A Trailing Stop is a type of stop-loss order that adjusts according to the instructions defined by the trader. This feature helps in managing trades and risk, and if used correctly, it increases the success rate of trades.

As the price moves in the direction of profit, this order moves along with it, securing the profit of the trade. The main goal of this order is to protect the trade’s profit against the price movement trend.

What is Trailing Stop?

A trailing stop loss is an order designed for risk management during trading. The range of this order moves with the price when it goes in the direction of profit and remains fixed when the price moves toward loss.

The distance of this order from the current market price depends on the trading strategy; in some cases, it is determined as a percentage of the price, and in other cases, it is specified by the unit of volatility measurement in that market (for example, a pip in the Forex market).

In the trailing stop tutorial article on Investopedia, this trade-management tool is explained in full detailand serves as a clear reference for anyone who wants to explain trailing stop in a practical way .

History and Evolution of the Trailing Stop

The idea of the trailing stop originated in the early days when professional traders had to manually move their stop loss to protect their profits.

With the advancement of trading platforms and the expansion of automated systems, this feature was added to modern tools so traders could adjust their stop loss according to price movement without direct intervention.

For this reason, almost all trading software today supports this capability.

The Best Time to Use a Trailing Stop

A trailing stop is most effective when the market is in a clear and strong trend. Under such conditions, price has more room to move, and this tool helps protect potential profits.

In ranging or highly volatile markets, using a trailing stop may cause the trade to close prematurely, so it is better to evaluate trend conditions and volatility before activating it.

Advantages and Disadvantages of Using Trailing Stop

If the price trend suddenly changes and the price moves toward loss, the Trailing Stop preserves part of the profit earned up to that point and closes the trade.

If such a sudden price move is only a short-term correction, the trailing stop loss causes an early exit from the trade, leading to reduced profit gained from the trade.

Advantages and Disadvantages of Using Trailing Stop:

Advantages | Disadvantages |

Protects trade profit | Possibility of early exit from a trade |

Reduces trade losses | Requires high trading experience |

Saves time | Requires continuous internet connection |

Applicable in all trading styles | Poor performance in ranging markets |

Trailing Stop Loss Example

For instance, consider a buy trade on Solana at the price of $100 with a trailing stop range of 5%. If the price starts dropping immediately from $100, the trade will close at $95 with a loss.

However, if the price rises to $120, the Trailing Stop moves upward along with the price in the direction of profit.

If a downward move begins, the stop-loss order will activate at $114, thereby protecting part of the profit.

Comparison Between Trailing Stop and Regular Stop Loss

A regular stop loss and a trailing stop loss are both tools for risk management and reducing losses in trades. The main difference between them lies in how they react to price volatility.

A Trailing Stop adjusts automatically with market price fluctuations according to the trader’s instructions, while a fixed stop loss remains unchanged unless manually modified, showing no reaction to price movement during the trade.

Comparison of Trailing Stop and Regular Stop Loss:

Comparison Parameter | Regular Stop Loss | Trailing Stop |

Reaction to price volatility | No reaction to market fluctuation | Adjusts with price movement toward profit |

Operation method | Requires manual adjustment based on market conditions | Order range changes automatically |

Need for continuous internet connection | No | Yes |

Performance in different market phases | Same performance in all market phases | Relatively weak in ranging phases |

Placing a Trailing Stop Order in MetaTrader

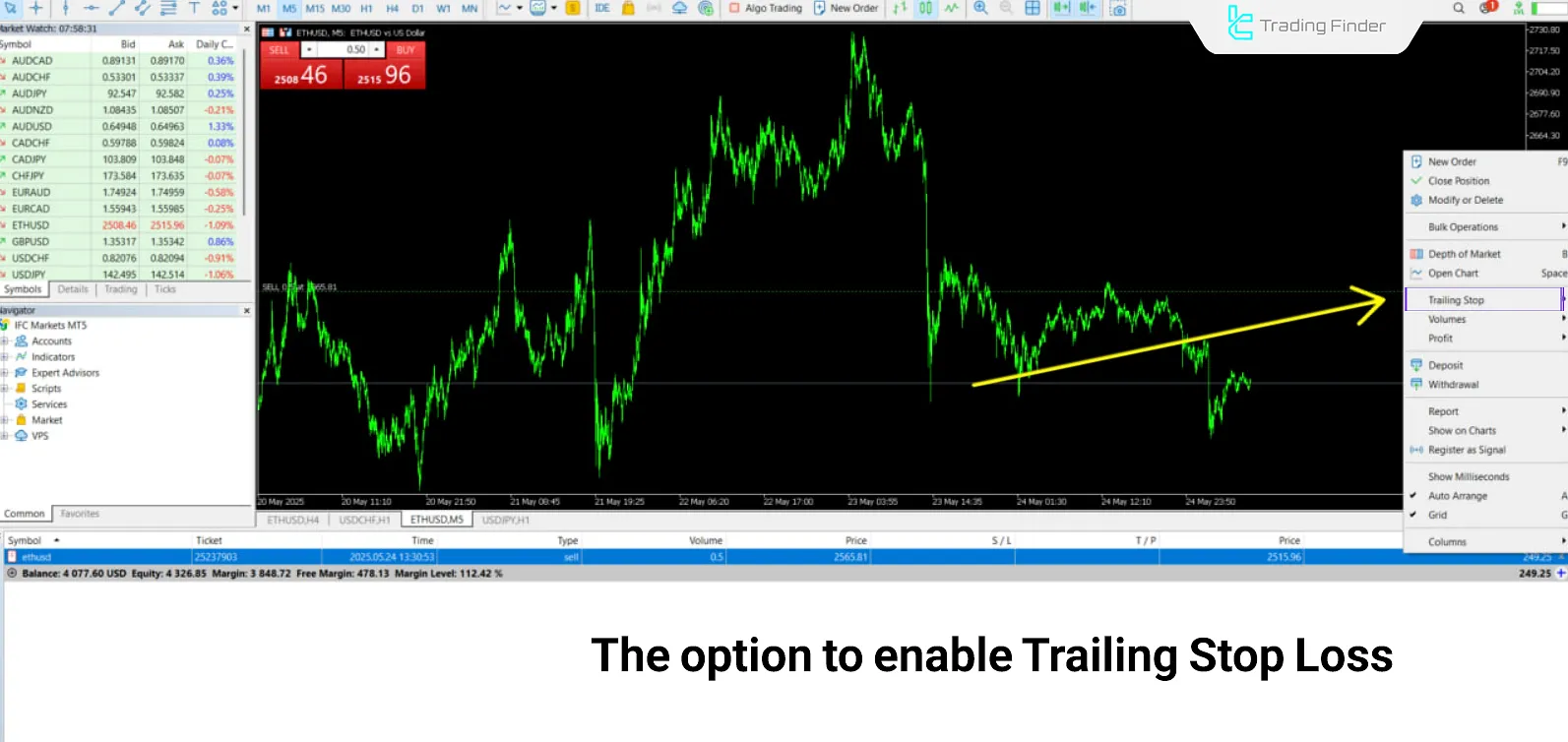

To place a Trailing Stop order, the trade must first be opened according to the type of analysis.

Note: It is not mandatory to set a regular stop loss when placing a trailing stop, but to reduce risk, it is recommended to set a standard stop loss as well. This way, if the price moves against the prediction, excessive loss is prevented.

Steps to Place a Trailing Stop in MetaTrader 4 and MetaTrader 5:

- Open a trade: To set a trailing stop loss, a trade must be opened first;

- Set the trailing stop loss: Right-click on the trade and activate the “Trailing Stop” option;

- Specify the trailing stop range: After clicking on the Trailing Stop option, by default, several options between 15 to 50 points will be displayed.

Note: Every 10 points equals 1 pip.

The Custom option is designed to specify the trailing stop loss range at any desired interval. To use this option, click on it and in the input box, enter the desired trailing stop range in points.

Comparison of Trailing Stop Performance in Different Markets

The effectiveness of a trailing stop varies across different markets. In Forex, due to constant volatility and high trading volume, it is used most frequently. In the stock market, this tool is generally more suitable for medium-term trades.

In the cryptocurrency market, it must be used more carefully because sudden volatility may trigger the stop loss earlier than expected.

Table of Comparison between trailing stop performance in different markets

Financial market | Volatility level | Best timeframe to use | Main advantage of trailing stop | Important usage note |

Trailing stop in Forex | High | Short-term to medium-term | Protecting profits in strong trends | Set the trailing distance based on currency-pair volatility |

Trailing stop in stocks | Medium | Medium-term to long-term | Locking in profits during steady price movements | Use in combination with moving averages and trading volume |

Trailing stop in futures and crypto | Very high | Short-term | Loss control during sudden price moves | Set a wider trailing distance than usual |

Trailing stop in commodities (gold, oil, etc.) | Medium to high | Medium-term | Following long price trends | Observe price reactions to economic new |

Application of Trailing Stop in Trading

The main application of a Trailing Stop in trading is risk and capital management. This order executes based on defined instructions to secure a portion of the trade’s profit.

In Set & Forget trades, sometimes the price moves close to the take-profit order and then reverses toward the stop-loss order. The Trailing Stop ensures that if this happens, the trade not only avoids loss but also secures part of the profit and adds it to the account balance.

The Relationship Between the Trailing Stop, Trailing Stop Percentage, Risk Management, and Trader Psychology

A trailing stop is not just a technical tool; it plays an important role in managing a trader’s emotions as well. When configured correctly, especially when the trailing stop percentage is aligned with the strategy’s risk tolerance, it allows the trader to stick to their plan without emotional decision-making.

This feature is especially valuable in long term trading styles or Set and Forget strategies, helping maintain psychological control and trading discipline.

On the Arvabelle YouTube channel, the method of using a trailing stop is taught in video format:

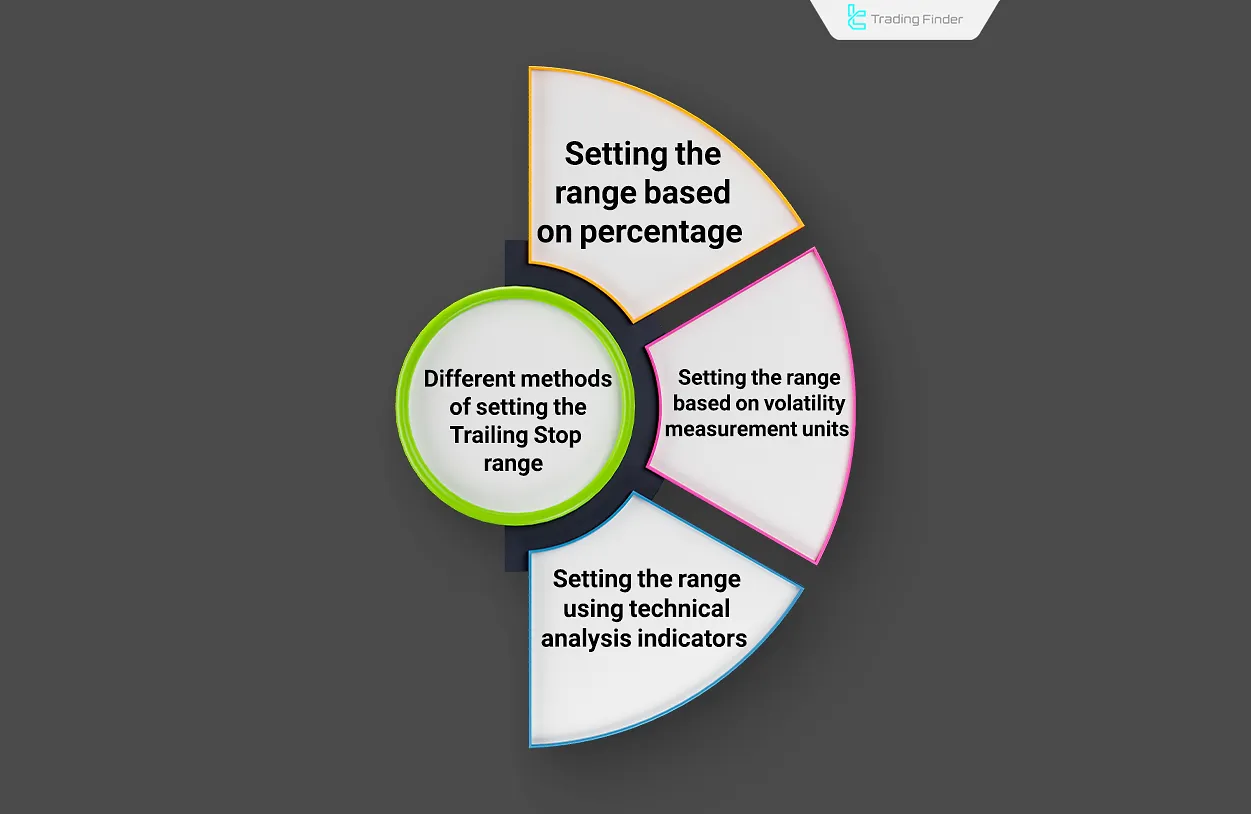

Different Methods of Defining the Trailing Stop Range

Depending on the asset being traded and the trading strategy, the method of determining the trailing stop loss range may differ. To select the right approach, factors such as market type, trade structure, volatility, and others must be considered.

Defining the Trailing Stop Range by Percentage

This method is more common in the cryptocurrency market, as price fluctuations are usually high. In this step, the trader defines the percentage distance at which the Trailing Stop will follow the current market price.

Note: In this method, the percentage is calculated continuously relative to the current market price throughout the trade.

Defining the Trailing Stop Range Based on Market Volatility Units

In different markets, volatility is measured using specific units. For example, in the Forex market, volatility is measured in pips.

In this method, the Trailing Stop range is measured and calculated based on the volatility unit of the respective market.

Defining the Trailing Stop Range Using Technical Indicators

In this method, the Trailing Stop range is determined using data from technical Analysis indicators. For instance, in a buy trade, the lower boundary of the Moving Average (MA) can be selected as the trailing stop range, and the stop loss will move upward along with the rising moving average.

Download the ATR Trailing Stop Indicator (ATR Trailing Stop Loss)

The ATR Trailing Stop indicator (ATR Trailing Stop Loss) is an intelligent tool for risk management and dynamic stop-loss adjustment on the MetaTrader platform. As part of its functionality, it operates similarly to a dynamic trailing stop loss, allowing the stop level to follow price movements in a fully automated way.

This indicator is built on the calculation of the Average True Range (ATR) and adjusts the stop loss according to the direction and intensity of price movement by analyzing recent market volatility.

As a result, the trader can keep their stop loss aligned with the price trend automatically, without the need for manual modifications or using a basic trailing order configuration.

On the chart, green lines above the price represent the suggested stop loss for Sell positions, while red lines below the price are used for Buy trades. This color structure helps traders quickly understand market conditions and make faster decisions.

By analyzing the true volatility range, the ATR Trailing Stop continuously determines an appropriate distance between the current price and the stop loss to prevent premature exits or excessive losses.

This indicator can be used in Forex, stocks, crypto, and commodities. In high-volatility markets such as currency pairs or cryptocurrencies, the ATR value is higher, and therefore the stop-loss distance increases accordingly. In contrast, in lower-volatility markets such as certain stocks, this distance decreases to improve exit accuracy.

For example, in an uptrend on the EUR/USD pair, the indicator widens the ATR range as price rises and increases the stop-loss distance to maintain enough breathing room for natural market fluctuations.

In a downtrend, the same logic applies in reverse, and the green lines act as an exit guide for Sell positions.

In the settings of this indicator, the main parameters include Inp Period with a default value of 10 and Inp Coeff with a value of 4.0. These parameters can be adjusted and optimized depending on the trader’s style.

Overall, the ATR Trailing Stop is an efficient tool for traders who want to protect their capital in volatile markets and preserve their earned profits without losing control of their trades.

Key Points for Placing a Trailing Stop Order

If mistakes occur when identifying the correct Trailing Stop area, a significant portion of the profit may be lost, and the account’s overall performance may drop.

If the range is placed too close to the market price, the trade may close prematurely due to normal fluctuations. Conversely, if the range is set too far from the price, a large portion of the profit may be lost.

Key Points for Placing a Trailing Stop Order:

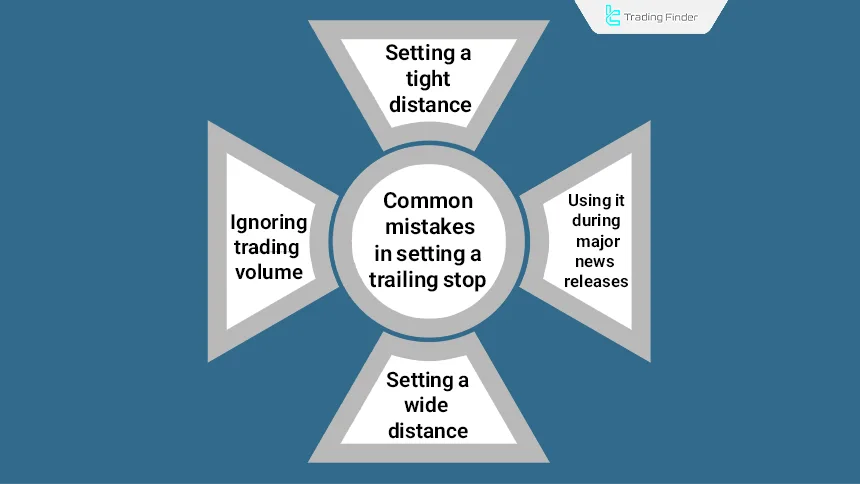

Common Mistakes in Setting a Trailing Stop

Many traders make errors when using a trailing stop, which can lead to unwanted exits or loss of potential profit.

Some of these issues occur when traders rely on a dynamic trailing stop without adjusting it to market conditions or when they set parameters without using a proper trailing stop calculator. For example:

- Setting the trailing distance too close causes the stop loss to trigger prematurely;

- Setting the distance too wide may result in losing potential profit;

- Using this instruction during periods of high volatility or major news releases increases the risk of sudden exits;

- Ignoring trading volume when determining an appropriate distance is one of the most common mistakes traders make.

Conclusion

A Trailing Stop is a dynamic stop-loss order used for both risk and trade management. This order adjusts based on the trader’s instructions, moving with the price in the direction of profit, and helps secure gains.

Proper use of this order enhances trading account efficiency and saves time during trading.

However, correct application requires sufficient experience and skill in trading strategies, since any mistake in placing this order increases the chance of losing part of the profit.