Over 13 years of operation, the platform has facilitated more than 400,000 BTC transactions and continues to serve thousands of users every day.

With a default 1.0% trading fee on the BL3P platform, Bitonic supports multiple payment methods, including iDEAL with 0% fees and Bancontact with a 0.5% deposit fee, allowing both small and large traders to transact seamlessly.

The platform offers a minimum deposit of €10, with a minimum trade size of €10, while its OTC desk caters to trades above €100,000, with fees decreasing incrementally from 0.9% for €200,000 orders down to 0.3% for trades above €5,000,000.

Bitonic; Introduction to the First Bitcoin Company in the Netherlands

Bitonic B.V. was founded on 1st May 2012 by Niels van Groningen and Robert de Waard.

Previously known as iDealCoin, the company is registered with theDutch Central Bank (DNB). Bitonic won the Dutch Fintech award in the Bitcoin category in 2015. Key features of Bitonic:

- Bits automated Bitcoin savings plan

- NL educational platform

- BL3P professional Bitcoin exchange

- Support for the Lightning Network

Notably, Bitonic has never experienced a successful hacking incident. While the platform does not offer an investor compensation scheme or U.S. regulatory coverage, it maintains high operational integrity.

KYC is required for all users, and service is restricted in sanctioned jurisdictions including the United States, Russia, Iran, North Korea, and over 50 others.

Bitonic CEO

Niels van Groningen is a Dutch entrepreneur and the co-founder of Bitonic.

Based on Niels van Groningen LinkedIn profile, before venturing into the cryptocurrency industry, Niels earned a degree in Artificial Intelligence and worked in tech support at KPN, a major Dutch telecommunications company.

His passion for programming and technology led him to co-found IQYOU, Kleiman & Van Groningen, and Entix, showcasing his diverse entrepreneurial spirit.

Under his leadership, Bitonic has become a pioneer in the Dutch crypto market, processing over 400,000 Bitcoins and facilitating seamless transactions through iDEAL, a popular Dutch payment method.

Bitonic Exchange Table of Specifications

The crypto exchange offers various services, including an OTC desk for high-volume traders (100K+) and the Bitonic Academy, which is in partnership with the Netherlands Ministry of Finance.

Exchange | Bitonic |

Launch Date | 2012 |

Levels | No |

Trading Fees | 1.0% |

Restricted Countries | North Korea, Iran, Syria, Libya, Somalia, South Sudan, Yemen, Democratic Republic of the Congo, Central African Republic, Eritrea, Guinea-Bissau, Iraq, Lebanon, Mali, Sudan, Russia, Belarus, Myanmar, United States |

Supported Coins | 1 |

Futures Trading | No |

Minimum Deposit | €10 |

Deposit Methods | iDEAL, Bancontact, SEPA, Bitcoin |

Withdrawal Methods | SEPA, Bitcoin |

Maximum Leverage | 1:1 |

Minimum Trade Size | €10 |

Security Factors | Self-Built Infrastructure, Segregated Accounts, Cold Wallets, Multi-Signature Wallets |

Services | Savings, Bitcoin.nl, Academy, OTC Desk |

Customer Support Ways | Email, Ticket, Telegram, Twitter, Call Center |

Customer Support Hours | 09:30 until 20:30 and during the weekend from 10:00 until 18:00 (GMT+2) |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

Bitonic Advantages and Disadvantages

Let's take a closer look at the pros and cons of using Bitonic for your Bitcoin trading needs.

Upsides | Downsides |

Long track record with over a decade of experience | Limited cryptocurrency options (only BTC) |

Fixed transaction fees | Mandatory bank account verification |

Automatic Bitcoin purchasing | No leverage trading |

Affiliate program | Geographical restrictions |

Bitonic User Levels

The exchange doesn't provide a traditional user level system for reduced fees on spot and futures futures markets. However, Bitonic offers fee reductions on OTC orders above €200,000 based on the order size.

Bitonic Exchange Pricing

Creating and maintaining an account on the platform is free of cost. Key points about Bitonic's fee structure:

Trading | 1.0% |

Bitonic Savings | 0.89% + €0.13 |

Instant Buy (iDEAL) | 0.99% + €0.56 |

Instant Buy (Bancontact) | 0.99% + €0.62 + 0.36% |

Instant Sell (SEPA) | 1.24% + €0.25 |

The exchange features an OTC desk for large trades (over €100,000). The OTC fees vary based on the order size:

Order Size | OTC Fee |

>= €200,000 | 0.9% |

>= €350,000 | 0.8% |

>= €500,000 | 0.7% |

>= €750,000 | 0.6% |

>= €1,000,000 | 0.5% |

>= €2,500,000 | 0.4% |

>= €5,000,000 | 0.3% |

While the platform charges no commissions on Bitcoin transactions, users must pay a network fee for withdrawals.

Available Digital Assets on Bitonic

The company is a Bitcoin-only exchange, which means it focuses solely on Bitcoin (BTC) trading against the euro (EUR).

This specialization allows Bitonic to provide deep liquidity and expertise in Bitcoin trading, but it may not be suitable for users looking to diversify their cryptocurrency portfolio.

Leveraged Trading on Bitonic

At the time of writing this Bitonic review, the exchange does not offer leveraged trading options. The maximum leverage available on the platform is 1:1, which means users can only trade with the funds they have deposited.

Bitonic Exchange Registration and Verification

To start trading on Bitonic, users must be above 18 and complete a Know Your Customer (KYC) verification process.

The platform emphasizes financial transparency, requiring proof of identity, address, and income before granting trading access.

Here's an overview of the steps to Bitonic registration:

#1 Access the Bitonic Website

Navigate to the official Bitonic exchange homepage and click on “Create Account” to begin registration.

#2 Email and Phone Verification

Submit a valid email address and mobile number. A verification link and code will be sent to complete this step.

After clicking on the link, your account will be created.

#3 Submit Verification Documents

Upload:

- Proof of ID (passport or government-issued ID)

- Proof of residence (utility bill or recent bank statement)

- Proof of income (such as an annual income declaration)

Once documents are reviewed and approved, your account will be activated for full trading access.

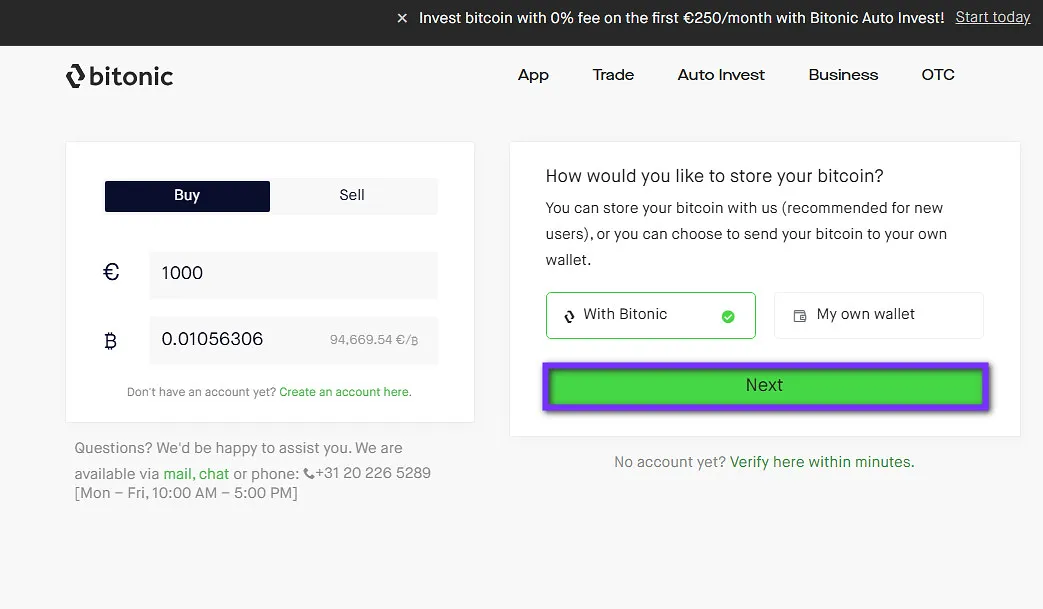

How to Trade on Bitonic

Bitonic is all about simplicity in trading. Therefore, buying or selling Bitcoin in the Bitonic exchange won’t be hard at all. Simply follow these steps:

#1 Enter the Exchange

On the homepage of the platform, click on “Trade” from the top menu.

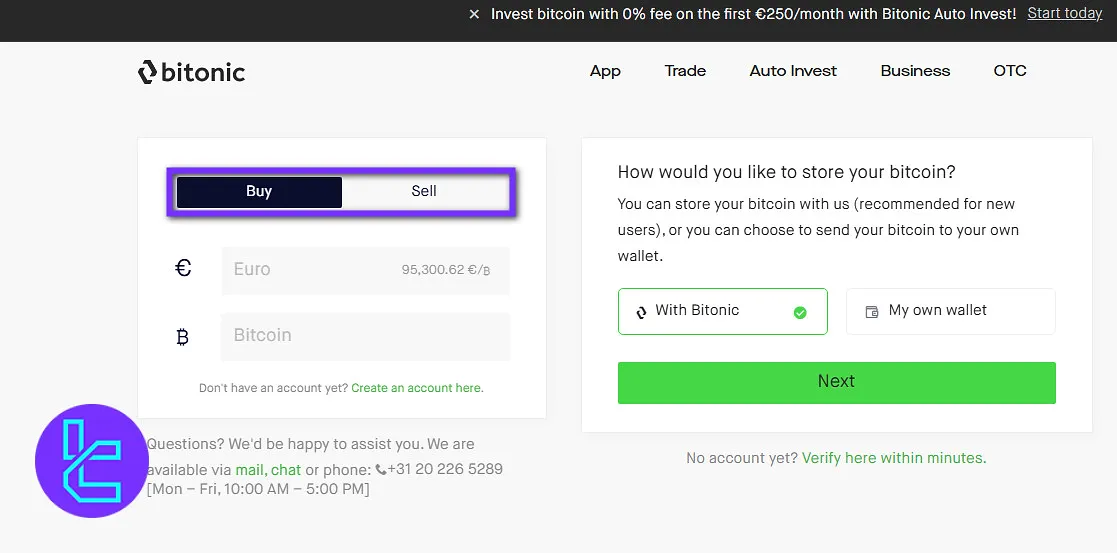

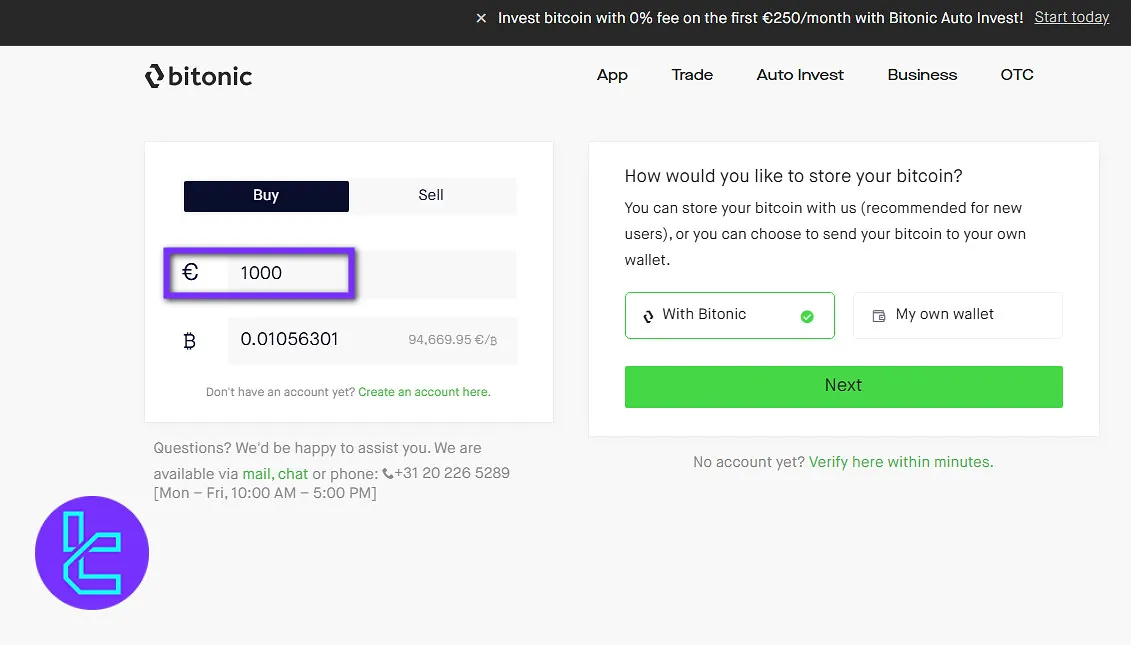

#2 Select Sell or Buy

Now you should select “Buy” if you want to buy Bitcoin and click on “Sell” if you want to sell it.

#3 Enter the Amount

Now, you need to enter the amount of cryptocurrency you are willing to buy or sell.

#4 Confirm the Trade

Now select “Next” and follow to on-screen instructions to confirm the trade.

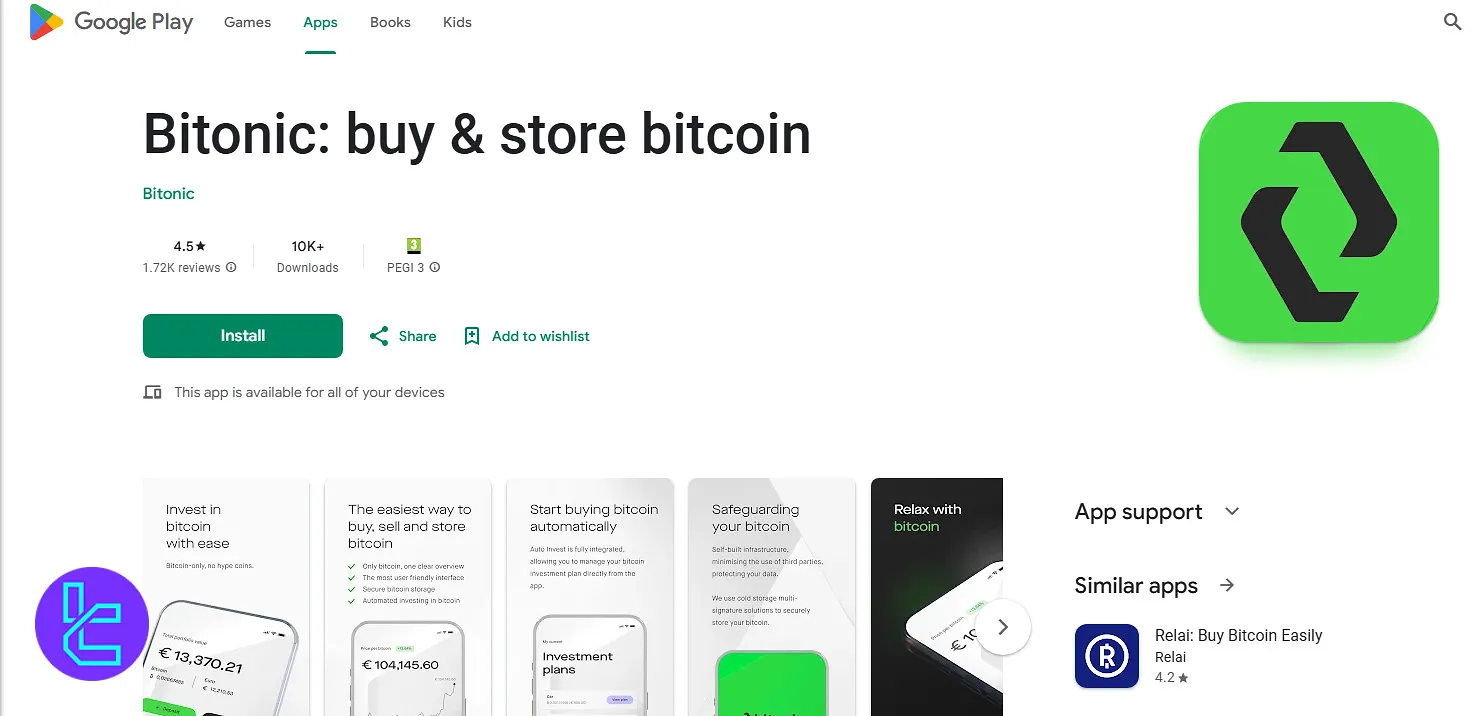

Bitonic App and Trading Platform

The exchange has developed a trade engine called BL3P, which is available via the web platform and mobile apps.

Both platforms provide a straightforward experience for Bitcoin trading, focusing on simplicity and ease of use. The absence of other cryptocurrencies helps keep the interface clutter-free and user-friendly.

It's worth noting that BL3P lacks integrations with TradingView, algorithmic bots, or multi-asset charting tools.

Bitonic Services

Using the table below, you can check if your favorite trading service is available on Bitonic or not:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

Bitonic Safety and Security

The exchange has built its infrastructure with servers in the Netherlands, ensuring privacy and protecting data from foreign regulations. Bitonic security measures:

- Two-factor authentication (2FA)

- Multi-signature and cold storage

- Segregated user funds

- Regulatory compliance (Registered with the Dutch Central Bank)

Bitonic Funding and Withdrawal

The exchange supports EUR and Bitcoin payments and processes them via various channels, including:

Payment Method | Deposit Fee | Withdrawal Fee |

iDEAL | None | Not Available |

Bancontact | 0.5% | Not Available |

Manual SEPA | None | Not Available |

Easy SEPA | 0.5% | Not Available |

Bitcoin | None | Not Available |

EUR (Bank Transfer) | Not Available | None |

Bitcoin | Not Available | Network fee |

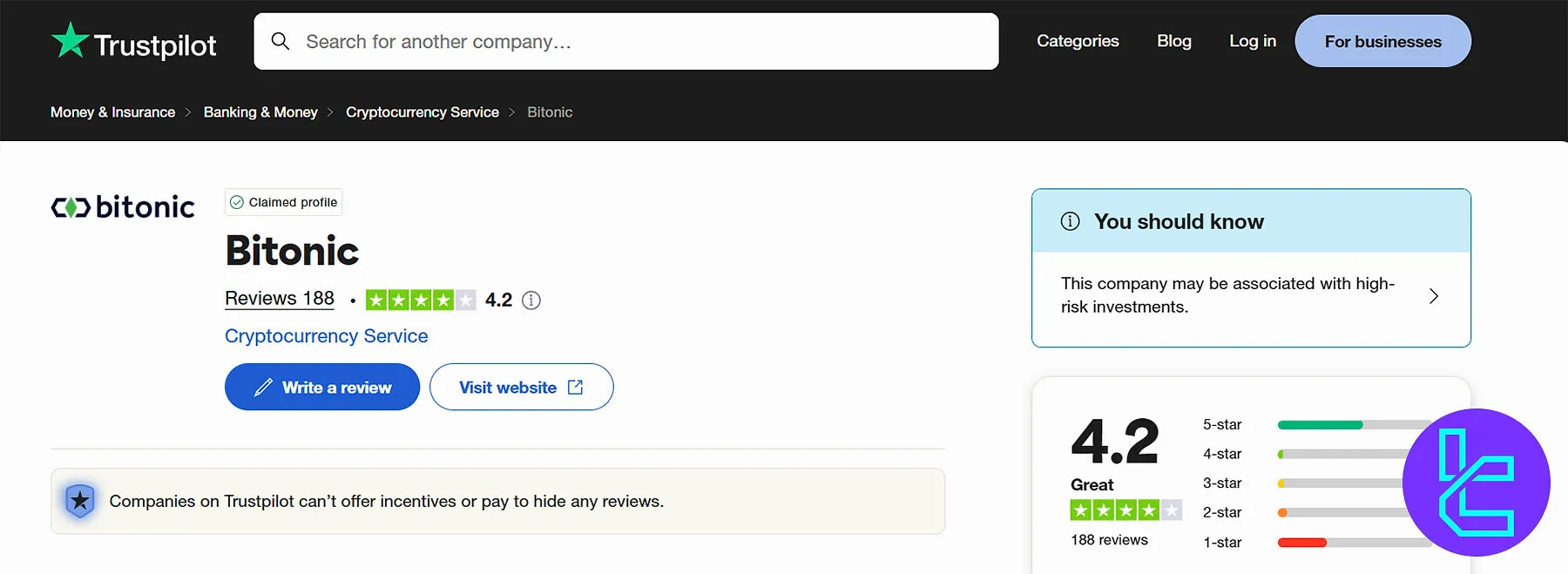

Bitonic Exchange Ratings

The Bitonic Trustpilot profile has received excellent feedback with a score of 4.2 out of 5. The exchange is also featured on Google Reviews and has a good score.

Trustpilot | 4.2/5 based on 188 reviews |

Google Reviews | 3.7/5 based on 113 comments |

58% of Bitonic reviews on TP are positive (4-star and 5-star), and only 38% are negative (1-star and 2-star).

Bitonic Features

This section provides an overview of the exchange's additional services:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

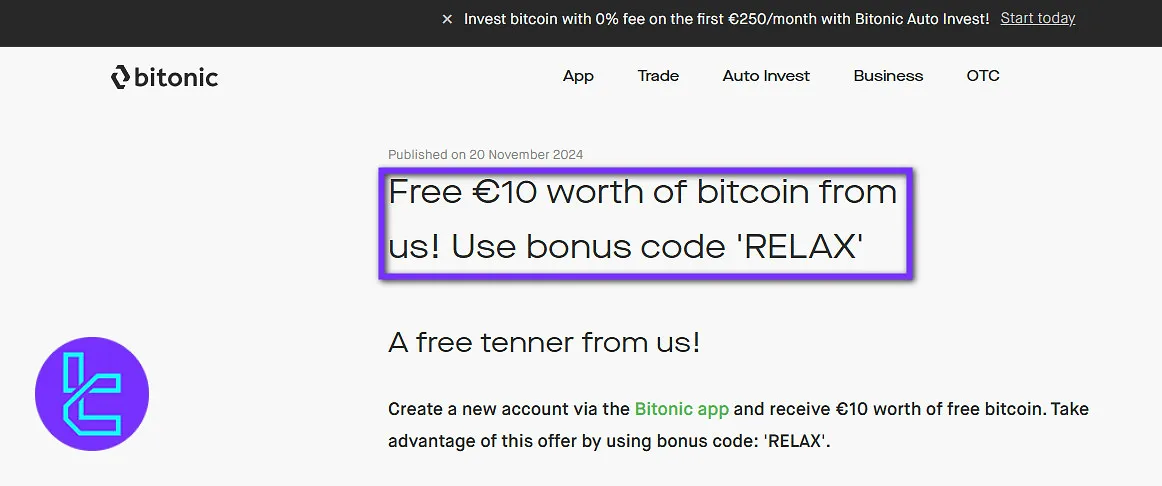

Bitonic Bonus

Bitonic is rewarding its users with exciting bonus opportunities! Here are the details:

Bonus Type | How to Claim | Requirements | Reward |

New User Bonus | Create an account via the Bitonic app, deposit €100, trade €100, enter code ‘RELAX’ | Minimum €100 deposit & €100 trade (can be multiple transactions) | €10 worth of Bitcoin |

Referral Bonus | Share your unique referral link/code, referral signs up, deposits & trades €100 | Referral must trade €100 within 30 days | €10 Bitcoin for both referrer & referee |

Welcome Bonus

New customers can receive €10 worth of free Bitcoin by creating an account via the Bitonic app, making a minimum deposit of €100, and trading at least €100 in Bitcoin.

Once these requirements are met, users can enter the bonus code ‘RELAX’, and the €10 Bitcoin reward will be automatically credited to their account.

Only new users or existing users who have not yet traded can claim this bonus, and the trading requirement can be fulfilled through multiple transactions.

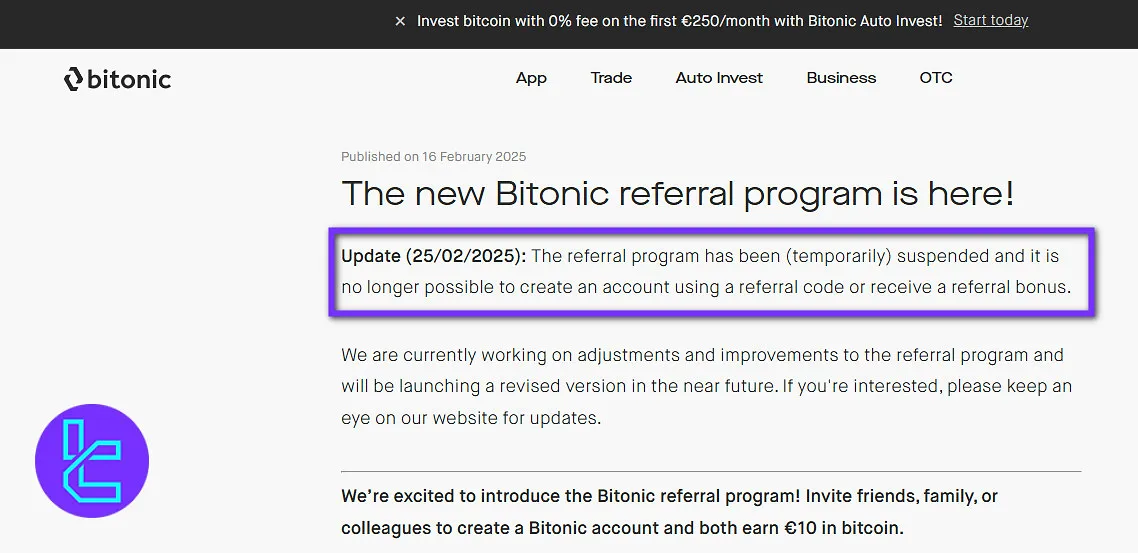

Referral Bonus

Bitonic has a referral program that allows users to earn €10 in Bitcoin for themselves and their friends. By sharing a unique referral link or code, Bitonic users can invite friends, family, or colleagues to create an account.

When the referral signs up, deposits, and trades €100 within 30 days, both the referrer and the referee will receive €10 in bitcoin. This process is fully automated, making it fast and simple to earn extra Bitcoin without additional effort.

Currently, the referral program is temporarily suspended for adjustments, but a revised version will be launched soon.

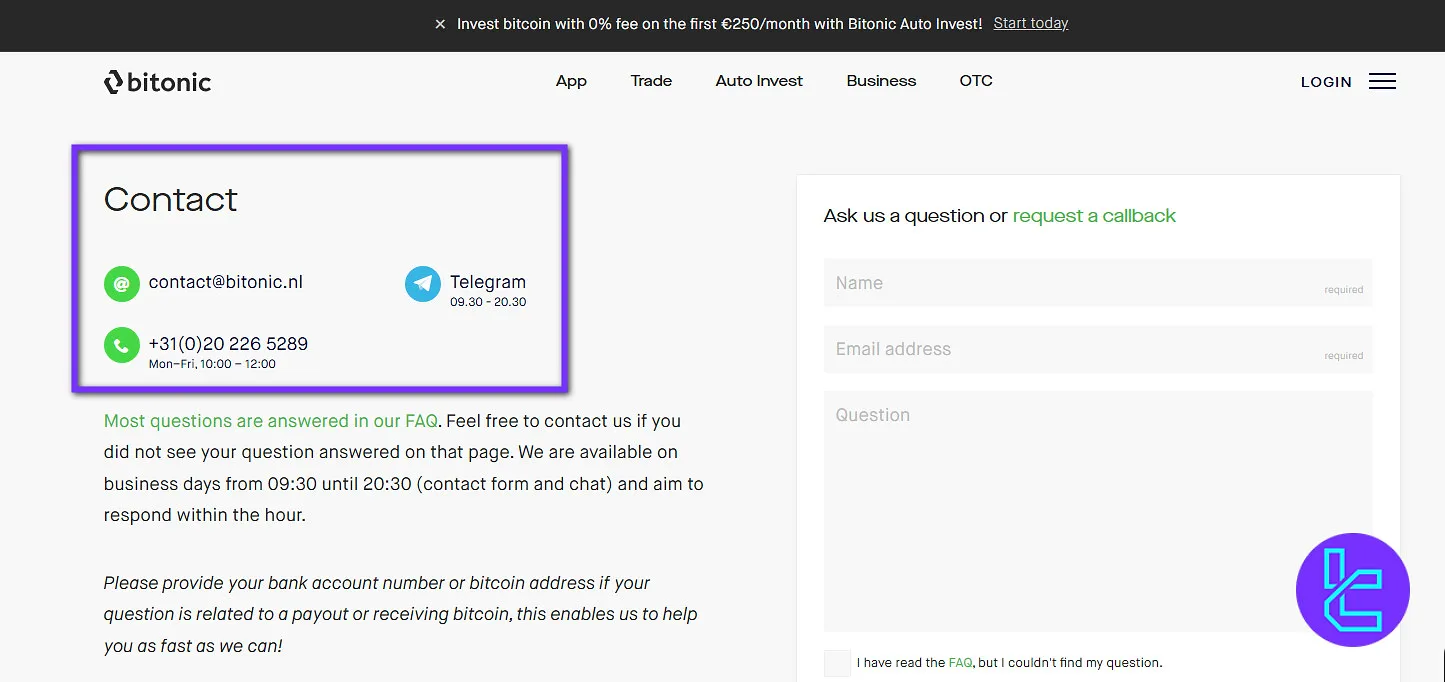

Bitonic Support Channels

The company provides support every day from 09:30 until 20:30 and during the weekend from 10:00 until 18:00 through various channels, including:

- Email: contact@bitonic.nl

- Phone: +31(0)202265289

- Bitonic Telegram Support

- Bitonic Twitter Support

Note that the call center is available Monday to Friday from 10:00 to 17:00 (GMT+2).

Does Bitonic Offer Investment or Growth Plans?

While Bitonic doesn't offer traditional investment or growth plans, it does provide a Bitcoin Savings program that can help users accumulate BTC over time.

Bitonic Savings is an automated Bitcoin savings plan that allows users to purchase small amounts of Bitcoin regularly (daily, weekly, or monthly) with a minimum requirement of €5.

The exchange also features a referral program that rewards the affiliate and the new user with €10 in Bitcoin.

Prohibited Countries on Bitonic

The company doesn’t accept clients from countries sanctioned by the Netherlands, the European Union, or the United Nations, including:

- North Korea

- Iran

- Syria

- Libya

- Somalia

- South Sudan

- Yemen

- Democratic Republic of the Congo

- Central African Republic

- Eritrea

- Guinea-Bissau

- Iraq

- Lebanon

- Mali

- Sudan

- Russia

- Belarus

- Myanmar

- United States

Bitonic Compared to Other Platforms

The table in this section provides a fair comparison:

Features | Bitonic Exchange | HTX Exchange | LBank Exchange | Bybit Exchange |

Number of Assets | 1 (Only Bitcoin) | 700+ | 700+ | 1300+ |

Maximum Leverage | 1:1 | 1:200 | 1:125 | 1:100 |

Minimum Deposit | €10 | $1 | Varies by Cryptocurrency | Varies by Cryptocurrency |

Spot Maker Fee | 1% | From 0.02% | 0.02% | 0.005% - 0.1% |

Spot Taker Fee | 1% | From 0.02% | 0.02% | 0.015% - 0.1% |

Mandatory KYC | Yes | Yes | No | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Final Words

With a minimum €10 deposit, trades starting from €10, and support for recurring Bitcoin purchases, users can accumulate BTC steadily over time. The OTC desk supports trades up to €5,000,000, with fees ranging from 0.9% to 0.3% depending on the order size.

The exchange has facilitated BTC trading worth hundreds of millions of euros and maintains positive user ratings, including a 4.2/5 Trustpilot score and a 3.7/5 rating on Google Reviews.

For those seeking a regulated, secure, and professional Bitcoin platform in Europe, Bitonic stands as a reliable option with over 13 years of experience, 400,000 BTC processed, and millions of euros in cumulative trade value.