With more than 65 Spot pairs, 110 Futures pairs, and 3 Options pairs, BIT.com has become a hub for both professional and retail traders seeking advanced trading tools.

The platform facilitates daily trading volumes exceeding $90 million in Spot markets and Futures volumes that often surpass $2.5 billion during peak periods.

Its affiliate program is highly rewarding, providing up to 80% commission, while copy trading money managers can earn as much as 15% profit share.

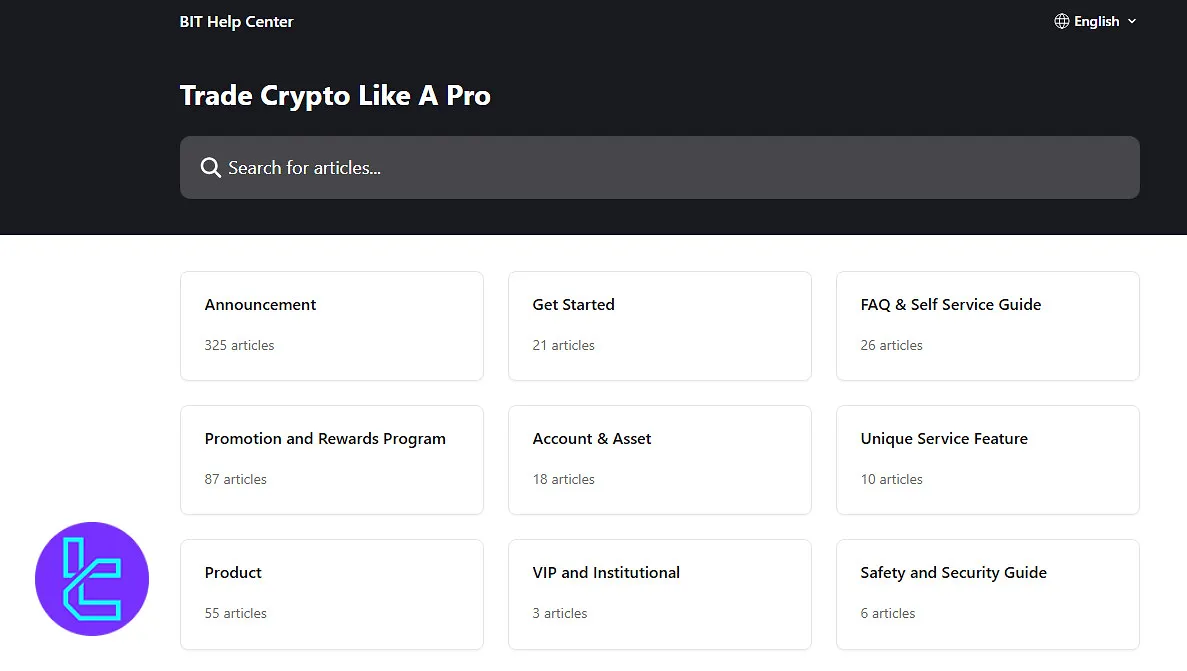

BIT; Introduction to the Exchange

BIT, powered by Matrixport, is a full-featured cryptocurrency exchange launched in August 2020.

The exchange reached an Options daily trading volume of over $6B in 2021 and ranked No.2 in the market. Key features of BIT:

- USDT-margined trading pairs

- Fiat payments

- Third-party custodians

- C2C cloud mining

BIT Exchange CEO

BIT Exchange is led by Zingho Chan, a figure known for steering the platform toward becoming one of the more innovative players in the digital asset space.

Under his leadership, BIT has emphasized secure trading infrastructure, institutional-grade products, and regulatory compliance while continuing to expand its global presence.

Chan’s approach focuses on combining advanced derivatives products, such as options and perpetuals, with spot trading and liquidity solutions, making BIT attractive for both retail traders and institutions.

With a vision centered on risk management, product innovation, and operational transparency, he has played a key role in shaping BIT’s reputation as a professional-grade exchange rather than just another retail-focused platform.

BIT Exchange Specific Features

BIT crypto exchange, leveraging the power of Matrixport, offers a suite of unique features that cater to both retail and institutional traders.

Exchange | BIT |

Launch Date | 2020 |

Levels | VIP 1 – VIP 9 |

Trading Fees | Variable based on the user level and instrument |

Restricted Countries | China Mainland, North Korea, Hong Kong, Iran, Japan, Myanmar, Singapore, Syria, Uzbekistan, American Samoa, Canada, Cuba, Guam, Puerto Rico, the Northern Mariana Islands, the United States of America, Crimea, Sevastopol |

Supported Coins | 60+ |

Futures Trading | Yes |

Minimum Deposit | $20 |

Deposit Methods | Credit / Debit Cards, Crypto |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:100 |

Minimum Trade Size | $10 |

Security Factors | 3rd Party Custodians, Off-Exchange Settlements, Penetration Test, Whitelist, Cold Wallets, Multi-Signature Wallets |

Services | Spot, Futures, Options, Cloud Mining, Copy Trading, RMM Strategy, API |

Customer Support Ways | Live Chat, Telegram, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

Upsides and Downsides

As with any cryptocurrency exchange, BIT has its strengths and weaknesses. Let's examine some of the key upsides and downsides of using the BIT platform:

Pros | Cons |

Wide range of trading products (spot, futures, options) | Relatively new platform, still building trust |

Advanced API connectivity for algorithmic trading | Low trust score on review websites |

Copy trading and cloud mining services | No fiat withdrawals |

Fee reductions based on trading volume | Geo-restrictions |

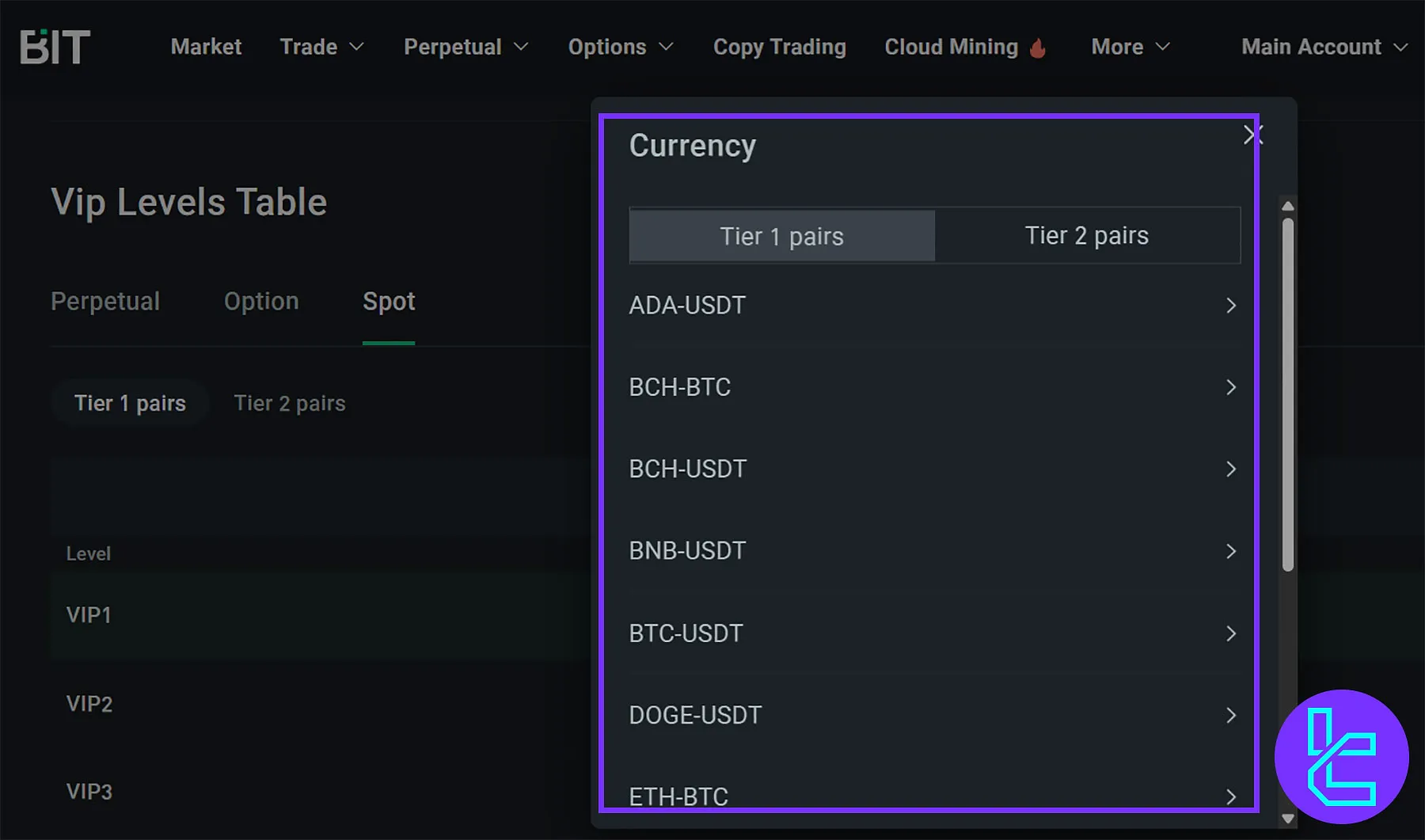

BIT User Levels

BIT implements a tiered VIP system to reward active traders with reduced fees. The VIP levels range from VIP 1 to VIP 9, with each level offering progressively better perks.

Note that the required trading volume for each level differs based on themarket.

BIT Exchange Fees Explained

As mentioned in the previous topic of this BIT review, the platform implements a tiered fee system based on user levels and trading volume.

Here's a breakdown of the various fees on the BIT exchange:

BIT.com Spot VIP Levels (Tier 1 pairs)

Level | 30D Trading Volume (USDT) | Maker/Taker |

VIP 1 | < 5,000 | 0.1000% / 0.1000% |

VIP 2 | > 5,000 | 0.0980% / 0.0980% |

VIP 3 | > 10,000 | 0.0960% / 0.0960% |

VIP 4 | > 20,000 | 0.0940% / 0.0940% |

VIP 5 | > 50,000 | 0.0900% / 0.0900% |

VIP 6 | > 150,000 | 0.0850% / 0.0850% |

VIP 7 | > 500,000 | 0.0750% / 0.0750% |

VIP 8 | > 1,000,000 | 0.0700% / 0.0700% |

VIP 9 | > 5,000,000 | 0.0000% / 0.0500% |

BIT.com Spot VIP Levels (Tier 2 pairs)

Level | 30D Trading Volume (USDT) | Maker/Taker |

VIP 1 | < 5,000 | 0.2000% / 0.2000% |

VIP 2 | > 5,000 | 0.1900% / 0.1900% |

VIP 3 | > 10,000 | 0.1800% / 0.1800% |

VIP 4 | > 20,000 | 0.1600% / 0.1600% |

VIP 5 | > 50,000 | 0.1400% / 0.1400% |

VIP 6 | > 150,000 | 0.1200% / 0.1200% |

VIP 7 | > 500,000 | 0.1000% / 0.1000% |

VIP 8 | > 1,000,000 | 0.0700% / 0.0700% |

VIP 9 | > 5,000,000 | 0.0000% / 0.0500% |

BIT.com Perpetual VIP Levels

Level | 30D Trading Volume (USDT) | Maker/Taker |

VIP 1 | < 200,000 | 0.0300% / 0.0600% |

VIP 2 | > 200,000 | 0.0300% / 0.0580% |

VIP 3 | > 500,000 | 0.0300% / 0.0550% |

VIP 4 | > 1,000,000 | 0.0200% / 0.0500% |

VIP 5 | > 2,000,000 | 0.0200% / 0.0450% |

VIP 6 | > 5,000,000 | 0.0150% / 0.0400% |

VIP 7 | > 10,000,000 | 0.0100% / 0.0350% |

VIP 8 | > 30,000,000 | 0.0000% / 0.0280% |

VIP 9 | > 100,000,000 | -0.0050% / 0.0250% |

Note: The negative maker fee is deducted from the order amount, and you’ll enjoy a discount when executing trades.

BIT.com Options VIP Levels

Level | 30D Trading Volume (USDT) | Maker/Taker |

VIP 1 | < 1,000,000 | 0.0200% / 0.0500% |

VIP 2 | > 1,000,000 | 0.0180% / 0.0475% |

VIP 3 | > 2,000,000 | 0.0160% / 0.0450% |

VIP 4 | > 5,000,000 | 0.0140% / 0.0425% |

VIP 5 | > 10,000,000 | 0.0120% / 0.0400% |

VIP 6 | > 30,000,000 | 0.0100% / 0.0375% |

VIP 7 | > 100,000,000 | 0.0080% / 0.0350% |

VIP 8 | > 300,000,000 | 0.0060% / 0.0325% |

VIP 9 | > 500,000,000 | 0.0040% / 0.0300% |

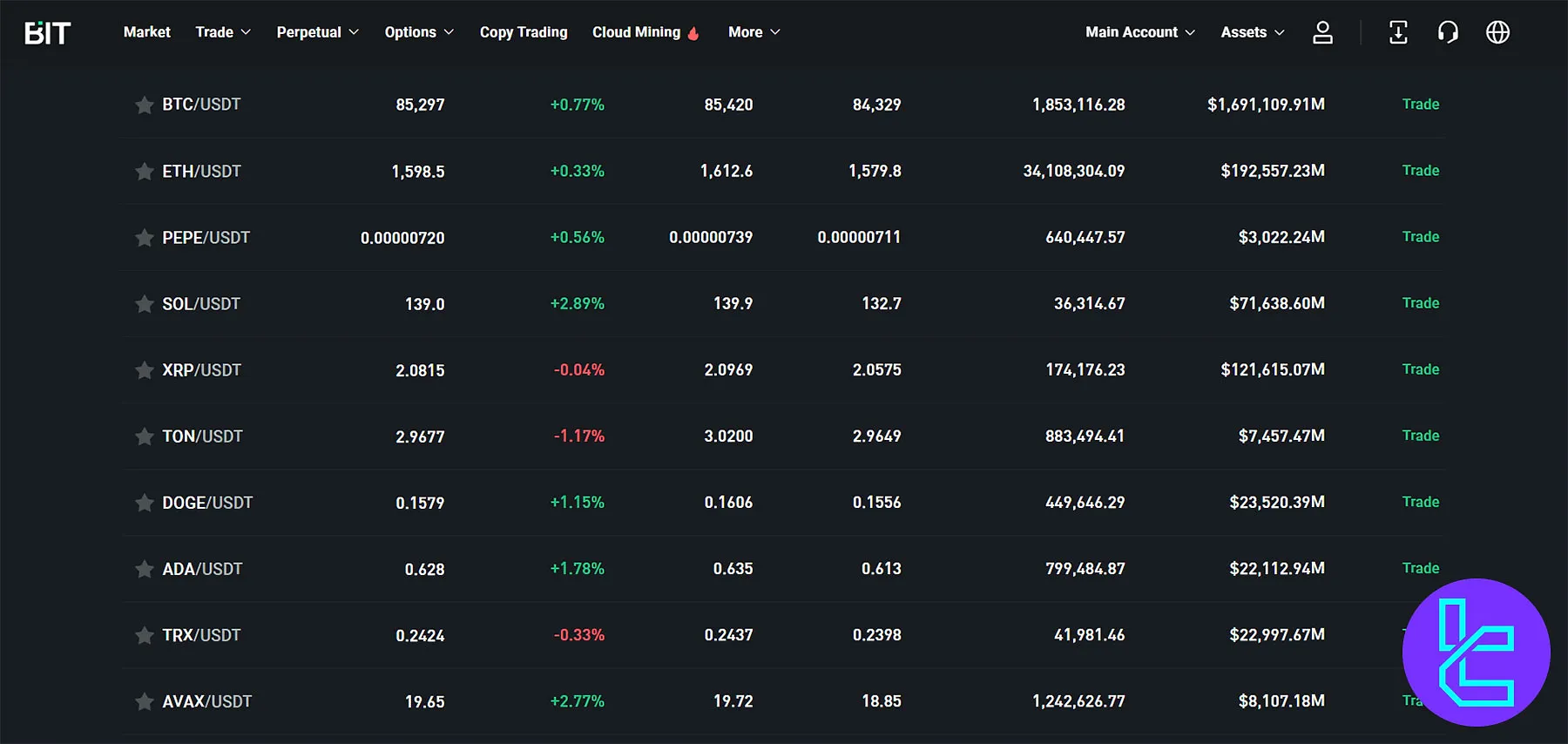

Listed Cryptocurrencies on BIT.com

BIT exchange supports up to 60+ cryptocurrencies for trading in Spot, Futures, and Options markets, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP (XRP)

- Solana (SOL)

- Tether (USDT)

- Dogecoin (DOGE)

- Cardano (ADA)

- Chainlink (LINK)

- Avalanche (AVAX)

- Polkadot (DOT)

- Litecoin (LTC)

- Binance Coin (BNB)

- Shiba Inu (SHIB)

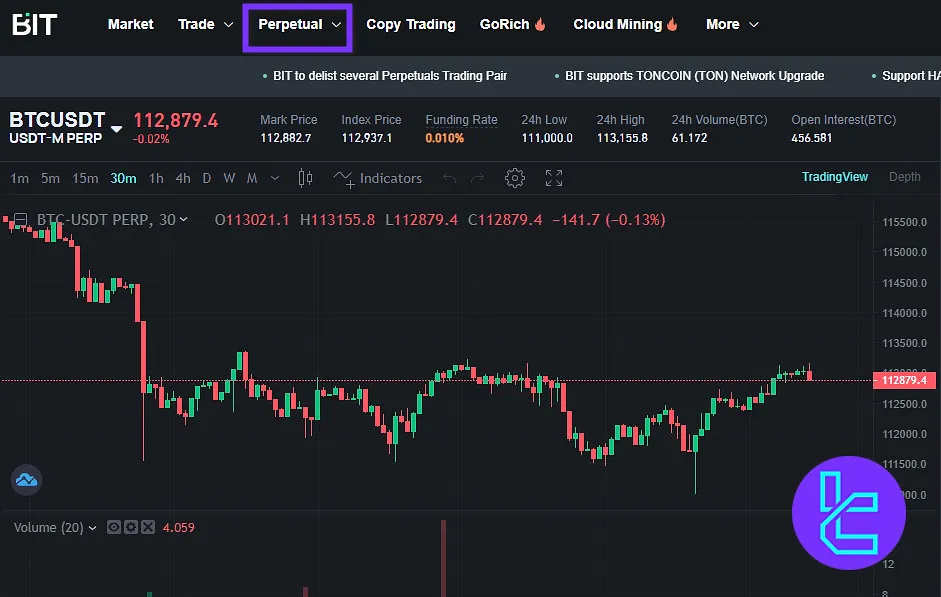

BIT Perpetual and Option Contracts

Supporting crypto derivative contracts is one of the advantages in this BIT review. The exchange offers USDT-based futures markets and options with specific expiry dates.

- Leverage options of up to 1:100

- 110 futures trading pairs

- USDT-Margined options on BTC, ETH, and XRP

- Expiry dates of up to 160 days

BIT Exchange Sign Up and KYC

Signing up for a BIT account and completing the Know Your Customer (KYC) process is a crucial step for users looking to access the full range of trading features.

#1 Navigate to the Exchange's Official Website

Visit the exchange’s official website and click “Sign Up” to reach the application form.

#2 Provide Register Information

Enter your email address and set a strong password for your account.

#3 Proceed with the Verification Procedure

Navigate to the “Verification” menu through the client dashboard and follow these steps:

- Provide personal information;

- Upload government-issued ID;

- Complete face authentication;

- Provide address information for advanced verification ($12M daily withdrawal limit).

Note: You must complete the Basic verification to trade Spot and Derivatives. This level of KYC enables daily withdrawals of up to $8 million.

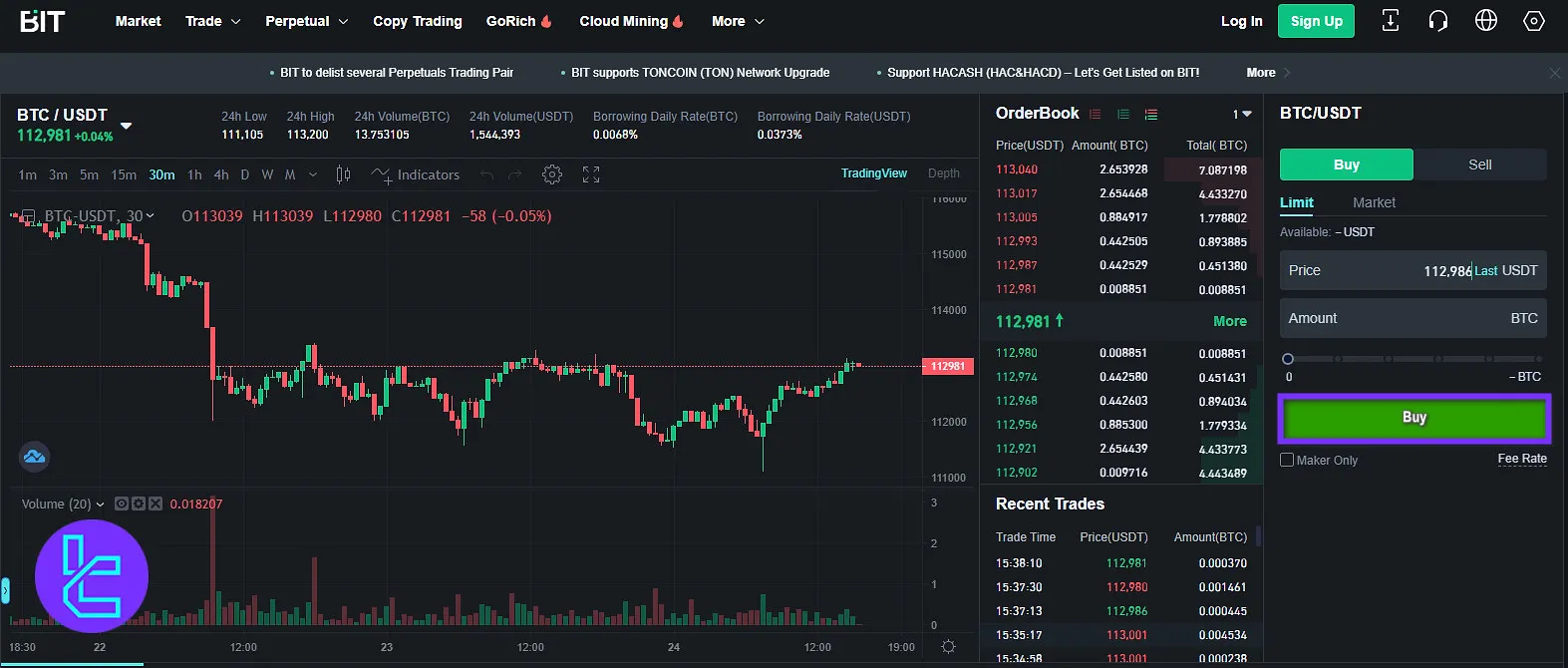

BIT.com Trading Guide

In order to start trading on the BIT platform, you only need to follow these instructions:

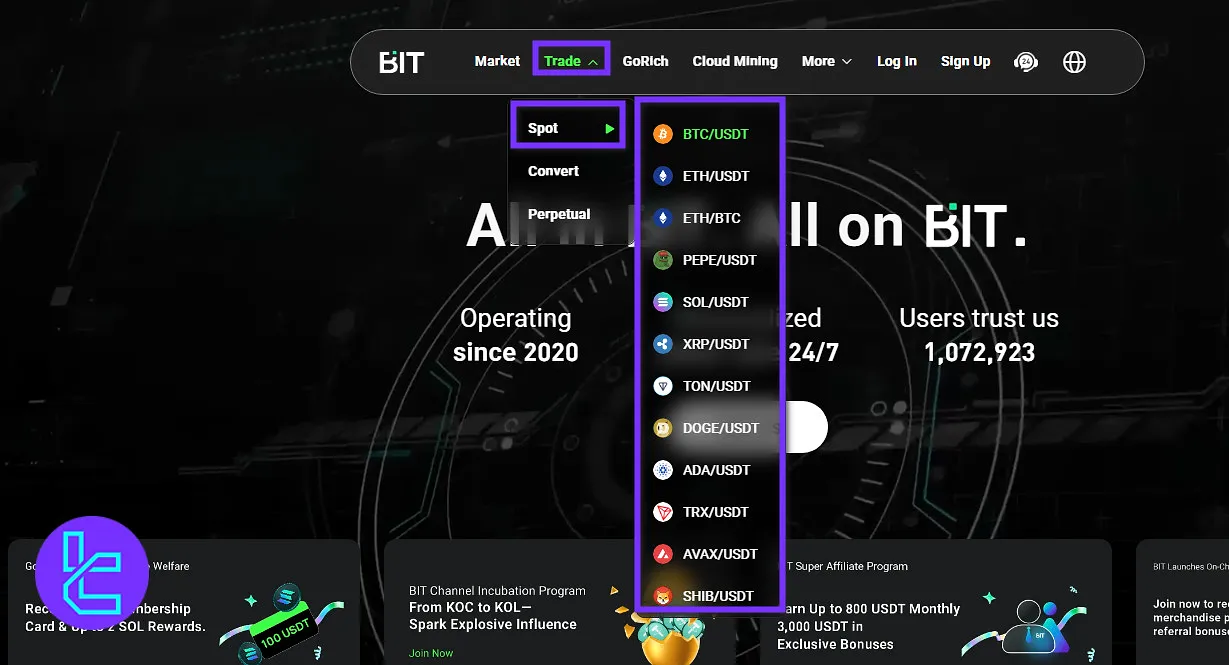

#1 Pick a Trading Pair

On the main page of BIT.com, first select “Trade” from the top menu, then hover your mouse pointer over “Spot”. Now, select one of the main trading pairs.

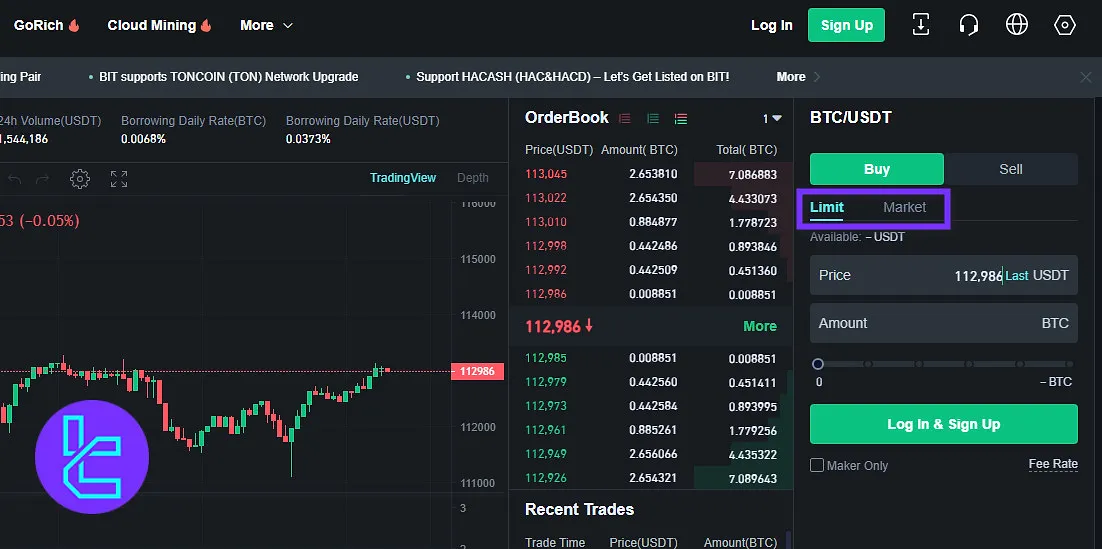

#2 Pick a Trading Order

BIT only offers limit and market orders. Select one of them from the right side menu.

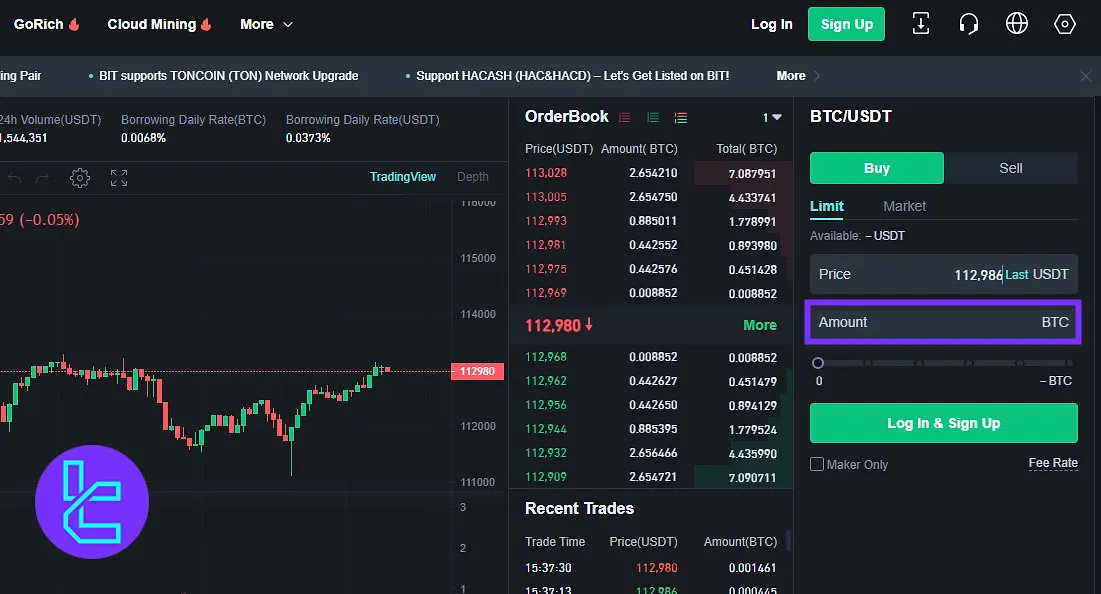

#3 Enter the Amount

Now, enter the amount of cryptocurrency you are willing to buy or sell in the “Amount” field.

#4 Confirm the Trade

Now the only thing you need to do is to click on “Buy” or “Sell” to confirm your trade. Before that, make sure you have entered the correct amount for the trade.

BIT.com App and Trading Platform

The exchange offers a comprehensive trading platform accessible through web-based and mobile interfaces with access to Trading View charts and tools.

The BIT.com trading platforms are designed to provide a seamless trading experience across devices, allowing users to stay connected to the markets and manage their crypto portfolios efficiently, whether they're at home or on the move.

BIT Trading Volume

According to the BIT CoinGecko chart, over the last 3 months, the BIT exchange has maintained a relatively active trading flow, with volumes consistently moving between $40 million and $120 million per day.

The chart shows strong fluctuations, especially in late July and late August, where peaks reached close to $110M–$115M.

From early July, the daily trade volume started below $50M, but quickly climbed above $90M in mid-July. The activity then experienced several ups and downs, reflecting traders’ short-term strategies and market sentiment.

During August, volatility increased, with multiple sharp spikes above $100M the highest in this period. The second half of August showed particularly strong liquidity, with daily volumes often surpassing $80M.

Moving into September, the numbers remained more moderate, fluctuating mostly between $50M–$80M, with fewer extreme spikes compared to the previous month.

Still, the exchange maintained a solid presence, rarely dropping below $40M in daily trading activity.

BIT Services

The table below is useful to check out the availability of trading services in BIT.com:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

BIT Security Factors

BIT.com has partnered with Cactus Custody, Copper.co, Chainalysis, Fireblocks, and Jumio to maintain continuous data and fund safety.

The exchange also implements several robust security measures, including:

- Cold and multi-signature crypto wallets

- Advanced encryption

- Two-factor authentication (2FA)

- Regular security audits

- Insurance fund

- Address whitelisting

- 3rd Party custodians

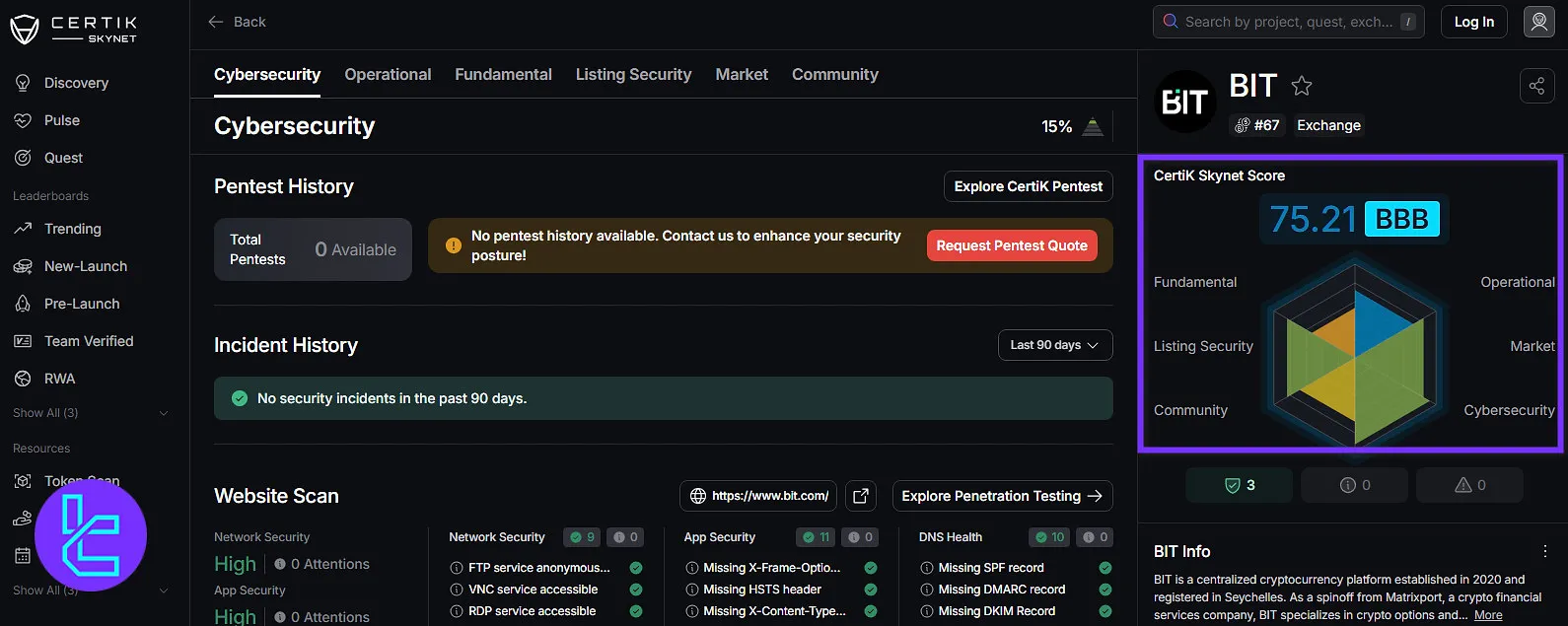

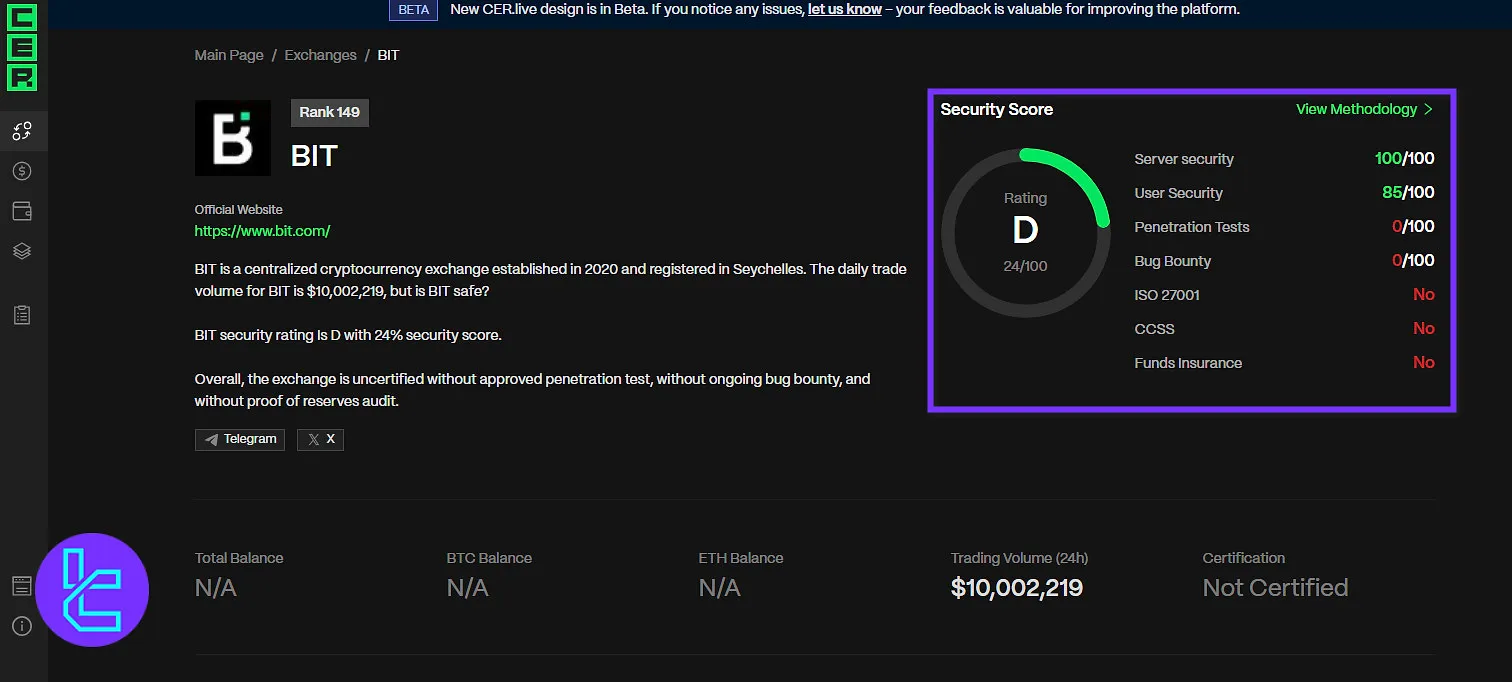

BIT Security Rankings

According to the BIT CertiK Skynet rating, BIT achieved an overall score of 75.21/100 (BBB grade), reflecting strengths in areas such as cybersecurity (92.24), market stability (84.56), and listing security (83.74).

However, weaker metrics were noted in fundamentals (53.36) and community trust (68.20).

On the other hand, the BIT CER.live results are less favorable, giving BIT an overall security score of just 24% (D grade).

While the platform scored 100/100 in server security and 85/100 in user protection, it showed critical gaps in key areas: no penetration testing (0/100), no bug bounty program, and a lack of recognized certifications such as ISO 27001 and CCSS.

Additionally, the exchange does not provide funds insurance, which is a significant drawback for user protection.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 75.21 / 100 (BBB) |

Fundamental | 53.36 | |

Operational | 72.38 | |

Listing Security | 83.74 | |

Market | 84.56 | |

Community | 68.20 | |

Cybersecurity | 92.24 | |

CER.live Score | Overall Score | 24% (D) |

Server Security | 100/100 | |

User Security | 85/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 0/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

BIT.com Payment Options

BIT exchange accepts fiat and crypto payments. It processes Credit/Debit Card transactions via Banxa and Circle. Here’s a list of available funding & withdrawal methods on the exchange:

- Cryptocurrencies

- Banxa Fiat Gateway

- Circle

Note that fiat withdrawals are not available on BIT.com.

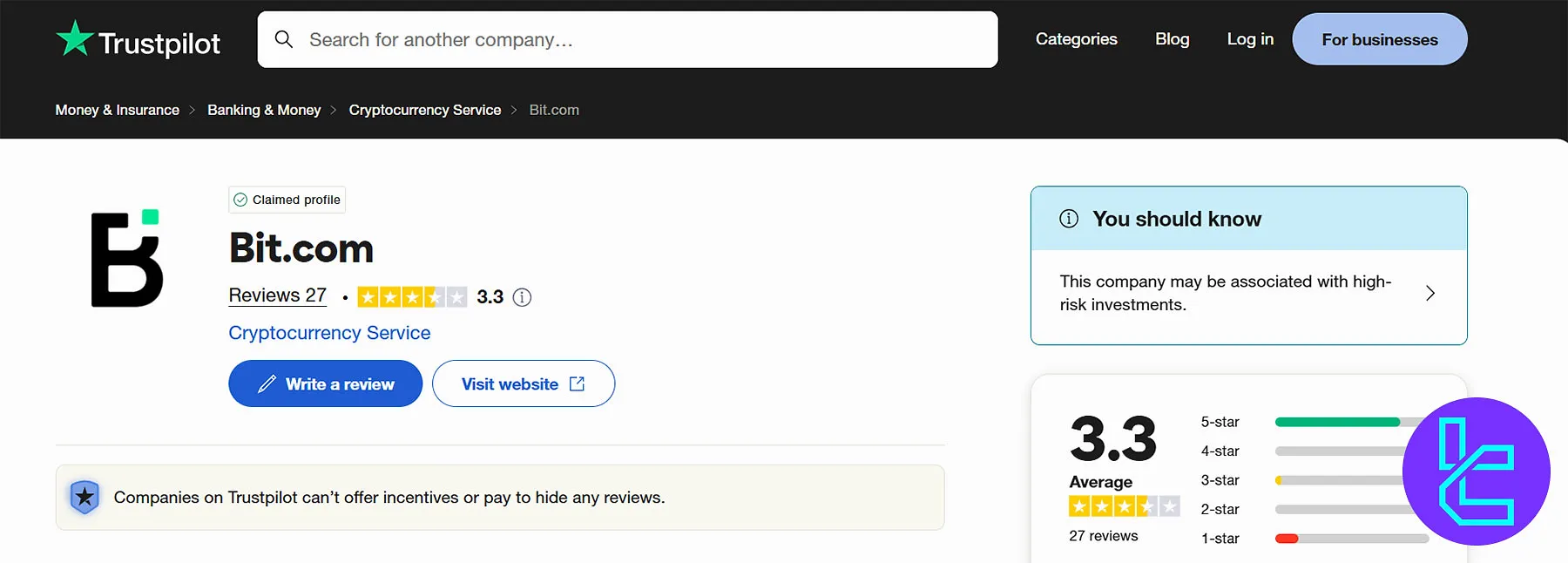

BIT Exchange Trust Scores

There are 27 BIT reviews on Trustpilot, resulting in an average score. However, CoinGecko experts have rated the platform as a poor exchange.

3.3 out of 5 | |

CoinGecko | 3 out of 10 |

While 81% of comments on the exchange’s TP profile are positive (5-star), 15% are negative (1-star).

The ScamAdviser website has rated BIT.com a slightly low trust score of 46 out of 100. The low score is primarily due to the crypto services, which can be high-risk. Here are its positive highlights:

- High traffic

- SSL certificate

- Classified as safe by Maltiverse

BIT.com Features

Let's check if BIT.com offers special services, such as copy trading:

Staking | No |

Yield Farming | No |

Social Trading | Yes |

Liquidity Pool | No |

Crypto Cards | No |

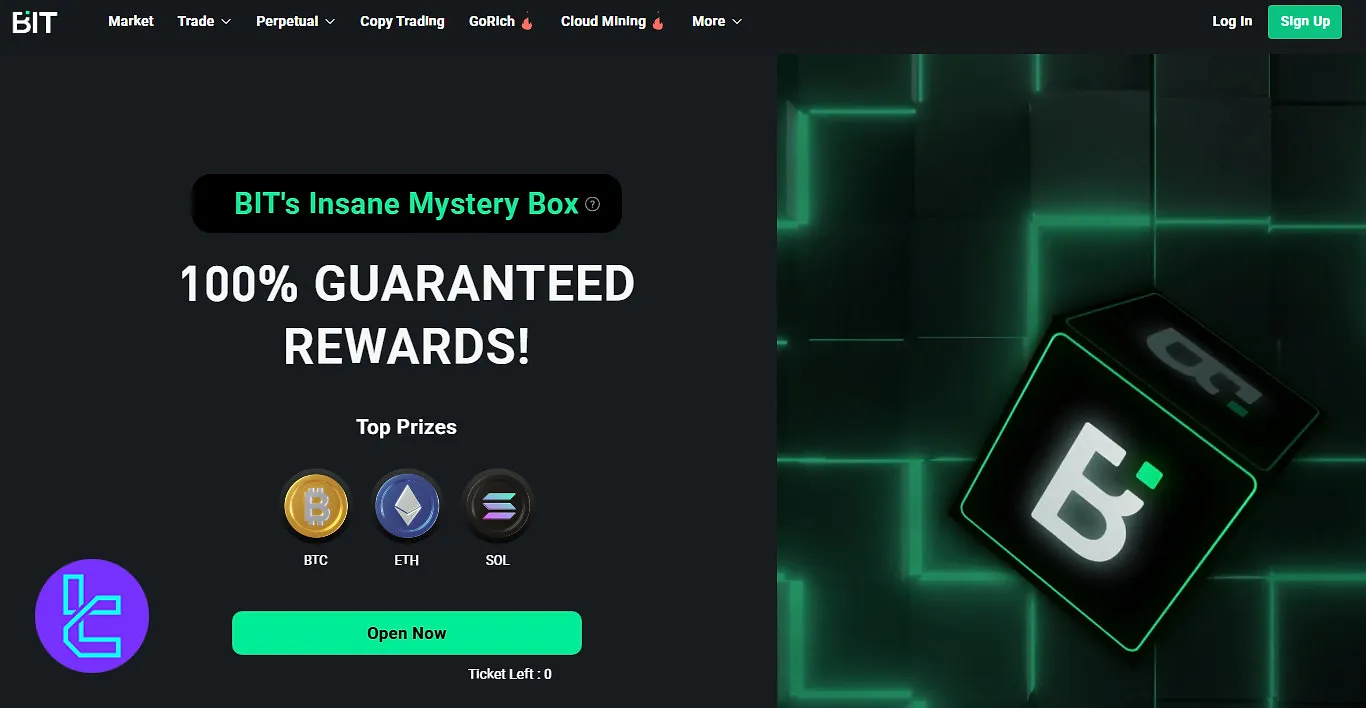

BIT Exchange Bonus

BIT.com offers two main bonus programs that provide traders with guaranteed rewards and daily engagement incentives:

Promotion | Reward |

BIT’s Insane Mystery Box | Prize BTC, Prize ETH, Prize SOL – 100% guaranteed |

Daily Check-In Rewards | Day 1–4: 0.01 USDT Day 5–6: 0.02 USDT Day 7: Bonus USDT |

BIT’s Insane Mystery Box

This promotion delivers 100% guaranteed rewards to participants. Traders have the chance to win top crypto prizes, including:

- Prize BTC

- Prize ETH

- Prize SOL

The mystery box system ensures that every participant receives a reward, making it an attractive incentive for both new and existing users.

Daily Check-In Rewards

BIT.com also runs a daily check-in bonus program tied to trading activity. Users can claim free inscriptions and token airdrops simply by logging in and trading each day. The structure is as follows:

- Day 1: 0.01 USDT

- Day 2: 0.01 USDT

- Day 3: 0.01 USDT

- Day 4: 0.01 USDT

- Day 5: 0.02 USDT

- Day 6: 0.02 USDT

- Day 7: Bonus USDT

BIT Customer Support

The exchange provides support through various channels, including email and a live chat feature. The limited contact channels are among the biggest letdowns in this BIT review.

- Email: support@bit.com

- Live Chat: Available on the official website

- Telegram community: https://t.me/bitcom_exchange

Investment and Growth Plans

The exchange provides various services for investment and growth, including Copy Trading, Cloud Mining, and RMM strategy.

- Copy Trading: 14 strategy providers to copy from (up to 15% profit share for money managers)

- Cloud Mining: C2C cloud mining for passive BTC profit

- Rebalancing Market Making Strategy: Automatic trading based on the balance ratio of two crypto assets in the portfolio with APYs up to 300% (Buy Low, Sell High)

BIT.com Red Flag Countries

The exchange doesn’t provide services to individuals or corporations located, incorporated, established in, or citizens or residents of any of the following countries:

- China Mainland

- North Korea

- Hong Kong

- Iran

- Japan

- Myanmar

- Singapore

- Syria

- Uzbekistan

- American Samoa

- Canada

- Cuba

- Guam

- Puerto Rico

- the Northern Mariana Islands

- the United States of America

- Crimea

- Sevastopol

BIT.com vs Other Exchanges

The table below compares BIT.com features and services with other exchanges in the market.

Features | BIT.com Exchange | OKX Exchange | HTX Exchange | LBank Exchange |

Number of Assets | 60+ | 7800+ | 700+ | 700+ |

Maximum Leverage | 1:100 | 1:12 | 1:200 | 1:125 |

Minimum Deposit | $20 | N/A | $1 | Varies by Cryptocurrency |

Spot Maker Fee | 0.0% - 0.2% | -0.01% - 0.14% | From 0.02% | 0.02% |

Spot Taker Fee | 0.05% - 0.2% | 0.03% - 0.23% | From 0.02% | 0.02% |

Mandatory KYC | Yes | Yes | Yes | No |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | Yes | Yes | Yes | Yes |

Writer’s Opinion and Conclusion

The exchange processes daily transactions that can surpass $95 million in Spot markets and $3 billion in Futures markets, demonstrating a solid trading ecosystem.

Security remains a top priority with partnerships involving 5 major custodians, advanced encryption protocols, and multi-layer verification processes.

With Trustpilot ratings averaging 3.3/5, a CertiK Skynet score of 75.21/100, and a CER.live rating highlighting areas for improvement, BIT.com provides a mix of professional trading tools, institutional features, and retail-friendly services, making it a notable player in the competitive crypto exchange market.