The MEXC copy trading feature allows investors to replicate the strategies of professional futures traders in just 5 simple steps, without requiring advanced market knowledge.

The process is exclusive to the futures market and enables traders to find perfect strategy providers by using various filters such as highest ROI, top traders, and more.

MEXC Copy Trading Activation Guide

After completing the MEXC verification, financial activities such as mirror trading become available in the MEXC exchange dashboard. MEXC copy trading:

- Access the social trading section from the "Futures" menu;

- Explore the social trading dashboard and learn about the available tools;

- Select a lead trader profile and review performance data;

- Customize social trading mode, investment amount, and settings;

- Manage active social trades and track portfolio performance.

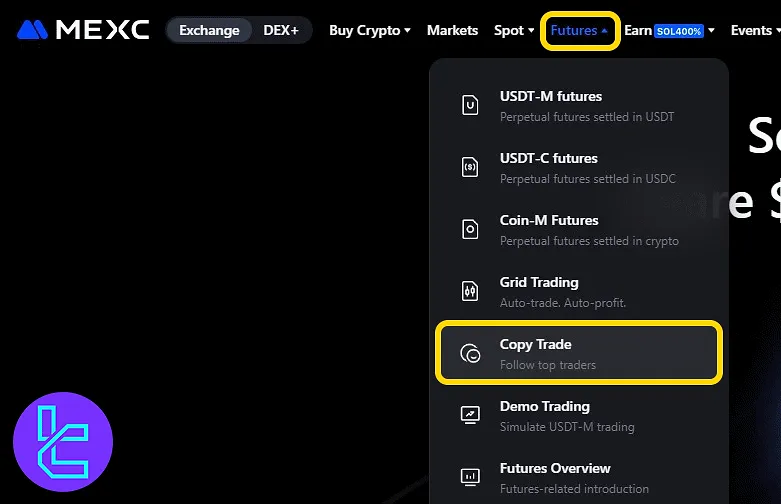

#1 Accessing the “Copy Trade” Section

From the main MEXC dashboard, click on the "Futures" tab in the top menu and select "Copy Trade" from the dropdown list.

#2 Exploring the Copy Trading Dashboard

The dashboard offers quick access to:

- "Copy Trade Tutorial": Short guides for new users;

- "Become a Trader": Apply to provide strategies and earn commissions.

Below, trader lists are displayed with ranking tabs such as "Top Traders", "Overall", "Highest ROI", and more.

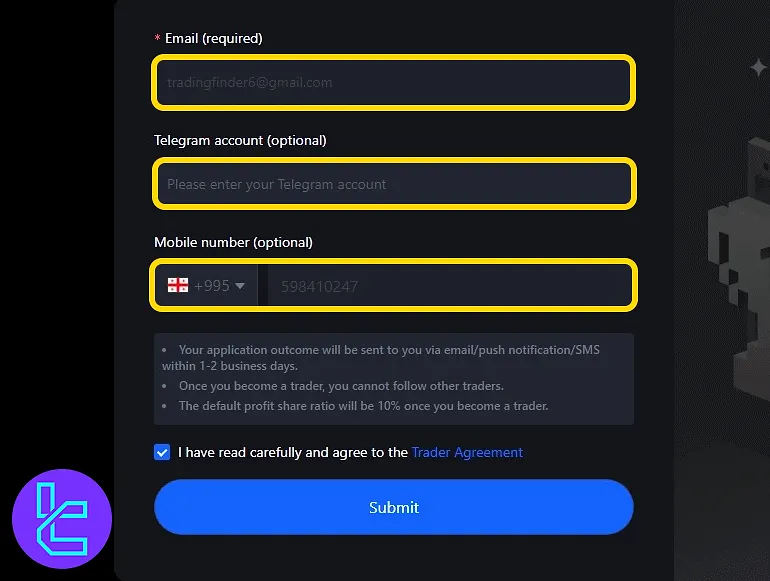

Clicking "Become a Trader" opens a registration form requiring:

- Email address (mandatory)

- Telegram account (optional)

- Mobile number (optional)

By completing this form, you can trade as a strategy provider.

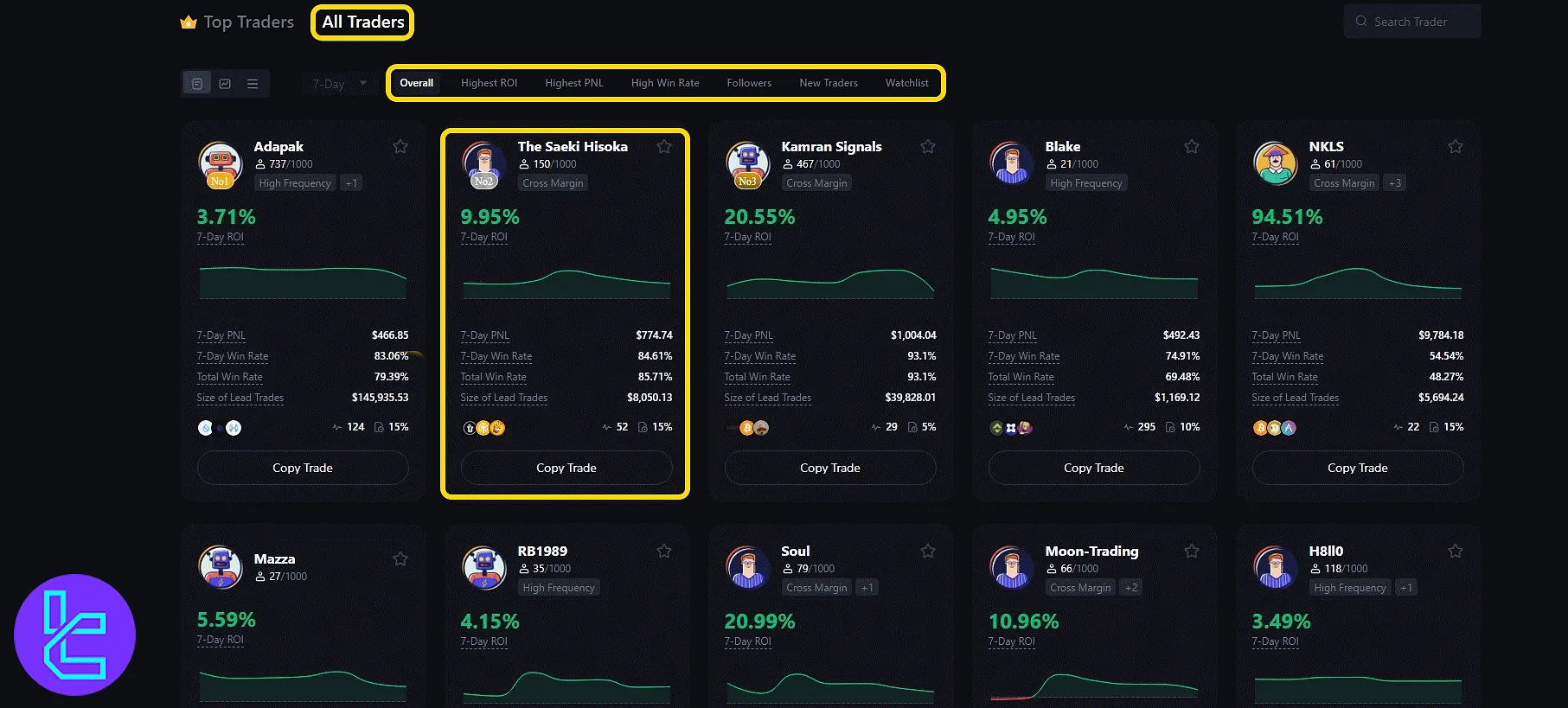

#3 Selecting a Lead Trader

Use the "All Traders" tab and apply filters such as ROI, win rate, and follower count. Each trader card shows:

- Name & avatar

- Current/maximum followers

- 7-day ROI & PnL chart

- Win rate & total win rate

- Size of latest trades

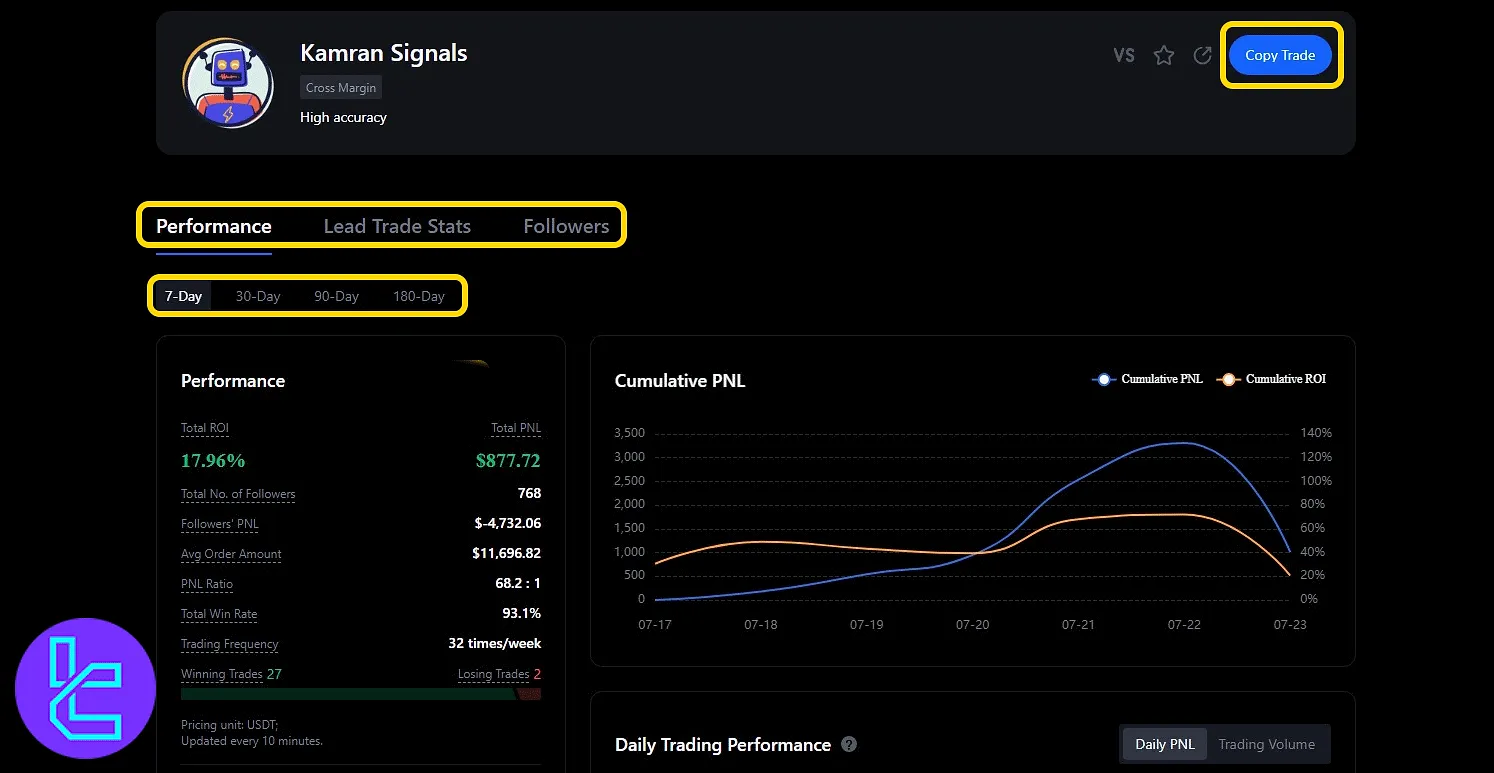

Clicking on a trader’s name opens a comprehensive profile page containing detailed statistics and analytics. Here, the trader’s ROI, total profit and loss, and number of followers are displayed prominently.

Additional key metrics include trading frequency, the count of winning and losing trades, and a breakdown of asset allocation. The profile also shows the profit share percentage that will apply when copying the trader.

After reviewing these details, if the profile meets the desired criteria, click on the "Copy Trade" button to proceed with the setup.

#4 Customizing the Social Trading Parameters

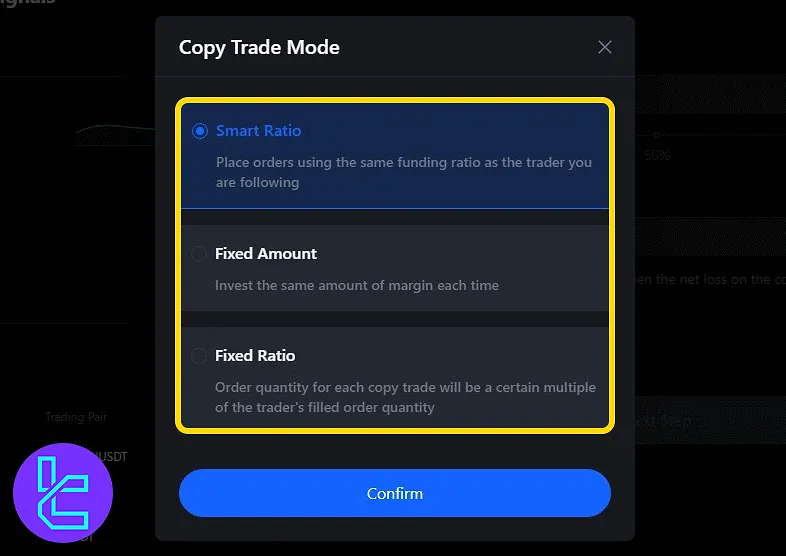

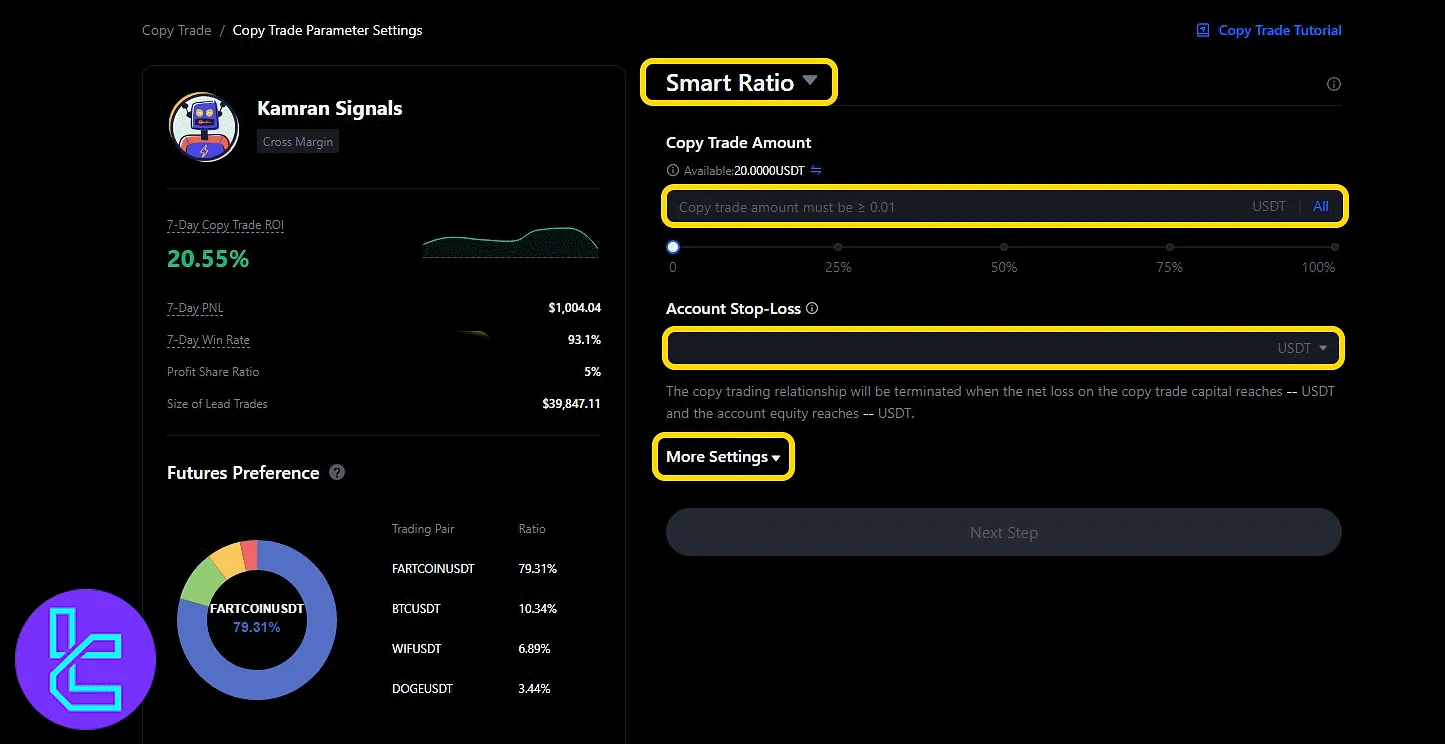

Start by selecting the preferred social trading mode from the 3 available options:

- Smart Ratio: Matches the trader’s funding ratio proportionally

- Fixed Amount: Allocates a fixed amount of margin per trade

- Fixed Ratio: Mirrors the trader’s order quantity as a set multiple

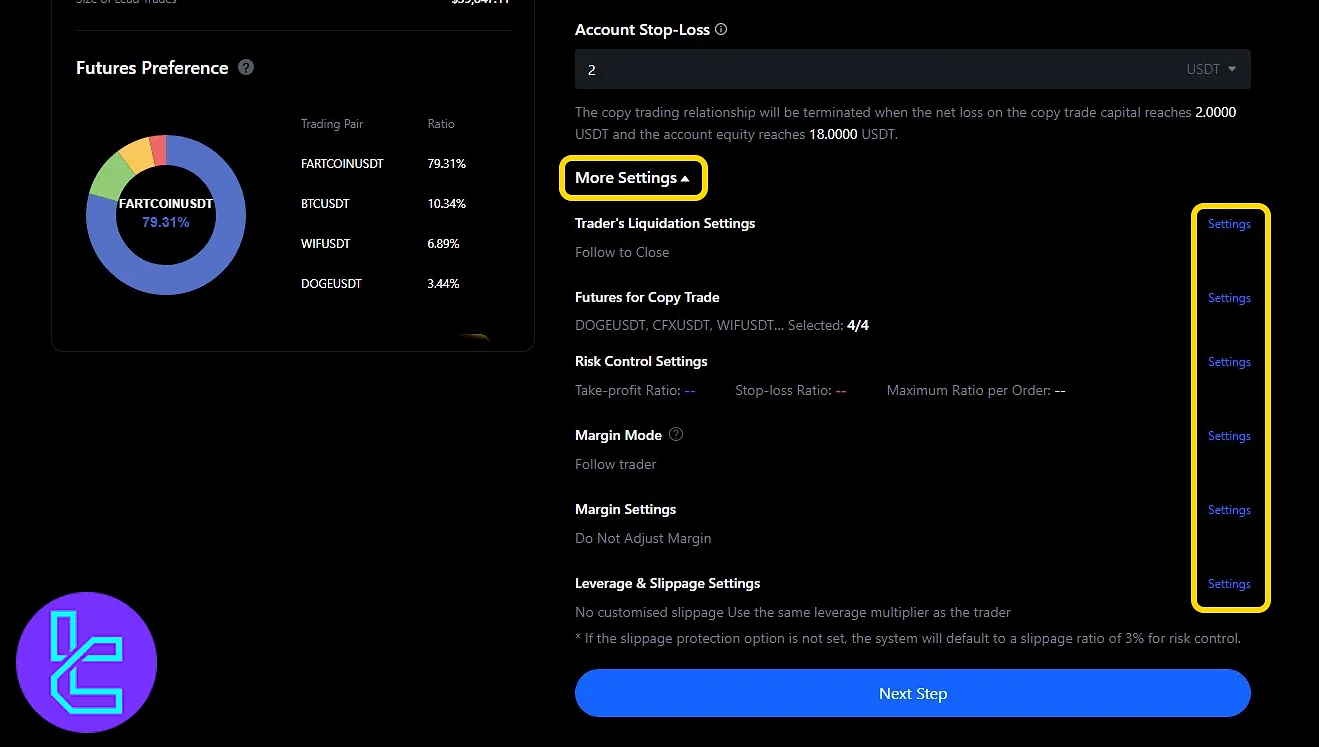

Next, enter the total investment amount for mirror trading and define an account stop-loss to cap potential losses.

This ensures trades automatically stop if equity falls below the specified threshold.

By clicking "More Settings", additional customization options become available, including:

- Choosing specific futures pairs for copying

- Setting trader liquidation behavior

- Applying risk control ratios (take-profit/stop-loss)

- Selecting margin mode and margin adjustments

- Configuring leverage and slippage limits

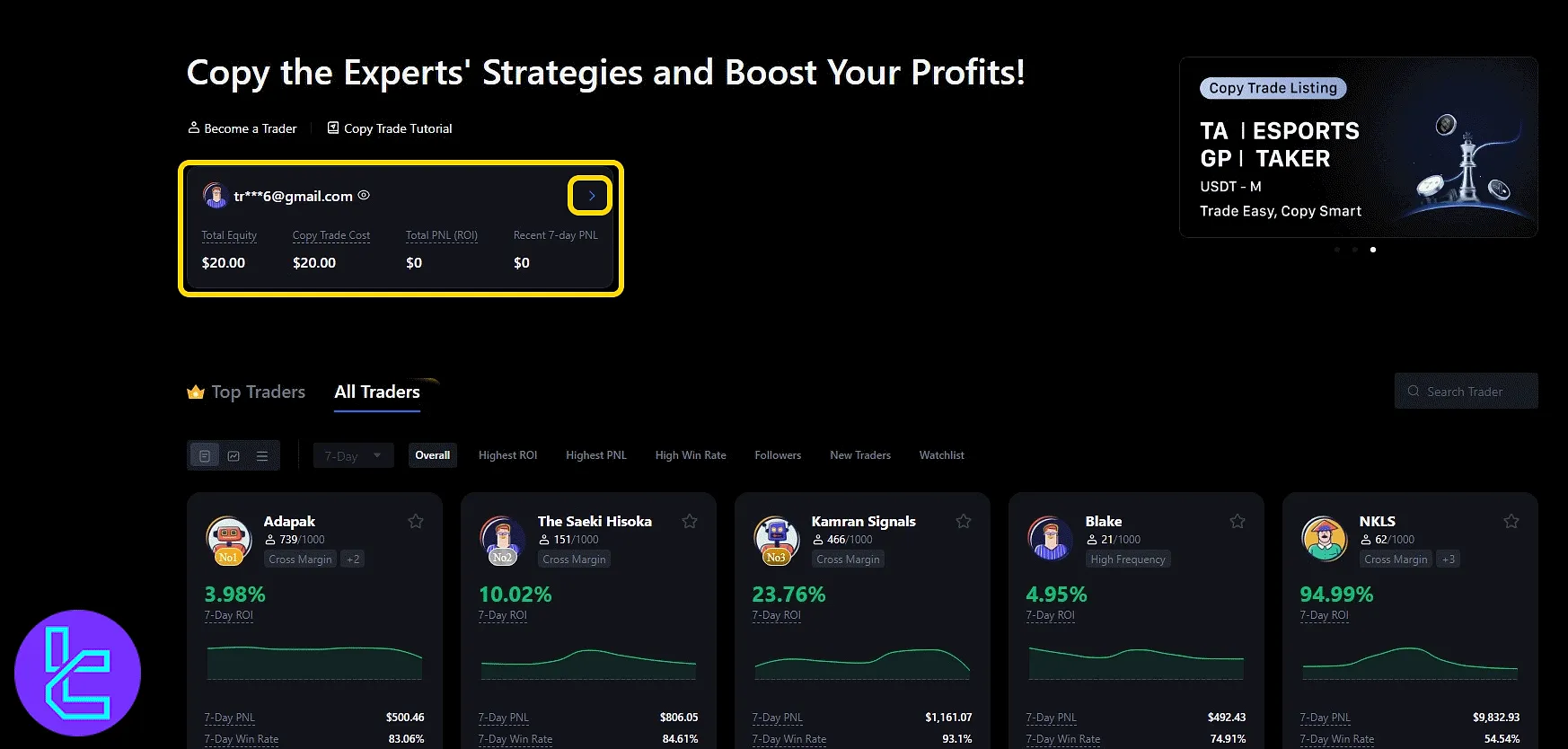

#5 Managing Active Social Trades

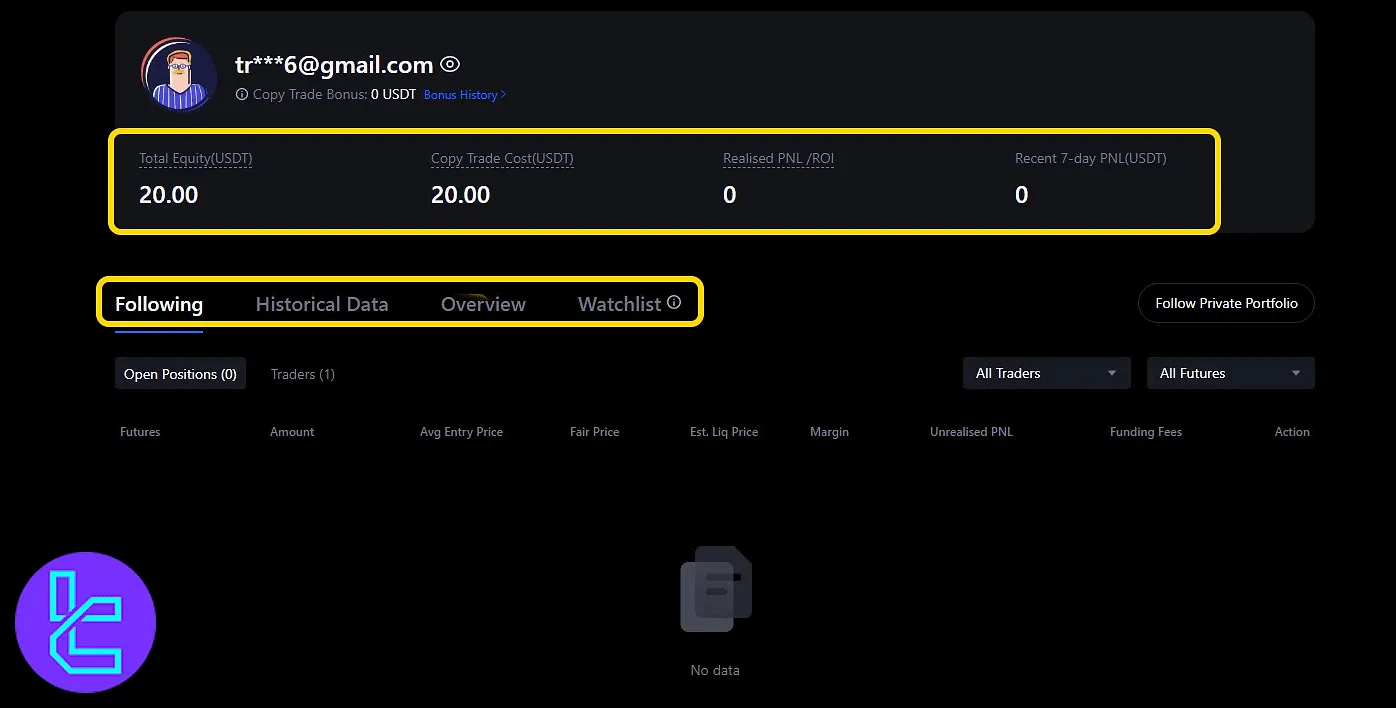

By returning to the "Copy Trade" menu after activation, a portfolio panel will display an overview of the account’s performance.

This includes the total equity, copy trade cost, and total and 7-day profit/loss.

For more in-depth insights, click the arrow icon to open a detailed account view, where information such as open and closed positions, the list of traders being followed, historical trade records, and tabs for account overview and watchlist management are available.

TF Expert Suggestion

MEXC copy trading can be activated in under 10 minutes, requiring only an active futures account and a verified email. Lead traders typically set a profit share ratio between 5% and 35%, with follower limits per account.

To explore more about MEXC deposit and withdrawal method to manage your social trading wallet, visit the MEXC tutorial section.