In financial markets, a position refers to an open trade an investor holds in a financial asset this trade can take the form of a buy (Long) or sell (Short).

Every trade begins with opening a position, which plays a pivotal role in determining risk, profitability, and capital management.

Positions in trading are not limited to choosing entry and exitpoints they are directly connected to the trader’s psychology, capital management strategy, and overall portfolio composition.

What Is a Trading Position?

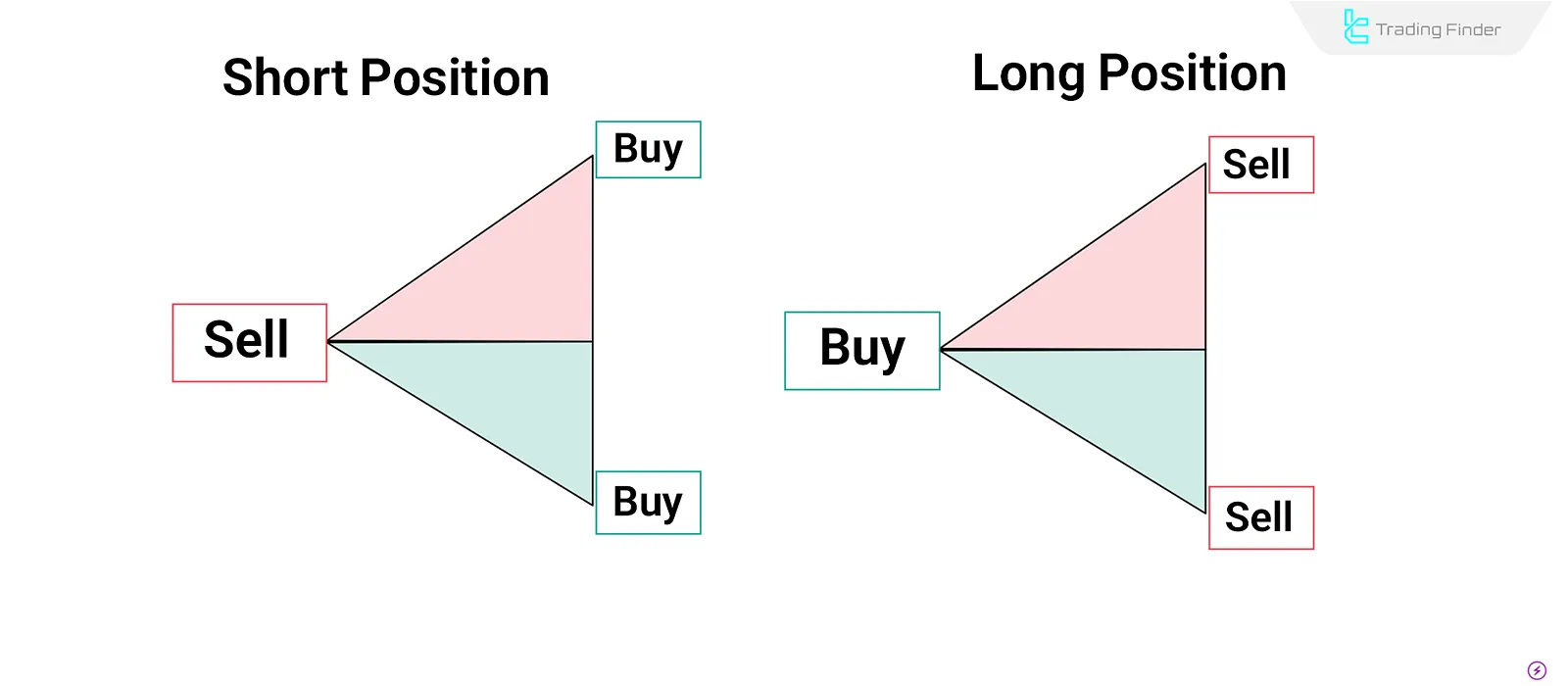

In financial markets, aposition represents a trader’s active stance on the price direction of an asset. This stance is reflected through either a Long Position (buy) or a Short Position (sell), signaling the trader’s expectation of the market’s futuretrend.

In other words, when a trader buys an asset expecting its price to rise, they are in a long position. Conversely, when they sell an asset anticipating a price drop, they are in a short position.

A position is more than just an order; it is a live and open status that persists until the trade is closed. Every position is defined by four key elements:

- Direction – Buy or Sell

- Size – Volume of the trade or number of asset units

- Entry Price

- Exit Price or Pending Plan

In practice, opening a position is always analysis-based, using either technical or fundamental analysis. Choosing the correct type and size of a position is crucial for risk control.

Every position affects account balance and free margin this impact is more significant in leveraged markets such as Forex market and Cryptocurrencies.

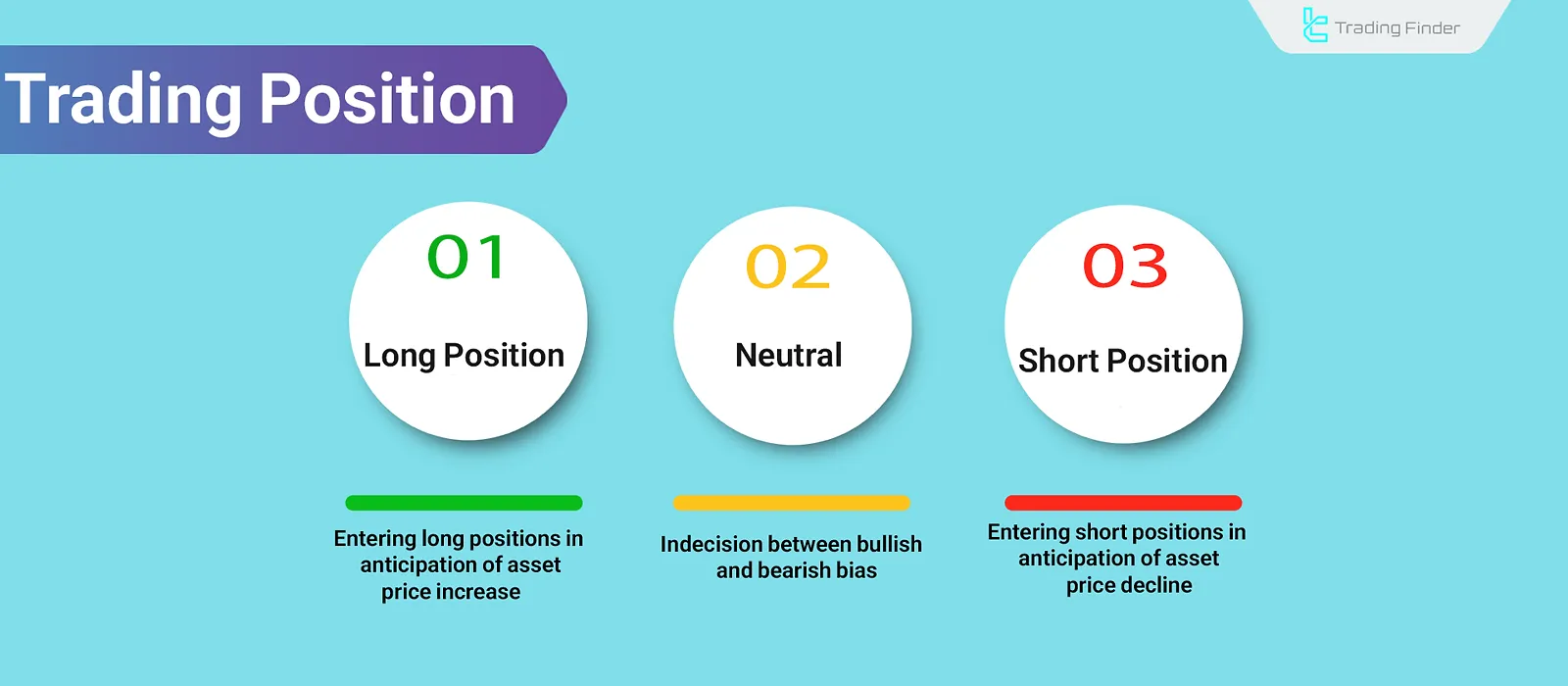

Types of Positions Based on Trade Direction

In financial markets, the direction of a position reflects a trader’s price movement prediction. Thus, positions based on direction are categorized into three main types:

Long Position

When a trader expects the price of an asset to increase, they take a Long Position buying the asset at a lower price to sell it higher later for a profit.

Short Position

In this case, the trader anticipates a price decrease. They borrow the asset and sell it at the current price, aiming to repurchase it later at a lower price, thus profiting from the drop.

Neutral Position

In a neutral position, the trader is uncertain about market direction. This is often executed using strategies like hedging or arbitrage. The goal is to reduce or eliminate risk from price volatility, which is primarily used by professional or algorithmic traders.

Types of Positions Based on Holding Duration

Position types based on holding time are essential for defining a trading style. They are generally categorized into four types:

Scalping

A very short - term trading style where trades last seconds to minutes. The goal is to capture very small but frequent profits. This method requires speed, low spreads, and precise execution - suitable for volatile, liquid markets.

Intraday Trading

All positions are opened and closed within the same trading day, with no carry-over. Day traders rely heavily on technical analysis and emphasize risk management.

Swing Trading

In this style, positions are held for several days to weeks. The goal is to profit from larger price moves during trends or waves. Swing traders combine technical, fundamental, and price action analysis and do not need constant market monitoring.

Position Trading

This is a long-term strategy where positions may be held for months or years. It relies on fundamental analysis, macroeconomic views, and long-term outlooks—closely resembling investing. It requires patience and a long-term perspective.

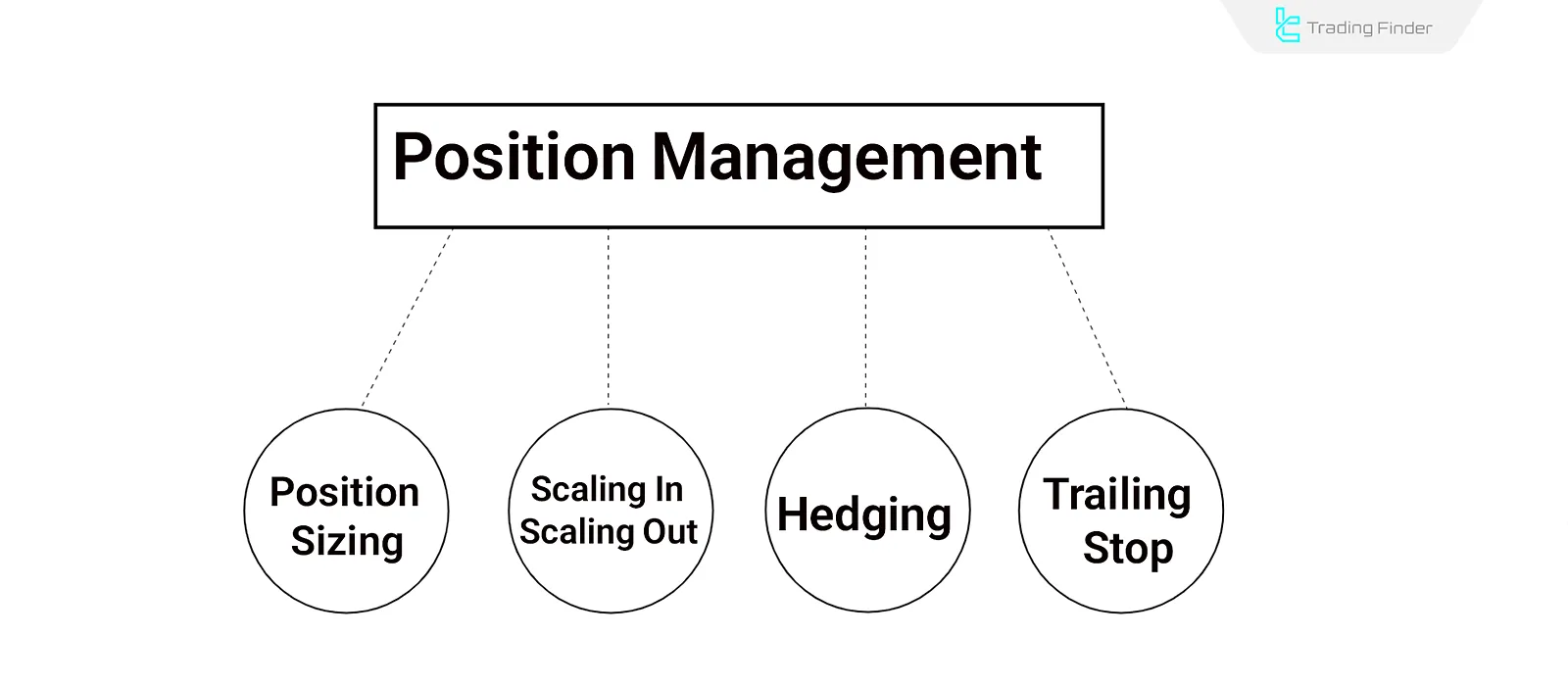

Position Management

Position management in financial markets is a set of control decisions taken after a position is opened, aiming to maintain balance between profit, risk, and portfolio stability.

Traders use this process not only when entering a trade, but also throughout its entire duration. The four core elements of position management include:

Position Sizing

Determining the appropriate trade volume based on account balance, acceptable risk, and stop loss distance. Proper sizing is a critical risk control tool that helps prevent major losses during sudden market moves.

Scaling In/Scaling Out

Scaling allows a trader to gradually enter or exit a position. Scaling Inincreases position size; Scaling Out decreases it to preserve profits or control risk.

Hedging Strategy

Hedging means opening an opposite position to reduce or neutralize potential risk. This is useful in volatile markets or during major economic news releases and helps protect portfolio value.

Trailing Stop

Trailing Stop is a dynamic stop loss that automatically moves with the price in a favorable direction. If the price reverses, it triggers the stop at a predefined level. It is highly effective for locking in profits during strong trends without constant monitoring.

Positions in Different Markets

The type and structure of positions vary by market, influencing risk management, leverage usage, holding time, and trading tools:

Forex Market

In Forex, positions are typically opened using high leverage, with the ability to go long or short on all currency pairs. Due to fast movements and high volume, position management requires careful selection of lot size, stop loss, and exit strategy.

Cryptocurrency Market

Positioning in crypto is similar to Forex but involves higher volatility and lower liquidity. High leverage is common on derivative platforms, so effective management requires tighter emotional and technical control.

Futures and Options Market

Here, positions can be more complex than spot trades, as instruments like futures contracts with expiration dates, financial leverage, and combination strategies are used.

Professional traders often use spread, straddle, or hedging strategies to profit from volatility or protect assets from unexpected risks.

Positioning Strategies

Timing and direction of entry are based on positioning strategies. These are the tools traders use to analyze markets and decide on opening, closing, or managing trades. The four core approaches include:

Technical Analysis

In this approach, traders use charts, price patterns, indicators, and historical price structures to forecast potential trends. It’s widely used in short and medium-term trades like scalping or swing trading.

Fundamental Analysis

This focuses on economic, financial, or news factors affecting asset value - like earnings reports, interest rates, inflation, or policies. It is mainly applied in medium and long-term strategies.

Price Action

Price action deals with pure price movement without relying on indicators. It uses candle patterns, support and resistance zones, and behavior at key levels. This minimalist, fast-reacting method is ideal for short-term traders.

Hybrid Strategies

Many pro traders combine technical and fundamental analysis for more accuracy. For instance, a trader may have a long-term fundamental outlook but use technical tools for entry/exit timing. This reduces errors and improves position-taking decisions.

Psychological Management of Positions

Psychological management refers to the ability to control emotions while trading. Fear causes early exits; greed causes overextended holds. A successful trader sticks to their trading plan rather than reacting emotionally.

Executing stop loss and take profit orders precisely, as well as planning entry and exit, is essential for consistent profitability.

Key Concepts Related to Trading Positions

To manage a position effectively, understanding several key concepts is essential:

- Position Size: Indicates how much capital is committed to a trade.

- Leverage: Allows trading with more capital than in the account. It magnifies both profits and losses.

- Margin: The required capital to open a position. It is locked as collateral and determines capacity in leveraged markets.

- Risk/Reward Ratio: Shows the potential profit versus potential loss. It helps traders take more rational and controllable

- Stop Loss/Take Profit: Crucial tools for exitplanning. They prevent emotional decisions and define exit points in advance.

Conclusion

A trading position is the foundation of decision - making in financial markets and reflects the trader’s view on price direction. Understanding position types, holding durations, trade sizes, and entry / exit points is vital to building a sound trading strategy.

Managing a position goes beyond opening and closing it involves choosing appropriate size, using leverage wisely, setting stop loss and take profit, and applying strategies like hedging and scaling to balance risk and return.