CEX.io offers access to over 450 trading pairs in Spot and Margin markets with leverage options of up to 10 and BTC and USDT as base currencies. Default maker/taker fees are 0.15%/0.25%.

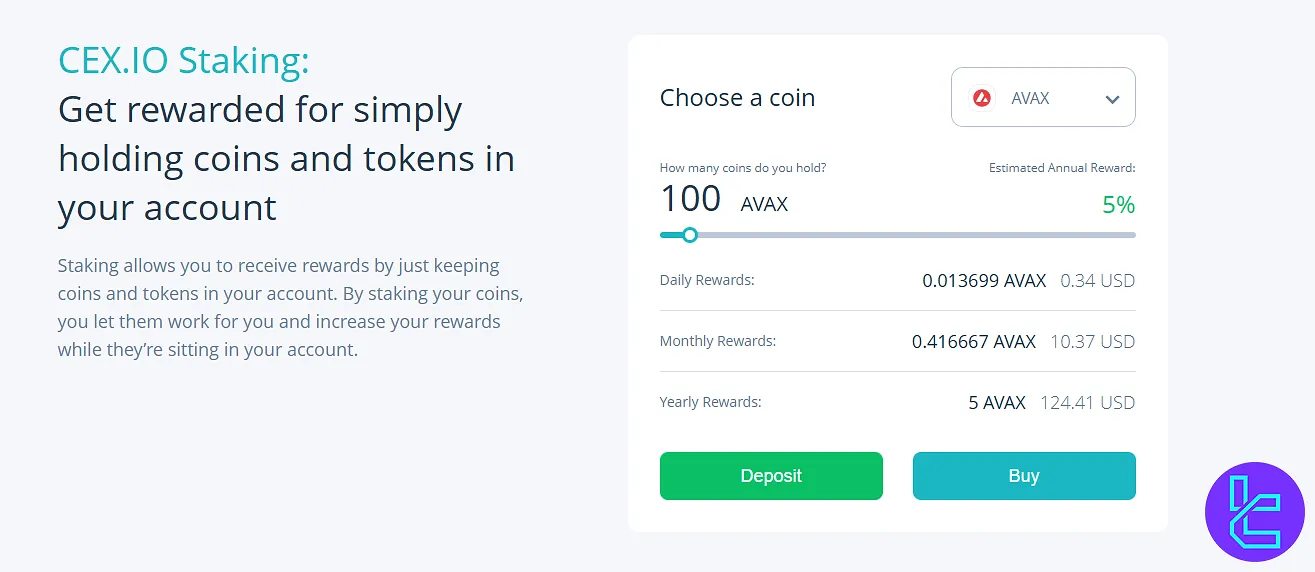

CEX.io exchange has multiple earning programs, including Savings and Staking accounts with rewards of up to 30%.

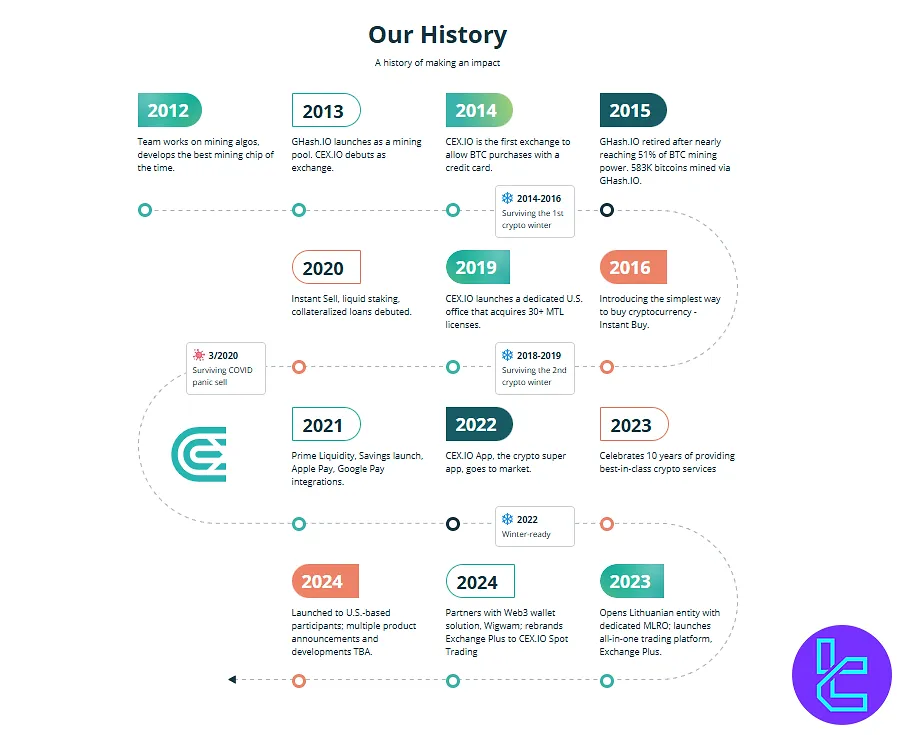

CEX.io is the first crypto exchange to provide BTC purchases with credit cards back in 2014

CEX.io is the first crypto exchange to provide BTC purchases with credit cards back in 2014

CEX.io (An Introduction to the Exchange and Its Regulatory Status)

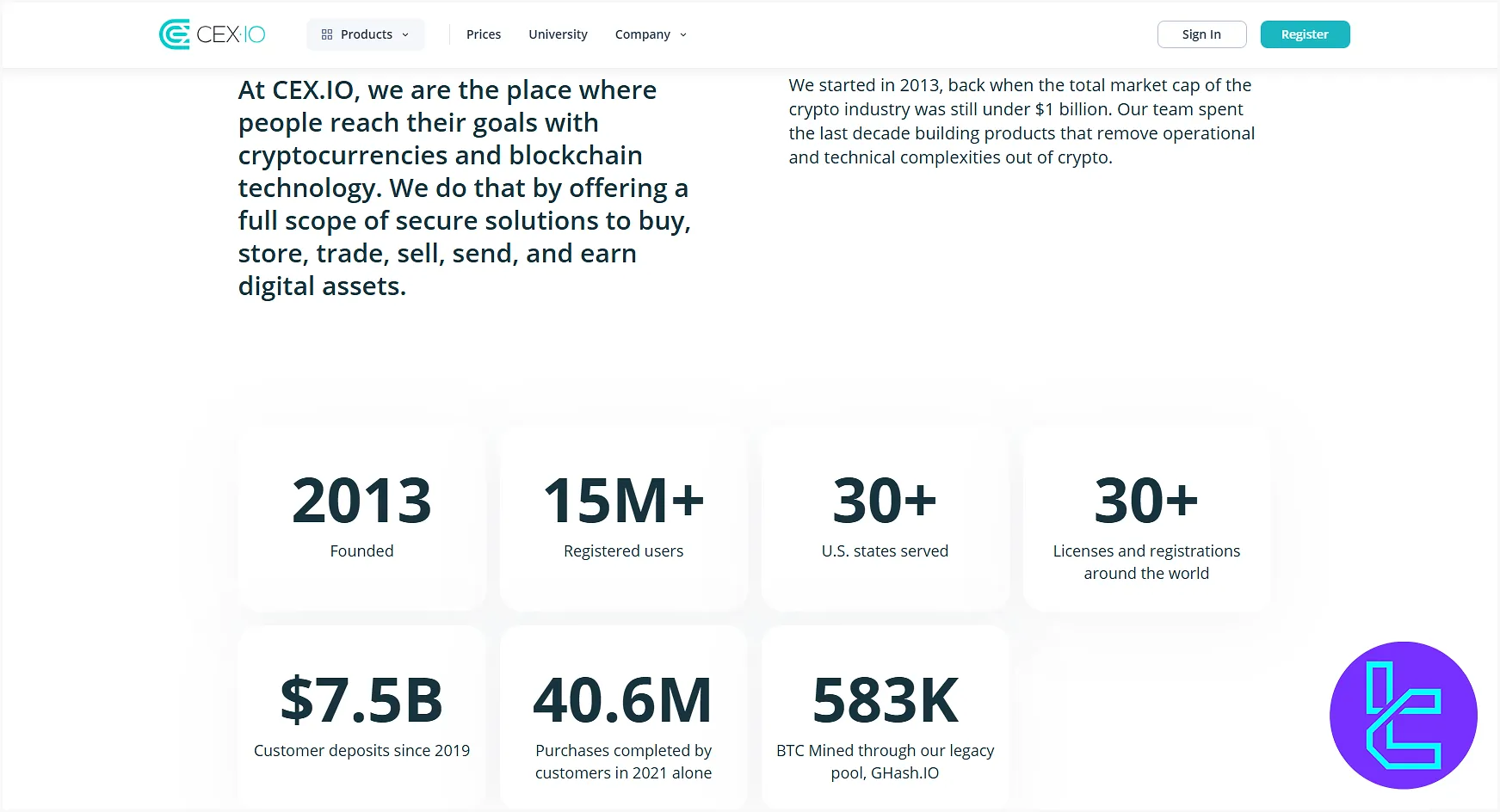

Founded in 2013 in London, CEX.io has grown from a Bitcoin trading platform to a comprehensive cryptocurrency ecosystem.

The Cryptocurrency Exchange has built a solid reputation, serving over 15 million users globally and processing billions in customer deposits.

The exchange takes regulatory compliance seriously, which is evident from its impressive presence in30+ US states.

The US Financial Crimes Enforcement Network (FinCEN) requires virtual currency service providers to comply with both federal and state legislation requirements. Key facts about CEX.io regulatory status:

- Registered as a Money Services Business (MSB) with FinCEN in the United States

- Various Money Transmitter Licenses (MTLs) across 35 US states

- Registered as a Virtual Asset Service Provider (VASP) in Lithuania, allowing operations across the European Union

This regulatory framework reinforces its compliance across both European and American jurisdictions.

CEO of CEX.io

Oleksandr Lutskevych, born in February 1982, is the CEO and Director of CEX.IO Ltd, a role he has held since November 2013.

Over his career, he has been appointed to six companies in the UK and Ukraine, including CEX.IO Technology Ltd, Decent Finance Ltd, Crypto.ID Ltd,Wallet.ID Ltd, and KYC Labs Ltd, most of which are now dissolved.

Lutskevych, a Ukrainian national residing in the United Kingdom, has consistently held senior roles such as Chief Executive Officer and Director throughout his appointments.

CEX.io Table of Specifications

The company is registered in multiple jurisdictions, including the US, the UK, Lithuania, and Nevis. Here are the key features that set this international exchange apart.

Exchange | CEX.io |

Launch Date | 2013 |

Levels | Level 1 - 16 |

Trading Fees | Maker 0.00% - 0.15% Taker 0.01% - 0.25% |

Restricted Countries | Afghanistan, Belarus, Canada, The Democratic Republic of Congo, Cuba, Guam, Guinea Bissau, Haiti, Honduras, Iran, Iraq, Japan, Lebanon, Libya, Mali, Myanmar, Nicaragua, North Korea, Palestinian Territory, Puerto Rico, Russian Federation, Singapore, Somalia, South Sudan, Sudan, Syria, United States Virgin Islands, Venezuela, Yemen |

Supported Coins | 166+ |

Futures Trading | No |

Minimum Deposit | 5 USDT |

Deposit Methods | Crypto, Visa/MasterCard, SWIFT, SEPA, Google/Apple Pay, Domestic Wire, Faster Payments, Skrill, Neteller, EPay, PayPal, MoneyGram, Open Banking |

Withdrawal Methods | Crypto, Visa/MasterCard, SWIFT, SEPA, Google/Apple Pay, Domestic Wire, Faster Payments, Skrill, Neteller, EPay, PayPal, MoneyGram |

Maximum Leverage | 1:10 |

Minimum Trade Size | variable based on the trading pair |

Security Factors | 2FA, Cold Storage, DDoS attack protection, SSL encryption |

Services | Margin Trading, API Trading, Crypto Debit Card, Staking, Wallet, CeDeFi Swap |

Customer Support Ways | Online Chat, Email |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | CEXP |

CEX.io Exchange Pros and Cons

The decentralized ecosystem, led by CEO Oleksandr Lutskevych, has a mining pool that once controlled 50% of Bitcoin mining back in 2014.

However, CEX.io has flaws, too.

Pros | Cons |

Long-standing reputation | Higher fees compared to some competitors |

Well-regulated | Limited asset offerings |

Crypto savings and staking programs | No futures trading |

Crypto debit card | Lack of copy trading |

Does CEX.io Offer User Levels?

The company’s user levels are configured based on the monthly trading volume. There are currently 16 levels that offer a tiered fee structure.

Level | 30D Trade Volume (USD) | Maker | Taker |

1 | ≤ 10,000 | 0.15% | 0.25% |

2 | ≤ 100,000 | 0.13% | 0.23% |

3 | ≤ 500,000 | 0.09% | 0.19% |

4 | ≤ 1,000,000 | 0.07% | 0.17% |

5 | ≤ 2,500,000 | 0.05% | 0.15% |

6 | ≤ 5,000,000 | 0.03% | 0.13% |

7 | ≤ 10,000,000 | 0.01% | 0.11% |

8 | ≤ 20,000,000 | 0.00% | 0.10% |

9 | ≤ 50,000,000 | 0.00% | 0.08% |

10 | ≤ 100,000,000 | 0.00% | 0.07% |

11 | ≤ 200,000,000 | 0.00% | 0.06% |

12 | ≤ 500,000,000 | 0.00% | 0.05% |

13 | ≤ 1,000,000,000 | 0.00% | 0.04% |

14 | ≤ 2,000,000,000 | 0.00% | 0.03% |

15 | ≤ 5,000,000,000 | 0.00% | 0.02% |

16 | > 5,000,000,000 | 0.00% | 0.01% |

CEX.io Fee Structure

As we mentioned earlier in this CEX.io review, spot/margin trading fees range from 0.00% - 0.15% for makers and 0.01% - 0.25% for takers. However, the fee structure also involves Deposit and Withdrawal commissions.

While crypto funding comes with no additional charges, withdrawal fees vary based on the currency and the blockchain network. Fiat payment commissions:

Method | Deposit Fee | Withdrawal Fee |

Visa/MasterCard | 0.49% — 4.99% + service charge | 0.49% — 4.99% + service charge |

Google/Apple Pay | 0.49% — 4.99% + service charge | N/A |

SWIFT | 0.1%, min $10 | 0.3% + $25 (min $50) |

SEPA | €2.99 | €2.99 |

Skrill | 3.99% + $3 | 3.99% + $3 |

Neteller | 3.99% + $3 | 3.99% + $3 |

PayPal | 3.99% + $5 | 3.99% + $5 |

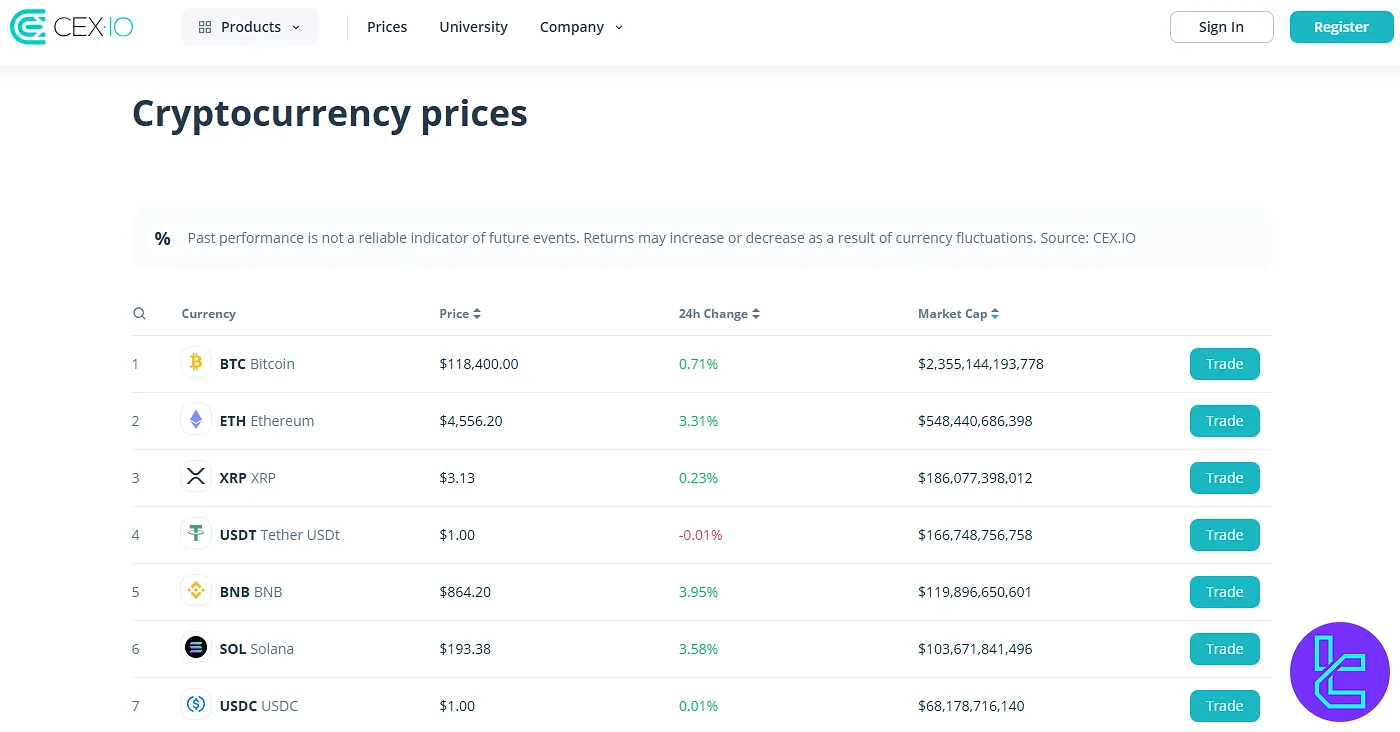

CEX.io Exchange Listed Coins

The company offers a rather limited selection of cryptocurrencies, with over 160 coins available for buying, selling, and swapping.

Some of the popular cryptocurrencies listed on CEX.io:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Cardano (ADA)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Tether (USDT)

- AAVE (AAVE)

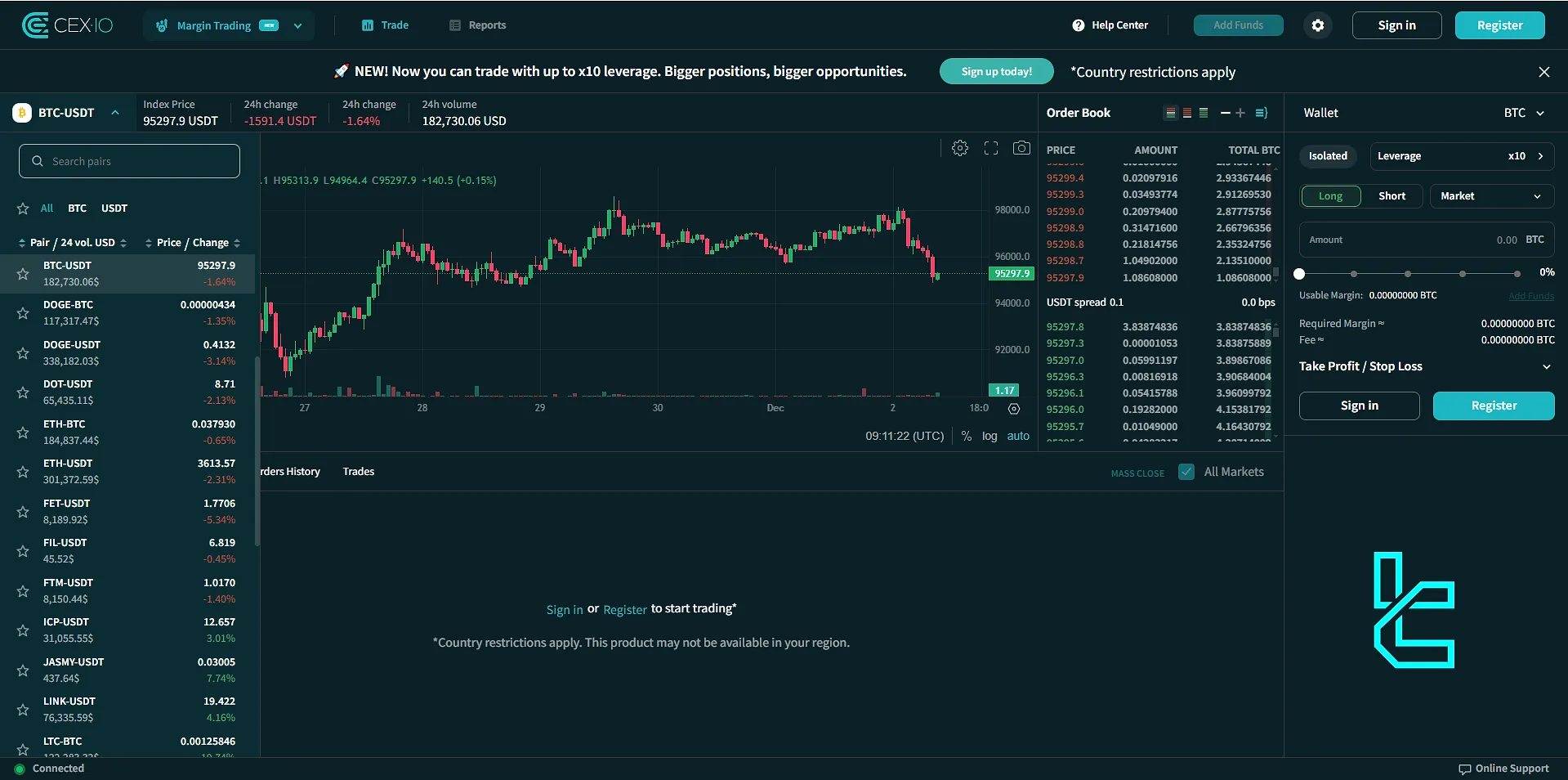

CEX.io Margin Trading

While the company doesn’t offer Futures trading services, it supports margin trading with leverage options of up to 1:10. Key features of the CEX.io Margin market:

- 35 trading pairs with USDT and BTC as base currencies

- TradingView charts

- Flexible leverage options of up to 1:10

- Professional trading tools, including chart drawing tools and advanced indicators, such as Volatility Index, Volume, Williams Alligator, and Zig Zag

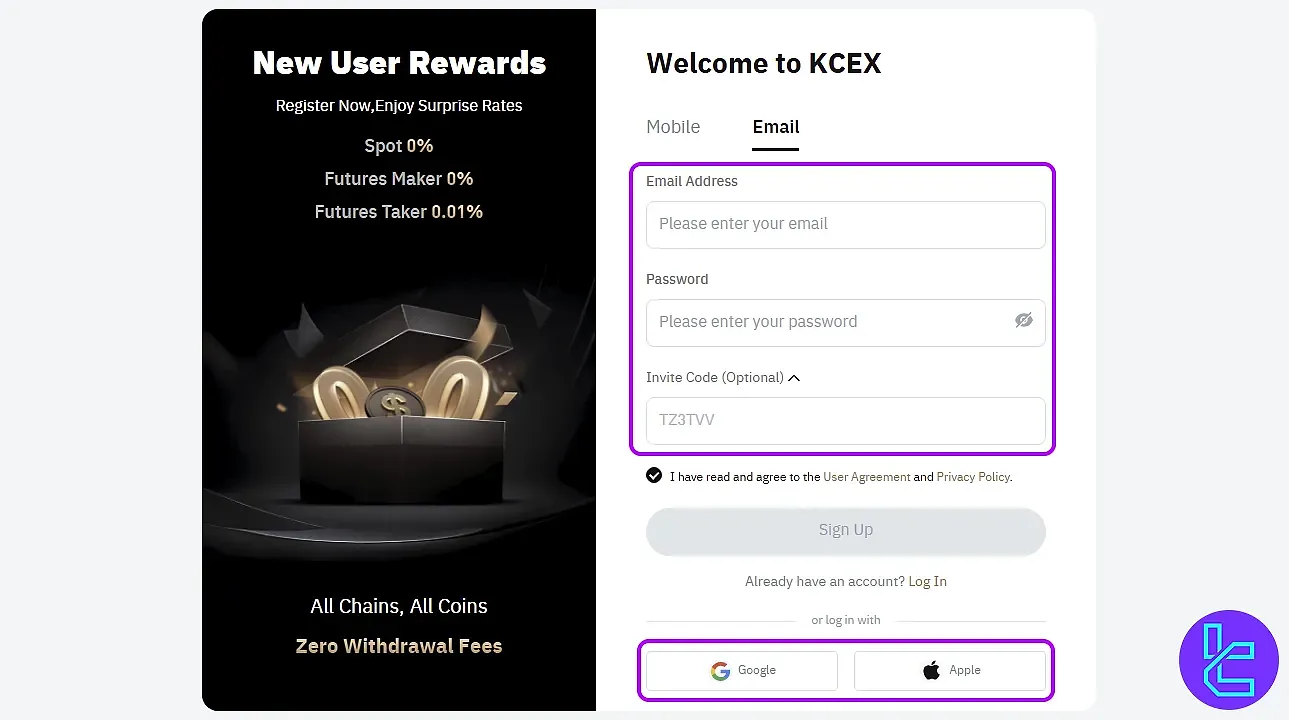

CEX.io Account Opening and KYC

The CEX.io registration takes less than 5 minutes and supports both traditional and social logins. Users can sign up with an email and password or link their Google or Apple accounts.

After email verification, access to the trading dashboard is granted instantly. This onboarding process ensures a quick entry while complying with the requirements of centralized exchanges.

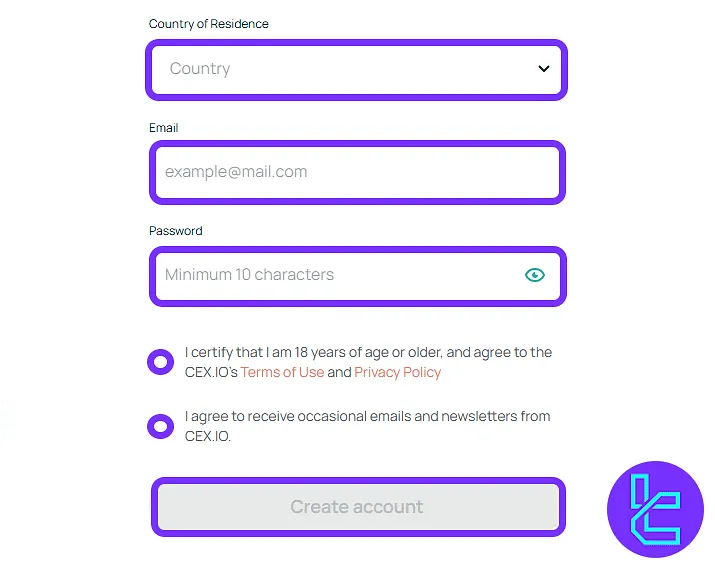

#1 Start the Registration

Go to the CEX.io homepage and click “Register” or “Open an Account”.

You’ll land on the welcome screen, where you can choose between manual signup or logging in with Google/Apple credentials.

#2 Complete the Signup Form

Fill out the application form with the following details:

- Country of residence

- Valid email address

- Password (minimum 10 characters)

Agree to the terms and privacy policy, then submit the form.

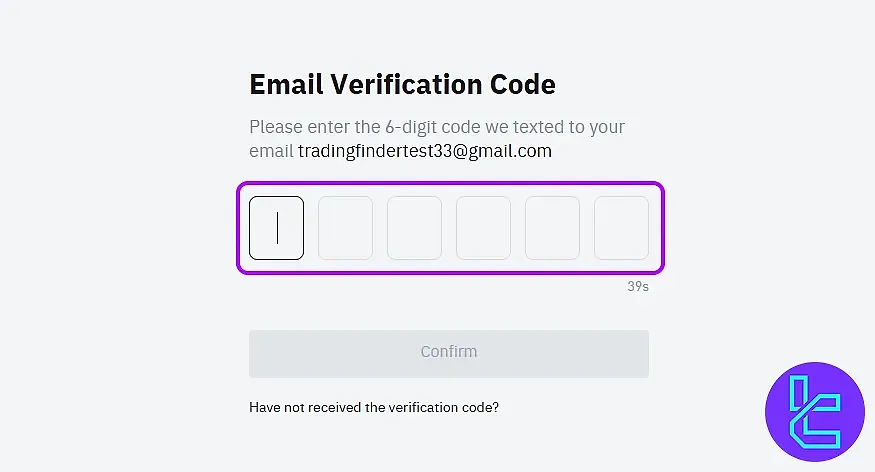

#3 Verify Your Email

Check your inbox for a confirmation email from CEX.io. Click the verification link to activate your account and reach your personal dashboard. No documents are needed at this stage.

#4 Proceed with the KYC Verification

The CEX.io verification procedure is done through the mobile app, so make sure to download it before proceeding.

Provide residential address, complete the questionnaire, enter your phone number, complete the facial recognition check, and scan one of the following documents, including:

- Passport

- National ID

- Driving license

Lastly, provide personal and document information.

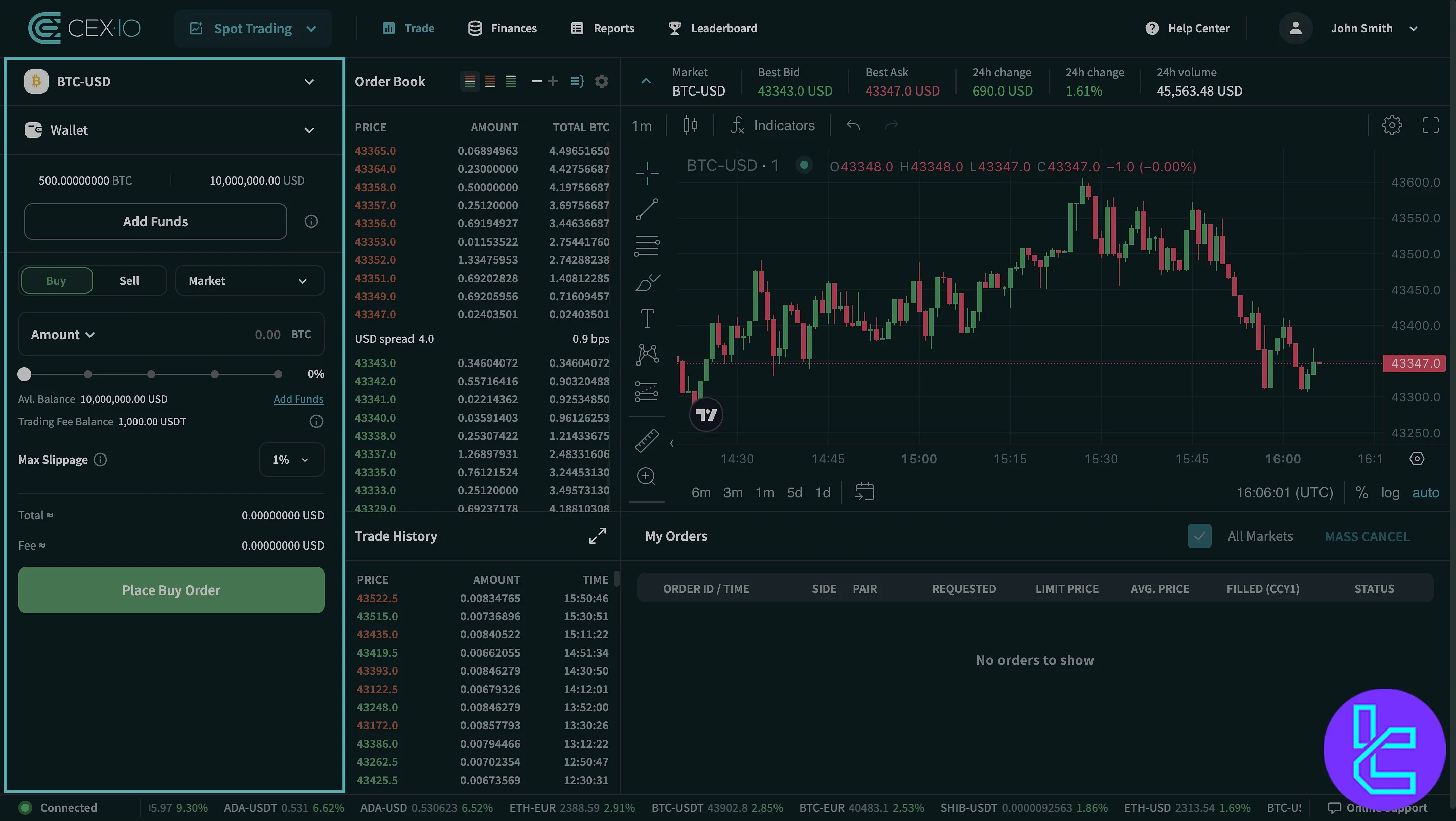

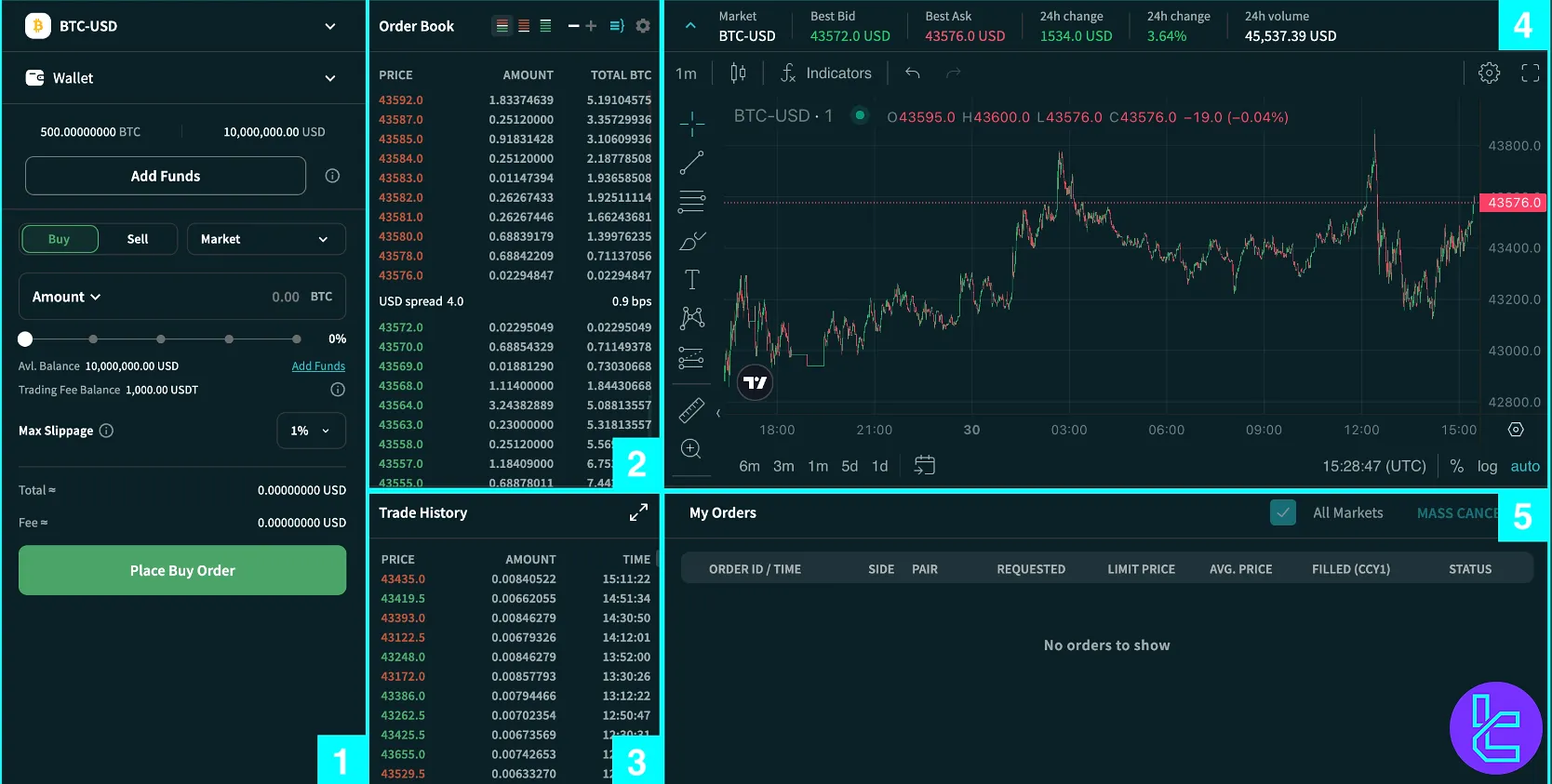

CEX.IO Spot Trading: Trade Page Overview

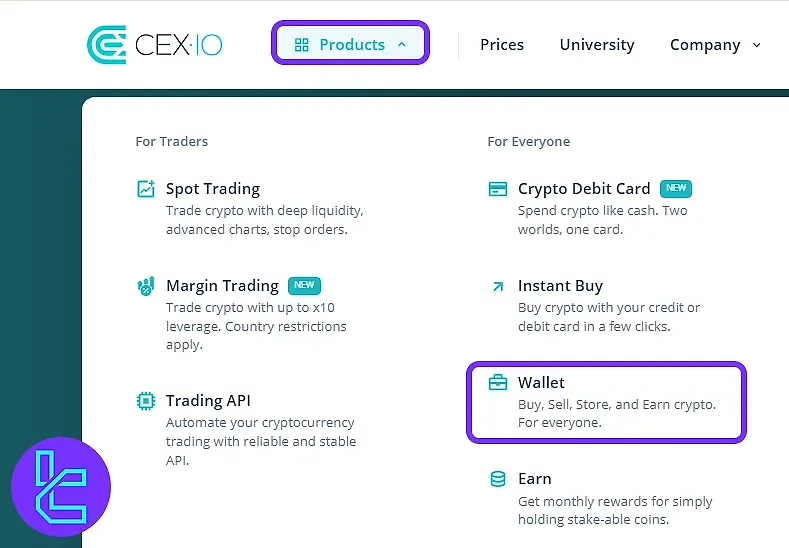

The CEX.IO Spot Trading terminal can be accessed either through the Products menu on the exchange’s homepage or directly from the Trade page. This section provides traders with the full functionality needed to manage orders and analyze markets in real time.

Key Features of the Trade Page

- Place buy and sell orders across supported pairs;

- Track liquidity through the order book;

- Review trade history and pending transactions;

- Analyze price charts for market trends;

- Manage account-specific resources via the Buying Power widget.

Customizing a New Order

When initiating a trade, users can personalize several parameters:

- Order types: Market, Limit, Stop Limit

- Execution sides: Buy or Sell

- Conditions: Amount, price, or total value

- Advanced settings: Slippage controls for market orders and Time in Force (TIF) options for limit orders, including Good Till Cancel (default), Good Till Date, and Immediate or Cancel

Traders may also operate across up to five sub-accounts, making it possible to test strategies separately from the primary Wallet Account .

Order Placement

Before confirming, the interface provides a summary of trade size and applicable fees. Orders can be finalized with the Place Buy/Sell Order button or modified before confirmation. Once submitted, transactions appear in the terminal for monitoring or cancellation.

Important Notes

Spot Trading on CEX.IO is subject to jurisdictional restrictions and market risk. The platform is not a registered broker-dealer with FINRA, and crypto holdings are not covered by FDIC or SIPC insurance. Traders may also have tax obligations on gains, for which independent advice is recommended.

CEX.io App and Trading Platform

CEX.IO offers a multi-channel trading experience with TradingView integration through its web platform, mobile applications (iOS and Android), and fully documented APIs foralgorithmic trading.

This flexibility caters to both retail investors and institutional traders seeking automated or on-the-go access. The exchange also features a Crypto Web3 Wallet.

Trading Platform

Wigwam Wallet

Check TradingFinder's list of TradingView indicators to access additional analytical tools.

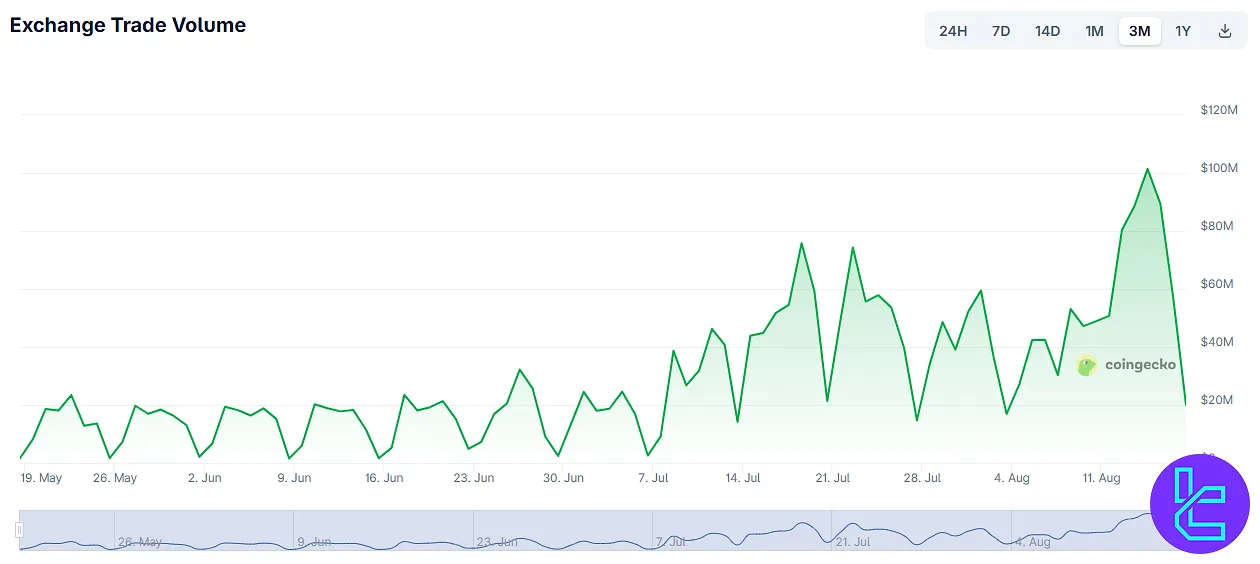

Exchange Trade Volume (3M Overview)

Over the past three months, exchange trade volume has shown a clear upward trend. In late May and early June, daily activity remained below $20M. Starting mid-July, volumes began to rise sharply, with multiple peaks above $60M.

The highest level was recorded in mid-August, when daily transactions surpassed $100M. Toward the end of the period, activity contracted again, falling back near $20M.

Services

Evaluating an exchange is not only about security scores but also about the range of services it provides to traders. Beyond compliance and safety, the availability of features such as API connectivity, OTC trading, or referral systems can significantly influence how different users interact with the platform.

The table below outlines the service availability on CEX.IO, showing which functions are currently supported and which are not.

Service | Availability |

TradingView Integration | Not Available |

Auto Trading (Bots) | Not Available |

API Access | Available |

P2P Trading | Not Available |

OTC Trading | Available |

Demo Account | Not Available |

Launchpad | Not Available |

NFT Marketplace | Not Available |

Referral Program | Available |

DEX Trading | Not Available |

Auto-Invest (Recurring Buy) | Not Available |

CEX.io Security Measures to Protect User Data and Funds

CEX.IO enforces comprehensive security protocols including two-factor authentication (2FA), SSL encryption, and cold storage solutions for off-exchange crypto holdings.

Compliance with PCI DSS standards and registration with the UK’s ICO ensures adherence to best practices in data protection and financial security.

- Two Factor Authentication (2FA)

- Cold Storage

- DDoS attack protection

- SSL encryption

- 10-Character passwords

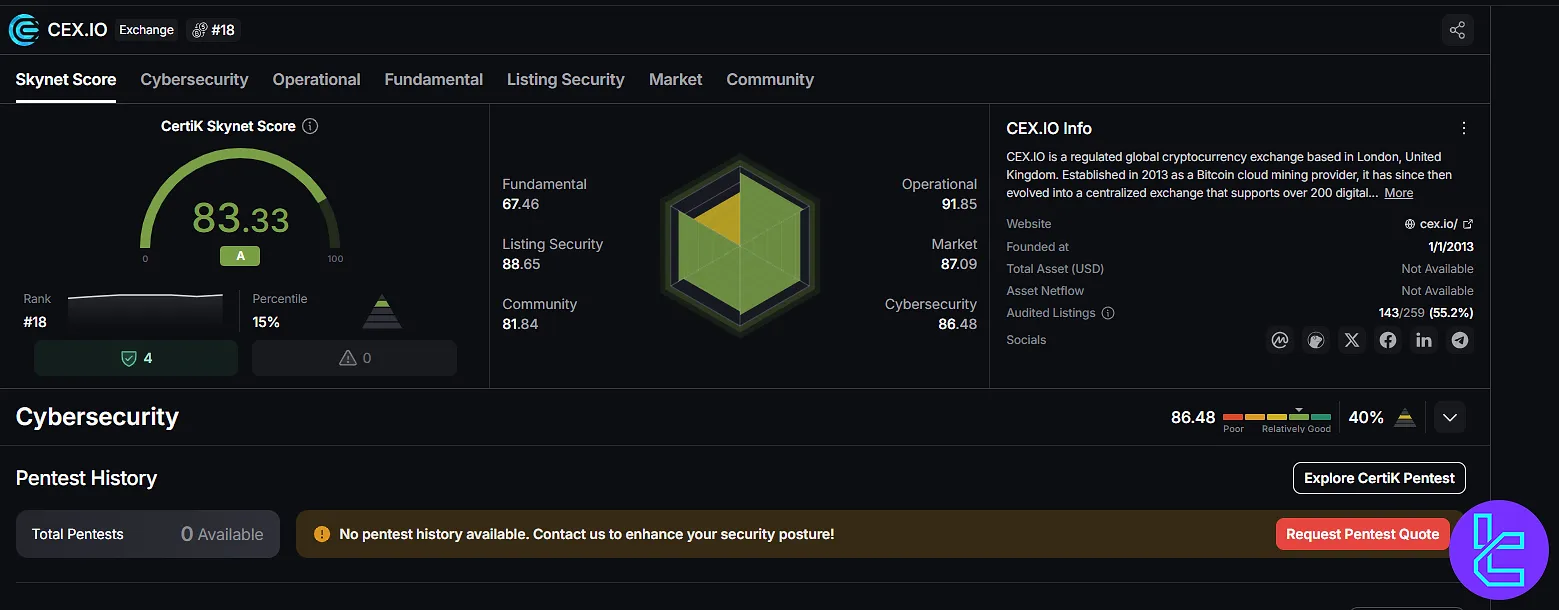

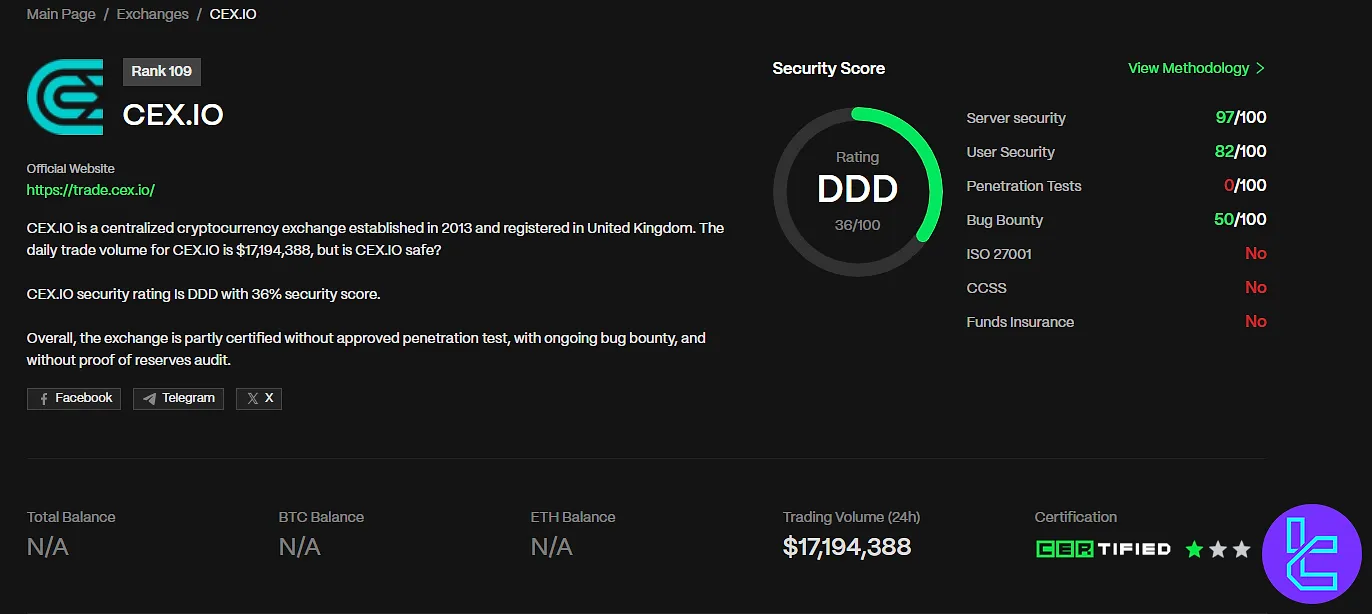

Security Rankings

When evaluating the reliability of a cryptocurrency exchange, security ratings from independent platforms can provide valuable insights.

Two of the most referenced sources are CertiK Skynet and CER.live, both of which assess exchanges across different dimensions such as cybersecurity, operational stability, and user protection.

The table below compares CEX.IO’s security scores from these two platforms, highlighting key metrics like penetration testing, bug bounty programs, server security, and overall risk evaluation.

Category | Metric | Value |

Certik Skynet Score | Overall Score | 83.33 (A) |

Operational | 91.85 | |

Market | 87.09 | |

Cybersecurity | 86.48 | |

Fundamental | 67.46 | |

Listing Security | 88.65 | |

Community | 81.84 | |

CER.live Security Score | Overall Score | 36/100 (DDD) |

Server Security | 97/100 | |

User Security | 82/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 50/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

Supported Payment Options on CEX.io Exchange

The ecosystem supports crypto and fiat transactions for deposits and withdrawals. You can use various cryptocurrencies, such as ZRX, 1INCH, USDT, USDC, ARB, BCH, and BTT, to charge your account. CEX.io deposit & withdrawal methods:

Method | Daily Deposit Min/Max | Daily Withdrawal Min/Max |

Visa | $20 / Unlimited | $20 / $50,000 |

MasterCard | $20 / Unlimited | $20 / $2,500 |

Google/Apple Pay | $20 / $1,000 | N/A |

SWIFT | $300 / Unlimited | $300 / Unlimited |

SEPA | €20 / Unlimited | €20 / Unlimited |

Skrill | $20 / $10,000 | $20 / $10,000 |

Neteller | $20 / $10,000 | $20 / $10,000 |

PayPal | $20 / $1,000 | $20 / $10,000 |

Account level determines deposit and withdrawal limits: Basic users face tighter caps (e.g. $1,000/month), whereas Verified Plus and Corporate users enjoy virtually unlimited transactions.

CEX.IO BTC Deposit Guide

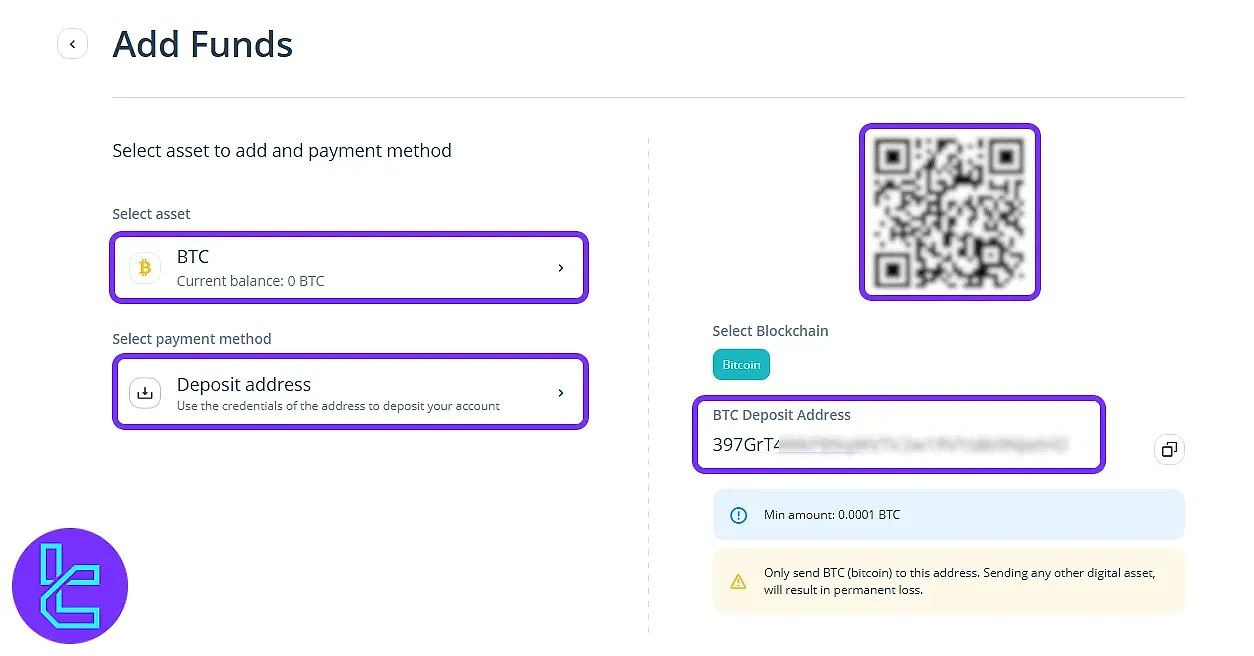

Funding a CEX.IO account with Bitcoin (BTC) requires just three steps, with a 0.0001 BTC minimum deposit. The platform supports both QR code and wallet address transfers.

Step 1 – Access BTC Wallet

From the top menu, go to Products > Wallet, find Bitcoin (BTC), and click Add Funds. Users seeking lower fees may consider USDT TRC20 deposits.

Step 2 – Generate Address

On the funding page, confirm BTC, then copy the deposit address or scan the QR code. Ensure your wallet supports the BTC network and meets the minimum.

Step 3 – Verify Status

Check Transaction History in Wallet. Deposits usually show as Completed within minutes, depending on blockchain confirmations.

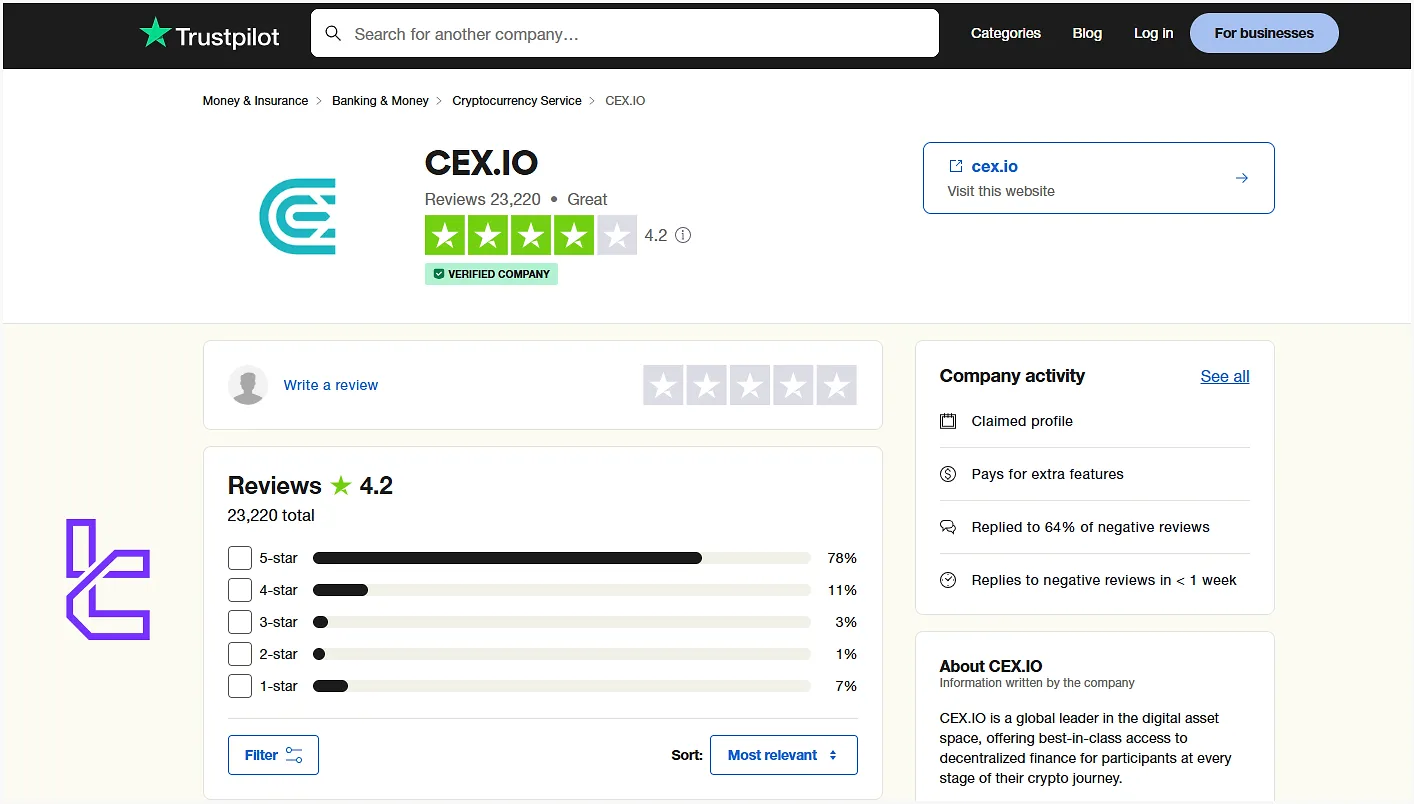

CEX.io Trust Score

User satisfaction is one of the most important topics in this CEX.io review. The platform has garnered great reviews over the course of more than 10 years.

4.2/5 based on 23,220 comments | |

CoinGecko | 7/10 |

CEX.io Crypto Products

Let's explore the crypto-specific services, such as Crypto staking and cards, that CEX.io has to offer:

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Crypto Cards | Yes |

CEX.io credit cards, powered by Mastercard, are accepted by over 30 million merchants, supporting EUR payments and more than 200 cryptocurrencies.

CEX.IO bonus

CEX.IO offers both Trading Bonuses and Staking Promos, each with distinct conditions. Trading rewards are linked to the size of a user’s first spot trade and credited to the Trading Fee Balance, while staking campaigns (e.g., MATIC and ATOM) provide a temporary APY boost through a spin-the-wheel system.

The table below compares these programs, highlighting reward tiers, eligibility, distribution, and key metrics.

Promotion | Reward Structure | Eligibility & Conditions | Mechanism / Claim |

CEX.IO Trading Fee Bonus Program | Up to 1,000 USDC based on first spot trade size: • Any trade: 10 USDC • $500+: 50 USDC • $5,000+: 200 USDC • $50,000+: 1,000 USDC | New users; onboarding required | Complete first trade, claim via app notification, credited to Trading Fee Balance |

CEX.IO Spot Trading Bonus | Up to 1,000 USDC based on trade volume: • Under $500: 10 USDC • Over $500: 50 USDC • Over $5,000: 200 USDC • Over $50,000: 1,000 USDC | New verified users; ID verification required; availability varies by jurisdiction | Opt-in, complete first trade, claim reward via app Notification Center |

Polygon Crazy Eights – MATIC Staking Promo | Spin wheel for 20%–30% APY boost on new MATIC deposits; valid 7 days | Verified users; min. 10 MATIC; only new deposits/purchases count | One spin per participant; bonus credited within 7 business days |

Cosmos Big Six – ATOM Staking Promo | Spin wheel for 50%–200% APY boost on new ATOM deposits; valid 7 days | Verified users; min. 1 ATOM; only new deposits/purchases count | One spin per participant; bonus credited within 7 business days |

CEX.IO Trading Fee Bonus Program

CEX.IO offers new users the opportunity to receive up to 1,000 USDC in trading fee rewards. The bonus is linked to your first spot trade, with rewards increasing based on trade size.

- Any spot trade: 10 USDC

- $500+ trade: 50 USDC

- $5,000+ trade: 200 USDC

- $50,000+ trade: 1,000 USDC

To claim the bonus, complete your first trade, tap the notification in the CEX.IO app, and the reward will be instantly credited to your Trading Fee Balance.

All participants are required to finish a short onboarding process after registration.

CEX.IO Spot Trading Bonus

CEX.IO provides new users with a sign-up offer of up to 1,000 USDC credited to their Trading Fee Balance after completing their first spot trade. The reward is determined by the trade size:

- Trade under $500: 10 USDC

- Trade over $500: 50 USDC

- Trade over $5,000: 200 USDC

- Trade over $50,000: 1,000 USDC

To participate, users must opt in to the promotion, complete their first spot trade, and claim the reward through the CEX.IO mobile application’s Notification Center. Rewards are automatically added to the Spot Trading Fee Balance once claimed.

All new participants are required to complete identity verification. Availability may vary depending on jurisdiction, and the offer is subject to terms and conditions.

CEX.IO Polygon Crazy Eights – MATIC Staking Promo

CEX.IO introduced a limited-time promotion called Polygon Crazy Eights, allowing verified users to boost their MATIC staking APY by spinning a raffle wheel. The increase applied ranged from 20% to 30% APY, valid for a seven-day period after new deposits or purchases of MATIC during the promo timeline.

Promo Details:

- Period: November 14 – November 27, 2022

- Eligibility: Verified users with a minimum balance of 10 MATIC

- Reward Mechanism: One spin per participant; random APY increase of 20%, 25%, or 30%

- Distribution: Bonus credited within 7 business days after the staking period ends

MATIC Staking Metrics (at promo launch):

- Total Staking Assets: $42,200,000

- Paid Rewards: $465,000

- Clients: 25,000+

- Next Reward Date: December 2, 2022

Participation was restricted in jurisdictions where staking is not supported, includingHawaii, New York, and West Virginia .

CEX.IO Cosmos Big Six – ATOM Staking Promo

CEX.IO launched the Cosmos Big Six promotion in October 2022, offering verified users the chance to increase their ATOM staking APY by up to 200% through a spin-the-wheel mechanism. The reward boost applied for a period of seven days after new deposits or purchases of ATOM.

Promo Details:

- Period: October 3 – October 16, 2022

- Eligibility: Verified users with a minimum balance of 1 ATOM

- Reward Mechanism: One spin per participant; staking APY boost of 50% to 200%

- Distribution: Bonus credited as a separate payment within 7 business days after the staking period

ATOM Staking Metrics (at promo launch):

- Total Staking Assets: $42,200,000

- Paid Rewards: $465,000

- Clients: 25,000+

- Next Reward Date: November 2, 2022

The promotion was available in all supported jurisdictions, with exceptions including Hawaii, New York, and West Virginia. Terms and conditions were subject to change at the discretion of CEX.IO.

CEX.io Exchange Support Channels

The company offers support mainly through online chat.

While the working hours are not specified on the official website, 24/7 support is guaranteed by using a Chatbot.

support@cex.io | |

Live Chat | Available on the official website and application |

While there is no phone support, the exchange's London headquarters underscores physical legitimacy and accessibility for escalated concerns.

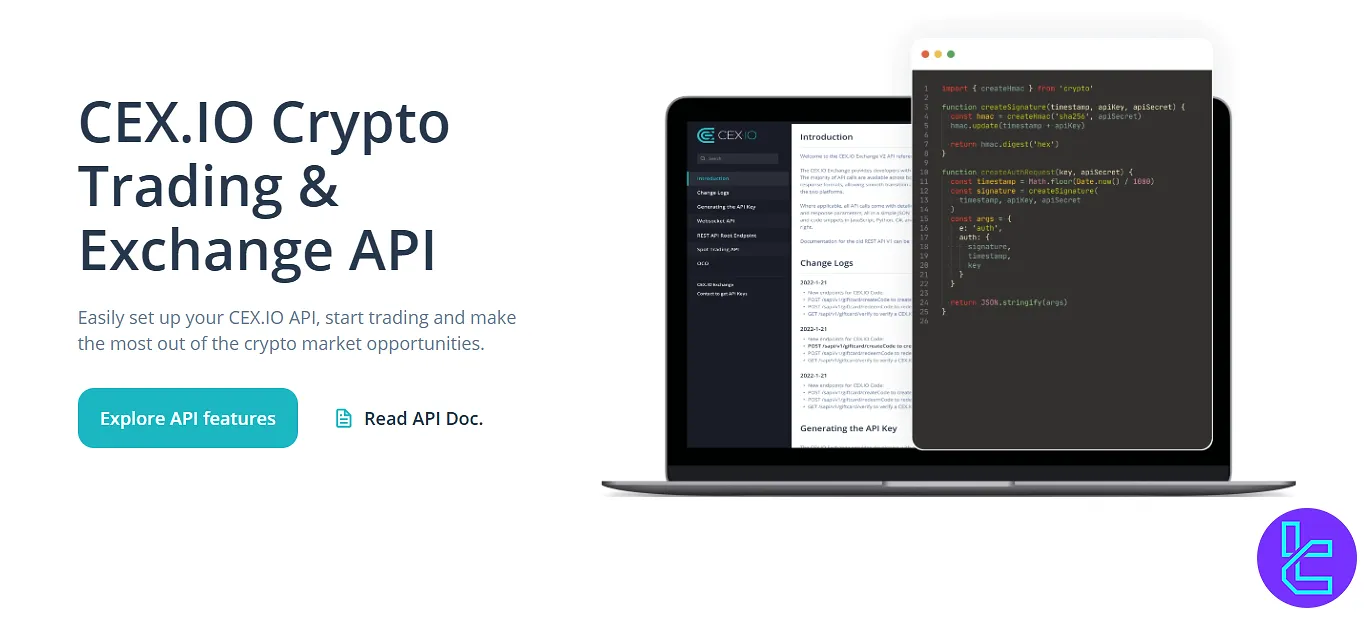

CEX.io Earn Programs and API Service

While the ecosystem doesn’t offer copy trading, it provides a robust API service and multiple earn programs.

- Staking: Available on SOL, AVAX, POL, XTZ, TRX, ADA, ZIL, ATOM, DOT, FLR, KSM, AVAX, ONT, and KAVA with rewards up to 30%

- Savings: Available for 16 coins, such as BTC, USDT, and USDC, with rewards up to 5%

- API: WebSocket and REST protocols with 24/7 access to the spot market supported by platforms like Shrimpy.io, Alpha Bot, and Coinigy

CEX.io Exchange Prohibited Countries

CEX.IO offers services in over 220 countries and territories; however, access is restricted in high-risk jurisdictions, including Iran, North Korea, Syria, and more.

- Afghanistan

- Belarus

- Canada

- The Democratic Republic of Congo

- Cuba

- Guam

- Guinea Bissau

- Haiti

- Honduras

- Iran

- Iraq

- Japan

- Lebanon

- Libya

- Mali

- Myanmar

- Nicaragua

- North Korea

- Palestinian Territory

- Puerto Rico

- Russian Federation

- Singapore

- Somalia

- South Sudan

- Sudan

- Syria

- United States Virgin Islands

- Venezuela

- Yemen

CEX.io Comparison Table

Here's a table comparing CEX.io features and services with three popular crypto exchanges:

Parameters | CEX.io Exchange | Gate.io Exchange | Bitget Exchange | Kucoin Exchange |

Number of Assets | 166+ | 2800+ | 10000+ | 700+ |

Maximum Leverage | 1:10 | 1:100 | 1:125 | 1:100 |

Minimum Deposit | $5 | Varies by Payment Method | $15 | $1 |

Spot Maker Fee | 0.0% - 0.15% | From -0.005% | 0.10% | From 0.005% |

Spot Taker Fee | 0.01% - 0.25% | From 0.025% | 0.10% | From 0.025% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | No | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | No |

Writer's Opinion and Conclusion

CEX.io provides BTC/USDT, ETH/BTC, and 32 more trading pairs in its margin market.

It has listed 160+ coins and offers CeDeFi swaps with zero gas fees utilizing the Wigwam Web3 wallet.

A great trust score of 4.2 on TrustPilot, integration with MetaMask wallet, and staking services on 14 cryptocurrencies are some of the strong points of CEX.io exchange.

The lack of a Futures market and copy trading services are its main weaknesses.