CoinSwitch offers 250+ cryptocurrencies for Spot trading with a minimum purchase requirement of ₹100. The fees are variable based on monthly trading volume, from 0.04% to 0.40%.

The exchange offers INR deposits and withdrawals through a partnership with Mobi Kwik and IDBI Bank.

CoinSwitch; An Introduction to the Company

CoinSwitch, founded in 2017, started with a simple yet ambitious goal: to make money equal for all.

What began as a small team has now blossomed into India's largest crypto app, boasting over 2 crore (20 million) users and a workforce of more than 500 employees.

The company's rise hasn't gone unnoticed, attracting investments from global heavyweights like a16z, Tiger Global, and Sequoia Capital India. CoinSwitch key features:

- Founders: Ashish Singhal, Vimal Sagar Tiwari, and Govind Soni

- Headquarter: Bangalore, Karnataka, India

- Company Value in October 2021: $1.9B

- Licenses: Financial Intelligence Unit (FIU) of India and ISO certification

CEO Introduction

Ashish Singhal is the Co-founder and CEO of CoinSwitch, India’s largest crypto investing platform with over 20 million users. With a background in computer science from Netaji Subhas Institute of Technology, he previously led engineering teams at Amazon and Microsoft.

Ashish is also the founder of Lemonn, a new app launched in 2023 aimed at simplifying investments in stocks and mutual funds for Indian retail users. His leadership at CoinSwitch has been instrumental in democratizing access to crypto and digital assets in India, with a user-first design and seamless KYC onboarding. Across both ventures, his mission remains clear:to make money equal for all.

Connect with the CEO through the link below:

CoinSwitch Specifications

Formerly known as CoinSwitch Kuber, the crypto exchange is a product of PeepalCo. It offers more than 250 cryptocurrencies and 430 Futures contracts.

Exchange | CoinSwitch |

Launch Date | 2017 |

Levels | 9 levels |

Trading Fees | Spot Maker / Taker (0.4% / 0.4%) Futures Maker / Taker (0.02% / 0.05%) |

Restricted Countries | N/A |

Supported Coins | 250+ |

Futures Trading | Yes |

Minimum Deposit | ₹100 |

Deposit Methods | Crypto, Fiat |

Withdrawal Methods | Crypto, Fiat |

Maximum Leverage | 1:25 |

Minimum Trade Size | Variable based on the asset |

Security Factors | FIU registered, ISO certification, SOS 2 Type II custody |

Services | CoinSwitch Pro, API Trading, Systematic Investment Plans, SmartInvest, Ventures |

Customer Support Ways | Email, Help Center, Ticket |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | None |

CoinSwitch Advantages and Disadvantages

The company is the biggest crypto exchange in India and has processed more than ₹500B in trades since its inception. However, like any other online trading provider, it has weaknesses, too.

Pros | Cons |

User-friendly interface | Limited support channels |

Crypto Futures contracts | Higher than average fees (0.4% for spot trading) |

INR deposits and withdrawals | Limited range of cryptocurrencies (250+) |

ISO certified | No Crypto withdrawals |

Does CoinSwitch Offer User Levels?

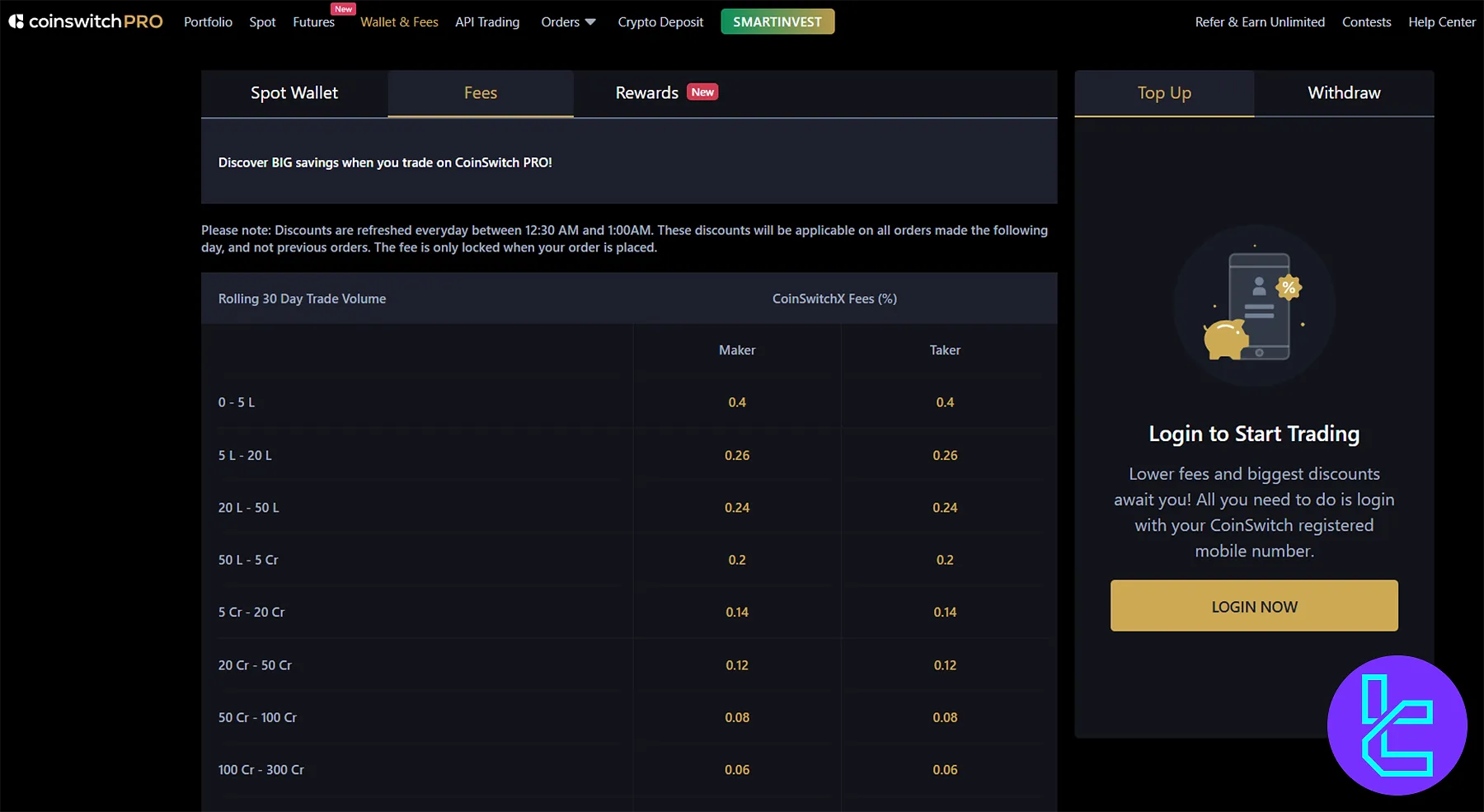

The platform offers competitive fees for those who trade more through a tiered fee structure with9 levels, including:

30D Trading Volume (INR) | Maker | Taker |

0 – 500K | 0.40% | 0.40% |

500K – 2M | 0.26% | 0.26% |

2M – 5M | 0.24% | 0.24% |

5M – 50M | 0.20% | 0.20% |

50M – 200M | 0.14% | 0.14% |

200M – 500M | 0.12% | 0.12% |

500M – 1B | 0.08% | 0.08% |

1B – 3B | 0.06% | 0.06% |

3B – 50B | 0.04% | 0.04% |

In this CoinSwitch review, we must mention that the exchange offers lower futures trading fees to higher user levels. However, the exact figures are not available.

CoinSwitch Fees and Commissions

The platform offers a trading volume-based fee structure for Futures and Spot trading. However, the default charges for these contracts are as follows:

Market | Maker | Taker |

Spot | 0.40% | 0.40% |

Futures | 0.02% | 0.05% |

Trading Assets

CoinSwitch Kuber offers a diverse range of 250+ crypto assets, catering to various investment preferences, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Ripple (XRP)

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

- Binance Coin (BNB)

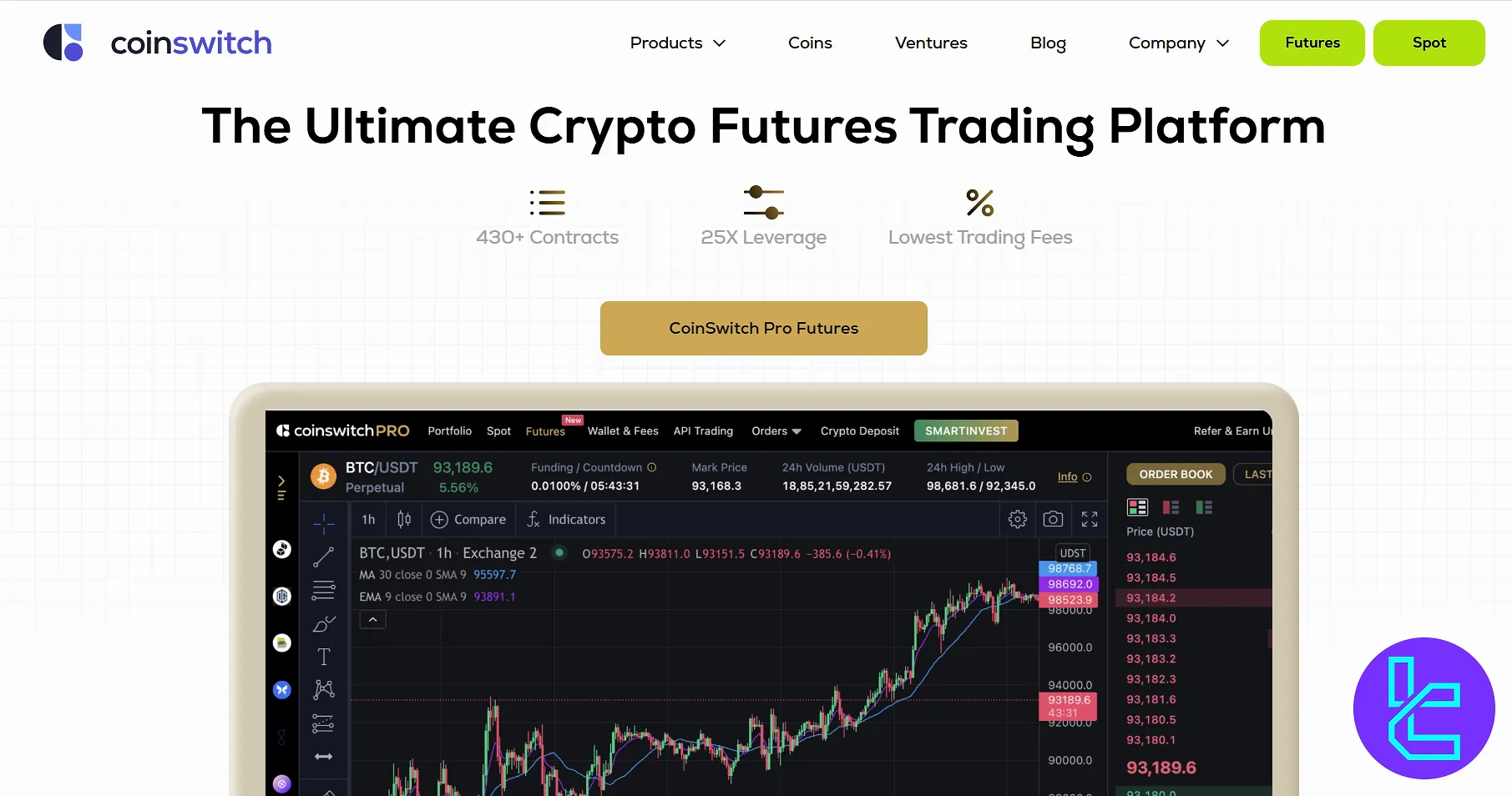

Does CoinSwitch Offer Crypto Futures Trading?

The ecosystem offers comprehensive crypto trading services, including Spot and Futures. It introduces the CoinSwitch Pro for crypto trading purposes with the following key features:

- Leverage options of up to 1:25

- Market, Limit, and Stop Limit orders

- 250+ coins

- 430+ leveraged contracts

- Access to India’s top exchanges for Arbitrage opportunities

Registration and Verification

Traders can easily open an account with the CoinSwitch exchange and trade cryptocurrencies. CoinSwitch registration:

#1 Visit CoinSwitch and Start Registration

Go to the CoinSwitch exchange site and click on “Begin Your Crypto Journey.” Select “Sign Up” to initiate your account setup.

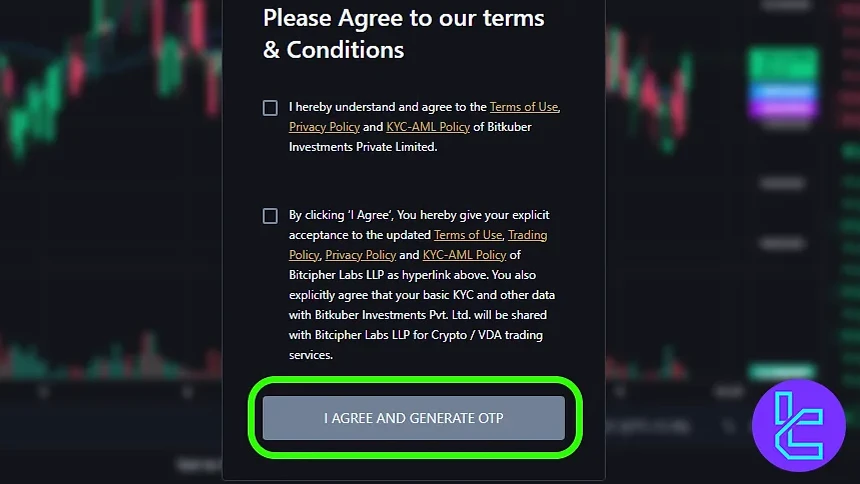

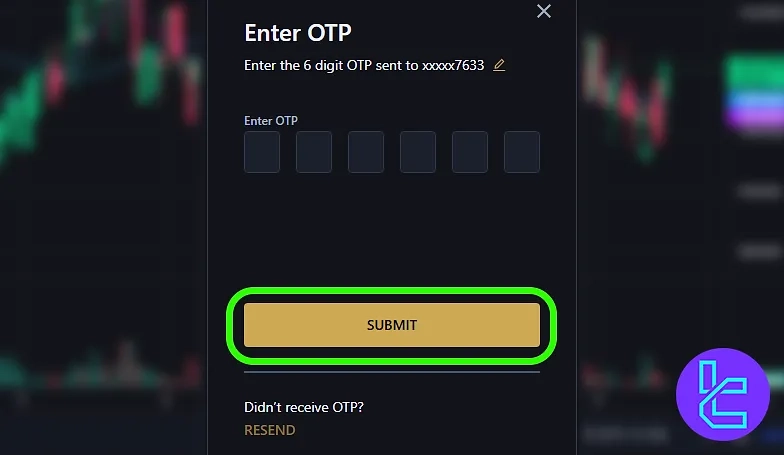

#2 Submit Mobile Number and Request OTP

Enter your valid phone number and agree to the terms and conditions. Tap “Generate OTP” to receive your SMS verification code.

#3 Enter OTP and Complete Setup

Input the OTP received on your phone and hit “Submit”. You’ll be redirected to your CoinSwitch dashboard, confirming that your account is active.

#4 Verify Your Account

In this step, you must upload proof of identity (PAN Card) and proof of residence (Aadhaar, Voter ID, or Passport).

How to Trade on CoinSwitch Exchange

Trading on CoinSwitch is simple and designed for both beginners and experienced users. Here’s a quick guide to buying and selling cryptocurrencies on the platform.

#1 Deposit Funds

You can deposit INR via bank transfer or UPI. For crypto trades, CoinSwitch supports popular digital wallets.

#2 Choose Your Crypto

Navigate to the “Markets” section, search for your desired token, and select it to view price charts and details.

#3 Buy or Sell

Click “Buy” or “Sell", enter the amount, and confirm your order. Transactions are executed instantly at the best available price.

#4 Track Your Portfolio

Use the in-app dashboard to monitor your holdings, market trends, and past trades in real time.

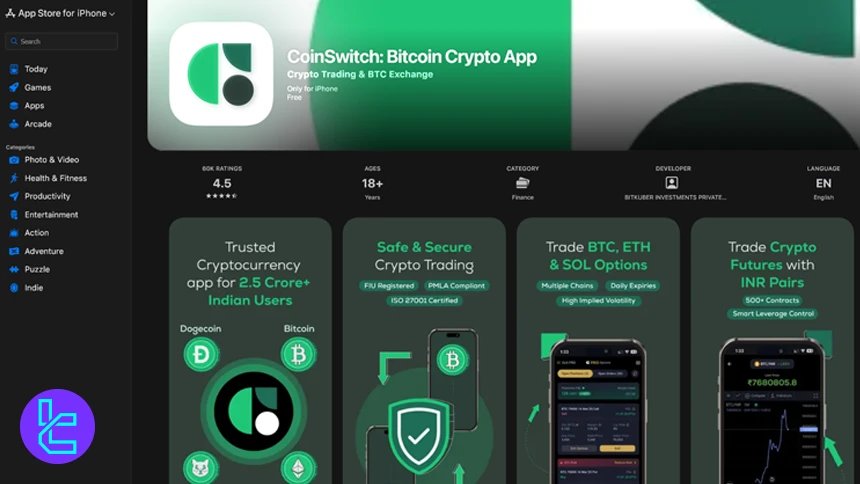

CoinSwitch Kuber App Download Links

India's leading cryptocurrency trading app is readily available for download on both major mobile platforms, including:

Traders can also use the CoinSwitch Pro web platform, which provides access to TradingView charts and rates from top Indian exchanges.

TradingFinder has developed a wide range of TradingView indicators that you can use for free.

CoinSwitch Services

This exchange is not one of those with a long list of additional products and services besides trading. The table below provides a summary:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

| No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

CoinSwitch Exchange Safety and Security

The platform prioritizes the safety and security of user data and funds. This is evident in its approach to obtaining an FIU license and ISO/IEC 27001:2022 certification.

It also has implemented various security factors, including:

- SOC 2 Type II certified custodians

- 100% Proof of Reserves

- Cold storage of users’ funds

- 2-step verification

What Payment Methods are available?

The exchange has partnered with MobiKwik and IDBI Bank to offer fiat deposits.

While the platform supports INR transactions, it also allows deposits of 100+ Cryptocurrencies. Note that crypto withdrawals are not available at the time of writing this CoinSwitch review.

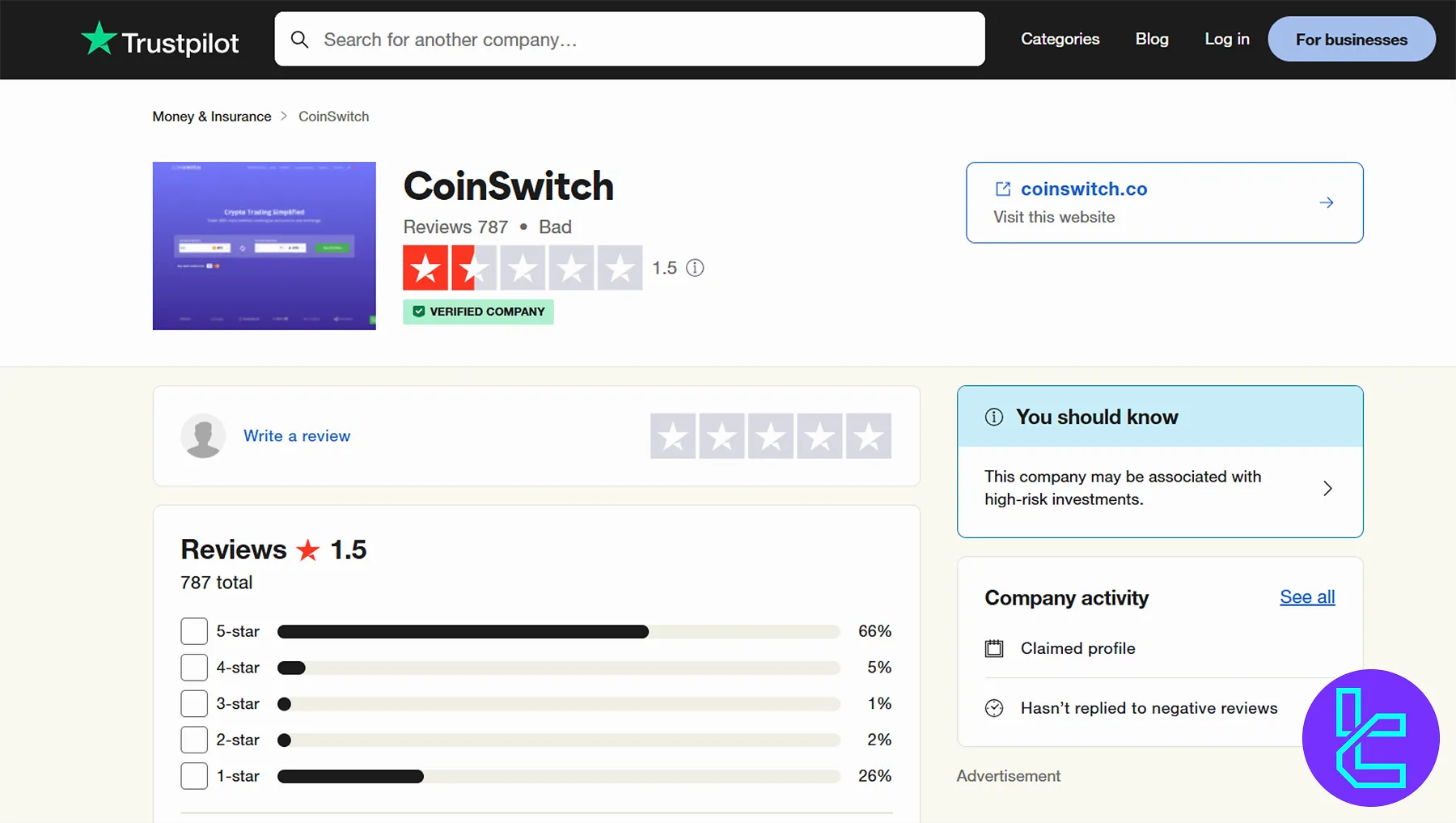

CoinSwitch User Satisfaction

Exploring the company’s ratings on reputable websites provides a clear view of its operation and quality of services.

While CoinSwitch claims to be the biggest Indian crypto exchange with a client-centric approach, the user reviews paint a poor picture.

1.5/5 based on 787 reviews | |

Reviews.io | 2.1/5 based on 37 ratings |

CoinSwitch Features

To attract new users and retain existing customers, CoinSwitch offers a range of services. CoinSwitch features:

Feature | Availability |

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | Yes |

CoinSwitch Bonus

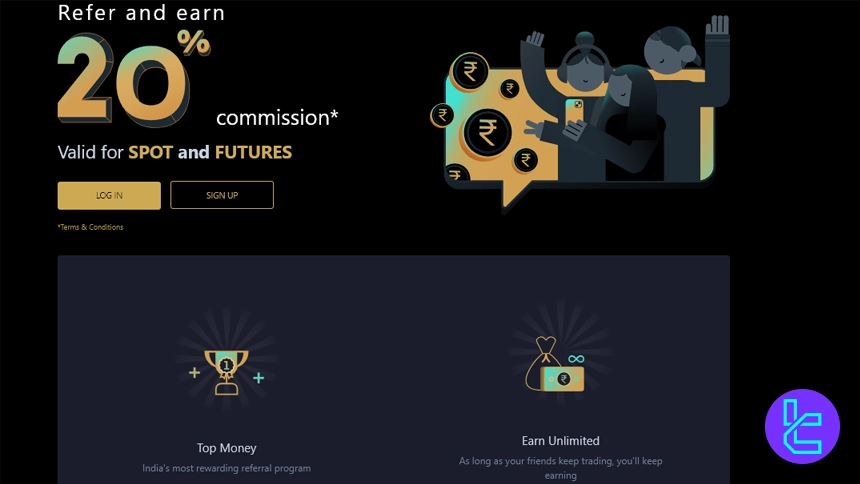

The exchange has only one promotional offer for its users. Here's an overview of the program:

Program Name | Details |

CoinSwitch Referral Program | Earn up to 20% commission from referral trading fees across Spot and Futures markets. Rewards are performance-based, scale with trading volume, and have no fixed income cap as long as referrals stay active. |

Referral Program

The CoinSwitch referral program is designed for users who want to monetize their network through trading activity. Referrers earn up to 20% commission on their friends’ trading fees, and the reward structure applies to both Spot and Futures markets.

Earnings are performance-based and scale with the volume your referrals generate, meaning there’s no fixed cap on income potential as long as your network stays active. The process is straightforward; share your unique referral link, invite users to join PRO, and receive a commission on every completed trade.

CoinSwitch Kuber Support Channels

The support is one of the biggest weaknesses in this CoinSwitch review. The platform doesn’t provide a Live Chat feature or hotlines.

support@coinswitch.co | |

Ticket | Available on the official website |

Help Center | A comprehensive FAQ section |

Does CoinSwitch Offer Copy Trading or Growth Plans?

While the ecosystem doesn’t offer a dedicated crypto copy trading software, it features a comprehensive list of trading strategies for investors to choose from, allowing them to earn profits.

- Up to 80% in profits

- Minimum investment from ₹5,000

- 15% - 22% profit sharing

The company also offers a Systematic Investment Plan (SIP) that traders can use to automatically buy a predetermined amount of cryptocurrencies monthly to counter market volatility.

Restricted Countries on CoinSwitch Exchange

While the platform doesn’t provide a list of geo-restrictions on its website, it likely prohibits users from countries like Iran, North Korea, and Yemen from using its services.

CoinSwitch in Comparison with Other Exchanges

By reviewing the table below, traders can easily understand the advantages and disadvantages of choosing CoinSwitch over other cryptocurrency exchanges.

Parameters | CoinSwitch Exchange | |||

Number of Assets | 250+ | 400+ | 700+ | 10000+ |

Maximum Leverage | 1:25 | 1:125 | 1:200 | 1:125 |

Minimum Deposit | ₹100 | $1 | $1 | $15 |

Spot Maker Fee | 0.04% - 0.4% | 0.02% - 0.1% | From 0.02% | 0.10% |

Spot Taker Fee | 0.04% - 0.4% | 0.04% - 0.1% | From 0.02% | 0.10% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer’s opinion and conclusion

CoinSwitch provides access to Crypto Spot and Futures trading with leverage options of up to 1:25.

The platform offers 430+ leveraged contracts with a maker / taker commission of 0.02% / 0.05%. While the CoinSwitch exchange has more than 20M users and a value of $1.9B, its TrustPilot score is 1.5.