Buda.com has grown into one of the most recognizable cryptocurrency exchanges in Latin America. With 600,000+ registered users and over $3 billion traded on the platform, it has carved out a niche for itself in a competitive market that includes global giants like Binance and regional challengers.

Unlike exchanges offering thousands of coins, Buda.com focuses on 6 carefully selected cryptocurrencies and 20 trading pairs across 5 markets: CLP (Chilean Peso), COP (Colombian Peso), PEN (Peruvian Sol), Bitcoin (BTC), and USDC.

The exchange charges a 1.2% buy/sell fee, 2.4% for swaps, and no fees for crypto deposits. With its 7-tier trading level system, frequent traders can lower their maker/taker fees significantly, down to as little as 0.10% (maker) and 0.20% (taker) at the top level.

Buda Exchange Key Details

Buda Exchange, headquartered in Santiago, Chile, has established itself as a prominent cryptocurrency platform in Latin America since its inception in 2015.

Founded by Guillermo Torrealba, Buda.com SpA is funded by multiple companies, including Digital Currency Group, Inversiones Sauzalito, and Mintic.

Buda has never experienced a successful hack and implements essential security practices such as cold storage and two-factor authentication.

Buda CEO and Co-Founder

Jaime Bunzli is one of the co-founders of Buda.com, a leading cryptocurrency exchange in Latin America. He first served as CPO from 2015 to 2023 and has been the company’s Chief Executive Officer (CEO) since September 2023.

With over 10 years of hands-on experience in fintech and blockchain startups, Bunzli has played a key role in shaping Buda.com’s growth and positioning it among the region’s top digital asset platforms.

Based on Jaime Bunzli LinkedIn, beyond Buda.com, he has been a co-founder and advisor at Platanus since 2012, contributing to tech development and startup acceleration.

He also served nearly 7 years as Director at Fintual, a well-known online investment platform, and previously co-founded QueHambre in 2011, one of his earliest entrepreneurial ventures in Santiago, Chile.

Buda.com Table of Specifications

Users have traded $3B+ on Buda. Let’s see what features have made the company the largest crypto exchange in South America.

Exchange | Buda |

Launch Date | 2015 |

Levels | 7 levels |

Trading Fees | Maker 0.10% - 0.40% Taker 0.20% - 0.40% |

Restricted Countries | Only available in Chile, Colombia, Peru, and Argentina |

Supported Coins | 6 |

Futures Trading | No |

Minimum Deposit | $1 |

Deposit Methods | Crypto, CLP, COP, PEN |

Withdrawal Methods | Crypto, CLP, COP, PEN |

Maximum Leverage | 1:1 |

Minimum Trade Size | Variable based on the market |

Security Factors | Cold Storage, Partnership with Chainalysis, Dynamic Key |

Services | Spot Trading, API, OTC Market |

Customer Support Ways | Live Chat, Twitter, Email |

Customer Support Hours | Monday through Friday from 9:00 AM to 6:00 PM (GMT-3) |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | No |

Buda.com Pros & Cons

When considering Buda.com as a cryptocurrency exchange platform, it's essential to weigh its advantages and disadvantages.

Pros | Cons |

Local fiat currencies support | Limited digital assets |

web and mobile trading platform | No margin trading |

Referral program | No copy trading or staking services |

90% of user funds stored in cold storage | Only available in select South American countries |

Buda User Levels

The exchange has implemented a 7-tier user-level system offering fee discounts based on 30-day trading volume in USD.

Tier | 30-D Trading Volume (USD) |

Tier 1 | 0 - 2K |

Tier 2 | 2K - 20K |

Tier 3 | 20K – 100K |

Tier 4 | 100K – 500K |

Tier 5 | 500K – 2.5M |

Tier 6 | 2.5M – 5M |

Tier 7 | 5M+ |

Buda Exchange Fees Explained

The platform charges 1.2% for buy/sell transactions, 2.4% for crypto swaps, and no fees on crypto deposits.

The trading fee varies based on the user level. We’ll list the trading fees for each user level in this Buda review.

User Level | Maker | Taker |

Tier 1 | 0.40% | 0.80% |

Tier 2 | 0.35% | 0.70% |

Tier 3 | 0.30% | 0.60% |

Tier 4 | 0.25% | 0.50% |

Tier 5 | 0.20% | 0.40% |

Tier 6 | 0.15% | 0.30% |

Tier 7 | 0.10% | 0.20% |

Note that the exchange offers up to 50% additional discounts for trading selected pairs, such as USDC/PEN and USDC/COP.

As a recent promotion, it charges no commissions for trading USDT/USDC.

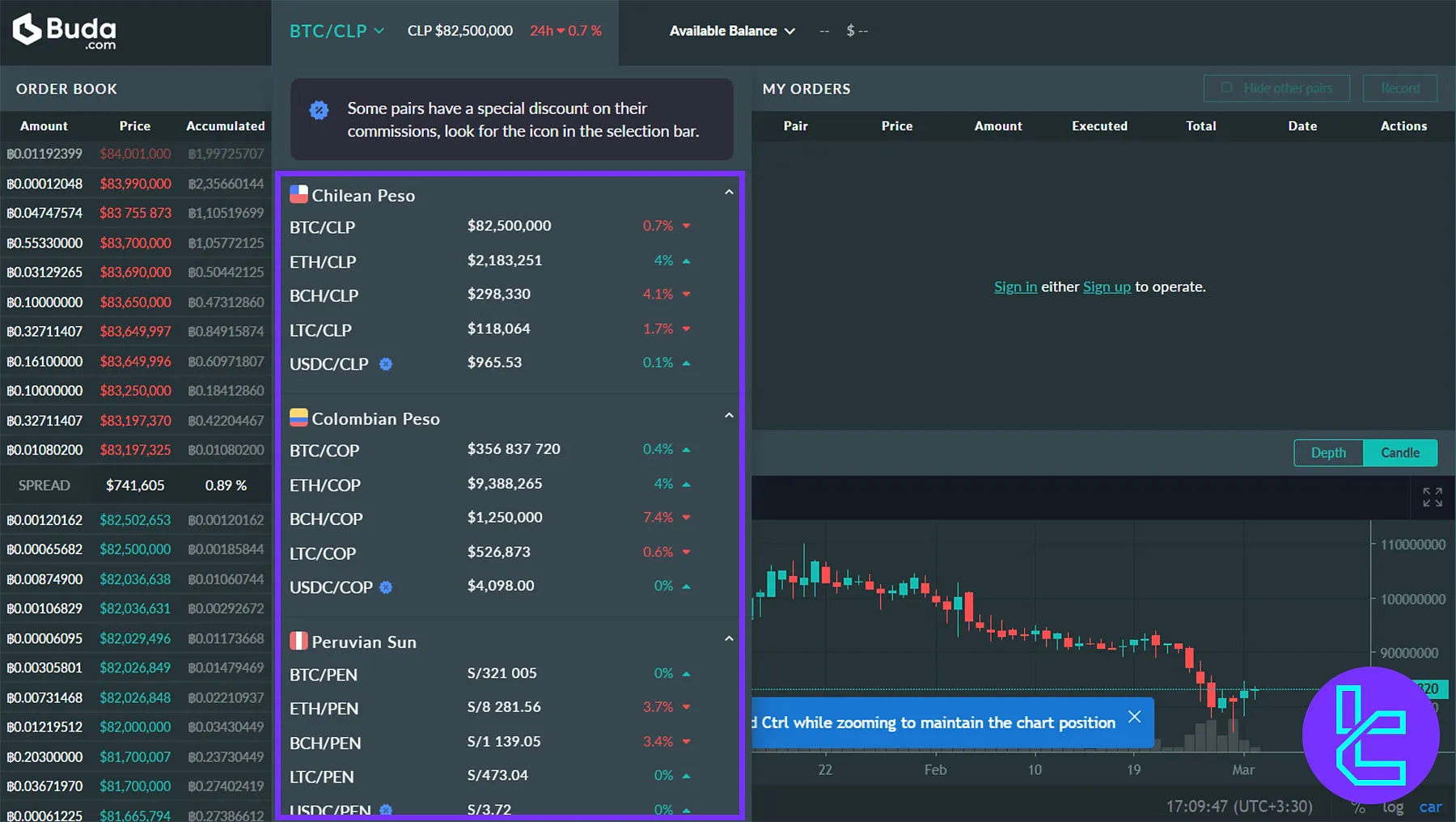

Supported Cryptocurrencies on Buda.com

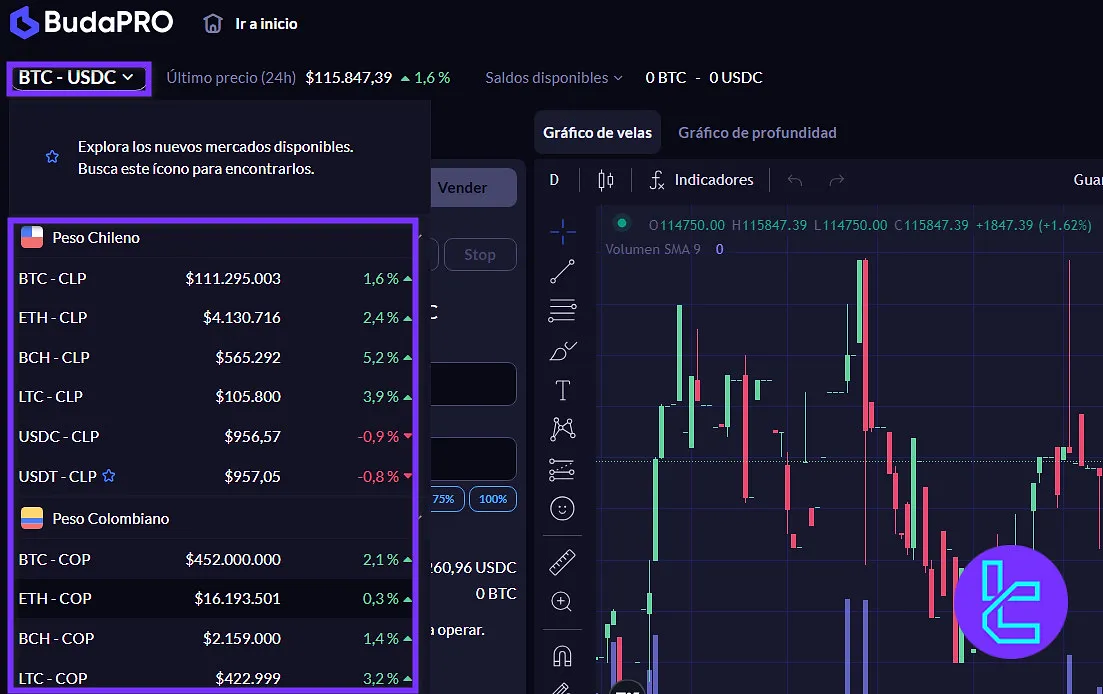

The exchange has listed 6 cryptocurrencies and 20 trading pairs in 5 markets.

Available markets include Chilean Peso (CLP), Colombian Peso (COP), Peruvian Sun (PEN), Bitcoin, and USDC. Available digital currencies on Buda exchange:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Ethereum (ETH)

- USDC

- Tether (USDT)

Does Buda Offer Leveraged Trading?

Buda Exchange does not offer Futures markets and Margin trading.

This decision aligns with the platform's focus on providing a straightforward and relatively low-risk trading environment for its users, particularly in the context of the South American market, where cryptocurrency adoption is still growing.

Buda.com Registration and KYC

Opening an account on Buda.com requires an email and completing the Know Your Customer (KYC) process.

#1 Visit the Official Website

Go to the broker's site and click on “Create Account.” Enter your email and set a secure password.

#2 Email Confirmation

Open your inbox and click the verification link to activate your account.

#3 Identity Verification

In the user dashboard, select “ID Verification”, pick your country, and scan the QR code to continue on your smartphone.

#4 Submit Documents & Biometrics

Use your phone to scan your government-issued ID and complete biometric verification.

#5 Address & Investor Profile

Upload a proof of address (like a utility bill), and configure your investor profile to match your trading preferences.

How to Trade with Buda Exchange

Trading on Buda.com is simple and straightforward. After registration and verification, just follow these steps:

#1 Start Trading

To begin, go to the homepage of Buda and click on “BudaPro” to access the trading interface.

#2 Choose a Trading Pair

On the left-hand side, click on the current trading pair and select your preferred one from the list of available pairs.

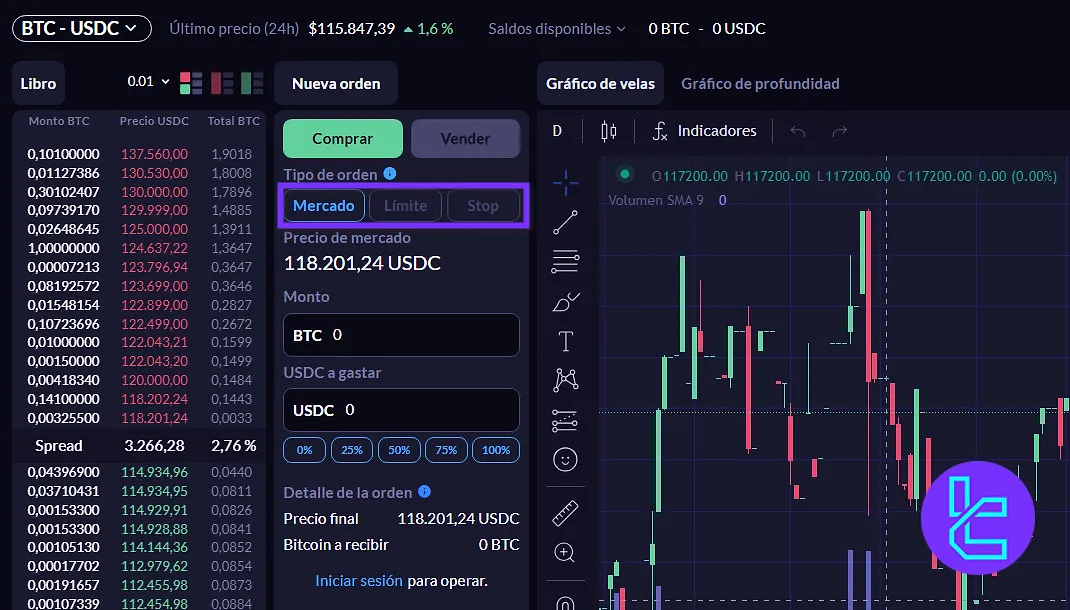

#3 Pick an Order Type

Next, choose your order type. Buda.com supports market, limit, and stop orders.

#4 Specify the Amount

Enter the amount you want to trade in the “Monto” field.

#5 Confirm the Trade

Finally, click on the green button to buy or the red when you are selling to confirm your order.

Buda Exchange App and Platform

Developing a trading platform with TradingView integration is one of the upsides of this Buda review.

The exchange offers a web-based platform and a mobile application available across multiple operating systems, including:

Buda Services

Check out the table below to make sure your favorite trading services are available in the Buda exchange.

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

Demo Account | No |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Buda Safety and Security

The exchange keeps 90% of the clients’ assets in offline cold wallets.

Buda.com previously offered up to $5,000 in rewards through its Bug Bounty Program; however, the program has been suspended since early 2023. Buda security measures:

- Partnership with “Chainalysis” as a third-party solution to monitor transactions

- Dynamic Key to the login account

- Cold storage

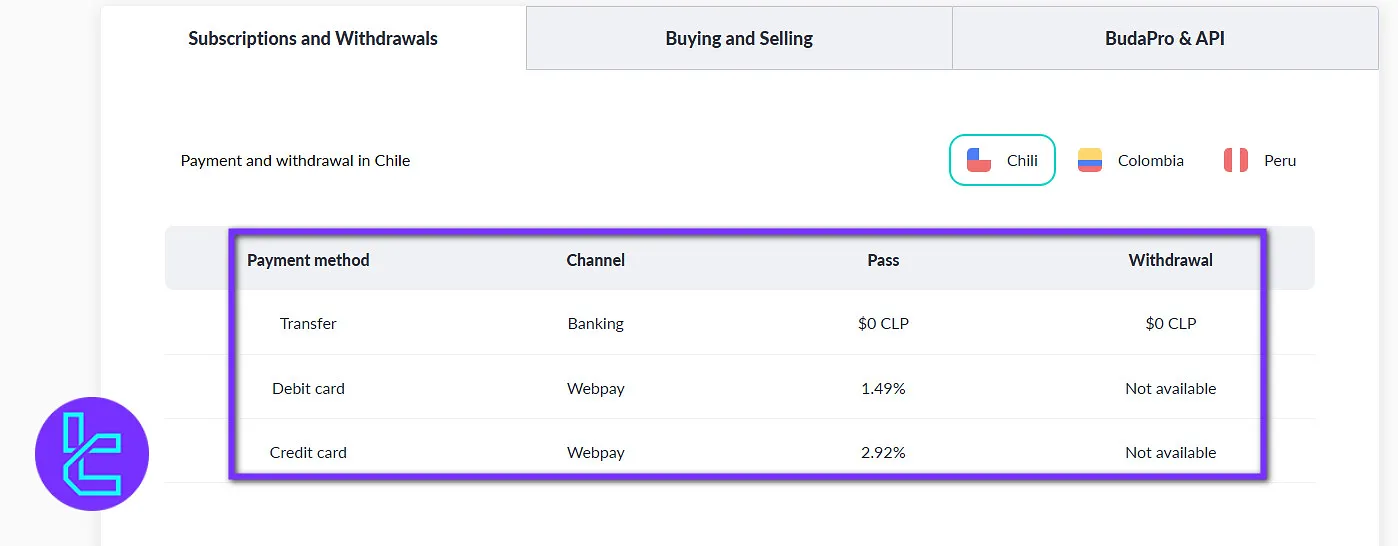

Buda.com Payment Methods

The platform supports Fiat and Crypto transactions. The supported fiat currencies include Chilean Peso (CLP), Colombian Peso (COP), and Peruvian Sun (PEN). Buda exchange deposit and withdrawal options:

Currency | Method | Deposit Fee | Withdrawal Fee |

Chilean Peso (CLP) | Bank Transfer | 0 | 0 |

Credit Card WebPay | 1.49% | Not Available | |

Debit Card WebPay | 2.92% | Not Available | |

Colombian Peso (COP) | Bank Transfer PSE | COP 3,000 | Not Available |

Bank Transfer ACH | Not Available | COP 2,150 + 0.4% | |

Transfer TPaga | Not Available | 0 | |

PSE TPaga | COP 2,500 | Not Available | |

Peruvian Sun (PEN) | Bank Transfer | 0 | PEN 4 |

Debit Card | 2.25% + PEN 0.70 | N/A | |

Credit Card | 3% + PEN 0.70 | N/A |

Buda Exchange User Experience

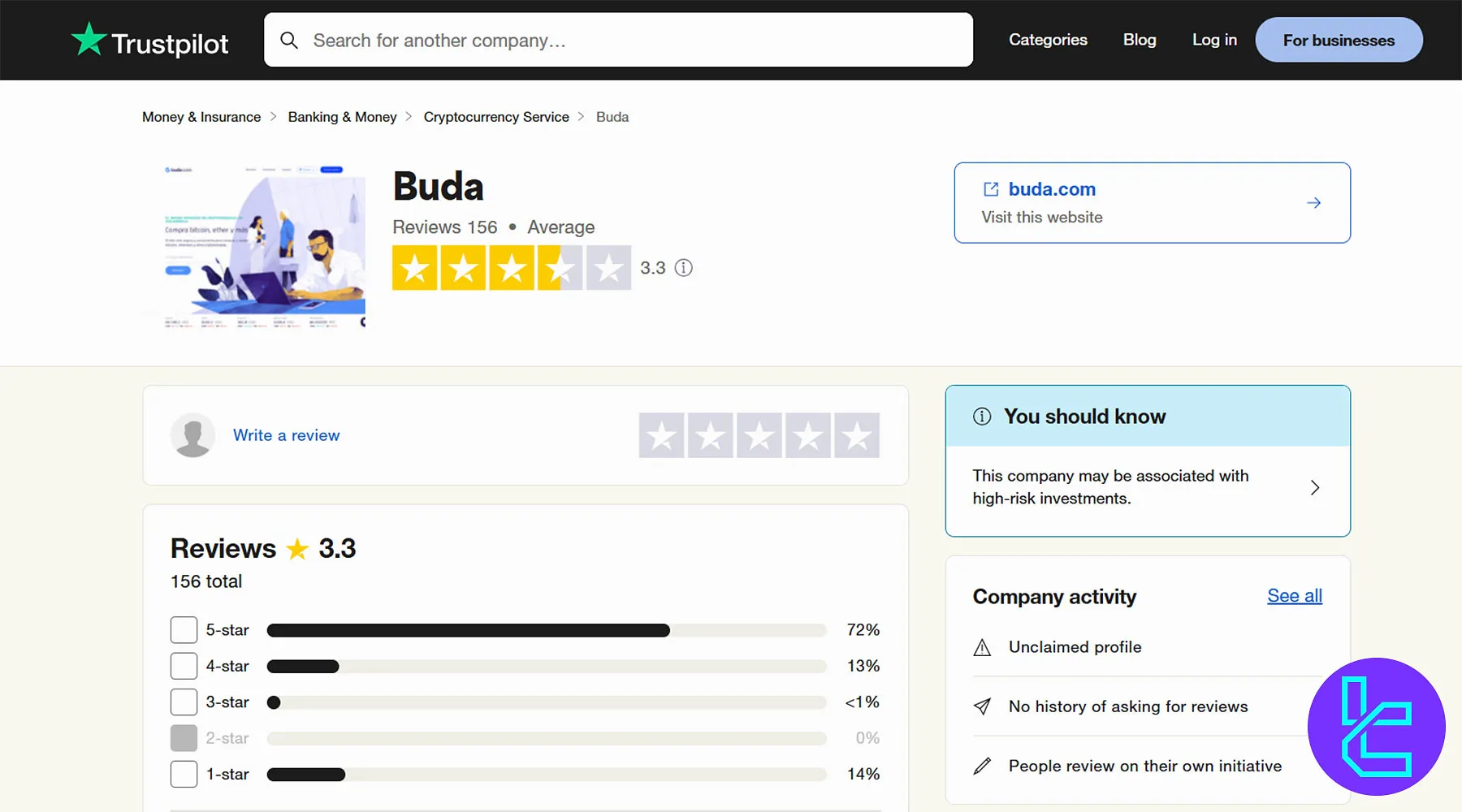

The company has an acceptable standing in clients’ views. There are 156 comments on the Buda Trustpilot profile resulting in a score of 3.3 out of 5. While 85% of Buda reviews on TP are positive (4-star and 5-star), only 14% are 1-star.

Buda Features

The exchange does not offer a wide range of additional features and services to its users:

Staking | No |

Yield Farming | No |

Social Trading | No |

Launchpool | No |

Crypto Cards | No |

Buda Bonus

Buda.com currently does not offer traditional trading bonuses such as deposit matches or welcome rewards.

Instead, the exchange focuses on low fees, high liquidity, and fast fiat-to-crypto conversions across Latin America. Its main incentive program is a referral bonus:

Bonus Type | Reward |

Referral Program | 20% commission |

Buda Referral Program

With Buda’s referral program, users can invite friends and earn 20% of what they pay in commission for a full year.

Unlike some exchanges that rely on aggressive bonus campaigns, Buda.com emphasizes transparency, regulatory compliance, and long-term growth, aiming to deliver consistent value to traders rather than short-term promotional offers.

Buda Customer Support

We must mention in this Buda review that the exchange provides support Monday through Friday from 9:00 AM to 6:00 PM (GMT-3) through various channels, including Buda Twitter, email, and a live chat feature.

- Email: soporte@buda.com

- Live chat: Available on the official website

Does Buda.com Support Copy Trading or Investment Plans?

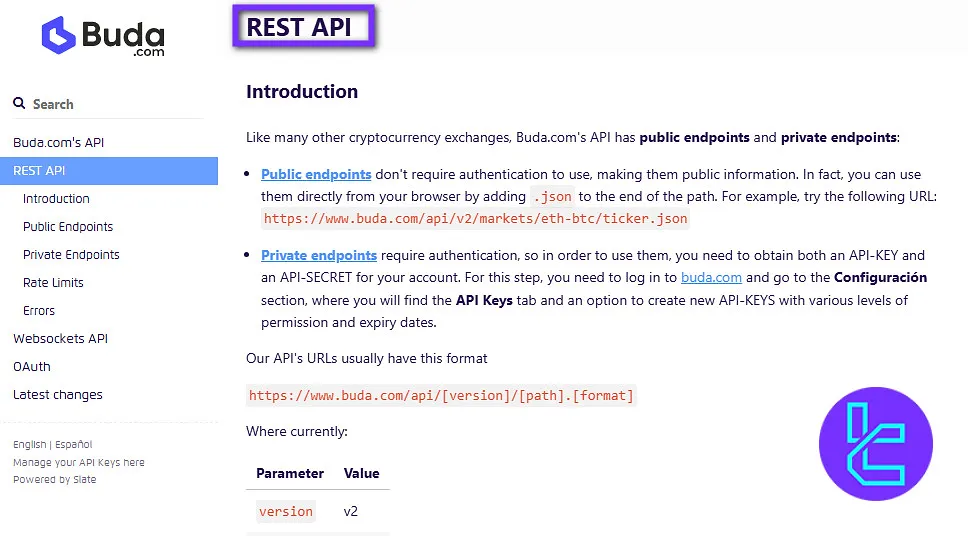

While the exchange doesn’t offer copy trading or investment plans, it provides two API protocols, includingREST and Websockets, suitable for developing EAs and automated trading. The exchange also offers an affiliate program for passive income with the following features:

- 20% of referred clients’ commissions

- No limits

- Tax included in Chile

- Monthly payouts

Buda Exchange Restricted Countries

The platform focuses on the South American market, and its services are only available in four countries, including:

- Chile

- Colombia

- Peru

- Argentina

Buda Compared to Other Crypto Exchanges

The platform does not have much to say in comparison to the competition:

Features | Buda Exchange | BitMart Exchange | Deribit Exchange | Cex.io Exchange |

Number of Assets | 6 | 1700+ | 30+ | 166+ |

Maximum Leverage | 1x | 1:100 | 1:100 | 1:10 |

Minimum Deposit | $1 | $1 or 0,0001 in BTC | $5 / 0.00001 BTC | $5 |

Spot Maker Fee | 0.1% - 0.4% | From 0.04% | 0% | 0.0% - 0.15% |

Spot Taker Fee | 0.2% - 0.8% | From 0.045% | 0% | 0.01% - 0.25% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | No |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | No | Yes |

Copy Trading | No | Yes | No | No |

Writer’s Opinion and Conclusion

In conclusion, Buda.com remains a specialized yet reliable platform for South American traders in 2025.

With access to 20 trading pairs and support for local currencies like CLP, COP, and PEN, it offers much-needed convenience for regional users who often face barriers when using global exchanges.

Its fee system, ranging from 0.10% to 0.40% for makers and 0.20% to 0.80% for takers, provides flexibility, while promotions such as zero commissions on USDT/USDC pairs enhance its competitiveness.

On the user side, the exchange maintains a Trustpilot score of 3.3/5, based on 156 reviews, where over 85% of feedback is positive.

Its mobile application has crossed 100,000 downloads on Google Play, with a 4.0/5 rating, reflecting a solid user experience.