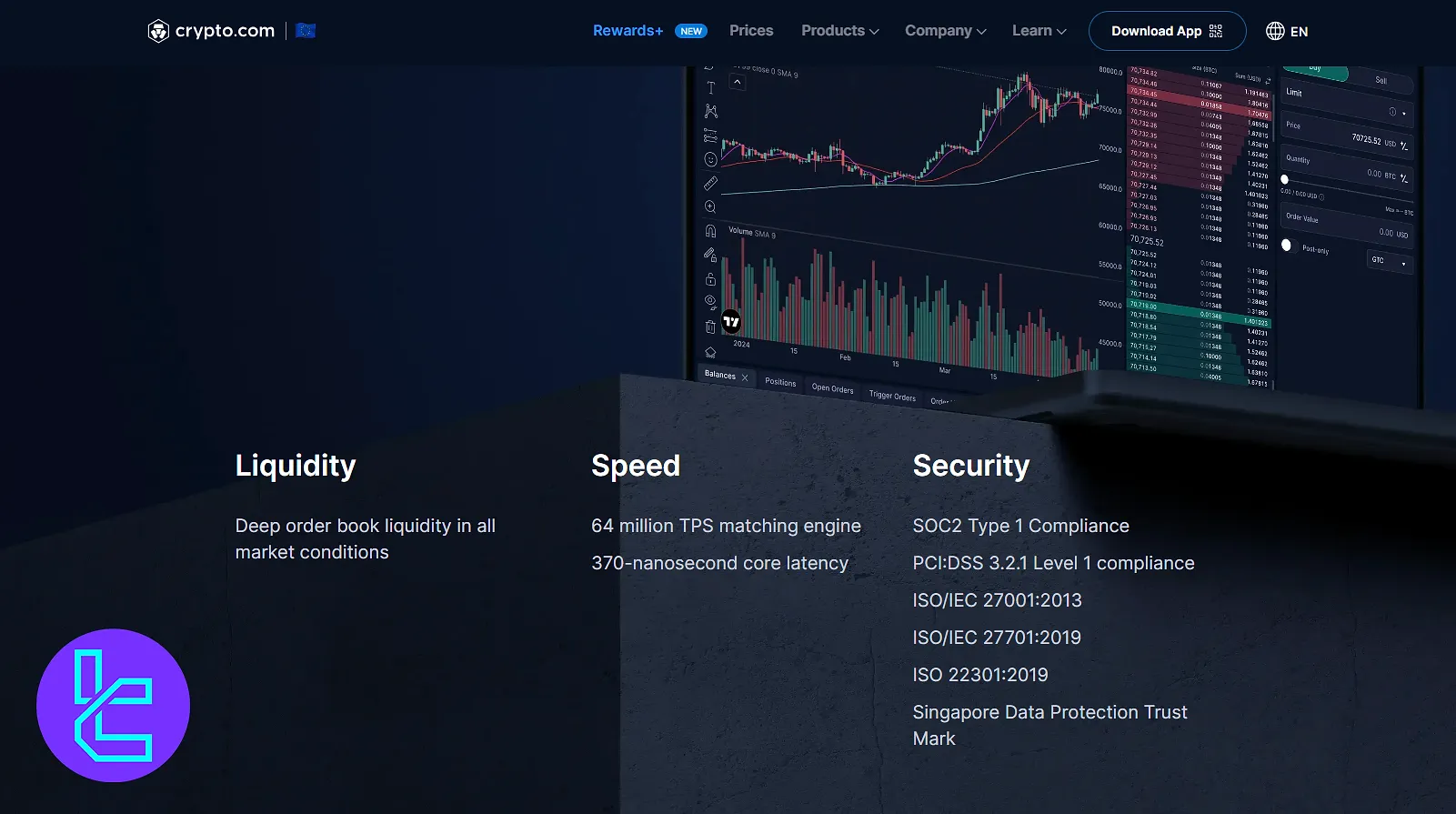

Crypto.com provides access to Futures contracts on 2 trading pairs, including BTC/USD and ETH/USD, with a liquidation fee of 0.5%. The platform is in compliance with ISO, NIST, and SOC 2.

Crypto.com exchange accepts fiat withdrawals viaApple/Google Pay and Visa and has implemented a minimum deposit requirement of $1. It also offers a comprehensive staking program with an APY of up to 19.07%.

Crypto.com (Company Information + Regulation)

Crypto.com, the world's fastest-growing cryptocurrency platform, was founded in July 2016 by Kris Marszalek, Rafael Melo, and Bobby Bao.

The company operates in more than 90 countries across the globe and has gained various licenses in different regions. This commitment to working within regulatory frameworks has resulted in several key approvals and registrations:

- Cyprus Securities and Exchange Commission (CySEC) approval

- Registration as a Digital Asset Service Provider (DASP) by the Autorité des marchés financiers (AMF) in France

- Approvals in Greece, Italy, Singapore, Dubai, South Korea, the Cayman Islands, the Netherlands, and Ireland

Moreover, Crypto exchange has achieved impressive security and compliance certifications, including:

- SOC 2 compliance

- ISO27001 and ISO27701

- PCI: DSS 3.2.1 (Level 1)

These certifications underscore the company’s unwavering dedication to security, privacy, and regulatory compliance principles that have been at the core of its business since inception.

With its user base exceeding 100 million worldwide, Crypto.com continues to expand its ecosystem, introducing products and services that adhere to the highest standards of security and trust.

Crypto.com CEO and Co-Founder

Kris Marszalek is the CEO and Co-Founder of Crypto.com, one of the world’s leading cryptocurrency exchanges and fintech platforms.

With a strong background in business and technology, Marszalek has played a key role in shaping the company’s global strategy since its launch in 2016.

Under his leadership, Crypto.com has expanded to serve over 80 million users worldwide, offering services ranging from spot and derivatives trading to a widely used crypto Visa card and an NFT marketplace.

Marszalek is particularly recognized for his vision of “cryptocurrency in every wallet”, aiming to accelerate the adoption of digital assets through accessible products and partnerships.

You can connect with Marszalek via the link below:

Crypto.com Table of Specifications

The Cryptocurrency Exchange offers a comprehensive suite of features catering to traders with different levels of experience and budgets.

Here’s a quick look at what you need to know before trading with Crypto.com.

Exchange | Crypto.com |

Launch Date | 2016 |

Levels | 7 VIP levels |

Trading Fees | Transaction fees, withdrawal fees, and interest rates |

Restricted Countries | Albania, Belize, Cameron, Ecuador, Georgia, Iran, Jamaica, Lebanon, US New York state, and more |

Supported Coins | More than 429 |

Futures Trading | Available |

Minimum Deposit | $1 |

Deposit Methods | Bank transfers, Credit/Debit cards, Apple Pay, Google Pay, and Cryptocurrencies |

Withdrawal Methods | Swift, Fedwire, SEPA, and Crypto wallets |

Maximum Leverage | 10× |

Minimum Trade amount | $1 for all pairs |

Security Factors | Secure storage, Bug Bounty Program, Anti-Phishing Codes, HSMs, FIDO2, and MFA methods |

Services | Staking, Copy Trading, NFT, Earn+, Reward+ |

Customer Support Ways | Live chat, Support email |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Limit, Market |

Native Token | Cronos (CRO) |

Crypto.com Advantages and Disadvantages

The company has positioned itself as a one-stop shop for everything concerning the crypto world, offering many services beyond mere trading. Let's break down some of the Crypto.com exchange’s key advantages and disadvantages.

Pros | Cons |

Wide range of services (trading, earning interest, and Visa debit card) | Complex user interface for beginners |

Low trading fees, especially for CRO token holders | Restrictions in some countries |

Over 429 cryptocurrencies are available globally | Low Trust Score |

Advanced trading features (margin trading, derivatives) | Staking requirements for best rates and features |

Strong security measures and regulatory compliance | Occasional withdrawal issues reported by users |

While the exchange offers a comprehensive ecosystem that caters to various crypto needs, it's important to note that the experience may vary depending on your location and level of expertise.

US users, in particular, may find some features limited due to regulatory constraints.

Crypto.com User Levels

The exchange offers a VIP program for high-volume traders. The plan rewards loyalty and activity with VIP fees, Increased API rate limits, exclusive support, and many more. Here’s a quick breakdown of Crypto’s VIP program.

- Levels: The plan consists of 7 levels, each with unique requirements

- Rewards: Decreased trading fees, Virtual private link, White glove support, Optimization sessions, early access to beta programs, and Bespoke OTC capability

- Eligible traders: Companies, Business entities, and individual clients

The company’s "Rewards+” program is also an innovative user-level system that rewards users based on their trading activity and CRO token balance. Here's a breakdown of how the Crypto Reward+ works.

- Automatic Enrollment: Users are automatically enrolled upon creating an App account (except for UK users)

- Multiple Levels: The program features various levels (up to 20 tiers), unlocked by meeting specific criteria such as trading volume or CRO balance

- Increasing Benefits: Higher levels offer more perks, including Enhanced trading rebates, Higher Earn Plus rewards, and Increased Visa Card spending rewards

- No Expiration: Benefits don't expire, but users must maintain the level requirements to continue enjoying them

- Progress Tracking: Traders can monitor their Rewards+ progress in the app's Missions section

- NFT Boost: Holding a Loaded Lion NFT automatically upgrades the user to the next Rewards+ tier

This tiered system encourages user engagement and loyalty, offering tangible benefits for active participants in the Crypto ecosystem.

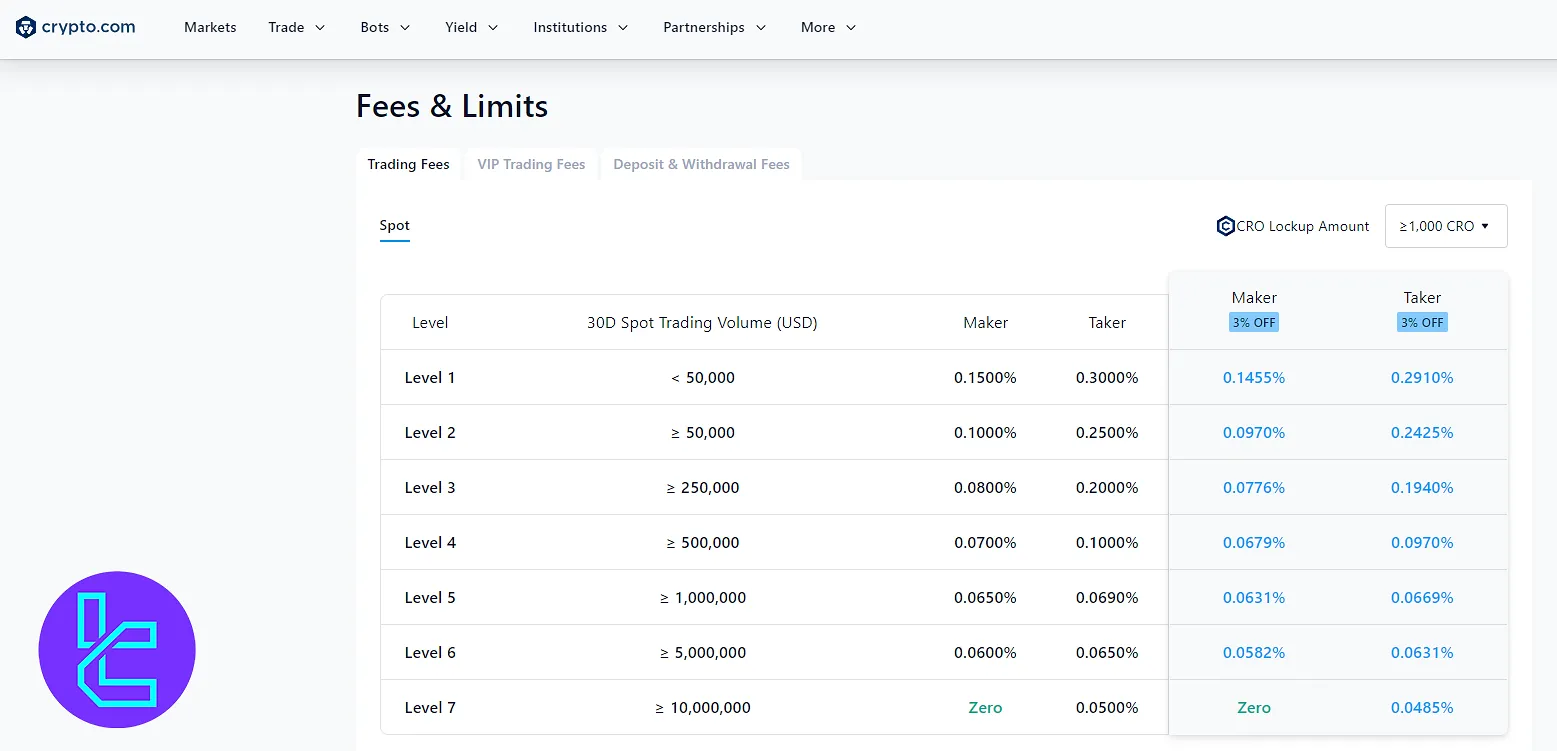

Crypto.com Commission and Fees

The Company’s fee structure is designed to be competitive while encouraging platform engagement. The main costs include trading fees, deposit/withdrawal commissions, and Interest rates. Here's a breakdown of the Crypto.com trading fees:

- Trading Fees: The Maker and the Taker pay costs based on the 30D Spot Trading Volume

- Liquidation: A 0.5% commission is charged on orders required to liquidate a position (subject to change)

- Deposit/Withdrawal: The exchange doesn’t charge additional fees for deposits. However, there is a withdrawal commission which varies based on the asset and preferred network

- Margin Interest Rates: there is an interest (daily and annual) applied to all coins which differs based on the token and locked up amount of CRO

Users should always review the current fee schedule, which can change over time. Here is the list of the Company’s charged fees for Spot & Margin trading with CRO locked up amount of 50,000 to 100,000.

Level | 30D Spot Trading Volume (USD) | Maker | Taker |

Level 1 | < 50,000 | 0.1500% | 0.3000% |

Level 2 | ≥ 50,000 | 0.1000% | 0.2500% |

Level 3 | ≥ 250,000 | 0.0800% | 0.2000% |

Level 4 | ≥ 500,000 | 0.0700% | 0.1000% |

Level 5 | ≥ 1,000,000 | 0.0650% | 0.0690% |

Level 6 | ≥ 5,000,000 | 0.0600% | 0.0650% |

Level 7 | ≥ 10,000,000 | Zero | 0.0500% |

What Coins Are Available on Crypto.com?

Crypto.com offers access to more than 429 cryptocurrencies, positioning it among the largest centralized exchanges by asset coverage. Users can trade a wide selection of leading digital assets, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Cardano (ADA)

- Dogecoin (DOGE)

- USD Coin (USDC)

- Shiba Inu (SHIB)

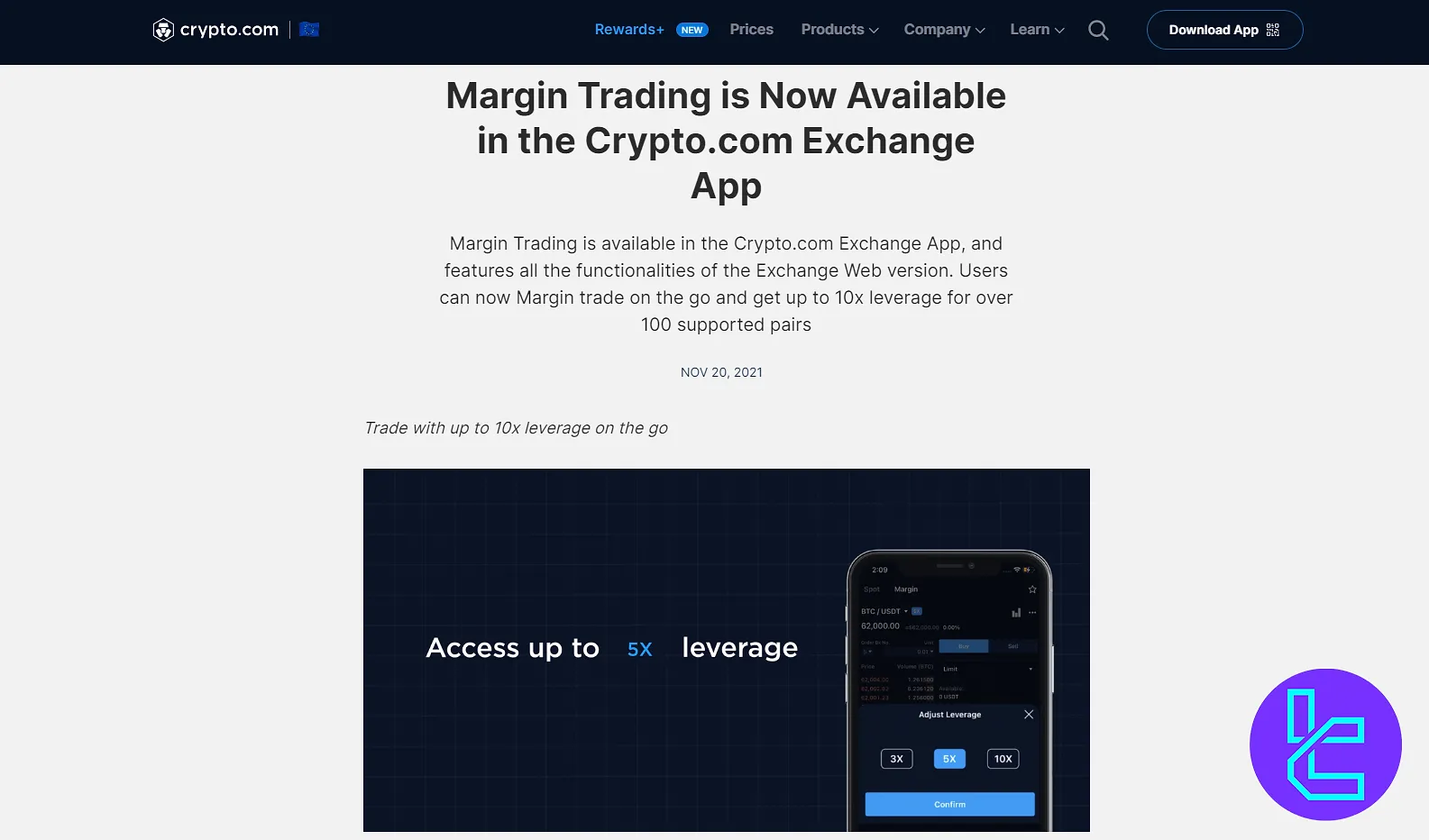

The exchange supports over 250 spot trading pairs, 100+ margin trading pairs with up to 10x trading leverage, and 100+ perpetual contracts. Futures markets are also available on select assets.

While Crypto.com covers 15 of the top 20 cryptocurrencies by market cap, it currently does not support TRON (TRX), Lido Staked Ether (STETH), or LEO Token.

Overall, the platform offers one of the broadest crypto markets for retail and professional users alike.

Does Crypto.com Support Futures and Margin Trading?

The Company supports Margin andFutures trading, allowing users to amplify their positions and use leverages up to 10×. However, there are limitations that you should know about before trading on Crypto.com.

Here is an overview:

Features | Futures | Margin |

Applicable Coins | BTC/USD and ETH/USD contracts | Coins with apparent negative balances |

Trading Fee/Interest | Quantity x Entry Price x Derivatives Trading Fee Rate (%) | Interest = Borrowed Virtual Assets × ((1+Hourly Interest Rate) × (Time in Hours - 1)) |

Crypto.com Sign-up and Verification Process

Opening a new Crypto.com account and verifying it is easy, even for beginner traders. Crypto.com registration:

#1 Visit the Crypto.com Website and Start Registration

Begin by heading to the Crypto.com homepage and clicking on the "Sign Up" button located at the top right. This will direct you to the registration panel where account creation begins.

#2 Submit Your Email Address

Input a valid email address and choose to create a new account. A confirmation email will be sent. Click the link inside it to activate your profile.

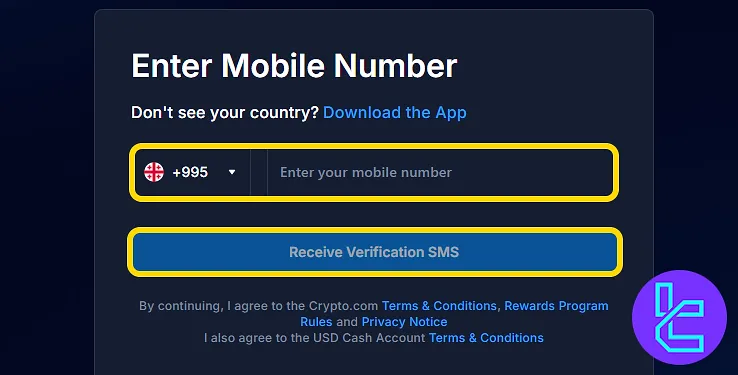

#3 Verify Mobile Number and Set a Secure Passcode

Enter your mobile number with the correct international code. After receiving a 6-digit SMS code, input it for phone verification. Then, create a 6-digit passcode to secure your account and enable login and transaction approval.

#4 Complete KYC Process

As an international exchange, Crypto.com complies with anti-money laundering laws and requires all traders to verify their identity. For this, traders must provide the following steps:

- Access the verification section

- Provide your full legal name

- Upload a picture of your passport, driver's license, or ID card

- Pass the authentication selfie

Crypto.com Trading Guide

In order to start trading on Crypto.com, you need to complete the registration and verification process. After that, simply follow these steps:

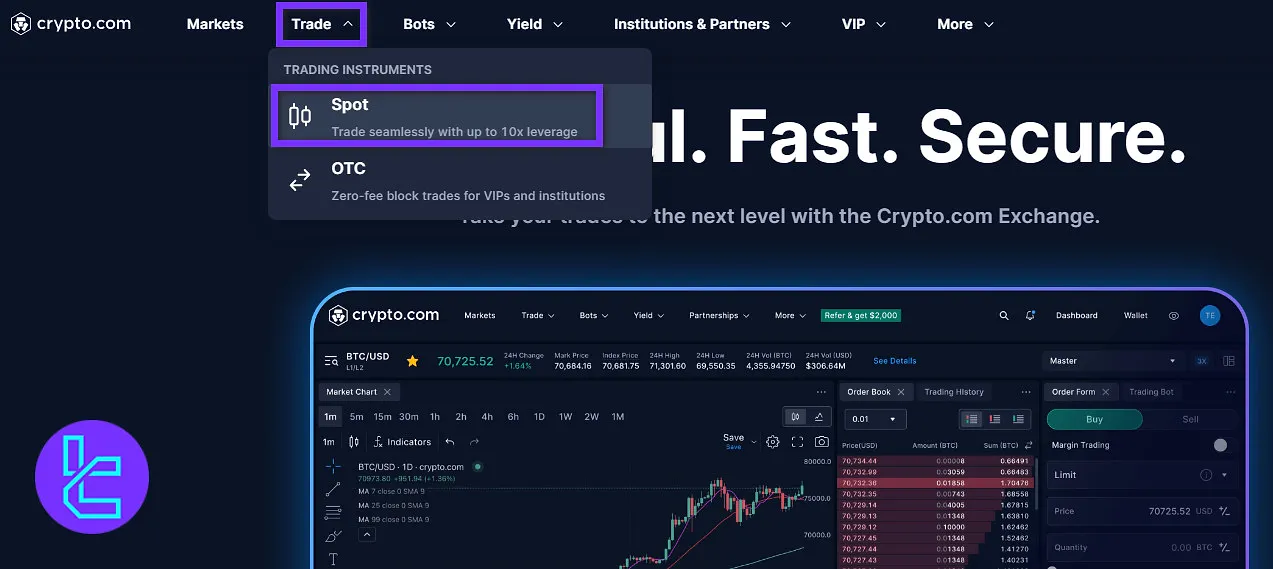

#1 Access the Trading Page

From the Crypto.com Exchange homepage, select “Trade” from the top and then click on “Spot” to open the spot trading interface.

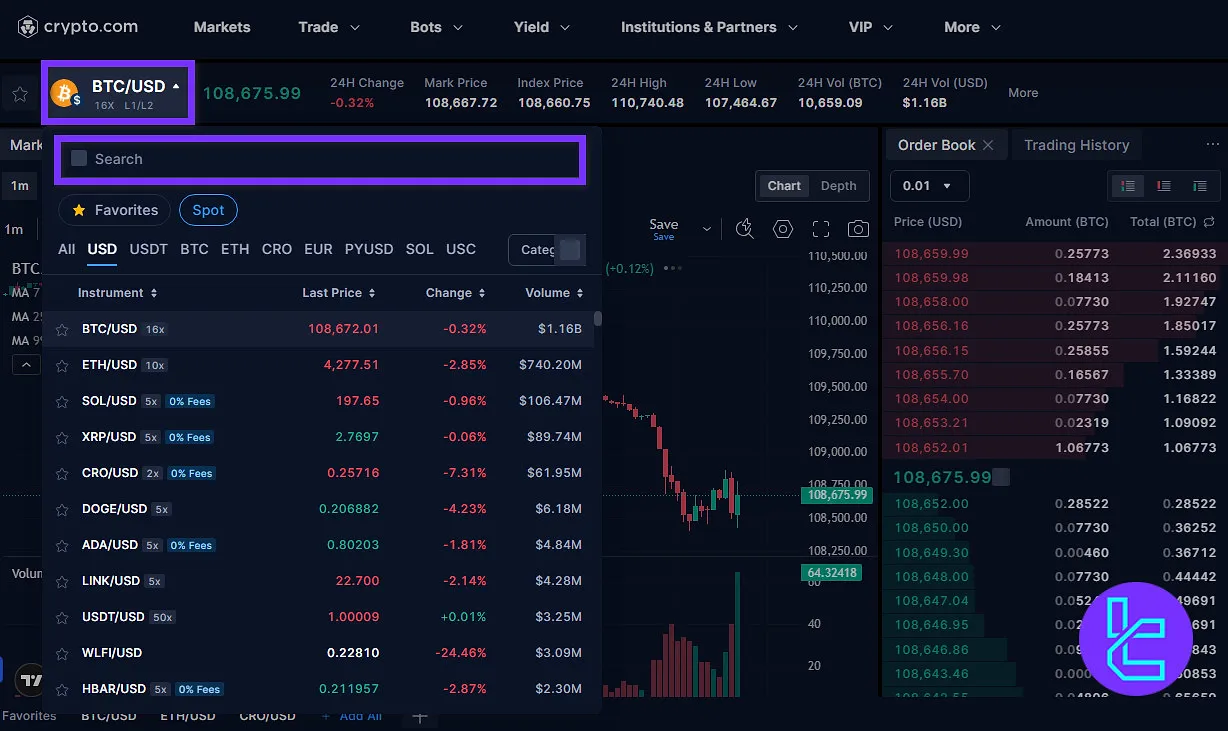

#2 Choose a Market Pair

Click on the current market pair on the left side. Then use the search bar to browse or quickly find the trading pair you want.

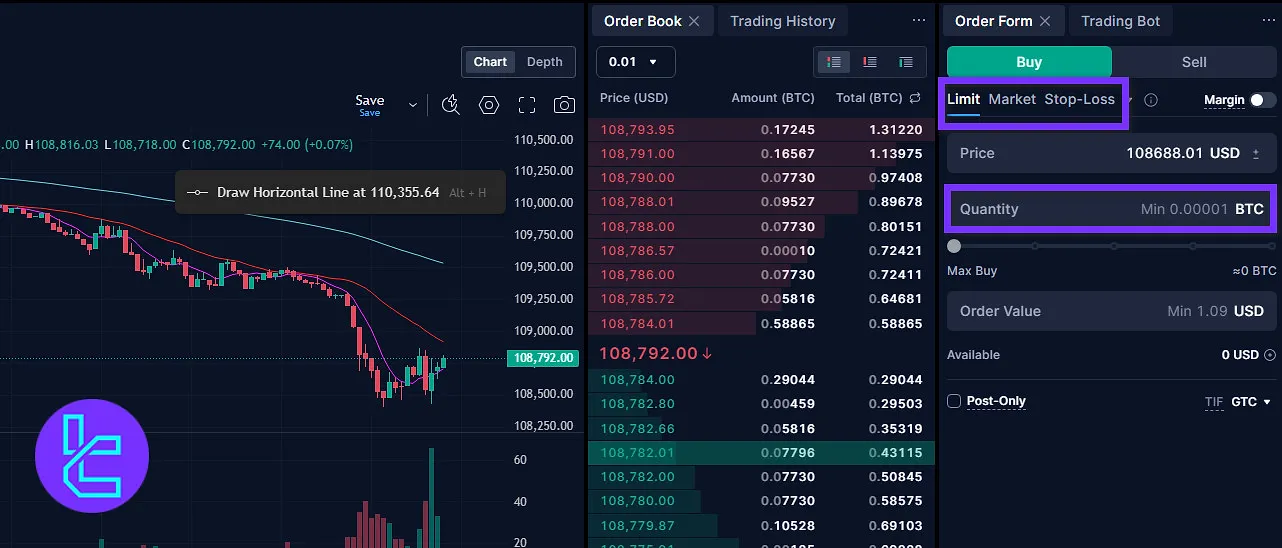

#3 Decide Order Type & Input Amount

In the right-side trading panel, select whether you want a limit, market, or stop-loss order, then type in the amount of crypto you plan to buy or sell.

#4 Place Your Order

Double-check all details, then confirm by clicking “Buy” or“Sell” to execute the trade.

Crypto.com Trading Platforms

The exchange offers two main trading platforms, including the exclusive web trader and the mobile app. These two offer a wide range of features catering to novice and experienced traders. Download links for Crypto.com trading platforms:

The platform provides access to TradingView charts. TradingFinder has developed various advanced TradingView indicators that you can use for free

Crypto.com Trading Volume

Based on the CoinGeckoCrypto.com page, over the last three months (June to the end of August), Crypto.com’s trading volume has shown noticeable fluctuations, ranging between $0.5 billion and $6 billion. The peak was recorded on August 15, reaching $6.2 billion in daily volume.

Despite the ups and downs, the overall trend during this period has been gradually upward, with the minimum daily volume now standing higher than in early June, indicating improved liquidity and stronger market activity on the platform.

Crypto.com Services

Crypto.com provides advanced trading services. You can check out the ones that are currently available through the table below:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | Yes |

Demo Account | No |

Launchpad | No |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | Yes |

Crypto.com Security Measures to Protect User Data and Money

The exchange strongly emphasizes security and data privacy, considering them fundamental to mainstream cryptocurrency adoption.

Their commitment is evident in the Zero Trust and Defense in Depth security strategies.

Here is a general review of the measures taken by Crypto.com to protect your data and money.

- Secure Fund Storage: Fiat currencies held in regulated custodian bank accounts and Crypto assets in 100% reserve accounts, verifiable by users

- Rigorous Access Controls: Adhering to the least privilege principle for cold and hot crypto wallets

- Secure Software Development: Following a Secure Software Development Lifecycle with peer review and code analysis

- Latest security features: Passkeys, HSMs, FIDO2, and MFA methods

- User Account Protection: Anti-Phishing Codes, mandatory whitelisting of withdrawal addresses, and 24/7 customer support

- Industry-Leading Certifications: First cryptocurrency company to attain ISO, NIST, and SOC 2 compliance

These multi-layered security measures demonstrate the exchange’s commitment to protecting user assets and information, setting a high standard in the cryptocurrency industry.

However, there are always risks and safety hazards involved with online trading, so make sure to understand the situation fully and never invest more than what you can lose.

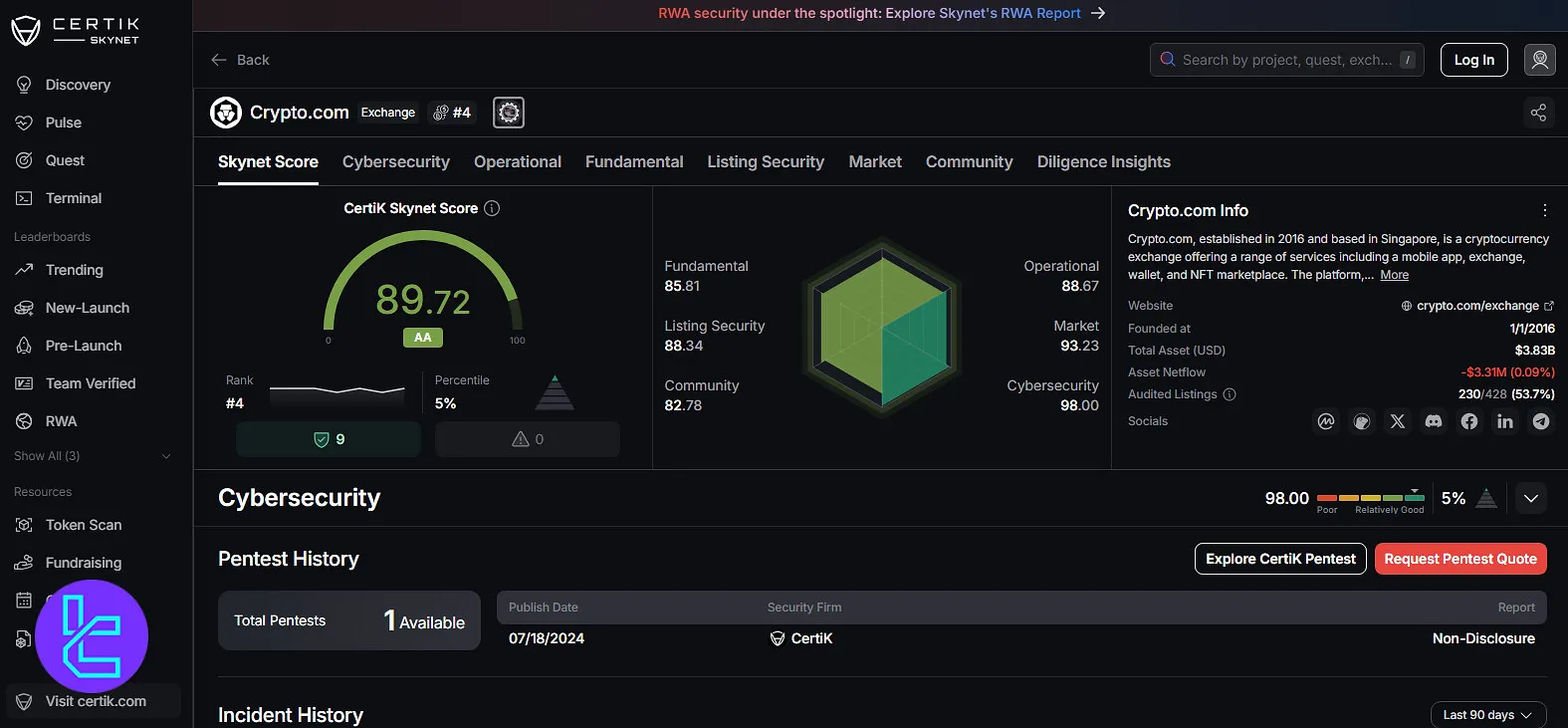

Crypto.com Security Rankings

According to Crypto.com CertiK Skynet, the exchange demonstrates a strong security profile with an overall score of 89.72/100 (AA).

The exchange shows balanced performance across multiple areas, including Fundamental (85.81), Operational (88.67), and Listing Security (88.34).

It scores particularly high in Market (93.23) and Cybersecurity (98.00), indicating a solid infrastructure and proactive risk management.

The relatively lower Community score (82.78) highlights room for improvement in user engagement and transparency, but overall, the platform ranks among the most secure exchanges monitored by CertiK.

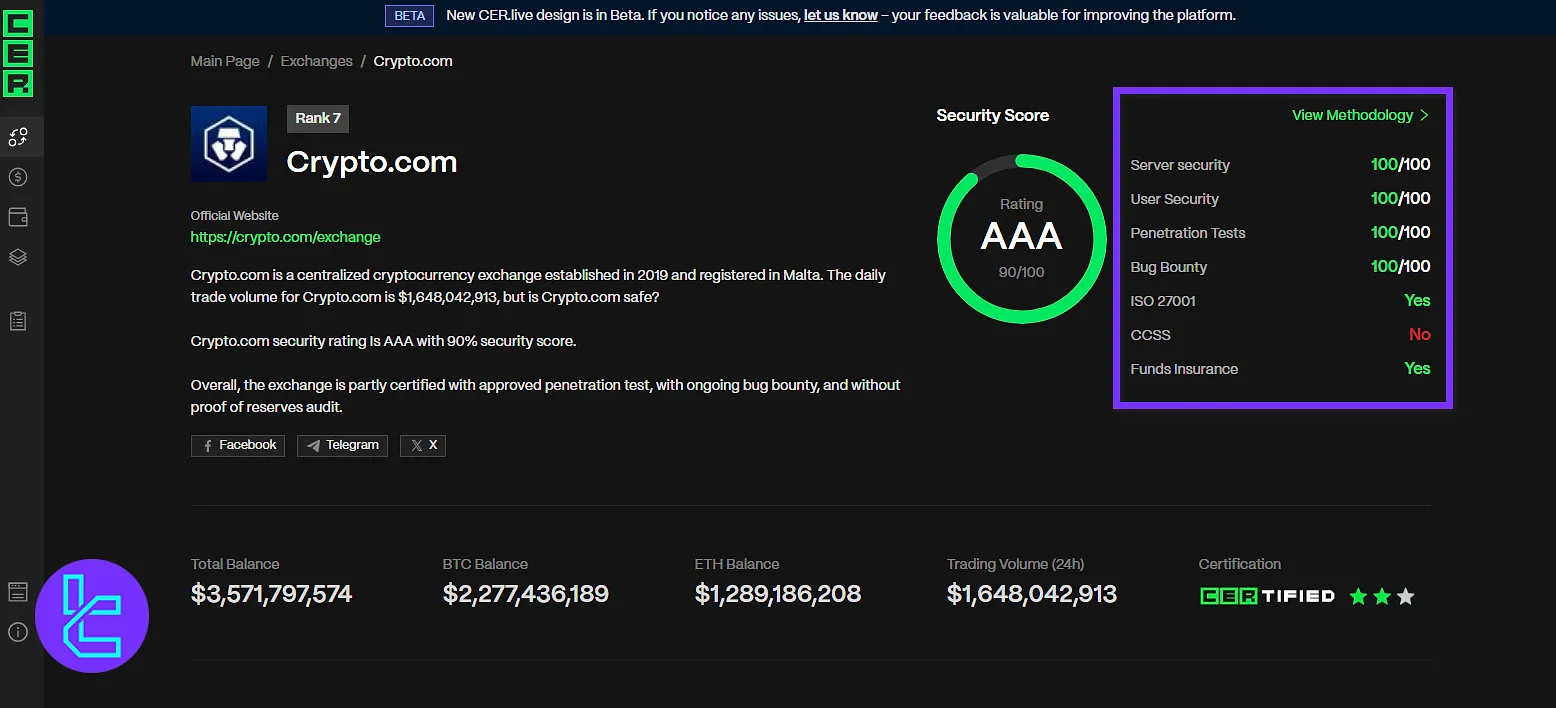

On the Crypto.com CER.live review, the exchange achieves an AAA rating with a 90% score, reflecting near-top-tier security standards.

The platform scores a perfect 100/100 across Server Security, User Security, Penetration Testing, and Bug Bounty programs, showcasing its comprehensive defense measures.

Additionally, Crypto.com holds an ISO 27001 certification, proving compliance with international information security standards, and it also provides funds insurance, enhancing user protection.

However, the absence of CCSS (Cryptocurrency Security Standard) certification marks a minor gap in coverage.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 89.72 / 100 (AA) |

Fundamental | 85.81 | |

Operational | 88.67 | |

Listing Security | 88.34 | |

Market | 93.23 | |

Community | 82.78 | |

Cybersecurity | 98.00 | |

CER.live Score | Overall Score | 90% (AAA) |

Server Security | 100/100 | |

User Security | 100/100 | |

Penetration Tests | 100/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Crypto.com Deposit & Withdrawal Methods and Conditions

Crypto.com offers a wide range of deposit and withdrawal options tailored for global accessibility. Users can deposit funds using:

- Bank transfers (SWIFT, SEPA, and local options)

- Credit and debit cards

- Apple Pay & Google Pay

- Direct crypto transfers

Deposits are typically processed free of charge, with fiat support available in USD, EUR, GBP, and more, depending on the region. For withdrawals, users can choose:

- Crypto withdrawals to external wallets (fees vary by token and network)

- Bank transfers (SWIFT, SEPA, Fedwire)

- Internal transfers to the Crypto.com App wallet, a fee-free method

To enhance security, withdrawal requests may be held or flagged if suspicious activity is detected, and additional verifications like 2FA and whitelisted address checks are enforced.

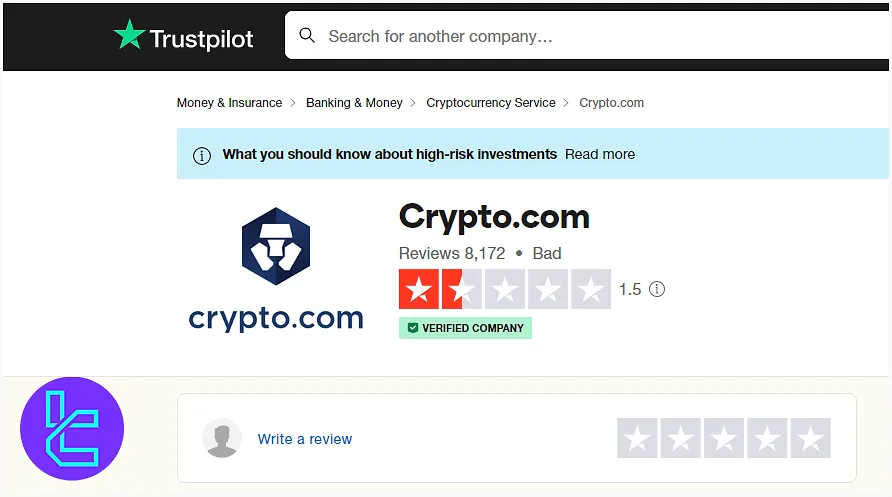

Crypto.com Trust Scores

The next step in the Crypto.com review is to check the company’s trust scores from users. Despite its popularity, the exchange has received mixed reviews from users on Trustpilot.

1.5/5 | Complex interface, time-consuming manual process, slow withdrawal |

Poor trust score and numerous user complaints suggest that potential clients should exercise caution and conduct thorough research before using Crypto.com Exchange.

It's important to note that online reviews can be biased, and experiences may vary. However, the consistency of negative feedback across multiple platforms is a cause for concern.

Crypto.com Features

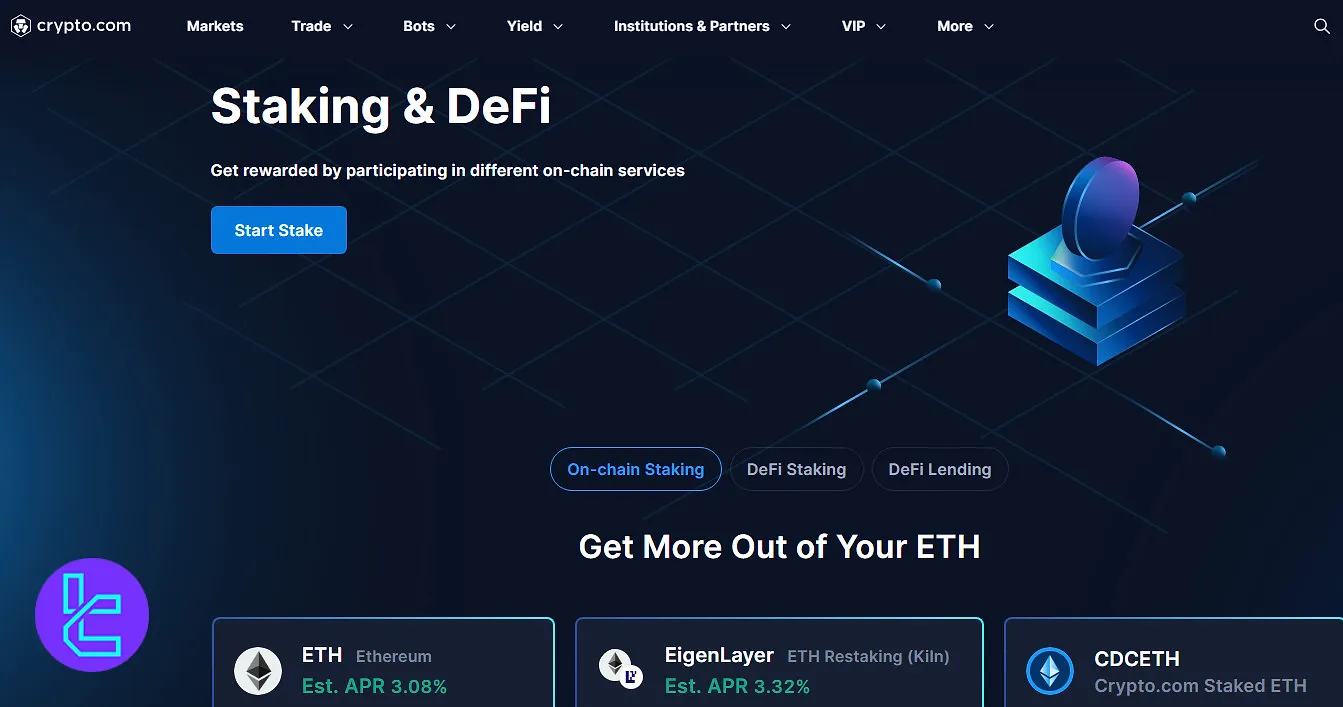

Let's review all the features that Crypto.com offers besides spot and futures market trading. Crypto.com features:

Feature | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | Yes |

Crypto.com Bonus

Here are a few key bonuses and rewards that Crypto.com offers:

Bonus Type | Reward | Requirements | Details |

Sign-Up Bonus | $25 USD in CRO | Register via referral link and stake CRO for a Visa Card tier | Bonus credited to Crypto.com App wallet after completing CRO staking |

Referral Bonus | $25 – $2,000 USD in CRO | Invite friends; referee must stake CRO for a Visa Card | Both referrer and referee receive rewards once staking is confirmed |

Sign-Up Bonus

Crypto.com offers new users a welcome bonus of $25 USD in CRO tokens when they sign up through a referral link and complete the required CRO staking.

This bonus is automatically credited to the user’s wallet inside the Crypto.com App after they lock in the minimum CRO stake for their chosen Visa Card tier. It’s designed to give newcomers an incentive to start using the ecosystem right away.

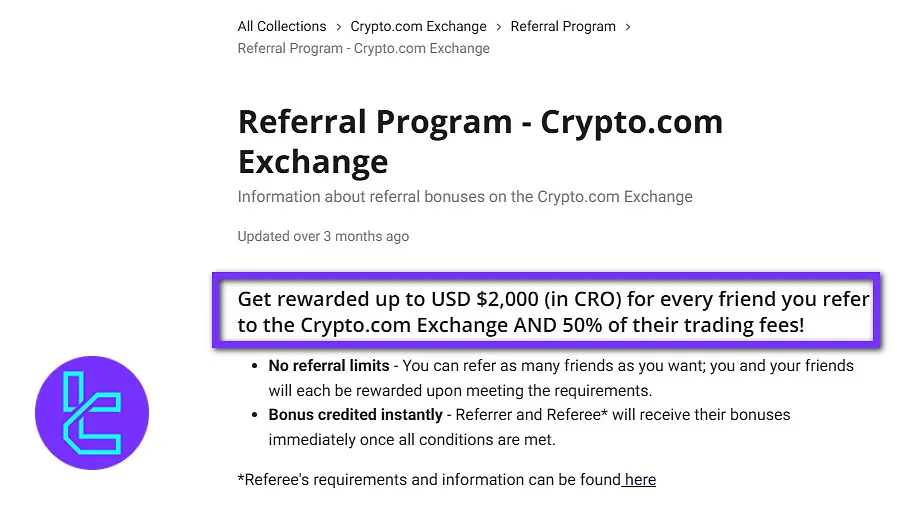

Referral Bonus

The referral program allows existing users to invite friends and earn rewards. Both the referrer and the referee benefit: depending on the referee’s staking tier, the bonus can be anywhere from $25 up to $2,000 USD in CRO tokens.

The reward is unlocked once the referee stakes the required amount of CRO for their Visa Card. This creates a win-win setup while also expanding the Crypto.com community.

Crypto.com Customer Support

The exchange provides a comprehensive Help Center to assist users with various aspects of their platform. However, there is no call center, and the only ways to contact the support team are through emails, mail, and Live chat.

Help Center | Accessible at “help.crypto.com” |

Support email | complaints@crypto.com |

Office Address | Level 7, Spinola Park, Triq Mikiel Ang Borg, St Julians SPK 1000 Malta |

Live Chat | Accessible at “chat.crypto.com” |

While the Help Center is a valuable resource, it's worth noting that some users have reported issues with customer support response times and resolution of complex problems.

As with any financial platform, it's advisable to thoroughly understand the product and its potential risks before engaging.

Crypto.com Copy Trading and Other Investment and Growth Plans

Many users wish to earn income from crypto without doing anything. The exchange offers various options catering to these customers, including copy trading and staking. Here’s a breakdown of Crypto.com’s growth plans.

- Copy Trading: Allows users to replicate trades of experienced traders, Beneficial for cryptocurrency novices, and automatically replicates in the follower's account

- Staking: Up to 19.07% annual passive income from your assets. Differs based on the staked token

- Earn program: Lend out your cryptocurrencies to earn profits

While copy trading can be an attractive option for beginners, it's important to remember that all trading carries risks. Users should carefully assess their risk tolerance and investment objectives before implementing any trading strategy.

Crypto.com Restricted Countries

The exchange has implemented restrictions on certain countries and regions, limiting access to its platform and services in accordance with regulatory conditions. Restricted countries on Crypto.com:

- Afghanistan

- Bangladesh

- China

- Ethiopia

- Iran

- Iraq

Detailed Comparison of Crypto.com and Other Crypto Exchanges

By checking the data in the table below, traders can understand the pros and cons of trading with Crypto.com compared to other famous exchanges.

Parameters | Crypto.com Exchange | |||

Number of Assets | 429+ | 1300+ | 2800+ | 7800+ |

Maximum Leverage | 1:10 | 1:100 | 1:200 | 1:12 |

Minimum Deposit | $1 | Varies by Cryptocurrency | $1 | N/A |

Spot Maker Fee | 0% - 0.15% | 0.005% - 0.1% | 0.05% | -0.01% - 0.14% |

Spot Taker Fee | 0.05% - 0.3% | 0.015% - 0.1% | 0.05% | 0.03% - 0.23% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | Yes | Yes | Yes | Yes |

Writer’s Opinion and Conclusion

Crypto.com is a leading company in providing Margin trading, Derivatives, Copy Trading, and Staking on over 429 Cryptocurrencies with leverage options of up to 1:10.

Crypto.com exchange implements various safety factors, including MFA, FIDO2, and 100% reserve accounts for client funds.

However, the lack of live chat support and reported withdrawal issues have caused many Crypto.com negative reviews on Trustpilot and a score of 1.5 for the platform.