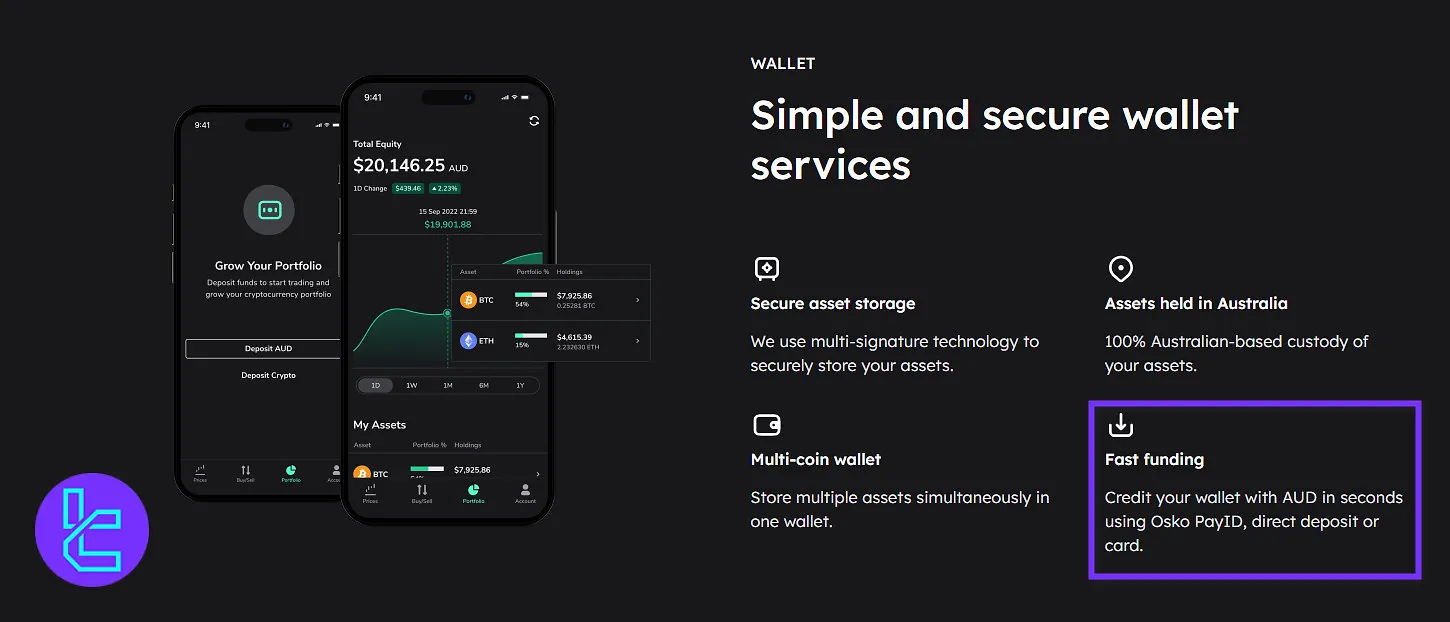

BTC Markets offers 36 cryptocurrencies to Australian clients for simple buy and sell via AUD. The platform supports NPP, OSKO, and PayID payments with no charges.

It also offers Self Managed Super Funds (SMSFs) services allowing users to diversify their retirement savings with cryptocurrencies.

The platform stands out for being 100% Australian-owned and regulated, with compliance under AUSTRAC registration (ACN 164 093 887 | ABN 45 164 093 887).

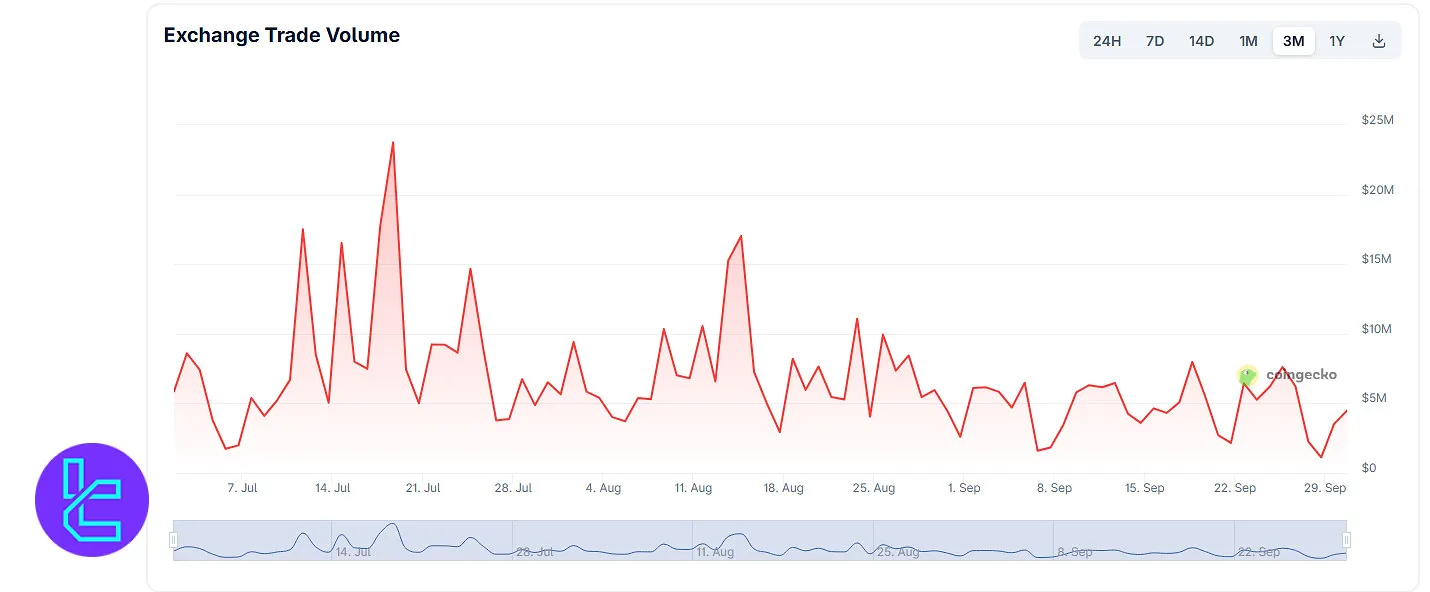

As of 2025, BTC Markets is considered one of the country’s most reliable trading venues, handling daily trade activity that fluctuates between $2 million and $22 million according to recent data.

It provides support for AUD deposits through Visa, MasterCard, debit/credit cards from Australian banks, NPP, OSKO, and PayID, with no extra charges on deposits.

BTC Markets; An Introduction to the Crypto Exchange

BTC Markets is a secure and user-friendly cryptocurrency exchange based in Australia, catering to local crypto enthusiasts since 2013.

The platform offers a range of trading features, from a simple buy/sell interface for beginners to more advanced tools like limit orders and an over-the-counter (OTC) desk for larger trades. BTC Markets Pty Ltd. key features:

- CEO: Caroline Bowler

- Registered with the Australian Transaction Reports and Analysis Centre (AUSTRAC) with ACN 164 093 887 | ABN 45 164 093 887

- A member of the Digital Economy Council of Australia (DECA)

- FinTech Australia’s membership

- Headquartered in Sydney

Founded by Martin Bajalan, the exchange has become one of the most established digital currency platforms, tailored exclusively to Australian residents, offering full support for AUD as the sole fiat currency, alongside AUD-to-crypto and crypto-to-crypto trading pairs.

Geographic restrictions apply; international users cannot trade or withdraw funds, making it a domestic-focused platform built for Australians seeking a secure and streamlined crypto experience.

BTC Markets CEO

Caroline Bowler has been the CEO of BTC Markets since 2019 and brings over 17 years of experience in the financial services industry.

Her leadership is centered on strategic direction and sustainable growth, ensuring that BTC Markets remains at the forefront of Australia’s digital asset landscape.

She collaborates closely with government regulators and industry stakeholders to push forward responsible legislation, positioning Australia as a global hub for crypto and blockchain innovation.

Her career spans a wide range of institutions, including investment banks, hedge funds, fintech firms, and financial advisory companies.

Caroline entered the blockchain and digital asset sector in 2015, and since then, she has become a recognized figure in shaping the industry.

Beyond BTC Markets, she has also served as a board member of Blockchain Australia.

In recognition of her influence, Caroline received the 2022 Blockchain Leader of the Year award at the Blockchain Australian Awards.

BTC Markets Specifications

With a focus on the Australian market, the cryptocurrency exchange provides 100% Australian-based customer support, an OTC desk, and a VIP program.

Exchange | BTC Market |

Launch Date | 2013 |

Levels | 20 levels |

Trading Fees | Variable based on the market |

Restricted Countries | Only available in Australia |

Supported Coins | 36 |

Futures Trading | No |

Minimum Deposit | $30 |

Deposit Methods | Crypto, Visa, MasterCard, Debit or Credit cards from an Australian banking institution, NPP, OSKO, PayID |

Withdrawal Methods | Crypto, Bank Transfer, NPP |

Maximum Leverage | 1:1 |

Minimum Trade Size | N/A |

Security Factors | 2FA, Whitelists, Biometrics, Bug Bounty |

Services | Self Managed Super Funds (SMSFs), API Trading, Multi-Coin Wallet, Mobile Trading |

Customer Support Ways | Ticket |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | N/A |

Orders Execution | Market |

Native Token | None |

Upsides and Downsides

One of BTC Markets' standout features is its Self Managed Super Funds (SMSFs) offering, which allows Australians to diversify their retirement portfolios with cryptocurrencies.

Pros | Cons |

Strong focus on security and regulatory compliance | Limited selection of cryptocurrencies |

User-friendly interface suitable for beginners | Services restricted to Australian residents only |

Competitive fees for high-volume traders | Lack of advanced trading features like futures or margin trading |

API Trading | No copy trading services |

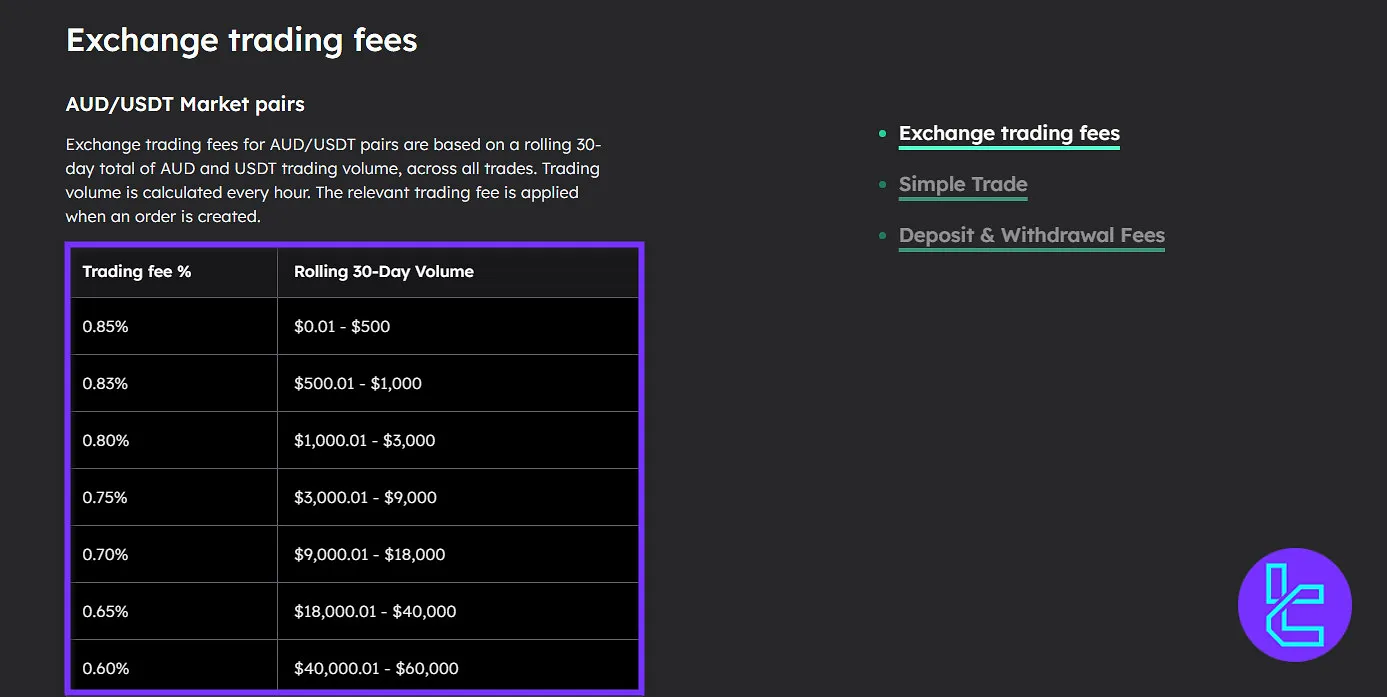

Does BTC Markets Exchange Have User Levels?

The platform implements a tiered system with 20 volume-based levels. The higher your trading volume, the lower your trading fees.

However, the fee discount only applies to AUD/Crypto markets.

30D Trading Volume (AUD) | Trading Fee |

< 500 | 0.85% |

> 500 | 0.83% |

> 1,000 | 0.80% |

> 3,000 | 0.75% |

> 9,000 | 0.70% |

> 18,000 | 0.65% |

> 40,000 | 0.60% |

> 60,000 | 0.55% |

> 70,000 | 0.50% |

> 80,000 | 0.45% |

> 90,000 | 0.40% |

> 115,000 | 0.35% |

> 125,000 | 0.30% |

> 200,000 | 0.25% |

> 400,000 | 0.23% |

> 650,000 | 0.20% |

> 850,000 | 0.18% |

> 1,000,000 | 0.15% |

> 3,000,000 | 0.13% |

> 5,000,000 | 0.10% |

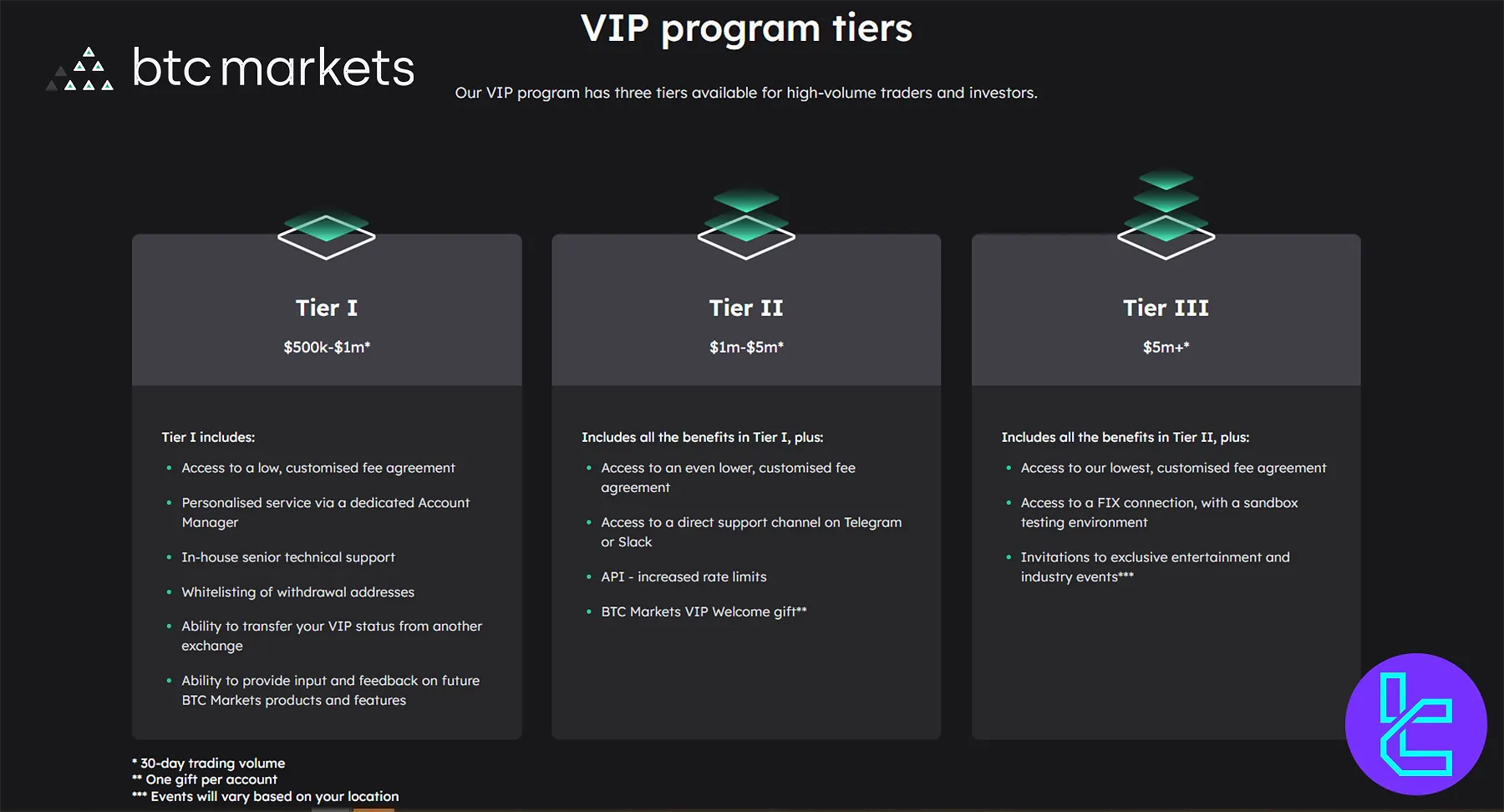

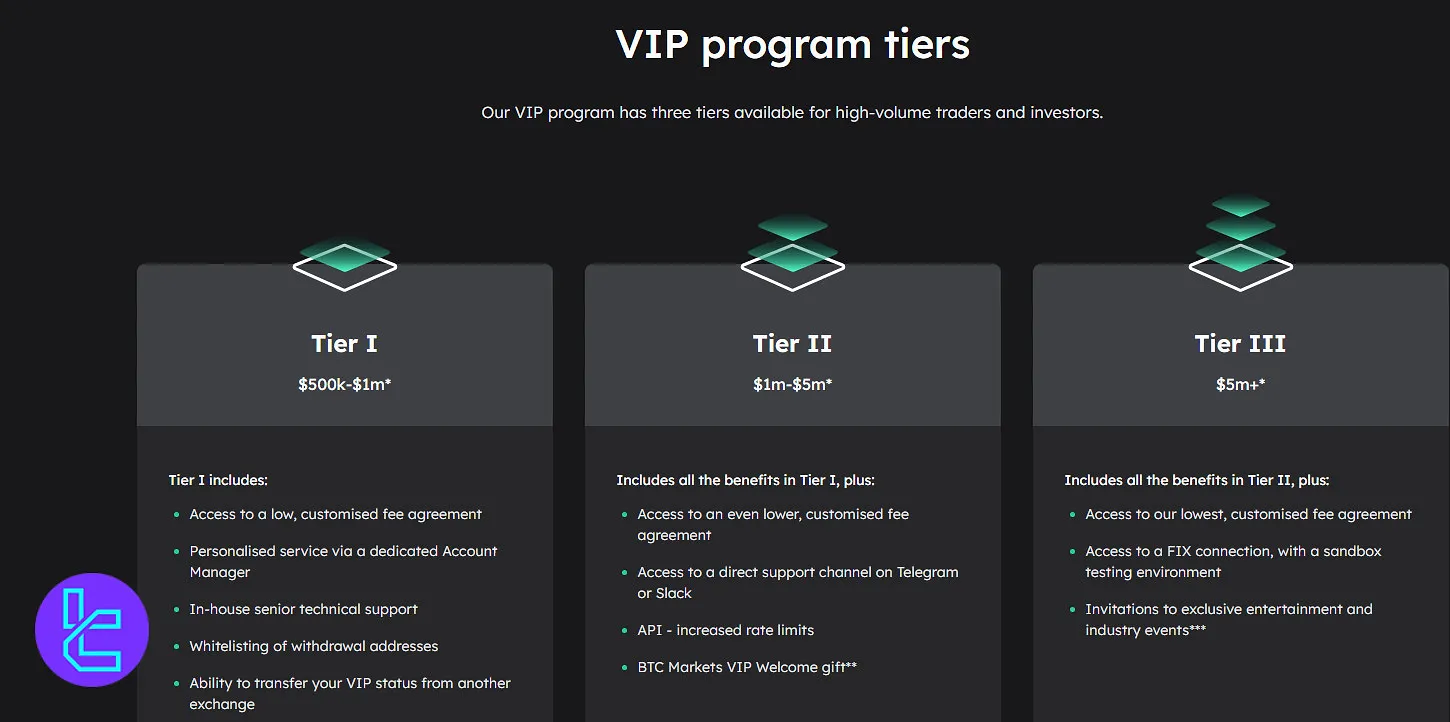

The ecosystem also offers a VIP program for traders who want to place orders worth more than AUD 100,000. The program unlocks fee discounts, personal account managers, and API enhancements.

Fees Explained

As we mentioned in the previous topic of this BTC Markets review, the platform offers higher than average fees, ranging from 0.10% to 0.85% on the AUD/Crypto markets.

However, the BTC market is different and provides competitive commissions.

BTC Market Maker | BTC Market Taker |

-0.05% | 0.2% |

The negative fee is credited to BTC market makers’ accounts as rebates.

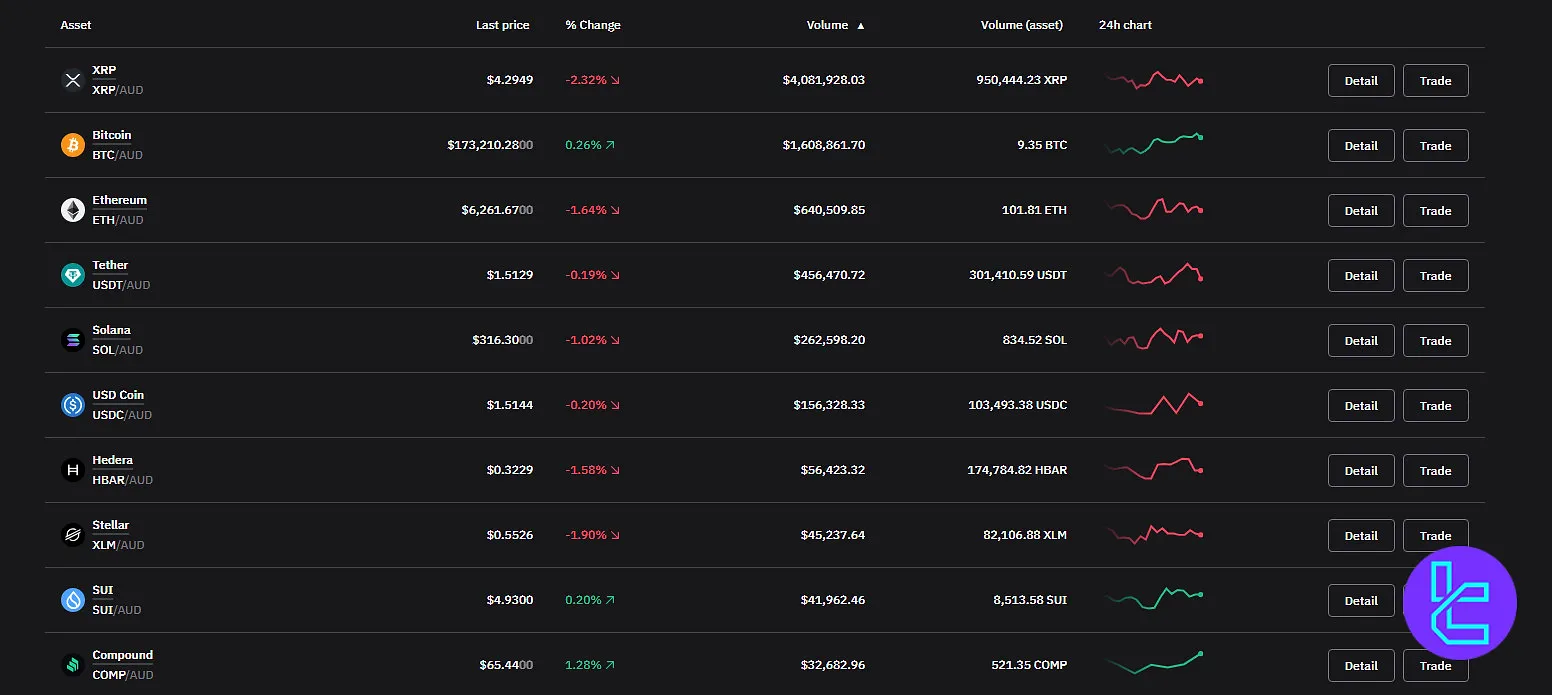

Listed Cryptocurrencies on BTC Markets

The exchange has listed 36 cryptocurrencies and allows for spot trading on them. While the list is not as extensive as some global exchanges, it covers most major coins and some promising altcoins, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Ethereum Classic (ETC)

- Stellar Lumens (XLM)

- Cardano (ADA)

- Tether (USDT)

- Chainlink (LINK)

- Aave (AAVE)

- Solana (SOL)

- Compound (COMP)

- Avalanche (AVAX)

- Meld Gold (MCAU)

- Ondo (ONDO)

- Pendle (PENDLE)

- Hedera (HBAR)

- Axie Infinity (AXS)

- Immutable X (IMX)

These assets are paired with AUD, USDT, or BTC, supporting simple spot trading.

While its coin selection is modest compared to global exchanges, it covers the essential high-liquidity tokens needed by most Australian traders and SMSF investors.

Are Crypto Futures Available on BTC Markets?

The exchange primarily focuses on spot trading of cryptocurrencies, catering to the needs of retail and institutional investors in Australia. It has 3 market pairs, including AUD, BTC, and USDT.

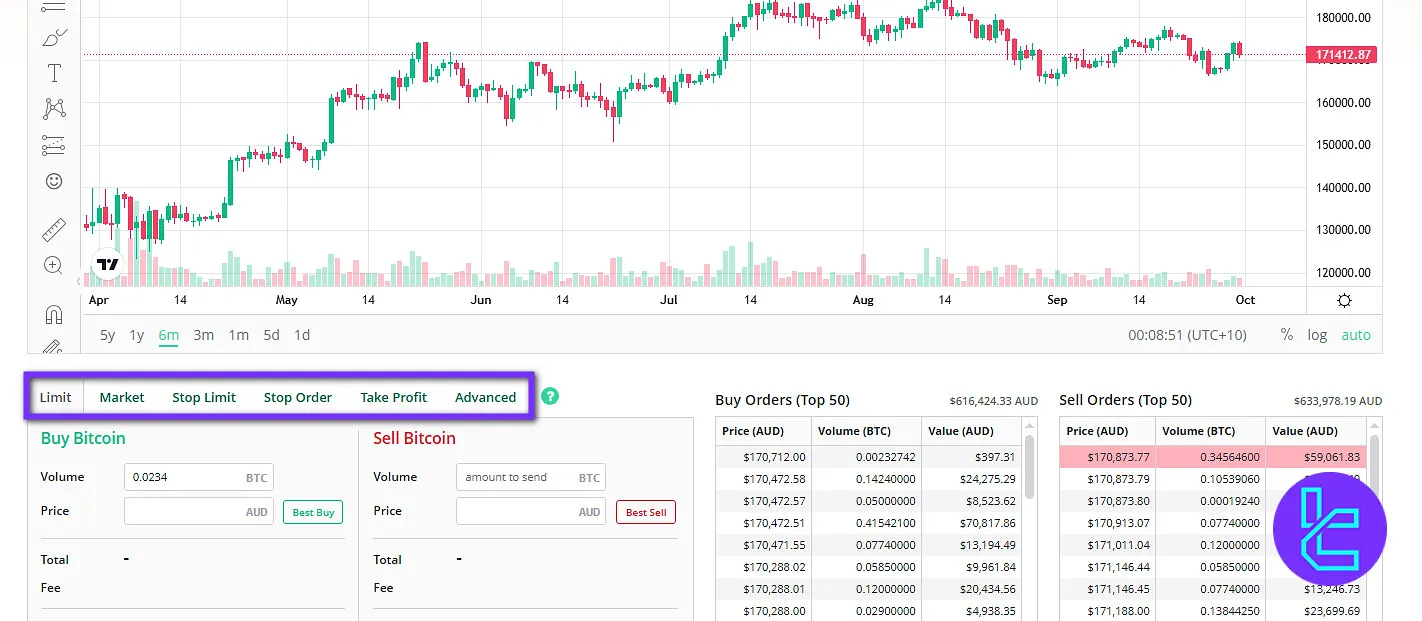

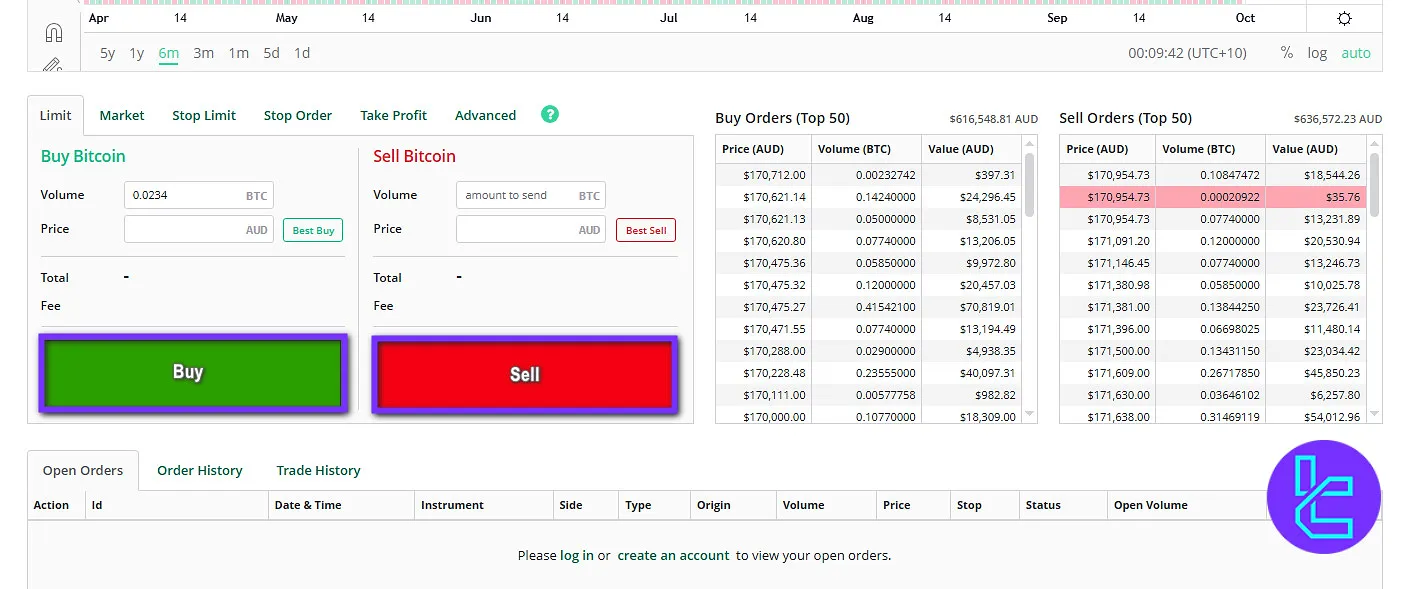

While BTC Markets doesn’t support Futures markets or Margin trading, it provides various order types in the Spot market, including Market, Stop Limit, Limit, Stop Order, and Take Profit.

BTC Markets Exchange Sign Up and KYC

BTC Markets offers fast account creation with immediate access to your trading dashboard.

Only a valid email and secure password are needed to get started. Identity verification is optional at BTC Markets Registration but required for full access and higher withdrawal limits.

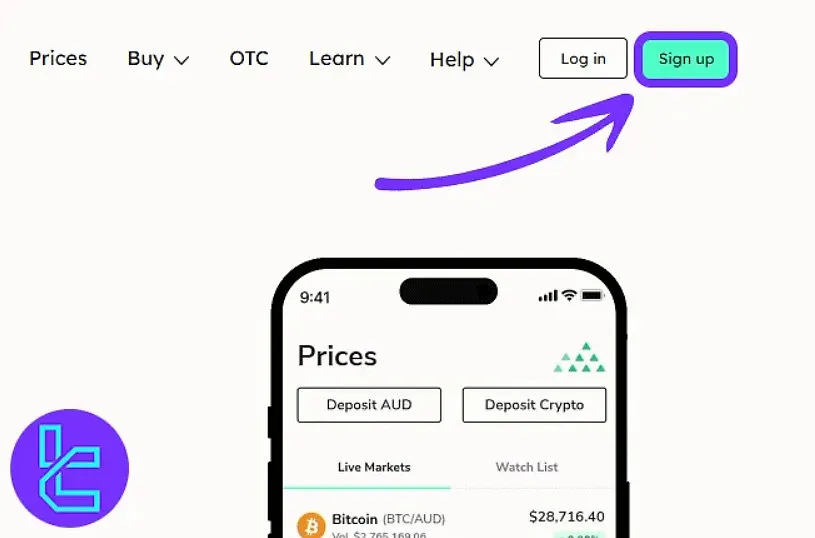

#1 Visit the Registration Page

Go to the official BTC Markets site and click “Sign Up”. Select “Open an Account” to start the process.

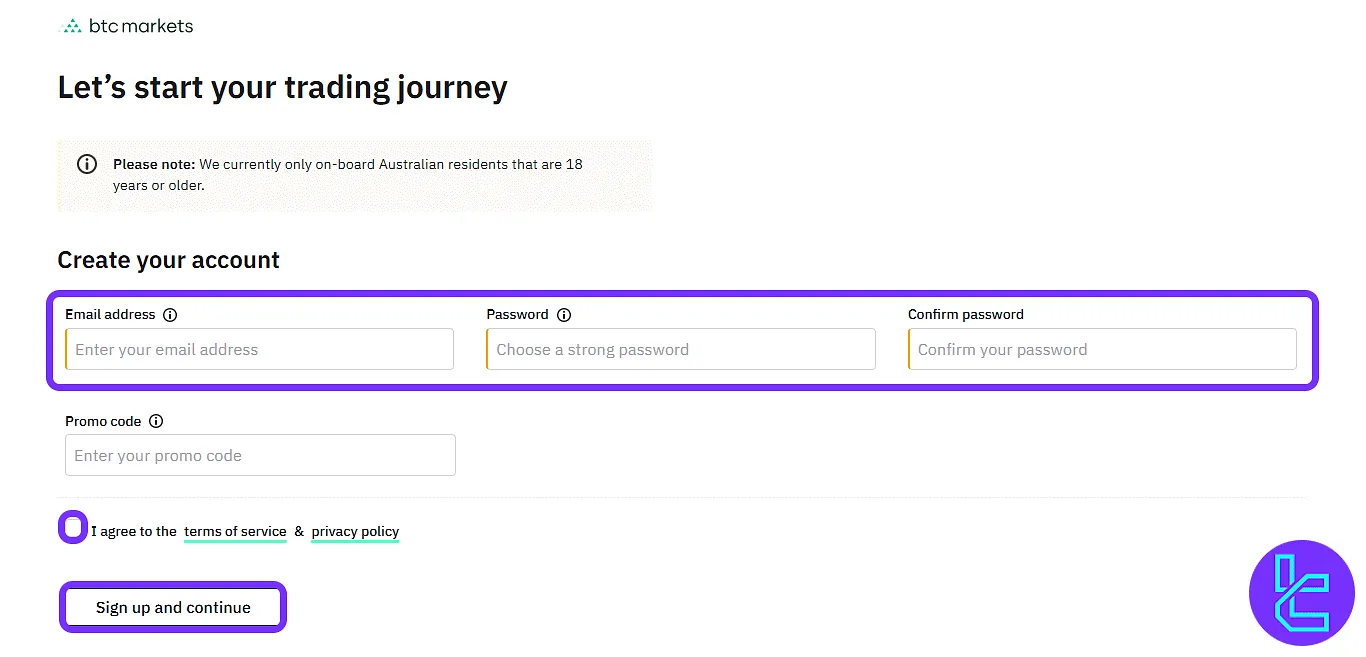

#2 Complete the Sign-Up Form

Enter your email address, create a strong password, and confirm it. Accept the terms and conditions, then click “Sign Up and Continue”. Promo codes can be added here if available.

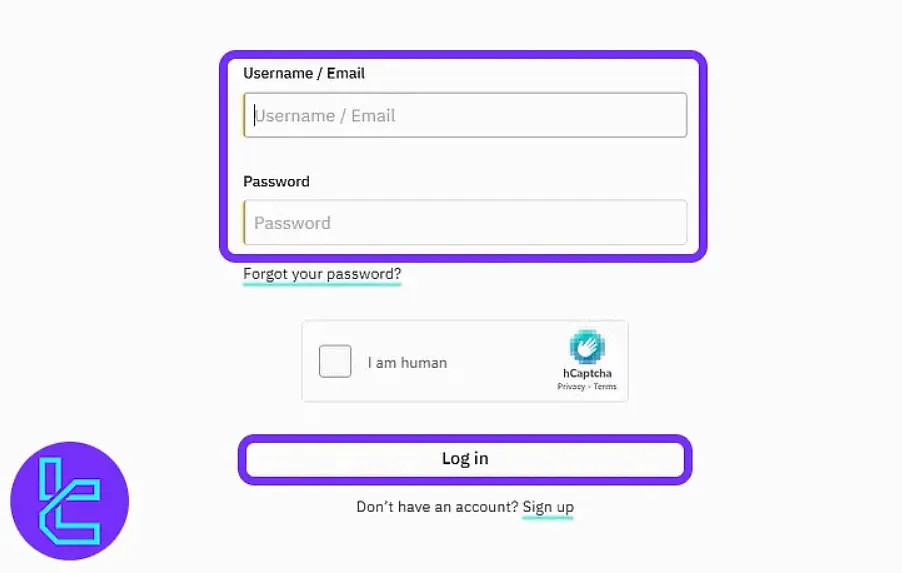

#3 Complete the KYC Procedure

On the login screen, input your email and password, complete the CAPTCHA, and enter your account dashboard instantly.

Verify your phone number and for KYC verification, upload supporting documents, including:

- Passport

- Australian driving license

BTC Markets requires full identity verification (KYC) for all users engaging in AUD transactions, in accordance with AUSTRAC regulations.

How to Trade on BTC Markets

Trading on BTC Markets is quite easy, and you only need to follow these steps after registration and verification:

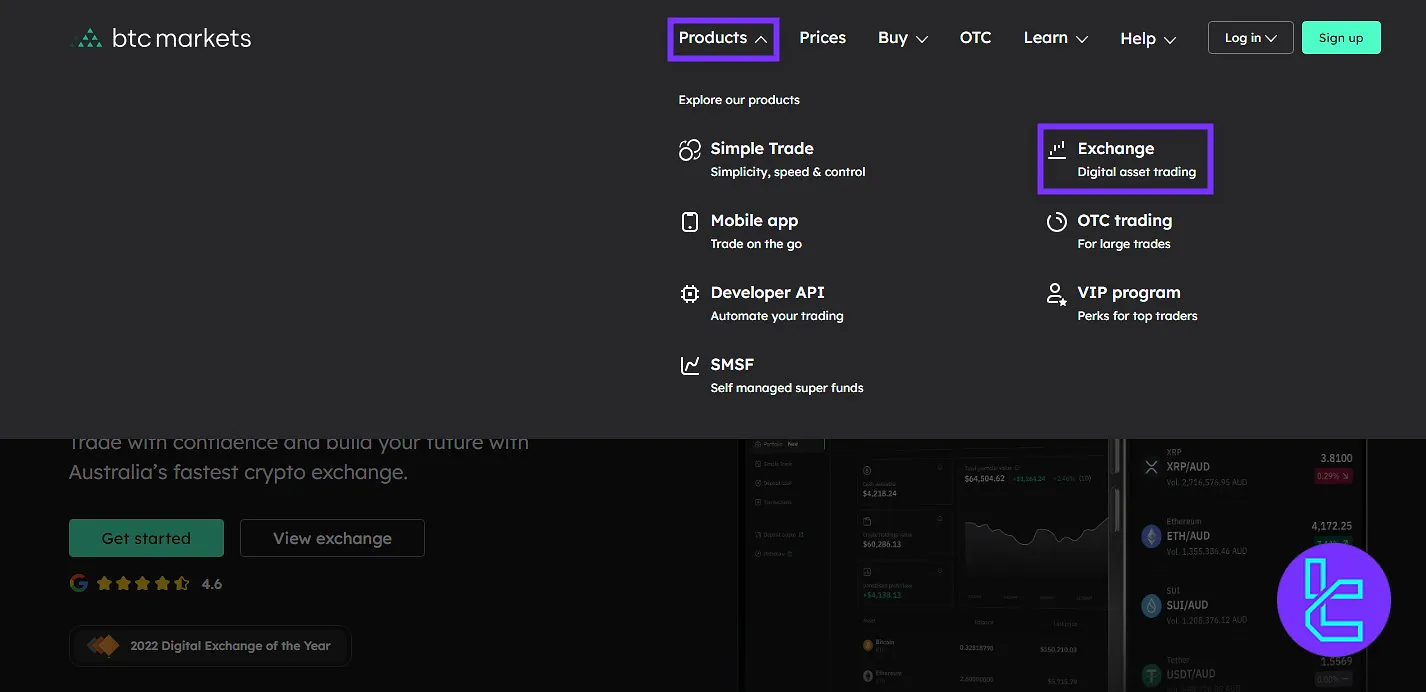

#1 Start Trading

To begin, on the homepage of BTC Markets, click on “Products” and then “Exchange” to access the trading interface.

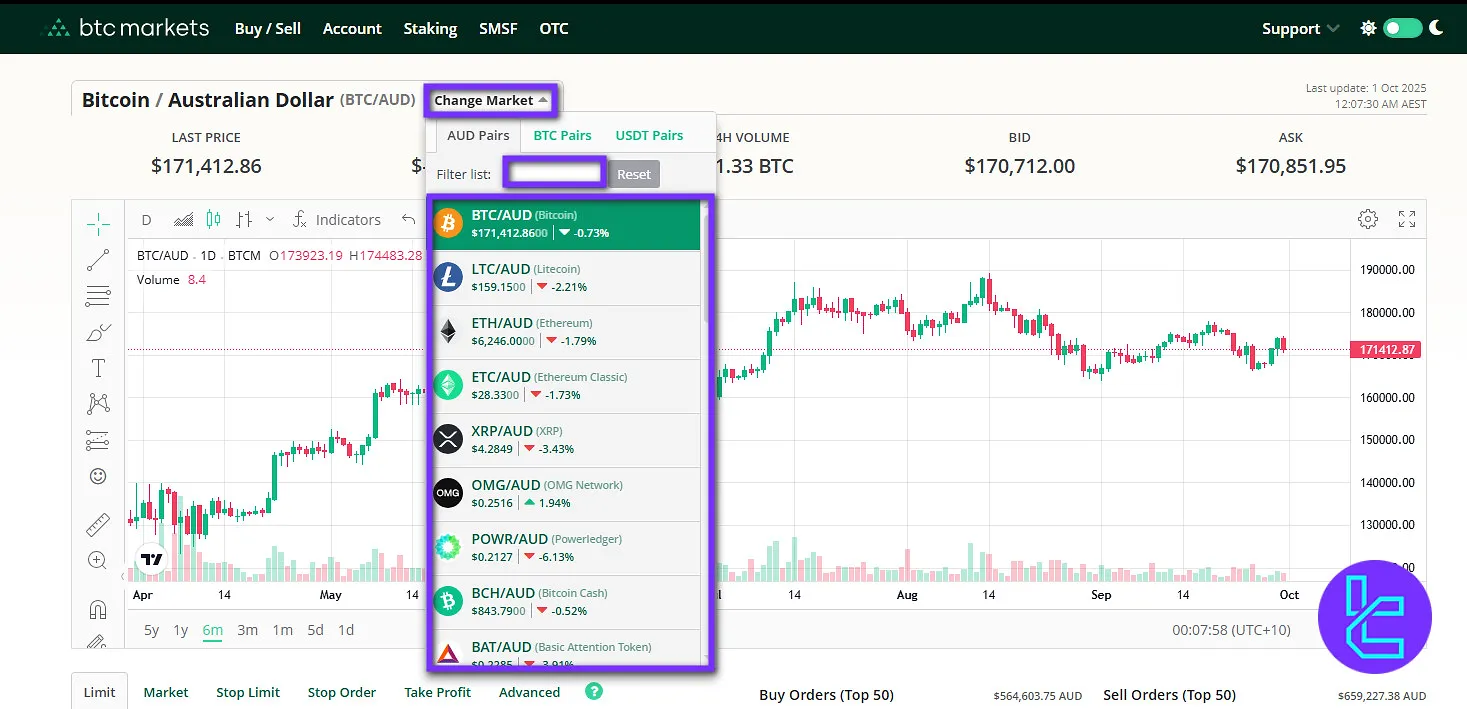

#2 Choose a Trading Pair

Now, you should click on “Change Market” and select your preferred one from the list of available pairs. You can use the search box to find a trading pair, too.

#3 Pick an Order Type

Next, choose your order type. BTC Markets supports market, stop limit, stop orders, and take profit orders.

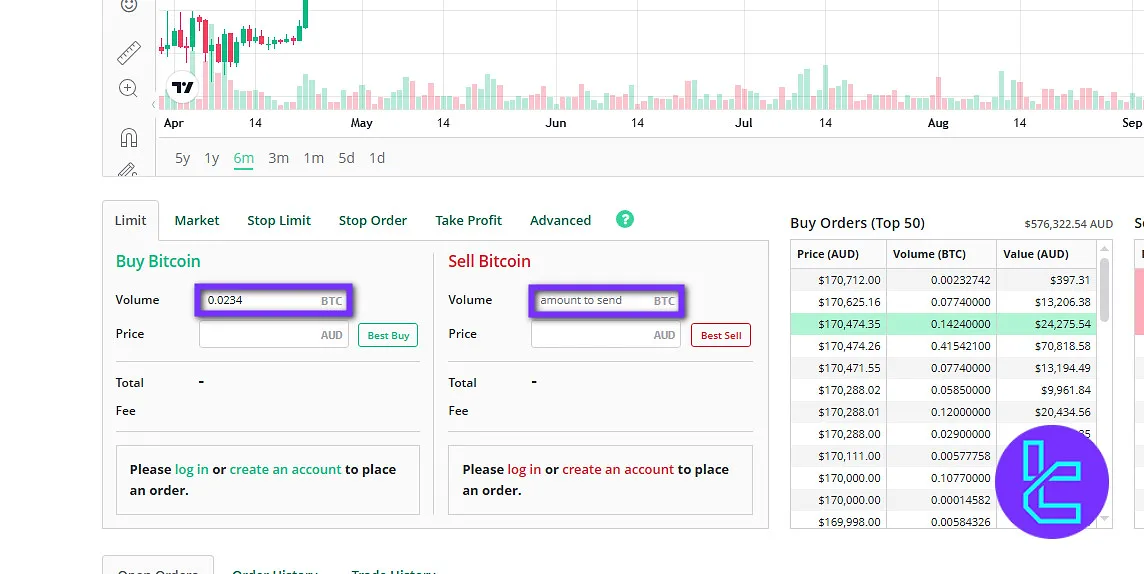

#4 Specify the Volume

Enter the amount you want to trade in the “Volume” field.

#5 Confirm the Trade

Finally, click on “Buy” or “Sell” to confirm your order.

Applications and Platforms

BTC Markets is accessible via both desktop and mobile platforms.

Its web interface supports advanced order types, while the mobile app available for Android and iOS provides real-time market data, portfolio tracking, and charting tools powered by TradingView.

This cross-device support makes it easy for users to manage their assets on the go.

TradingFinder has developed a wide range of TradingView indicators that you can use for free.

BTC Markets Trading Volume

According to the BTC Markets CoinGecko chart, over the past 3 months, BTC Markets has seen daily trading volumes fluctuate between $2M and $22M, with sharp spikes occurring in mid-July and mid-August.

The highest recorded peak touched close to $23M, while the lowest levels occasionally fell below $2M, highlighting the volatility of market activity on this exchange.

September trading data shows a more stabilized range, averaging around $5M–$7M daily, although sudden drops to near $0.5M were also registered.

Compared to July, when volatility was at its maximum, the last weeks of September demonstrate a more consistent pattern in user activity.

This trading behavior indicates that BTC Markets continues to attract liquidity from both retail and institutional traders, with visible surges at times of major market events.

BTC Markets Services

In the table below, we have gathered the information about the availability of trading services on BTC Markets:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

BTC Markets Safety Measures

The exchange is ISO/IEC 27001:2013 certified with No. IS 737848. The certification is valid until 31st October 2025. It also has implemented multiple security factors, including:

- Two Factor Authentication (2FA)

- Wallet address whitelists for withdrawals

- Account biometric protection

- Bug Bounty program

The platform uses a hybrid crypto wallet system, where 98% of customer funds are held in cold storage across multiple off-site locations.

It performs twice-daily crypto reconciliations and hourly fiat checks.

BTC Markets Security Rankings

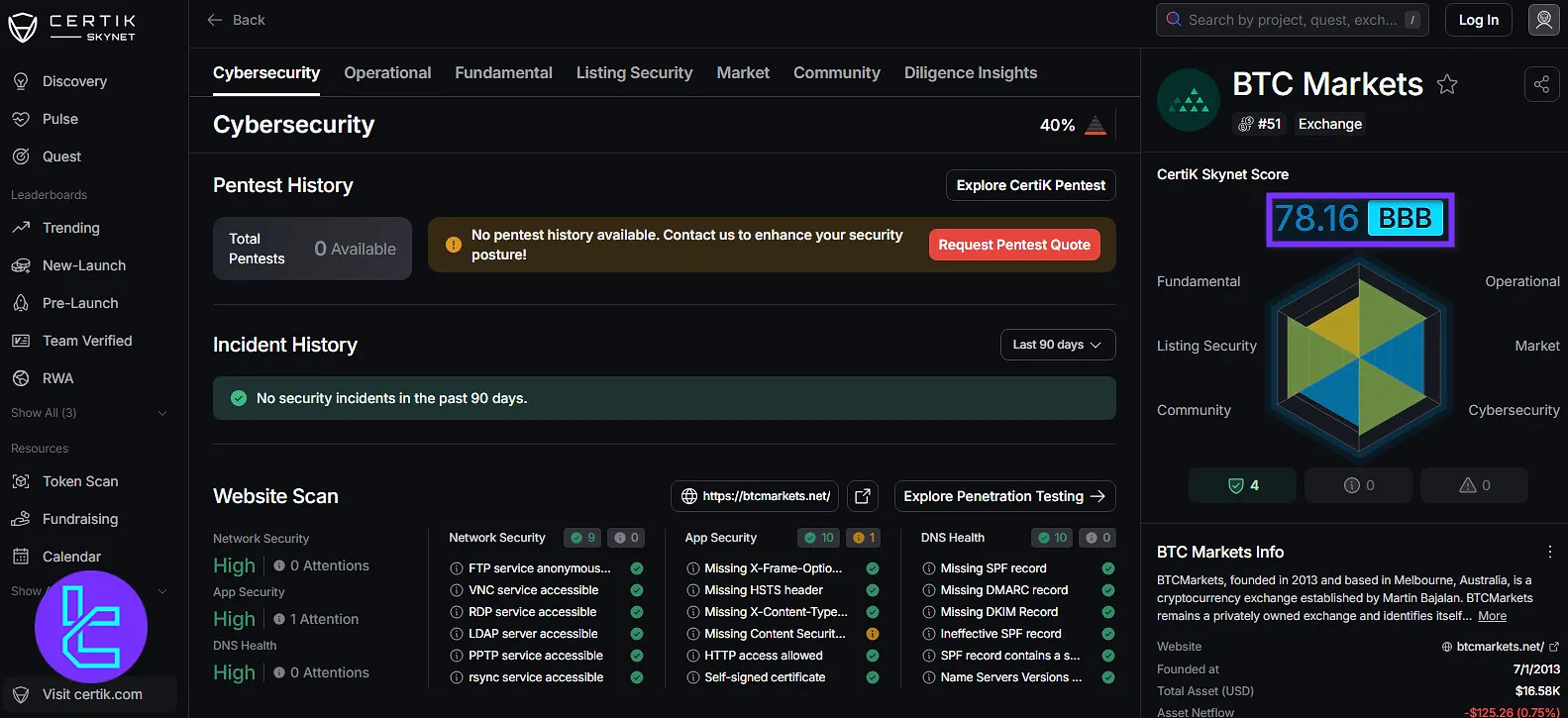

BTC Markets received an overall CertiK Skynet score of 78.16/100, corresponding to a BBB rating, reflecting a solid security posture.

Based on this BTC Markets Certik Skynet review, the platform performs strongest in Listing Security (89.21) and Operational aspects (83.62), while its Fundamental score is lower at 64.18, indicating areas for improvement in governance and structural measures.

Other category scores include Market (79.30), Community (73.72), and Cybersecurity (83.56).

Overall, the CertiK evaluation suggests BTC Markets has robust technical and operational safeguards but could further strengthen foundational protocols.

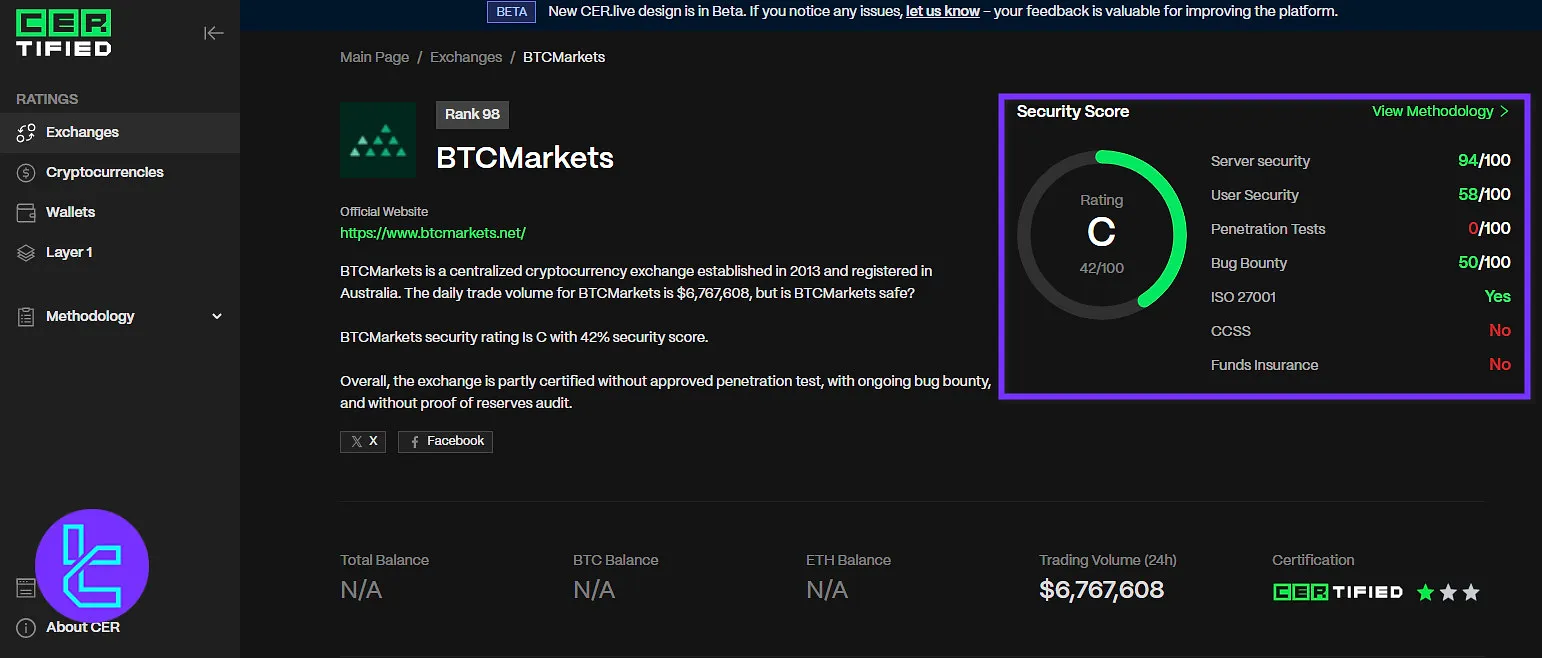

According to the BTC Markets CER.live review, the exchange achieved an overall score of 42% (C).

The exchange excels in Server Security with a score of 94/100, demonstrating strong protection against infrastructure attacks.

User-level security, however, scored 58/100, highlighting potential vulnerabilities in user account protections.

The platform scored 0/100 in Penetration Tests, indicating limited evidence of external testing, and 50/100 in Bug Bounty, reflecting moderate incentive for reporting vulnerabilities.

BTC Markets is ISO 27001 certified, but does not yet comply with CCSS or offer Funds Insurance, which could be important considerations for risk-averse users.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 78.16 / 100 (BBB) |

Fundamental | 64.18 | |

Operational | 83.62 | |

Listing Security | 89.21 | |

Market | 79.30 | |

Community | 73.72 | |

Cybersecurity | 83.56 | |

CER.live Score | Overall Score | 42% (C) |

Server Security | 94/100 | |

User Security | 58/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 50/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | No |

BTC Markets Payment Methods

The platform supports crypto and fiat transactions. Traders can fund their accounts with almost every cryptocurrency listed on the exchange.

BTC Markets processes AUD transactions through different methods, including:

- Deposits: Visa, MasterCard, Debit or Credit cards from an Australian banking institution, NPP, OSKO, and PayID

- Withdrawals: Bank transfer and NPP

The minimum purchase size is AUD $30. Withdrawals to Australian bank accounts are free, while crypto withdrawals are subject to fixed fees.

The withdrawal fee varies based on the asset type and the blockchain network; for example, 0.0005 BTC or 0.001 ETH per transaction.

Trust Scores

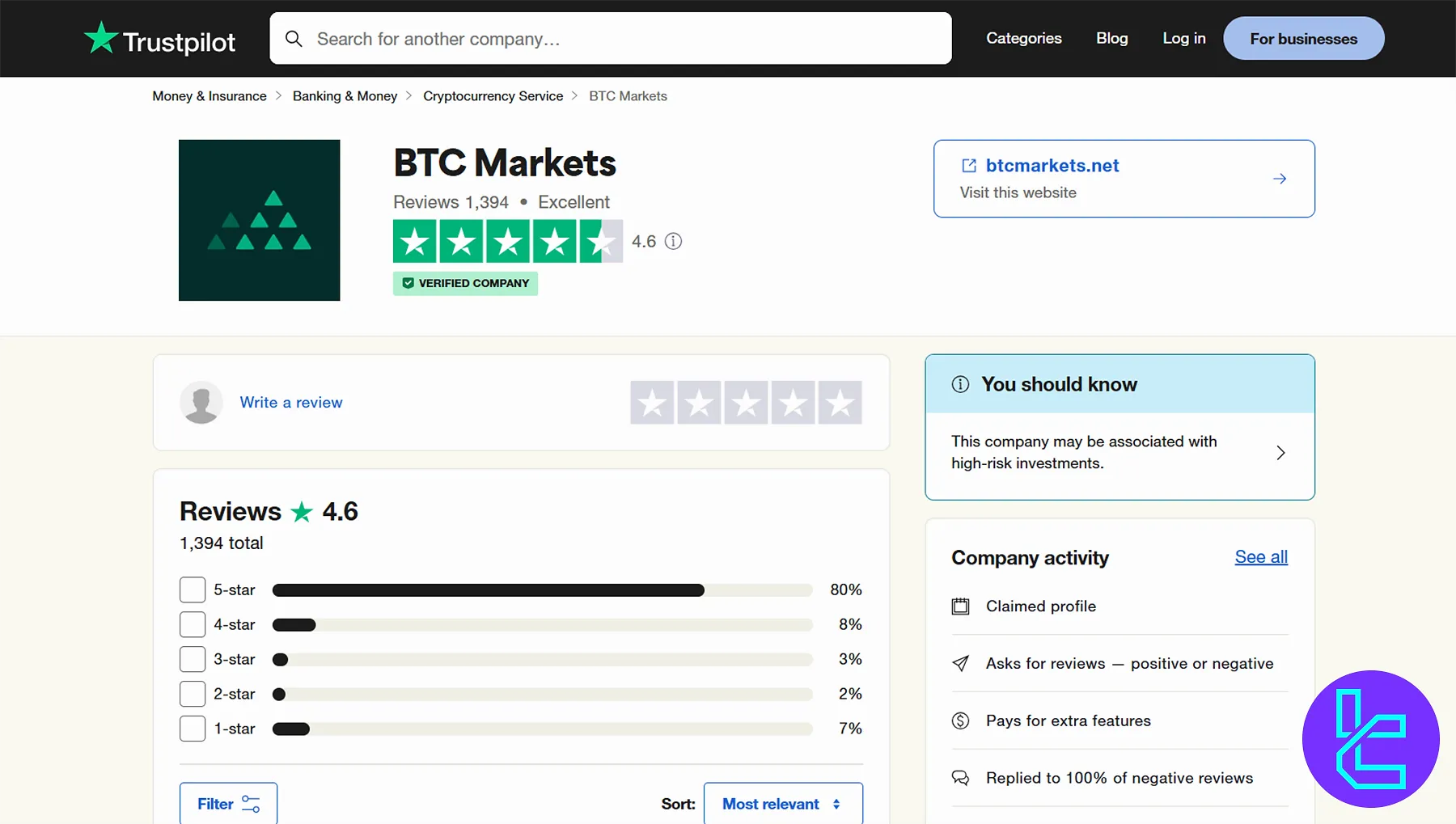

There are numerous positive reviews on the BTC Markets TrustPilot profile, resulting in an excellent score of 4.6 out of 5.

However, the exchange is not featured on other reputable sources like Forex Peace Army and Reviews.io.

BTC Markets Crypto Products

Let's check the availability of special services, such as copy trading or gift cards, on BTC Markets:

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | No |

BTC Markets Bonus

BTC Markets may not offer deposit or welcome bonuses, but it provides traders with valuable alternative perks through its VIP Program and time-limited promotions:

Bonus Type | Details |

VIP Program | Designed for high-volume traders; includes reduced fees, priority support, and exclusive features |

Promotions | Time-limited events like giveaways, anniversary rewards, fee discounts, and competitions |

VIP Program

The BTC Markets VIP Program is tailored to suit high-volume and institutional traders. Its main goal is to reduce trading costs and provide a smoother trading experience for professionals. Key features include:

- Lower Trading Fees: VIP clients can access reduced maker/taker fees, which can make a significant difference when trading large volumes;

- Priority Support: Faster response times and dedicated assistance for account-related issues;

- Exclusive Features: Early access to certain platform updates or premium services.

This program makes BTC Markets particularly attractive for seasoned traders who transact in higher amounts and want both efficiency and cost savings.

Promotions

In addition to its VIP benefits, BTC Markets also runs time-limited promotions that reward its broader user base. These campaigns often include:

- Anniversary Celebrations: For example, BTC Markets celebrated its 11th anniversary with prize giveaways and trading-related perks;

- Fee Discounts: Temporary reductions in trading fees during promotional periods;

- Competitions & Events: Traders can sometimes participate in contests with rewards such as crypto prizes or exclusive benefits.

These promotions are not permanent but give active users the chance to earn extra rewards or enjoy lower trading costs during special occasions.

BTC Markets Exchange Customer Support

The platform lacks proper support channels and offers only a Ticket system for customers in need. However, its website has a dedicated Help Center featuring the most frequently asked questions.

While the official website does not provide an email address, we found one on its Google Play Store page: support@btcmarkets.net

Does BTC Markets Offer Growth or Investment Plans?

While the platform previously offered crypto staking services, it no longer does so, as of the time this article was written, due to evolving Australian regulatory guidelines.

BTC Markets does not offer copy trading or social trading tools. The platform primarily focuses on self-directed spot trading and institutional OTC transactions, without community-based portfolio mirroring or automation.

However, it offers Self Managed Super Fund (SMSF) investment in digital assets. The program allows users to incorporate cryptocurrencies into their retirement portfolios.

Restricted Countries on BTC Markets Exchange

The platform is exclusively available to Australian residents. The exchange does not support users from other countries due to regulatory compliance requirements.

This restriction applies to all core features of the platform, including account creation, verification, deposits, trading, and withdrawals.

Alternative global exchanges like Binance or Coinbase may be more suitable options for international users looking to trade cryptocurrencies.

BTC Markets Compared to Other Platforms

Let's check BTC Markets' services in comparison with other exchanges:

Features | BTC Markets Exchange | Gate.io Exchange | Bitget Exchange | MEXC Exchange |

Number of Assets | 36 | 2800+ | 10000+ | 2800+ |

Maximum Leverage | 1:1 | 1:100 | 1:125 | 1:200 |

Minimum Deposit | $30 | Varies by Payment Method | $15 | $1 |

Spot Maker Fee | -0.05% | From -0.005% | 0.10% | 0.05% |

Spot Taker Fee | 0.2% | From 0.025% | 0.10% | 0.05% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

BTC Markets offers Spot trading on cryptocurrencies in 3 markets, including AUD, USDT, and BTC. AUD/USDT markets have variable fees, ranging from 0.10% to 0.85%.

The exchange has an excellent TrustPilot score of 4.6 out of 5.

In terms of security, the platform has achieved ISO/IEC 27001:2013 certification (valid until October 2025) and received a CertiK Skynet score of 78.16/100 (BBB), with particularly strong results in Listing Security (89.21) and Cybersecurity (83.56).

On the flip side, CER.live assigned a C rating (42%), pointing out gaps in penetration testing and user-level security.

Despite these weaknesses, BTC Markets holds 98% of client funds in offline cold storage and runs hourly reconciliations, practices that remain above the industry average.