In prop systems, every trader operates under the scrutiny of data and discipline. The goal, in addition to profit, is the ability to control risk, maintain behavioral consistency, and strictly adhere to prop firm rules.

Within such a structure, the trading journal serves as an analytical and managerial tool that systematically records the details of every decision, the logic behind entries and exits, and the trader’s emotional responses.

Consistent recording of these data in prop accounts allows for in-depth performance analysis and reveals weaknesses in strategy or deviations from the plan.

By reviewing the journal, a trader can identify recurring behavioral patterns, the real profitability of a strategy, and his or her level of compliance with the company’s evaluation criteria.

What is a Prop Journal?

A prop trading journal is a method of documentation and performance analysis designed for traders in proprietary trading firms.

This journal records all trade-related details from entry time and volume to the reasoning behind decisions and emotional reactions to create an accurate picture of the trader’s behavior.

Its distinction from regular journals lies in the fact that, beyond profit and loss, it also covers data on compliance with company rules, allowable risk percentages, and performance stability.

Trading Journal Indicator in Prop

TFlab Trading Journal is an advanced analytical tool for accurately recording and evaluating trades that extracts information directly from the trading account and displays it in a structured format without the need for manual data entry.

Relying on real data, this journal enables performance evaluation from statistical, temporal, and behavioral perspectives and provides a transparent view of strategy execution quality.

The structure of this program includes an analytical dashboard, trading calendar, complete trade list, and a tags and notes section. In the dashboard, metrics such as win rate, drawdown, risk to reward ratio, and net profit are presented in aggregate form to allow assessment of the trading system’s health in the shortest possible time.

The trading calendar separates daily and weekly performance and reveals time-based profit and loss patterns. In the trade list section, all details of each position are recorded, and filtering and in-depth analysis capabilities are available.

One of the most important applications of TFlab becomes evident in the prop journal environment. Traders who operate in prop firms require precise drawdown control, risk management, and full adherence to capital rules.

By monitoring balance and equity in real time, checking trade compliance with defined limits, and providing advanced statistical reports, this journal creates an organized framework for complying with prop firm rules.

Complementary modules such as the intelligent assistant, machine learning–based statistics, portfolio management, and mentoring system elevate data analysis to a deeper level and identify profitable patterns or recurring mistakes. The ability to add custom tags and notes also strengthens trading psychology analysis and adherence to the trading plan.

The Trading Finder trading journal goes beyond a simple trade log; it has become a professional performance evaluation system that adds consistency, discipline, and a data-driven structure to trading.

Download links for the TFlab Trading Journal Indicator:

The Role of the Journal in a Prop Trader’s Success

In the competitive world of prop trading, a trader is successful only when, in addition to profitability, they maintain behavioral consistency and analytical discipline. The trading journal acts as a tool for risk control and meticulous performance review along this path.

By precisely recording every trade detail, the trader can assess their adherence to company rules (such as maximum daily drawdown, maximum account loss, and profit target) and identify behavioral or trading deviations before they lead to errors.

Regular use of the journal fosters a stable decision-making pattern and acts as a barrier against emotional decisions following sudden losses or gains.

This process shifts the trader’s mindset from emotional to analytical responses, making their performance during firm evaluations more reliable and predictable.

Tutorial video about ow to build a prop journal from ASFX YouTube channel:

Specific Components of a Prop Trade Journal

A trading journal in prop accounts must go beyond simple trade recording and cover detailed criteria for Trader performance evaluation, psychological behavior, and compliance with company rules.

Table of essential and practical components of a prop journal:

Category | Fields | Practical Explanation |

Trade Details | Symbol, trade type (Buy/Sell), timeframe, entry and exit points, lot size, risk amount, final profit or loss | The quantitative foundation of journal data; used to calculate return and risk for each trade |

Prop Rules | Daily drawdown, max Loss, profit target, and allowed risk percentage per trade | Controls trader’s adherence to company limits and prevents rule violations |

Decision Logic | Entry reason, setup type, multi-timeframe confirmations, and market conditions | Evaluates the quality of decision-making and its alignment with the main strategy |

Trading Psychology | Mental state before entry, emotional reactions during volatility, and feelings after closing the trade | Analyzes emotional behavior and supports psychological stability in the prop environment |

Performance Analysis | Win rate, average profit and loss, risk-to-reward ratio (R:R), maximum drawdown | Extracts data to measure performance stability and improve key metrics |

Feedback and Improvement | Violated rules, recurring mistakes, review results, and performance improvement plan | A behavioral and technical correction tool for improving results in future evaluations |

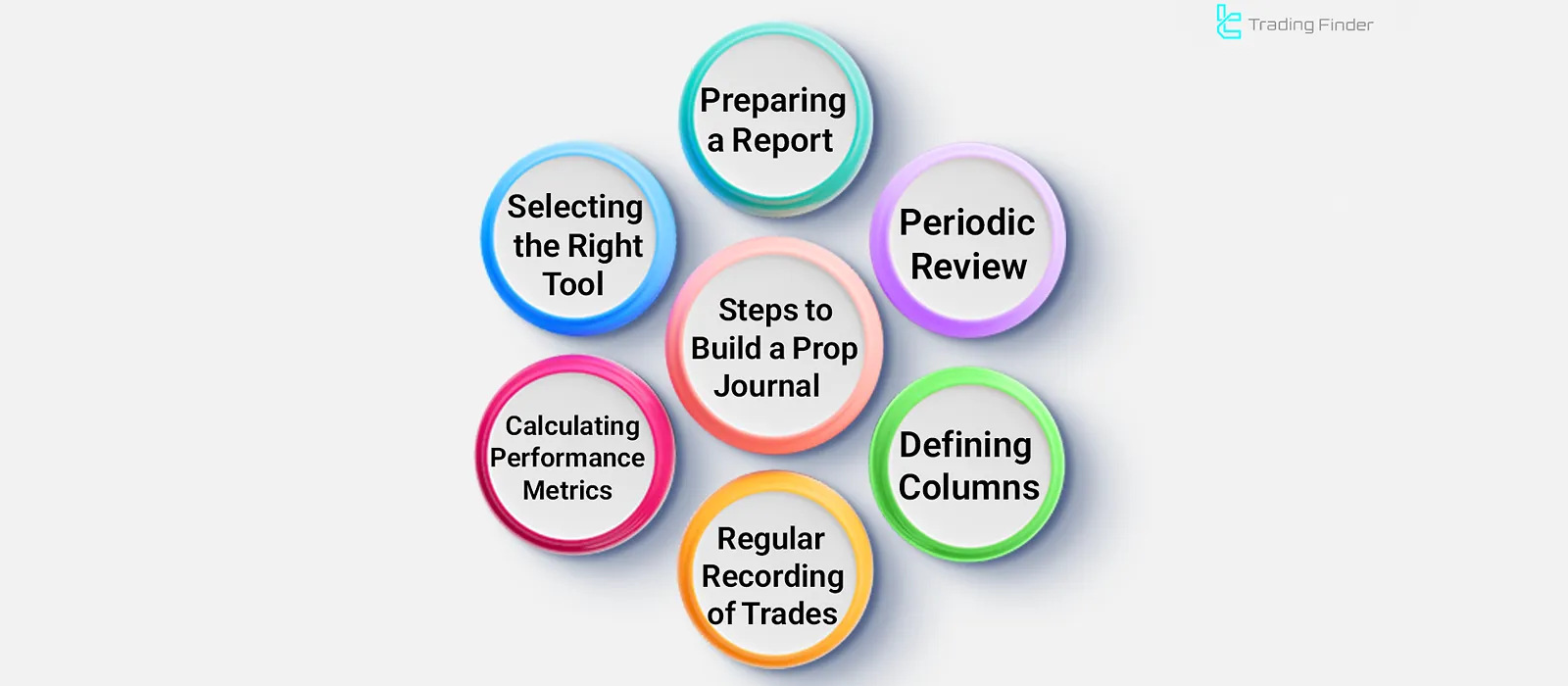

Steps to Build a Prop Trading Journal

Designing a trading journal for prop accounts must ensure that all performance indicators, company rules, and analytical data are traceable within it. Steps to build a prop journal:

Selecting the Right Tool

First, the data-recording platform must be defined. To begin, tools like "Excel" or "Google Sheets" are simple options. At more advanced levels, software such as "TradeZella", "Edgewonk", and "TraderSync" offer automated analytics, performance charts, and error tracking capabilities.

Defining Columns Based on Prop Rules

The journal’s structure must align with the prop firm’s requirements. Columns such as date, symbol, risk per trade, daily drawdown, profit target, and margin usage percentage must be precisely defined to allow evaluation of trader compliance with firm regulations.

Consistent Trade Logging

Data should be entered immediately after each trade or trading session. Quick recording maintains accuracy and prevents cognitive bias. In addition to quantitative data, qualitative notes such as entry rationale or mental state should also be added.

Calculating Performance Metrics

Using formulas, traders can calculate metrics such as win rate, risk-to-reward ratio, total drawdown, and average daily profit. These indicators are the foundation of professional evaluations in prop environments and reflect the trader’s performance consistency.

Periodic Review and Data Analysis

At the end of each week or evaluation phase, traders should review their trades to identify profitable patterns or recurring mistakes. This analysis must be data-driven rather than based on subjective impressions.

Preparing Reports for the Evaluation Phase

In prop firms, many evaluations rely on performance data. The journal should be organized in a way that allows the extraction of analytical reports and summary performance charts. These reports serve as decision-making criteria for firms regarding continuation of cooperation or capital allocation increases.

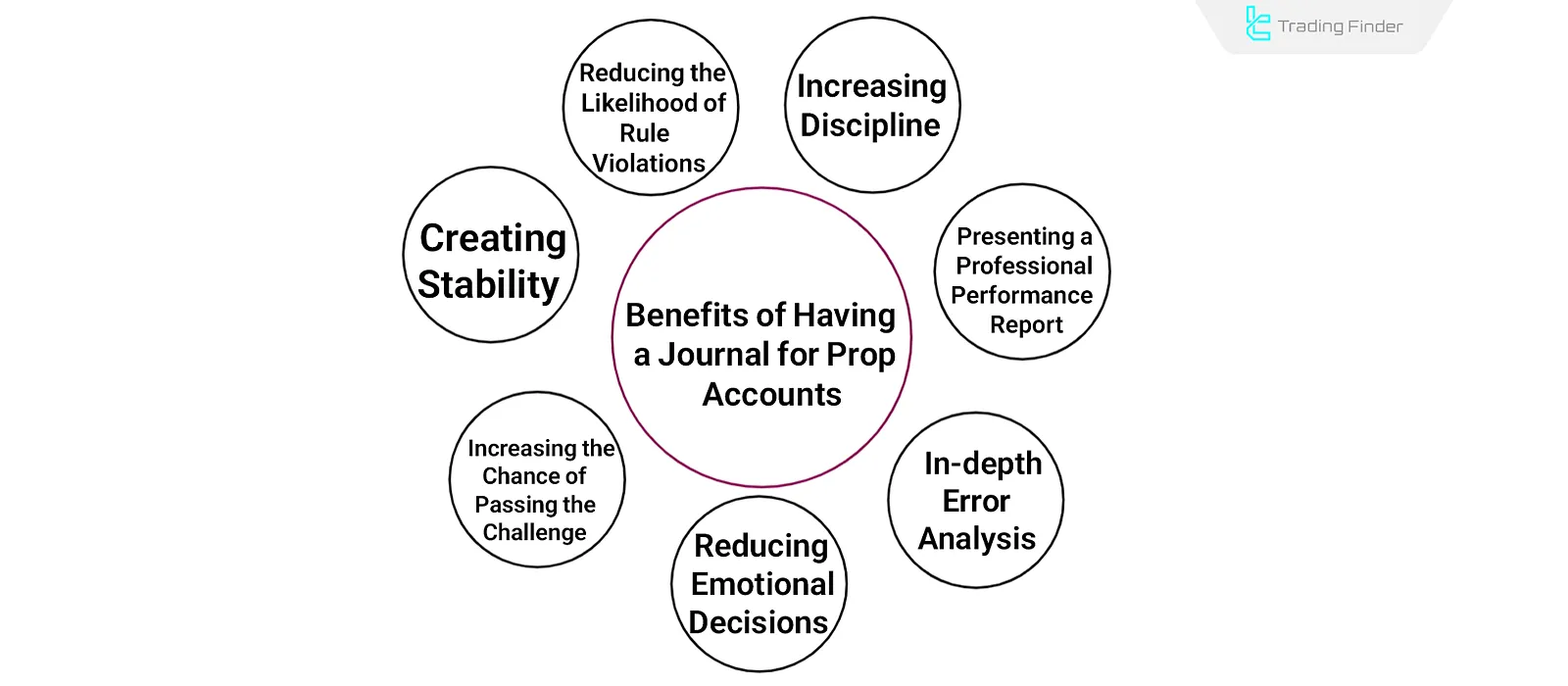

Benefits of Having a Journal for Prop Accounts

In prop accounts, a trading journal functions as a performance control tool and a means to ensure adherence to technical limitations. This journal records data such as risk levels, margin usage percentage, win rate, and performance stability.

Benefits of maintaining a prop trading journal:

Increasing the Chances of Passing the Challenge Phase

Consistent data recording enables traders to align their trading behavior with company standards and identify mistakes before violating any rules. Through performance trend analysis, weaknesses in strategy and risk management can be detected.

Creating Stability in Trading Performance

Continuous data analysis fosters consistency in decision-making and reduces behavioral fluctuations in profit or loss situations. This helps the trader maintain a more rational outlook, psychological discipline, and emotional control in high-risk conditions.

Reducing Emotional Decisions and Mental Errors

By reviewing recorded trades, traders recognize their emotional patterns and learn to manage irrational reactions. Consequently, trading decisions are made based on logic, data, and predefined strategies.

In-Depth Error Analysis and Profit Pattern Recognition

Journal data allows for statistical evaluation of trades, exposing both weaknesses and strengths within the strategy. This enables the trader to assess and optimize their trading method using numerical evidence.

Providing Professional Performance Reports to the Prop Firm

A well-structured journal simplifies evaluation and presents a more accurate image of a trader’s stability and discipline. Thus, account managers or investors can assess the trader’s reliability and decision-making quality based on documented data.

Enhancing Discipline and Self-Control in Trading

The requirement to record each trade reduces impulsive decisions and encourages stricter risk management. Before opening any position, the trader must articulate the reasoning, goals, and stop-loss levels in writing.

Reducing the Likelihood of Rule Violations

Daily monitoring of stop-losses and performance metrics through the journal prevents accidental breaches of firm limitations. This feature allows the trader to take corrective action promptly when nearing maximum risk thresholds.

Building the Firm’s Trust and Credibility Toward the Trader

Accurate recording, continuous analysis, and regular performance reporting make the trader appear professional and trustworthy in the company’s view.

This approach demonstrates discipline, transparency, and accountability in capital management and adherence to standards.

Common Mistakes Traders Make When Using Prop Journals

Improper use of a prop trading journal can significantly diminish its effectiveness. A journal is valuable only when its data are real, continuous, and analytical.

Common mistakes in using a prop journal:

- Not recording trades due to fear of recognizing mistakes;

- Focusing solely on profit and loss while ignoring entry rationale;

- Failing to record psychological and behavioral conditions;

- Disregarding firm rules when analyzing data;

- Using the journal without periodic review.

Not Recording Trades Out of Fear of Mistakes

One of the common behaviors among prop traders is omitting losing trades from the journal. This creates cognitive bias in data analysis and prevents recognition of recurring errors.

Focusing Only on Profit and Loss and Ignoring Entry Reasons

An effective journal is not limited to financial results; it must also include the logical reasoning behind entry and exit decisions. Without such analysis, the learning and strategy improvement process is hindered, leading to repetition of past mistakes.

Failing to Record Psychological and Behavioral Conditions

In prop accounts, emotional control is crucial; neglecting to record pre- and post-trade emotions leads to incomplete psychological analysis and obscures the connection between mental state and trading outcomes.

Disregarding Firm Rules When Analyzing Data

When reviewing the journal, a trader must assess indicators such as maximum drawdown, daily loss limit, and average trade risk according to company policies. Analyzing without these constraints is inconsistent with the reality of a prop account.

Using the Journal Without Periodic Review

A journal is valuable only when its data are reviewed and analyzed regularly; failing to conduct weekly or monthly reviews prevents identification of behavioral patterns, statistical errors, and improvement points, halting the trader’s development.

Example of Using a Prop Journal

In a prop account, a trader records three consecutive trades with small losses. Reviewing the journal revealed that in all three cases, the entries were made without confirmation on the higher timeframe.

After correcting this mistake and adding a multi-timeframe confirmation condition to the strategy, two profitable trades were recorded the following week.

This example demonstrates how a journal can uncover hidden mistakes and lead to measurable improvement in trading performance.

Conclusion

In prop accounts, success is not solely dependent on strategy or profitability it relies on the trader’s ability to trading data analysis and control behavior. Precise trade recording and analysis establish decision-making rules and prevent the repetition of mistakes.

Regular journal use strengthens order, consistency, and mental discipline, ultimately forming a stable performance pattern. In the end, traders manage their data analytically and take responsibility for their trading evolution.