.

In such situations, using Order Blocks (OB) and Fair Value Gaps (FVG) as retracement zones, provides valid entry opportunities.

How to Trade Using Order Block in Trend Following with ICT

For a better understanding of how to trade with order blocks in trend-based ICT style, you may refer to the article lean trade continuation in smart money ICT as well as the educational video available on the TTrades YouTube channel:

To enter the middle of a trend using the ICT style, follow the steps below:

#1 Higher Time Frame Price Analysis

When the price low is accumulated using the SMT divergence technique and candlesticks form as an Order Block in the same zone, the next step is to check the lower timeframe to identify a bullish structure.

At this stage, correct identification and recognition of bullish and bearish order blocks are crucial and form the basis for advancing the next steps in this trading strategy.

Below we define bullish and bearish order blocks along with how to identify valid ones:

Types of Block Orders (Bullish/Bearish)

A Bullish Order Block is the last bearish candle before a strong upward move, indicating the accumulation of buy orders by financial institutions and banks. Price returning to this zone usually results in support.

Conversely, a Bearish Order Block is the last bullish candle before a sharp downward move, representing heavy sell order entries.

Price returning to this zone usually results in resistance and continuation of the downtrend.

Comparison Table of Bullish and Bearish Types of Block Orders:

Type of Order Block | Formation Conditions | Advantages | Disadvantages | Practical Example |

Bullish Order Block | Forms in the support zone; usually after a Break of Structure (BOS) or Change of Character (CHOCH) | Indicates smart money entry; a strong signal for trend continuation | May be false in a ranging or low-volume market | In the 1H timeframe, the last bearish candle before a strong rally |

Bearish Order Block | Forms in the resistance zone; after bearish BOS or CHOCH confirmation | Provides an opportunity to enter a short trade | May become invalid in news-driven or highly volatile markets | In the 4H timeframe, the last bullish candle before a sharp drop |

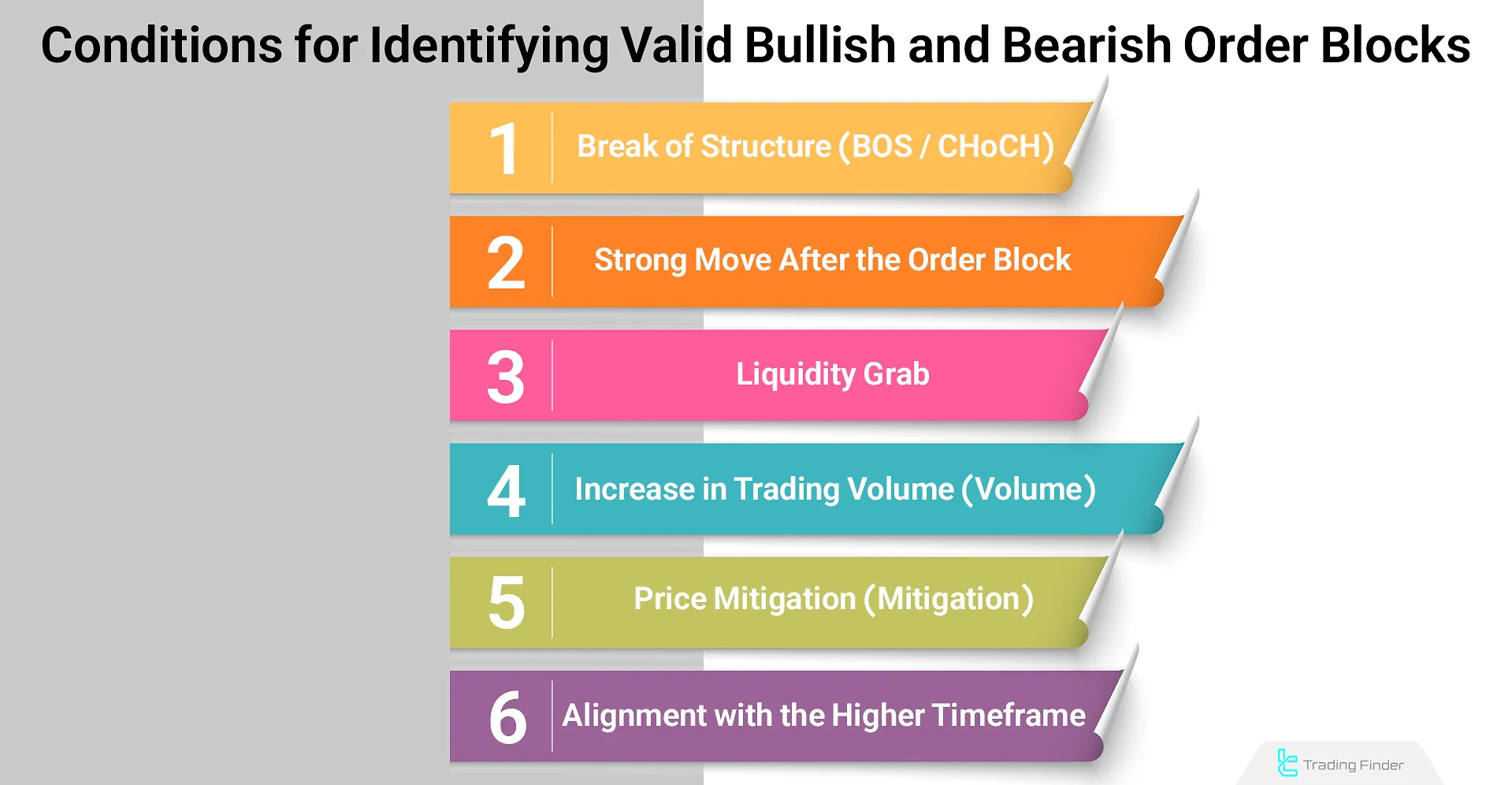

Identifying Valid Order Blocks

To identify valid bullish and bearish order blocks, the following key conditions must be met:

- Break of Structure (BOS/CHOCH): After the formation of the order block, a clear structural break must occur; an order block without BOS has little value;

- Strong move after the order block: Price must leave the zone with strong candles and high volume; weak slow moves indicate lack of effective orders;

- Liquidity Grab: Often before the order block forms, the market sweeps liquidity above/below the previous high/low;

- Volume: An increase in volume when moving away from the order block shows institutional orders;

- Price Mitigation: When price revisits the order block and reacts (without breaking the area completely), its validity increases;

- Alignment with higher timeframe: Order blocks aligned with the higher timeframe trend are usually more reliable.

#2 Switching to a Lower Time Frame to Find a Higher Low

At this stage, you should look for the formation of a Higher Low (HL) or a reaction to an FVG. There may be several FVGs in this path, and it’s unnecessary to predict which one is valid in advance.

Instead, we wait for the price to react to one of them, form a low, and then confirm the entry scenario by forming a Single Order Block with a shadowed candle.

#3 Confirmation for Trade Entry

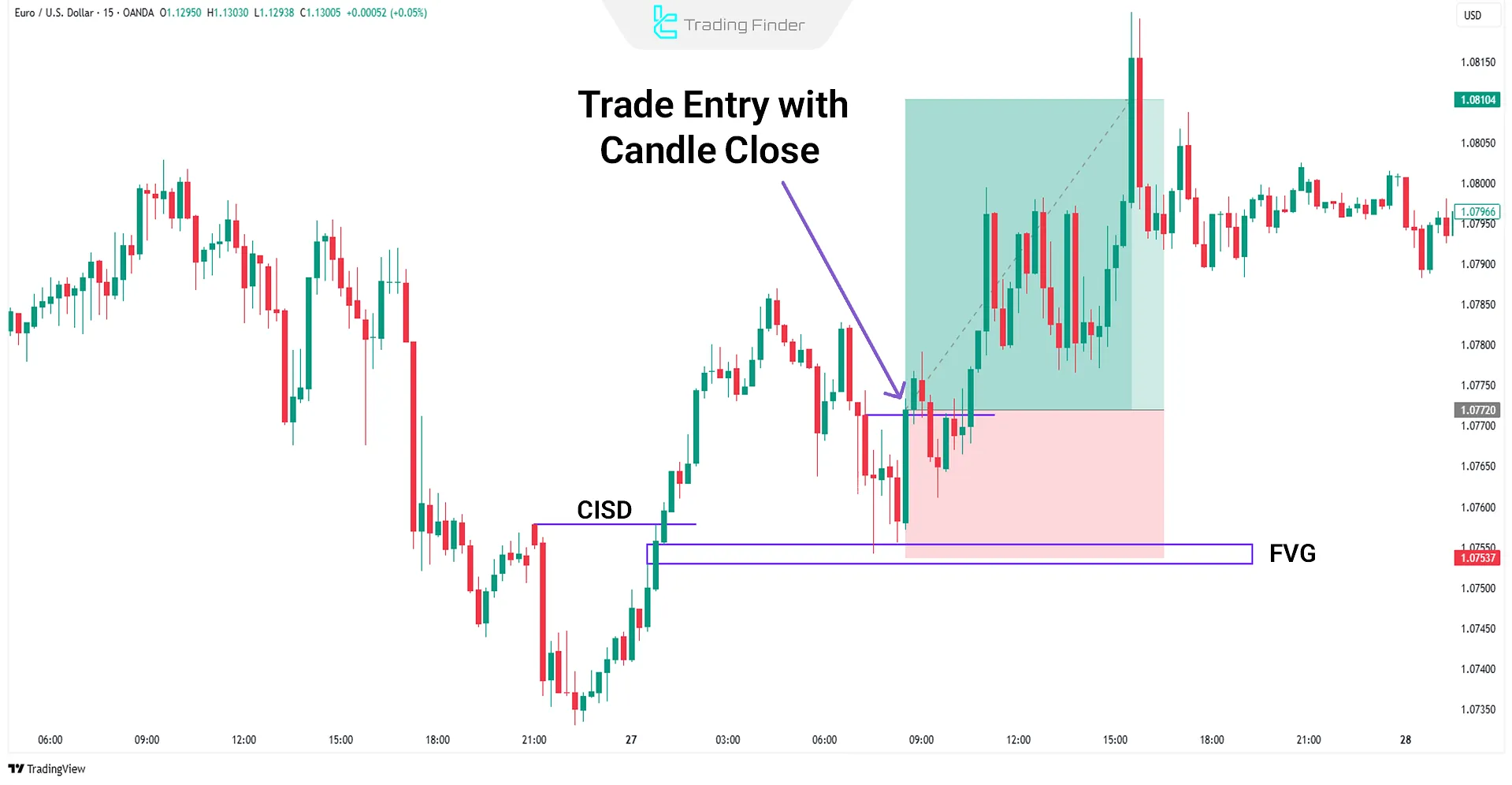

In this structure, for Trading with Order Block in Trend Following with ICT combined with confirmation candlestick signals, there are two main confirmations which differ depending on timing and entry zone in the trend.

At the beginning of a trend, confirmation occurs when there's a Change in the State of Delivery (CISD), a pullback to the Fair Value Gap (FVG) on a lower time frame, and a candle closes above the open of the initial bearish candles.

Midway through the trend, once the top is confirmed and the price continues upward, entry is triggered after a candle closes above the open of the candle that started the downward move during the correction and Fair Value Gap (FVG) return.

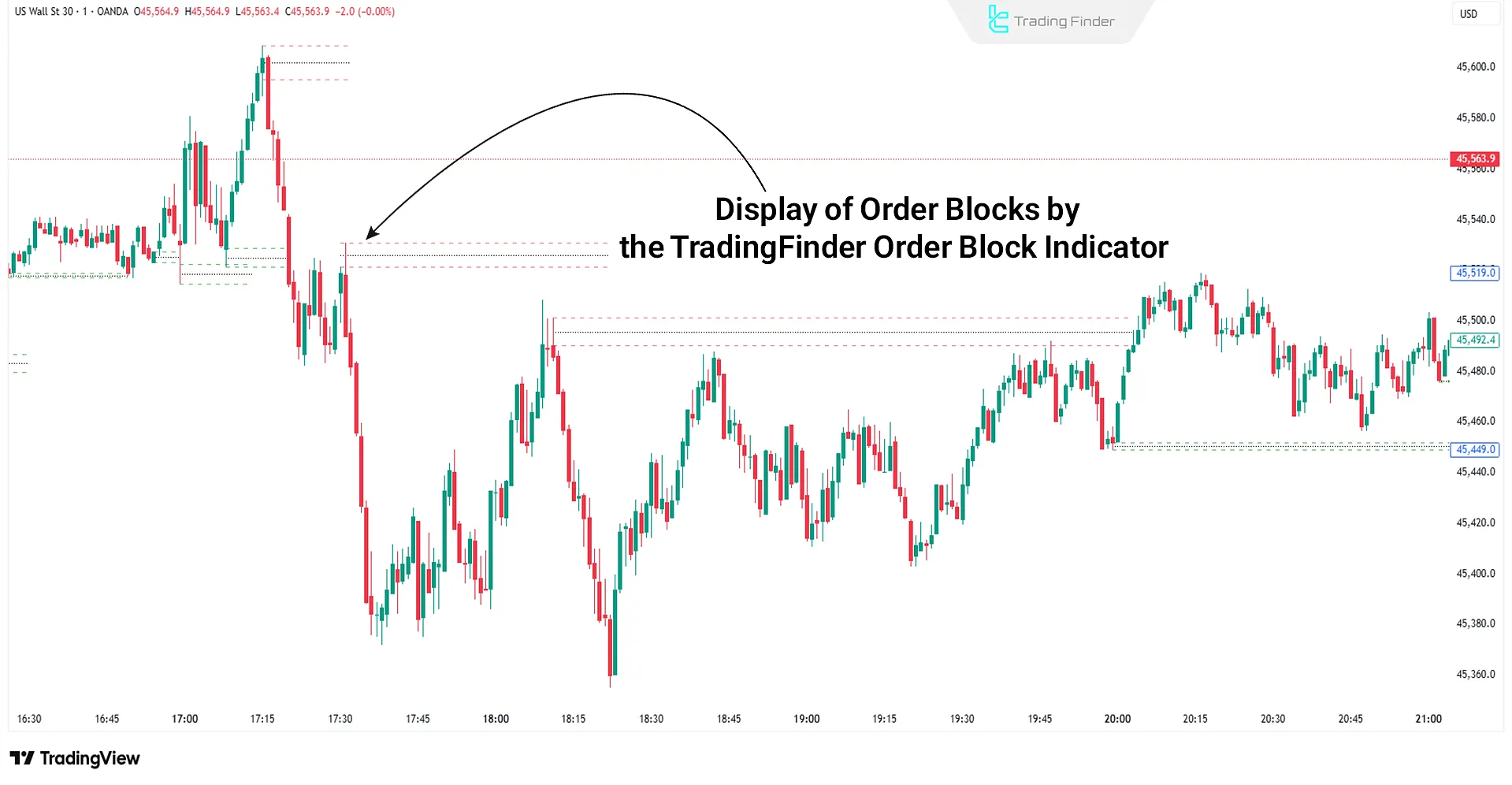

Order Block Indicator

The Order Block Indicator is one of the most important analytical tools in ICT and Smart Money concepts used by professional traders to identify liquidity zones.

These zones, due to order accumulation, act as key support or resistance points and are usually the main price targets.

This indicator visually displays high-risk zones and simplifies the analysis process:

Displays major high/low levels with colored lines;

- Plots bullish order blocks (Bullish OB) in green and bearish order blocks (Bearish OB) in red;

- Shows the 50% midpoint of each block with a dashed line as a key entry/reaction level;

- Includes the Order Block Refine feature for automatic optimization of block zones;

- Supports multi-timeframe analysis, making it suitable for daily, swing, and even scalping strategies.

In an uptrend, a break of Major High indicates a Change of Character (CHOCH) or Market Structure Shift (MSS). In this case, Demand OBs are considered major support zones, and BOS confirms the continuation of the uptrend.

Conversely, in a downtrend, after a break of Major Low, price reaching Bearish OBs signals continuation toward lower levels.

This indicator allows customization, including showing or hiding major levels, selecting refinement types, and changing block colors.

It is used in Forex, cryptocurrency, stocks, commodities, and indices markets and is ideal for day traders and advanced market participants.

The Order Block Indicator is a combined tool of OB, BOS, CHOCH, and MSS concepts that identifies liquidity zones and market structure shifts, creating more reliable entry and exit opportunities.

These features have made it one of the most widely used indicators on TradingView.

This indicator is available on TradingView and MetaTrader platforms:

- Order Block Indicator on TradingView

- Download Order Block Indicator for MetaTrader 5

- Download Order Block Indicator for MetaTrader 4

Invalidation and Re-entry Conditions

Invalidation refers to conditions indicating that the trading scenario is no longer valid and the trade should be exited or avoided. Invalidation conditions for Trading with Order Block in Trend Following with ICT:

- Break of the main Order Block high/low;

- Lack of continuation and quick price reversal;

- Absence of a valid Market Structure Shift (MSS) formation in the lower timeframe.

Sometimes the initial entry may not be possible due to invalidation of the first FVG or initial OB. In such cases, entry can be made on the next FVG or OB with a valid MSS. This type of entry usually has lower risk because liquidity has been collected and the new structure is confirmed.

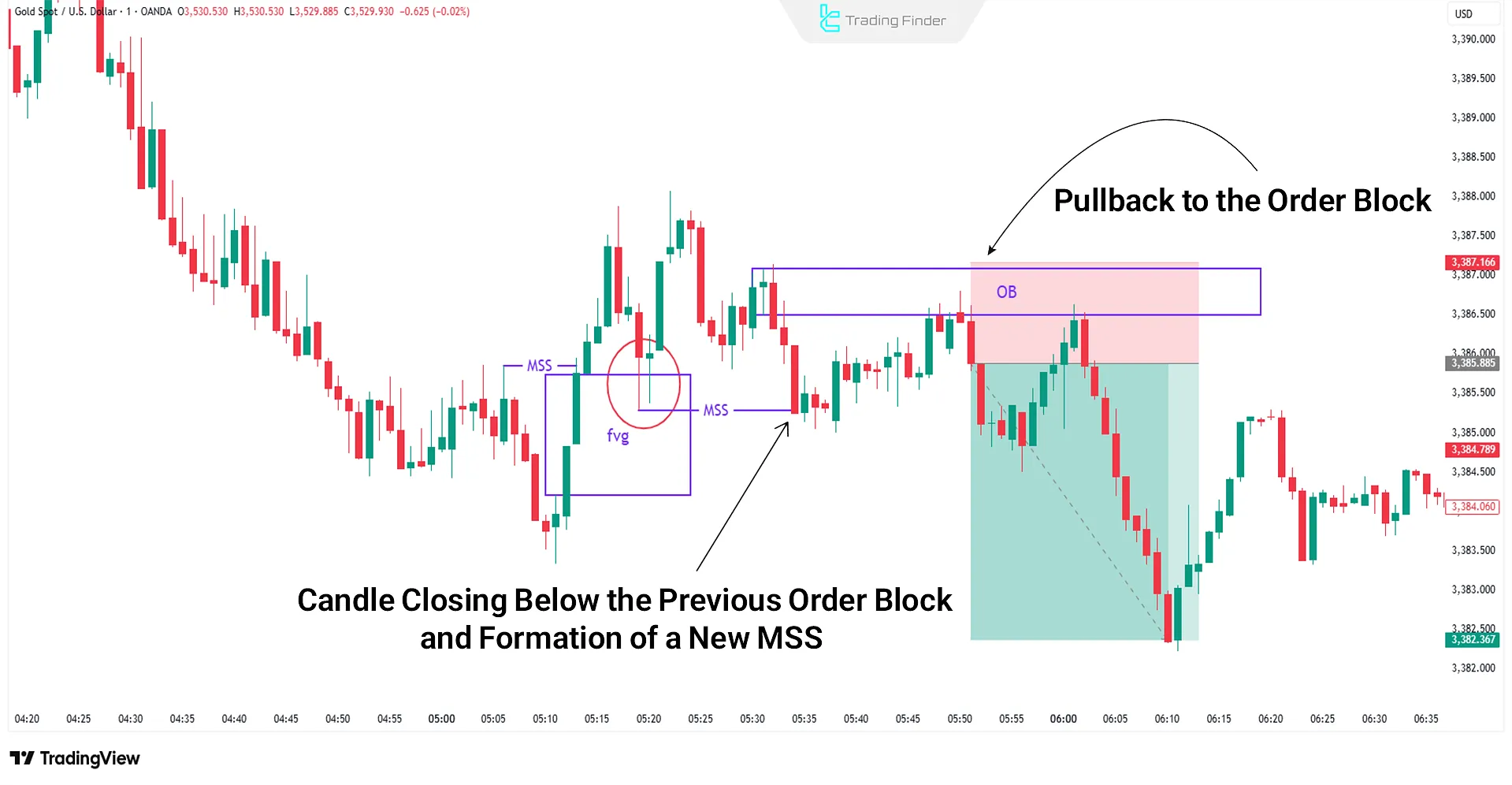

Example of Invalidation and Re-entry

In the example below, after a strong market direction change, price pulled back into an FVG acting as an order block but failed to continue its bullish path.

When a candle closed below the order block, a new MSS was formed. Then, with price pulling back to the next FVG or OB in the opposite direction, a reverse trade setup became available.

In fact, invalidation of a bullish scenario in this strategy means creating a reverse scenario, providing the trader an opportunity to enter in the opposite direction.

Advantages and Limitations of Trading with Order Block in Trend Following with ICT

Using Order Blocks in the ICT style is a high-precision tool for entering trades in the direction of the trend.

This approach is more suitable for experienced traders who apply multi-layered confirmation. Below are the pros and cons:

Limitations | Advantages |

Requires precise synchronization across time frames to confirm structure | Precise entry during trend correction using Order Block (OB) and Fair Value Gap (FVG) |

A misidentified OB can quickly trigger stop loss | Small stop loss placed behind OB or FVG with a favorable risk-reward ratio |

High mastery of advanced ICT and price behavior required | Full alignment with SMT, CISD, and Break of Structure (BOS) |

Misleading in sideways or low-liquidity markets | Effective in lower time frames (M1 to M15) with step-by-step confirmation |

Potential misanalysis of liquidity structure across different time frames | Utilizes liquidity draw zones for powerful entries |

Common Mistakes of Trade Using Order Block in Trend Following with ICT

In this mid-trend entry strategy, traders often make errors that result in failed entries, early stop-outs, or missed real opportunities. Common mistakes include:

- Misidentifying Single Order Blocks for confirmation;

- Focusing solely on OB while ignoring FVG;

- Entering without structural confirmation;

- Ignoring the higher time frame context;

- Overlooking SMT divergence;

- Setting a stop loss without technical reasoning.

Note: When Trading with Order Block in Trend Following with ICT, due to sufficient liquidity, it is recommended to trade during session overlaps and on highly traded instruments.

Risk Management Parameters for Trading with Order Block in Trend Following

To define Stop Loss (SL) and Take Profit (TP) levels in this ICT strategy, the following criteria should be considered:

- Stop Loss: Positioned behind the Order Block (OB) or the low formed in reaction to the Fair Value Gap (FVG);

- Take Profit: Set at the previous structural high or based on a 1:2 risk-to-reward ratio.

Key Notes on Trading with Order Block in Trend Following

Accurate execution of Trade Using Order Block in Trend Following with ICT depends on several critical principles:

- Mid-trend re-entry is only valid upon receiving structural confirmation from the market;

- The combined use of Order Block (OB) and Fair Value Gap (FVG) reduces trade risk;

- Alignment between higher and lower time frames filters false signals and validates price structure across levels;

- Tools like SMT and CISD are essential in identifying the beginning of new waves;

- No trading in the absence of a pullback to FVG after CISD is one of the key rules of this strategy that must be considered.

For more details on this strategy, you can also use TradingView educational resources:

Note: All scenarios mentioned for bullish trend entries apply in reverse for bearish setups.

Conclusion

Using structural concepts like Order Block and Fair Value Gap during a trend allows re-entry even after the initial price move, but only if clear confirmations are received.

In the ICT framework, such entries rely on price action in lower time frames, confirmed by CISD, long-wick candles, and validated high/low structures.

Multi-timeframe analysis, correct placement of stop loss, take profit, and deep understanding of price behavior around liquidity areas make this method one of the most advanced continuation entry strategies in trading.