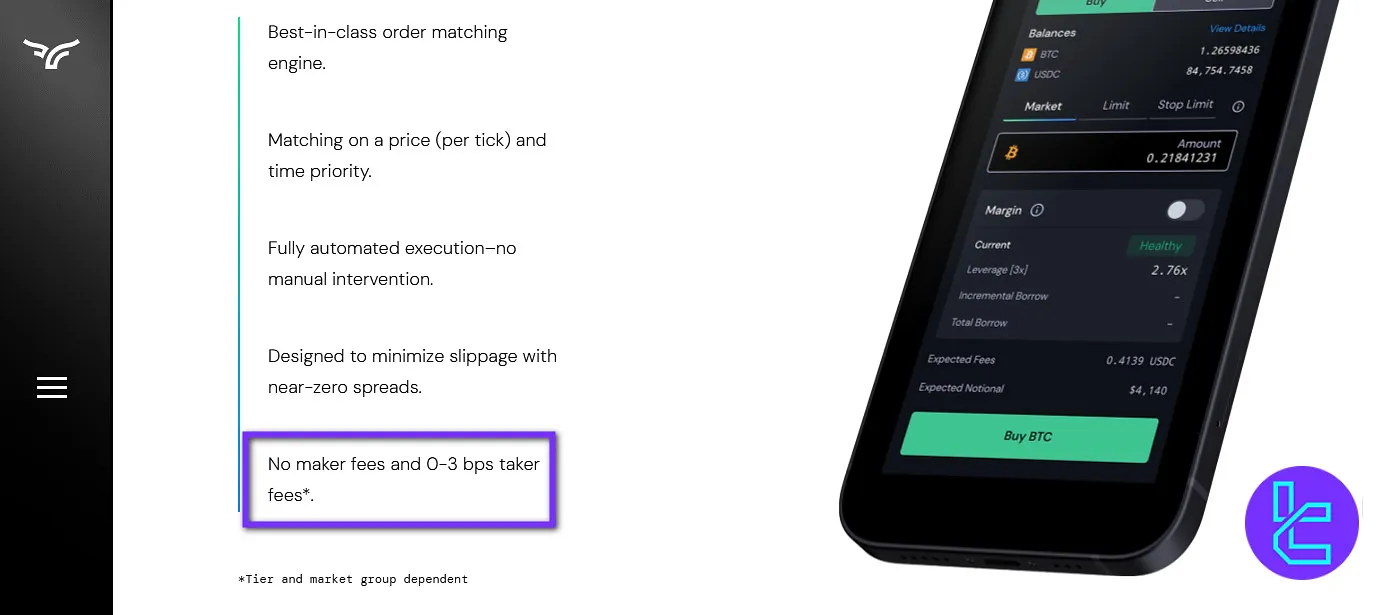

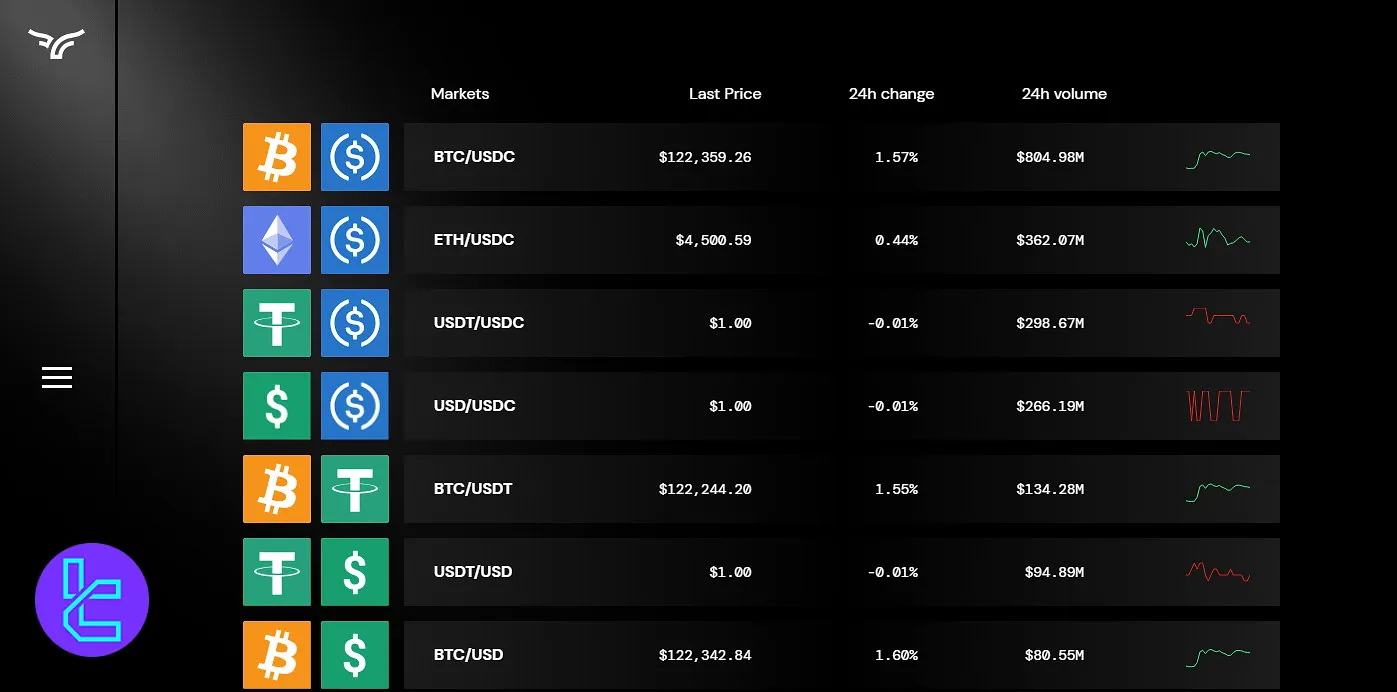

Bullish as a centralized exchange offers access to Crypto Spot and Perpetual markets with a maximum leverage of 1:7. The exchange charges no maker fees, while taker fees range from 0.0% to 2.0%.

Spreads for ETH/USDC and BTC/USDC pairs are $0.01 and $0.10, respectively. Since its launch in 2021, Bullish has processed over $25 billion in cumulative trading volume, serving a growing base of institutional and retail traders across more than 50 countries.

Daily trading volumes frequently exceed $150 million, demonstrating significant market activity despite being a relatively new entrant in the crypto exchange space.

Bullish; An Introduction to the Crypto Exchange

Bullish is a blockchain-based crypto exchange founded in 2021 as a subsidiary of Block.one backed by PayPal cofounder "Peter Thiel".

The company operates through three legal entities in multiple jurisdictions, including Global, Germany, and Hong Kong, with the following licenses:

- Hong Kong Securities and Futures Commission (SFC) with CE No. BUQ958

- Gibraltar Financial Services Commission (GFSC) with DLT license No. FSC1038FSA

- German Federal Financial Supervisory Authority (BaFIN)

This Bullish review will explore the global branch’s offerings and features.

Bullish Exchange CEO

Tom Farley serves as the Chief Executive Officer of Bullish, leading the company’s strategic vision and growth initiatives.

With decades of experience in global finance, Tom previously held top leadership roles including CEO, President, and Chairman at Far Peak Acquisition Corporation and Far Point Acquisition Corporation. He also chairs Global Blue Group Holding AG (NYSE: GB).

Before joining Bullish, Tom Farley was President of the NYSE Group at Intercontinental Exchange Inc. (ICE) from 2014 to 2018, overseeing the world’s largest equities listing and trading venue.

During his tenure, he spearheaded major operational and strategic transformations, tripling profits, doubling pre-acquisition operating margins, cutting annual costs by US$550 million, and modernizing NYSE technology.

Prior roles include SVP of Financial Markets at ICE and President, CFO, and COO of SunGard Kiodex, giving him a deep well of executive leadership experience across exchanges, financial markets, and technology modernization initiatives.

You can connect with him through the link below:

Bullish Exchange Table of Specifications

Led by CEO"Tom Farley", the crypto exchange offers a wide range of solutions, from API services to perpetual trading.

Exchange | Bullish |

Launch Date | 2021 |

Levels | 5 levels |

Trading Fees | Up to 0.02% for Spot Taker Orders 0% for Maker Orders |

Restricted Countries | Canada, China, Japan, Israel, The Russian Federation, United Kingdom, Iran, North Korea, Myanmar |

Supported Coins | 39 |

Futures Trading | Yes |

Minimum Deposit | $1 |

Deposit Methods | Wire Transfer, Crypto |

Withdrawal Methods | Wire Transfer, CUBIX, Crypto |

Maximum Leverage | 1:7 |

Minimum Trade Size | $1 |

Security Factors | Two-Factor Authentication (2FA), Cold storage, Multi-signature wallets |

Services | Spot Trading, Perpetual Markets, AMM, Dated Futures, API services |

Customer Support Ways | Ticket |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | Market |

Native Token | No |

Bullish Pros & Cons

The exchange supports crypto spot and futures trading in 9 markets. However, like any trading platform, Bullish has some downsides, too.

Pros | Cons |

Variable trading services, from Spot and Futures to Automated Market Making | Relatively new in the market |

Strong foundation and backing from industry leaders | A complex fee structure can be confusing for beginners |

Deep liquidity pools and tight spreads | No mobile app available |

Regulated and compliant platform | Limited cryptocurrency offerings |

Bullish User Levels

The exchange doesn’t offer a traditional user level system. However, it categorizes clients based on two parameters: Average Daily Taker Volume (ADTV) and Same-Direction.

- Average Daily Taker Volume (ADTV): Measures the percentage of the client’s daily taker volume out of all taker orders

- Same-Direction: Measures the percentages of subsequent taker orders sent by all market participants on the same market in the same direction as your taker order

Tier | Client ADTV | Client Same-Direction |

Level 1 | Under 0.01% | Any |

Level 2 | Over 0.01% | Under 60% |

Level 3 | Over 0.01% | 60% to 75% |

Level 4 | Over 0.01% | 75% to 88% |

Level 5 | Over 0.01% | Over 88% |

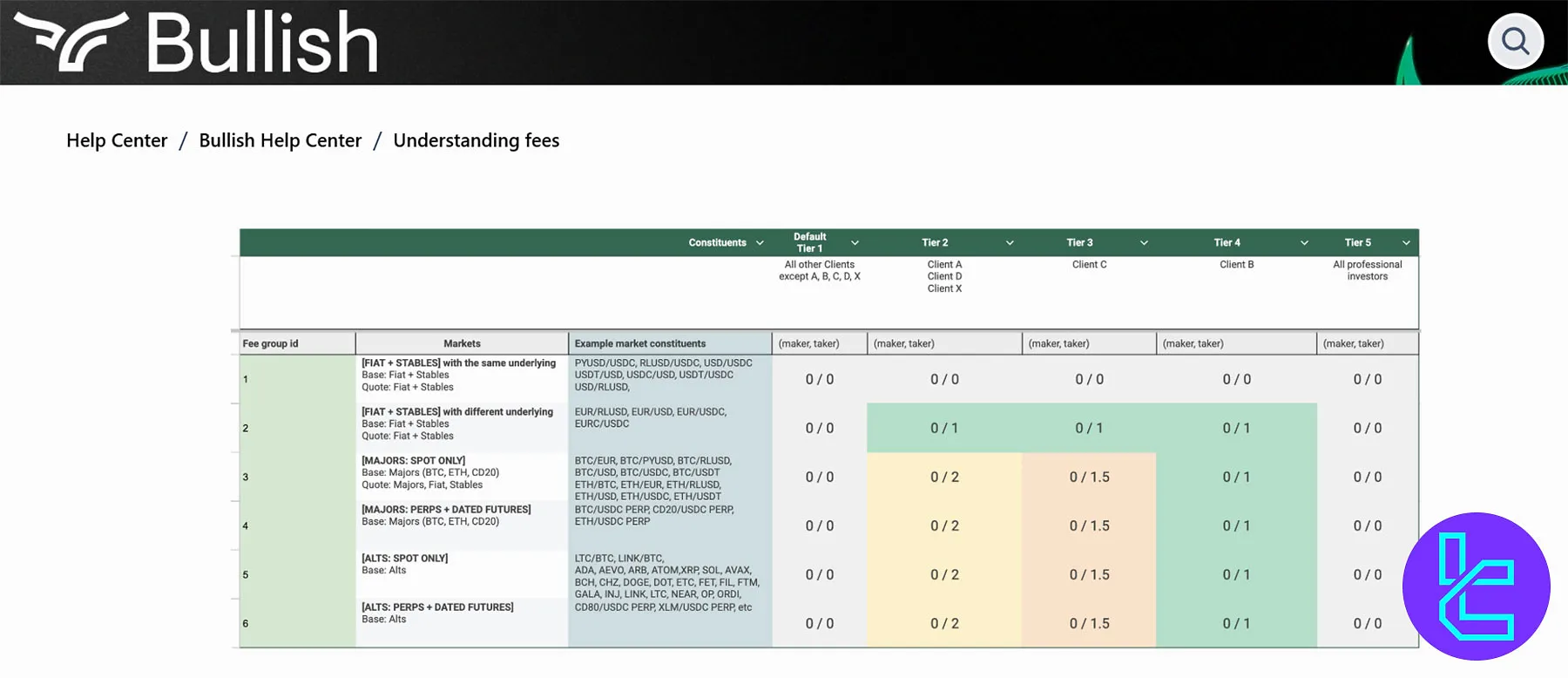

Bullish Exchange Fees and Commissions

The company has implemented a maker/taker fee structure. While it charges no fees on maker orders, Taker fees are calculated based on the user level and the digital asset:

User Level | Spot fiat/stable markets with the same underlying | Spot fiat/stable markets with a different underlying | All other markets |

Level 1 | 0% | 0% | 0% |

Level 2 | 0% | 0.01% | 0% |

Level 3 | 0% | 0.01% | 0.01% |

Level 4 | 0% | 0.01% | 0.015% |

Level 5 | 0% | 0.01% | 0.02% |

The platform charges hourly interest rates for borrowing assets to participate in the Margin market. At least one hour’s interest (APR) applies to all loans. Bullish exchange formula for the perpetual market interest rates:

- Borrower Interest Charge = ((1 + APR) ^ (1 / 365 * 24) - 1) * Borrow * (1 + Multiplier * Taker Fee)

For the AMM (Automated Market Making) services, the exchange calculates fees in three tiers, including 25%, 10%, and 0%. It also charges an additional 0.5% rate for each order that the Liquidation Engine fills.

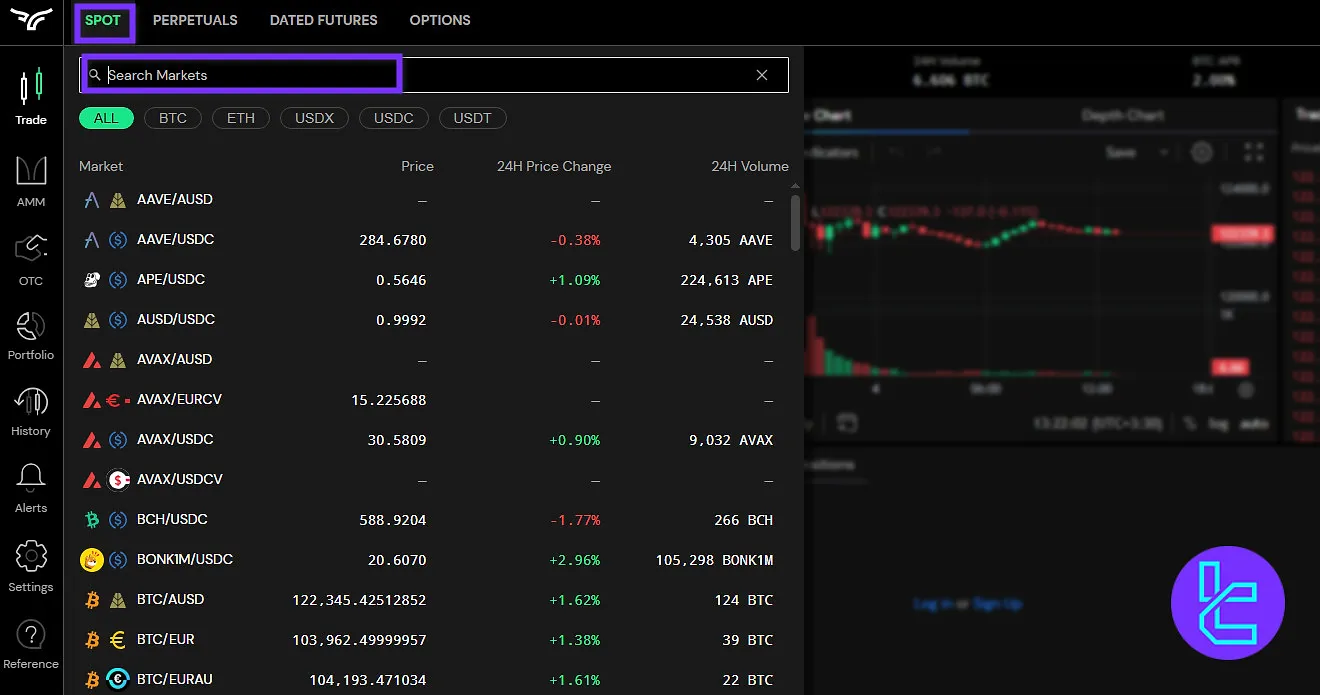

Available Digital Assets on Bullish

In this Bullish review, we must mention that the exchange offers spot trading in USD, EUR, RLUSD (Ripple USD), PYUSD (PayPal USD), USDC, USDT, BTC, XRP, and ETH markets. Alist of some of the popular cryptocurrencies available on Bullish:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Solana (SOL)

- Aave (AAVE)

- Chainlink (LINK)

- Curve DAO Token (CRV)

- Sushiswap (SUSHI)

- Uniswap (UNI)

It's important to note that asset availability may vary by jurisdiction.

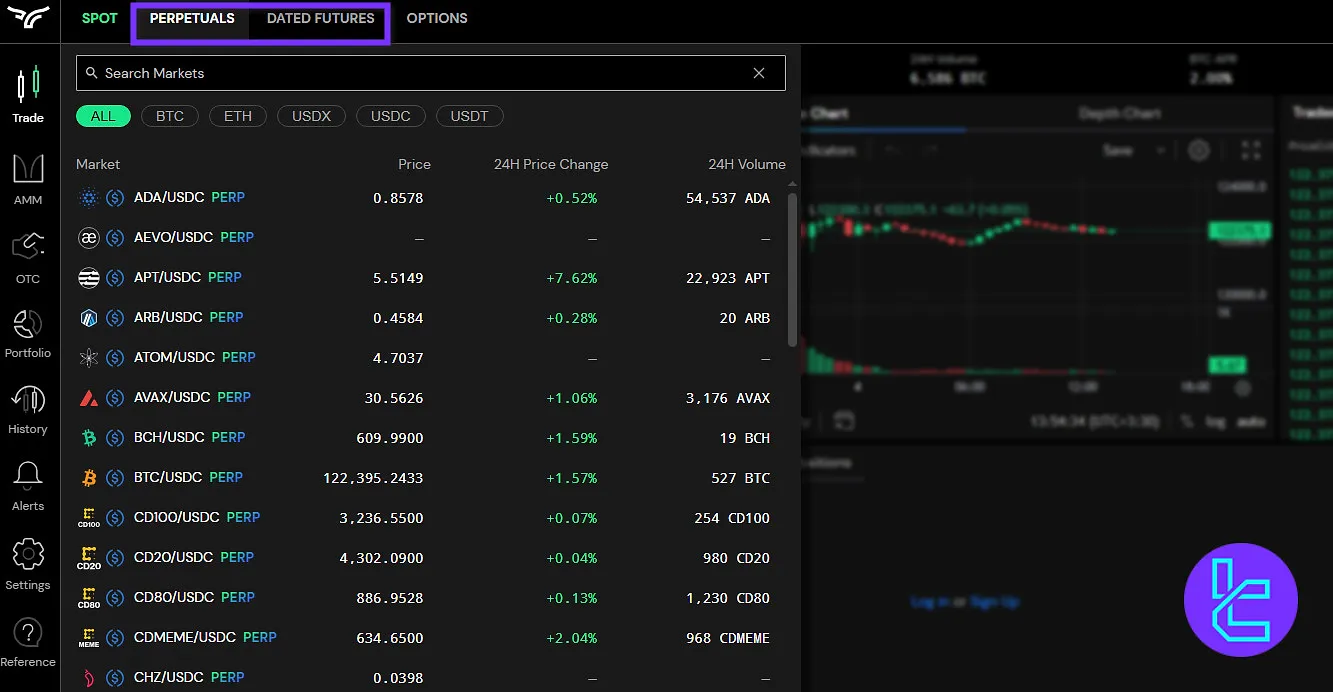

Bullish Futures Market

The exchange has a Perpetual market offering leveraged trading of up to 1:7 on 28 Crypto/USDC trading pairs. Available cryptocurrencies for margin trading on Bullish exchange:

- BTC

- ETH

- CD20 index

- AVAX

- XLM

- LINK

- NEAR

- XRP

- ADA

- UNI

- OP

- BCH

Available crypto perpetual contracts on the Bullish platform

The exchange also offers access to Dated-Futures, which involves buying or selling a specific asset at a predetermined price and date in the future, with the contract expiring on that particular date.

Bullish Exchange Registration and KYC

To register on Bullish, you need an email address, a strong password, and a two-factor authenticator, such as WebAuthn passkey, Google Authenticator, and Authy.

#1 Access and Begin Registration

Visit the platform’s official website and click “Sign Up” to initiate the account creation process.

#2 Verify Email and Set Credentials

Enter a valid email address, verify it through the confirmation link, choose a security question, and create a secure password.

#3 Activate 2FA

Enable two-factor authentication (2FA) using an app like Google Authenticator to enhance login security.

#4 Complete KYC via Persona

Upload valid ID documents, provide proof of address, and finish the liveness check using Persona to fully verify your identity.

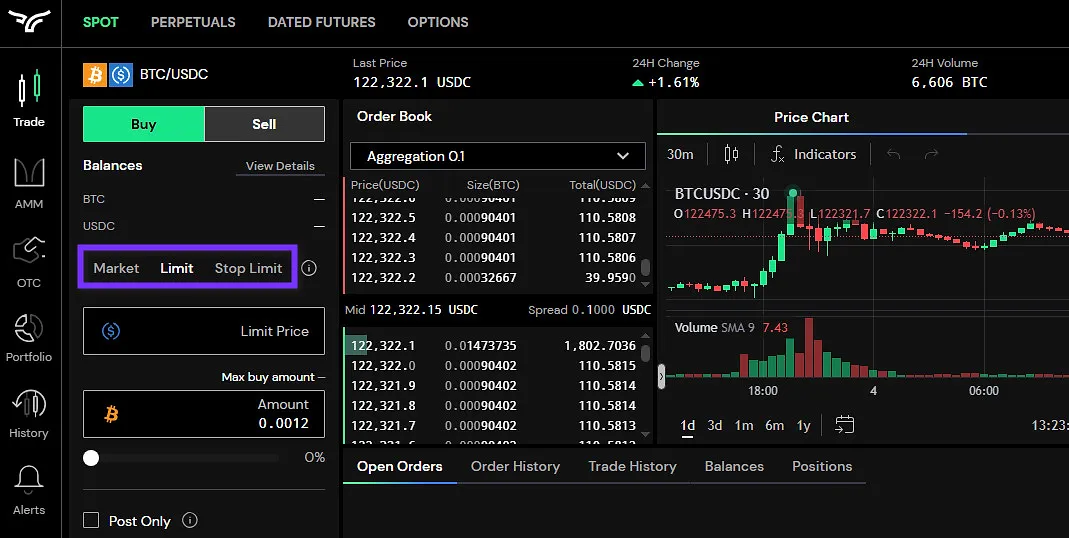

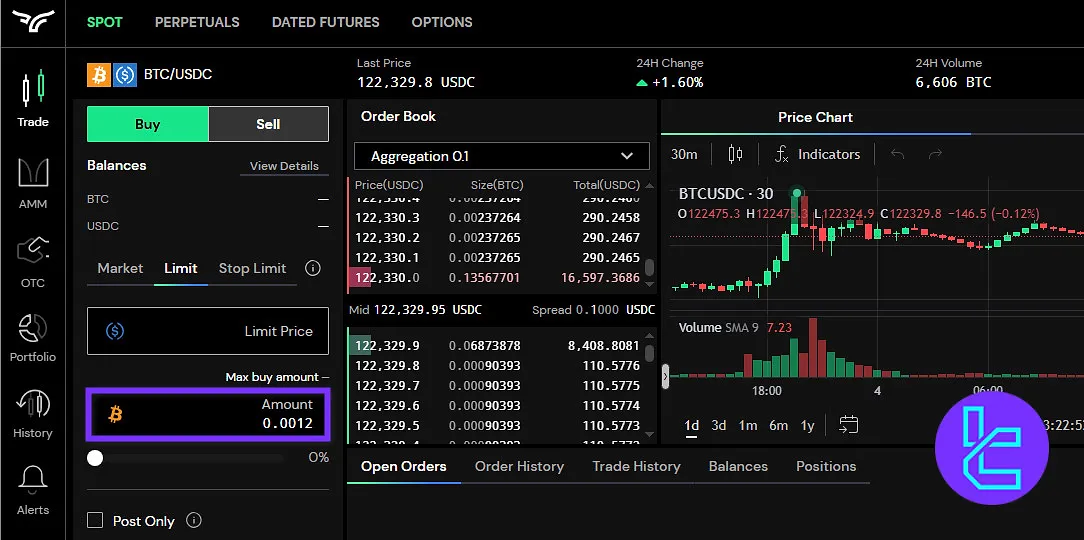

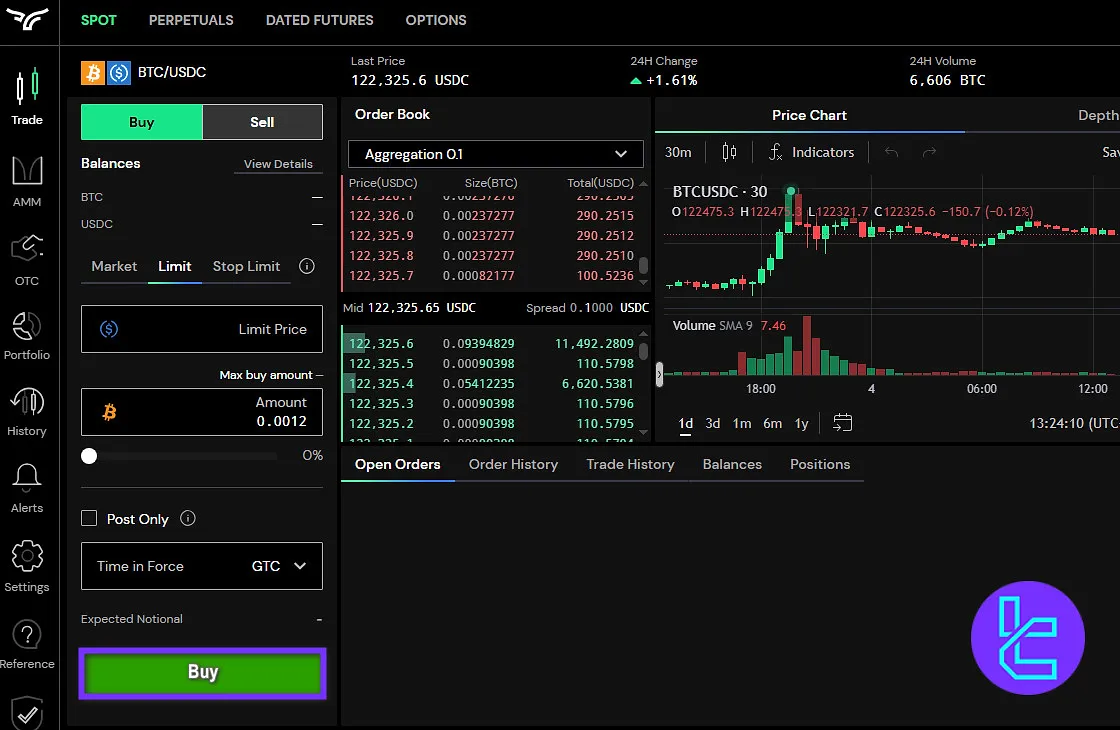

How to Trade on Bullish Exchange

Trading on Bullish Exchange is simple, and you only need to follow these steps after registration and verification:

#1 Start Trading

To begin, on the Bullish homepage, click on “Exchange”.

#2 Choose a Trading Pair

Next, hover your mouse pointer over the “Spot” section and then enter your preferred trading pair in the search box and select it.

#3 Pick an Order Type

Now, select an order type. Bullish Exchange offers limit, market, stop-loss, and stop-limit orders.

#4 Specify the Amount

Enter the trading volume in the “Amount” section to set how much you want to trade.

#5 Confirm the Trade

Finally, click “Buy” or “Sell” to complete the trade.

Bullish App and Platform

One of the biggest letdowns in this bullish review is the lack of a dedicated mobile application. Trading is only available through a web-based platform.

While the lack of a dedicated mobile app might be inconvenient for some users, the web platform's responsiveness ensures that traders can still access their accounts and execute trades from their mobile devices through a web browser.

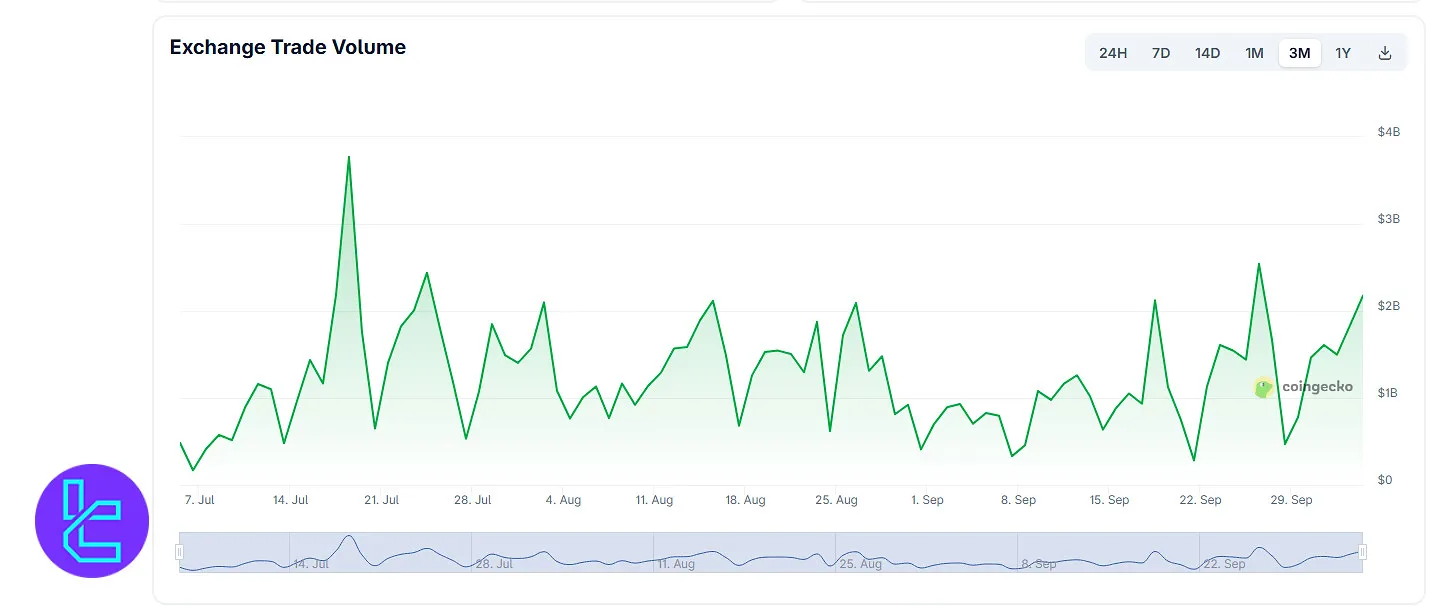

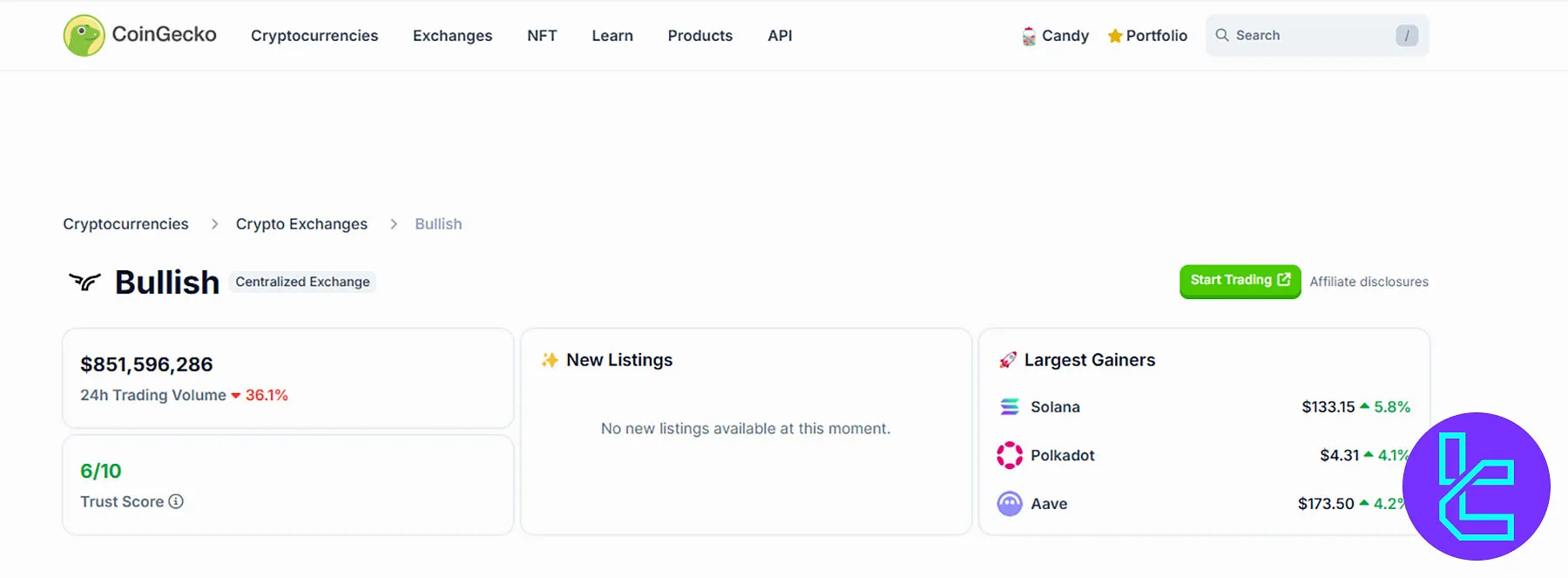

Bullish Exchange Trading Volume

According to the Bullish CoinGecko chart, over the past three months, trading activity has shown a strong upward momentum, signaling renewed confidence among market participants.

After several mid-cycle dips in August, volume surged again toward late September, closing the quarter above the $2 billion mark.

This consistent rebound pattern suggests that buyers are re-entering the market with conviction, maintaining a bullish sentiment that could carry forward into Q4.

Bullish Exchange Services

Using the table below, you can check out the availability of trading services in Bullish exchange:

Service | Availability |

TradingView Integration | No |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | No |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Bullish Exchange Security

The platform prioritizes clients’ funds safety by supporting various two-factor authenticators, including hardware security tokens through WebAuthn. Bullish security factors:

- Regulated by multiple financial authorities, including the SFC, GFSC, and BaFIN

- Audited by Deloitte

- Two-Factor Authentication (2FA)

- Cold storage

- Offline cold key storage

- Multi-signature wallets

- Globally distributed backup keys

- Partnerships with BitGo and Fireblocks as custody solution providers

- Verified track record of no successful hacks

It's worth noting that the exchange does not employ an investor protection fund scheme despite being regulated.

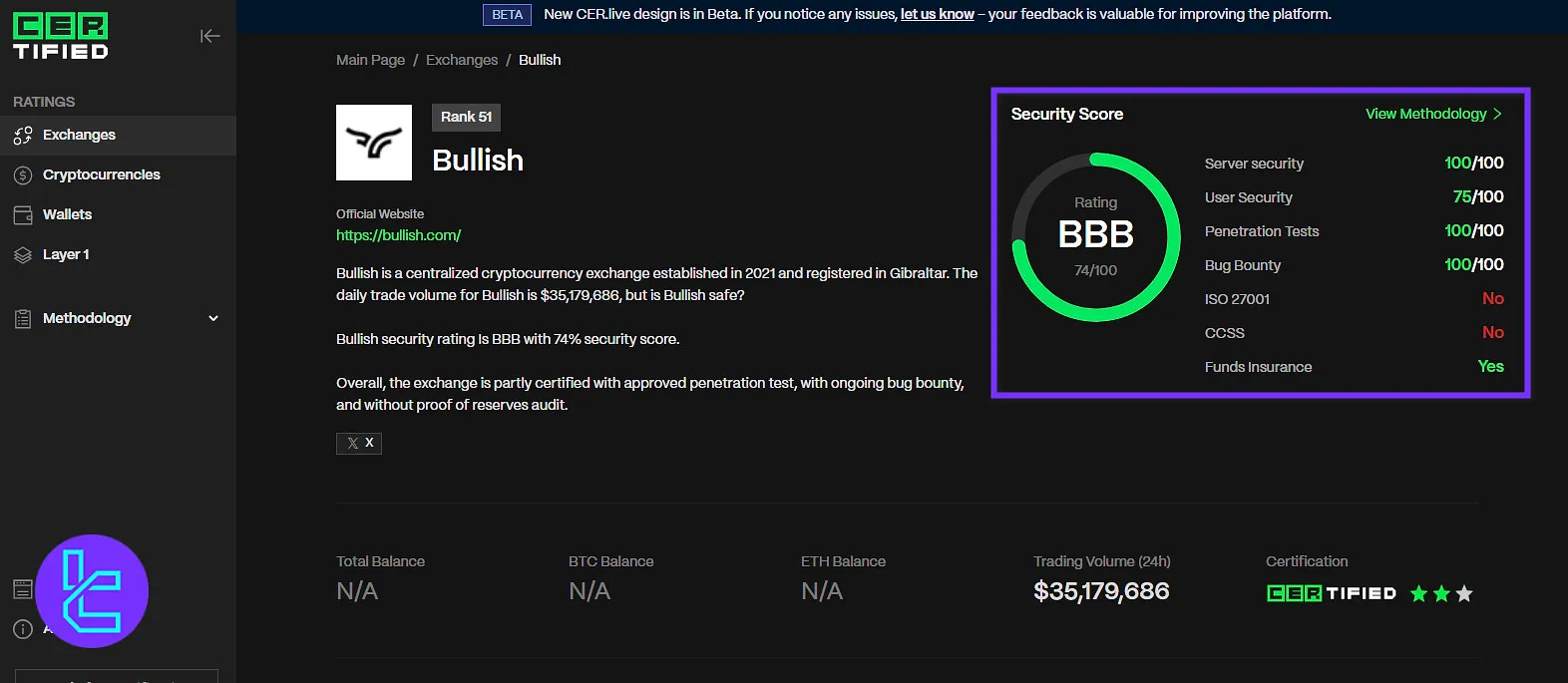

Bullish Security Rankings

Bullish Exchange demonstrates a strong commitment to platform security, earning an overall score of 74% (BBB) in its latest assessment by CER.live.

The exchange excels in critical areas such as server security, penetration testing, and its bug bounty program, all scoring a perfect 100/100, reflecting robust technical safeguards.

According to the Bullish CER.live review, user security is solid as well, with a score of 75/100, while additional protections like funds insurance provide an extra layer of confidence for traders.

However, the platform does not currently hold ISO 27001 or CCSS certifications, highlighting areas for potential future improvement.

Overall Score | 74% (BBB) |

Server Security | 100/100 |

User Security | 75/100 |

Penetration Tests | 100/100 |

Bug Bounty | 100/100 |

ISO 27001 | No |

CCSS | No |

Funds Insurance | Yes |

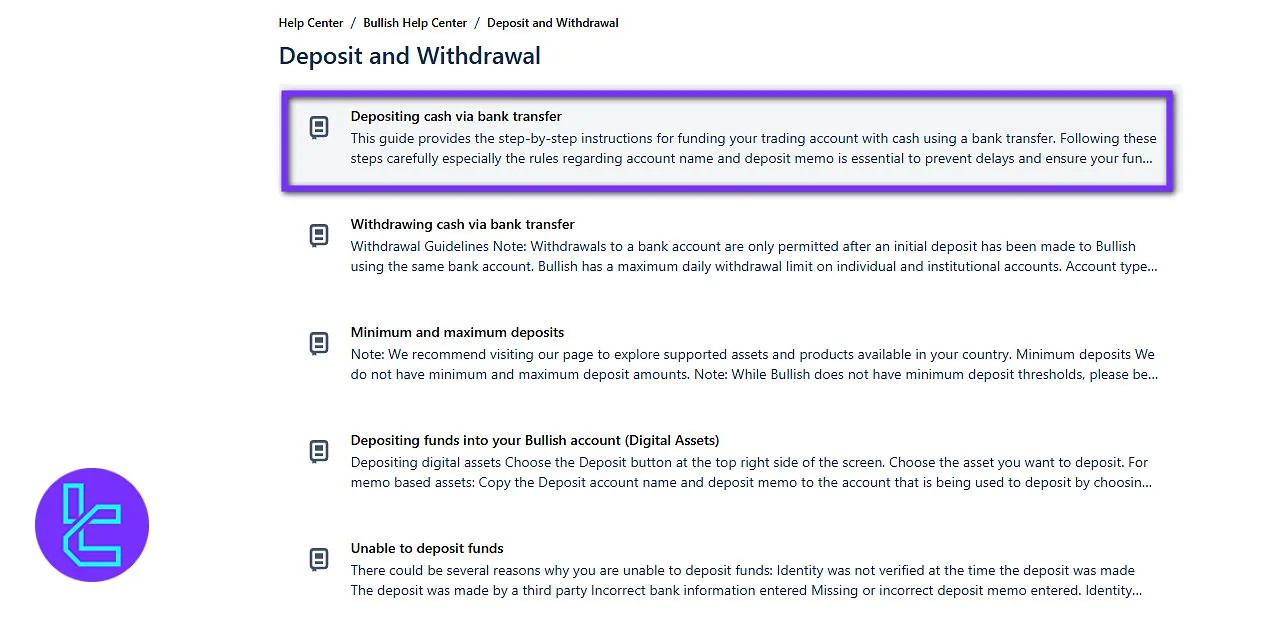

Available Payment Options on Bullish

The exchange supports USD and EUR fiat transactions in addition to Crypto deposits and withdrawals. The available options for fiat funding are SWIFT, SEPA, and CBIT. Available fiat payment methods on Bullish:

- SWIFT

- SEPA

- CBIT

- CUBIX (only withdrawal)

- Bank Wire

While all deposits and CUBIX withdrawals are free of charge, wire withdrawals incur a $30 commission.

Bullish Exchange Trust Scores

There are no Bullish reviews on platforms like Trustpilot and Forex Peace Army. However, CoinGecko experts have rated the platform as an average crypto exchange. The Bullish Exchange CoinGecko profile has a 6 out of 10 score.

ScamAdviser, a website evaluation platform, has assigned a decent "Trustscore" of 76/100 to the mentioned exchange, based on rankings from Tranco, DNSFilter, and Maltiverse, as well as other factors.

Bullish Features

This exchange does not go beyond basic trading features:

Staking | No |

Yield Farming | No |

Social Trading | No |

Launchpool | No |

Crypto Cards | No |

Bullish Exchange Promotion

Currently, Bullish exchange only offers one promotion for first-time depositors. Below you can see the details of this promotion:

Bonus Type | Reward |

First-Time Deposits | $100 USDC |

Deposit Bonus

New clients can receive a $100 USDC trading credit after their first deposit of at least 100 USDC and executing any spot or derivatives trade.

The promotion is available to the first 50 qualifying users, giving traders a quick boost to start their journey on the platform.

Bullish Customer Support

Another downside in this Bullish review is the lack of proper support channels like live chat or a call center. The exchange provides a comprehensive “Help Center” with answers to the most common questions.

It also implements a ticket system as the single method for contacting the support team.

Investment and Growth Plans on Bullish Exchange

While the platform doesn’t offer traditional copy trading services, it has developed various Crypto indices tracking price changes of digital asset bundles, including:

- CoinDesk 20 (CD20)

- CoinDesk 80 (CD80)

- CoinDesk Meme (CDMEME)

- CoinDesk 100 (CD100)

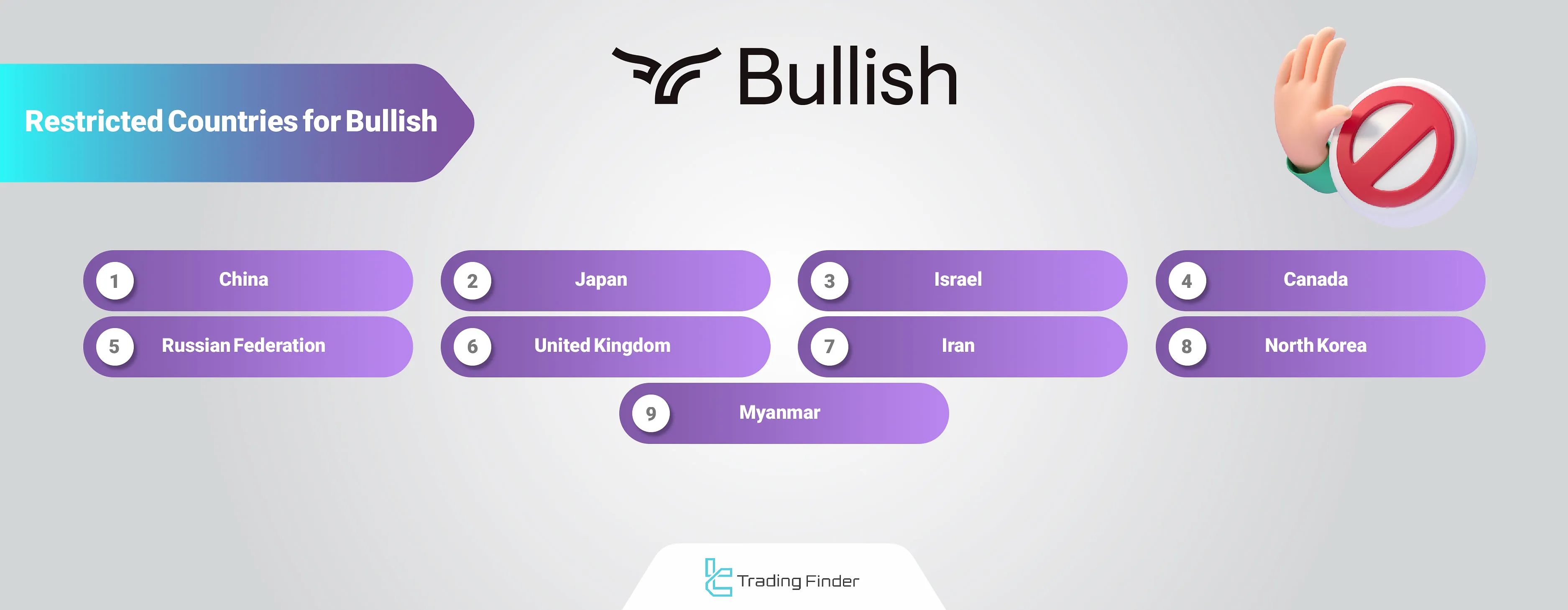

Prohibited Countries on Bullish Exchange

The platform doesn’t service persons in China, Japan, Israel, Canada, the Russian Federation, or any jurisdiction subject to sanction, such as Iran and North Korea. Bullish Red Flag Countries:

- China

- Japan

- Israel

- Canada

- Russian Federation

- United Kingdom (Only available to professional investors)

- Iran

- North Korea

- Myanmar

Comparison Between Bullish and Other Exchanges

For a fair evaluation of Bullish's specifications from a comparison point of view, check out this table:

Features | Bullish Exchange | LBank Exchange | Bybit Exchange | |

Number of Assets | 39 | 700+ | 1300+ | 800+ |

Maximum Leverage | 7x | 1:125 | 1:100 | 1:125 |

Minimum Deposit | $1 | Varies by Cryptocurrency | Varies by Cryptocurrency | $1 |

Spot Maker Fee | 0% | 0.02% | 0.005% - 0.1% | 0.005% - 0.1% |

Spot Taker Fee | 0% - 0.02% | 0.02% | 0.015% - 0.1% | 0.02% - 0.1% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

The Bullish exchange is a growing player in the crypto market, providing access to 39 digital assets, 28 perpetual trading pairs, and 71 spot contracts.

The platform has executed more than 1.2 million trades over the past year alone, with average daily trading volumes surpassing $150 million.

Deposits are supported via CUBIX, SEPA, and SWIFT with no minimum requirements for account funding, making it highly accessible to new users.

Security-wise, Bullish maintains cold storage for 95% of client funds, uses multi-signature wallets, and implements two-factor authentication across all accounts.