CoinW offers Futures, Spot, and OTC trading on 1000+ crypto assets. The company also offers various investment plans, from simple HODL to structured products.

The exchange provides trading with a leverage of up to 200x and a native token [CWT]. Also, a CoinW Card service is available for users.

Security measurements such as anti-DDoS protection and a bug bounty program are taken for the safety of funds and data.

CoinW is an exchange with a $1M prize pool (Winning Legends Cup 2024)

CoinW is an exchange with a $1M prize pool (Winning Legends Cup 2024)

CoinW (Is the Exchange Regulated?)

CoinW is located in Dubai, UAE, and was founded in 2017. The company has 16 Localized Trading Service Centers across 13 countries. The exchange has over 1000 employees from 30 nations. Key features of CoinW:

- Founded in 2017 in Dubai, UAE

- Over 7 million users globally

- 1,000+ listed crypto tokens

- 500+ spot trading pairs

- Up to 1:200 leverage

- Licenses across multiple jurisdictions, including Poland, Saint Vincent and the Grenadines, the USA, Taiwan, and Australia

Note that despite the exchange’s claims about having multiple licenses, there is no clear evidence of such documents.

CoinW CEO and Founder

Based on Mingguo BaiLinkedIn, he currently serves as the CEO of the cryptocurrency exchange.

Prior to his involvement in the decentralized finance (DeFi) space, Bai was a financial advisor to the royal family of Abu Dhabi.

Under his leadership, CoinW has expanded its global presence, establishing its headquarters in Dubai in 2025 to capitalize on the city's supportive regulatory environment and vibrant tech ecosystem.

This strategic move aims to accelerate Web3 adoption and enhance the company's position in the digital economy.

CoinW Summary of Specifications

The Crypto exchange provides services in 120+ countries and has 300+ qualified projects. Let’s see other features that make CoinW stand out.

Exchange | CoinW |

Launch Date | 2017 |

Levels | VIP 1 – VIP 6 |

Trading Fees | Spot 0.2% Futures maker 0.01% / taker 0.06% |

Restricted Countries | Afghanistan, Algeria, Bahamas, Bangladesh, Bolivia, Botswana, Burundi, China (Mainland), Cambodia, Canada, Congo, Crimea, Cuba, Egypt, Ethiopia, Ghana, Hong Kong, Japan, Iran, Iraq, Lebanon, Libya, Mali, Myanmar, Morocco, Nepal, Nicaragua, North Korea, Pakistan, Panama, Qatar, Singapore, Somalia, Sri Lanka, Sudan, Syria, Tunisia, the United States, Venezuela, Asia Door, Zimbabwe |

Supported Coins | 1000+ |

Futures Trading | Yes |

Minimum Deposit | Variable based on the Currency |

Deposit Methods | Crypto, Fiat |

Withdrawal Methods | Crypto |

Maximum Leverage | 1:200 |

Minimum Trade Size | Variable based on the currency |

Security Factors | Identity Verification, Account Integrity, Cold Storage, Anti-DDoS Protection, Bug Bounty Program |

Services | Affiliate, Earn services, CoinW card, Trading tournament |

Customer Support Ways | Chat Bot, Ticket, Telegram Community |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | CWT |

CoinW Exchange Pros & Cons

The company boasts 24/7 support, diverse markets P2P/OTC and Futures), and dedicated trading bots. However, CoinW surely has downsides too.

Advantages | Disadvantages |

A wide range of trading options | Not available in the United States |

User-friendly interface | Relatively new |

No security breaches in more than 5 years | Limited information on regulatory compliance |

Copy trading feature for beginners | - |

CoinW User Levels

CoinW operates a tiered VIP system determined by a user's 30-day trading volume and holdings of the native CoinW Token (CWT).

Advancing through the VIP levels offers benefits, including reduced trading fees and priority access to services.

Level | Price (CWT) |

VIP1 | 0 |

VIP2 | 680 |

VIP3 | 2,680 |

VIP4 | 12,800 |

VIP5 | 38,600 |

VIP6 | 86,800 |

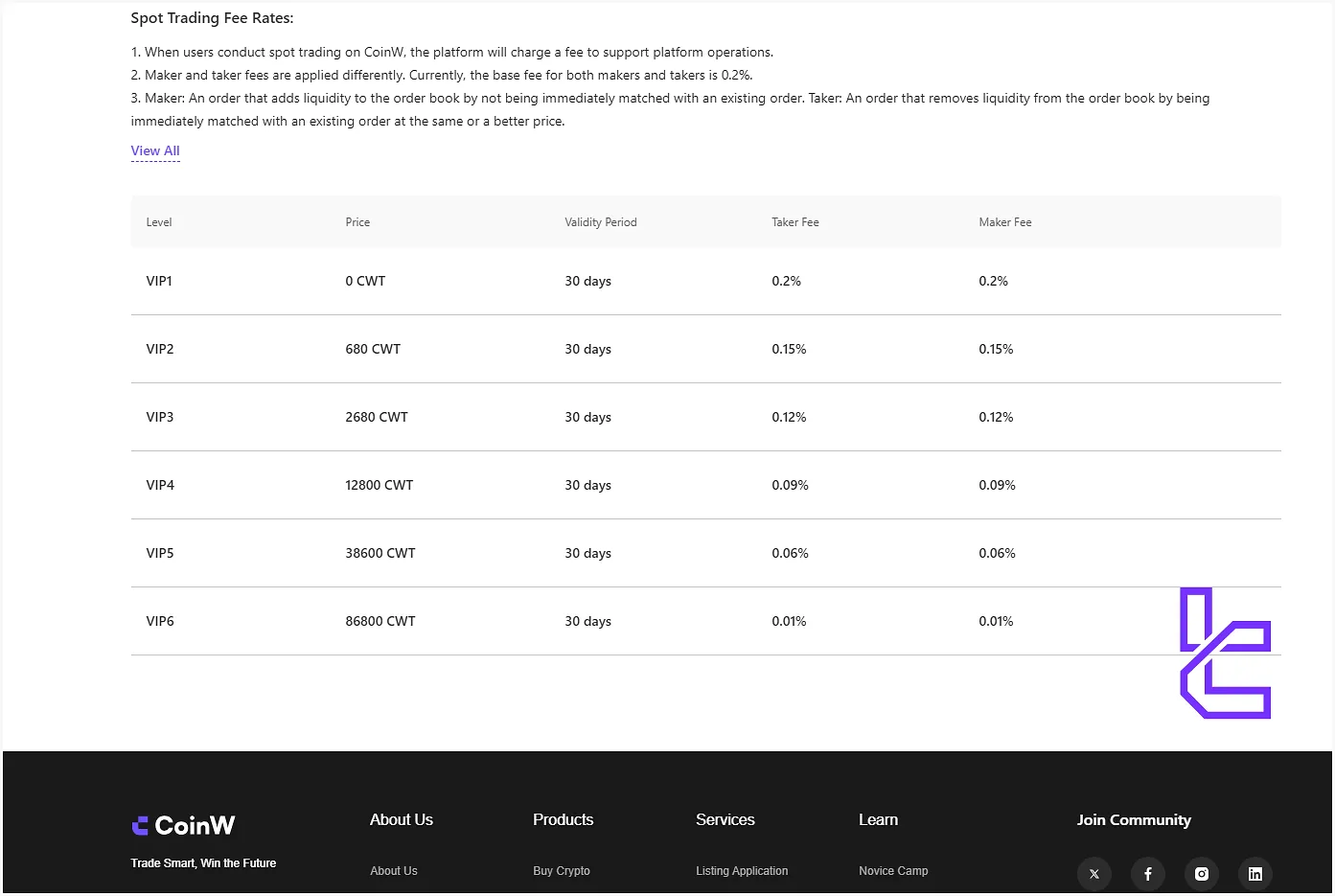

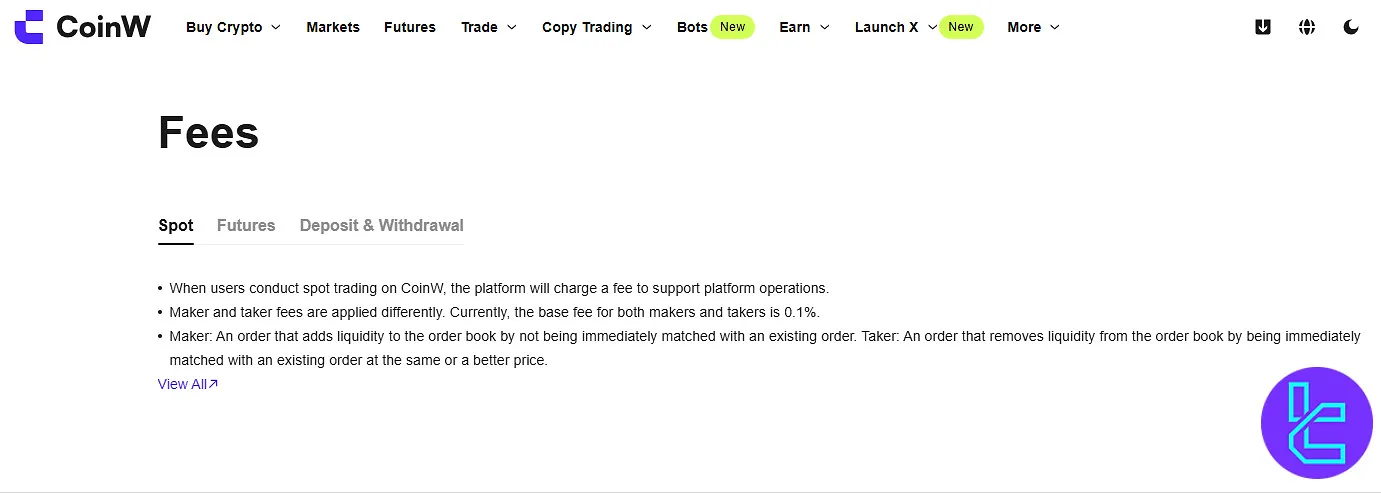

CoinW Fees and Commissions

The company follows a straightforward pricing model for trading costs, applying a 0.2% maker/taker fee on Spot trades, while in the Futures market it charges a 0.01% fee for makers and a 0.06% commission for takers, ensuring transparent and competitive conditions for all traders.

However, the exchange reduces the Spot trading costs based on your user level.

Level | Price (CWT) | Taker Fee | Maker Fee |

VIP1 | 0 | 0.2% | 0.2% |

VIP2 | 680 | 0.15% | 0.15% |

VIP3 | 2,680 | 0.12% | 0.12% |

VIP4 | 12,800 | 0.09% | 0.09% |

VIP5 | 38,600 | 0.06% | 0.06% |

VIP6 | 86,800 | 0.01% | 0.01% |

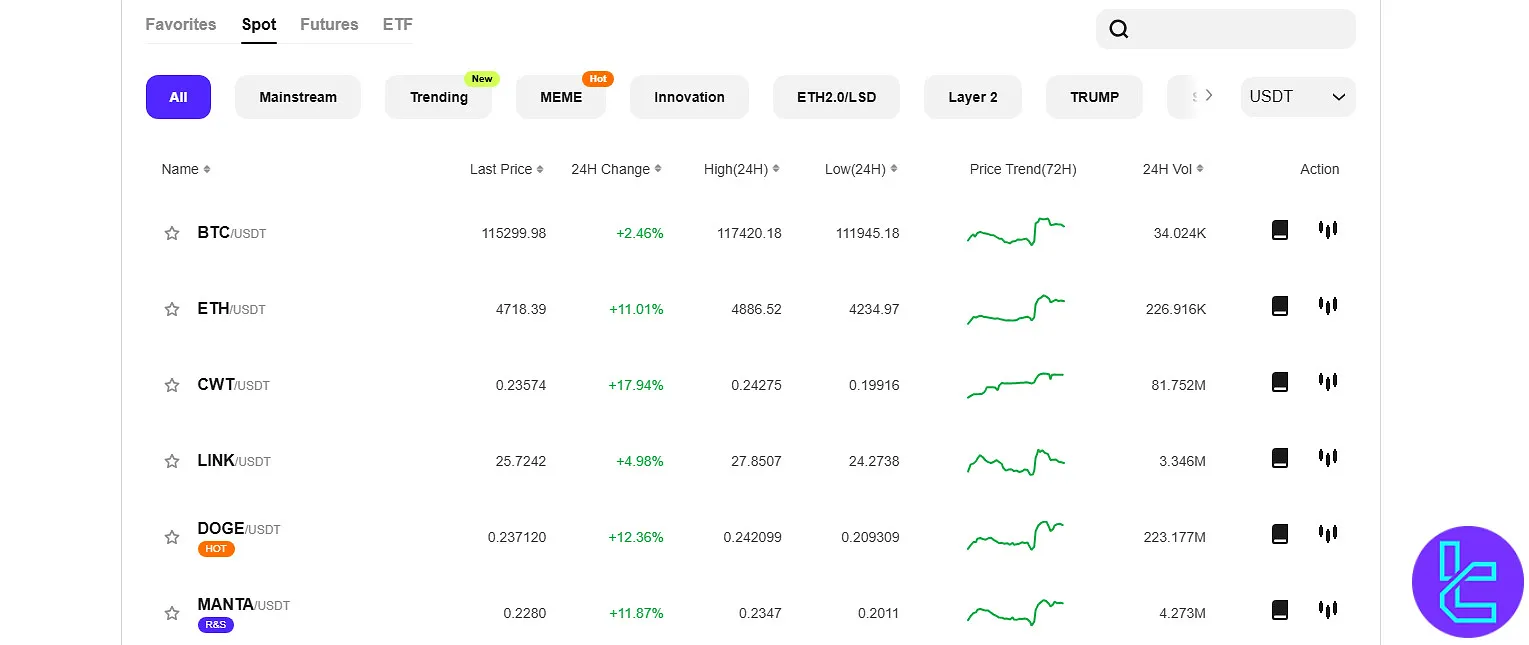

Available Coins on CoinW

Available cryptocurrenciesmust be discussed in all CoinW reviews. The exchange has listed over 1,000 digital tokens and frequently updates them with new listings.

In order to buy crypto, you must first navigate to the P2P market on the CoinW website and purchase USDT, then proceed to the Spot section, where you can purchase your preferred token. Some of the most popular assets available on CoinW:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- Ripple (XRP)

- Dogecoin (DOGE)

The minimum purchase requirement on CoinW’s spot market is typically around 2 USDT, although this threshold may vary depending on the specific cryptocurrency being traded.

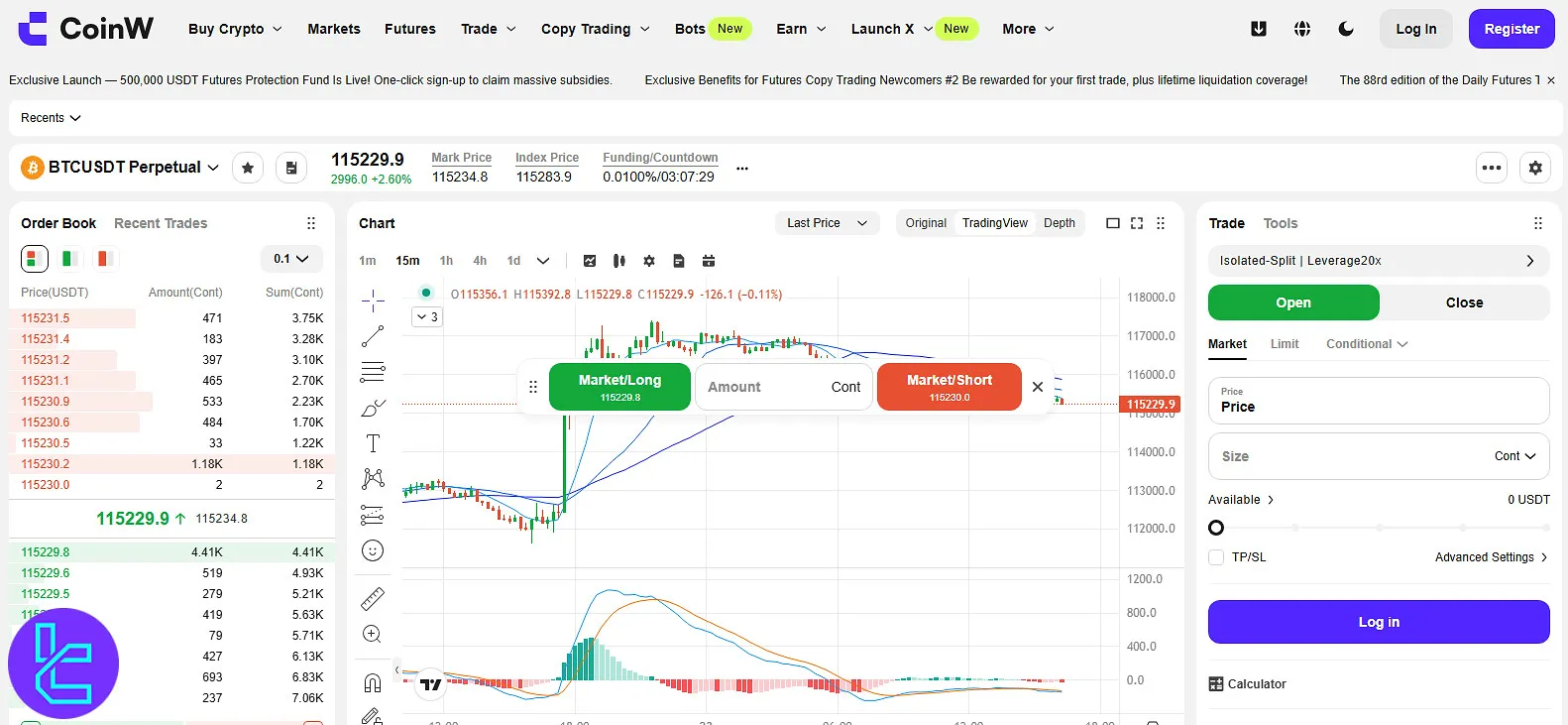

CoinW Futures and Margin Trading

CoinW provides a comprehensive Futures market with leverage options of up to 1:200 and 110+ perpetual contracts, including:

- APE/USDT

- ATOM/USDT

- BCH/USDT

- BNB/USDT

- DOGE/USDT

- ETC/USDT

- ETH/USDT

- LTC/USDT

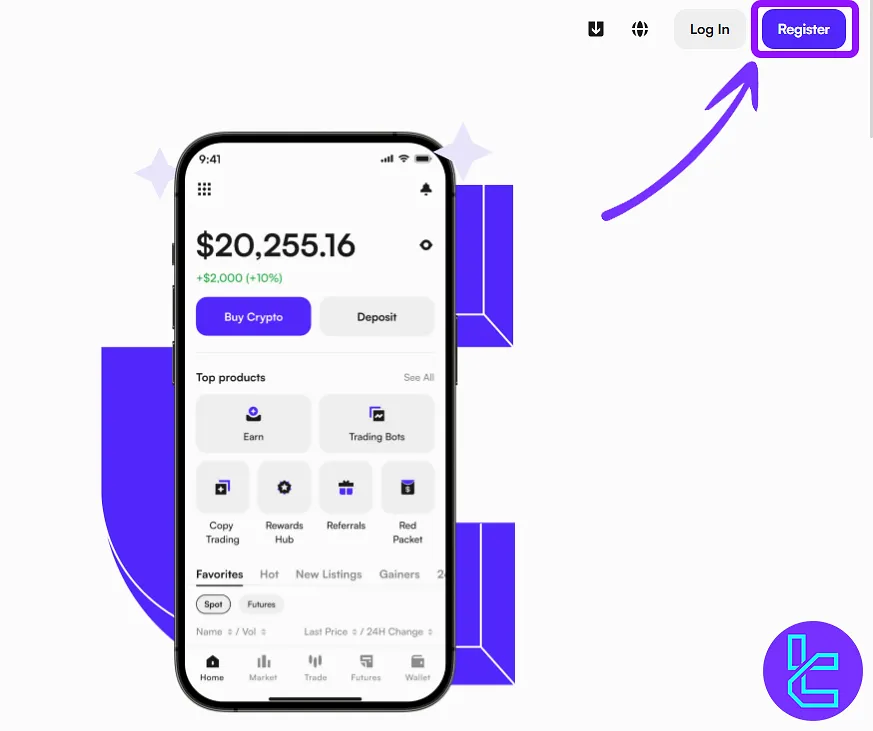

CoinW Signup Guide

To open an account, verify your account with CoinW exchange, follow the steps provided below:

#1 Enter the CoinW Official Website

First, search for CoinW on your browser and access the official website. Then, click on the "Register" button.

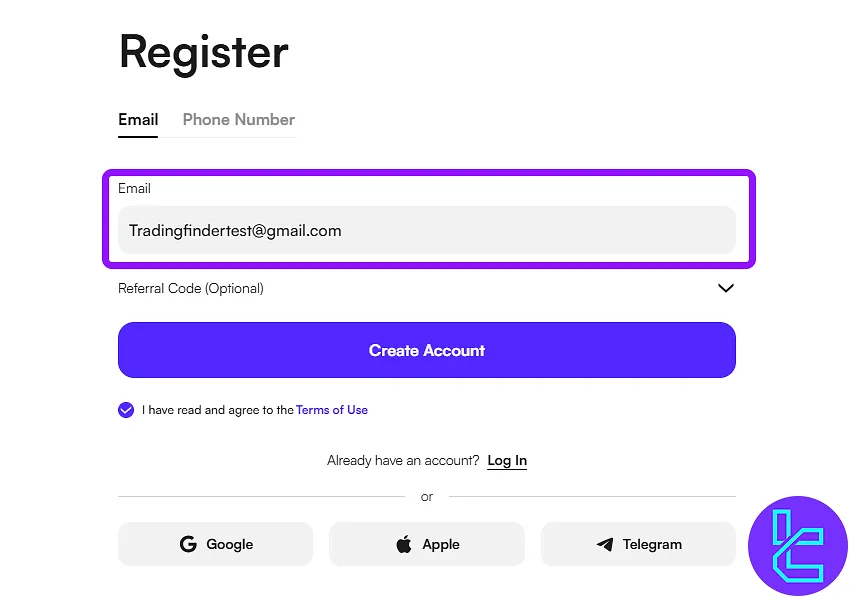

#2 Use your Email or Phone to Signup

Enter your phone number or email in the designated field and accept the platforms terms and conditions.

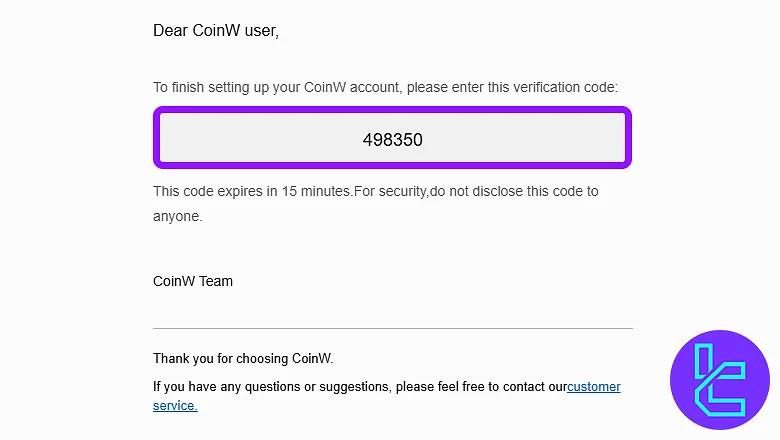

#3 Verify Your Phone Number or Email Address

The exchange now sends you a verification code via email or SMS. Enter it to continue the process.

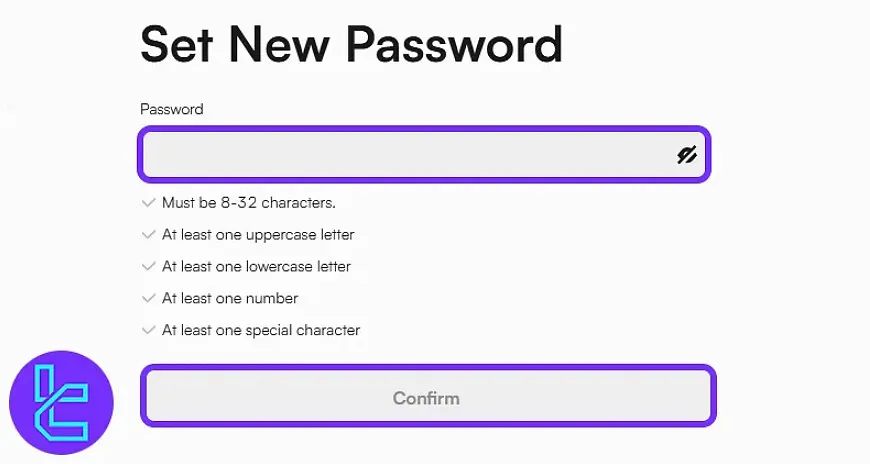

#4 Set a Password

Now, set a strong and uniquepassword to safeguard your account.

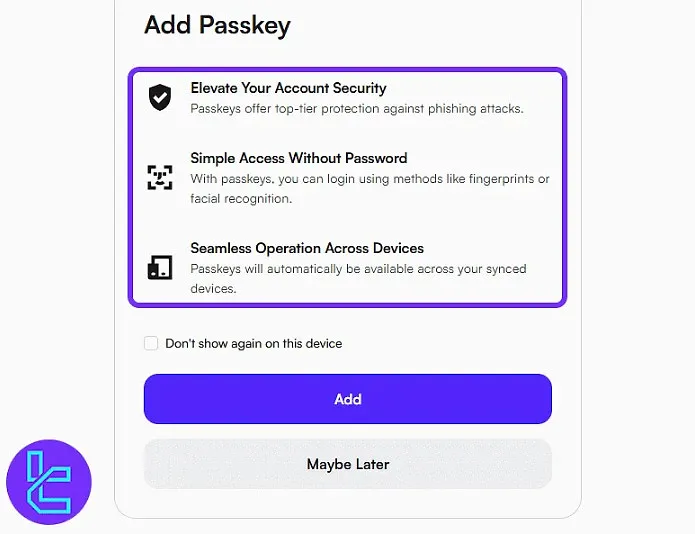

#5 Add Passkey (Optional)

After setting your password, you’ll see a screen with three options:

- Add: Enable passkey-based login using facial recognition or fingerprint.

- Maybe Later: Skip this step for now and decide later.

- Don't Show Again: Hide this prompt permanently.

Enhance your CoinW account security by adding a passkey, which allows multi-device login.

Once completed, your CoinW account setup is finalized, and you’re logged into the dashboard, ready to explore all trading features.

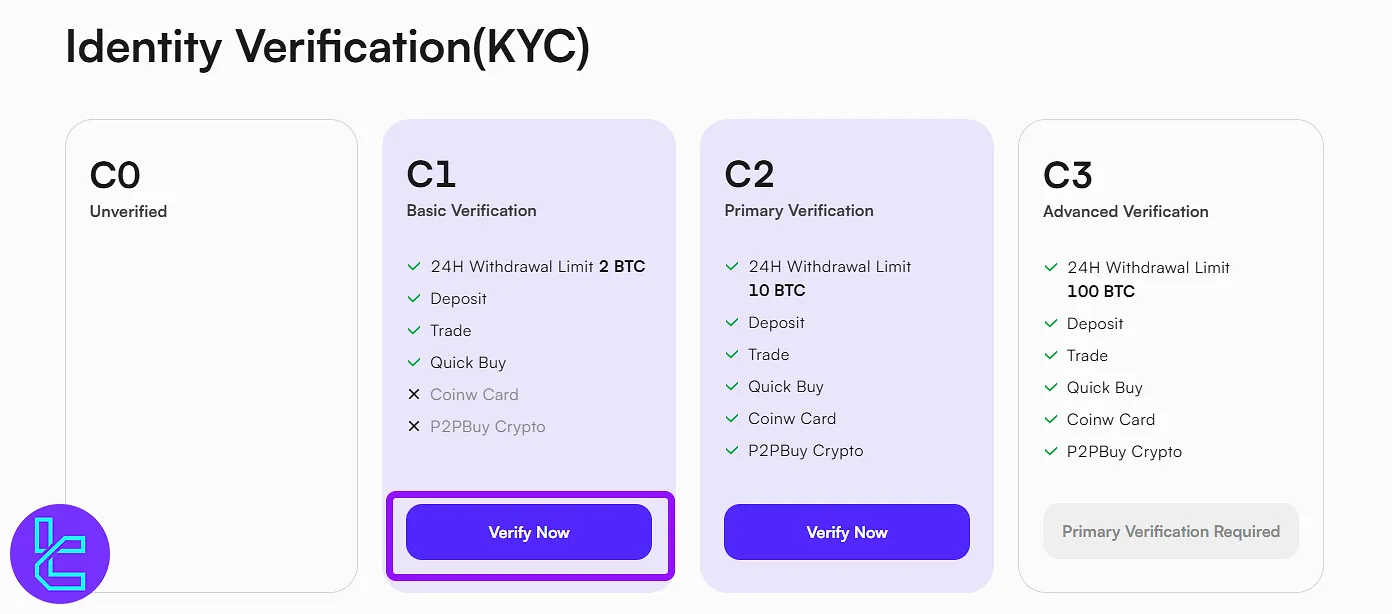

CoinW Verification

To comply with AML laws, CoinW requires all traders to complete Basic and Primary verifications. The required information and documents for this process include:

- Full name

- Country of residence

- Date of birth

- Gender

- Proof of Identity: Passport, ID card, or driver's license

- Proof of Address: Utility bill or bank statement

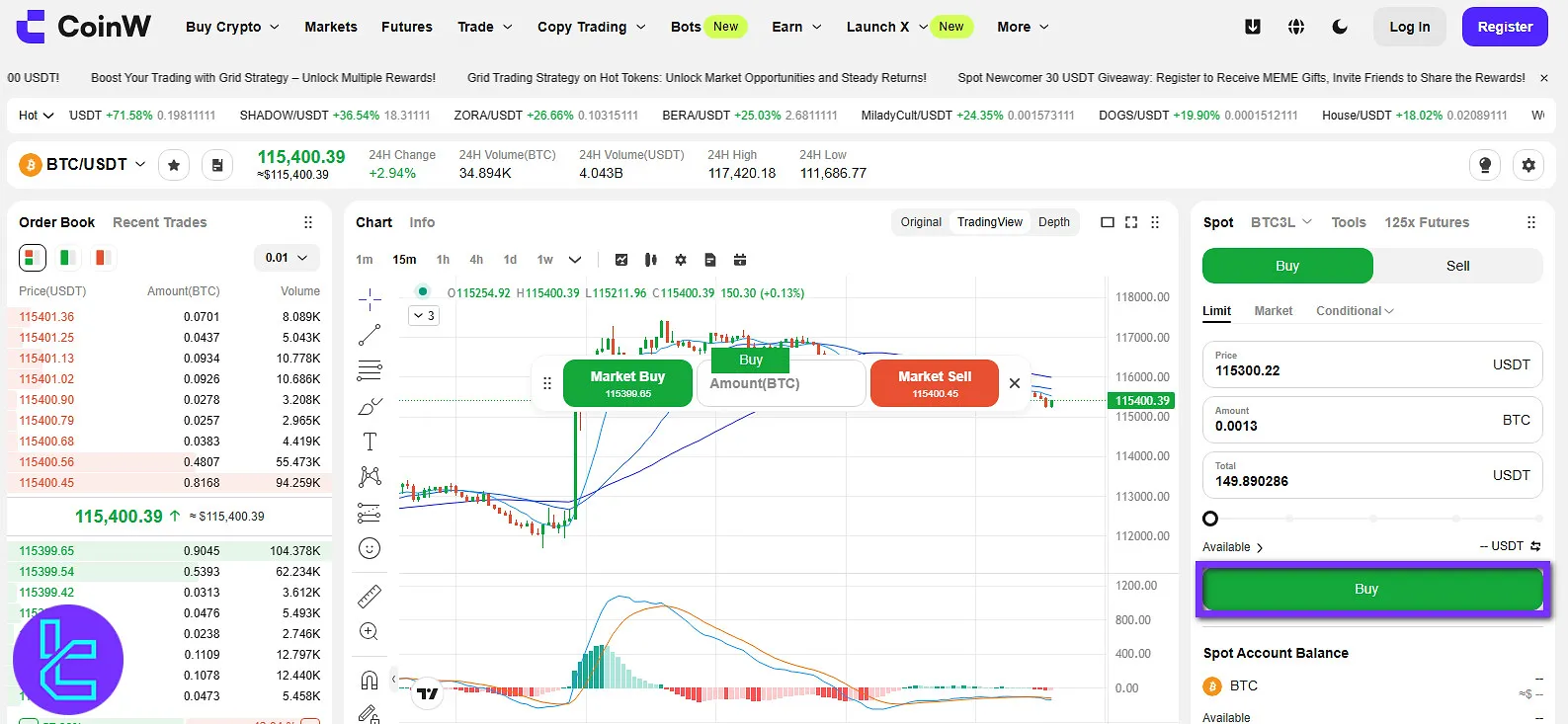

How to Trade on CoinW

Follow these simple steps to learn the best way to spot trade on CoinW exchange:

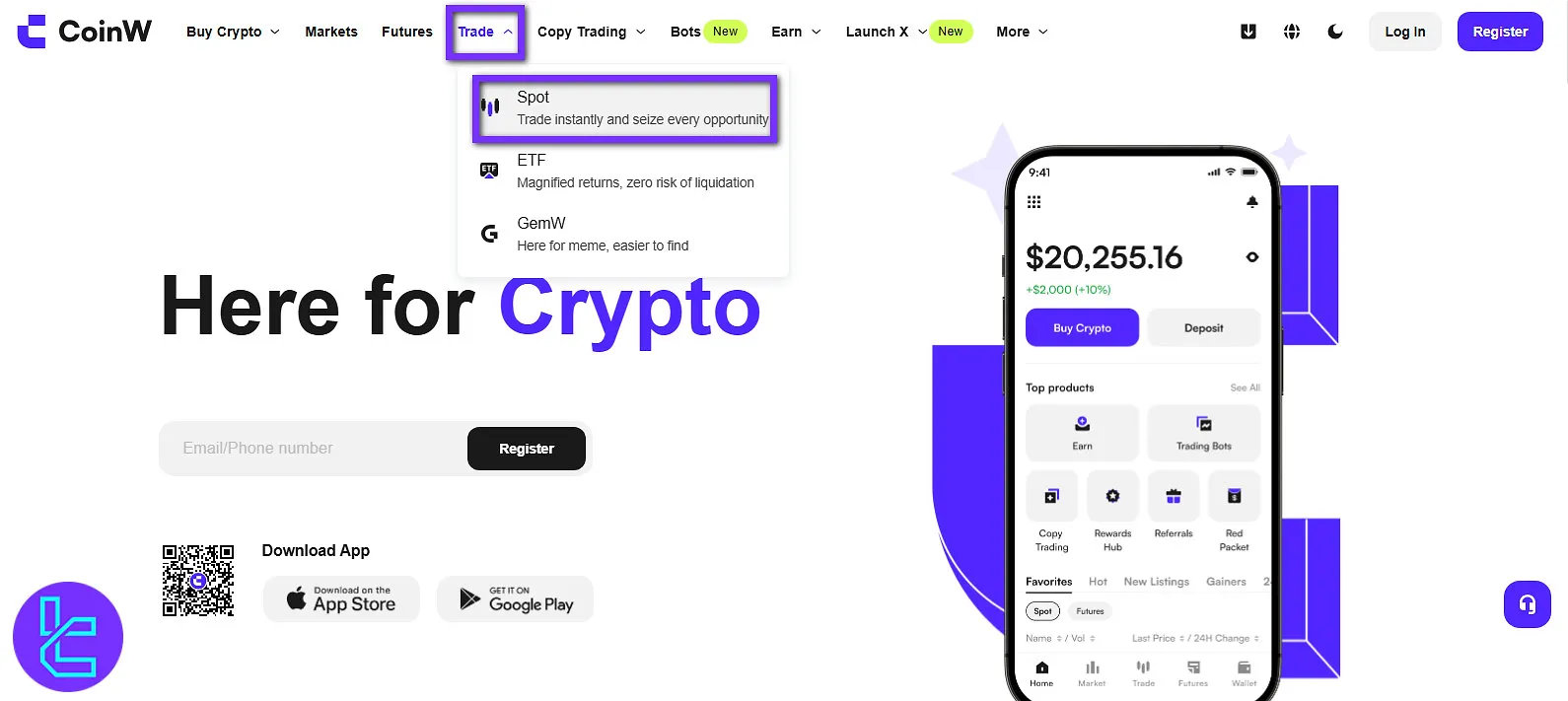

#1 Enter the Spot Trading Section

On the CoinW homepage, after registration, hover your mouse pointer over “Trade” and then choose “Spot” from the dropdown menu.

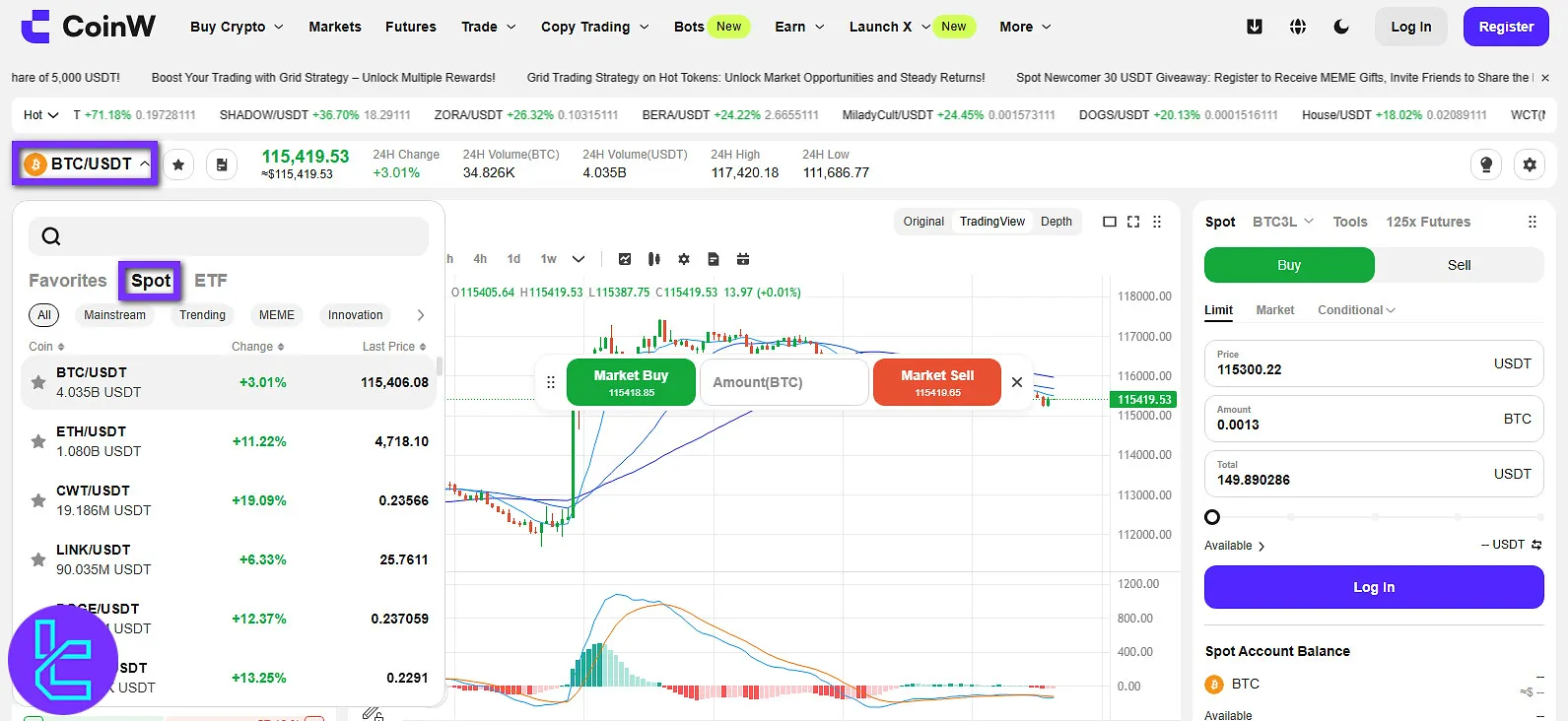

#2 Select the Trading Pair

To select your preferred trading pair, hover your mouse pointer over the current selected pair and then choose the one you want from the dropdown menu.

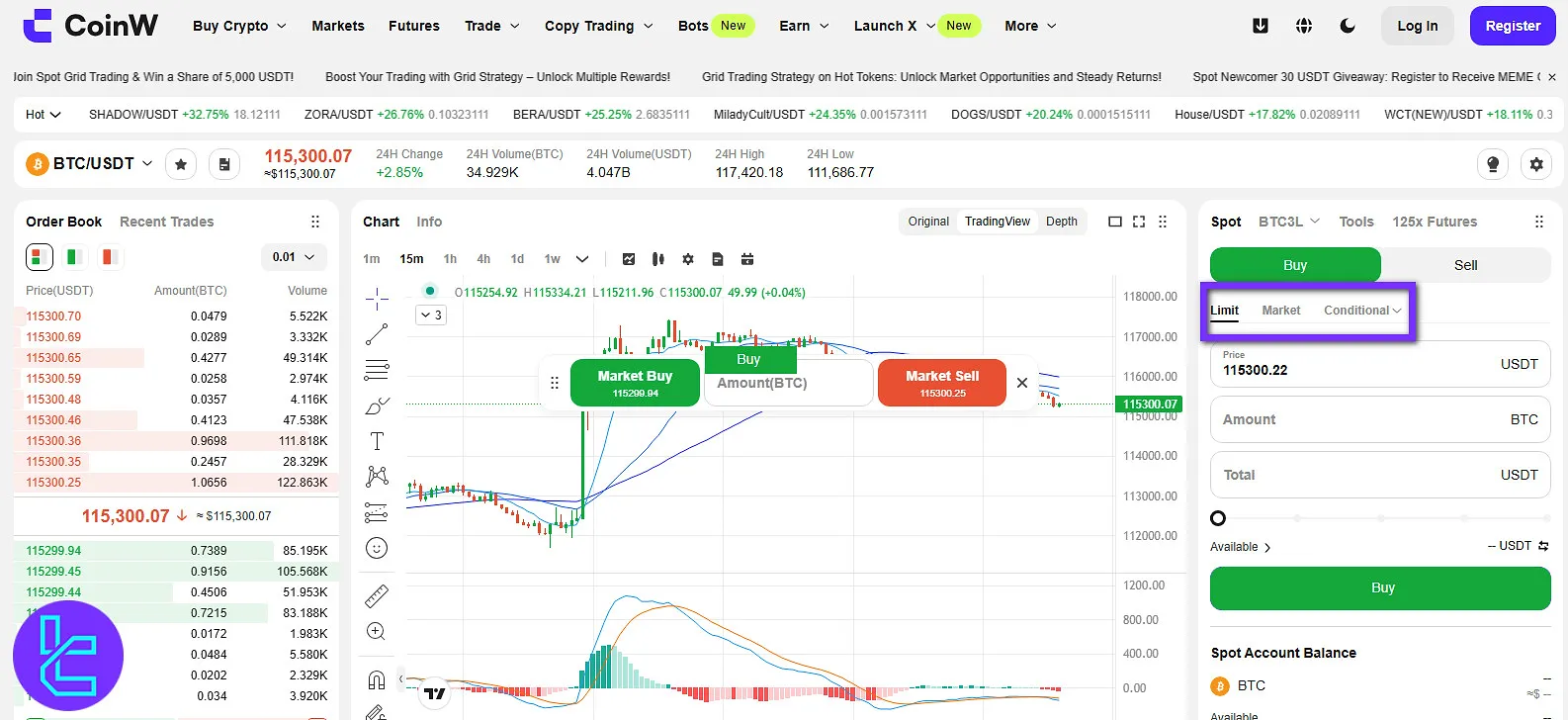

#3 Pick the Order Type

Now it’s time to select the order type you want. CoinW offers limit orders, market orders, and 6 different types of conditional orders. You can choose the order type from the right-side menu.

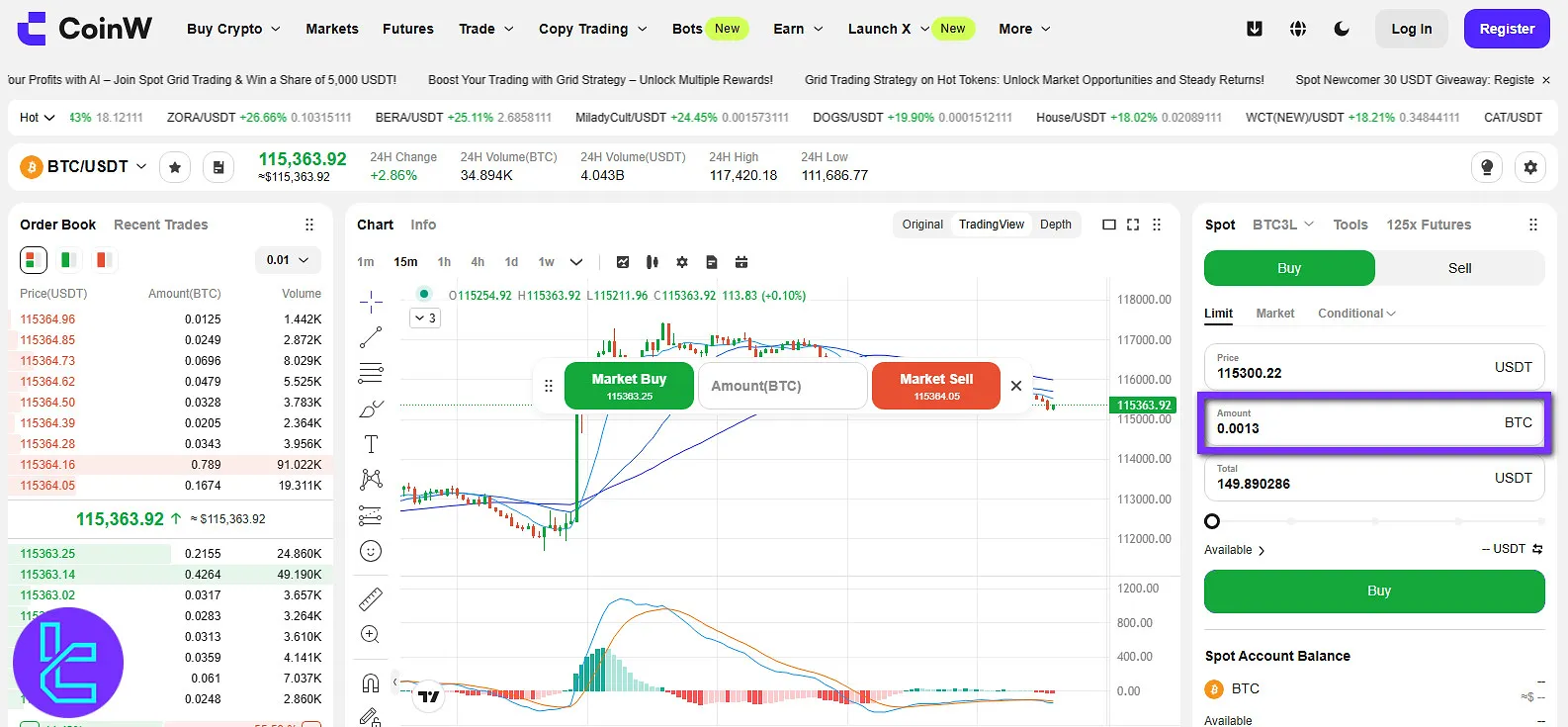

#4 Specify the Amount

You need to enter how much you want to buy or sell. The input field for the amount of the trade is a bit under the order types.

#5 Initiate the Order

Start the trade by simply clicking on “Buy” or “Sell” at the bottom of the menu on the right.

CoinW Exchange Trading Platforms

The company offers a proprietary platform with access to TradingView indicators and charts for various operating systems and devices, including:

- CoinW Android

- CoinW iOS

- Windows

- Mac

- Web

CoinW Trading Volume

Based on CoinW CoinGecko, over the past three months, CoinW has demonstrated notable fluctuations in trading activity.

Daily trading volumes have ranged from around $2 billion to peaks exceeding $8 billion.

For instance, on August 5, 2025, at 15:20 GMT+3:30, the exchange recorded a volume of approximately $3.46 billion.

The volume trend shows a pattern of periodic spikes, indicating surges in trader activity, likely driven by market events or high-demand trading pairs.

Overall, CoinW maintains robust liquidity, providing users with a dynamic trading environment and the ability to execute large orders with minimal slippage.

CoinW Services

Using the table below, you can check the availability of trading services on the CoinW exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

Demo Account | No |

Launchpad | Yes |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

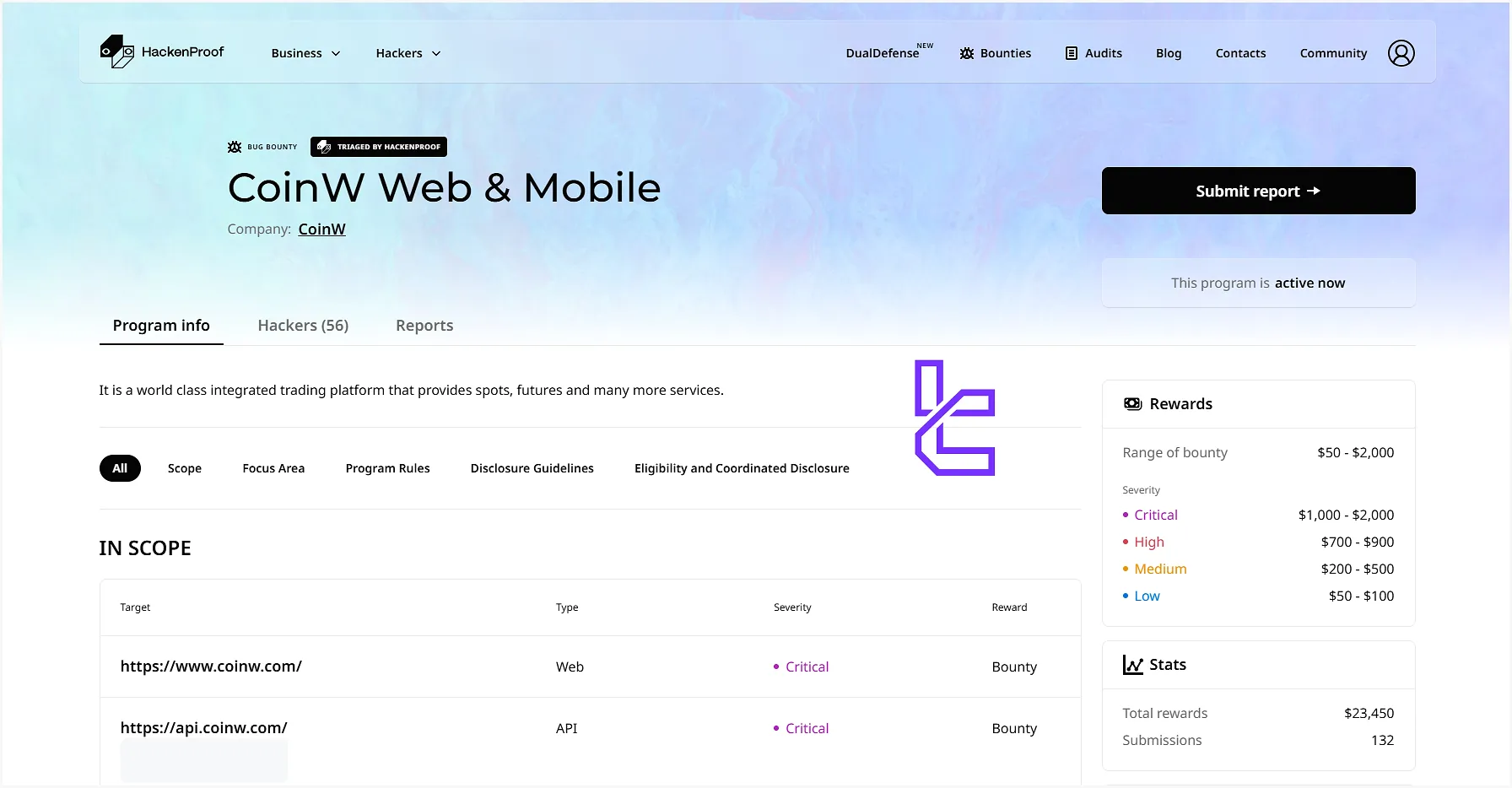

CoinW Security Measures to Protect Users' Data and Funds

CoinW implements several security measures to safeguard user assets and information, including:

- Identity Verification: Cell phone verification code, Google Authenticator, Twilio, or U2F security key

- Account Integrity: Recording IP data of each customer and wrong password notification

- Cryptocurrency storage: Using MPC (Multi-Party Computing) wallet for on-chain transactions, a military-grade security chip, and offline cold storage

- Anti-DDoS Protection: Measures in place to prevent distributed denial-of-service attacks

- Bug Bounty Program: Rewards for identifying and reporting security issues

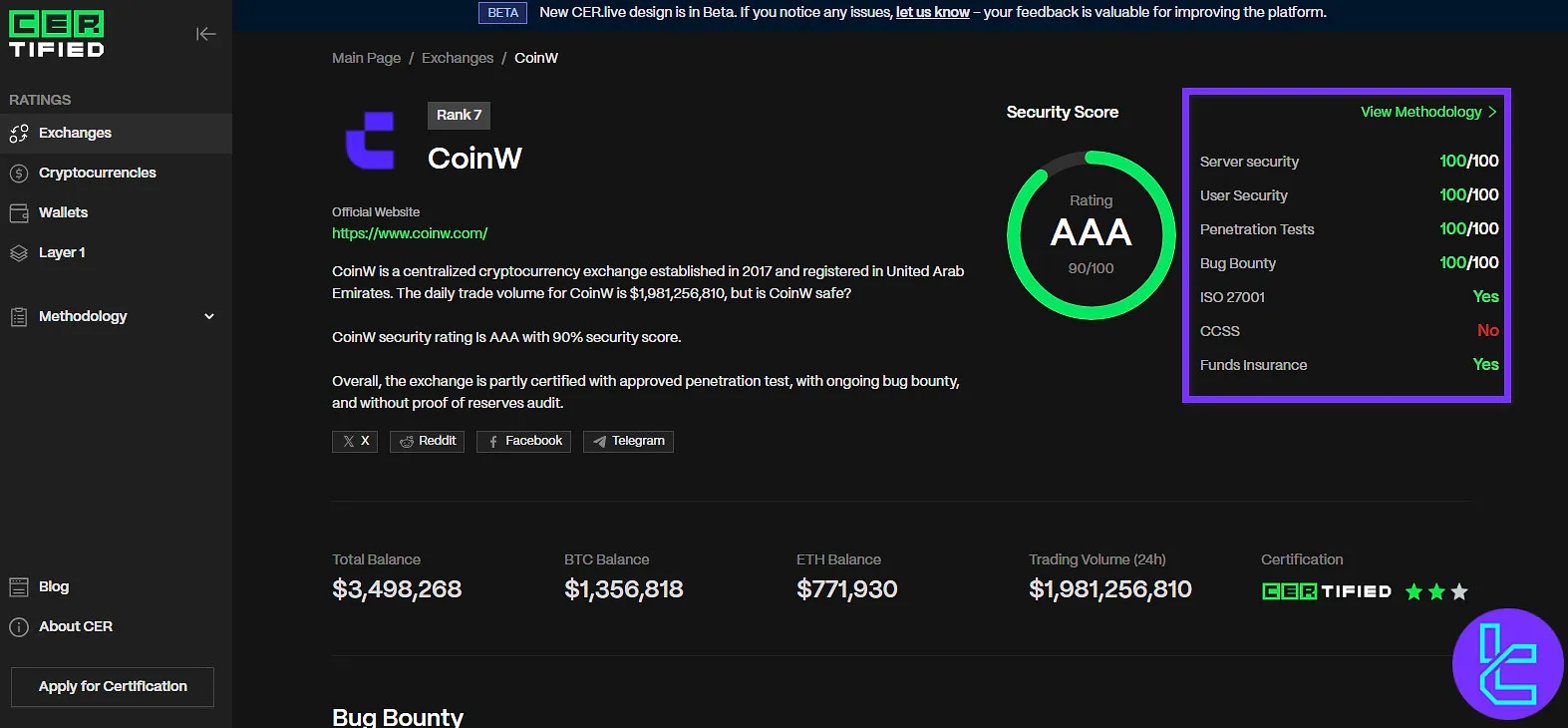

CoinW Security Rankings

CoinW demonstrates a strong commitment to platform security, earning high marks across multiple industry-standard evaluations.

According to CoinW CertiK Skynet, the exchange achieves an overall score of 82.23/100 (A), with particularly strong performance in operational and market security.

Additionally, CoinW CER.live rates the exchange with an AAA (90%) overall score, highlighting top-tier server and user security, successful penetration tests, and robust fund protection measures.

This combination reflects a secure environment for trading and safeguarding assets.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 82.23 / 100 (A) |

Fundamental | 67.15 | |

Operational | 88.73 | |

Listing Security | 87.63 | |

Market | 93.01 | |

Community | 66.55 | |

Cybersecurity | 82.00 | |

CER.live Score | Overall Score | 90% (AAA) |

Server Security | 100/100 | |

User Security | 100/100 | |

Penetration Tests | 100/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

What Payment Methods Are Available on CoinW?

CoinW reviews must discuss deposit and withdrawal options. The exchange supports 20+ fiat currencies and lots of tokens for deposits via HyperPay. However, it only provides crypto withdrawals.

Note that the minimum amount differs based on the token you select. While deposits come with zero commissions, blockchain fees may apply to withdrawals.

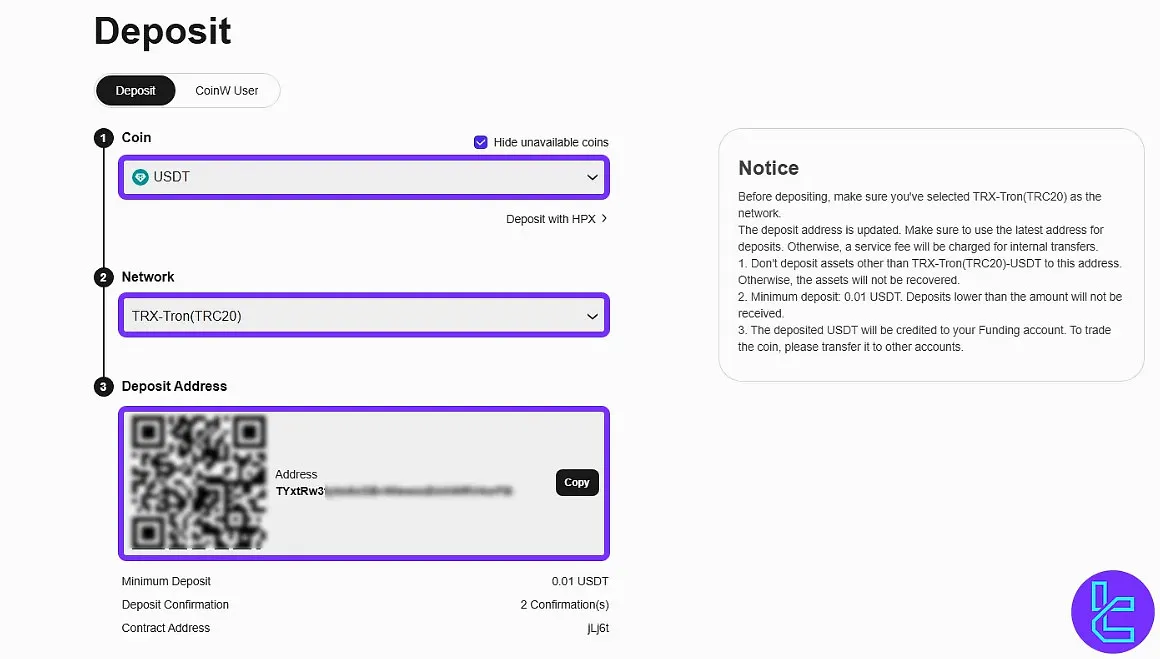

CoinW USDT TRC20 Deposit Guide

CoinW USDT TRC20 deposit is a convenient and cost-efficient 3-step method to fund your account. The minimum deposit is 0.01 USDT, requiring only 2 confirmations on the TRON blockchain.

#1 Access the Deposit Section

From your CoinW dashboard, click the "Deposit" button to open the top-up interface.

#2 Select Coin and Network to Generate Address

Choose "USDT" from the coin list and select "TRX-TRON (TRC20)" as the network. A unique wallet address and QR code will be generated.

Transfer your funds from your personal wallet to this address.

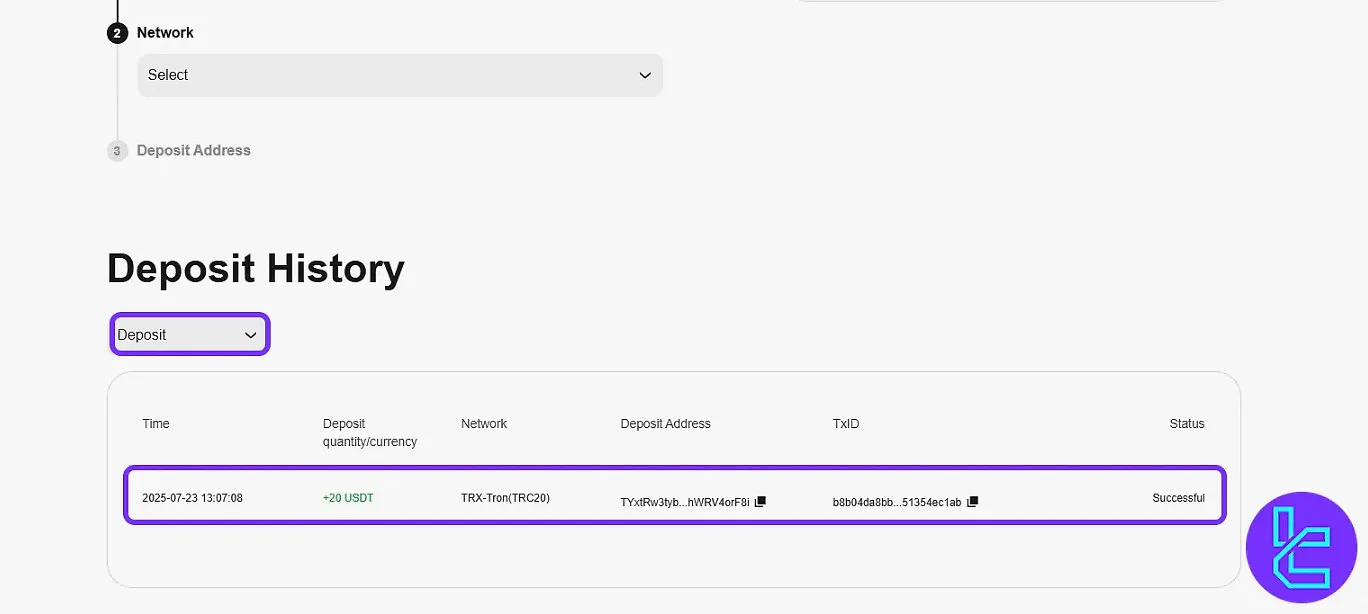

#3 Monitor the Deposit Status

Scroll down to the "Deposit History" section to check transaction details such as amount, network, Transaction ID, and status.

Note: CoinW also supports TRC20 withdrawals, allowing you to cash out using the same blockchain and cryptocurrency used for deposits.

CoinW USDT TRC20 Withdrawal Guide

CoinW USDT TRC20 withdrawal is a secure 3-step process for cashing out Tether (USDT) via the Tron blockchain:

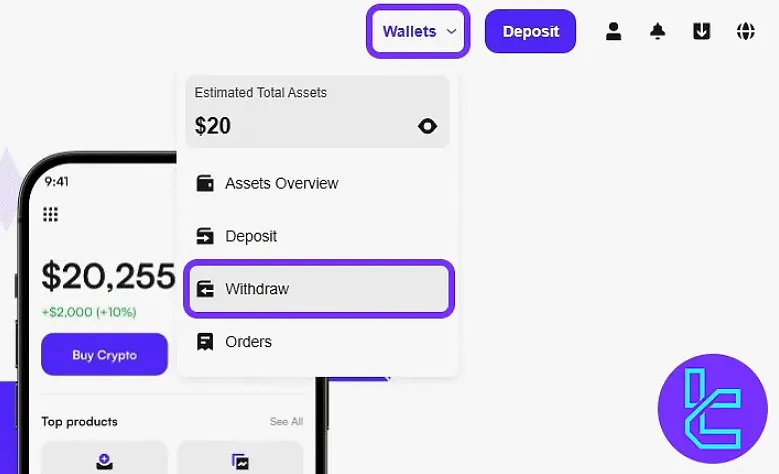

#1 Opening the Withdraw Section

Click on "Wallets" in the dashboard header and select the "Withdraw" option to start the cash-out process.

If this is your first withdrawal, ensure that 2FA is activated for added security.

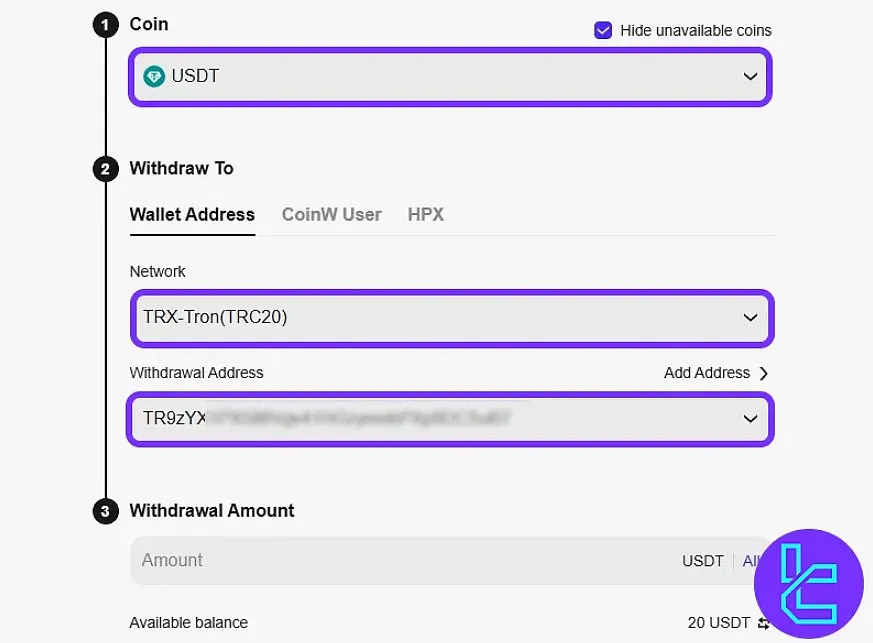

#2 Submitting the Withdrawal Request

Select "USDT" as the coin and "TRX-TRON (TRC20)" as the network. Enter the destination wallet address and the amount to withdraw.

Click "Add Address" to register a new wallet if needed.

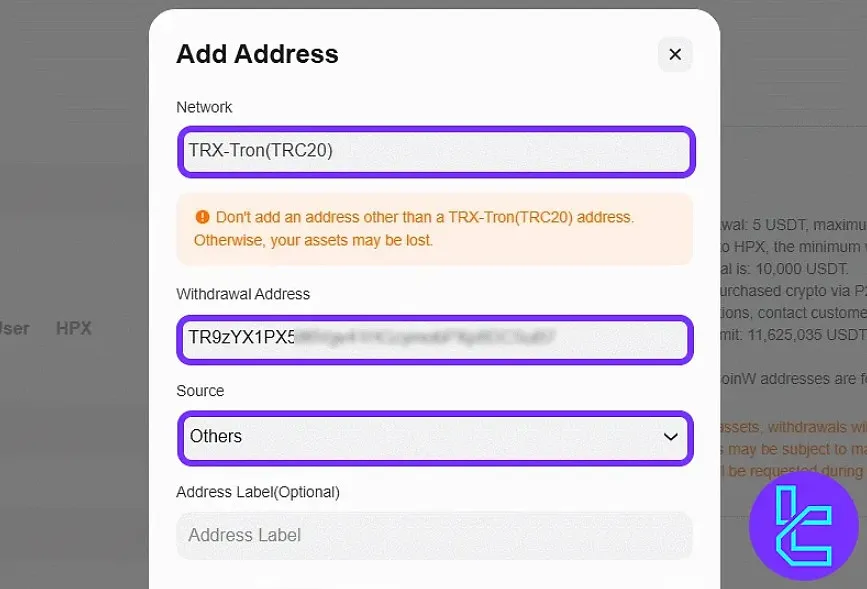

To add a new wallet address, select the correct network, enter the destination wallet, choose a source, and optionally add a label.

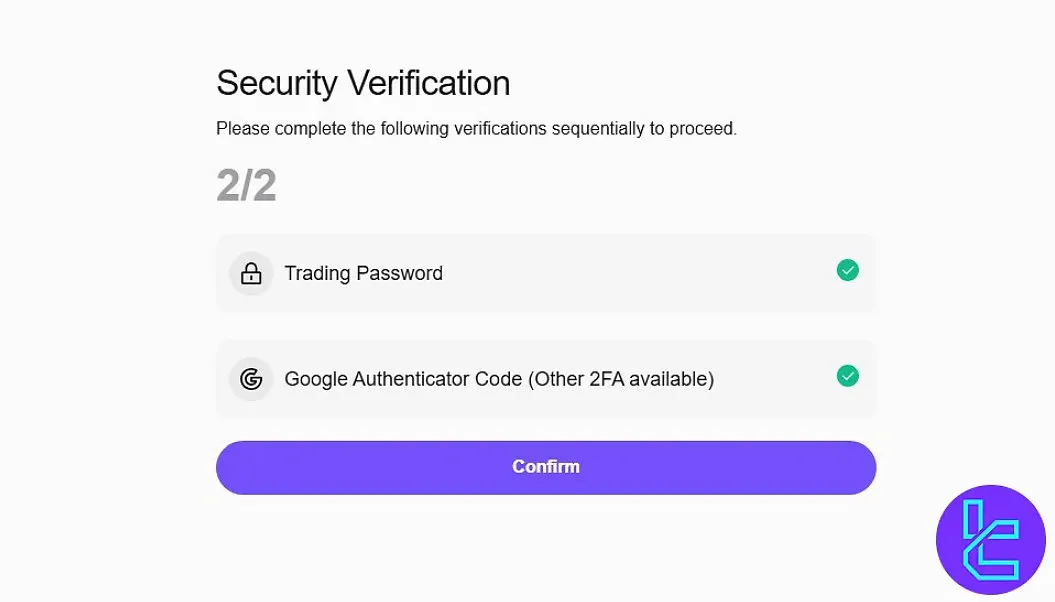

Then confirm the wallet address by entering your trading password and Google Authenticator code.

Before submitting your request, CoinW requires a final security verification. Enter your trading password and current Google Authenticator code, then click "Confirm".

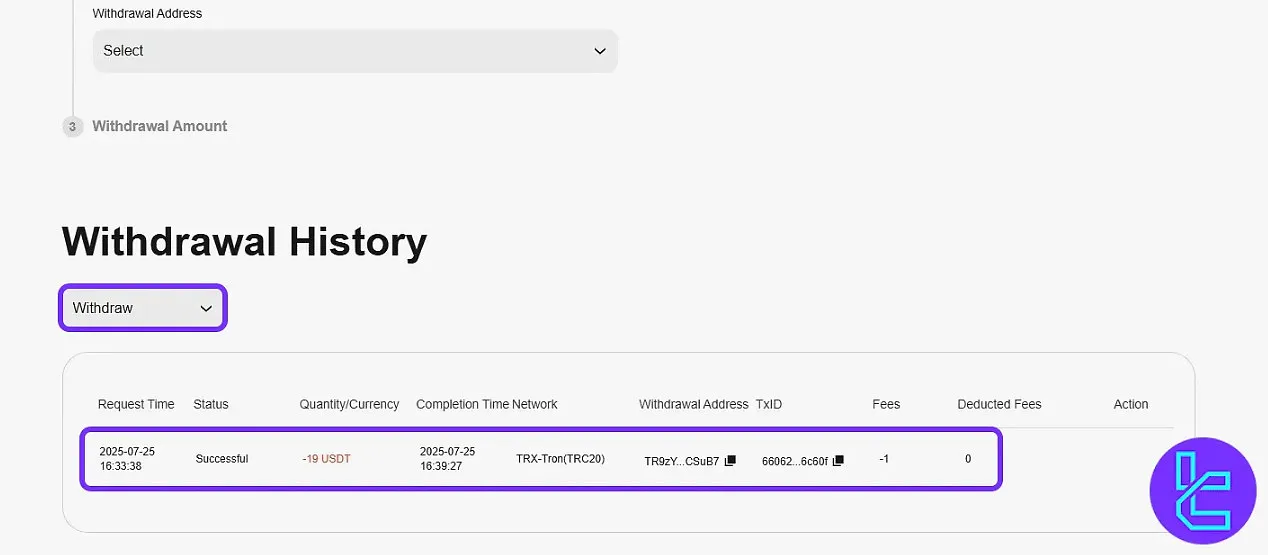

#3 Tracking the Transaction

Scroll to the bottom of the payout page to the "Withdrawal History" section. Here, you can monitor the withdrawal request details, including time, amount, network, wallet address, TxID, and fee.

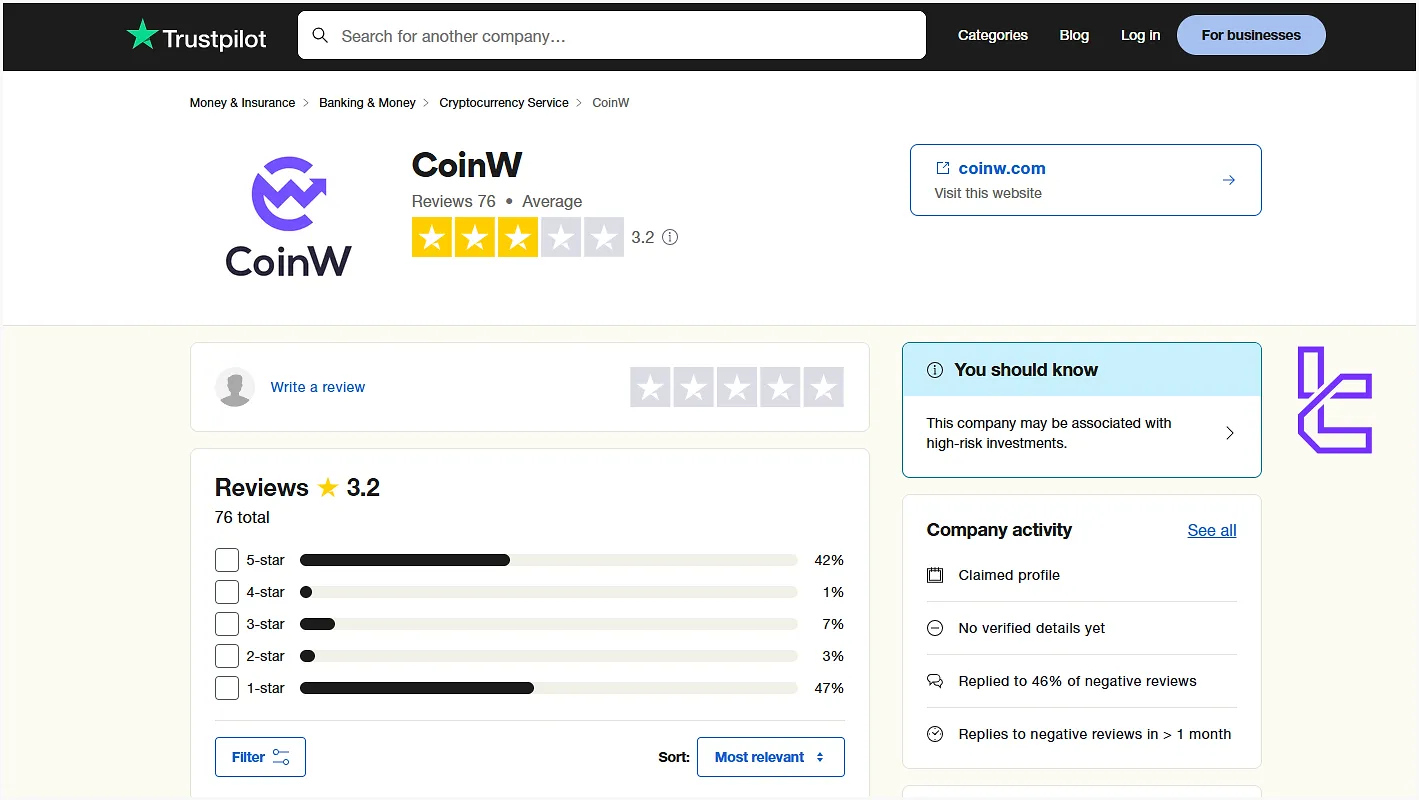

CoinW Reviews and Trust Score

The company has garnered mixed reviews across multiple reputable review platforms. While TrustPilot users give CoinW an average score, experts in CoinGecko rate it as a trustworthy exchange.

Reviews.io | 2.4 out of 5 based on 145 comments |

3.2 out of 5 based on 76 reviews | |

CoinGecko | 8 out of 10 |

CoinW Features

The table below provides important information about the available services and features on the CoinW exchange.

Feature | Availability |

Staking | No |

Yield Farming | Yes |

Social Trading | Yes |

Liquidity Pool | Yes |

Gift Card | Yes |

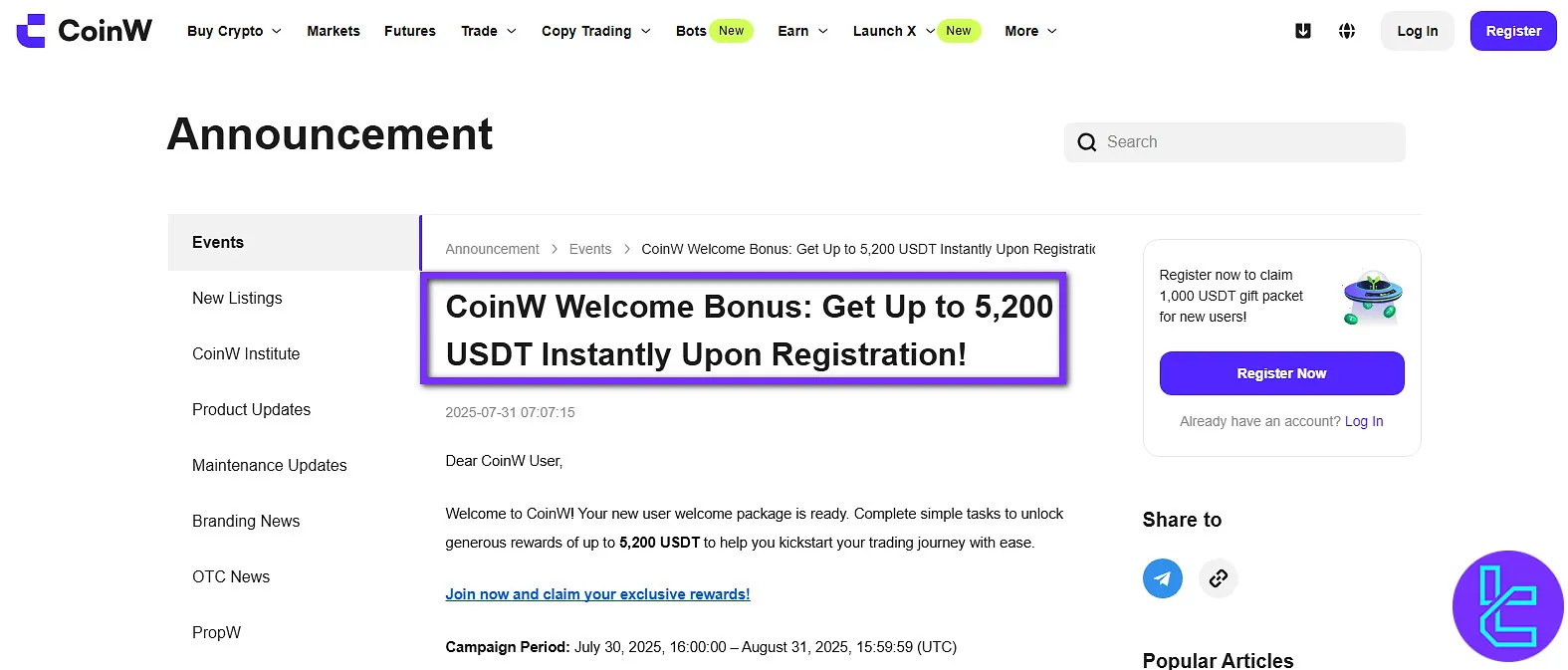

CoinW Bonuses

CoinW offers a variety of bonuses to enhance your trading experience. Here's an overview of the current promotional offerings:

Bonus Type | Details | Maximum Reward |

Welcome Bonus | Complete registration and initial trading tasks to receive rewards | 5,200 USDT |

Futures Bonus | Open a futures account and trade to earn instant and additional rewards | 1,000 USDT |

Referral Program | Invite friends who register and trade to earn rewards per referral | 500 USDT |

Welcome Bonus

New users can earn rewards by completing a series of onboarding tasks. For example, making a first deposit, executing the first spot trade, and completing the first futures trade all unlock separate rewards.

This bonus package can provide up to 5,200 USDT, giving beginners extra funds to start trading confidently.

Futures Bonus

When opening a futures account, users receive an instant bonus upon activation. Additional rewards are available based on futures trading activity, encouraging users to explore leveraged trading. Altogether, this bonus can provide up to 1,000 USDT in total rewards.

Referral Program

Users can invite friends to join CoinW and earn fixed rewards per referral. Each successful referral who registers and completes the required trading volume earns the referrer a reward, with the total possible bonus reaching up to 500 USDT.

CoinW Customer Support

The company boasts 24/7 support through two main channels: a chat bot and a ticket system.

However, the lack of phone and email support may be disappointing for potential clients. Note that there are many complaints about CoinW’s poor customer support.

Chat Bot | Available on the official website |

Ticket | Via the contact form |

Telegram Community | https://t.me/coinwoff |

Copy Trading and Growth Plans on CoinW Exchange

The company offers Spot/Futures copy trading and various growth plans to help users maximize their earnings.

- 64,924 copy traders with a total profit of 37.76M USDT

- Long-term and short-term strategies

- Daily rewards on free assets

- Auto invest plans with customizable margin allocation and schedule

- Stacking pools (Lucky HODL program)

Prohibited Countries on CoinW Exchange

While the company is available in many countries, it is prohibited in some jurisdictions due to regulatory requirements. Red flag countries on CoinW:

- Afghanistan

- Algeria

- Bahamas

- Bangladesh

- Bolivia

- Botswana

- Burundi

- China (Mainland)

- Cambodia

- Canada

- Congo

- Crimea

- Cuba

- Egypt

- Ethiopia

- Ghana

- Hong Kong

- Japan

- Iran

- Iraq

- Lebanon

- Libya

- Mali

- Myanmar

- Morocco

- Nepal

- Nicaragua

- North Korea

- Pakistan

- Panama

- Qatar

- Singapore

- Somalia

- Sri Lanka

- Sudan

- Syria

- Tunisia

- United States

- Venezuela

- Zimbabwe

CoinW Compared with Other Exchanges

To better understand the quality of services on the CoinW exchange compared to other platforms, we suggest checking the table below.

Parameters | CoinW Exchange | |||

Number of Assets | 1000+ | 700+ | 2500+ | 10000+ |

Maximum Leverage | 1:200 | 1:125 | 1:100 | 1:125 |

Minimum Deposit | Variable based on the Currency | Varies by Cryptocurrency | Varies by Payment Method | $15 |

Trading Fees | Spot 0.2% Futures maker 0.01% / taker 0.06% | 0.02% | From -0.005% Maker, 0.025 Taker | 0.1% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | Yes | Yes | Yes | Yes |

Writer's Opinion and Conclusion

CoinW provides a full suite of trading services, including Spot, Futures, P2P, OTC, copy trading, and Staking on 1000+ crypto assets like BTC, ETH, and LTC. CoinW exchange offers its proprietary trading platform on Android, iOS, Mac, windows, and the web.

However, the lack of good customer support has resulted in a low trust score and many negative CoinW reviews on reputable websites like Trustpilot. On the other hand, though, it has received a high evaluation score of 8/10 on CoinGecko.