The Forex market (Foreign Exchange Market - Forex) is the largest financial market in the world, accessible digitally through online trading platforms.

Forex allows traders to profit from currency exchange rate fluctuations.

What is Forex?

The term Forex is derived from the combination of the words Foreign (international) and Exchange (exchange).

The word Foreign refers to foreign currencies, making Forex the process of exchanging different currencies.

Historically, currency exchange was done physically in places like banks or currency exchange offices for purposes such as international travel or purchasing foreign goods.

What is a Two-Way Market?

One of the unique features of the Forex market (FOREX) is its two-way trading capability.

This allows traders to profit from both rising and falling prices. In other words, one can simultaneously buy (BUY) or sell (SELL) a currency pair.

For example, if it is predicted that the EUR/USD currency pair will increase in value, a trader would buy (Buy) this pair.

The profit comes from the difference between the buying and selling price if the price increases.

Similarly, if a trader expects the price to drop, they can sell (Sell) the currency pair and repurchase it at a lower price to make a profit.

This feature enables continuous trading regardless of market conditions.

How Does the Forex Market Work?

In the Forex market (Foreign Exchange Market - Forex), currencies are traded as currency pairs. For instance, the USD/JPY pair represents an exchange between the U.S. dollar and the Japanese yen.

When this currency pair is bought, it means buying U.S. dollars and selling Japanese yen. Conversely, selling this pair means selling U.S. dollars and buying yen. Profits and losses are determined based on price fluctuations.

Features of the Forex Market

The Forex market possesses unique characteristics that differentiate it from other financial markets, including:

- High Liquidity: Over $6.6 trillion of liquidity is traded in Forex daily.

- Extended Trading Hours: The market operates 24 hours a day, five days a week.

- Leverage Trading: Allows traders to control larger positions with smaller capital. However, misuse of leverage can lead to significant losses.

Key Terms in Forex

To understand Forex better, familiarity with some common market terms is essential:

- Buy/Ask: The price at which a trader can buy a currency pair

- Sell/Bid: The price at which a trader can sell a currency pair

- Lot: The standard unit of measurement for trade volume in Forex

- Leverage: A tool that allows traders to execute large trades with a small investment, Overuse can lead to substantial losses

- Pip (Percentage in Point): The smallest unit of price change in a currency pair

- Take Profit (TP): A predetermined price level at which a trade automatically closes in profit

- Stop Loss (SL): A predetermined price level to limit potential losses

- Spread: The difference between the buying and selling price of a currency pair, considered the trading fee

- Fundamental Analysis (FA): Examining economic and political factors to forecast price movements

- Technical Analysis (TA): Using charts and historical data to predict price changes

Key Software & Trading Platforms for Forex Trading

To trade in the Forex market (Foreign Exchange Market - Forex), traders must use specific platforms. Some of the most popular platforms include:

- MetaTrader 4 (MT4): One of the oldest and most widely used trading platforms, suitable for both beginners and professionals.

- MetaTrader 5 (MT5): A more advanced version of MT4, featuring enhanced technical analysis and support for new trading tools.

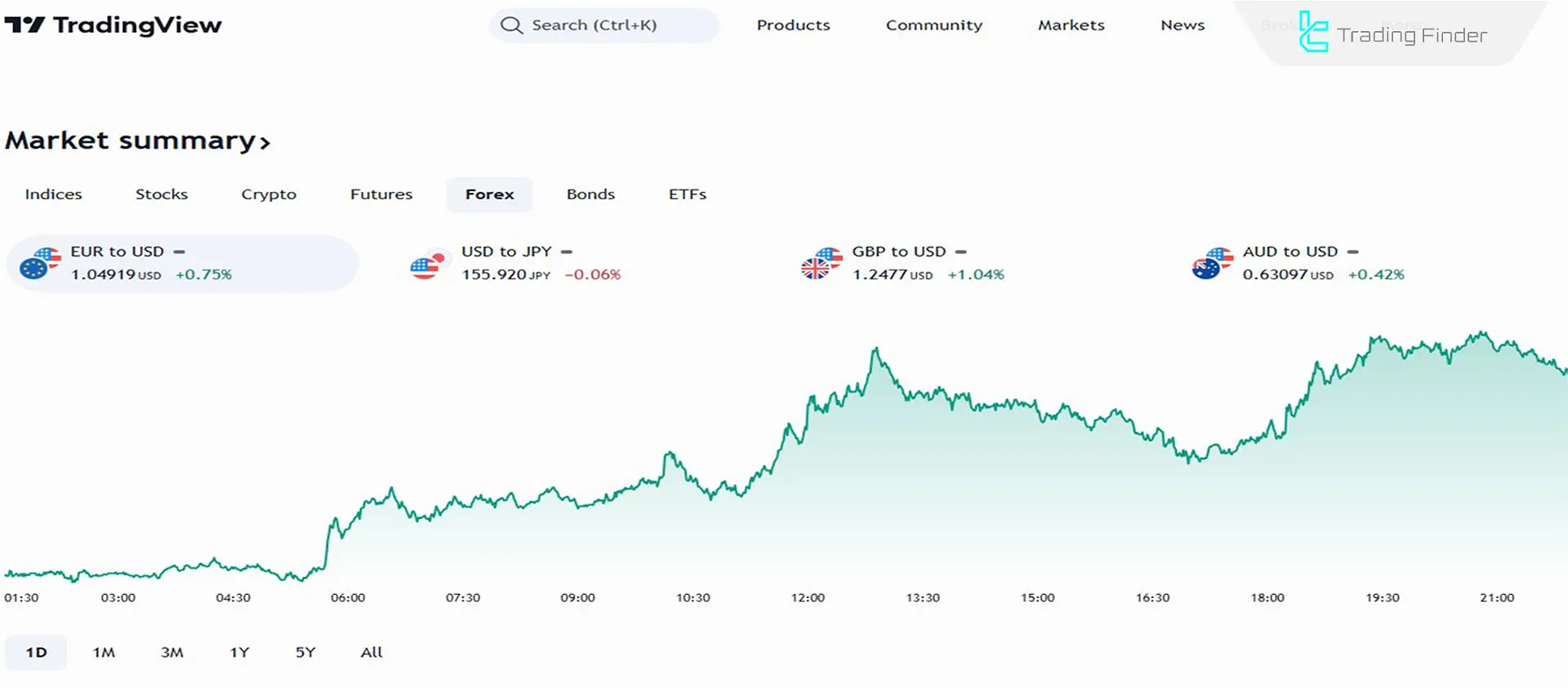

- TradingView: A powerful tool for technical analysis and chart viewing, known for its user-friendly interface and advanced tools.

Each platform has its own advantages and disadvantages. For instance, MT4 is more beginner-friendly, while TradingView offers more analytical tools for professional traders.

What is a Forex Broker?

To trade in Forex and open an account, traders must use reliable forex broker. Aregulated broker ensures trader funds are secure and provides features such as:

- Fast order execution

- Low spreads

- Comprehensive support

Risk Management and Emotional Control

One of the key factors for success in Forex trading is risk management and emotional control. Traders can avoid major losses by setting Take Profit (TP) and Stop Loss (SL) levels. Many beginners lose capital due to ignoring these principles.

Avoiding greed and emotional decision-making plays a crucial role in long-term success.

Conclusion

The Forex market is the largest and most dynamic financial market, where currency pairs such as EUR/USD and GBP/USD are traded.

With trading sessions in London session, New York session, and Asian session, traders can find diverse opportunities around the clock.

With its high liquidity and vast range of currency pairs, Forex is an ideal market for strategic trading.