Coincheck, a crypto exchange that requires a minimum deposit of $10 and at least 500 JPY or equivalent for opening an order. There are no fees for making deposits in JPY or cryptocurrencies on the platform, which is headquartered in Tokyo.

Coincheck stands as one of Japan’s largest crypto platforms, serving over 1.8 million verified users and supporting more than 30 tradable digital assets.

In 2025, the exchange consistently recorded daily spot trading volumes ranging between $50 million and $150 million, proving its strong liquidity despite offering fewer markets than global competitors.

Coincheck Company Information + Regulation

Based on the data on Crunchbase, Coincheck was founded in August 2012 by James Riney, Koichiro Wada, Masakazu Sasaki, and Yusuke Otsuka. The exchange has rapidly become one of Japan's leading cryptocurrency exchanges.

The company's journey hasn't been without challenges, but its resilience and commitment to improvement have solidified its position in the domestic market.

Key points about Coincheck's company information and regulation:

- Headquarters: Tokyo, Japan

- Parent Company: Monex Group

Coincheck is fully licensed to operate as a cryptocurrency exchange in Japan and adheres to strict national standards. It is audited by the Japan Blockchain Association and holds membership in regulatory bodies, including the Japan Virtual Currency Business Operator Association and the General Association of FinTech.

The exchange maintains capital reserves of approximately ¥92 million, affirming its financial stability.

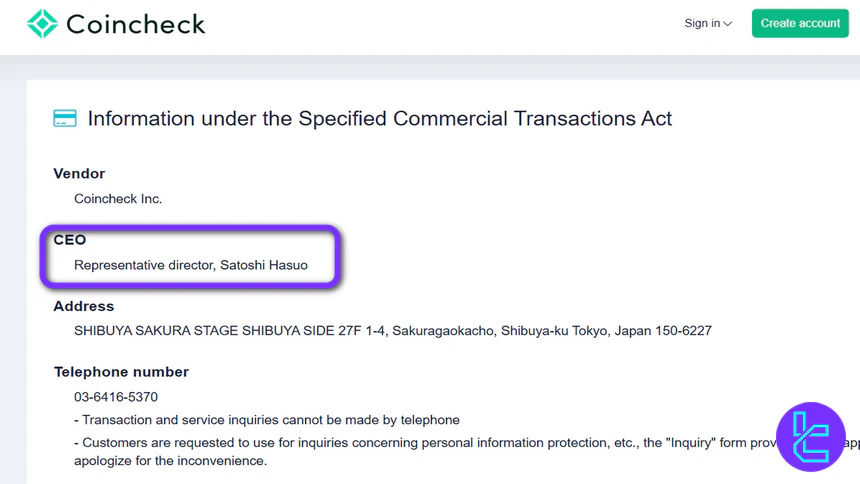

Coincheck CEO

Based on the official website of the exchange, the CEO of Coincheck, Inc. is Satoshi Hasuo, serving as the company’s Representative Director.

Beyond this designation, there is very limited public information available about him. No verified LinkedIn, Crunchbase, or other professional profiles are currently accessible.

Summary of Key Features

In this section, we will take a look at a table that includes the company's main specifics. Coincheck's Specifications:

Exchange | Coincheck |

Launch Date | 2012 |

Levels | N/A |

Trading Fees | 0-0.1% |

Restricted Countries | United States, Canada, Germany, France, Netherlands, etc. |

Supported Coins | BTC, ETH, SHIB, LTC, etc. |

Futures Trading | No |

Minimum Deposit | 10 USDT |

Deposit Methods | Crypto, Bank Transfer |

Withdrawal Methods | Crypto, Bank Transfer |

Maximum Leverage | N/A |

Minimum Trade Amount | 500 JPY |

Security Factors | 2FA, Cold Storage |

Services | Lending, Denki, Coincheck Gas |

Customer Support Ways | Phone Call, Email Address, Ticket |

Customer Support Hours | Not Specified |

Fiat Deposit | JPY |

Affiliate Program | No |

Orders Execution | Not Specified |

Native Token | N/A |

Benefits and Drawbacks

Like any crypto exchange, Coincheck has its strengths and weaknesses in providing user services. Let's break them down:

Benefits | Drawbacks |

User-Friendly Interface | Fewer Trading Pairs Compared To Global Exchanges |

Mobile App For Convenient Trading | Limited Advanced Trading Features |

Crypto Lending | - |

User Leveling System on Coincheck

Based on the investigations made on the website and the available resources, the mentioned exchange does not work on a user-level structure.

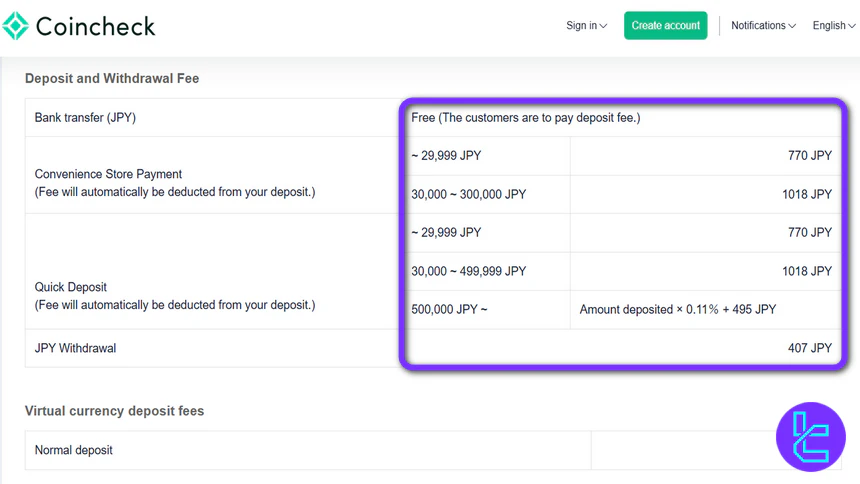

Fees and Commissions: How Much Does Trading Cost on Coincheck?

Fees are so important when it comes to trading; they can make a huge difference in the final output of the order. Coincheck's Commissions:

Spot Trading | 0-0.1% |

Deposits (Crypto) | Free |

Deposits (JPY) | Free |

Withdrawals | Varies |

The company does not offer a tier system for commissions, which is a bold drawback. Always check the current fee schedule on Coincheck's website for the most up-to-date information.

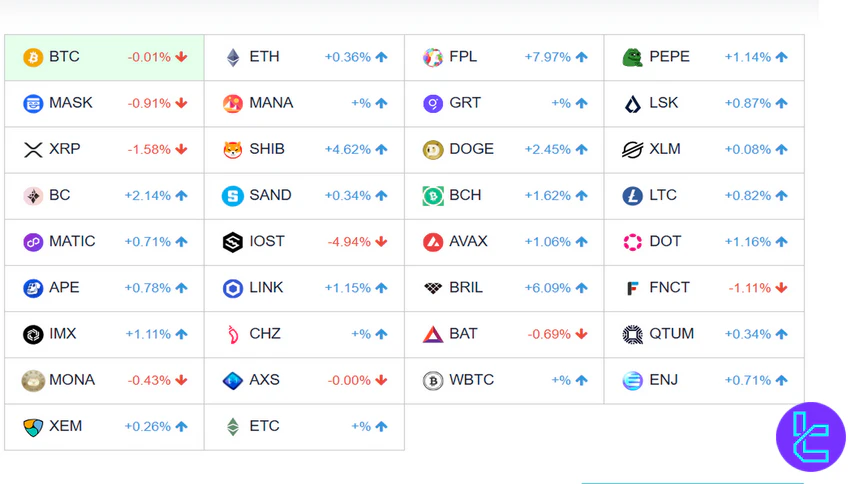

List of Coins and Tokens

Coincheck offers a limited range of cryptocurrencies for trading. However, the selection covers several popular options. Coincheck Assets List:

- Bitcoin [BTC]

- Ethereum [ETH]

- Ripple [XRP]

- Bitcoin Cash [BCH]

- Litecoin [LTC]

- Shiba Inu [SHIB]

- Apecoin [APE]

- Polygon [MATIC]

Additionally, Coincheck regularly evaluates new cryptocurrencies for potential listing, expanding its offerings to meet market demands and trends.

Does The Exchange Offer Futures and Margin Trading?

Based on our investigations on the website, Coincheck used to offer margin trading, allowing users to amplify their potential profits (and risks) by trading with borrowed funds. However, the situation has changed, and the exchange has stopped offering such a service.

The exchange does not offer a futures trading option either.

Registration and Verification on Coincheck Exchange: Step-by-Step Tutorial

Coincheck registration involves both email-based signup and a KYC process aligned with regulatory standards.

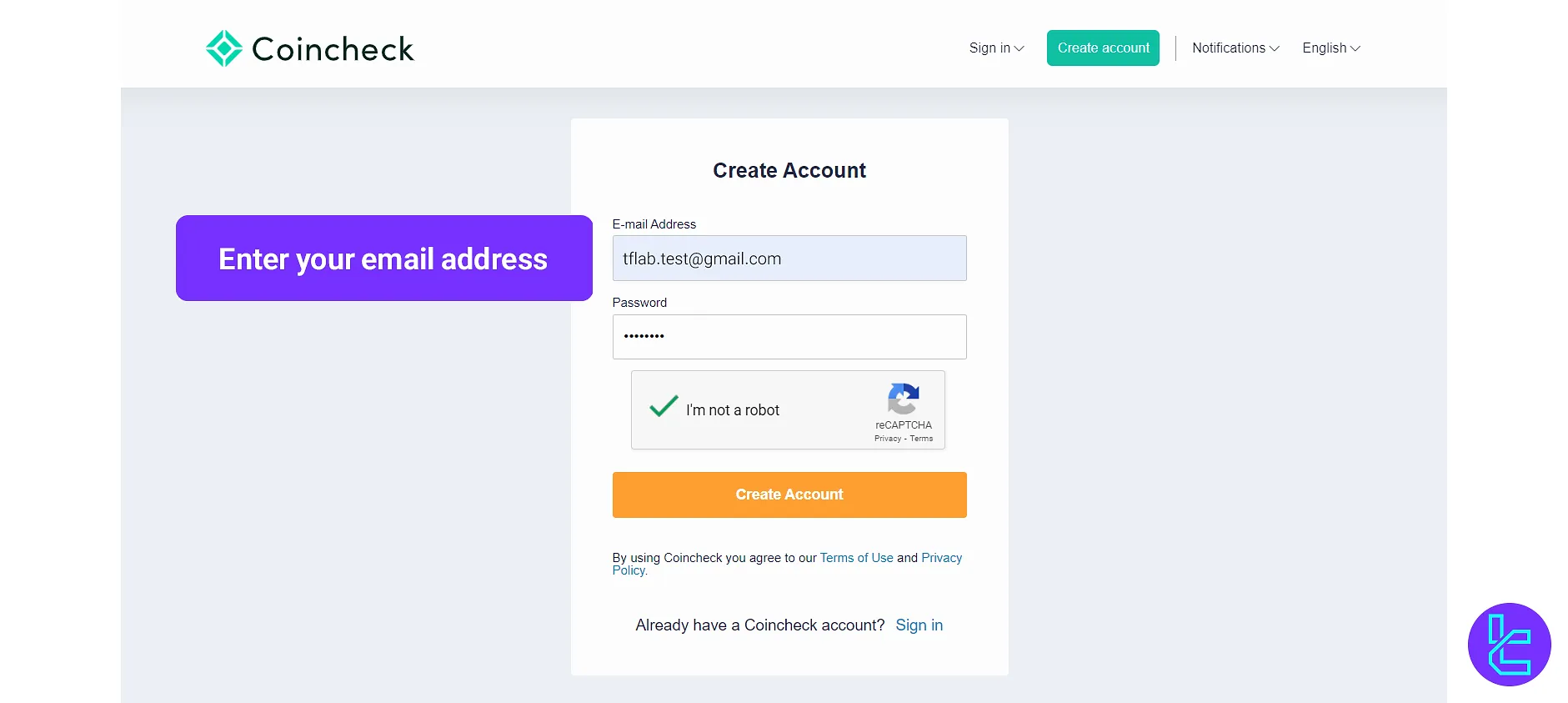

#1 Create Your Coincheck Account

Visit the official Coincheck website and select "Register". Input a valid email address and choose a secure password.

Confirm your registration by clicking the activation link sent to your inbox.

#2 Start the KYC Procedure

Log in and click "Verify Account" to begin. Submit the following:

- A mobile number for SMS confirmation

- Full personal details including name, birthdate, and residential address

- A clear image of a valid government-issued ID (passport, driver’s license, etc.)

- A selfie holding your ID and a handwritten note with the word “Coincheck” and today’s date

#3 Await Verification

Once submitted, your documents will be reviewed. If approved, you’ll receive access to trading and withdrawal features.

- Visit the Coincheck website and click on "Register";

- Enter your email address and create a strong password;

- Verify your email address by clicking the link received in your inbox.

Now, your account is created. To verify, click on "Verify Account" to begin the KYC process. You will be required to:

- Enter and verify your phone number;

- Provide personal information (name, address, date of birth, etc.);

- Upload a clear photo of a valid government-issued ID (passport, driver's license, etc.);

- Take a selfie holding your ID and a piece of paper with "Coincheck" and the current date written on it.

After passing these phases, wait for your account to be verified by the company.

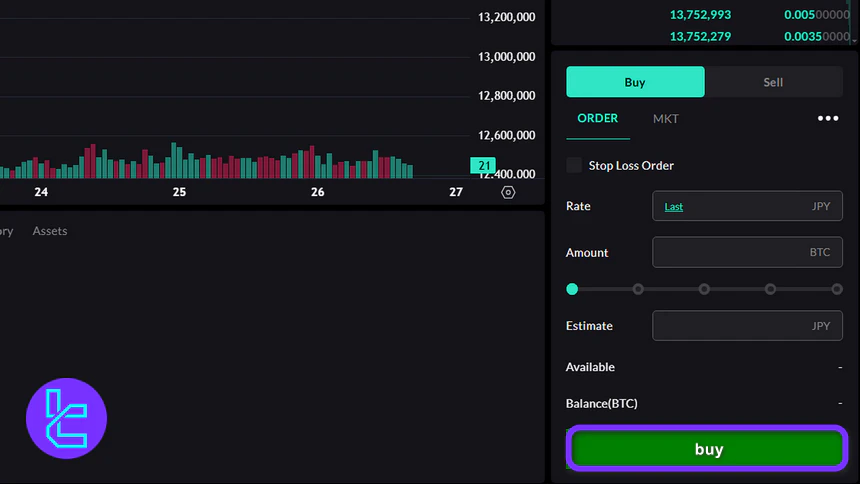

How to Trade Coincheck

Trading on Coincheck is straightforward, even for beginners. Before you start, make sure your account is funded. Once you’re ready, follow these simple steps:

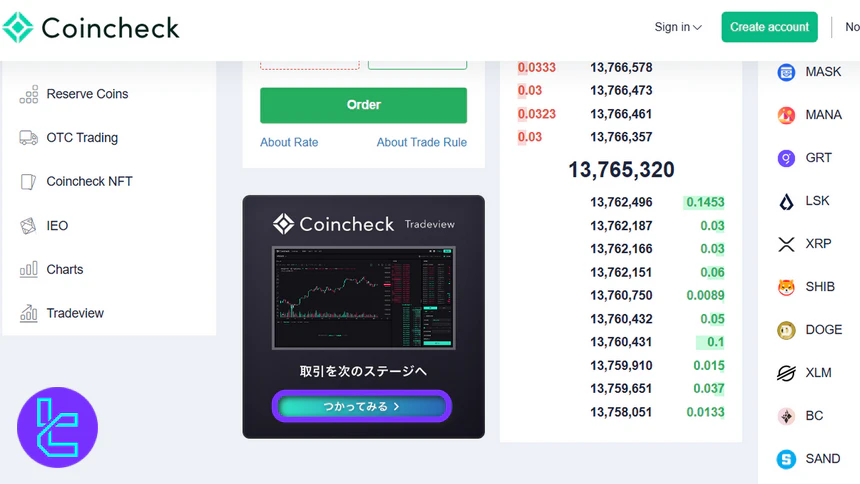

#1 Enter the Trading Page

From the Coincheck homepage, navigate to the “Exchange” section, then scroll down a bit and select the blue button under “Tradeview” to access the spot trading interface.

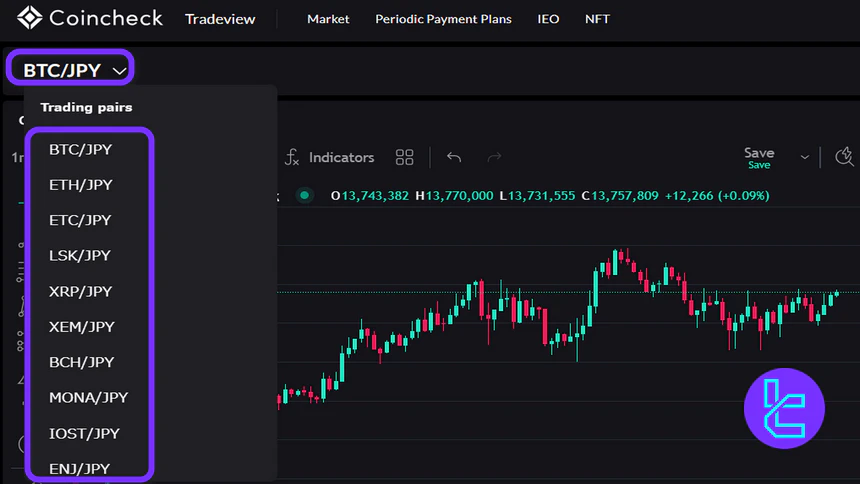

#2 Select the Trading Pair

Click on the displayed trading pair at the top of the screen to open the full list of available markets. Search for and choose the trading pair you want to trade.

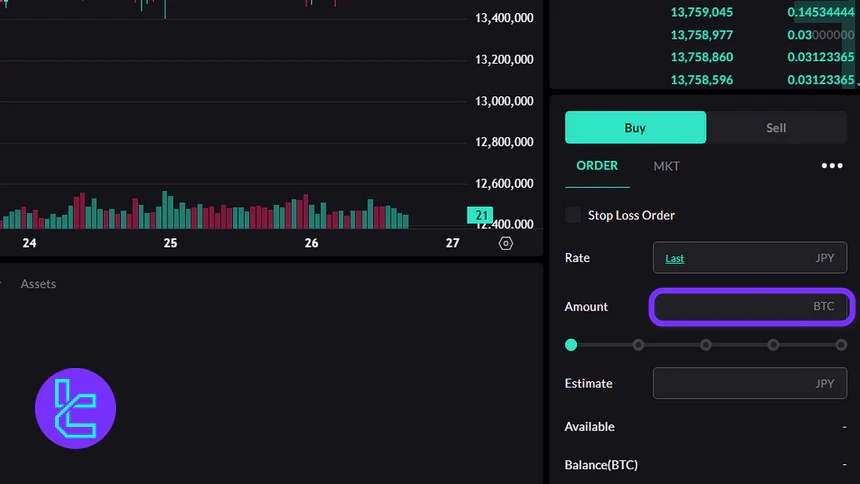

#3 Specify the Order Volume

Enter the amount of cryptocurrency you want to buy or sell in the quantity field below the order form.

#4 Confirm the Trade

Review your order details carefully. When everything looks correct, click “Buy” or “Sell” to execute your trade.

Platforms and Applications

Usually, crypto exchanges develop their proprietary platforms for trading. Coincheck is no different and offers these platforms:

- Trade View (Web): A user-friendly interface accessible from any modern web browser, more suitable for PC users

- Mobile App: Available for Android devices, offering full trading functionality on-the-go in a very convenient way

The mobile app has achieved a decent score of 4/5 from users on the Google Play Store.

We suggest iOS users work with Trade View. You can download or access the platforms mentioned above via these links:

Key features of Coincheck's platforms

- Real-time market data and charts with access to indicators

- Multiple order types (market, limit, stop)

- Portfolio tracking and performance analysis

- News feed and market insights

- Secure login with 2FA support

Coincheck Trade Volume

According to the Coincheck CoinGecko chart, Over the past three months, Coincheck’s trading activity has shown a consistent upward trajectory, marked by strong liquidity and recurring volume spikes.

Daily trading volume fluctuates mostly between $50M and $150M, with occasional surges that push close to the $200M–$250M range.

The trend shows a notable increase beginning in early October, followed by repeated high-volume peaks throughout late October and November.

This pattern indicates sustained trader engagement and healthy order flow across the platform. Despite natural market pullbacks, Coincheck maintains a stable baseline volume, reinforcing its position as one of Japan’s most active cryptocurrency exchanges.

Coincheck Services

Let’s check out the availability of popular trading services on Coincheck:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

No | |

Launchpad | Yes |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

Security & Safety Evaluation

Security is paramount in the crypto world, and Coincheck has tried to take serious measures in this regard. Here's an overview of the exchange's current security practices:

- Cold Storage: User funds are stored in offline, cold wallets

- Two-Factor Authentication (2FA): Mandatory for all accounts during login

- SSL Encryption: All data transmissions are encrypted

- Confirmed System Security: Security confirmed with multiple safety firms from across the globe

Keep in mind that no exchange is 100% secure, and you should always have the necessary level of caution.

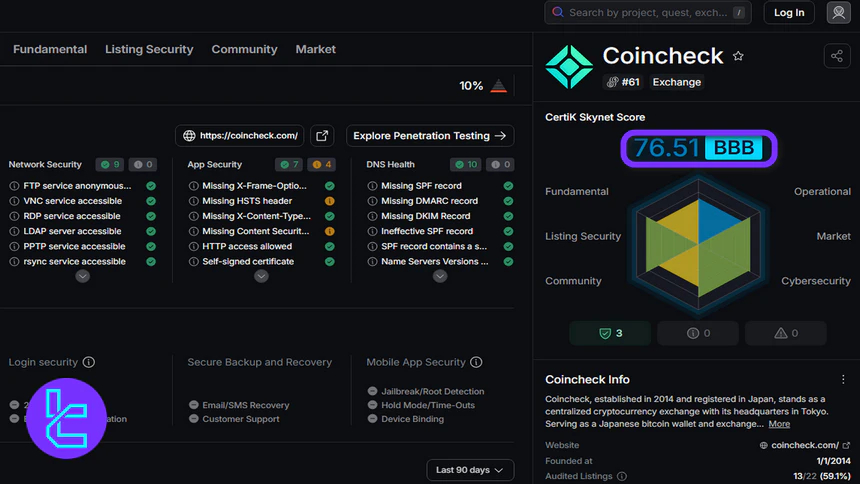

Coincheck Security Rankings

Coincheck’s CertiK Skynet review provides a well-rounded picture of its technical and operational resilience. With an overall score of 76.60/100 (BBB), the exchange demonstrates relatively strong performance in key areas such as Operational Security, Listing Security, and Cybersecurity.

While its Fundamental and Community metrics show room for improvement, the CertiK evaluation suggests that Coincheck maintains a generally reliable infrastructure supported by consistent security practices.

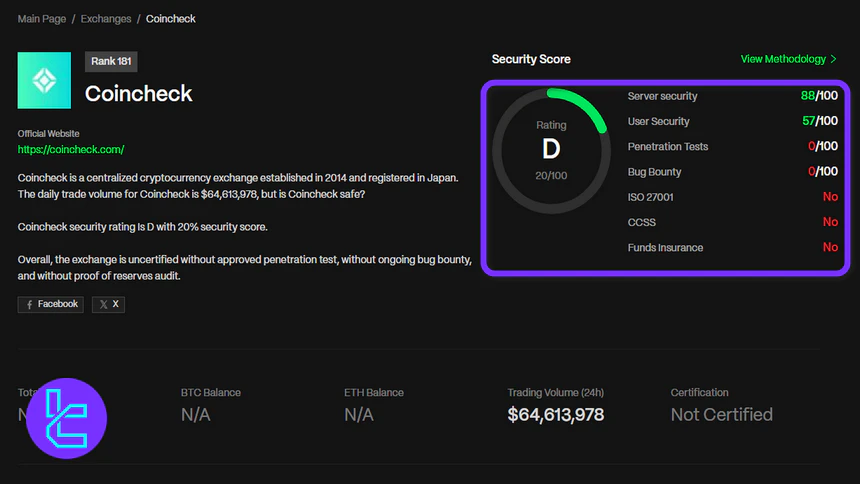

CER.live Coincheck review presents a more critical view of the exchange’s security posture, assigning the exchange an overall score of just 20% (D).

Despite achieving high marks in User Security, Coincheck lacks essential components such as penetration testing, bug bounty programs, and global standards like ISO 27001 or CCSS.

This creates a noticeable contrast between strong user-side protections and the absence of deeper institutional security frameworks.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 76.60 / 100 (BBB) |

Fundamental | 68.63 | |

Operational | 70.79 | |

Listing Security | 85.24 | |

Market | 83.57 | |

Community | 65.41 | |

Cybersecurity | 81.20 | |

CER.live Score | Overall Score | 20% (D) |

Server Security | 87/100 | |

User Security | 57/100 | |

Penetration Tests | 0/100 | |

Bug Bounty | 0/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

What Payment Methods are Used with Coincheck?

The exchange takes a normal approach to the deposit and withdrawal options. Actually, it offers a short list of methods:

- Bank Transfer: The most common method for JPY deposits and withdrawals

- Cryptocurrency Deposits: Direct transfers from external wallets

The company could also provide credit/debit card payments or support for e-wallets such as PayPal, Neteller, etc., to perform better in this regard.

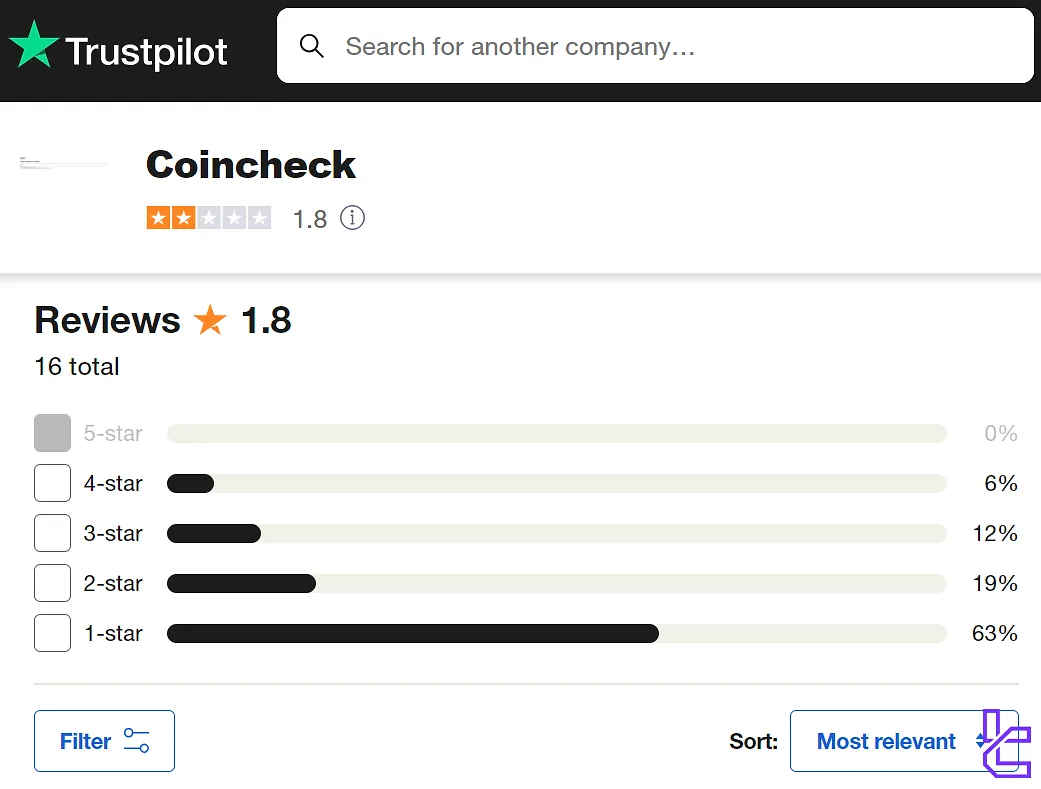

Trust Scores and Reviews

Most companies have a page on certain websites, such as Trustpilot, showing an evaluation or a trust score. That rating could help us have a good overview of the company's situation. Coincheck Trust Scores:

- Coincheck Trustpilot: 1.8/5 stars (based on more than 15 user reviews)

- REVIEWS.io: 2.8 out of 5 (with over 10 ratings)

- CoinGecko: 5/10, evaluated by the website

Overall, this crypto exchange hasn't been able to achieve a good enough score on trust websites. Also, the number of scores is too low. This could be because its services are limited for clients from outside of Japan.

Coincheck Features

The crypto exchange does not offer much beyond spot trading options. Look at this table:

Staking | No |

Yield Farming | No |

Social Trading | No |

Launchpool | No |

Crypto Cards | No |

Coincheck Bonus

Coincheck, Inc., a leading Japanese cryptocurrency exchange, offers multiple ways for users to earn rewards and grow their crypto holdings. Below, we introduce the main programs currently available.

Family & Friends Referral Bonus

Coincheck rewards both the referrer and the referred person with ¥2,500 worth of BTC when the referred person completes identity verification and account setup.

Conditions & Precautions:

- Login is required;

- Each user can refer up to 1,000 people per month; referrals beyond this limit are not eligible;

- Campaign terms may change, extend, or terminate without notice;

- Certain users are ineligible, including those with closed accounts, those residing outside Japan, or those engaging in fraudulent activities;

- BTC is awarded at the rate at the time of the bonus.

Cryptocurrency Lending Service

Coincheck allows users to lend their crypto assets and earn interest, growing their holdings passively.

Details:

- The maximum annual interest rate is 5%;

- Supported cryptocurrencies: BTC, ETH, XRP, NEM, and others handled by Coincheck;

- Users maintain full control of their assets; Coincheck holds the crypto for the agreed lending period and returns the same amount plus interest at the end.

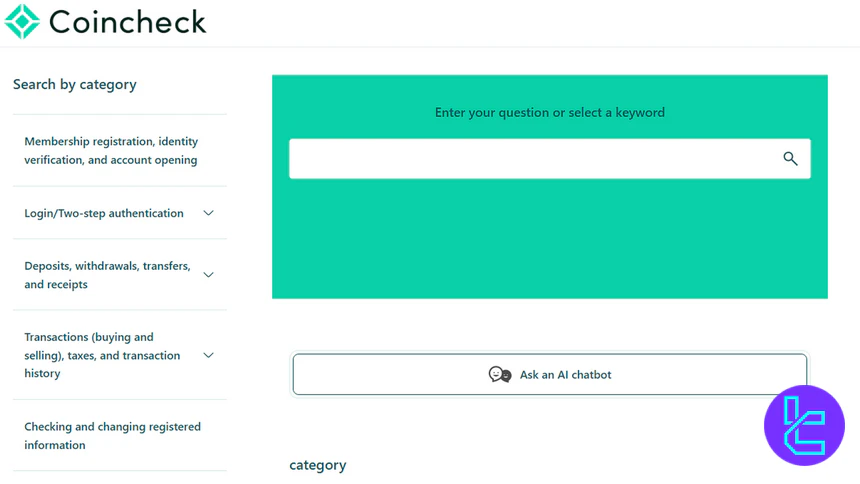

Support Contact Methods and Working Schedule

Coincheck offers several support channels to assist users. However, we couldn't find a live chat button anywhere on the official website. Contact Methods:

- Email: info@coincheck.com

- Phone Call: 00810570026200

- Ticket: Submit on the website

Also, the website has a "Help Center" section covering the answers to the most frequently asked questions related to the exchange's services, platforms, etc.

Another drawback regarding this company's support is it does not state any working hours for answering users' questions.

Copy Trading Services and Investment Options

Copy Trading is one of the most popular ways for traders to earn passive income in the crypto market. Unfortunately, Coincheck does not offer copy trading services. However, another investment option is available.

This platform offers a product called "Coincheck Lending". With this service, you can lend your digital assets and earn interest on them. Lending Key Features:

- All crypto assets listed on the exchange are available for lending

- Maximum annual interest rate up to 5%

- Payments are done after the assets are returned to the user

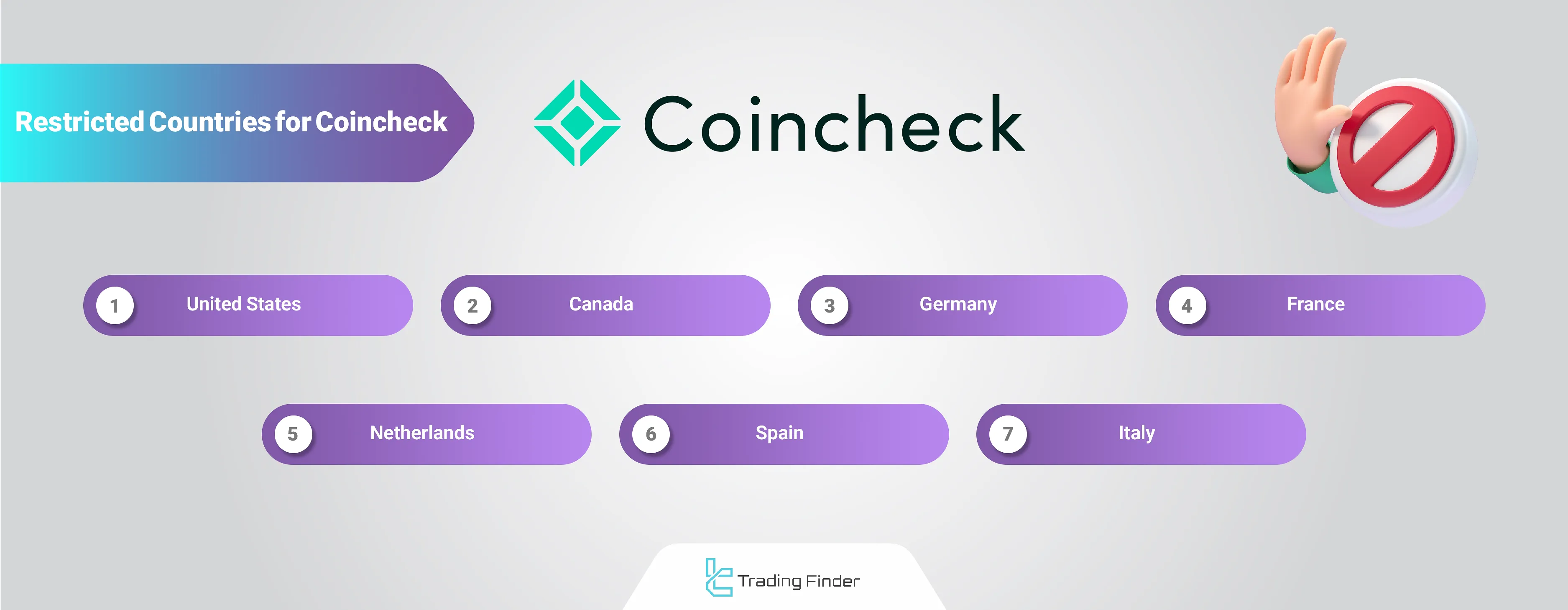

Coincheck Restricted Countries: Can You Trade on This Exchange?

The exchange primarily serves the Japanese market and has limited availability internationally. The list of restricted countries and regions includes, but is not limited to:

- United States

- Canada

- Germany

- France

- Netherlands

- Spain

- Italy

Users outside Japan should verify their eligibility before attempting to use Coincheck's services.

Coincheck or Another Exchange? Table of Comparison

The comprehensive comparison drawn in the table below demonstrates a fair evaluation of Coincheck's offerings and advantages:

Features | Coincheck Exchange | LBank Exchange | Gate.io Exchange | MEXC Exchange |

Number of Assets | 30+ | 700+ | 2800+ | 2800+ |

Maximum Leverage | N/A | 1:125 | 1:100 | 1:200 |

Minimum Deposit | 10 USDT | Varies by Cryptocurrency | Varies by Payment Method | $1 |

Spot Maker Fee | 0% - 0.1% | 0.02% | From -0.005% | 0.05% |

Spot Taker Fee | 0% - 0.1% | 0.02% | From 0.025% | 0.05% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | No | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's opinion and conclusion

Coincheck has received a 1.8/5 score on the Trustpilot website, with +15 user reviews. Traders on the REVIEWS.io platform have given the exchange a 2.8/5 with over 10 ratings. Furthermore, CoinGecko has evaluated the company's performance and services as 5/10.