- TradingFinder

- Education

- Forex Education

- Trading Education

Trading Education

Trading refers to the buying and selling of financial assets with the aim of making a profit from price fluctuations. This activity is based on three main pillars: market analysis, risk management, and selecting a trading style suited to market conditions and individual goals. Market analysis in TradingFinder is divided into two categories: technical analysis and fundamental analysis. In technical analysis, the focus is on price behavior, and the trader identifies trend structures, support and resistance zones, and uses charts, price patterns, indicators, and tools such as price action. In fundamental analysis, TradingFinder utilizes economic data such as interest rates, inflation reports, central bank monetary policies, and corporate financials to analyze the intrinsic value of an asset. Trading styles include scalping, day trading, swing trading, and position trading. The trading style is selected by considering the timeframe used, risk tolerance, available time for trading and type of target market.

Learn RSI Divergence: Hidden & Regular Divergence

RSI Divergence is a tool for identifying potential price reversal points in the market. Detecting RSI Divergence is one of the...

Scaling in Trading: Multi-Stage Entry and Exit with Position Size Adjustments

Scaling in trading refers to the process of increasing or decreasing the position size of a trade based on market conditions and...

Learn the Concept of POI in ICT– Entering a Trade Using Points of Interest (POI)

In financial market analysis using the ICT style, Points of Interest (POI) in higher timeframes are used to analyze the ongoing...

Win Rate; How to Calculate Win Rate and Its Importance in Forex

Win Rate in Trading represents the percentage of successful trades out of the total number of trades. By analyzing and...

Combining Fibonacci and Candlestick – Best Candlestick Patterns for Fibonacci

The Fibonacci tool offers high compatibility with other technical analysis concepts such as support and resistance, classic...

What Is the Martingale Strategy and How Does It Work? (Full Guide + Types)

The Martingale strategy, originally designed in the 18th century for gambling purposes, is now widely used as a capital management...

What is Margin Trading? A Guide to Margin Trading

Margin Trading is a form of leveraged trading that allows traders to operate with capital exceeding their available balance. In...

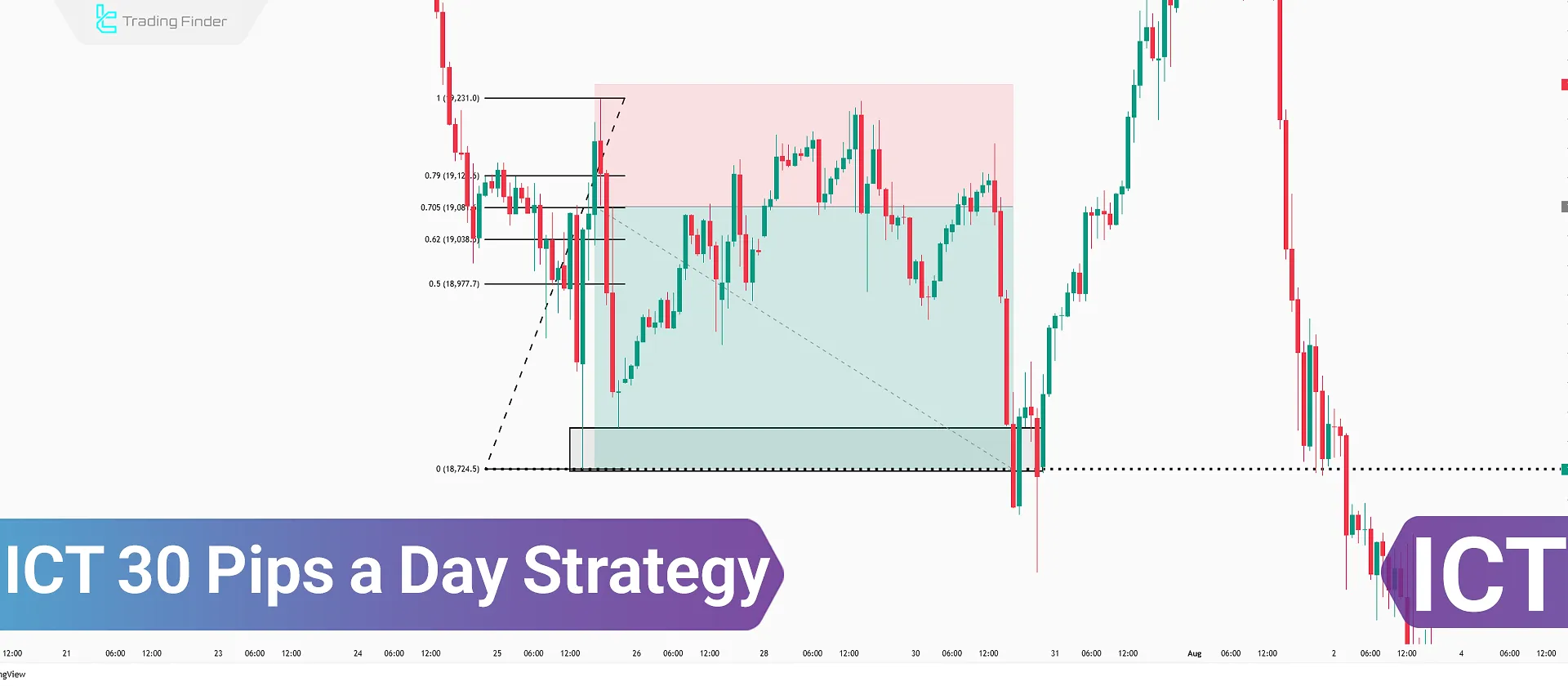

ICT 30 Pips a Day Strategy – Combining OTE & DOL to Identify Entry & Exit Points

The ICT 30 Pips a Day Strategy incorporates various concepts from the ICT Style such as Draw On Liquidity (DOL), Optimal Trade...

What is News Trading? The Most Influential News in the Forex and Crypto Markets

Economic and political news plays a key role in market direction and sentiment. Due to the surge in volume and volatility...

ADX Indicator: Average Directional Index for Trend and Range Detection

In technical analysis, identifying the strength of a trend is just as important as recognizing its direction. The ADX Indicator...

Risk Management in Financial Markets: Guide to Effective Risk Control Strategies

Risk management refers to the identification, analysis, and control of harmful factors, applicable in all financial markets such as...

What Is Money Management? How to Implement Money Management in Trading

Money management encompasses a set of rules designed to maximize investment returns while mitigating risk. Therefore, in the long...