Deribit provides trading contracts with leverage of up to 100x. A total of 3 contract types [spot, futures, options] are available on the platform. This exchange requires at least $10 for opening a position on its markets.

Founded in 2016, Deribit has grown into a global platform with millions of monthly users and billions in daily derivatives volume. Despite offering 30+ supported assets, the exchange focuses heavily on major cryptocurrencies like BTC and ETH, ensuring high liquidity and fast execution.

Deribit Company Information and Regulation

Deribit was founded in June 2016. Operating under the legal name DRB Panama Inc., the company is now headquartered in Dubai, United Arab Emirates.

Based on our investigations, the company is not regulated by any financial authorities.

Deribit CEO

Luuk Strijers is the Chief Executive Officer of Deribit, a leading cryptocurrency derivatives platform. He oversees the company’s operations across the Asia-Pacific region, including ASEAN and Southeast Asia.

Based on the Luuk Strijers Crunchbase page, he brings a strong academic and strategic background, having completed the Oxford Blockchain Strategy Programme at Saïd Business School, University of Oxford, and studied at Maastricht University.

Under his leadership, Deribit continues to expand its influence in the crypto derivatives market, serving clients from Singapore and beyond.

Deribit Exchange Key Specifications

The Cryptocurrency exchange operates according to a set of specific parameters and features. Some of them are mentioned below:

Exchange | Deribit |

Launch Date | June 2016 |

Levels | Unverified, Verified |

Trading Fees | 0% for Spot, Varying for Futures and Options |

Restricted Countries | Yemen, Iran, Iraq, United States, Canada, Japan, etc. |

Supported Coins | 30+ |

Futures Trading | Yes |

Minimum Deposit | 5 USD / 0.00001 BTC |

Deposit Methods | BTC, ETH, USDC |

Withdrawal Methods | BTC, ETH, USDC |

Maximum Leverage | 100x |

Minimum Trade Amount | $10 |

Security Factors | 2FA, Proof of Reserves |

Services | Futures, Options, Testnet, Position Builder, Options Wizard |

Customer Support Ways | Ticket, Email, Live Chat |

Customer Support Hours | 24/7 |

Fiat Deposit | No |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | N/A |

Notable Upsides and Downsides

Let's examine the pros and cons of using Deribit compared to other popular crypto exchanges:

Upsides | Downsides |

Low Latency | Relatively Limited Asset Selection |

Advanced Order Types and Risk Management Tools | No Private Chat Support for Unregistered Users |

1:1 Reserves of All Assets | - |

User Levels

Per our investigations of the exchange's website, there is no specific leveling structure designed for users. Basically, there are only two types of accounts: Unverified and Verified. Almost all features of the platform require users to verify their identity.

Deribit Exchange Fees

This platform has set a certain fee structure for trading and other operations. Trading Commissions Overview:

Contracts | Maker Fee | Taker Fee |

BTC/ETH Weekly Futures | -0.01% | 0.05% |

Futures and Perpetual | 0.00% | 0.05% |

BTC/ETH Options | 0.03% of the underlying (0.0003 BTC per options contract). However, this is capped at 12.5% of the options price. | |

Spot | 0% | |

Regarding fundings, no fees are charged for deposits, and withdrawal costs vary by the network.

Available Digital Assets

Deribit focuses on major cryptocurrencies, providing 3 types of trading contracts:

- Spot: BTC, ETH, SOL, XRP, and more

- Futures: BTC, BCH, LINK, ETH, and so on

- Options: BTC, ETH, PAXG, BNB, etc.

Per our examinations, no exact data is provided regarding the number of coins/tokens. However, it appears that over 30 cryptocurrencies are available.

Futures and Margin Options

Actually, Deribit specializes in cryptocurrency derivatives trading, offering:

- Futures market contracts

- Perpetual futures

- Options contracts

Key Features:

- Up to 100x leverage

- Portfolio margin capabilities

- Advanced order types

- Block trade functionality for large orders

Sign Up and KYC on Deribit

Traders only require a username and an email address to open an account with Deribit. Deribit registration:

#1 Visit the Deribit Website

First, search for Derbit and access the official website. On the main page, click "Create account" to begin the account opening process.

#2 Complete the Account Opening Form

Provide an email address and choose a country of residence. Check the box to agree to the mentioned terms and conditions, and then create a username and password for your account.

#3 Verify Your Email Address

Check your email inbox and click on the verification link to verify it.

#4 Verify Your Identity

For verification, you will need to activate 2FA, provide personal and address information, go through ID verification, and submit proof of residence.

Deribit Spot Trading Guide

After registration and verification, you can easily start spot trading on the Deribit exchange. To do so, follow these steps:

#1 Enter the Trading Page

From the homepage, click on “Trade” to open the Deribit trading interface.

#2 Select the Trading Pair

On the top of the page, click on “Spot” to view all available markets. Use the search bar to find and select the pair you want to trade.

#3 Choose the Order Type

Select your preferred order type from the right-hand panel. Deribit supports multiple order types, including market, limit and trailing stop orders.

#4 Specify the Order Volume

Enter the amount of the asset you want to buy or sell in the ”Amount” field under the order section.

#5 Confirm the Trade

Review your order details carefully, then click “Buy” or “Sell” to execute your trade.

Deribit Exchange Platform and Applications

Similar to many other cryptocurrency exchanges, Deribit offers a proprietary platform with features such as:

- Advanced analytics tools

- Real-time order book and trade history

- Risk management dashboard

- Volatility surface views

Access the terminal on your browser or download the applications via these links:

Deribit Trading Volume

According to the Deribit CoinGecko chart, Deribit’s trading activity has shown strong, high-frequency volatility over the last three months, with multiple daily spikes pushing above the multi-billion-dollar range.

The chart highlights several sharp surges, most notably in early October, followed by consistent intraday fluctuations that keep the platform’s liquidity highly active.

Overall, the 3-month trend reflects a healthy derivatives market with recurring volume peaks, steady baseline activity, and visible resilience during quieter periods.

This pattern reinforces Deribit’s position as one of the most dynamic and heavily traded crypto derivatives exchanges in the industry.

Deribit Services

In this section, we’ll check out the availability of trading services on the Deribit exchange:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | Yes |

API Access | Yes |

P2P Trading | No |

OTC Trading | No |

No | |

Launchpad | No |

NFT Marketplace | No |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Deribit Safety & Security

Deribit provides limited information about the security measures on its platform:

- Two-factor authentication (2FA): Available via a mobile authenticator app or a Yubikey

- Proof of Reserves: 1:1 reserves of all client funds held by the company

Some companies mention many different security factors on their official website.

Deribit Security Rankings

Based on the Deribit CertiK Skynet review, the exchange achieves an overall score of 66.29/100 (BB), with strong marks in Operational (83.39) and Cybersecurity (88.49), while Listing Security and Market metrics remain areas for improvement.

Meanwhile, the Deribit CER.live review rates the platform at 97% (AAA), highlighting robust protections with Server Security at 96/100, penetration tests and bug bounty programs at 100/100, and compliance with ISO 27001 and CCSS standards, alongside funds insurance coverage.

These rankings demonstrate a solid commitment to both technical and operational security for users.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 66.29 / 100 (BB) |

Fundamental | 71.99 | |

Operational | 83.39 | |

Listing Security | 50.00 | |

Market | 50.00 | |

Community | 67.87 | |

Cybersecurity | 88.49 | |

CER.live Score | Overall Score | 97% (AAA) |

Server Security | 96/100 | |

User Security | 81/100 | |

Penetration Tests | 100/100 | |

Bug Bounty | 100/100 | |

ISO 27001 | Yes | |

CCSS | Yes | |

Funds Insurance | Yes |

Deposit/Withdrawal Methods

Deribit does not accept fiat deposits on its platform and offers a limited selection of payment options. Funding Options:

- Bitcoin (native blockchain)

- Ethereum (native blockchain)

- USDC (ERC20 deposits only)

The website states that no other blockchains are accepted.

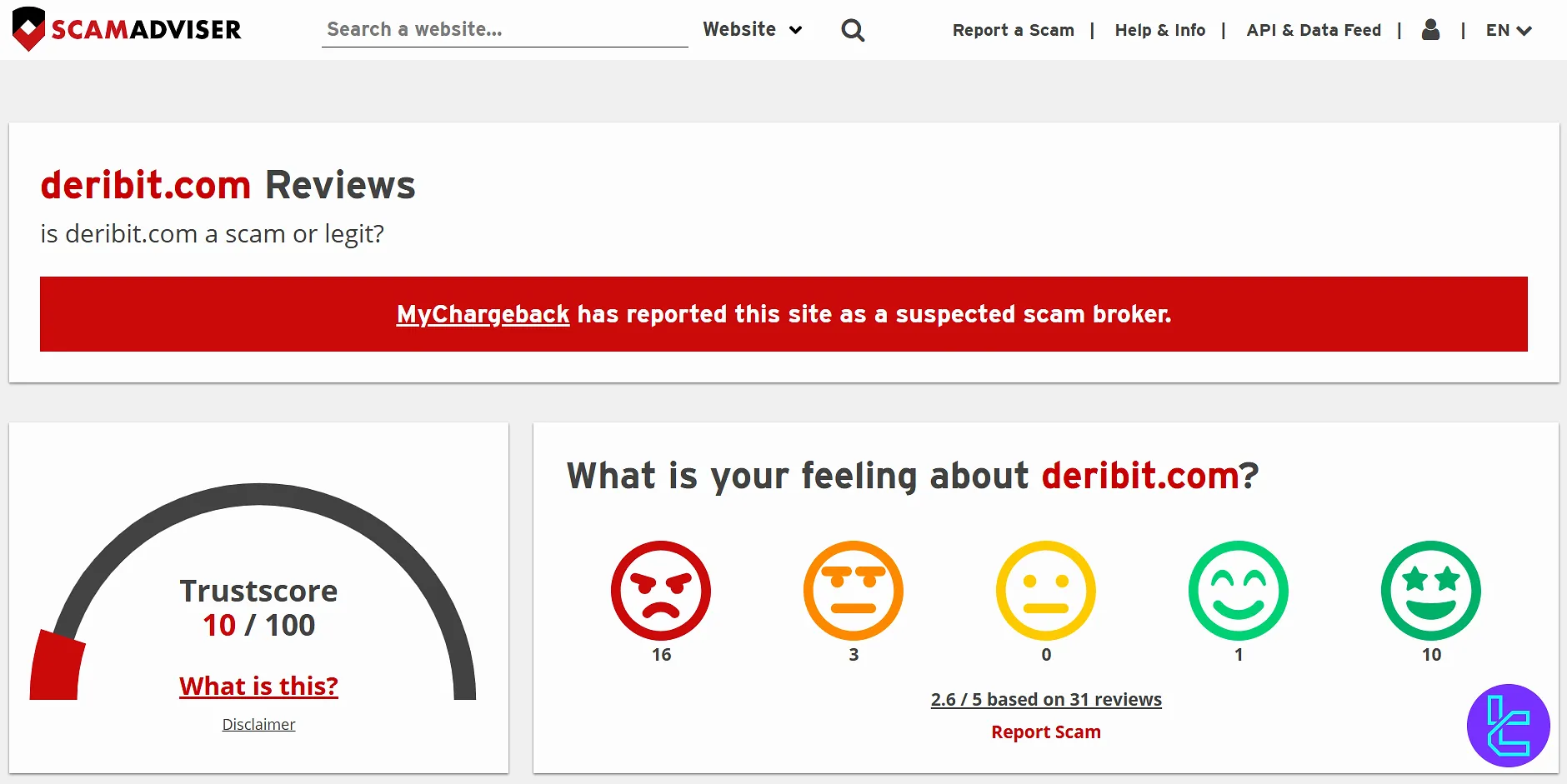

Deribit Trust Evaluations and Ratings

The company has received a limited number of reviews from trust rating platforms. This section discusses these scores:

- Deribit on Trustpilot: 4.1/5 stars (based on 10+ reviews)

- Deribit on ScamAdviser: 10/100 Trustscore

Deribit Features

Deribit exchange is solely focused on cryptocurrency trading contracts and doesn't provide other crypto-related services.

Feature | Availability |

Staking | No |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | No |

Deribit Promotions

Deribit currently offers two major promotional programs designed to reward active users and long-term account holders. These bonuses provide both earning potential through referrals and enhanced yields on USDC balances:

Bonus Name | Type | Reward / Benefit | Eligibility | Notes |

Affiliate Program | Referral Bonus | Up to 20% commission from referred users’ trading fees | DRB Panama clients only; not available in UAE or Excluded Countries | Referred users receive fee discounts; long-term income potential |

Boosted USDC Rewards 2025 | Deposit Yield Bonus | 7.5% APR on first 250,000 USDC; standard rate (~3.6%) on additional balance | Eligible jurisdictions only | Rewards calculated daily, paid monthly; promotion ends Dec 2025 |

Affiliate Program

Deribit’s Affiliate Program allows users to earn up to 20% commission from the trading fees generated by referred users. Activation is straightforward, clients simply enable the program from their account’s Affiliate page and accept the platform’s Terms of Service along with the program’s T&Cs.

However, eligibility is restricted: only users registered under DRB Panama Inc. can participate, and residents of UAE or any Excluded Country are prohibited.

The program provides a long-term income mechanism for users who actively bring traders to the platform.

By confirming that their account falls under Panamanian jurisdiction, affiliates gain access to recurring commissions as their referred users continue trading. This structure makes the Affiliate Program one of Deribit’s most accessible and scalable earning opportunities.

Boosted USDC Rewards (Until End of 2025)

For the remainder of 2025, Deribit offers a 7.5% APR promotional rate on the first 250,000 USDC held in eligible accounts. Any balance above this threshold continues to earn rewards at the standard rate, currently 3.6% APR (November).

Rewards are calculated daily and paid monthly, with the promotional rate active from 18 November to 31 December 2025. The boosted rate applies across the entire account, including subaccounts, until the 250k cap is reached.

This promotion provides a significantly higher yield than current basis trade rates, which are hovering slightly above 5% annually. Users holding USDC also gain indirect benefits such as potential VIP fee tier upgrades, VIP1 can be unlocked simply by maintaining a 100,000 USDC balance.

Combined with the ability to use USDC as trading collateral, the promotion offers a strong incentive for traders to increase their on-platform balances.

Customer Support Contact Channels and Hours

Deribit offers 3 common support methods for users, with one option limited to registered traders:

- Email: support@deribit.com

- Ticket: Through the website (Zendesk)

- Live Chat: On Telegram (group chat) and website (exclusive to registered users)

Most platforms offer a private chat option for all users, regardless of registration status. The company claims to offer 24/7 customer service.

Are There Any Copy Trading/Passive Income Options On Deribit?

Currently, the exchange does not offer direct copy trading or passive income options. In other words, it's impossible to earn profits passively on the Deribit platform.

List of Restricted Countries

Deribit has provided a complete and extensive list of restricted countries and regions on its website. Some of these countries include:

- Canada

- United States

- Japan

- Iran

- Iraq

- Russia

- Yemen

- Libya

Comparing Deribit with Other Cryptocurrency Exchanges

The most accurate way to assess the quality of services at Deribit is by comparing it to other cryptocurrency exchanges.

Parameters | Deribit Exchange | |||

Number of Assets | 30+ | 700+ | 2800+ | 400+ |

Maximum Leverage | 1:100 | 1:200 | 1:100 | 1:125 |

Minimum Deposit | 5 USD / 0.00001 BTC | $1 | Varies by Payment Method | $1 |

Spot Maker Fee | -0.01% | From 0.02% | From -0.005% | 0.02% - 0.1% |

Spot Taker Fee | 0.05% | From 0.02% | From 0.025% | 0.04% - 0.1% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | No | No | No | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Deribit offers additional products such as a Testnet for practicing, a Position Builder for trade simulation, and more.

Users can contact the company's support team via 3 methods [live chat, ticket, email]. However, private chat is exclusively available for registered users.