Among various technical analysis tools, momentum is one of the concepts that examines the speed and strength of pricemovements. A proper understanding of momentum can help prevent buying in overbought zones and selling in weakpoints.

What is Momentum?

Momentum in financial markets refers to the speed and strength of a price movement of an asset over a specific period. In other words, momentum reflects the velocity of price as it moves upward or downward.

Even if the price of an asset is increasing or decreasing, if it lacks momentum, the probability of a reversal or correction increases.

Momentum is usually measured as a quantitative indicator and can be used to distinguish stronger trends from weakerones.

Advantages and Disadvantages of Using Momentum

The table below illustrates the pros and cons of using momentum:

Advantages | Disadvantages |

Identifying strong market trends | Less effective in range-bound or sideways markets |

Ability to spot potential reversal points | False signals in short-term timeframes |

Suitable for short and medium-term strategies | Needs to be combined with other tools to reduce errors |

Importance and Applications of Momentum in Market Analysis

Momentum examines whether the strength of supply and demand in the market is sufficient to maintain the current price trend.

When momentum is positive, it means demand is high, and buying pressure is intense; conversely, negative momentum signals increasedsupply and sellingpressure.

Key applications of momentum in market analysis include:

- Entering trades in the direction of a strong trend;

- Identifying trend weakness;

- Spotting divergences to predict trend reversals;

- Recognizing overbought or oversold

Popular Momentum Indicators

Several tools are used to measure market momentum, each designed with its own algorithms and formulas. The most important momentum indicators include:

Relative Strength Index (RSI)

The Relative Strength Index is one of the most commonly used tools to measure momentum. RSI outputs a number between 0 and 100, where levels 30 and 70 indicate oversold and overbought conditions, respectively.

The divergence between RSI and price can also signal potential trend changes.

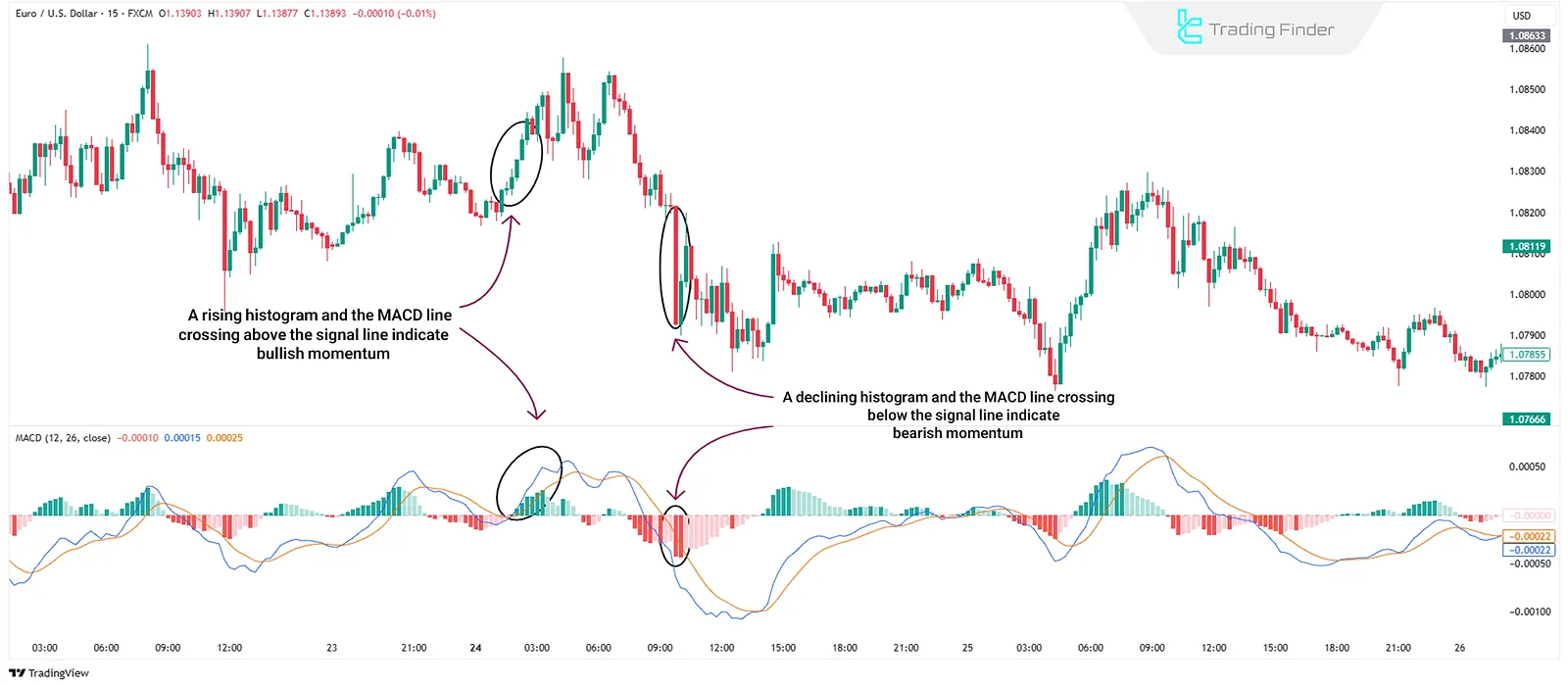

MACD Indicator

The MACD indicator calculates the difference between two exponential moving averages. If the MACD line crosses the signal line, it indicates strengthening or weakeningmomentum. The MACD histogram also reflects the intensity of momentum.

Momentum Indicator

This indicator directly shows the rate of price changes. A value above zero indicates bullish momentum, while a value below zero signalsbearishmomentum.

Types of Momentum

In general, there are two main types of momentum, each with its own specific application:

Confirmation Momentum

Confirmation momentum occurs when the movement of momentum indicators (such as RSI, MACD, or the Momentum Oscillator) aligns with the current price trend. This provides traders with confidence that the prevailing trend remains strong and is likely to continue.

Contrary Momentum

Contrary momentum forms when there is a discrepancy between price movement and the momentum indicator; that is, price moves in one direction but the momentum indicator signals the opposite.

This divergence often signals a weakening trend and serves as a warning for potentialreversals.

Momentum Analysis as a Trend Predictor

One of the most important features of momentum is its ability to predict trend changes. Typically, before the price enters a bullish or bearish trend, momentum shifts first. This is why technical analysts pay close attention to divergences.

- Positive divergence occurs when the price makes a new low, but the momentum indicator forms a higher low; this suggests seller weakness and a possible trend reversal to the upside;

- Negative divergence is when the price makes a new high, but the momentum indicator forms a lower high; this indicates the end of an uptrend.

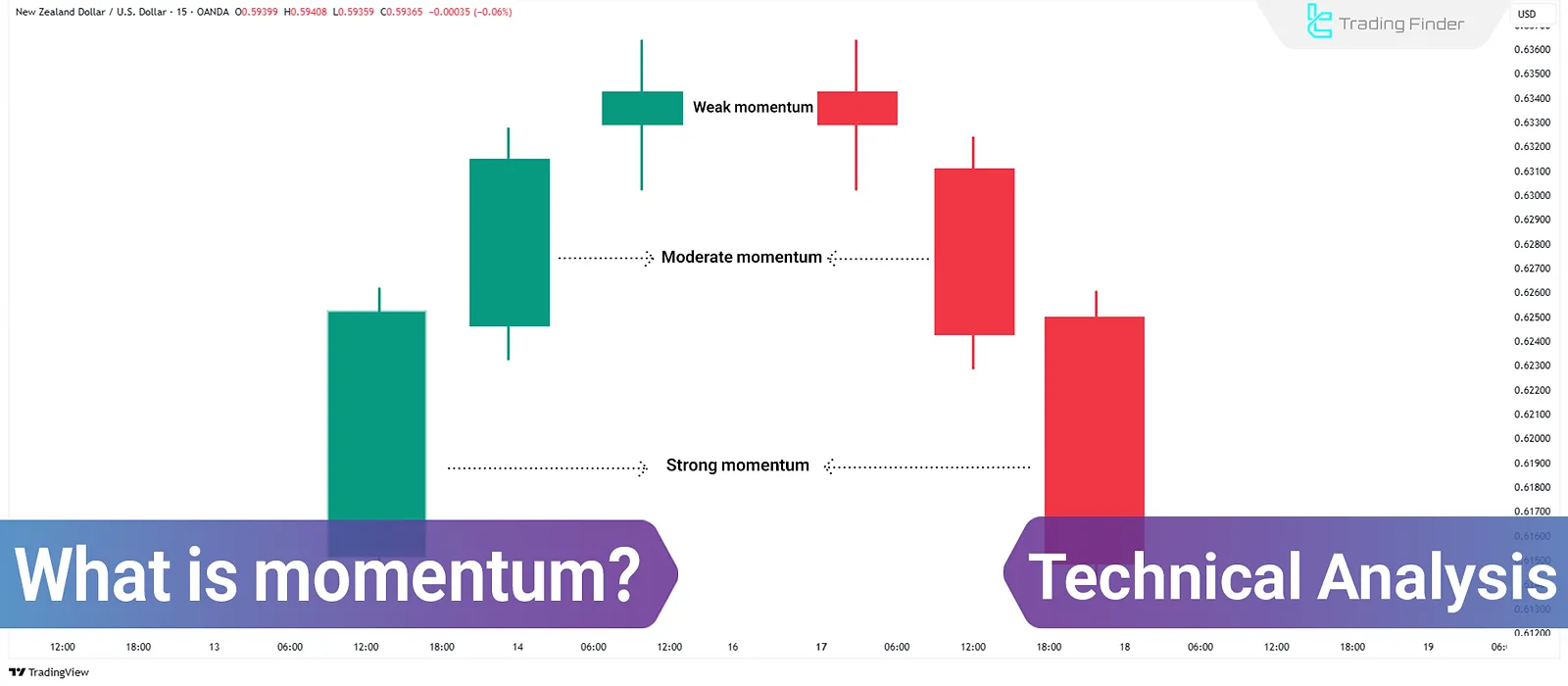

Forms of Momentum Candles

Momentum can be bullish, bearish, or neutral, each reflecting market conditions:

Bullish Momentum

When prices consistently rise, and the rate of increase accelerates, bullish momentum is present in the market. This indicates strong buyer power. Features of bullish momentum:

- Prices regularly form higher highs and higher lows;

- Indicators like RSI or MACD in overbought zones suggest a strong uptrend;

- This situation often signals a strong bull market and the likelihood of a continuing uptrend.

Bearish Momentum

When prices consistently fall and the decline accelerates, bearish momentum is present. This reflects strong seller power. Features of bearish momentum:

- Prices consistently form lower lows and lower highs;

- Indicators like RSI or MACD in oversold zones suggest a strong downtrend;

- This situation often signals strong selling pressure and a likely continuation of the downtrend.

Without Momentum (Neutral)

When prices move sideways for an extended period without a clear direction, neutral momentum forms.

In this case, the market is in a range, and neither side dominates. Features of a market without momentum:

- Prices move within a horizontal band or limited range without forming new highs or lows;

- Indicators do not show a clear trend and remain in the mid-zone;

- This reflects indecision between buyers and sellers.

How to Find an Exit Point Using Momentum

To find a suitable exit point using momentum, you can use the following methods:

- If momentum declines or shows divergence, it can signal an exit. For example, if a trader has bought in an uptrend and momentum drops, it may be time to close the trade and takeprofit;

- If a trader is short in a downtrend and momentum weakens, it is a good time to close the trade or prevent further loss.

Conclusion

Momentum is a fundamental principle in technical analysis that assesses the strength of price movement. This indicator is valuable for predicting potential trend changes.

However, momentum analysis should be combined with other factors such as price action, trading volume, and support and resistance levels.