VALR offers access to 36 Spot, 10 Margin, and 13 Futures Crypto pairs. It offers a 0.01% reward for market makers (those who make fiat pairs orders) and up to 30% in commissions to its affiliates.

The taker fee for Spot/Margin trading is 0.05%, and for Futures is 0.04% or 0.03% for VIP clients.

VALR; Company Information and Regulation

VALR (Pty) Ltd was founded in 2018 by CEO Farzam Ehsani. The company is headquartered in Johannesburg, South Africa.

The crypto exchange is licensed and registered as a financial services provider (FSP #53308). Key features of VALR:

- Registered with the Financial Intelligence Centre (FIC) in South Africa

- Backed by prominent investors, including Pantera and GSR

The exchange is also allowed to operate in Europe through its VASP license from the Ministry of Finance and the Tax Administration Chamber of Poland.

VALR CEO and Co-Founder

Farzam Ehsani is the co-founder and CEO of VALR. With a strong background in technology, finance, and blockchain innovation, Ehsani has played a central role in positioning VALR as one of the fastest-growing exchanges in Africa.

Based on the Farzam Ehsani LinkedIn, before founding VALR, he worked at Rand Merchant Bank and also served as the Chairperson of the South African Financial Blockchain Consortium (SAFBC), where he promoted the integration of blockchain technology into traditional financial systems.

His vision focuses on creating financial inclusivity and providing seamless digital asset services for both retail and institutional clients.

VALR Exchange Specific Features

The platform offers a robust set of features designed to cater to both beginners and advanced traders, including:

Exchange | VALR |

Launch Date | 2018 |

Levels | Standard, VIP |

Trading Fees | Spot Maker / Taker (0% / 0.05%) Futures Maker / Taker (0% / 0.04%) |

Restricted Countries | Canada, Cuba, India, Iran, Kazakhstan, North Korea, Russia, Somalia, Sudan, South Sudan, Syria, Ukraine, United States Of America |

Supported Coins | 75 |

Futures Trading | Yes |

Minimum Deposit | ZAR 0.0, $10, €1 |

Deposit Methods | Wire Transfer, SEPA, EFT, South African Credit / Debit Cards |

Withdrawal Methods | Crypto, Bank Transfer (ZAR) |

Maximum Leverage | 1:10 |

Minimum Trade Size | Variable based on the asset |

Security Factors | Cold Storage, 2FA, SSL encryption |

Services | VALR Pay, Staking, Lending, Futures Trading |

Customer Support Ways | Chatbot, Email, Help Center, Ticket |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | None |

VALR Pros and Cons

Founded by Farzam Ehsani, Badi Sudhakaran, and Theo Bohnen, the exchange offers crypto-related services, including staking and Futures trading.

However, it sure has some flaws, too. VALR advantages and disadvantages:

Pros | Cons |

Competitive trading fees | Limited cryptocurrency offerings |

Regulated and compliant | Primarily focused on the South African market |

Institutional-grade API | Limited educational resources for beginners |

Up to 5M USDT in rewards for top Futures traders | Limited leverage options (up to 10) |

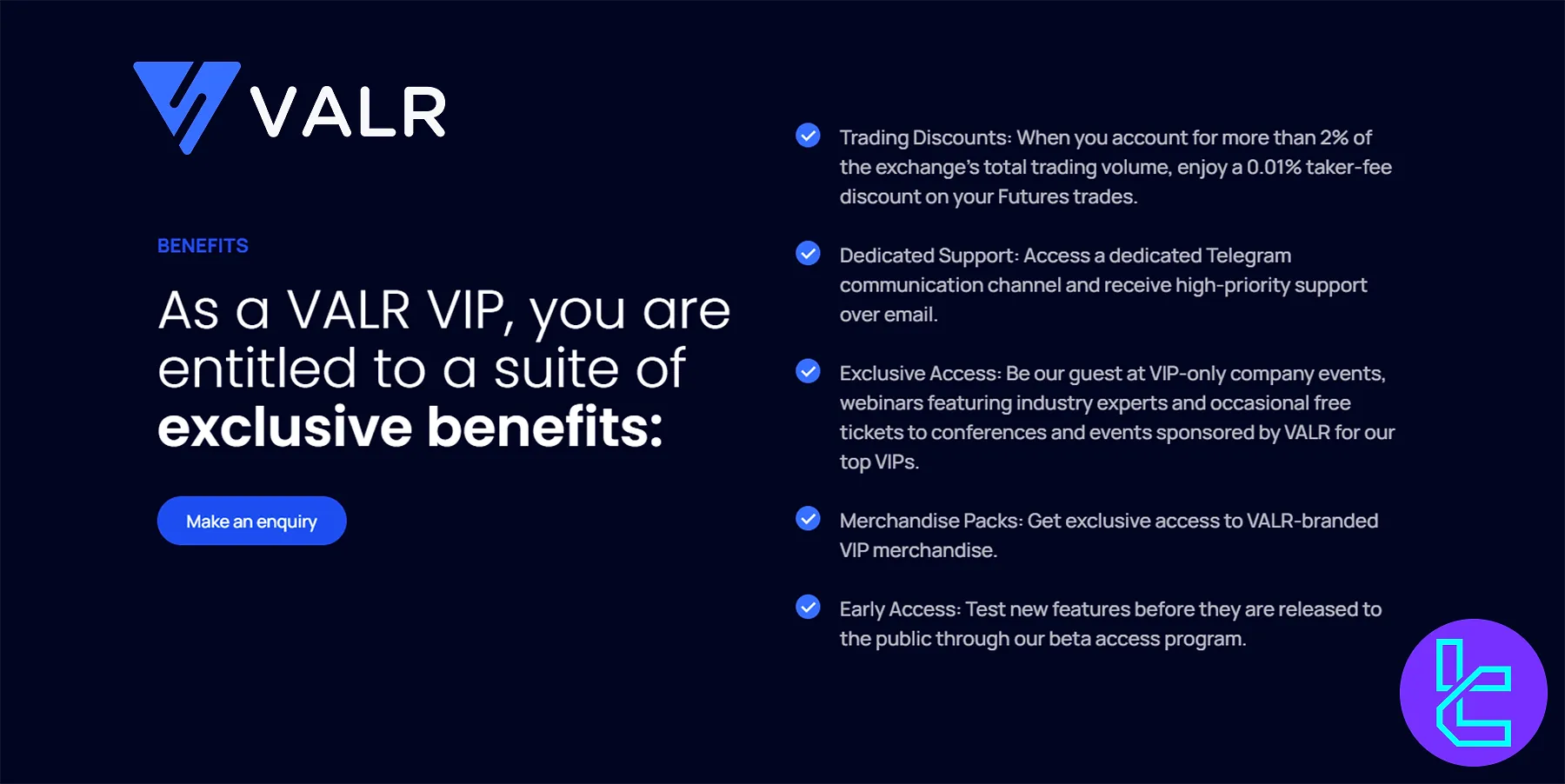

VALR User Levels

The company has a simple single-tier user level program: VIP. Traders must meet certain conditions in order to upgrade from the Standard to the VIP level.

Key features of VALR VIP:

- Trade more than 2% of the exchange’s monthly spot and futures trading volume;

- Maintain a balance of over $100,000;

- Exceed 30D trading volume of $10M across Spot and Futures markets;

- Get a 0.01% discount on the Futures taker fee.

VALR Exchange Fees Explained

The platform has implemented a transparent fee structure for trading, deposits, withdrawals, and simple buy/sell.

Market | Maker | Taker |

Fiat Pairs | -0.01% | 0.1% |

Spot / Margin | 0% | 0.05% |

Futures | 0% | 0.04% |

USD Stable to USD Stable (e.g., USDT/USDC) | 0% | 0.01% |

The ecosystem charges a 0.13% commission on EUR and USD deposits and a 3.9% fee on ZAR card deposits.

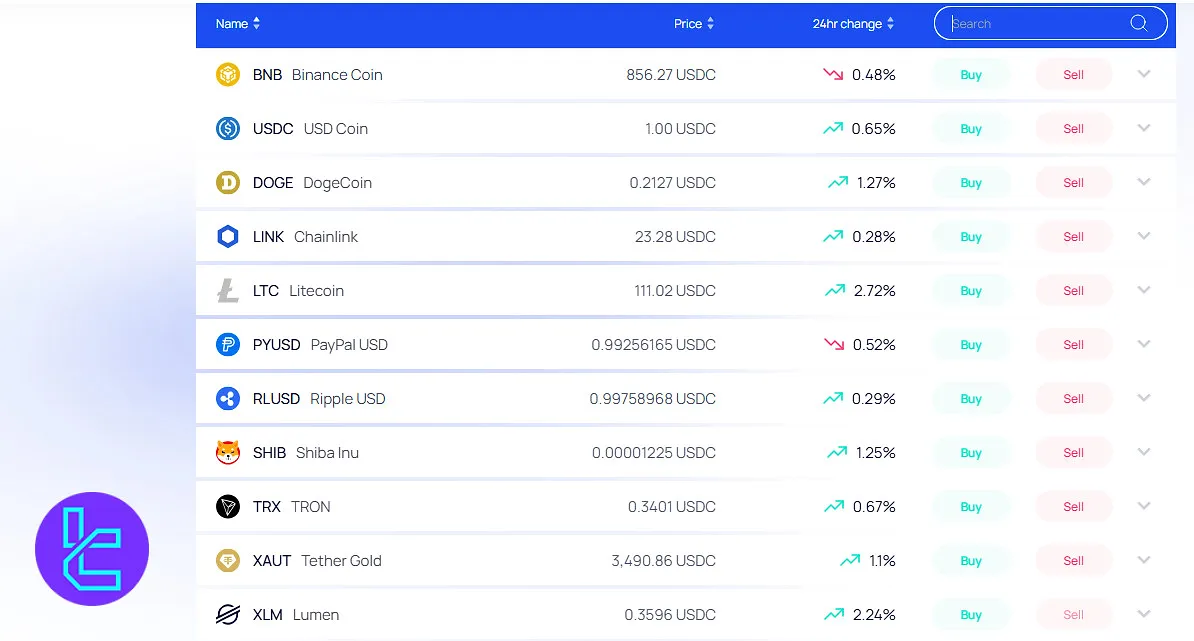

Listed Cryptocurrencies

The exchange provides Spot / Margin and Futures trading services alongside a simple buy/sell feature on a list of 75+ digital assets, including:

- BNB

- USDC

- PYUSD

- SHIB

- XAUT

- AVAX

- BTC

- XRP

- ETH

- DOGE

Futures and Margin Trading

As we mentioned earlier in this VALR review, the platform provides Futures trading with leverage options of up to 1:10 and Margin Trading with leverage options of up to 1:5. Key features of VALR perpetual and margin markets:

- 10 cryptocurrency pairs on the margin market with USDC, USDT, BTC, and ZAR as base currencies

- 13 trading pairs on the futures market with USDT and ZAR as base currencies

Account Opening and Verification

The company has been licensed in multiple jurisdictions. As a result, it has to comply with AML and KYC policies.

Upon signing up, users must complete the verification process. The VALR registration process is explained in 5 steps, in addition to a verification phase.

#1 Visit the VALR Platform

Visit the official VALR website and click “Open an Account” to get started.

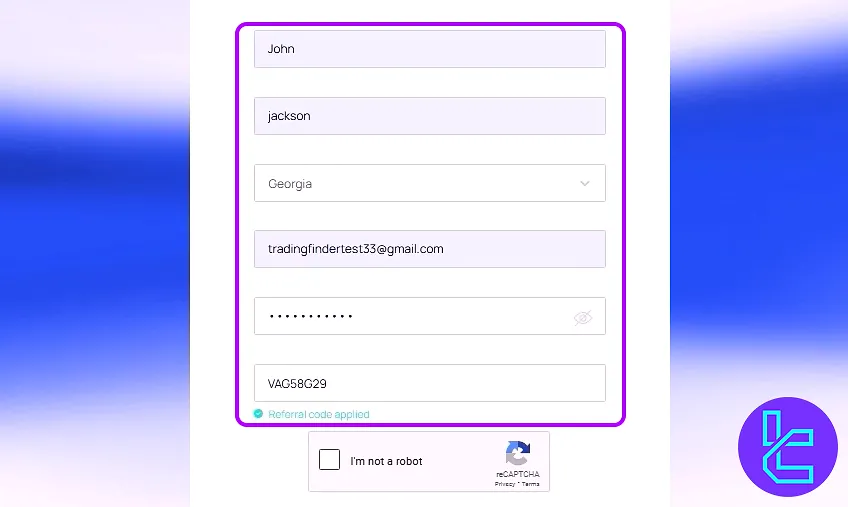

#2 Enter Personal Details

Fill out the form with these data:

- Name

- Country of residence

- Password

Optionally, connect via an Apple Account or a Google account.

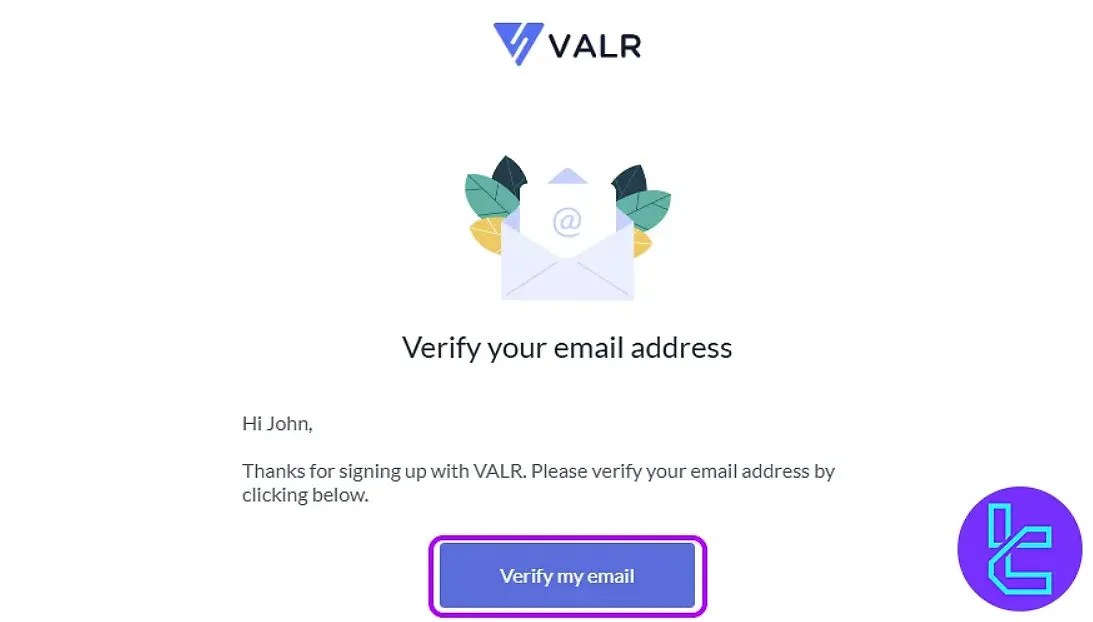

#3 Confirm Email Ownership

Check your inbox, click the validation link, and return to VALR to proceed.

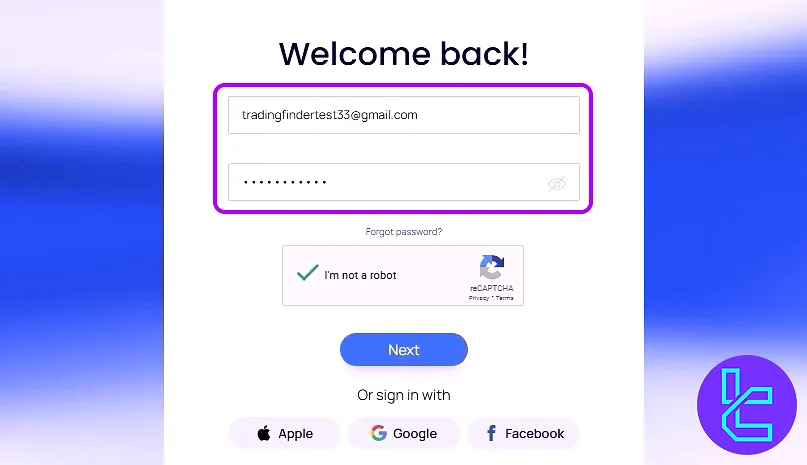

#4 Sign In

Use your credentials to log in securely.

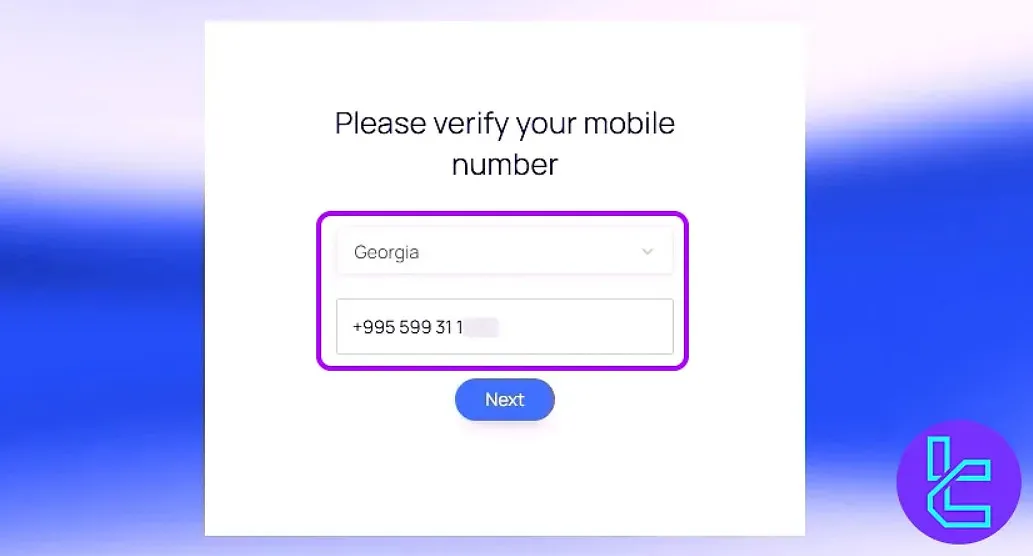

#5 Mobile Verification via OTP

Input your phone number and authenticate it with a one-time password (OTP) to finalize setup and access your account.

#6 Verification

To pass the KYC, provide the required residency and personal information, and upload proof of ID (passport or driving license).

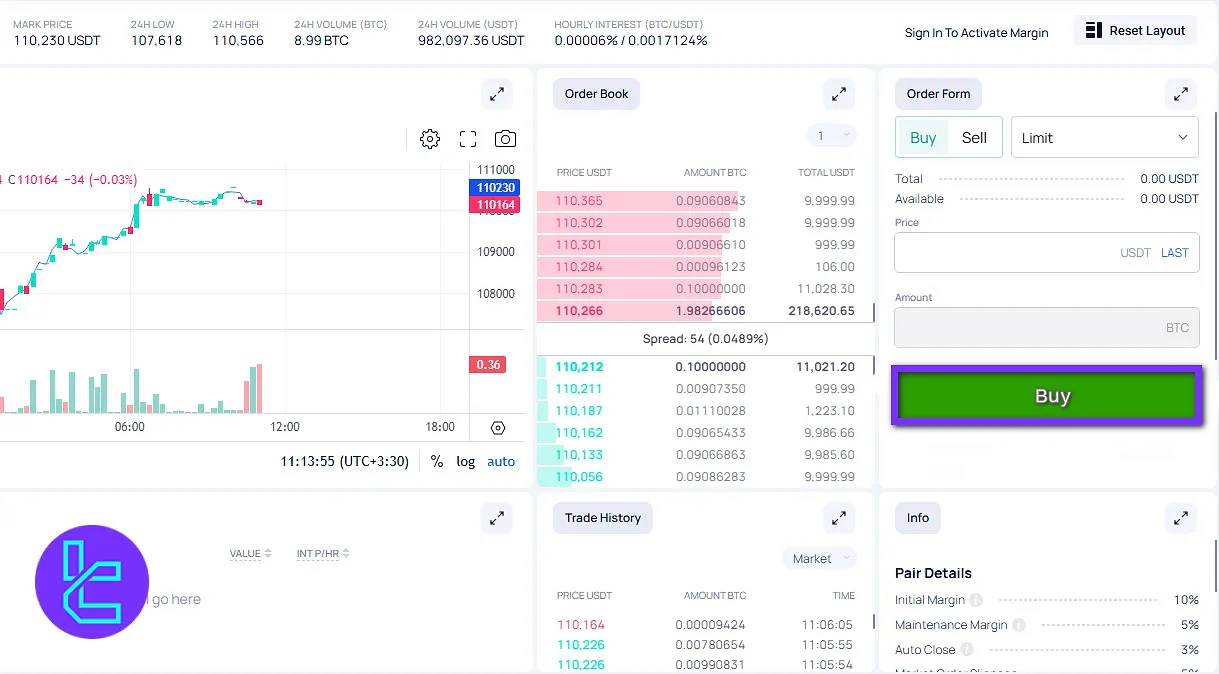

How to Trade on VALR

Follow these easy steps to start trading on the VALR exchange:

#1 Access the Trading Page

From the homepage, click on “Spot” under “Trade” to open the spot trading interface.

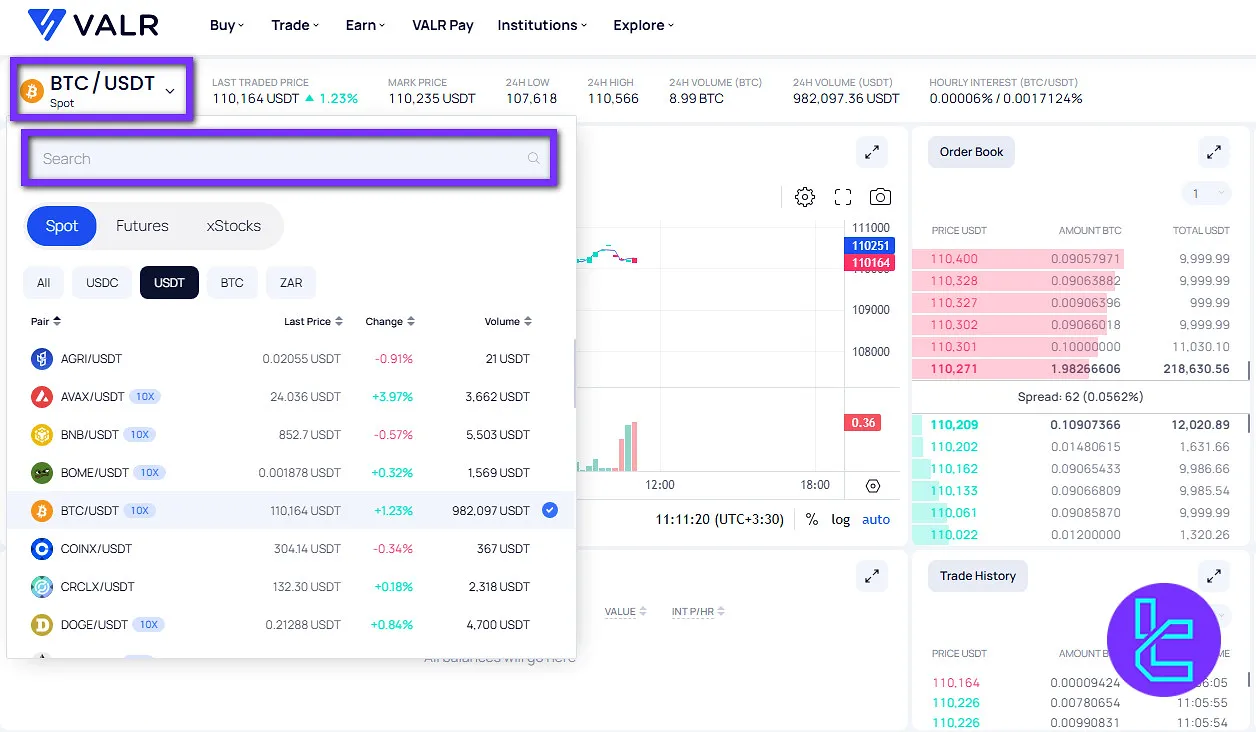

#2 Pick a Trading Pair

On the left-hand side, select the current trading pair to view all available options. Use the search bar to find the specific pair you want.

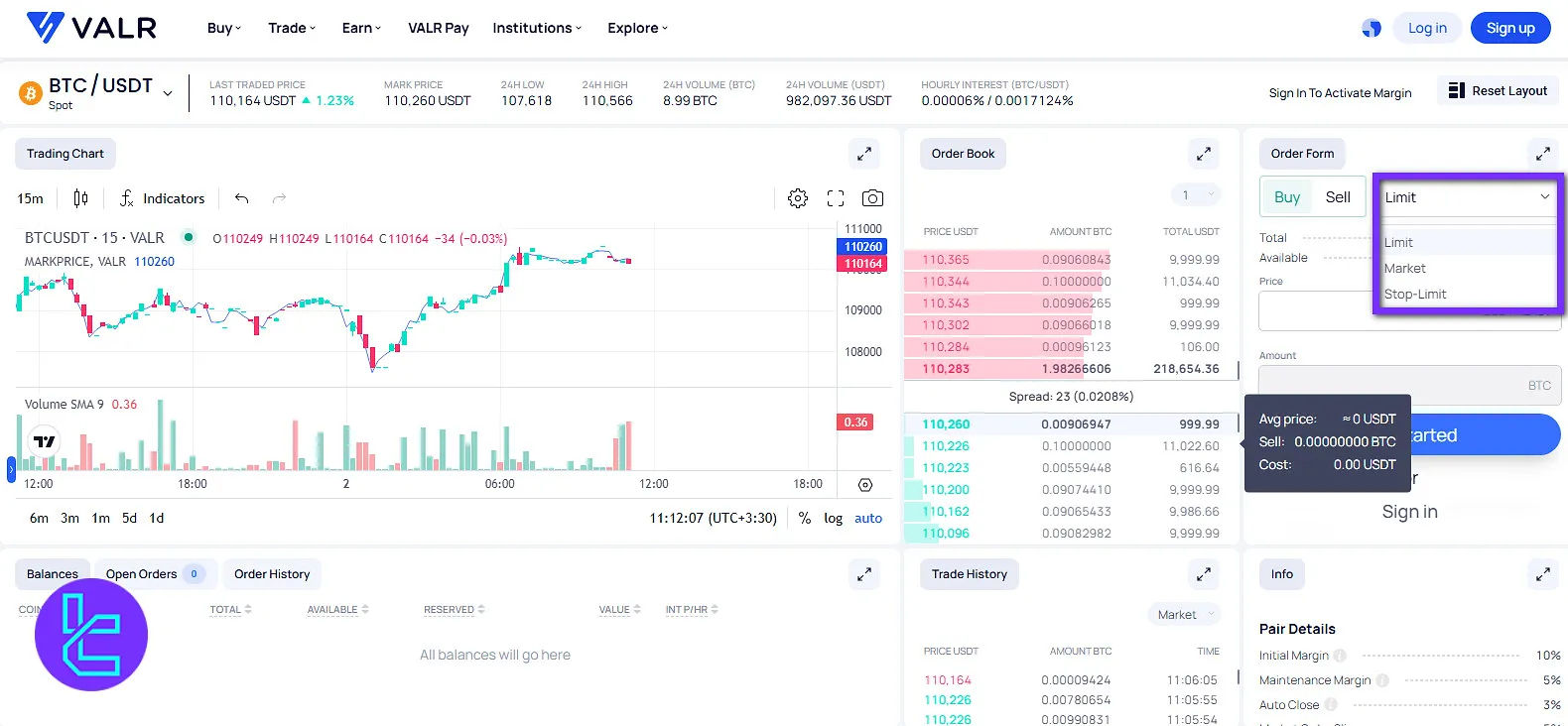

#3 Select the Order Type

On the right panel, pick the type of order you’d like to place. VALR supports limit, market, and stop-limit orders.

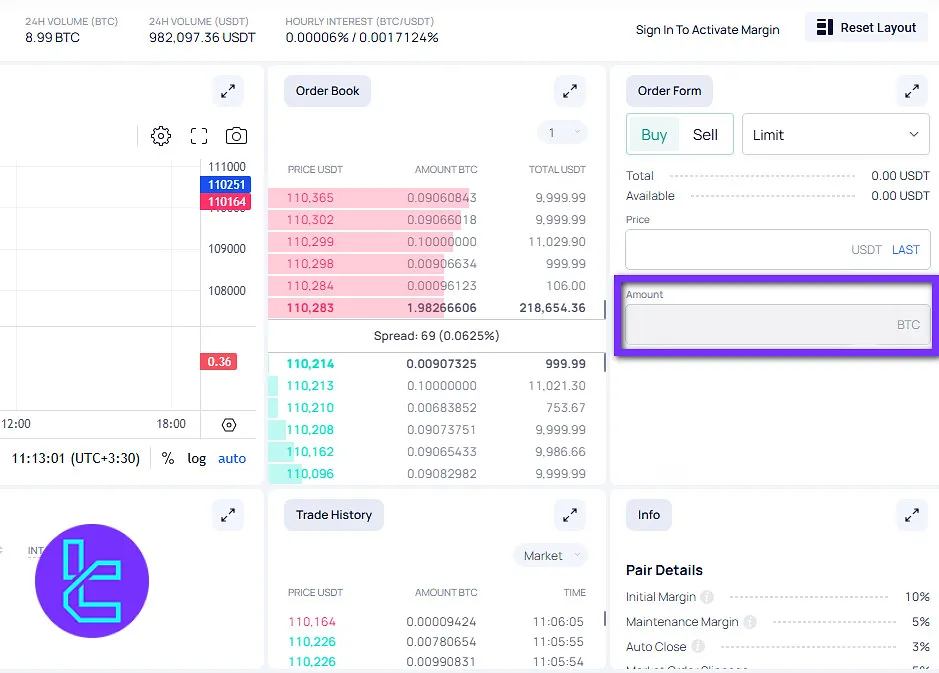

#4 Enter the Trade Amount

Under the order options, input the amount of cryptocurrency you wish to buy or sell.

#5 Execute the Trade

Review your order carefully, then click “Buy” or “Sell” to complete your transaction.

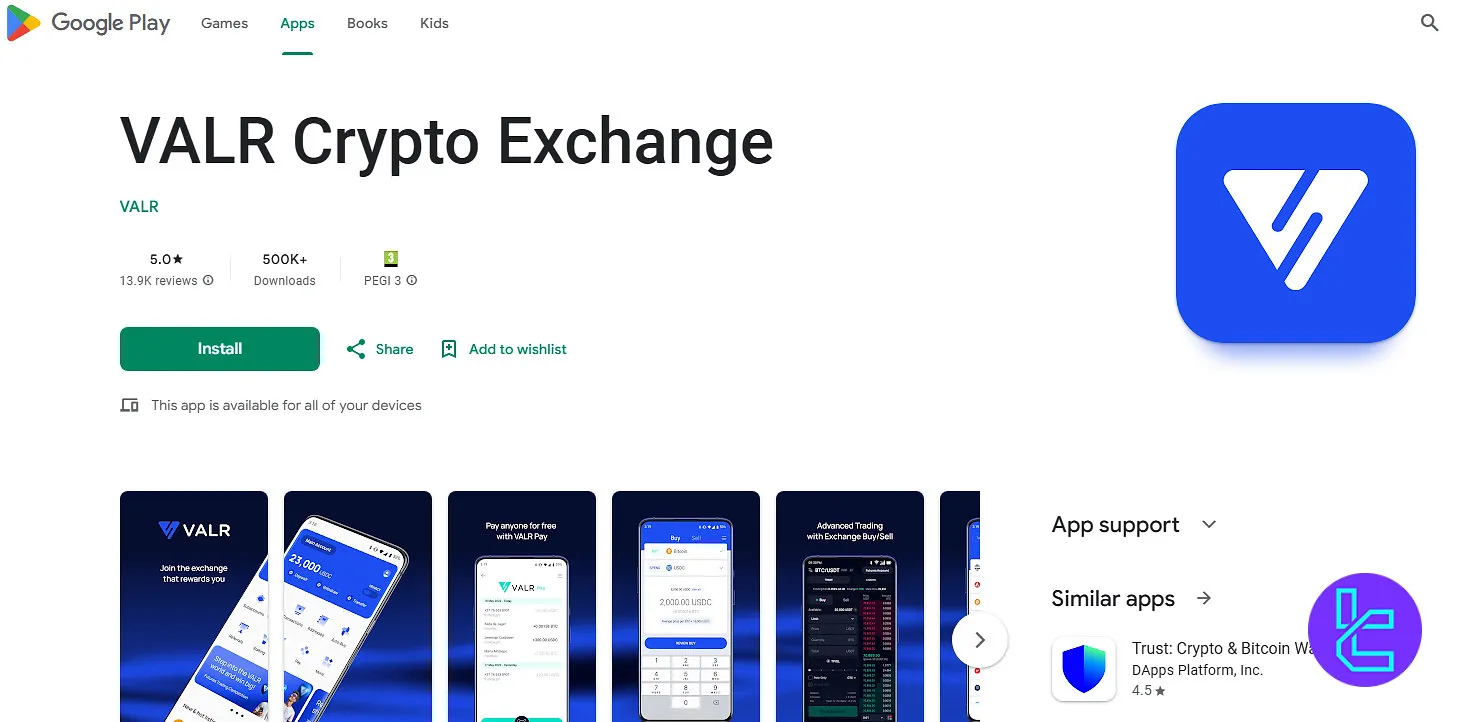

VALR App Download

In addition to a web-based platform with access to TradingView charts, the exchange offers a dedicated mobile application on various operating systems, including:

VALR Trading Volume

According to the VALR CoinGecko page over the past three months, VALR’s exchange has shown fluctuating but consistent activity, with daily volumes ranging between approximately $5 million and $45 million. The chart indicates sharp peaks and troughs, reflecting the dynamic nature of trading behavior on the platform.

- Highest spikes occurred in mid-June and mid-August, reaching close to the $45M mark;

- Lowest dips went down toward $5M, often following periods of high activity;

- Despite volatility, VALR has maintained a steady average range of $15M–$25M per day, highlighting a healthy liquidity environment and active user participation.

This trading pattern suggests that VALR continues to attract significant volume, making it a relevant player in the crypto exchange market.

VALR Services

In the table below, you can make sure your favorite trading services are available at VALR or not:

Service | Availability |

TradingView Integration | Yes |

Auto Trading (Bots) | No |

API Access | Yes |

P2P Trading | Yes |

OTC Trading | Yes |

Demo Account | No |

Launchpad | No |

NFT Marketplace | Yes |

Referral Program | Yes |

DEX Trading | No |

Auto-Invest (Recurring Buy) | No |

Is VALR Exchange Safe?

The company is licensed in multiple regions, including Europe, India, Dubai, South Africa, and Zambia.

In addition to a strong regulatory framework, VALR has implemented a multilayer protection system containing:

- Two Factor Authentication (2FA)

- White list (Crypto withdrawals to address book only)

- SSL Encryption

- Cold Storage

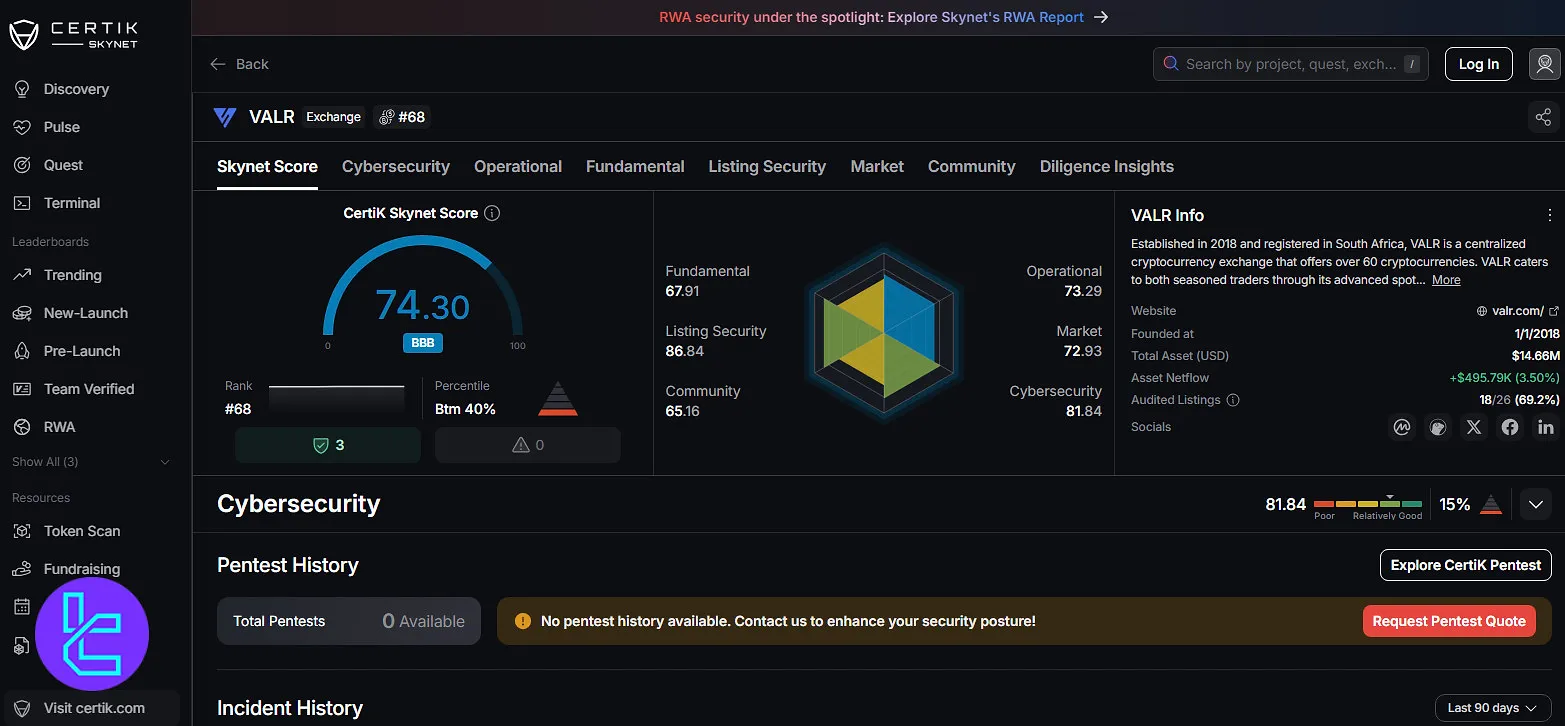

VALR Security Rankings

VALR has undergone a security assessment by CertiK Skynet, where it achieved an overall score of 74.30/100 (BBB rating).

This rating reflects balanced strengths across multiple categories, including a strong Listing Security score of 86.84 and a solid Cybersecurity score of 81.84.

According to the VALR CertiK Skynet review, operational and market resilience also performed well, though the Community score of 65.16 highlights room for improvement in user engagement and trust-building.

Overall, CertiK’s evaluation positions VALR as a reasonably secure exchange with some areas requiring further reinforcement.

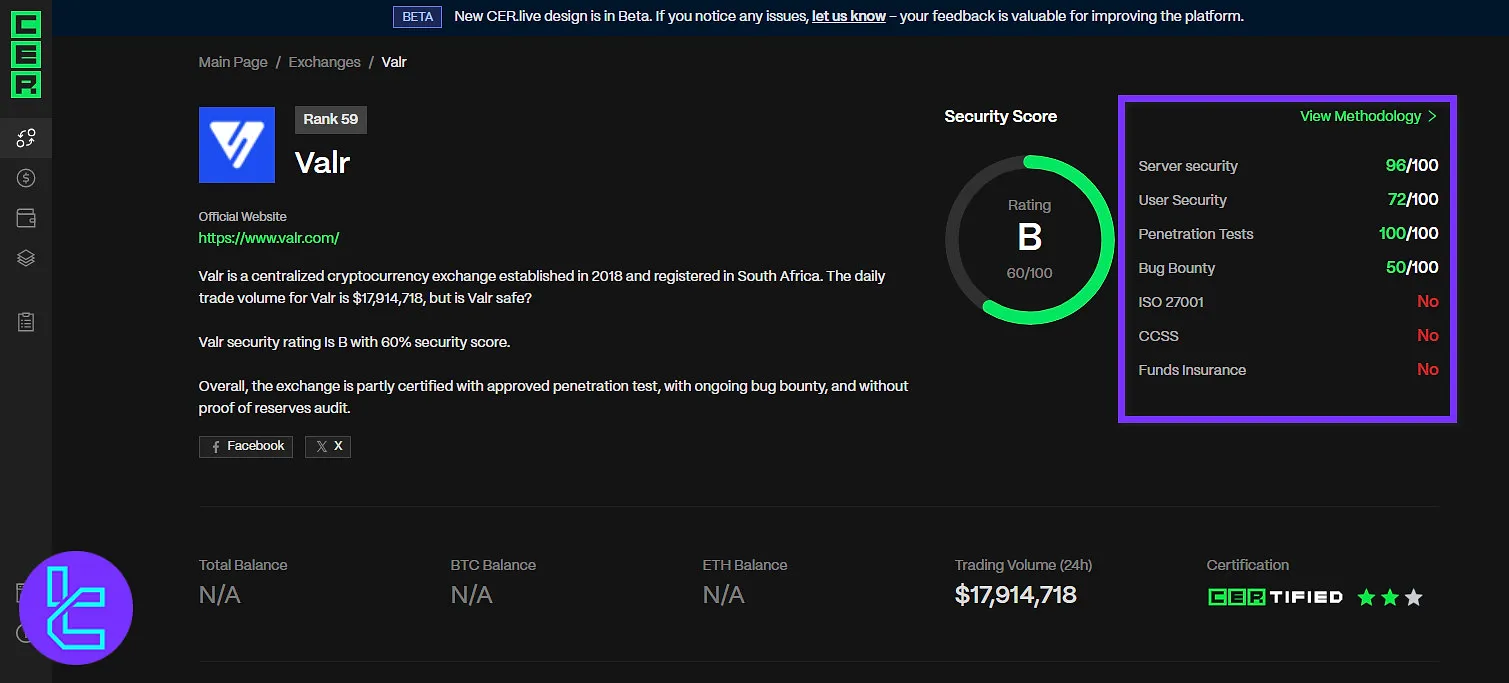

On the other hand, CER.live’s security review assigned VALR an overall rating of 60% (B grade).

Based on the VALR CER.live review, The platform excelled in Server Security (96/100) and achieved a perfect score in Penetration Tests (100/100), indicating strong technical safeguards.

However, its User Security (72/100) and Bug Bounty (50/100) scores suggest gaps in customer protection and vulnerability reporting mechanisms.

Additionally, the absence of ISO 27001 certification, CCSS compliance, and funds insurance places limitations on its overall safety framework compared to top-tier exchanges.

Category | Metric | Value |

CertiK Skynet Score | Overall Score | 74.30 / 100 (BBB) |

Fundamental | 67.91 | |

Operational | 73.29 | |

Listing Security | 86.84 | |

Market | 72.93 | |

Community | 65.16 | |

Cybersecurity | 81.84 | |

CER.live Score | Overall Score | 60% (B) |

Server Security | 96/100 | |

User Security | 72/100 | |

Penetration Tests | 100/100 | |

Bug Bounty | 50/100 | |

ISO 27001 | No | |

CCSS | No | |

Funds Insurance | No |

Payment Methods

The platform supports both fiat and crypto transactions for funding and withdrawals.

Whilebank transfer is the only option for fiat (ZAR) withdrawals, you can deposit EUR, USD, and ZAR through various options, including:

- USD: Wire and Swift

- EUR: Wire and SEPA

- ZAR: South African credit / debit cards and EFT

Crypto deposits are free, and the platform offers 30 free ZAR withdrawals per month with an R8.50 fee thereafter.

Deposits in fiat currencies are typically processed within 48 hours, while crypto deposits depend on blockchain confirmation speeds.

Importantly, there are no deposit fees charged by VALR, although network or bank-related fees may apply externally.

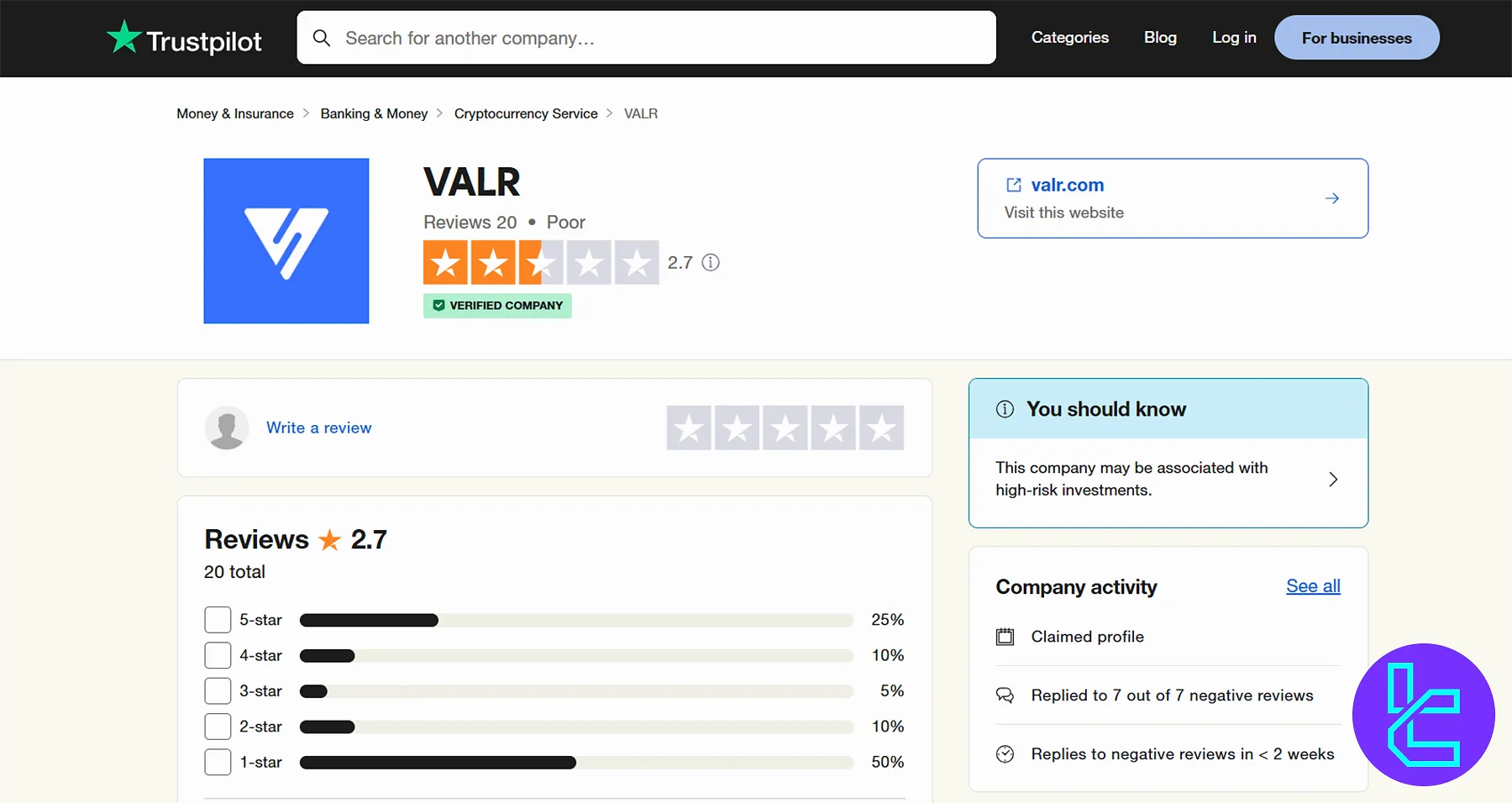

VALR Trust Score

Exploring the platform’s ratings on reputable websites like TrustPilot is one of the most important topics in this VALR review, which helps potential client to get feel of what they should be expecting.

2.7/5 based on 20 comments | |

Reviews.io | 2.0/5 based on 6 reviews |

CoinGecko | 6/10 |

Despite the wide range of services, user reviews paint a poor picture of the exchange. The most recurring subject in negative comments is withdrawal delay.

VALR Features

The table below lists the most important extra features found in the exchange:

Features | Availability |

Staking | Yes |

Yield Farming | No |

Social Trading | No |

Liquidity Pool | No |

Gift Card | No |

VALR Promotions

VALR provides bonuses with a focus on Futures and a Referral program. Here are the details:

Promotion | Period | Key Requirement | Reward Highlights |

First Futures Trade (Extended) | Aug 1 – Sep 7, 2025 | First Futures trade ≥ $50; fully verified | Mystery Gifts (up to 200 USDT or fee discounts up to 500 USDT); weekly top trader 100 USDT bonus |

Referral Program | Ongoing | Invite friends, verified | Rebates and commissions up to 30%, uncapped |

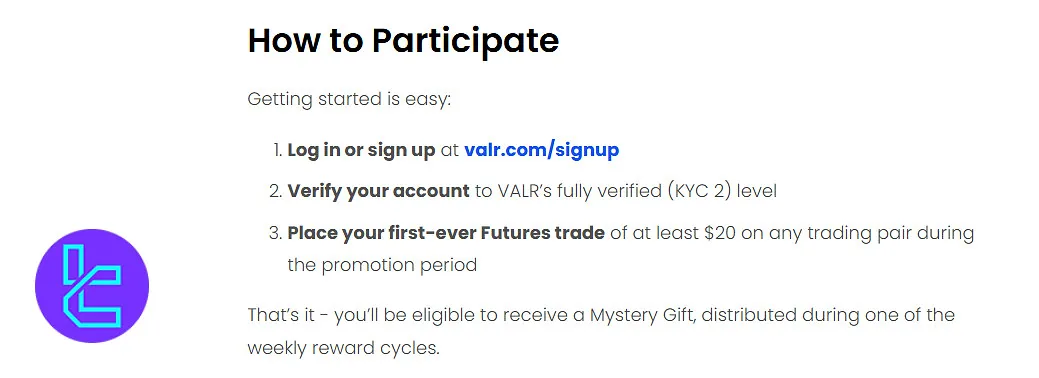

First Futures Trade Promotion

VALR is encouraging fully verified users to try out Futures trading for the first time with a special rewards campaign. To qualify, you must be KYC Level 2 verified and place your first Futures trade of at least $50 during the promotion period.

Rewards:

- Mystery Gifts: Crypto rewards of up to 200 USDT and futures trading fee discounts up to 500 USDT;

- Weekly Top Trader Prizes: The top 3 new Futures traders each week (who reach at least $10,000 in trading volume) receive 100 USDT each;

- Distribution: Mystery gifts are credited within 7 South African business days after the weekly cycle. Fee discounts are applied between September 8–15, 2025 and remain active afterward.

Referral Program

The referral program is VALR’s permanent bonus system for growing its user base. By inviting friends to join VALR and complete verification, you can earn rebates and commissions indefinitely.

Rewards:

- Trading Fee Rebates: Save up to 15% on your own trading fees depending on your referral level;

- Commissions on Referrals: Earn up to30% commission from the trading fees your referrals generate;

- Unlimited Earnings: No cap on how many people you can invite or how much you can earn.

VALR Customer Support

The exchange provides 24/7 support through its chatbot, a comprehensive help center, and a ticket system. However, the lack of a live chat feature and a hotline can be a letdown for potential clients.

- VALR email address: help@valr.com

Growth Plans and Copy Trading on VALR Exchange

While the platform doesn’t offer a dedicated copy trading service, it provides 2 earn programs, including Staking and Lending, with the following key features:

- Lend your assets (e.g., ZAR, BTC, ETH, USDT, and USDC) and earn up to 67% APR;

- Stake Solana (SOL), Avalanche (AVAX), TRON (TRX), and other cryptocurrencies and benefit from returns of up to 6%.

The exchange has implemented a referral program and rewards its affiliates with commissions of up to 30%. It also hosts seasonal trading competitions, such as Futures Trade Arena, which offers up to 120K USDT in rewards.

What Countries Does VALR Support?

While the exchange strives to serve a global clientele, its regulatory framework and local laws prevent it from operating in certain jurisdictions, including:

- Canada

- Cuba

- India

- Iran

- Kazakhstan

- North Korea

- Russia

- Somalia

- Sudan

- South Sudan

- Syria

- Ukraine

- United States of America

VALR Evaluated Against The Competition

The table in this section compares the exchange to its peers in several significant factors:

Parameters | VALR Exchange | Binance Exchange | OKX Exchange | LBank Exchange |

Number of Assets | 75 | 400+ | 7800+ | 700+ |

Maximum Leverage | 1:10 | 1:125 | 1:12 | 1:125 |

Minimum Deposit | ZAR 0.0, $10, €1 | $1 | N/A | Varies by Cryptocurrency |

Spot Maker Fee | 0% | 0.02% - 0.1% | -0.01% - 0.14% | 0.02% |

Spot Taker Fee | 0.05% | 0.04% - 0.1% | 0.03% - 0.23% | 0.02% |

Mandatory KYC | Yes | Yes | Yes | No |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

VALR provides access to Crypto Spot, Futures, and Margin trading with leverage options of up to 1:10 and 0.0% maker fees. The exchange accepts EUR, USD, and ZAR deposits via SEPA, Swift, and South African credit cards.

Despite the variety of services and a global clientele (more than 1M users), there are many negative VALR reviews on TrustPilot, gaining the platform a score of 2.7/5.