Bitbns is one of India’s fastest-growing cryptocurrency exchanges, listing over 641 digital assets across Spot, Margin, and Futures markets.

Since its inception almost 8 years ago, the platform has rapidly expanded to serve more than 4 million registered users, handling an average daily trading volume exceeding $2.1 million.

Traders on Bitbns benefit from advanced features such as diverse order types, including market, limit, and stop-limit orders, secure hot and cold wallets, margin trading with leverage of up to 1:4, and Futures contracts that support up to 10 major crypto trading pairs.

Bitbns (An Introduction to the Exchange and Its Regulatory Status)

Bitbns is a popular Indian cryptocurrency exchange founded on December 14, 2017. The platform has quickly grown to become one of the leading crypto exchanges in India, boasting over$2.1M daily trading volume. Key features of Bitbns:

- Diverse order types (market, limit, and stop-limit orders)

- Secure hot and cold wallets for cryptocurrency storage

- A wide selection of trading pairs

- Margin trading capabilities with leverage of up to 1:4

- Access to cryptocurrency Futures and Options (coming soon) trading

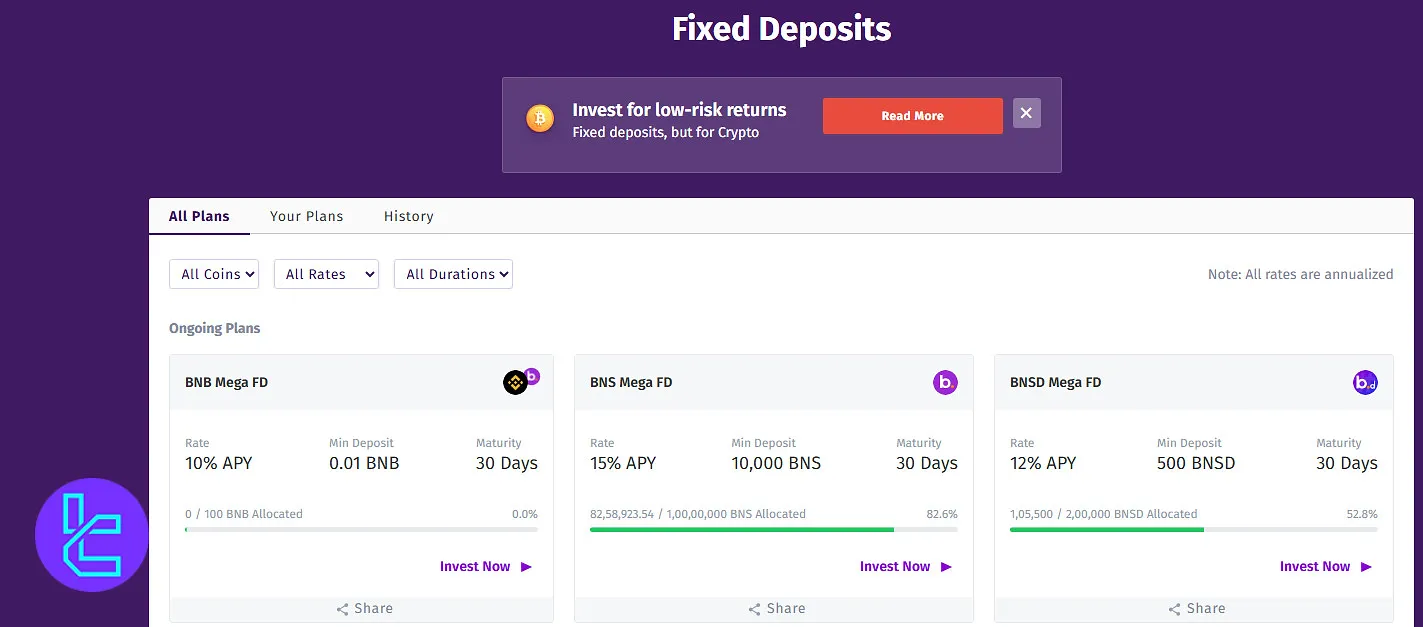

- Fixed deposit products for earning interest on crypto holdings

Regarding its regulatory status, Bitbns is registered with theFinancial Intelligence Unit of India (FIU-India).

This registration signifies that the exchange complies with the global standards of the Financial Action Task Force (FATF) for Virtual Asset Service Providers (VASPs).

Bitbns CEO

Gaurav Dahake is the CEO and co-founder of Bitbns, one of India’s leading cryptocurrency exchanges.

He graduated from the Indian Institute of Technology (IIT) Kharagpur with a degree in Engineering, where he first developed a strong interest in technology and entrepreneurship.

Based on the Gaurav Dahake LinkedIn profile, before launching Bitbns in 2017, he worked on multiple ventures in the tech space, including projects related to blockchain adoption and e-commerce.

Known for his forward-looking vision, he has been a strong advocate for making digital assets accessible to the wider public in India.

Beyond running the exchange, Gaurav actively participates in industry discussions, regulatory dialogues, and conferences to promote the responsible use of crypto.

His leadership style blends innovation with education, as he often emphasizes the need for financial literacy in digital markets.

Bitbns Table of Specifications

Bitbns offers a comprehensive suite of features and services tailored to meet the diverse needs of cryptocurrency traders.

Exchange | Bitbns |

Launch Date | 2017 |

Levels | Explorer – VIP 9 |

Trading Fees | Spot 0.25% - 0.03% Futures Maker 0.0% / Taker 0.1% Margin Borrower 0% / Lender 15% |

Restricted Countries | North Korea, Iran, Myanmar, Syria, Yemen, Algeria, Angola, Bulgaria, Cameroon, Croatia, Haiti, Mali, Nigeria, South Africa, Venezuela |

Supported Coins | 641+ |

Futures Trading | Yes |

Minimum Deposit | ₹100 |

Deposit Methods | UPI, Bank Transfer, Crypto |

Withdrawal Methods | Instant Transfer, Bank Transfer, Crypto |

Maximum Leverage | 1:10 |

Minimum Trade Size | 4 USDT |

Security Factors | 2FA, Fingerprint Access, Location Checks, Cold Storage, Penetration Test, Bug Bounty Program |

Services | Tax Filing, Staking, Gift Voucher, API Trading |

Customer Support Ways | FAQ Section, Ticket, Email |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes (INR, AED) |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | BNS |

Bitbns Exchange Upsides and Downsides

Bitbns has partnered with multiple platforms, including TradingView, Flippy, Finso, and Sahicoin, to offer advanced technologies and trading solutions.

However, like any other Crypto exchange, Bitbns also has some flaws, too.

Pros | Cons |

Comprehensive user levels with reduced trading fees | Limited support channels (only Ticket) |

Wide range of supported cryptocurrencies | Limited fiat currencies support (only INR and AED) |

Staking and API trading services | Some geo-restrictions outside India |

User-friendly interface for beginners | Commissions for instant withdrawals |

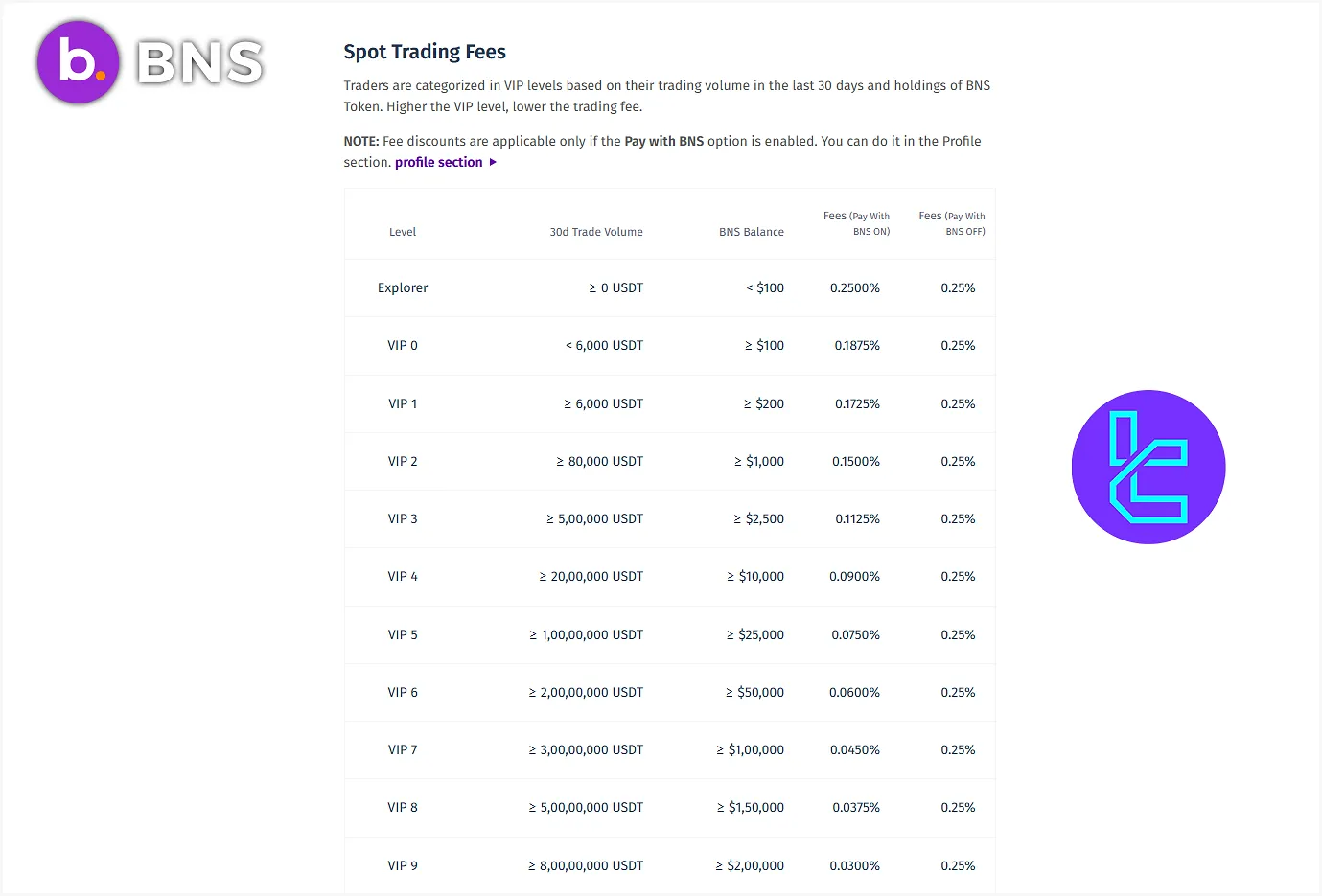

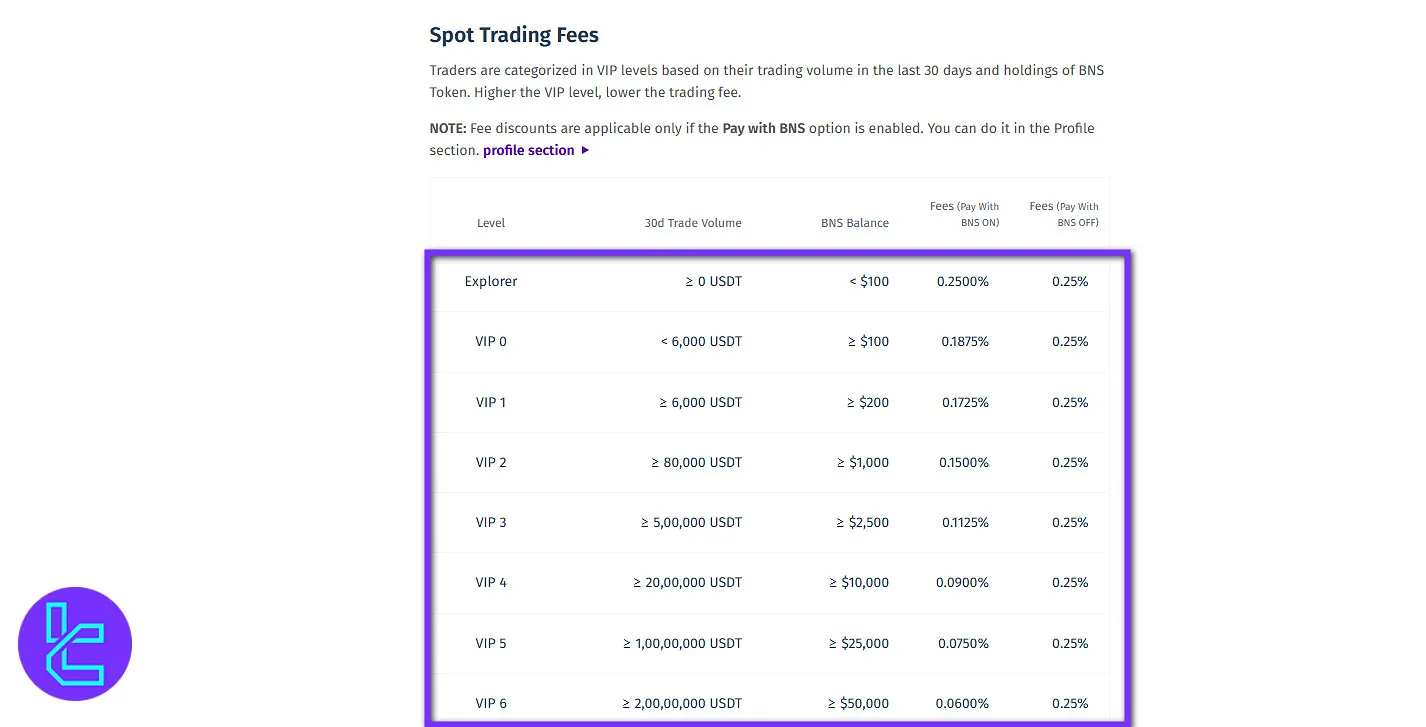

Bitbns User Levels

Bitbns implements a tier-based user level system where traders are ranked according to their 30-day trading volume.

As users move up the tiers, they gain access to reduced maker/taker fees, priority withdrawal processing, and increased deposit/withdrawal limits, incentivizing higher trading activity.

A look into Bitbns VIP levels and fee discounts

A look into Bitbns VIP levels and fee discounts

Note that fee discounts on Bitbns are only applicable when the "Pay with BNS" option is enabled, which automatically pays the fees in the ecosystem's native token, BNS.

Level | 30D Trading Volume (USDT) | BNS Balance (equal in USD) | Fees |

Explorer | ≥ 0 | < $100 | 0.2500% |

VIP 0 | < 6,000 | ≥ $100 | 0.1875% |

VIP 1 | ≥ 6,000 | ≥ $200 | 0.1725% |

VIP 2 | ≥ 80,000 | ≥ $1,000 | 0.1500% |

VIP 3 | ≥ 500,000 | ≥ $2,500 | 0.1125% |

VIP 4 | ≥ 2,000,000 | ≥ $10,000 | 0.0900% |

VIP 5 | ≥ 10,000,000 | ≥ $25,000 | 0.0750% |

VIP 6 | ≥ 20,000,000 | ≥ $50,000 | 0.0600% |

VIP 7 | ≥ 30,000,000 | ≥ $100,000 | 0.0450% |

VIP 8 | ≥ 50,000,000 | ≥ $150,000 | 0.0375% |

VIP 9 | ≥ 80,000,000 | ≥ $200,000 | 0.0300% |

Bitbns Fees and Commissions

The exchange applies a default trading fee of 0.25% for both makers and takers. However, high-volume traders and users holding the platform’s native BNS token can benefit from lower fees through tiered discounts.

This fee structure makes Bitbns more cost-effective for frequent or high-volume users. Key points about Bitbns' fee structure:

- Spot Trading: Ranging from 0.0300% to 0.2500% based on VIP level

- Derivatives (Futures): 0% for Makers (Introductory offer) and 0.1% for Takers

- Margin Trading: 0% for Borrowers and 15% for Lenders

- Crypto Withdrawal: Variable fee and minimum amount based on the token

- INR Withdrawal: Fees ranging from ₹0.0 to ₹9.0

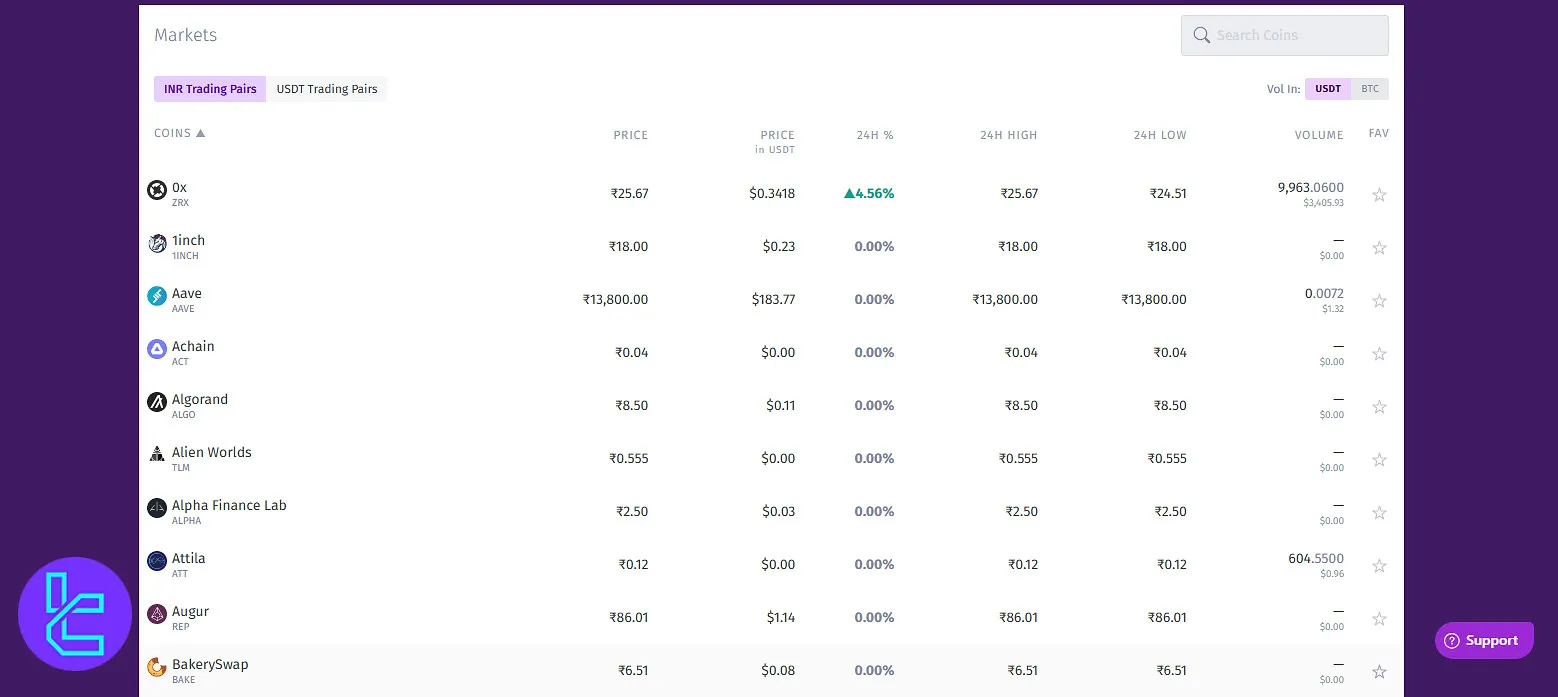

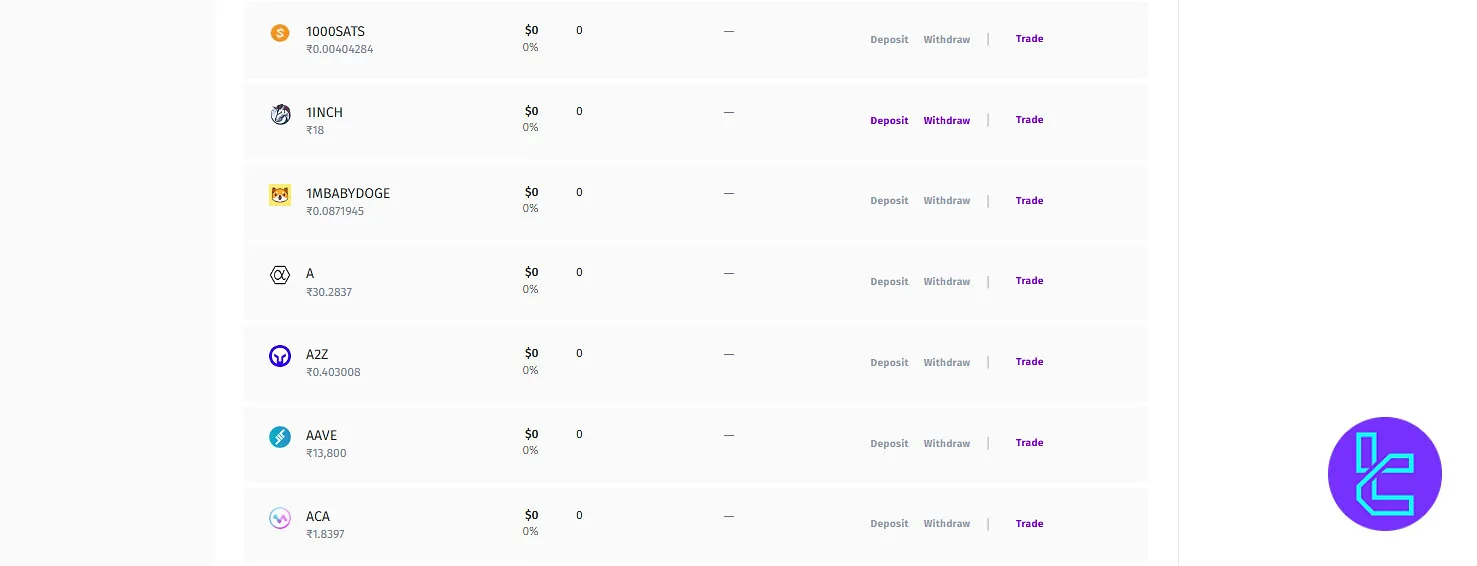

Listed Coins on Bitbns Exchange

The platform has listed over 641+ digital assets and many more trading pairs with INR and USDT as base currencies.

This wide asset variety includes both mainstream tokens like Bitcoin, Ethereum, and Ripple, as well as a broad selection of lesser-known altcoins, enabling users to diversify their portfolios across various blockchain networks. Some of the most popular tokens listed on Bitbns:

- BTC

- AAVE

- ETH

- BNB

- BCH

- DOGE

- ADA

- EOS

- FIL

- LTC

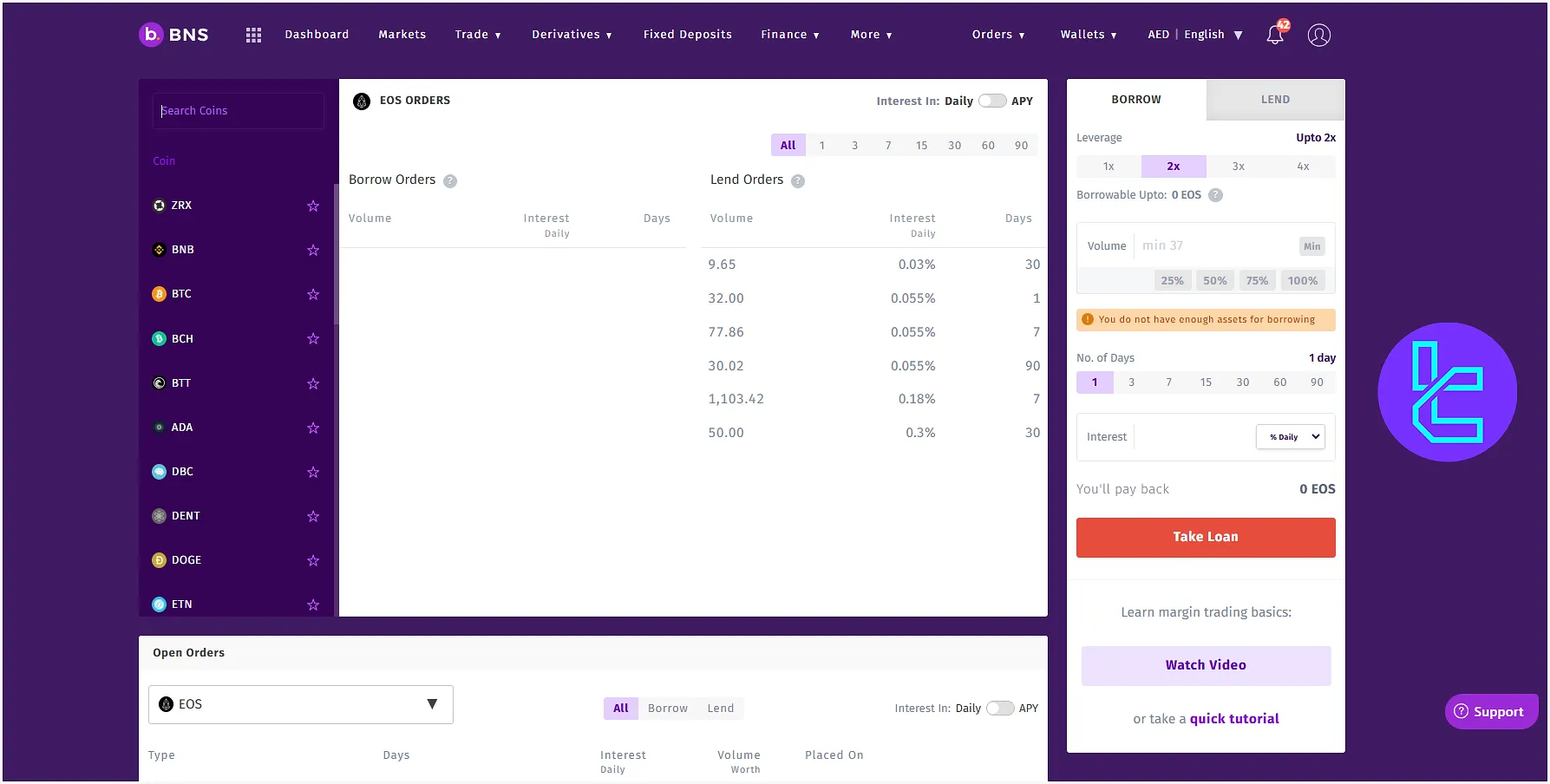

Derivatives and Margin Trading on Bitbns

In addition to a comprehensive Spot market, Bitbns also provides access to Crypto Futures and Margin trading with the following key features:

Derivatives (Futures)

- Leverage options of up to 1:10 in Derivatives

- 10 trading pairs on digital assets, such as BTC, SHIB, ADA, BNB, ETH

- Options trading (coming soon)

- Limit and Bracket

Margin

- Trading on 30 coins, including PHB, POLY, XRP, SIA, and USDT

- Leverage options of up to 1:4

- Suitable for investors to lend their free margin and earn interest rates and for borrowers to access a larger trading capital

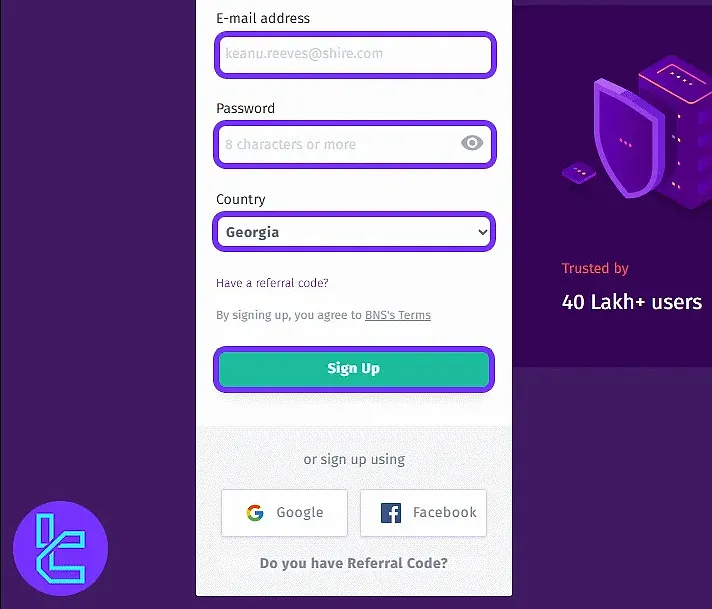

Bitbns Registration and KYC

To access trading features on Bitbns, users must complete both Bitbns registration and full KYC verification.

This ensures compliance with global financial regulations and secures access to crypto trading, withdrawals, and fiat integration.

#1 Sign Up on the Platform

Visit the official Bitbns website and click on “Sign Up”.

Fill in the required details, including:

- Account password

- Country of residence

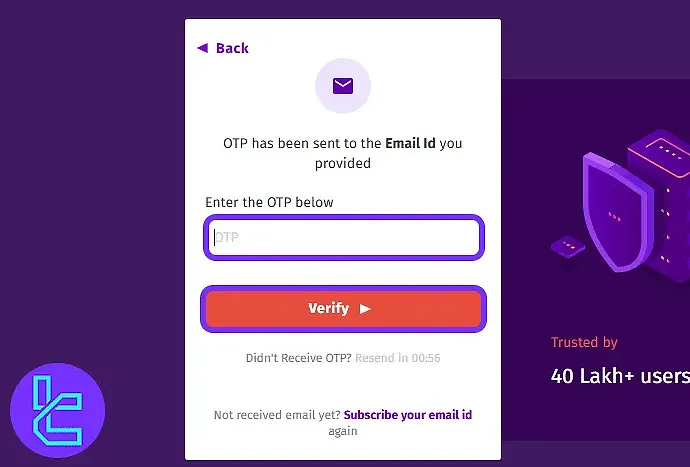

#2 Email Confirmation

Now, you need to confirm your email using the OTPsent to your inbox. Check out your email and get the code.

#3 Verify Account

Enter the code in the OTP field to verify your Bitbns account.

#4 Begin KYC Process

Head to your Profile section and click “Complete KYC”. Choose "International User" verification, enter your mobile number, and then upload supporting documents, including:

- ID Documents: Passport, National ID, or Driver’s license

- Proof of Address: Utility bill or Government-issued documents

#5 Complete Liveness Check

Record a short selfie video holding your ID and a handwritten note as instructed.

#6 Link Your Bank Account

Submit accurate banking details to enable fiat deposits and withdrawals.

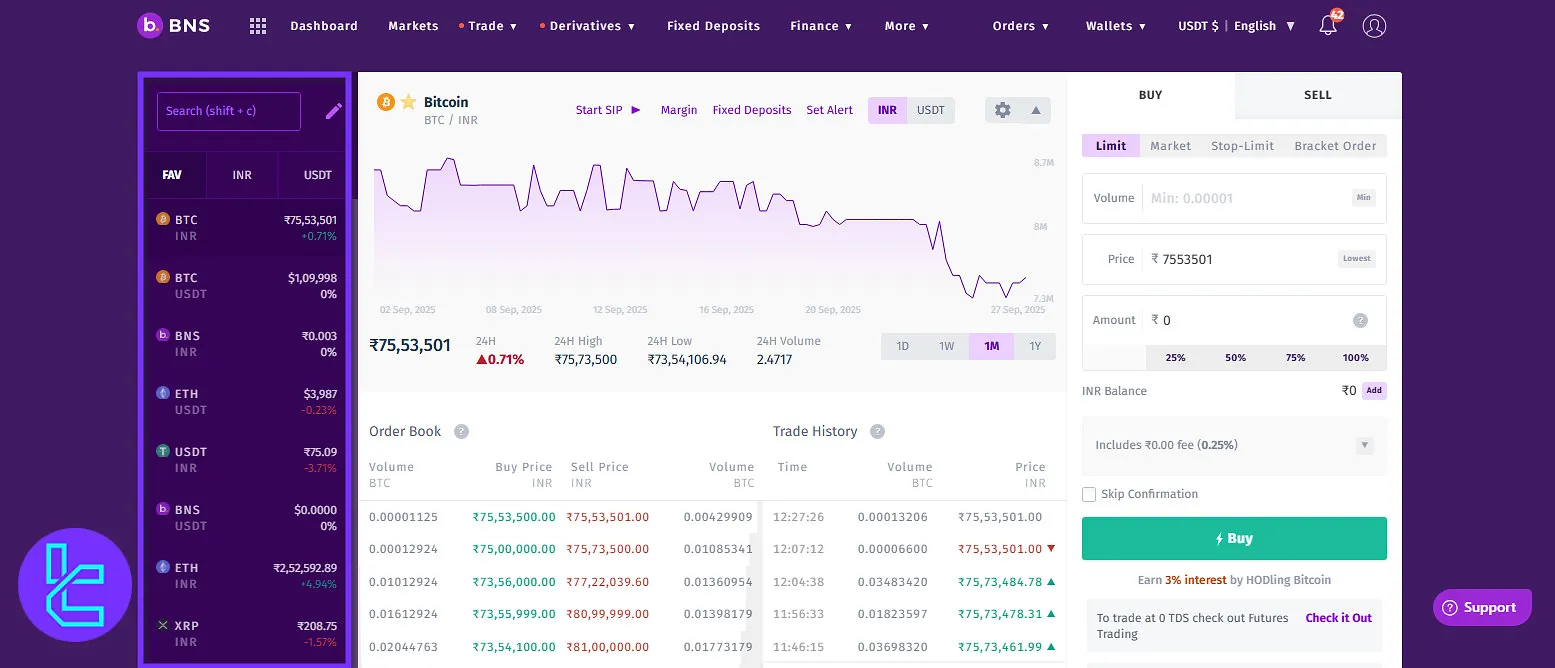

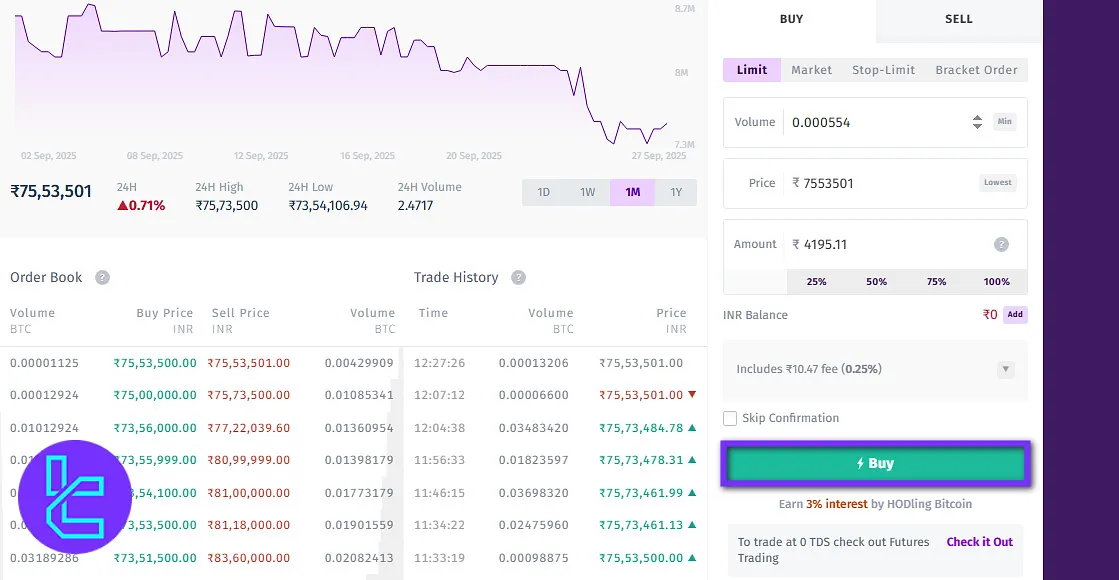

Bitbns Trading Guide

Trading on Bitbns is straightforward and designed for ease of use. Follow these steps to execute your trades quickly and with confidence.

#1 Access the Exchange

From the Bitbns homepage, click on “Trade” in the top navigation menu and then select “Start Trading”.

#2 Pick Your Trading Pair

Pick a trading pair from the left side list. If your preferred pair is not on the list, search for it using the search box.

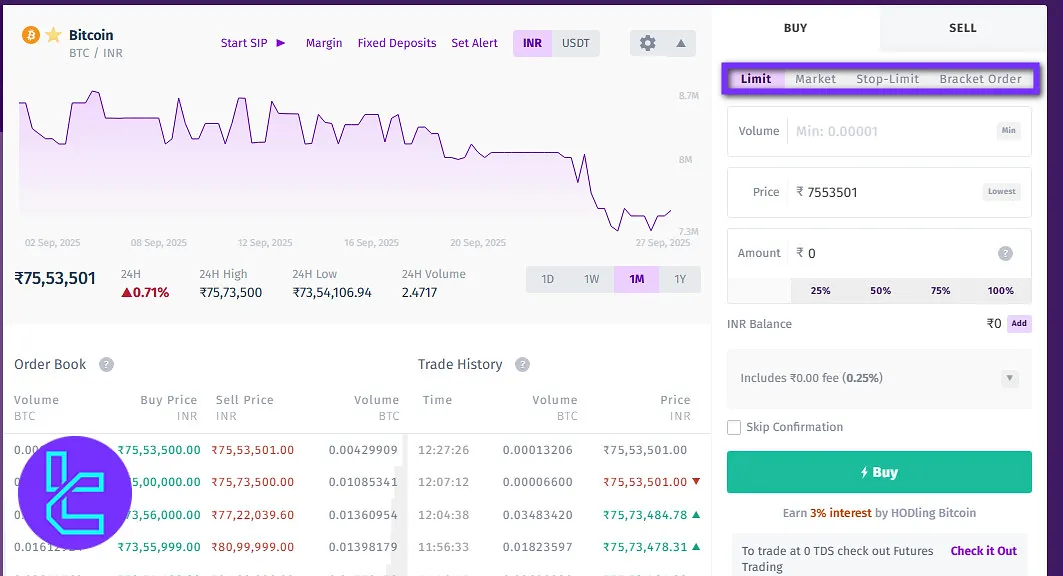

#3 Select the Order Type

Choose the order type you wish to place. Bitbns supports limit, market, stop-limit, and bracket orders, giving you flexibility over price execution and timing.

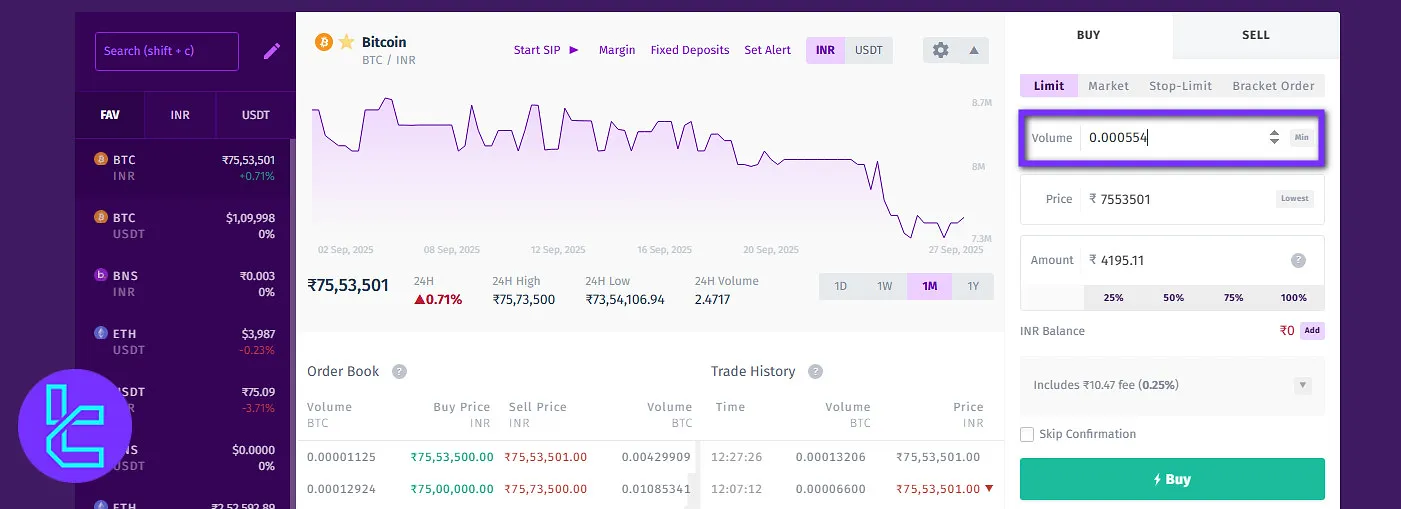

#4 Set Trade Volume

Enter the amount you want to trade in the “Volume” field.

#5 Confirm Your Trade

Click “Buy” or “Sell” to confirm and execute your trade instantly.

Bitbns Exchange Apps and Platforms

The platform offers a comprehensive mobile application alongside its WebTrader to answer the needs of mobile traders.

Bitbns also provides a unique browser extension to indicatearbitrage opportunities between 5 exchanges, including Binance, Huobi, Gate.io, Kucoin, and itself.

BNS: Crypto Trading Exchange

Bitbns Extension

The platform provides access to TradingView charts and tools. TradingFinder has developed a wide range of free and advanced TradingView indicators that you can use for free.

Bitbns Trading Volume

Based on the Bitbns CoinGecko chart, over the last 3 months, Bitbns has maintained a daily trading volume fluctuating between $1.5 million and $2.5 million, with occasional peaks reaching close to $3 million.

According to data sourced from CoinGecko, the platform has shown resilience despite market volatility, reflecting consistent liquidity and active participation from traders.

The exchange experienced a temporary dip around the beginning of September, where the volume briefly dropped near $500K, but quickly recovered back above the $1.5 million mark within days.

This stability in recovery indicates strong user engagement and sustained market activity on Bitbns.

On average, the platform has consistently delivered over $1.5 million in daily volume, positioning itself as a reliable exchange for both retail and professional traders.

Bitbns Services

Using the table below, let’s check the availability of trading services in Bitbns:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | No |

No | |

Launchpad | Yes |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

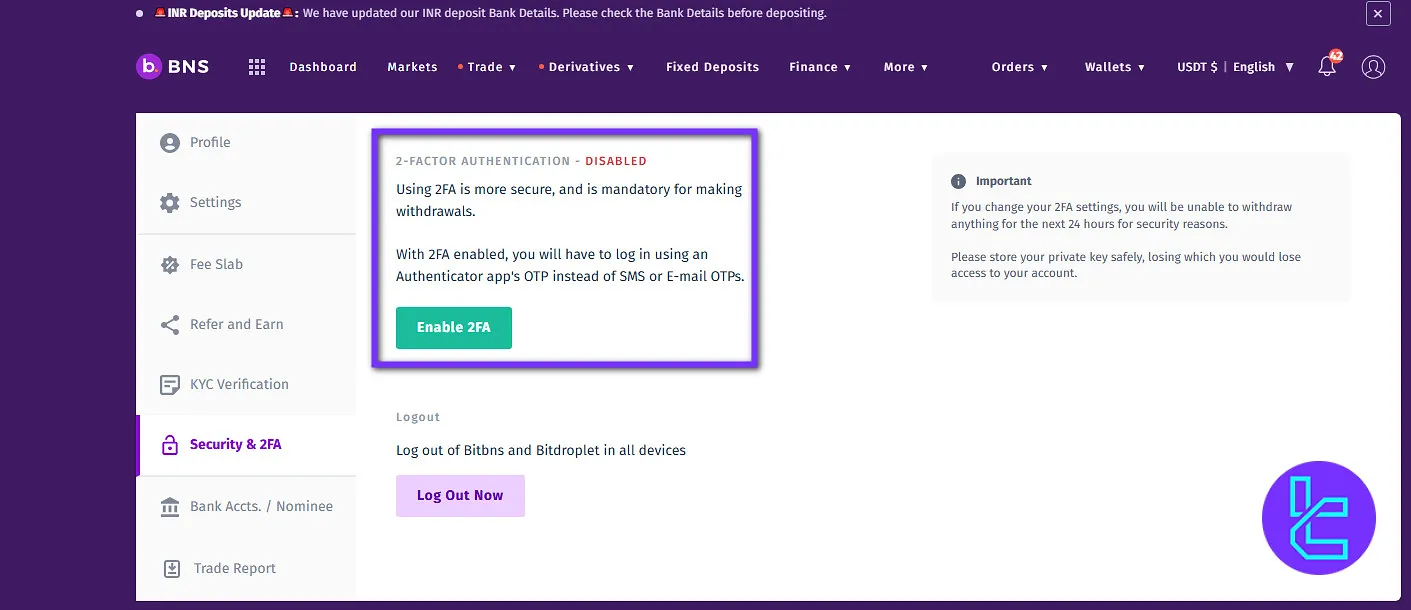

Bitbns Security and Safety

The company is an ISO 27001 certified exchange implementing a multi-layered security architecture, including multi-signature cold crypto wallet storage, two-factor authentication (2FA), KYC verification for account protection, and email-based login confirmations.

Regular third-party security audits and penetration testing further enhance the platform’s resilience against breaches. Bitbns security features:

- Two-Factor Authentication (2FA)

- Bug Bounty Program with a minimum reward of 1,000 INR

- Location checks for withdrawals

- Penetration test

- Security audits

- Cold storage

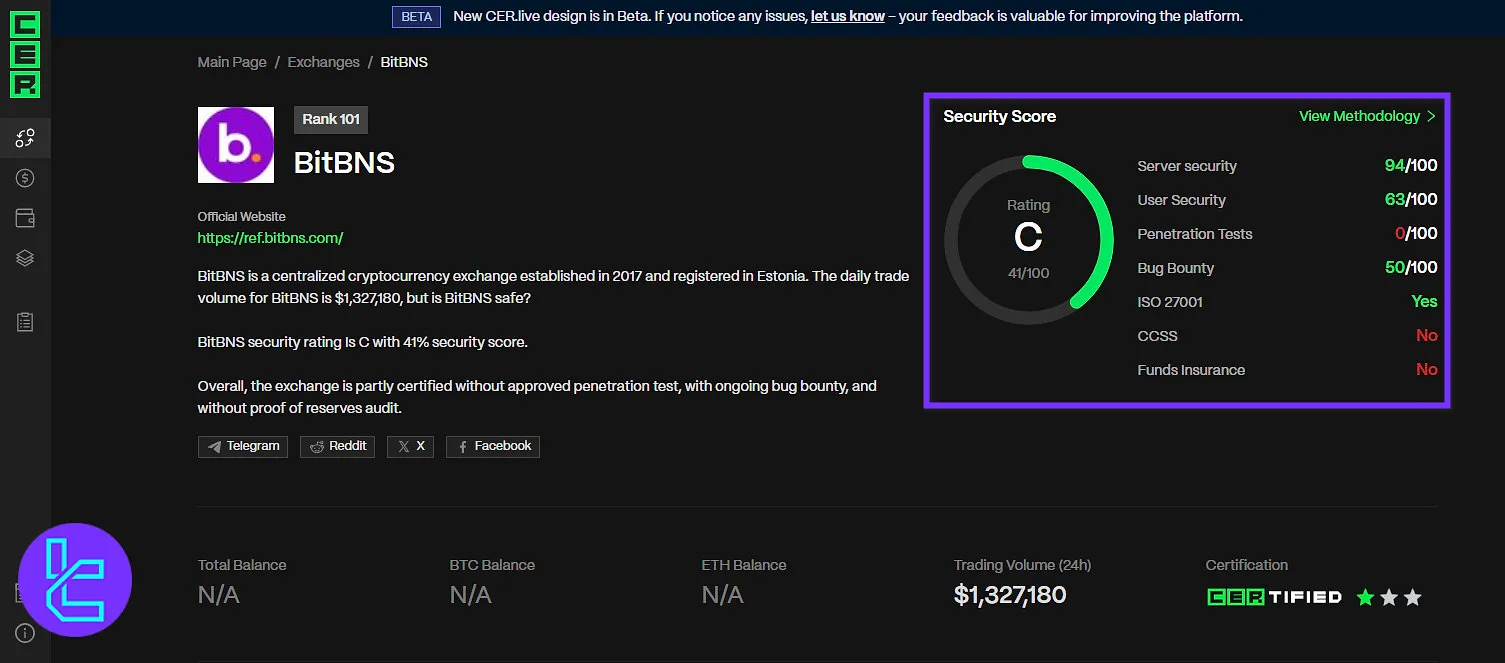

Bitbns Security Rankings

The latest CER.live security audit gives Bitbns an overall score of 41% (C rating), reflecting a mixed security profile.

Based on the Bitbns CER.live review, the exchange shows strong server security (94/100) but weaker user security (63/100), highlighting potential gaps in account-level protections.

While Bitbns has implemented ISO 27001 certification and maintains a partial bug bounty program (50/100), it still falls short in critical areas like penetration testing (0/100), CCSS compliance, and funds insurance.

Overall Score | 41% (C) |

Server Security | 94/100 |

User Security | 63/100 |

Penetration Tests | 0/100 |

Bug Bounty | 50/100 |

ISO 27001 | Yes |

CCSS | No |

Funds Insurance | No |

Bitbns Payment Methods

While the platform supports Crypto and Fiat transactions, the only available fiat currencies are INR and AED (for UAE citizens).

The available INR payment methods on Bitbns:

Deposit | UPI, Bank Transfer, P2P USDT |

Withdrawal | Normal (30 to 60 working days), P2P USDT, and Instant |

Bitbns requires a minimum investment of just ₹100 (approximately $1.20), making it one of the most accessible crypto platforms for beginners.

This low entry point allows new users to explore cryptocurrency trading without committing large funds upfront.

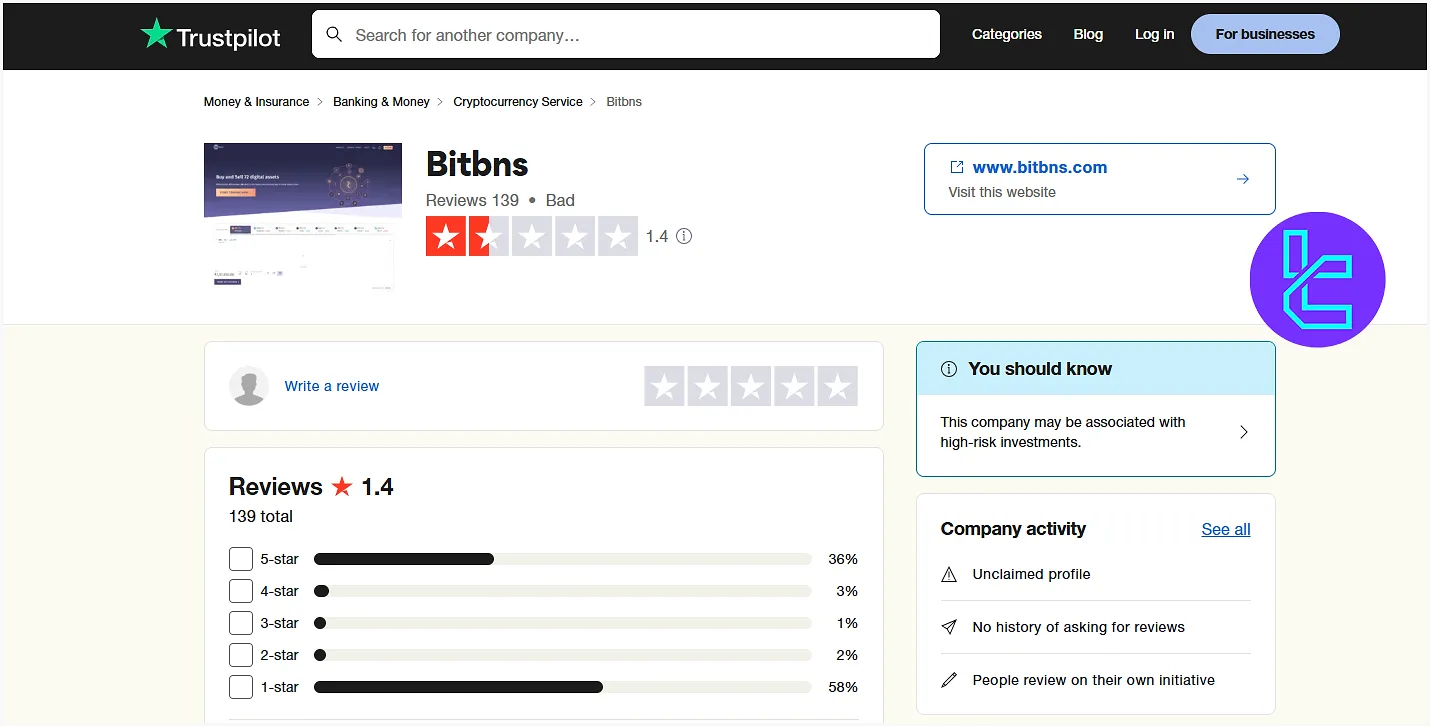

Bitbns User Satisfaction

Trust score may be the most important topic in this Bitbns review. Users’ feedback to the exchange is generally negative, with lower-than-average ratings on reputable platforms, including:

1.4 out of 5 based on 139 reviews | |

Reviews.io | 2.1 out of 5 based on 12 ratings |

CoinGecko | 4 out of 10 |

Users have complained about various issues, including withdrawals taking longer than they should, poor customer support, and fraudulent activities.

Bitbns Features

While Bitbns provides access to crypto staking opportunities, it doesn't offer copy trading services.

The platform also provides crypto gift cards, allowing users to send a specified amount of cryptocurrency to their friends as gifts.

Staking | Yes |

Yield Farming | Yes |

Social Trading | No |

Liquidity Pool | Yes |

Crypto Cards | Yes |

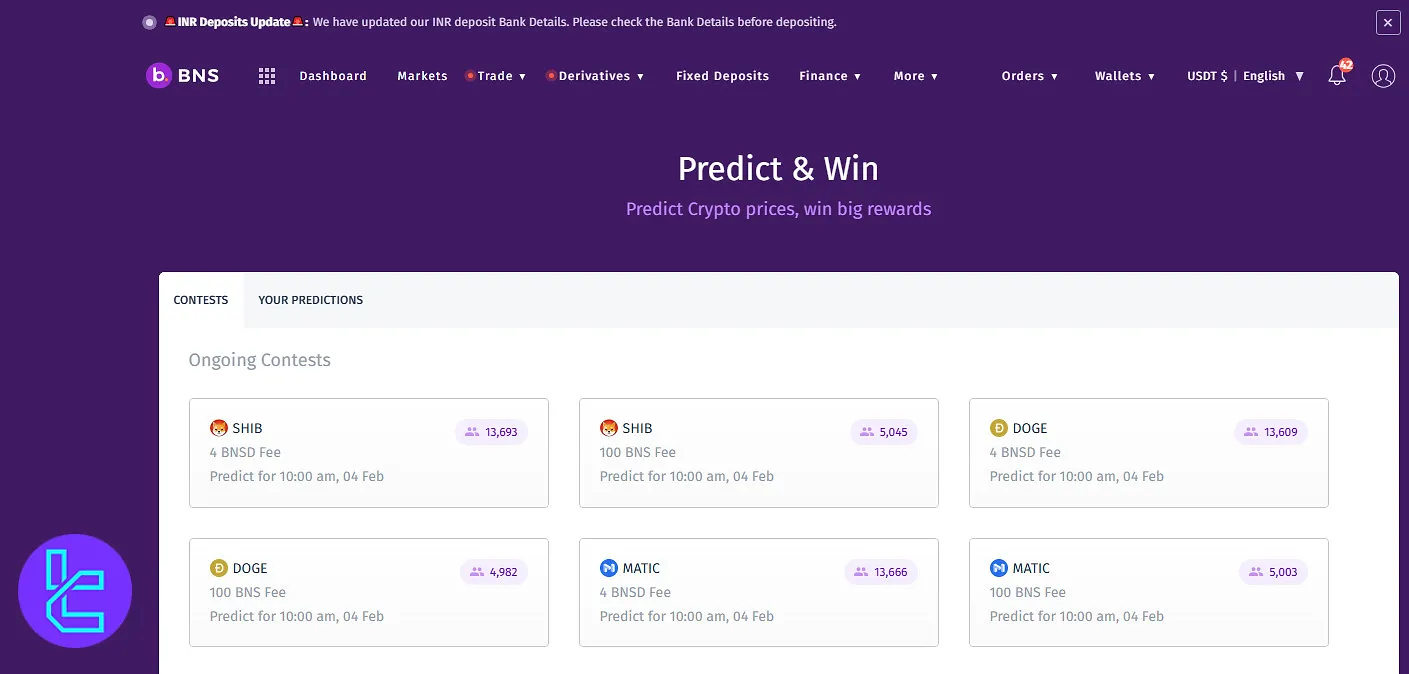

Bitbns Bonus

Bitbns offers users engaging bonus opportunities, mainly through its Prediction Game and periodic Trading Contests:

Bonus Type | Key Points |

Prediction Game | Predict crypto prices, entry fee per prediction, closer = higher reward, max 35,000 entries, guaranteed rewards, recorded on Polygon |

Trading Contests | Past events included TRACE (75,000 tokens), SERO (20,000 tokens), and ZIL (100,000 tokens). Currently not active but may return |

Prediction Game

The Bitbns Prediction Game lets users forecast crypto prices within set contests.

- Traders can enter multiple predictions, each requiring an entry fee;

- Rewards scale with accuracy; the closer the prediction to the actual price, the higher the payout;

- Each contest allows up to 35,000 predictions, with guaranteed rewards for all participants;

- In case of a tie, the earlier entry ranks higher;

- To ensure fairness and transparency, every prediction is recorded on the Polygon blockchain.

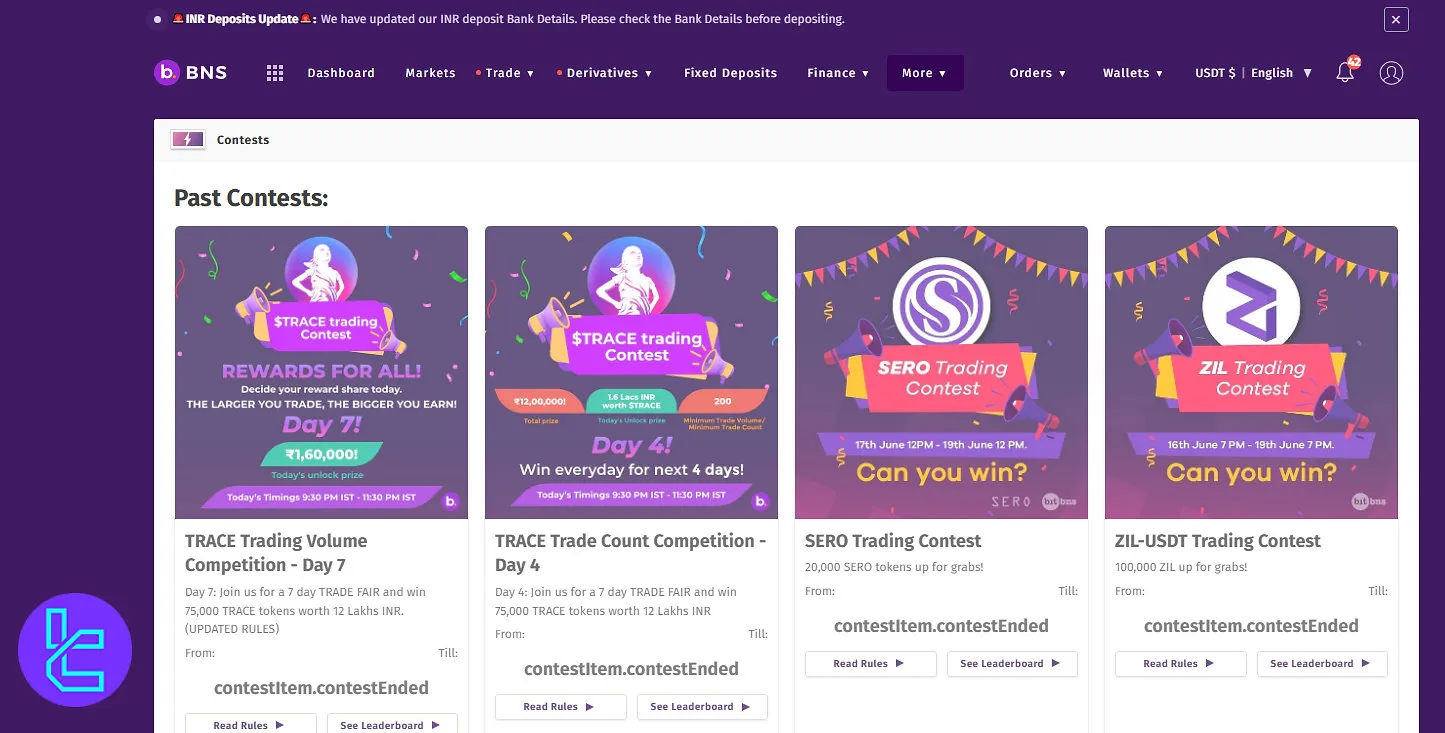

Trading Contests

Although Bitbns currently does not host live contests, it has previously organized several competitive trading events and is expected to relaunch them in the future. Past examples include:

- TRACE Trading Volume Competition: Win 75,000 TRACE tokens worth 12 Lakhs INR;

- TRACE Trade Count Competition: Part of the 7-day TRADE FAIR series;

- SERO Trading Contest: 20,000 SERO tokens distributed as rewards;

- ZIL-USDT Trading Contest: A prize pool of 100,000 ZIL tokens.

How to Reach Bitbns Customer Support?

We can consider Bitbns' customer support as its main weakness. The lack of a live chat feature can be a serious letdown for potential clients.

The exchange provides support through the following methods:

- Email: support@bitbns.com

- Ticket system

- FAQ section

Bitbns Copy Trading and Investment Plans

While the exchange doesn’t directly offer copy trading, it provides API Trading services for programmers through its Node and Python APIs and for novices with less coding knowledge via the Google Sheets API.

Bitbns also offers multiple investment opportunities, including:

- Margin Lenders: Interest rates for lending assets

- Bitdroplet: Systematic Investment Plan (SIP) in BTC, Gold, Silver, and ETH with a trade fee of 0.25%

- Staking: Fixed deposit products with APY of up to 15%

Prohibited Countries on Bitbns Exchange

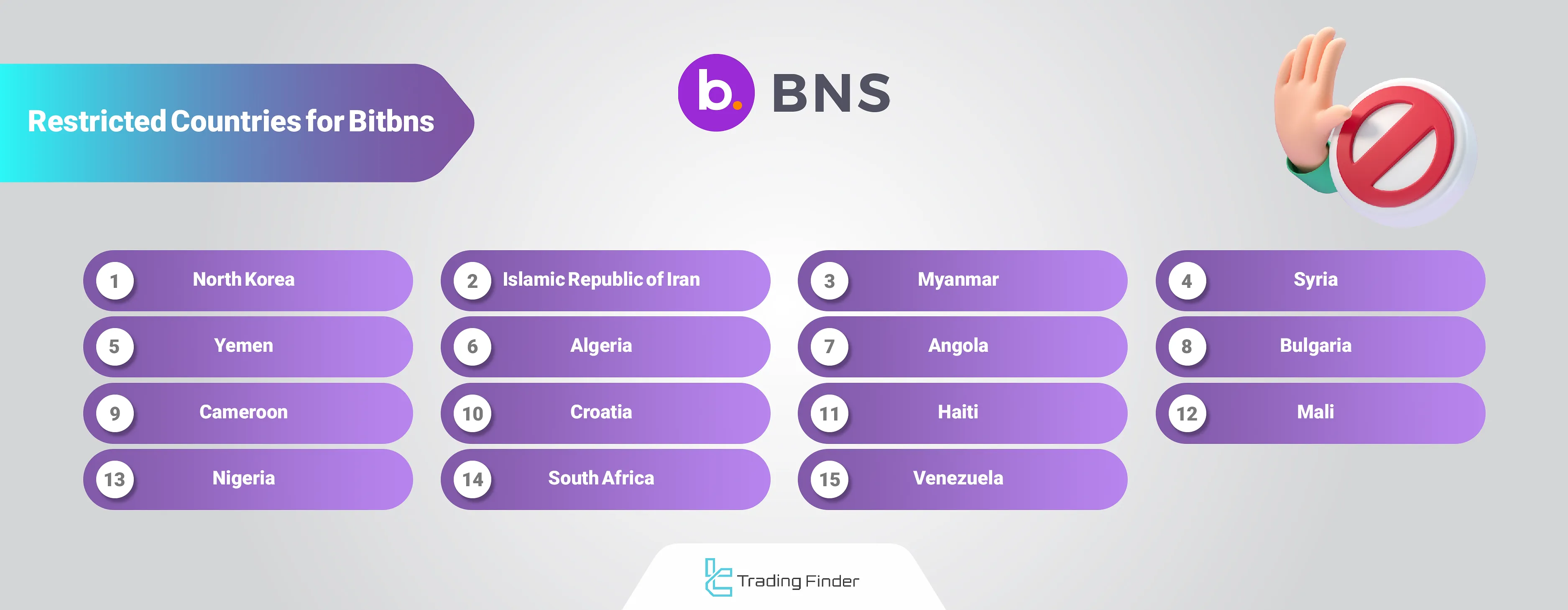

While the company strives to serve a global clientele, it requires clients not to belong to FATF-sanctioned countries, including:

- North Korea

- Iran

- Myanmar

- Syria

- Yemen

- Algeria

- Angola

- Bulgaria

- Cameroon

- Croatia

- Haiti

- Mali

- Nigeria

- South Africa

- Venezuela

Bitbns Comparison with Other Exchanges

Let's check Bitbns's services and features with top exchanges in the market:

Features | Bitbns Exchange | MEXC Exchange | BingX Exchange | Kucoin Exchange |

Number of Assets | 641+ | 2800+ | 800+ | 700+ |

Maximum Leverage | 1:10 | 1:200 | 1:125 | 1:100 |

Minimum Deposit | ₹100 | $1 | $1 | $1 |

Spot Maker Fee | 0.03% - 0.25% | 0.05% | 0.005% - 0.1% | From 0.005% |

Spot Taker Fee | 0.03% - 0.25% | 0.05% | 0.02% - 0.1% | From 0.025% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | No |

Writer’s Opinion and Conclusion

In conclusion, Bitbns stands out for offering leveraged trading up to 1:10 across Futures and Margin accounts on 40 cryptocurrency pairs, with Futures maker fees starting at 0% and taker fees at 0.1%.

Its ecosystem includes a Chrome and Firefox extension that monitors arbitrage opportunities across 5 major exchanges such as Binance, Kucoin, Gate.io, Huobi, and its own platform.

Traders can access crypto staking with annual percentage yields (APY) of up to 15%, and Bitdroplet SIPs allow systematic investment in BTC, ETH, Gold, and Silver, with a trade fee of 0.25% per transaction.