Gemini exchange was the first crypto platform to obtainSOC 1 Type 1 and SOC 2 Type 2 security certification.

ons. This company, offering +70 digital assets for trading, support hardware security keys [Yubikey and other brands] for 2-factor authentication on account sign in.

Gemini Information + Regulation Status

Founded in 2014 by the dynamic duo of Cameron and Tyler Winklevoss, Gemini is a cryptocurrency trading environment.

Operating under the legal name Gemini Trust Company, LLC., located at 600 Third Avenue, 2nd Floor, New York, NY 10016. This crypto exchange has grown to employ between 501-1000 individuals.

As a New York trust company, Gemini exchange it operates under the regulation of the New York State Department of Financial Services (NYSDFS). This exchange mentions these concepts as its4 pillars:

- Product

- Security

- Licensing

- Compliance

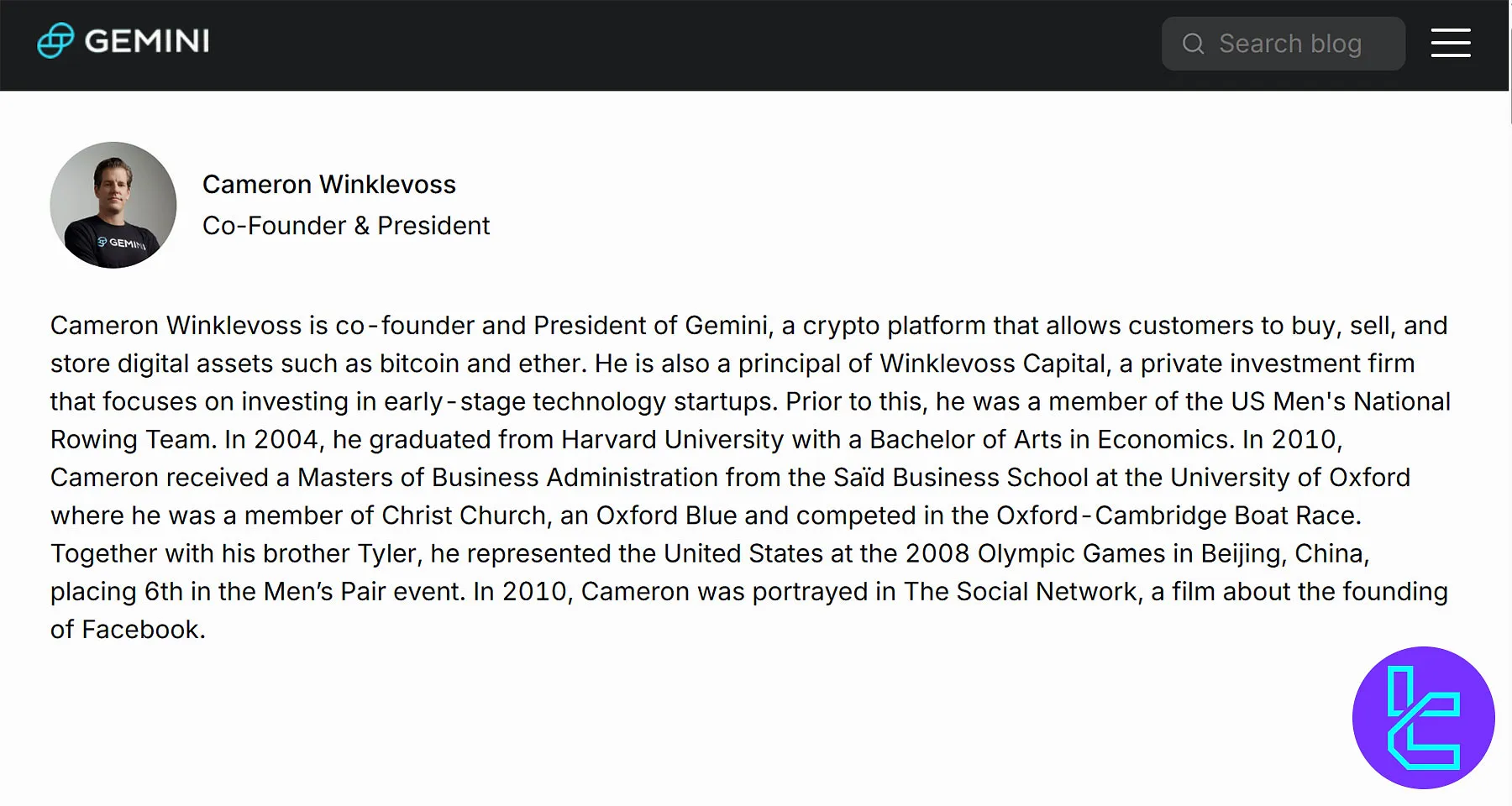

Gemini CEO

Tyler Winklevoss, co-founder and CEO of Gemini Exchange, has been a prominent figure in the cryptocurrency space since 2013, when he and his twin brother Cameron became early Bitcoin advocates.

His leadership continues to shape Gemini as a regulated, SEC-compliant crypto platform.

- Co-founder of Gemini (2014) with Cameron Winklevoss

- Early Bitcoin investor, reportedly holding 1% of BTC supply

- Known for Facebook legal settlement worth $85M

- Recently donated $1M in Bitcoin to Donald Trump

- Co-owner of Real Bedford F.C. after major 2024 investment

Gemini Exchange Features and Specifics

This company's services and offerings are based on a set of parameters and specifications. You can see a summary of them in the table below:

Exchange | Gemini |

Launch Date | 2014 |

Levels | None |

Trading Fees | Varies |

Restricted Countries | Japan, China, Iraq, Afghanistan, Australia, etc. |

Supported Coins | +70 |

Futures Trading | Yes |

Minimum Deposit | Depends on the Method |

Deposit Methods | PayPal, Bank Transfers, Crypto |

Withdrawal Methods | Bank Transfers, Crypto |

Maximum Leverage | 100x |

Minimum Trade Amount | Differs by Asset |

Security Factors | Regular Bank Exams, Cybersecurity Audits by the NYSDFS, Hardware Security Keys, SOC Certifications, Insurance, 2FA |

Services | Native Stablecoin (Gemini Dollar), Staking, Credit Card, Nifty Gateway, Cryptopedia |

Customer Support Ways | Ticket, Email, Phone Call |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | N/A |

Native Token | GUSD |

Strengths and Weaknesses

Like any cryptocurrency exchange, Gemini offers services with some advantages and disadvantages. Here is a breakdown:

Strengths | Weaknesses |

Regulated by NYSDFS | Limited Cryptocurrency Options Compared to Larger Exchanges |

Staking Service for Earning Passive Income | Derivatives Restricted for US, UK, and EU Users |

Futures Trading for Amplified Profits | - |

Several Security Measurements | - |

Does Gemini Have a User Levels System?

Most crypto exchanges have tier systems for verified users, based on the documents and personal details provided.

However, the discussed platform does not employ any structure for this matter.

Commissions and Transaction Fees

Gemini exchange has taken 2 different approaches regarding trading fees, depending on the order type [Instant, Limit]. For Instant orders, there is this structure based on the order size:

Order Size | Transaction Fee |

$0+ | $0.99 |

$10+ | $1.49 |

$25+ | $1.99 |

$50+ | $2.99 |

$200+ | 1.49% of the Oder Value |

For Limit orders, the fee system is different, calculated based on the 30-day trading volume:

30-DAY TRADING VOLUME | TAKER FEE | MAKER FEE |

0 | 0.40% | 0.20% |

≥ $10,000 | 0.30% | 0.10% |

≥ $50,000 | 0.25% | 0.10% |

≥ $100,000 | 0.20% | 0.08% |

≥ $1,000,000 | 0.15% | 0.05% |

≥ $5,000,000 | 0.10% | 0.03% |

≥ $10,000,000 | 0.08% | 0.02% |

≥ $50,000,000 | 0.05% | 0.00% |

≥ $100,000,000 | 0.04% | 0.00% |

≥ $500,000,000 | 0.03% | 0.00% |

Furthermore, there is a specific structure for perpetual fees, depending on the trailing 30-day average daily volume:

Trailing 30D ADV (USD) | Maker fee | Taker fee |

0 | 0.02% | 0.07% |

≥ $10,000 | 0.02% | 0.06% |

≥ $50,000 | 0.02% | 0.05% |

≥ $5,000,000 | 0.01% | 0.04% |

≥ $10,000,000 | 0.00% | 0.04% |

≥ $50,000,000 | -0.01% | 0.04% |

≥ $100,000,000 | -0.01% | 0.03% |

Note that negative fees are actually rebates paid to the trader. Liquidation orders are charged with a 0.5% fee.

Stablecoin trading commissions are at a fixed rate of 0.01% for taker and 0% for maker. You can use a crypto profit calculator to estimate the outcome of a trade considering fees.

Regarding transfers, there are commissions in cases listed below:

- 5% for fiat deposits via PayPal

- $25 for USD withdrawals via Wire transfers

- 3 SGD for withdrawals made through FAST transfers

There are no charges for deposits and withdrawals via other methods. Also, no fee for crypto deposits is charged by the exchange.

However, a dynamic Fee is applied for cryptocurrency withdrawals, depending on the blockchain.

Available Coins/Tokens for Trading

Gemini offers access to over 70 cryptocurrencies for trading, including top-tier coins and tokens from multiple sectors:

- Major assets: Bitcoin, ETH, LTC, BCH

- DeFi assets: AAVE, COMP

- Metaverse & gaming: SAND, MANA

- Stablecoins & altcoins: GUSD, UNI, etc.

This wide coverage enables users to create a diversified crypto portfolio and utilize various trading strategies across various sectors.

Gemini Exchange Futures Trading

This platform offers futures trading features to its traders with these main specifics:

- Exposure to assets without necessarily holding them

- Long/short positions

- Cross collateral allowing traders to use other assets than GUSD

- Perpetual contracts

- Leverage of up to 100x

As stated on the website, this service is not available to the residents of the United States, the United Kingdom, and the EU countries.

Account Registration and Verification on Gemini

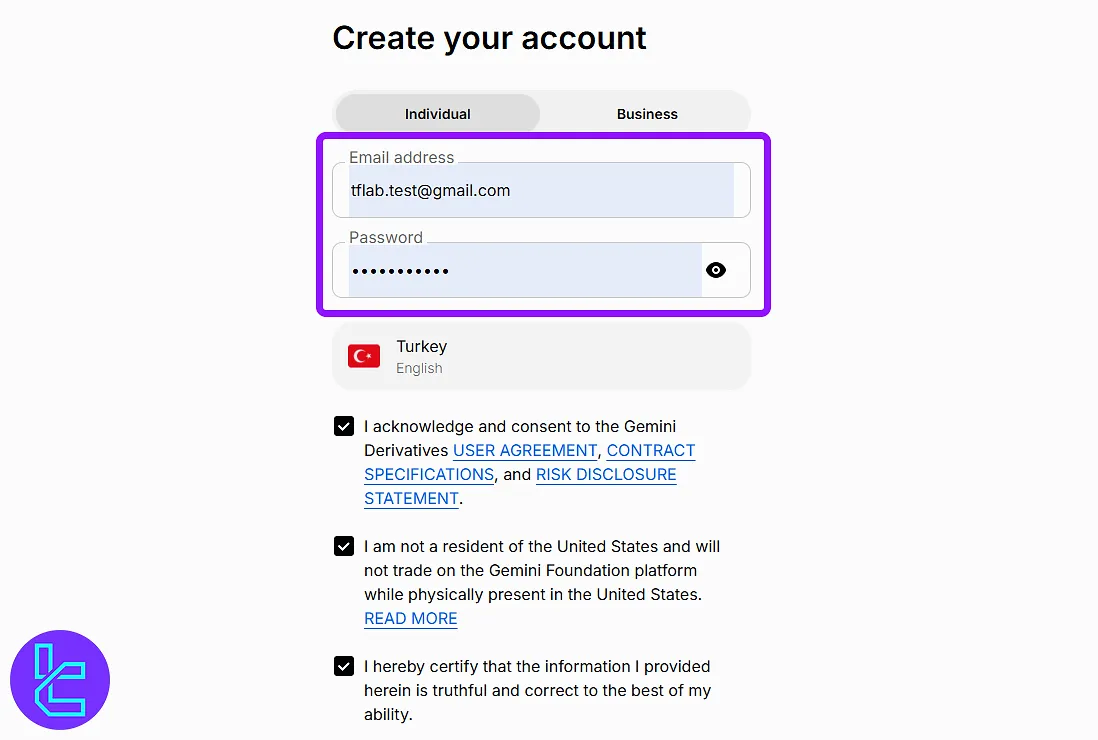

Creating an account with this exchange is a procedure with several stages.Gemini registration:

#1 Access the Official Gemini Website and Enter the Account Opening Section

Search for Gemini exchange on your prefered browser and enter it. Then, click on the "Sign Up" button.

#2 Provide Your Email and Create a Password

Enter your email address, create a secure password for your account, and select your country of residence. Agree to the exchange's terms and conditions to proceed to the next step.

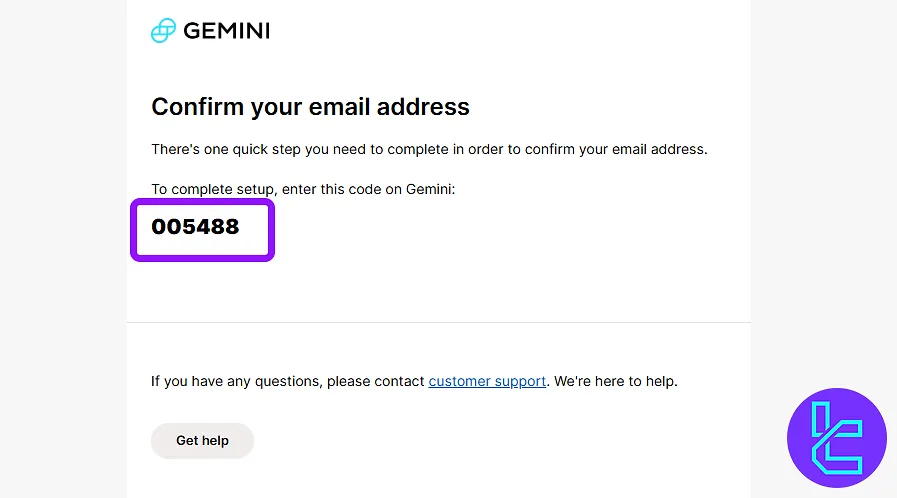

#3 Verify Your Email Address

Now, Gemeni will send you a verification code via email. Open your inbox, copy the code, and paste it in the designated setion to verify your email address.

#4 Create Gemini Passkey

To secure your account, Gemini asks you to scan a QR code with your phone and generate a passkey for your account.

#5 Input Personal inforamtion and Verify Your Identity

Now, you must enter your personal information, including:

- Full name

- Date of birth

- Country of residence

Then, you can proceed to the Gemini verification step, that requires traders to upload thier ID card, passport, or driver's license to verify thier identity.

How to Trade on Gemini?

Trading on Gemini Exchange is designed to be simple and beginner-friendly, offering secure options for buying and selling cryptocurrencies.

Using the web interface, traders can complete transactions in just a few steps with fast execution.

- Go to the "Trade" page, select crypto;

- Choose "Buy" (Once/Recurring), enter amount, click "Continue";

- Pick payment method, review, and confirm;

- For selling, select crypto, choose "Sell", enter quantity;

- Review order and click "Confirm" for instant execution.

Platforms and Applications for Trading

Gemini offers multiple platforms with different levels of complexity:

- Web Platform: A user-friendly interface for basic trading and account management

- Mobile App: Gemini iOS app and Gemini Android app availble for trader who prefer trading on-the-go

- ActiveTrader: A professional-grade terminal featuring advanced charting & trading tools and multiple order types

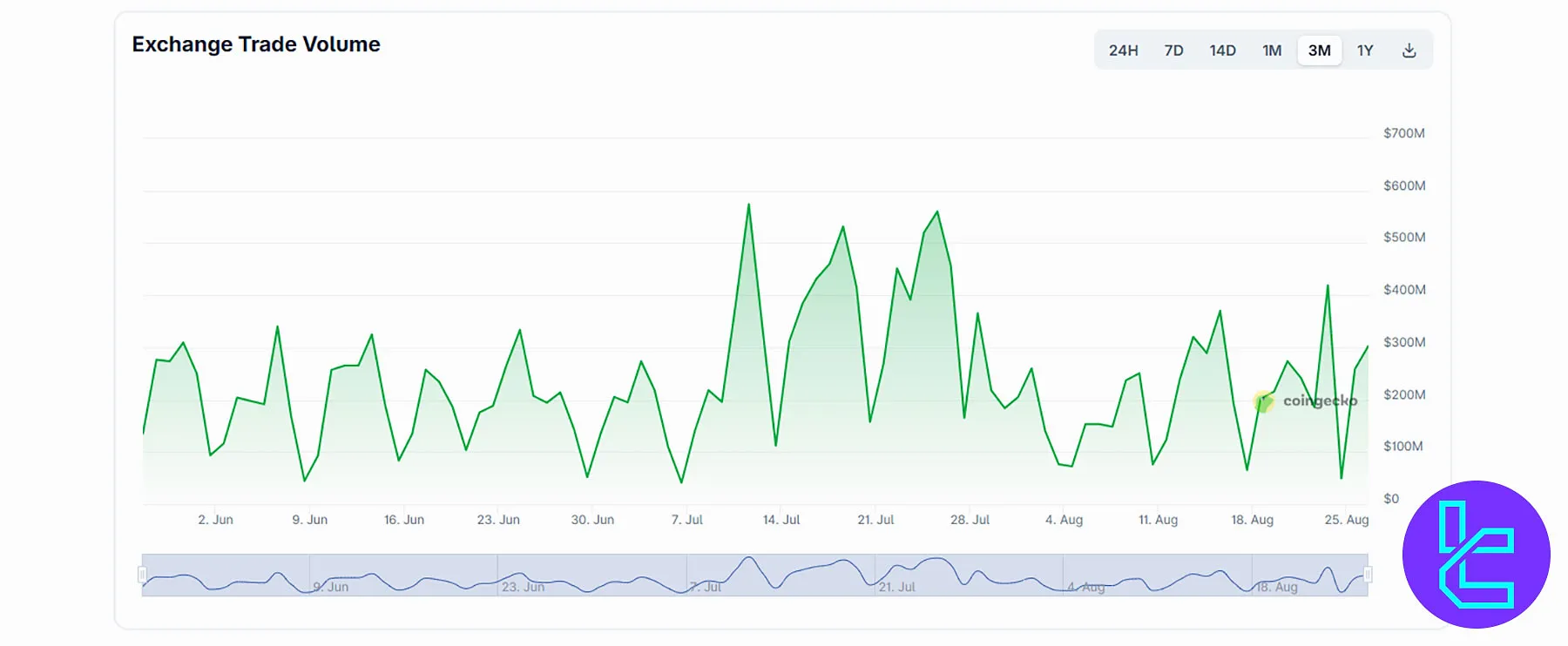

Gemini Trade Volume

The Gemini exchange has shown consistent trading activity over the past three months (June - August 2025), with daily volumes fluctuating across key levels.

This trend reflects strong market participation and reliable liquidity, making Gemini a preferred choice for active cryptocurrency traders worldwide.

- Daily trade volume ranged$100M to $700M

- Spikes observed in mid-July and late July

- Volume stability between $200M–$400M most days

- Lower dips occurred in early June and mid-August

- Data highlights Gemini’s consistent market engagement

Gemini Services

Gemini offers a wide range of crypto trading services designed for both retail and institutional investors.

From advanced TradingView integration to flexible investment options and an NFT marketplace, the platform provides tools that enhance accessibility, transparency, and efficiency in digital asset trading and portfolio management.

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

| No | |

Launchpad | No |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX | No |

Auto-Invest (Recurring Buy) | Yes |

Safety and Security Measurements in Gemini Crypto Exchange

Security is vital when it comes to users' funds, and Gemini takes this responsibility seriously. The exchange implements several measures to protect user funds and data:

- Two-factor authentication (2FA)

- Address whitelisting

- Hardware security keys support

- SOC 1 Type 1 and SOC 2 Type 2 (first certified crypto exchange), plus an ISO 27001 certification

- Insurance coverage for digital assets

Additionally, Gemini undergoes regular bank exams and cybersecurity audits by the NYSDFS, further ensuring the platform's security and compliance.

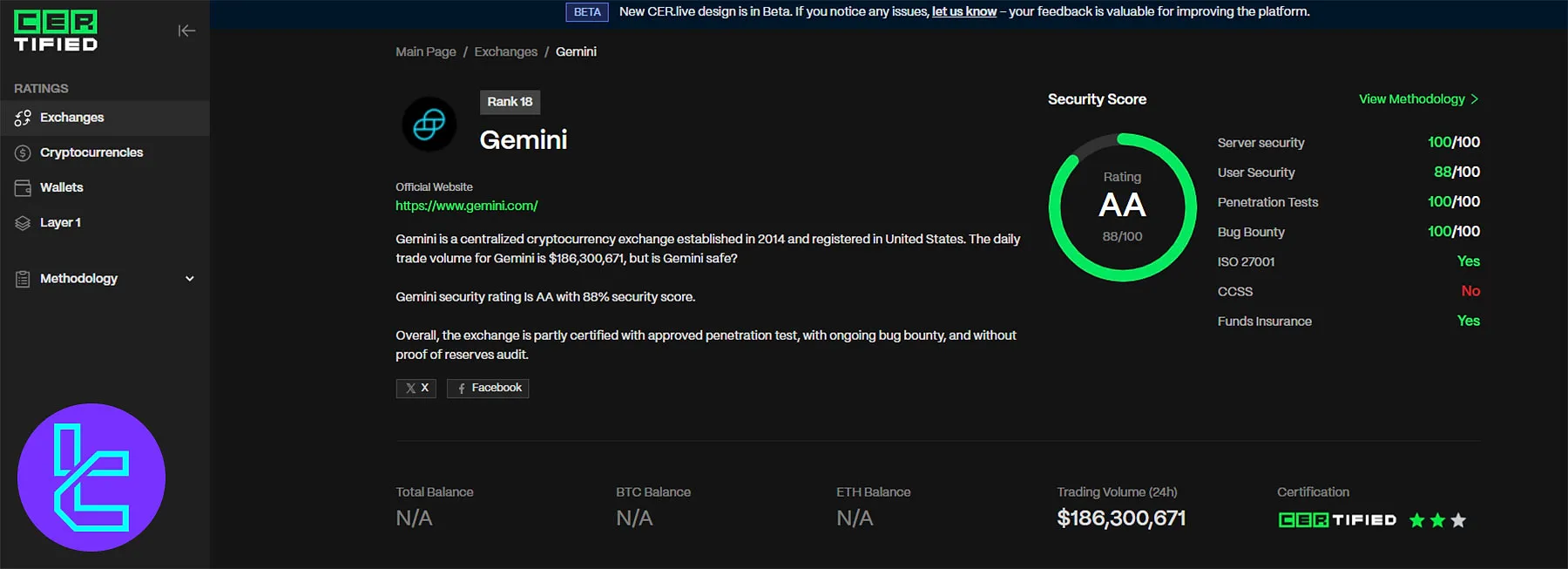

Gemini Security Rankings

The exchange maintains strong security with an AA rating (88/100) on the Gemini CER.live profile, reflecting top scores in server protection, penetration tests, and bug bounty programs.

Despite lacking CCSS certification, it benefits from ISO 27001 compliance, user security safeguards, and funds insurance.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 82.18% (A) |

Operational | 76.58% | |

Market | 86.48% | |

Cybersecurity | 83.84% | |

Fundamental | 80.79% | |

Listing Security | 86.92% | |

Community | 76.89% | |

CER.live Security Score | Overall Score | 88% (AA) |

Server Security | 100% | |

User Security | 88% | |

Penetration Tests | 100% | |

Bug Bounty | 100% | |

ISO 27001 | Yes | |

CCSS | No | |

Funds Insurance | Yes |

Fundings: Does Gemini Support Fiat Deposits?

This crypto platform supports 5 payment methods for depositing and withdrawing funds:

- ACH

- Wire transfers

- PayPal (Deposits Only)

- SGD FAST transfers

- Crypto blockchain transactions

As it appears, the company accepts fiat deposits from users.

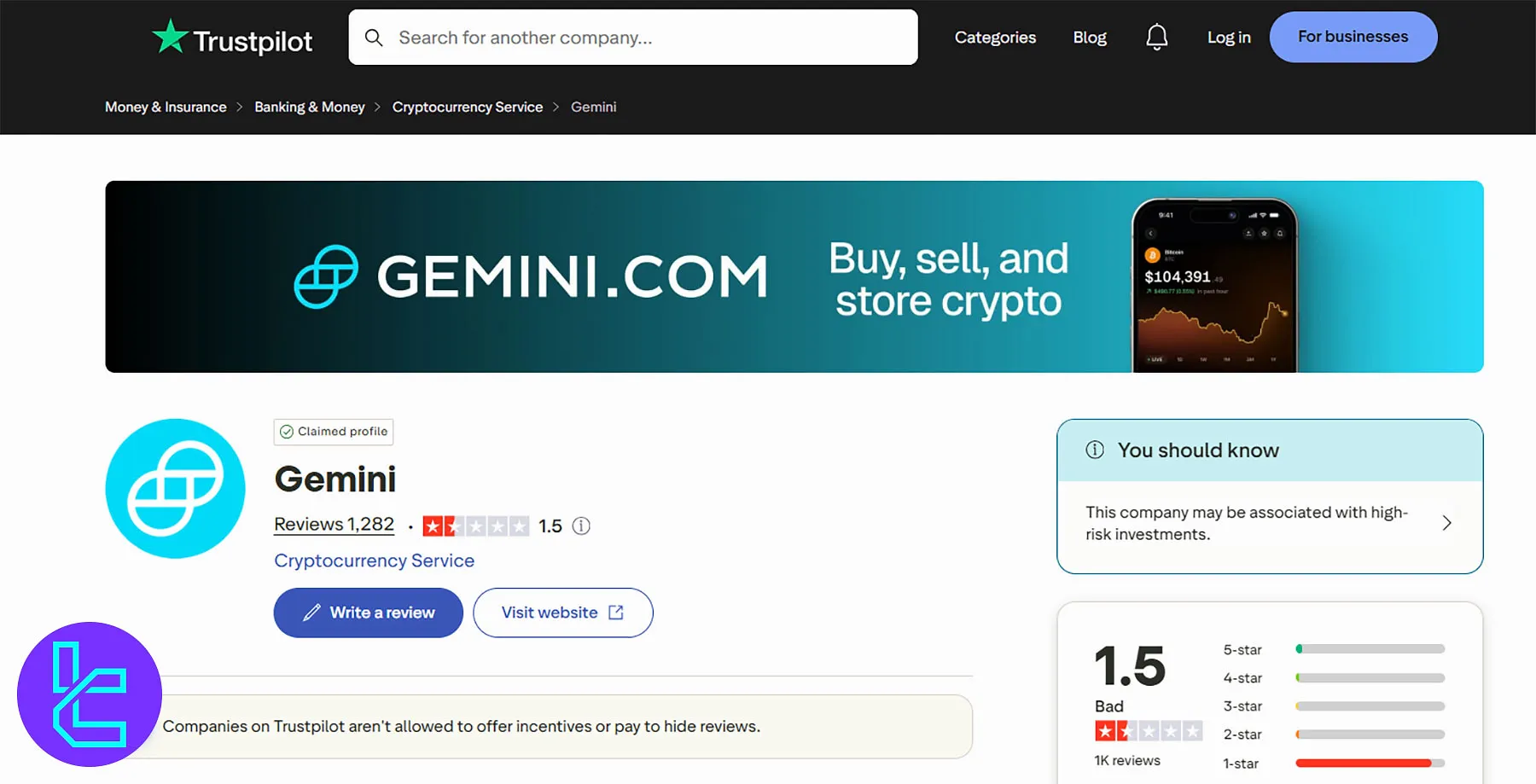

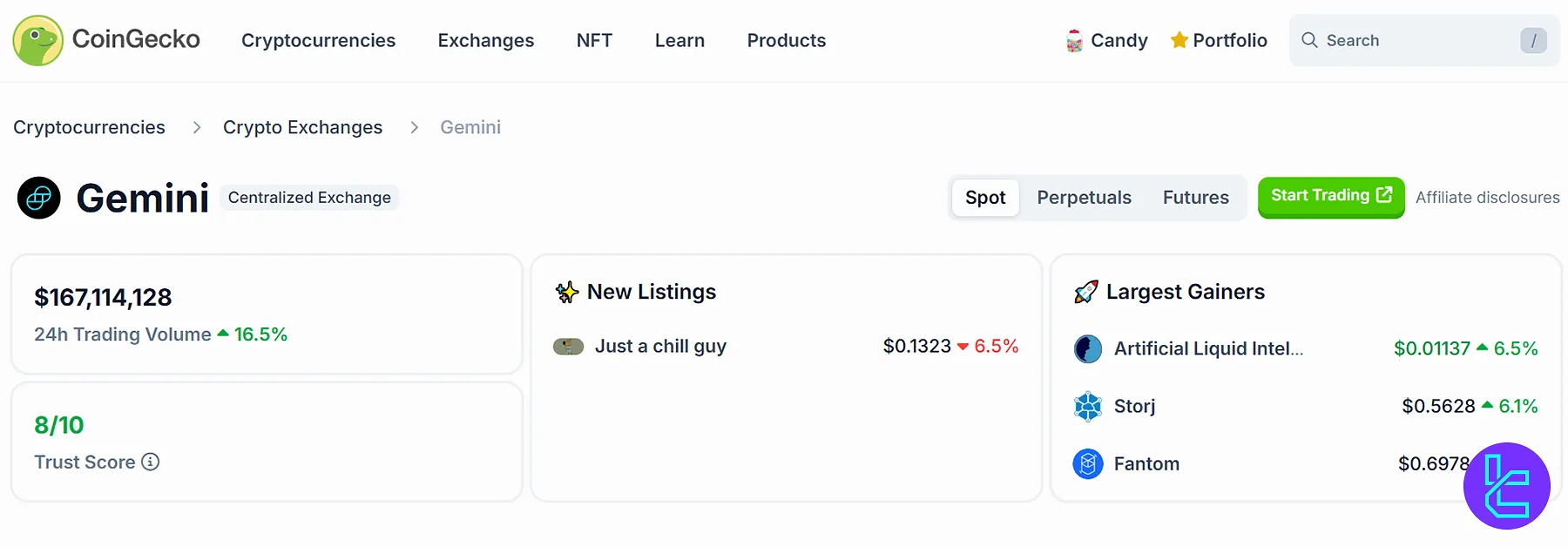

Trust Evaluation Scores on Reliable Sources

While Gemini is a regulated and reputable exchange, it's important to consider user feedback and trust scores on Trustpilot, CoinGecko, and other relevant websites:

- Gemini Trustpilot: 1.5/5 (1282 reviews)

- Reviews.io: 1.4/5 (60+ reviews)

- ScamAdviser: 1/100 Trustscore, 1.2/5 user evaluations (1200+ ratings)

- CoinGecko: 8/10, evaluated based on the company's algorithms

The discrepancy between the low user ratings and CoinGecko's high score suggests that while the platform itself may be reliable, some users have experienced issues, possibly related to customer support or technical difficulties.

Gemini Features

The Gemini exchange provides a wide variety of crypto-related services to all of its users.

Feature | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | Yes |

Gemini Bonus

Gemini runs an attractive Referral Club program, allowing users to earn crypto rewards for inviting friends.

With tiers offering both fixed bonuses and trading fee revenue shares, traders can maximize incentives while helping expand the Gemini community.

- Standard Tier: Earn up to $75 in crypto when referrals trade $100+ in their first 30 days;

- Icon Tier: Get 15% trading fee revenue share when referees trade $5,000–$49,999;

- Legend Tier: Unlock 25% revenue share for referrals trading $50,000+;

- Limits: Standard tier capped at $2,100 per year; rewards credited 32 days post sign-up.

Customer Services Channels and Open Hours

Gemini exchange offers 3 support channels for users:

- Email Address: support@gemini.com

- Ticket System: Available on the website

- Phone Call: +1 (866) 240-5113

Based on the available data gathered from the website, this platform provides 24/7 support services to its users.

Copy Trading and Investment Options on Gemini Exchange

This company offers passive income opportunities through its staking service, which allows users to earn interest of up to 4.11% APR on their cryptocurrency holdings.

However, the exchange does not currently offer copy trading features. At the time of writing this article, there are 3 digital assets available for staking:

- Polygon [MATIC] with a 4.11% APR

- Ethereum [ETH] with a 3.6% APR

- Solana [SOL] with an APR of 2.38%

List of Restricted Countries and Regions

Gemini states that it is available in 60+ countries. Therefore, it does have some geographical restrictions. Users from the countries listed below are banned:

- Cuba

- Iran

- North Korea

- Syria

- Libya

- Australia

- Afghanistan

- Iraq

- China

- Japan

- And more

Gemini Comparison with Well-Known Crypto Exchanges

The table below helps you understand the pros and cons of trading with the Gemini exchange compared to other exchanges.

Parameters | Gemini Exchnage | |||

Number of Assets | 70+ | 700+ | 2500+ | 10000+ |

Maximum Leverage | 1:100 | 1:125 | 1:100 | 1:125 |

Minimum Deposit | Depends on the Method | Varies by Cryptocurrency | Varies by Payment Method | $15 |

Trading Fees | From 0% Maker, Taker 0.03% | 0.02% | From -0.005% Maker, 0.025 Taker | 0.1% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Gemini exchange with a native stablecoin named Gemini Dollar [GUSD] and a staking service with an APR of up to 4.11%, has received a 1.2/5 score on Trustpilot, based on over 1,000 user reviews.

On the other hand, "CoinGecko" has given a 8/10 trust score to the platform.