Choosing a trading style helps establish discipline in trading and improves the success rate of a trading strategy. Therefore, having an accurate understanding of trading goals, skill level, capital size, and similar factors leads to selecting the right option among differenttypes of trading style used in Forex.

Trading styles in trading are generally divided into four categories of Scalping, Day Trading, Swing Trading, and Position Trading.

Types of Trading Styles

There are four different trading styles in the financial markets, each differing in trade duration, capital requirements, analytical approach, and other elements.

Types of trading styles in Forex:

- Scalping

- Day Trading

- Swing Trading

- Position Trading

This topic is explained in detail in the InidraTrade educational article on different types of trading style.

Scalping Trades

In this trading style, trades are executed at very high speed, and the duration they remain open is only a few seconds or at most a few minutes.

This model of trading requires high precision, real-time risk control, and uninterrupted order execution so that price slippage and sudden volatility have minimal effect on the outcome of the trade.

In this style, small market fluctuations are targeted, and traders use analytical tools and advanced algorithms to identify and capture profit from these micro-movements.

Market structure, liquidity depth, and volume behavior are typically analyzed on extremely low timeframes to select entry and exit points with the highest probability of success.

Features of Scalping Trades

The scalping trading style has unique characteristics such as a high number of trades, small profits, high trading volume, and similar traits that make many traders prefer this trading style.

Features of scalp trades:

Advantages and Disadvantages of Scalping

Using the scalpingtrading style allows every small movement inside the chart to become a trading opportunity. However, using this style requires strong trading experience and emotional control. Moreover, spread cost has a significant impact on scalping trades.

Advantages and Disadvantages of Scalping:

Advantages | Disadvantages |

High number of trades | Requires high experience and knowledge |

Not dependent on market direction | High cost (commission and spread) due to number of trades |

Fast outcome of trades | Requires strong emotional control |

No need to hold trades overnight | Requires continuous chart monitoring |

Reduced risk per trade | High impact of spreads |

Day Trading

In day trading, trades remain open from a few minutes to several hours. However, trades in thistrading style are closed by the end of the trading day and do not carry into the next day.

Day traders usually rely on technical analysis and identify entry points, take-profit, and stop-loss levels by examining price patterns.

Continuing this process, traders evaluate volume behavior, trend strength, and liquidity zones so their decisions align with intraday trading market structure and reduce potential errors.

Risk management is also performed based on the day’s volatility to minimize the impact of unexpected events.

Features of Day Trading

The day trading trading style relies heavily on examining the daily trend using various technical analysis approaches, including the ICT style. Additionally, analyzing impactful economic data helps identify the direction of daily trades.

Features of day trading:

- Trading in the direction of the daily trend

- Trade duration between a few minutes and several hours

- Use of technical analysis

- Closing all trades by the end of the trading day

- Multi-time-frame analysis

Advantages and Disadvantages of Day Trading

Day trading improves trading success by following the primary daily trend. However, if the daily trend is identified incorrectly, all trades for that day may result in loss.

Advantages | Disadvantages |

Trading in the direction of the daily trend | Risk of misidentifying the daily trend |

Reduced trading costs | Requires high skill in technical analysis |

Reduced spread impact | Requires correct understanding of economic data |

No overnight holding risk | Requires continuous chart monitoring throughout the day |

Swing Trading

Swing trades remain open for longer periods. Trades in this trading style usually last from a few days to several weeks. Therefore, both technical and fundamental analysis are used almost equally.

In this type of trading style, corrective moves within major and long-term trends are usually targeted, and trade durations rarely extend into multi-month periods.

Thus, selecting an accurate entry zone along with stop-loss and take-profit placement based on overall market structure becomes extremely important. Analytical consistency plays a larger role in the success of this trading style.

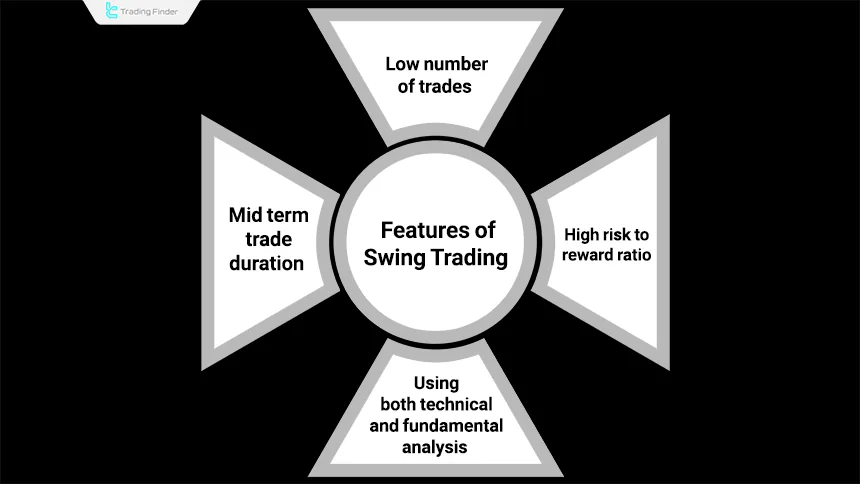

Features of Swing Trading

In this style, trade frequency is usually low, but the risk-to-reward ratio of each trade is often high. Successful trades yield significantly more profit relative to the capital risked.

Features of swing trading:

Advantages and Disadvantages of Swing Trading

Using the swing trading style requires patience and commitment to the trading plan. When applied correctly, it provides opportunities to capture trades with high risk-to-reward ratios.

Advantages and Disadvantages of Swing Trading:

Advantages | Disadvantages |

No need for daily chart monitoring | Long duration of trades |

High risk-to-reward ratio | Risk of holding trades over holidays |

Reduced trade risk | Cost of holding trades over days and weeks |

Saves time | Requires strong skill in both technical and fundamental analysis |

Position Trading

Theposition trading style targets long-term trends in price charts and relies primarily on the fundamental analysis of different assets. In this method, long-term trends are identified through analysis of economic news, financial reports, company performance, and similar data, while technical analysis is used mainly to identify precise entry points.

Through this approach, the trader usually ignores short-term market noise and focuses on evaluating macro market dynamics and the stability of fundamental drivers. This allows positions to be managed over several months or even several years.

In the One Minute Economics YouTube channel, different Training types of trading style in forex are taught visually based on their time classifications:

Features of Position Trading

Position trades typically last more than one week and can sometimes extend to years. For this reason, using this trading style requires sufficient capital to cover long-term holding costs.

Features of position trading:

- Long trade duration

- Targeting the primary long-term trend

- High risk-to-reward ratio

- Strong dependence on fundamental analysis

Advantages and Disadvantages of Position Trading

This trading style is suitable for those with limited time and sufficient capital because it does not require continuous trade monitoring. However, position trading demands relatively large capital and a strong understanding of the fundamental behavior of the asset.

Advantages | Disadvantages |

Saves time | Requires large capital |

High risk-to-reward ratio | Requires high patience to achieve trade results |

No short-term price-noise risk | High cost of holding long-term positions |

Minimal impact of spread | Requires deep understanding of fundamental analysis |

Trading Styles Based on Type of Analysis

In addition to time-based categories, trading style may also be selected based on the analysis method. Here, analytical tools and the market-evaluation approach determine the style.

- Technical Trading: Decision-making based on price action, chart patterns, key zones, and volumes;

- Fundamental Trading: Use of economic news, financial reports, and core market data for mid- and long-term decisions.

News Trading

In thistrading style, trade entries and exits are executed based on the timing of important economic news releases. The intense volatility at these moments creates short-term opportunities with high risk and reward. Therefore, applying this style requires timing skill and fast decision-making.

Features of News Trading

News-based trading is built on market reaction to newly released information.

Therefore, tools such as the economic calendar, fast interpretation, and strong risk management are essential.

- Using the economic calendar to track major news

- Highly sensitive to short-term volatility

- Suitable for fast and experienced traders

Advantages and Disadvantages of News Trading

With regard to the inherently volatile nature of this style, news-based trading can create rapid trading opportunities while also carrying risks that go beyond normal market conditions. The table below presents the key advantages and disadvantages of the News Trading style for easier comparison.

Advantages | Disadvantages |

Opportunity for fast profit at the moment of news release | Risk of slippage and sudden market shocks |

Ability to trade in low-volatility markets | Unpredictable and intense volatility |

No need for long trade holding | Requires extremely fast decision-making |

Price Action Styles

Price action is a set of analytical trading styles in which traders make decisions based solely on price behavior, market structure, and movement patterns.

No complex indicators are used in these methods; instead, the focus is on candlesticks, liquidity, and shifts in supply and demand.

This approach typically relies on reading price reactions in key zones, evaluating breakouts and pullbacks, and identifying the dominant direction of the market without relying on external tools.

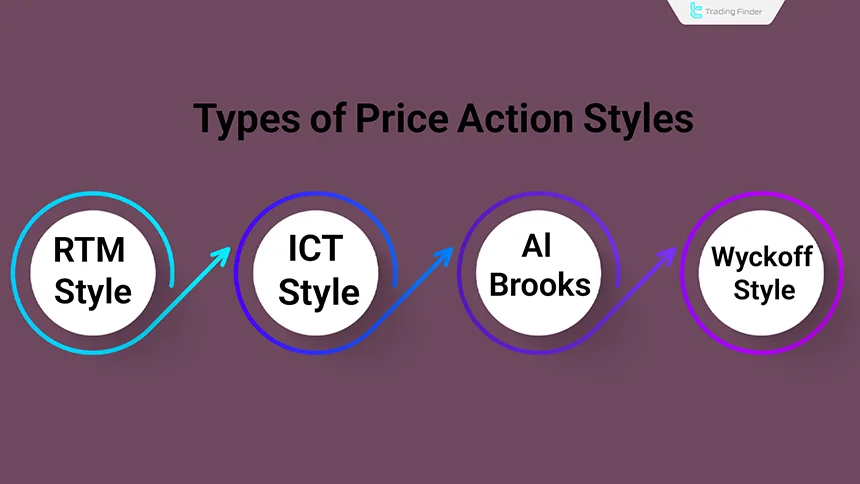

Types of Price Action Styles (ICT, RTM, Al Brooks, Wyckoff)

Below are the most widely used price action types of trading style, helping traders compare and understand each method clearly.

- RTM Trading Style: Focus on order blocks, decision zones, Fair Value Gaps (FL), and fake breakouts to determine precise entries;

- ICT Trading Style: Focus on liquidity, Kill Zones, order blocks, IPDA models, and multi-timeframe analysis;

- Al Brooks Price Action: Detailed candlestick interpretation, micro-trend analysis, and evaluation of buying/selling pressure;

- Wyckoff Method: Study of market cycles, including accumulation, distribution, supply tests, and structural breaks.

Advantages and Challenges of Price Action Styles

Although individual methods vary, all price action trading styles share a core principle: analysis of raw price behavior without reliance on indicators.

Below is a complete comparison of the main advantages and challenges, helping traders evaluate which may be the best trading style forex for them.

Advantages | Disadvantages |

No dependence on indicators and direct analysis of price behavior | Requires extensive experience and practice to understand market structure |

Ability to identify precise entries at key levels | Possibility of misinterpreting price patterns |

Suitable for all timeframes | Requires strong focus and continuous analysis time |

Usable across different trading styles | Strong dependence on market psychology |

Comparison of Trading Styles Based on Timeframe

Each trading style is executed in specific timeframes depending on the duration of holding trades and the type of volatility being targeted.

Recognizing the correct timeframe provides a clearer view of market structure and leads to proper use of analytical tools within the correct time window.

Trading Style | Suitable Timeframe | Trade Holding Duration |

Scalping | 1m – 5m | A few seconds to a few minutes |

Day Trading | 15m – 1h | A few minutes to a few hours |

Swing Trading | 4h – Daily | A few days to a few weeks |

Position Trading | Daily – Weekly | A few weeks to a few months |

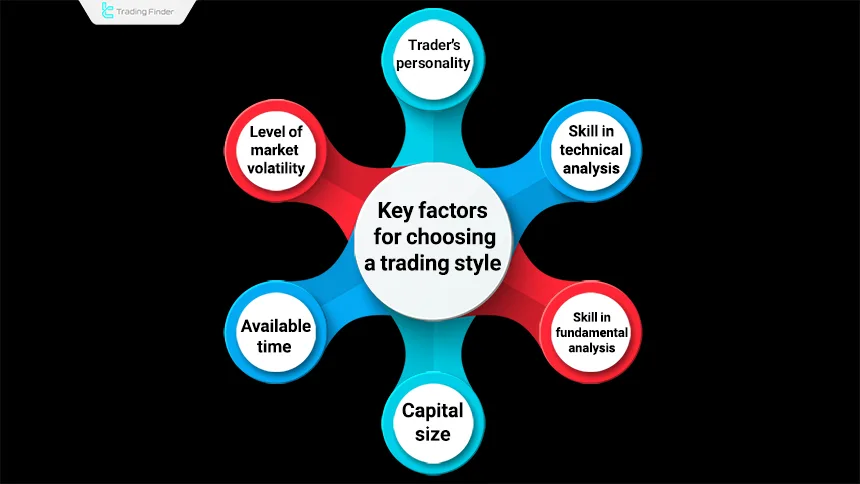

Guide to Choosing a Trading Style

Choosing the correct trading style depends on various factors, including trader personality, capital size, skill level, and more.

Main factors for choosing a trading style:

Evaluating all these factors helps determine the right choice among different types of trading style.

Choosing a Trading Style Based on Trader Personality

A trader’s personality has a direct impact on selecting an appropriate trading style, since tolerance for risk, reaction speed, concentration, patience, and the ability to handle volatility vary among individuals.

Each trading style requires a specific behavioral pattern, and any mismatch between the style and personal traits reduces analytical accuracy and increases decision-making errors.

The trader should evaluate compatibility with time pressure, volatility intensity, trade frequency, and stress management to determine which style ensures stable performance.

The Role of Capital in Choosing a Trading Style

Capital is a major deciding factor in choosing a trading style, because risk management, position sizing, and the ability to withstand volatility all depend on available capital.

Styles such as position trading require coverage of overnight and long-term holding costs and inherently larger stop-loss distances, making them less suitable for small accounts.

In contrast, scalping and day trading can be performed even with smaller capital due to short holding times and tighter stops.

Larger capital allows traders to benefit from mid- and long-term market movements through wider stops and deeper entries, which is essential in swing and position trading.

Trading Styles Suitable for Different Markets

Each financial market has its own volatility structure and behavior.

These characteristics make certain types of trading style more effective in one market than another.

Suitable trading styles for different markets:

- Forex: Ideal for scalping, day trading, and swing trading due to deep liquidity and stable mid-term volatility;

- Crypto: Suitable for swing and position trading because of strong trends and high long-term volatility;

- Stocks: Ideal for position trading and news-based trading due to structured behavior and dependence on fundamental data.

Risk Management Tips in Different Trading Styles

Risk management differs in each trading style, because volatility level, stop-loss distance, trade frequency, and holding costs vary across styles.

Therefore, traders must adjust their risk-management approach based on the characteristics of their chosen trading style to reduce errors and maintain long-term consistency.

Risk-management tips based on trading style:

- Scalping: Use small stop-losses, avoid holding trades, and monitor spread carefully;

- Day Trading: Trade with the daily trend, use fixed stop-losses, and avoid low-liquidity hours;

- Swing Trading: Adjust stop-loss based on mid-term volatility and evaluate structural key zones;

- Position Trading: Calculate long-term holding costs, use deeper stop-losses, and size positions according to capital.

Trading Style and Prop-Firm Rules

In prop-firm evaluations, the chosen trading style directly affects rule compliance, risk management, and pass probability.

Some types of trading style involve high volatility, high trade frequency, or special market conditions and may be restricted.

Understanding prop-firm rules before choosing a style helps prevent unintentional violations.

Important trading-style notes in prop firms:

- News trading: Restricted or prohibited in some prop firms;

- Scalping: Requires low spread and fast trade execution;

- Swing trading: Usually incurs overnight swap/holding fees;

- Position trading: Requires sufficient capital and wider stop-losses;

- High-frequency trading: Might be flagged and requires checking specific rules.

Common Mistakes in Choosing a Trading Style

Selecting a trading style without analyzing personal conditions and market characteristics causes unstable results and inconsistent performance.

Many traders suffer from reduced analysis quality and poor decisions because their chosen trading style does not match their personality.

Recognizing these mistakes helps avoid repetitive errors.

Common mistakes in choosing a trading style:

- Choosing a style without considering personality and risk tolerance;

- Switching styles repeatedly after a few losing trades;

- Misusing leverage, especially in swing and position trading;

- Making decisions solely based on others’ results;

- Ignoring time limitations and the psychological load of each style.

When Should We Change Our Trading Style?

Changing a trading style is necessary when the match between the trader’s method and personal conditions is lost.

Changes in free time, capital size, risk tolerance, or market volatility can make a trading style ineffective.

If results do not improve within a measurable period, or if the current style creates excessive psychological pressure, revisiting and changing the trading style can enhance long-term performance.

Reevaluating market structure, trading goals, and personal factors helps select a more suitable best trading style.

Roadmap for Choosing a Trading Style

Choosing a trading style becomes effective when the process follows a clear, step-by-step structure.

This helps traders understand their personal conditions, analytical capability, and limitations, enabling them to select the best trading style aligned with their mindset and finances.

Steps for choosing a trading style:

Price Action Trade Management Expert Box

The Price Action Trade Management Expert Box is a semi-automated tool that helps traders using the price action trading style manage entry and exit zones more quickly and systematically.

After launching the expert, a special panel appears on the chart displaying all recognized price-action patterns in a structured list.

The trader can select any pattern and place the corresponding trading box directly onto the chart.

When price enters the area selected by the trader, the expert automatically opens a buy or sell position.

Additional features such as Money Management, Risk Reward settings, and a News Filter to prevent entries during major news events are included.

These capabilities increase the trader’s control when executing a trading style based on price action.

Available patterns include Double Top, Double Bottom, Sequential Zones, Retest, Head and Shoulders, and the QM Pattern. For each pattern, the expert draws the initial trading boxes, and the trader manually aligns them with the forming market structure before activating automated execution.

Some patterns require additional conditions, such as complete wave formation or price exiting a zone within a certain number of candles, to reduce false entries.

The capital-management panel offers three position-sizing methods:

- Fixed Lot

- Percentage of Balance

- Risk Reward settings

The News Filter allows traders to set alerts and define pre- and post-news restrictions. This feature is available after enabling WebRequest and adding the news-source URL.

Overall, this expert acts as an auxiliary module for price-action traders, allowing them full control over trading zones instead of relying solely on automatic drawing.

By combining capital-management tools, confirmation systems, and real-time monitoring, it creates more structured and faster execution of analytical scenarios.

- Download link for the Price Action Trade Management Expert for MetaTrader 4

- Download link for the Price Action Trade Management Expert for MetaTrader 5

Example of Executing a Trade with the Double Bottom Pattern

In this example, the Double Bottom pattern is selected from the expert panel, and the trading box is placed over the area where price reacted twice.

After aligning the zone with real chart structure, the expert monitors price and waits for price to re-enter the defined support area.

When price returns to the specified box, pattern conditions and checkpoints are evaluated. After confirming all criteria, the panel displays a YES/NO confirmation.

By selecting YES, the expert opens a buy position automatically, and trade management (volume, stop-loss, risk-to-reward ratio) is handled according to the trader’s settings.

Conclusion

Selecting a trading style becomes effective when the trader fully understands personal conditions, analytical capability, and market limitations.

Comparing characteristics of each types of trading style, evaluating proper timeframes, understanding capital requirements, and reading market behavior all help form a more stable and structured trading approach.

Choosing the right trading style improves discipline in executing the trading plan and ensures the trader operates within a coherent framework aligned with personal conditions.

This alignment is the foundation for consistent and long-term success and helps identify the best trading style for each trader.