Bitso has established itself as one of the leading cryptocurrency exchanges in Latin America, listing over 50 cryptocurrencies with trading fees ranging from 0.04% to 0.25% for makers and 0.05% to 0.30% for takers in the USD market.

Bitso now serves more than 8 million global users and facilitates 3 billion+ international cryptocurrency transfers.

The platform supports 1,700+ corporate clients and has obtained licenses in Mexico, Brazil, and Argentina, while also being licensed by the Gibraltar Financial Services Commission (GFSC).

Bitso: Crypto Exchange Information

BITSO SAPI de CV is one of the leading crypto exchanges in LATAM. Ben Peters, Daniel Vogel, and Pablo Gonzalez founded the company in January 2014 as a Mexican start-up.

Led by CEO Daniel Vogel, the exchange has acquired licenses in Mexico, Brazil,and Argentina. Bitso Key Features:

- 3B+ cryptocurrency international transfers

- 8M+ global users

- 1,700+ corporate clients

Bitso's mission is clear: to bring cryptocurrencies to the mainstream in Latin America by providing a user-friendly, compliant, and secure trading platform for investors across the region.

The exchange is notably the first Latin American crypto company licensed under the Distributed Ledger Technology framework by the Gibraltar Financial Services Commission (GFSC).

Bitso CEO and Co-Founder

Daniel Vogel is the CEO and Co-Founder of Bitso, Mexico’s leading cryptocurrency exchange, where he has led the company since December 2017.

Under his guidance, Bitso has become the top choice for trading Bitcoin and Ripple in Mexico, offering advanced banking integrations, industry-leading security, and strong regulatory compliance.

Based on Daniel Vogel LinkedIn page, beyond Bitso, Daniel is a partner at Xochi Ventures and Bridge Latam, and a board member of FinTech México, supporting Latin America’s fintech ecosystem.

Bitso Exchange Specific Features

What sets Bitso apart from other crypto exchanges? Let's dive into some of its standout features.

Exchange | Bitso |

Launch Date | 2014 |

Levels | Variable based on the base currency |

Trading Fees | Variable based on the base currency |

Restricted Countries | 33 jurisdictions, including the USA |

Supported Coins | 50+ |

Futures Trading | No |

Minimum Deposit | N/A |

Deposit Methods | Crypto, Mexican Pesos, Argentinian Pesos, Digital Dollars (USDC), Brazilian Reais, Colombian Pesos |

Withdrawal Methods | Crypto, Mexican Pesos, Argentinian Pesos, Digital Dollars (USDC), Brazilian Reais, Colombian Pesos |

Maximum Leverage | 1:1 |

Minimum Trade Size | $10 |

Security Factors | Insurance-backed guarantee by Coincover, 2FA, Proof of Reserve |

Services | Alpha Pro, Earnings, Bitso Card |

Customer Support Ways | Live Chat |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | Market |

Native Token | None |

Bitso Advantages and Disadvantages

While the platform offers various features, including a Debit card service with MXN as its base currency (withdrawable from ATMs around the globe), it also has some weaknesses.

Pros | Cons |

Multi-layered security approach | Geo-restrictions |

Volume-based fee discounts | Region-specific services (Bitso card is only available for residents in Mexico) |

Regulatory compliance | No futures trading |

User-Friendly interface | Limited support channels |

Bitso User Levels

The exchange supports various base currencies for its trading pairs, including USD, MXN, BTC, BRL, ARS, DAI, USDT, and COP. Each market comes with different user levels and trading fees.

USD (USDC) Market

- 11 volume-based user levels from $0 to $30M

- Maker fees: from 0.04% to 0.25%

- Taker fees: from 0.05% to 0.30%

BTC Market

- 10 user levels with trading volumes of up to 950+

- Maker fees: from 0.05% to 0.075%

- Taker fees: from 0.065% to 0.098%

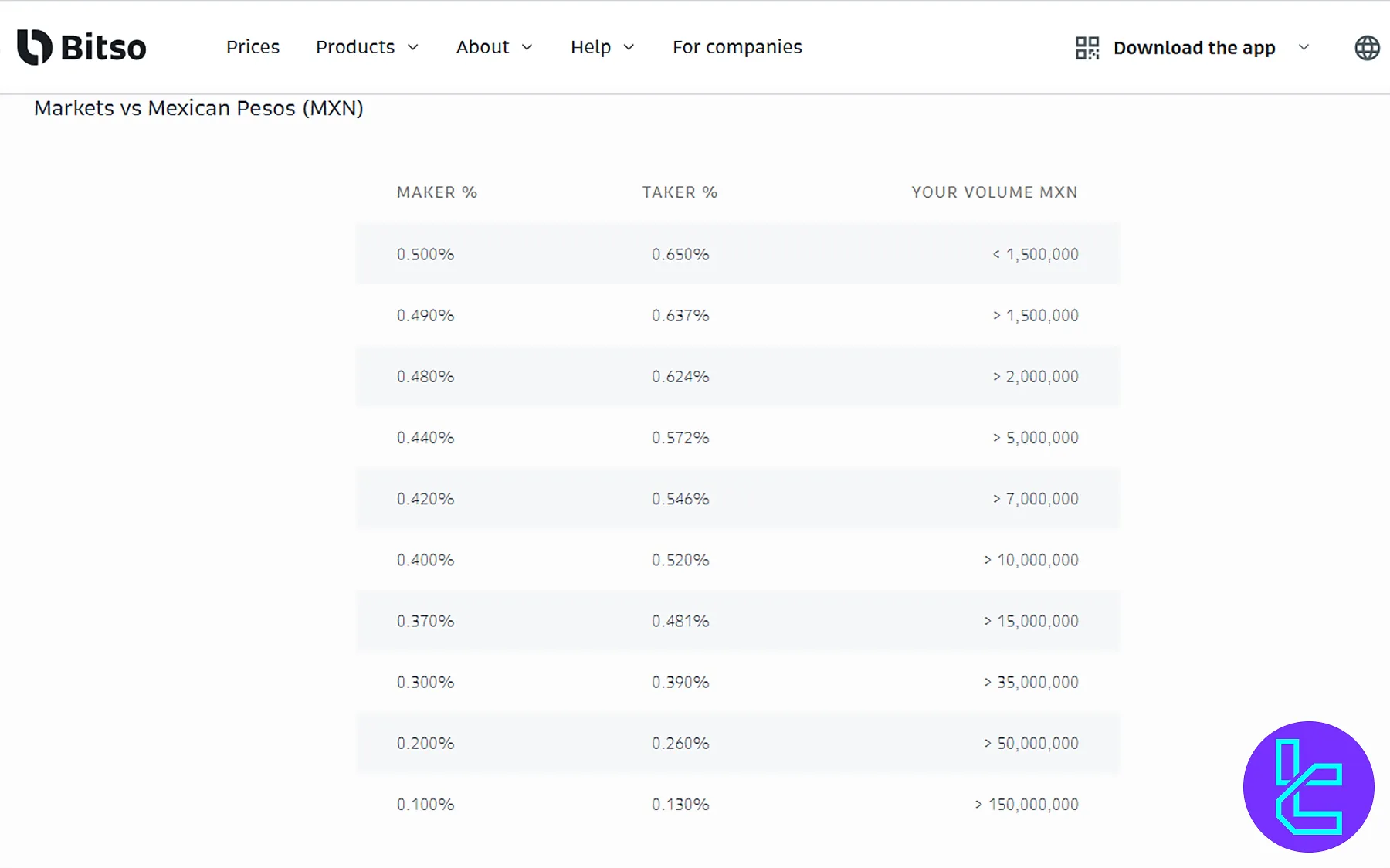

Mexican Pesos (MXN) Market

- 10 levels with trading volumes ranging from 0.0 to 150M+

- Maker fees: from 0.10% to 0.50%

- Taker fees: from 0.13% to 0.65%

Brazilian Reais (BRL) Market

- 10 user levels with trading volumes of up to 162.3M

- Maker fees: from 0.08% to 0.20%

- Taker fees: from 0.15% to 0.40%

Argentinian Pesos (ARS) Market

- 10 levels ranging from 0.0 to 3.9B+

- Maker fees: from 0.10% to 0.45%

- Taker fees: from 0.15% to 0.60%

DAI Market

- 10 user levels with trading volumes ranging from 0.0 to 19.5M+

- Maker fees: from 0.08% to 0.25%

- Taker fees: from 0.10% to 0.30%

Colombian Pesos (COP) Market

- 13 levels with trading volumes of up to 190B+

- Maker fees: from 0.12% to 0.50%

- Taker fees: from 0.17% to 0.65%

The platform also provides a USDT market with different user levels:

Trading Volume USDT | Maker | Taker |

< 500,000 | 0.095% | 0.099% |

> 500,000 | 0.090% | 0.099% |

> 1,000,000 | 0.084% | 0.099% |

> 1,500,000 | 0.080% | 0.095% |

> 3,000,000 | 0.075% | 0.090% |

> 5,000,000 | 0.069% | 0.080% |

> 10,000,000 | 0.060% | 0.069% |

> 15,000,000 | 0.050% | 0.060% |

> 20,000,000 | 0.040% | 0.050% |

Fees and Commissions

As mentioned in the previous section of this Bitso review, the platform offers eight different crypto trading markets with varying trading fees and discount percentages.

In the table below, we gather the trading fees for the USD market.

Trading Volume USD | Maker | Taker |

< 1,000 | 0.250% | 0.300% |

> 1,000 | 0.210% | 0.260% |

> 5,000 | 0.180% | 0.220% |

> 10,000 | 0.150% | 0.190% |

> 50,000 | 0.120% | 0.160% |

> 100,000 | 0.100% | 0.120% |

> 1,000,000 | 0.085% | 0.095% |

> 5,000,000 | 0.072% | 0.082% |

> 10,000,000 | 0.060% | 0.069% |

> 20,000,000 | 0.050% | 0.060% |

> 30,000,000 | 0.040% | 0.050% |

While the exchange charges no commissions forcrypto deposits and fiat transactions, crypto withdrawals have fees that vary depending on the currency.

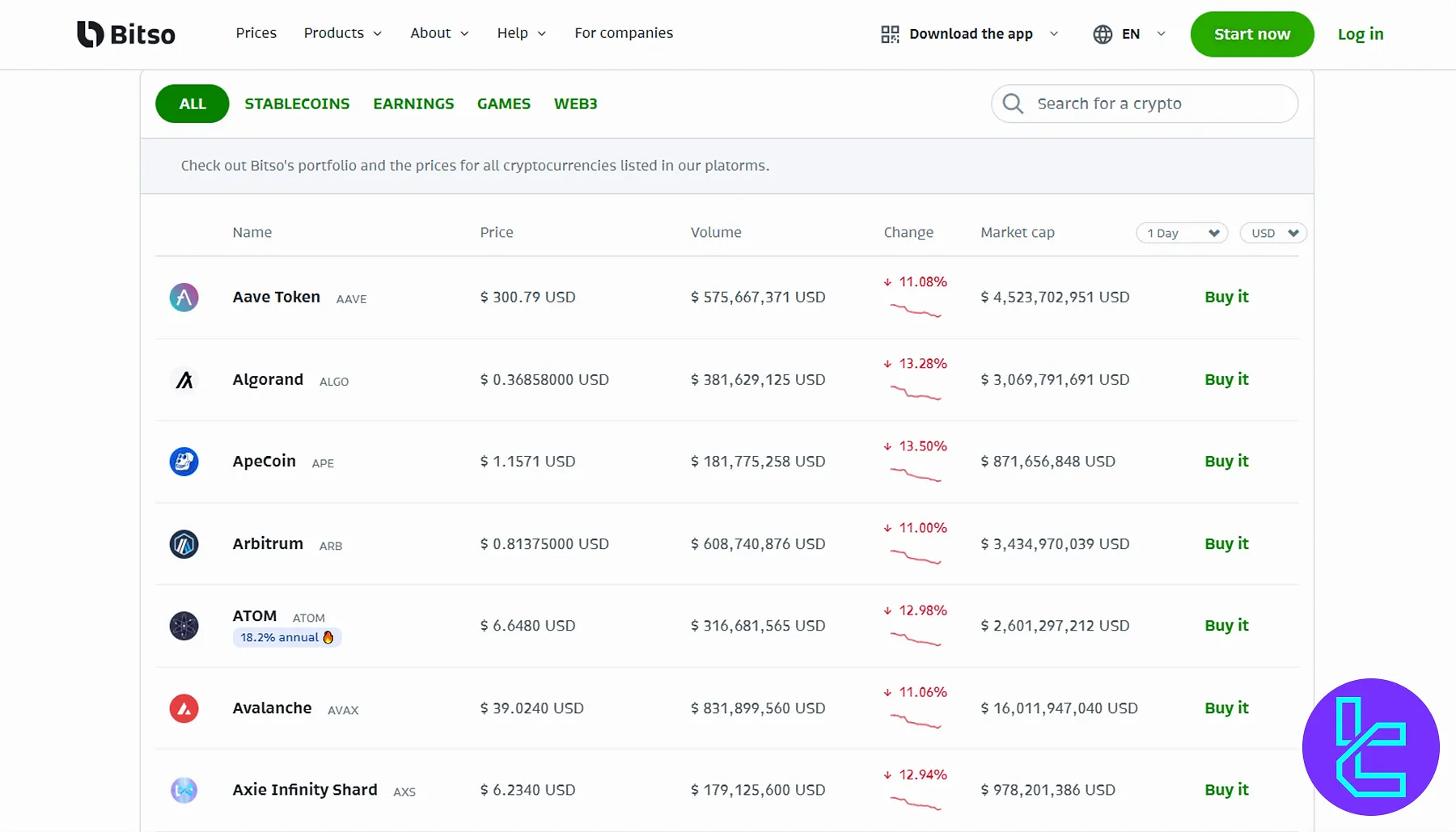

Bitso Exchange Crypto Offerings

The platform has listed over 50 popular cryptocurrencies in 4 categories, including Stablecoins, Games, Web3, and Earnings.

- DAI

- USDC

- USDT

- ADA

- ATOM

- APE

- GALA

- LINK

- SHIB

Futures and Margin Trading

The exchange doesn’t support Futures contracts or leveraged trading. It focuses on spot trading and provides a seamless experience through the Alpha Pro platform.

Leverage allows traders to potentially amplify their gains, but it also comes with increased risk. Thus, the lack of such services can potentially benefit novice traders.

Bitso Registration and Verification

In this Bitso review, we would like to note that to use the platform, you must be at least 18 years old, have a valid and current identification document, and operate within permitted jurisdictions. Here are the Bitso Registration and verification steps:

#1 Create Your Bitso Account

Start by visiting the official Bitso website and selecting the “Start Now” option to begin registration.

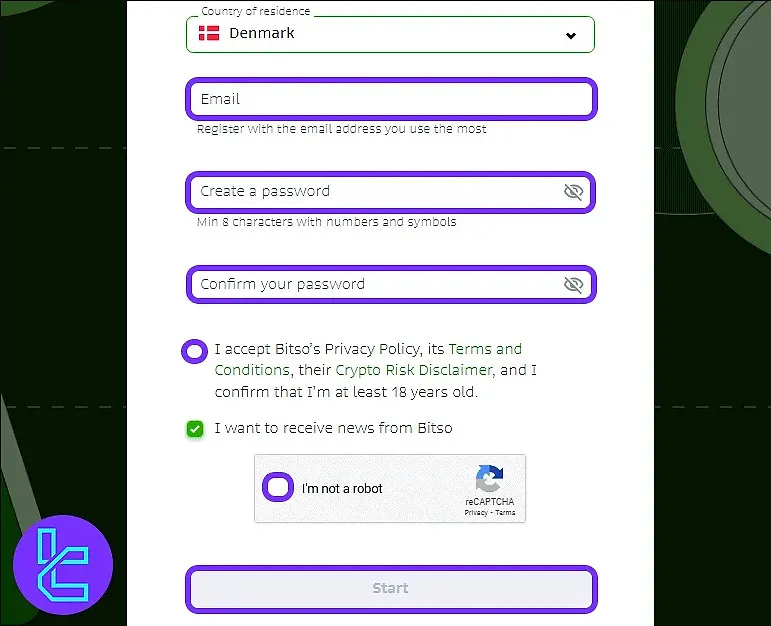

#2 Submit Registration Details

Enter your basic personal information, including name, email address, and password, to set up your account.

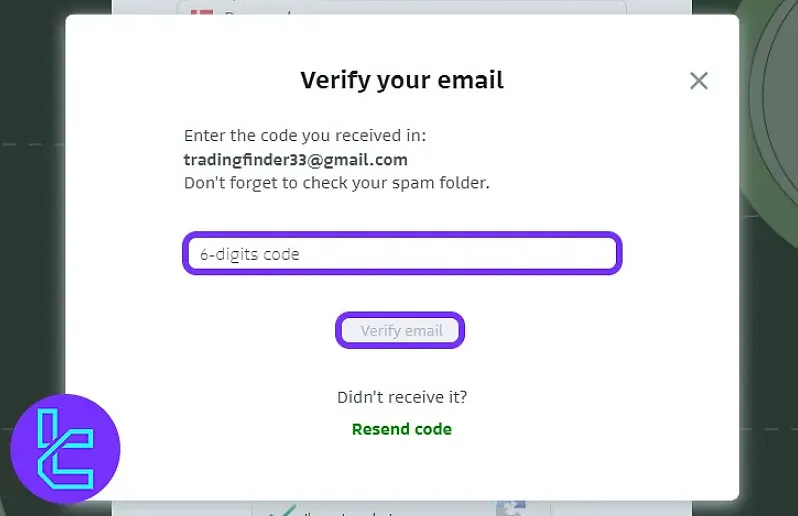

#3 Verify Email and Phone

Confirm your email address by clicking the link sent to your inbox, and then proceed to validate your mobile number.

#4 Complete Identity Verification

Upload proof of identity (passport or driver’s license) and proof of address (such as a utility bill or bank statement) to complete the KYC verification and gain access to full platform features.

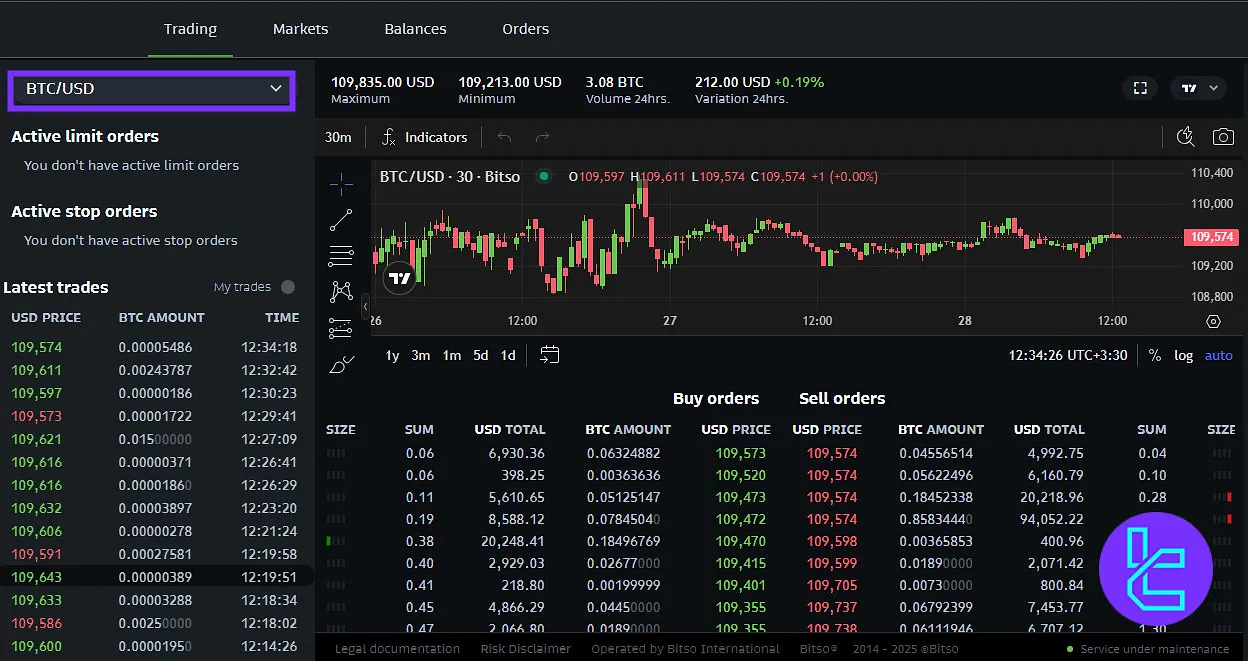

How to Trade on Bitso

Trading on Bitso is quite easy and you only need to follow these steps after registration and verification:

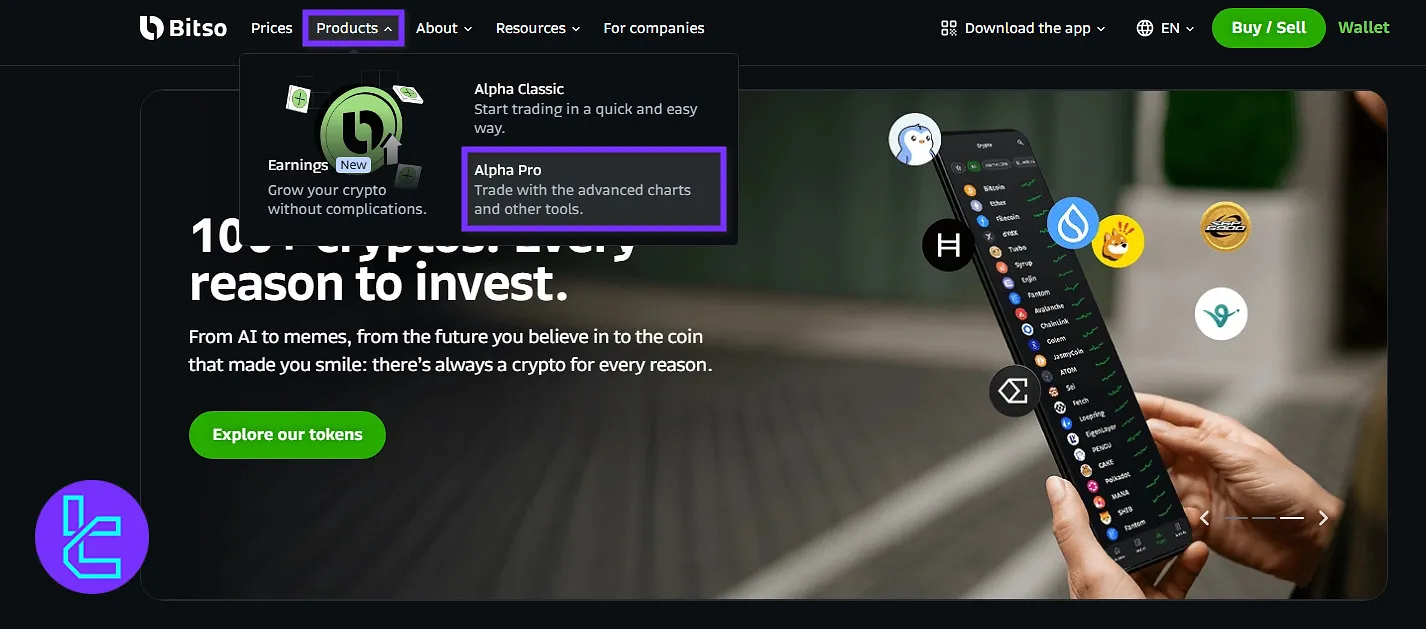

#1 Start Trading

To start the process, on the homepage of Bitso, click on “Products” and then select “Alpha Pro”.

#2 Choose a Trading Pair

Now, from the left side, you can click on the current trading pair and select your preferred one from the list.

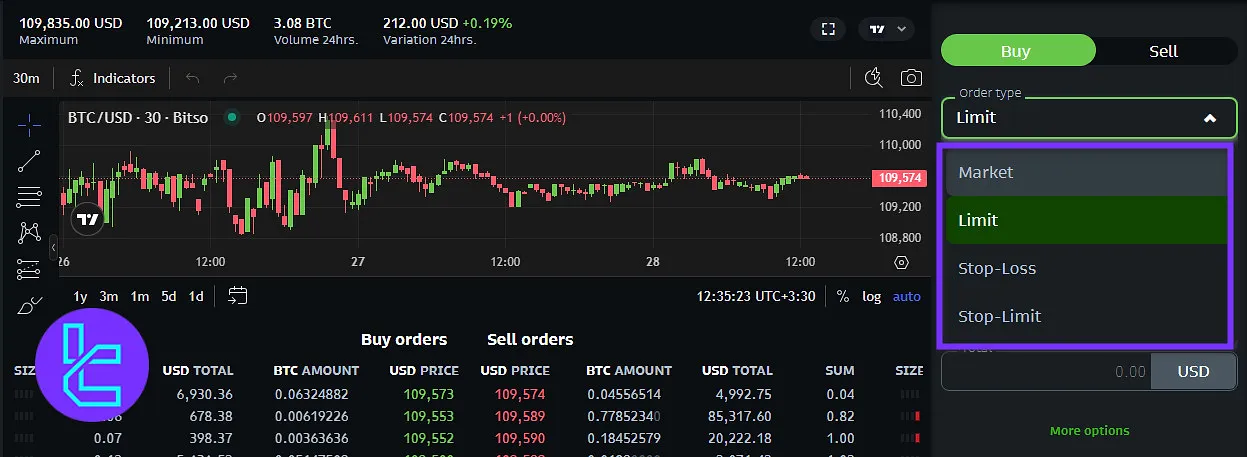

#3 Pick an Order Type

It’s time to pick an order type. Bitso offers limit, market, stop-loss, and stop-limit orders.

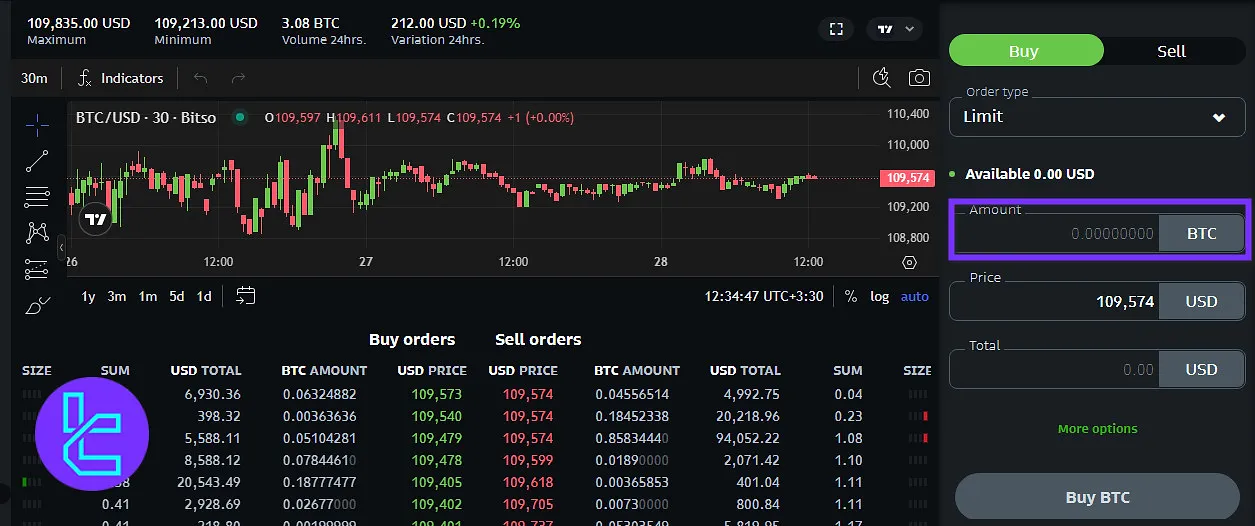

#4 Specify the Amount

Now, you need to enter the trading volume in the “Amount” section.

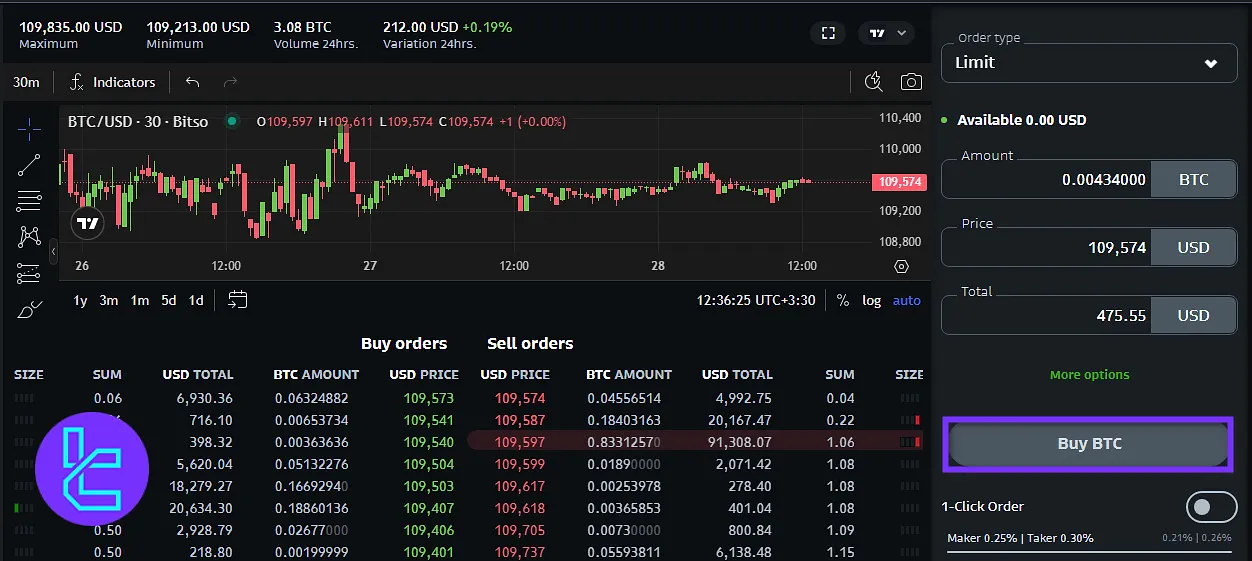

#5 Confirm the Trade

Finally click on “Buy” or “Sell” to finalize the trade.

Apps and Platforms

Bitso has developed 2 distinguished mobile applications, one for simple buy/sell and the Alpha for crypto trading with advanced TradingView charting tools and order types (e.g., Limit, Stop-Loss, and Stop-Limit).

TradingFinder has developed a wide range of TradingView indicators that you can access for free.

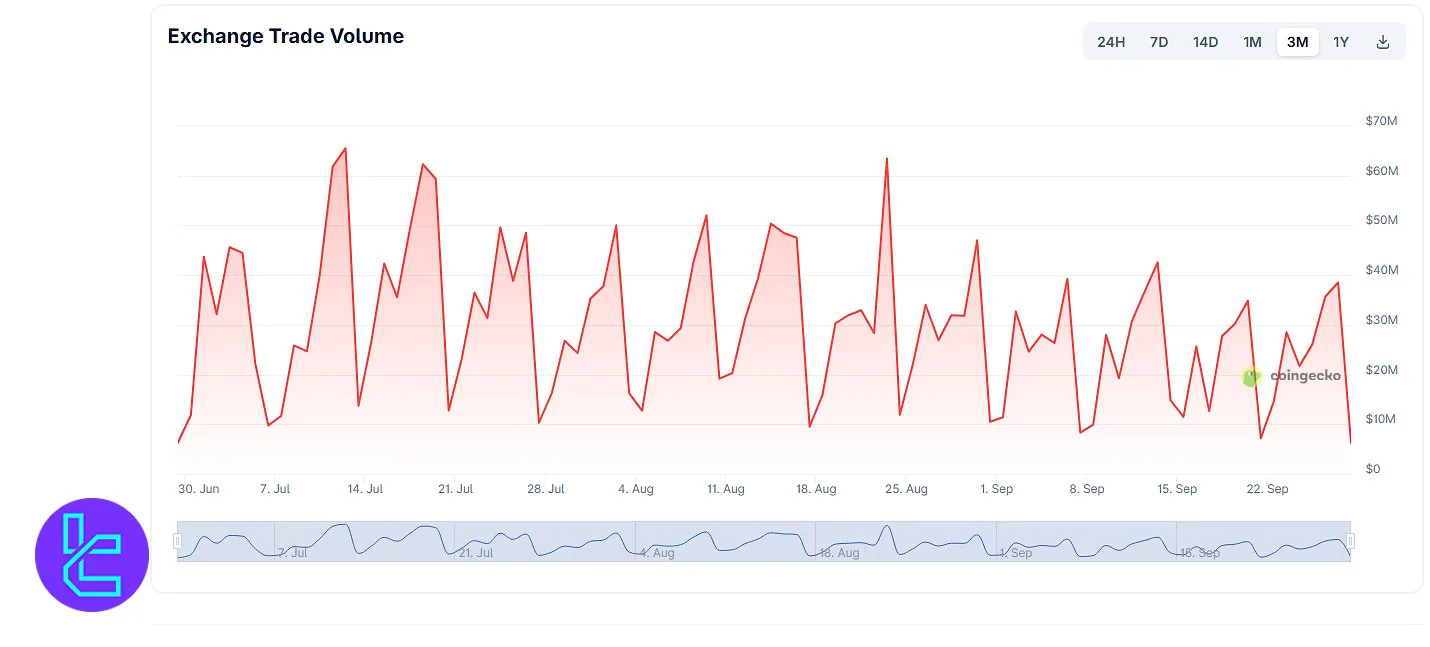

Bitso Trading Volume

Bitso has demonstrated consistent activity in its exchange trade volume over the past three months, with daily peaks frequently surpassing the $40M–$60M range.

According to the Bitso CoinGecko chart, the platform shows strong liquidity fluctuations, where trading volumes occasionally approach the $70M mark, reflecting both retail and institutional engagement.

Despite visible dips, the overall trend underscores Bitso’s active user base and market participation.

With its growing ecosystem and consistent transaction flow, Bitso continues to stand as one of the leading Latin American exchanges in terms of volume reliability and market trust.

Bitso Services

Check out the available trading services on the Bitso exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Safety and Security

The platform prioritizes the safety of user funds and data. Bitso claims to be the first company in Latin America to obtain a crypto license for both custody and trading.

The Bitso GFSC license is under the name “Badger Technology Company Limited” with incorporation No. 117775. The exchange has also implemented multiple safety factors, including:

- Multi-Signature Accounts

- Two-Factor Authentication (2FA)

- Insurance Coverage by Coincover

- Proof of Reserve

The platform has not suffered any confirmed hacks to date.

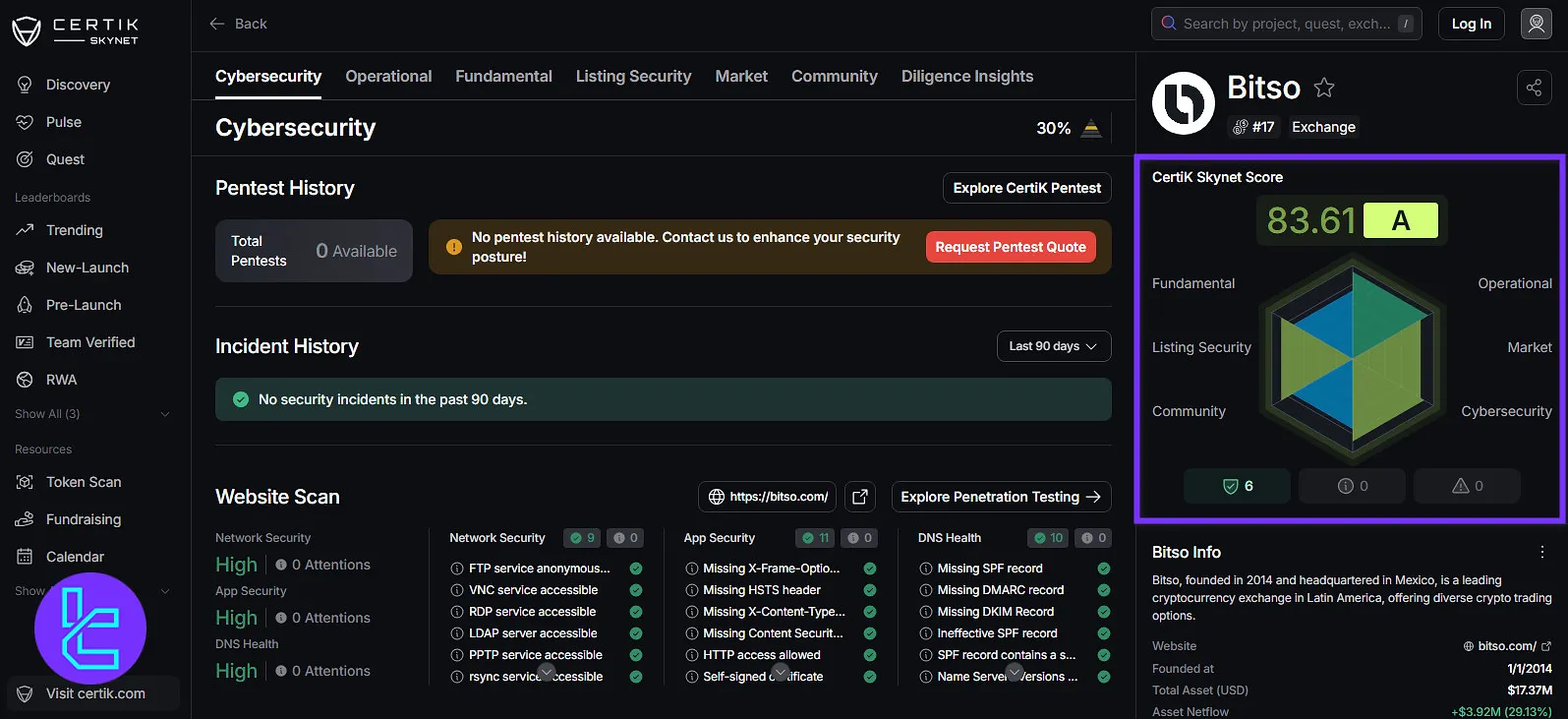

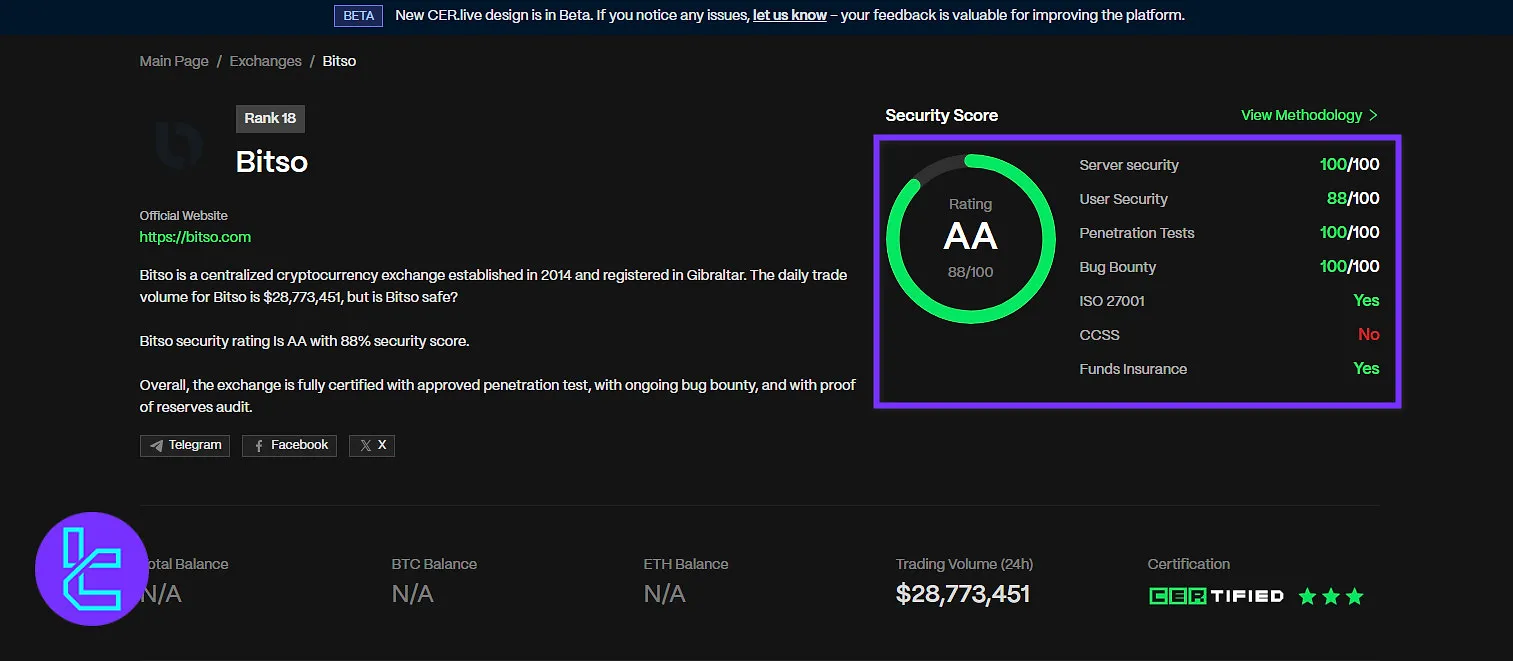

Bitso Security Rankings

Bitso holds a CertiK Skynet overall score of 83.61/100 (Grade A). The Bitso CertiK Skynet review reveals a 73.49 in fundamentals, 93.45 in operational security, 88.43 in listing security, 84.10 in market factors, 74.98 in community trust, and 88.24 in cybersecurity.

These numbers reflect a well-balanced security posture with particularly strong operational and cybersecurity measures.

Based on the Bitso CER.live review, the exchange achieves an even stronger overall score of 88% (Grade AA).

Specific highlights include a perfect 100/100 in server security, 100/100 in penetration testing, and 100/100 in bug bounty implementation.

User security stands at 88/100, while institutional safeguards include ISO 27001 certification and funds insurance. The only noted limitation is the absence of CCSS certification.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 83.61 / 100 (A) |

Fundamental | 73.49 | |

Operational | 93.45 | |

Listing Security | 88.43 | |

Market | 84.10 | |

Community | 74.98 | |

Cybersecurity | 88.24 | |

CER.live Score | Overall Score | 88% (AA) |

Server Security | 100/100 | |

User Security | 88/100 | |

Penetration Tests | 100/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Bitso Deposit and Withdrawal

The exchange supports crypto and fiat transactions for moving funds in and out of the platform.

Currency | Deposit Methods | Withdrawal Methods |

Mexican Pesos | Bank Transfer (SPEI) | Bank Transfer (SPEI), Debit Card, Mobile Transfer |

Argentinian Pesos | Bank Transfer (COELSA) | Bank Transfer (COELSA) |

Brazilian Reais | TED, PIX | TED, PIX |

Colombian Pesos | Bank Transfer | Bank Transfer |

The company also supports transactions of the above currencies free of charge via the Bitso Transfer service.

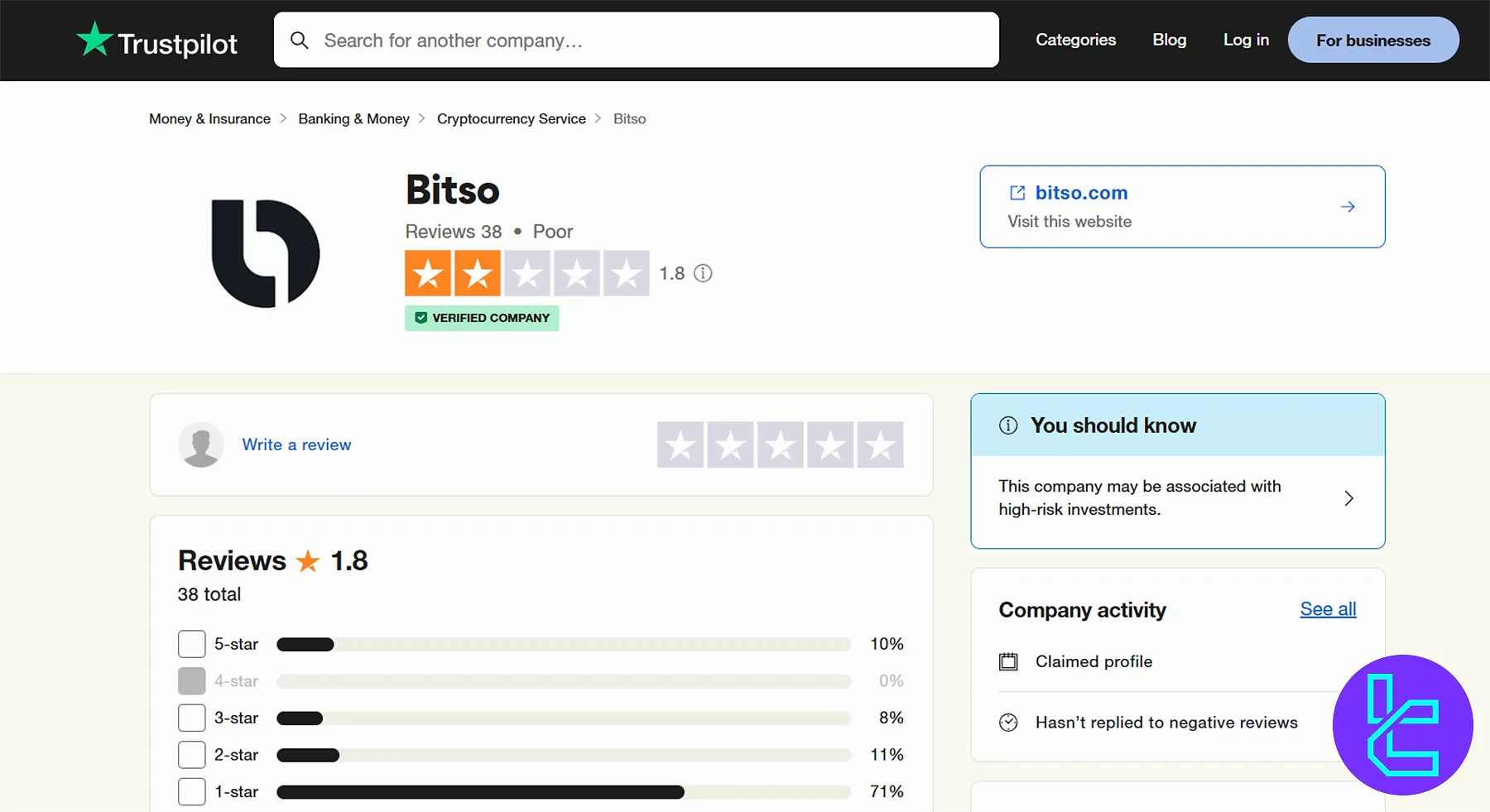

User Satisfaction

Exploring the platform’s trust score across reputable sources like TrustPilot and Reviews.io is vital to this Bitso review.

The crypto exchange doesn’t perform well in this regard since it has received a poor rating from users.

1.8/5 based on 38 ratings | |

Reviews.io | 1.9/5 based on 24 comments |

Bitso Features

Here are the major additional features offered by the exchange:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Launchpool | No |

Crypto Cards | Yes |

Bitso Bonus

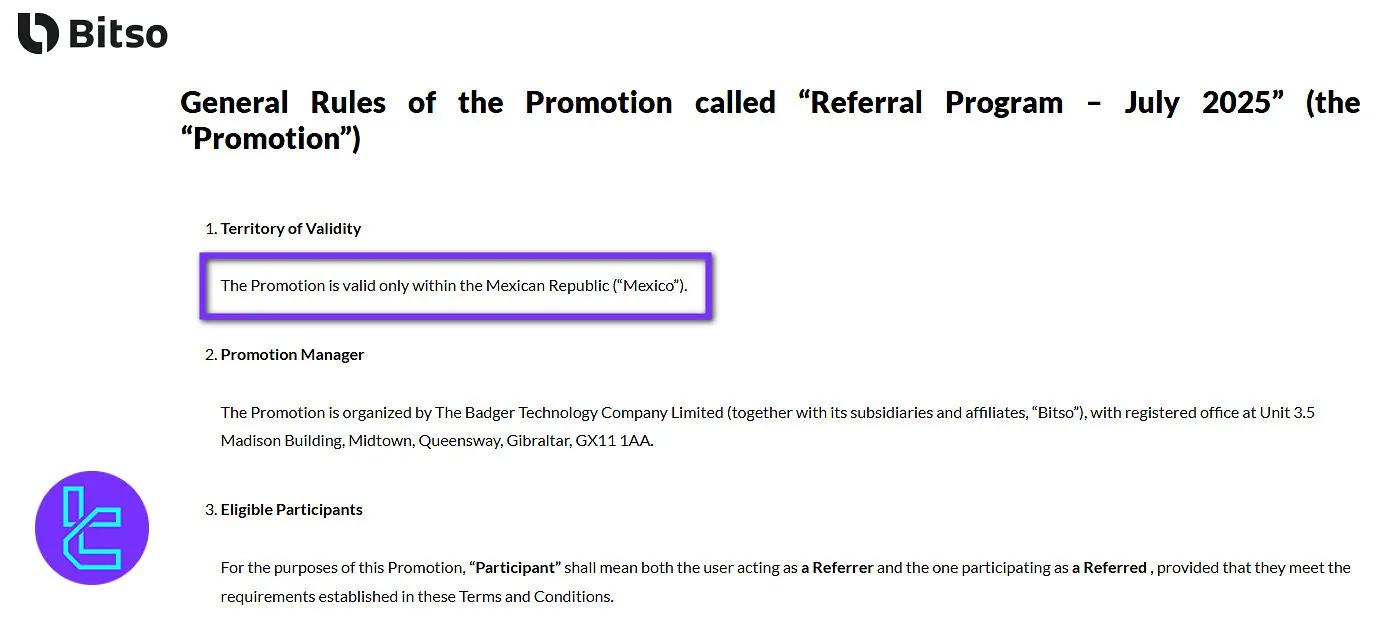

Bitso doesn’t offer many bonuses to its users. Currently, the only active bonus is the referral program. You can see the details of it below:

Promotion | Referral Program |

Who Can Join | Referrers: 18+, Mexico, verified Bitso account Referrals: 18+, Mexico, new account via referral link |

Deposit | Minimum USD $100 (or equivalent) |

Level 1 Bonus | Referrer: $10 BTC, Referral: $10 BTC |

Level 2 Bonus | Referrer: $25 BTC, Referral: $15 BTC |

Bitso Referral Program

Bitso’s Referral Program rewards both new and existing users in Mexico. The program allows verified Bitso users to share referral links via the mobile app.

New users who register through these links, verify their account, and deposit at least $100 (or equivalent in MXN or supported digital assets) within 7 days, while maintaining the balance for 30 days, qualify for rewards.

Level 1 grants USD $10 in BTC to both Referrer and Referral for a $100 balance, while Level 2 offers USD $25 to the Referrer and USD $15 to the Referral for a $250 balance.

Participation carries no extra cost beyond regular platform use, providing a fast, secure, and transparent way to earn bonus BTC.

Bitso Exchange Customer Support

The platform lacks proper support channels, as it only offers a 24/7 Live Chat feature and a Ticket system to customers who need it.

The exchange doesn’t provide an email address or physical location on its website.

Bitso Earnings Service

The exchange offers a dedicated service for users to earn passive income on their crypto holdings. Key features of the Earnings service:

- Free activation

- Up to 18.2% annual yield

- Available for 7 cryptocurrencies, including ATOM, ADA, USDT, SOL, DOT, ETH, and USDC

Bitso Supported Countries

The company provides a regulated environment for crypto enthusiasts all around the world. However, due to legal requirements, it has been restricted in certain jurisdictions, including:

- Afghanistan

- Belarus

- Bosnia and Herzegovina

- Burundi

- Central African Republic

- China

- Cuba

- Democratic People's Republic of Korea (DPRK)

- Democratic Republic of Congo

- Ethiopia

- Guinea

- Guinea Bissau

- Iran

- Iraq

- Kosovo

- Lebanon

- Libya

- Macedonia

- Mali

- Montenegro

- Myanmar (Burma)

- Nicaragua

- Russia

- Serbia

- Somalia

- South Sudan

- Sudan

- Syria

- Ukraine

- United States of America

- Venezuela

- Yemen

- Zimbabwe

Bitso Compared to Its Peers

The comprehensive table below compares the reviewed platform to three other exchanges in the crypto industry:

Features | Bitso Exchange | Binance Exchange | Kucoin Exchange | Bitunix Exchange |

Number of Assets | 50+ | 400+ | 700+ | 300+ |

Maximum Leverage | 1:1 | 1:125 | 1:100 | 1:125 |

Minimum Deposit | $10 | $1 | $1 | $10 |

Spot Maker Fee | From 0.04% | 0.02% - 0.1% | From 0.005% | 0.01% - 0.08% |

Spot Taker Fee | From 0.05% | 0.04% - 0.1% | From 0.025% | 0.01% - 0.1% |

Mandatory KYC | No | Yes | Yes | No |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | No |

Staking | Yes | Yes | Yes | No |

Copy Trading | No | Yes | No | Yes |

Writer's Opinion and Conclusion

The exchange demonstrates strong liquidity with daily trading volumes frequently ranging from $40 million to $60 million, and occasional peaks approaching $70 million, highlighting both retail and institutional participation.

Bitso has implemented top-tier security measures, including a CertiK Skynet score of 83.61/100 (Grade A) and a CER.live overall score of 88% (Grade AA), complemented by multi-signature crypto wallets, 2FA, proof of reserves, and insurance coverage via Coincover.

The platform also provides up to 18.2% annual yield on Earnings for seven cryptocurrencies, allowing investors to grow holdings safely.