Crystal Ball Markets allows you to trade Digital Options on 160+ financial instruments, including EUR/USD, S&P 500, WTI, Gold, Cocoa, and BTC. The maximum leverage option of 1:1000 is available with a minimum deposit of $50.

Crystal Ball Markets (Company Information)

Crystal Ball Markets has emerged as a prominent player in the online trading arena, boasting over 15 years of experience in the financial markets. Initially focused on private portfolio and wealth management, the company expanded its offerings to the public in 2020 by launching its brokerage services.

Registered in St. Vincent and Grenadines and regulated by FSA (262 LLC 2020) and FINTRAC (M21983070), the broker offers some of the best trading conditions on Binary Options. Key features of Crystal Ball Markets:

- Tightspreads from 0.0 pips

- Partnered with regulated top-tier liquidity providers

- 24/7 customer support

- Fast executions

- Options trading on various markets

- Shares of more than 40 companies

- Brent, WTI, and Natural Gas trading

- Access to metals (e.g., Gold and Silver) and agricultural commodities (e.g., Cocoa and Coffee)

- Digital Options, including High/Low, Up/Down, and Call/Put

- Crypto trading on major tokens, such as BTC, ETH, LTC, and DOGE

Crystal Ball Markets Broker Table of Specifications

Segregated accounts, various payment methods, demo accounts, and over 160 tradable instruments are some of the features Crystal Ball Markets has provided to smooth your trading journey.

Broker | Crystal Ball Markets |

Account Types | ECN PRO, Standard, Micro |

Establishment Year | 2020 |

Trading Platforms | Mobius Trader 7 |

Maximum Return | 70% |

Minimum Deposit | $50 |

Base Currencies | USD |

Deposit Methods | VISA, MasterCard, Perfect Money, Crypto, Bank Transfer |

Withdrawal Methods | VISA, MasterCard, Perfect Money, Crypto, Bank Transfer |

Minimum Trade Amount | $1 |

Maximum Trade Amount | unlimited |

Tradable Assets | 160+ |

Investment Options | Social Trading, Copy Trading |

Bonus | Affiliate Program |

Spreads | Floating from 0.0 pips |

Commission & Fees | N/A |

Maximum Leverage | 1:1000 |

Affiliate Program | Yes |

Trading Features | Charting tools, Economic Calendar, Market Insights |

Inactivity Fee | $5 |

Customer Support Ways | Email, Live Chat, Phone |

Customer Support Hours | 24/7 |

Crystal Ball Markets Binary Broker Account Offerings

The Binary Options broker caters to novice and seasoned traders with its diverse account offerings. The broker also allows use of EAs, scalping, and news trading. Key features of Crystal Ball Markets accounts:

Features | Micro | PRO ECN | Standard |

Business Model | STP | ECN | ECN |

Min Deposit | $50 | $1,000 | $300 |

Min Order Size | 0.0001 lot | 0.0001 lot | 0.0001 lot |

Maximum Leverage | 1:1000 | 1:500 | 1:500 |

Execution | Market | Market | Market |

Markets and Instruments | Cryptocurrencies, Forex, Stocks, Energies, Metals, Commodities | Cryptocurrencies, Forex, Stocks, Energies, Metals, Commodities | Cryptocurrencies, Forex, Stocks, Energies, Metals, Commodities |

Trading Platform | Crystal Ball Markets Platform | Crystal Ball Markets Platform | Crystal Ball Markets Platform |

Special Features | Spread from 1.9 pips | Spread from 0 pips | Spread from 1.2 pips |

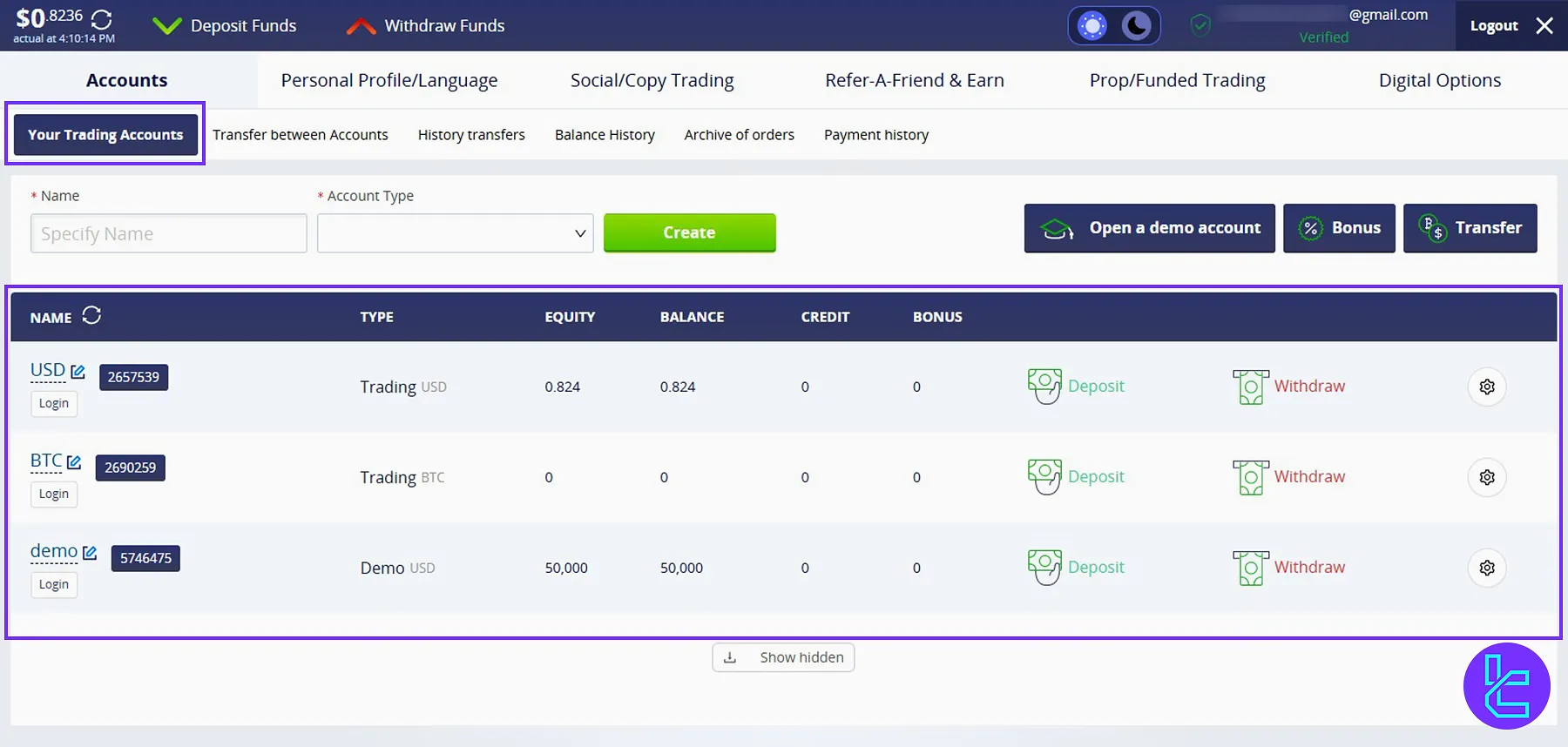

Demo Account

The binary broker provides access to a demo environment, similar to most of its peers. The account works exactly like the real trading terminal, with the only difference being the virtual funds instead of actual.

At first, 50,000 of these funds are available for the trader, but it is possible to recharge them as much as desired.

How Can I Open a Crystal Ball Markets Account and Verify It?

To enjoy trading with floating spreads from 0 pips and benefit from 24/7 support, you need to open an account with the broker. Crystal Ball Markets registration process:

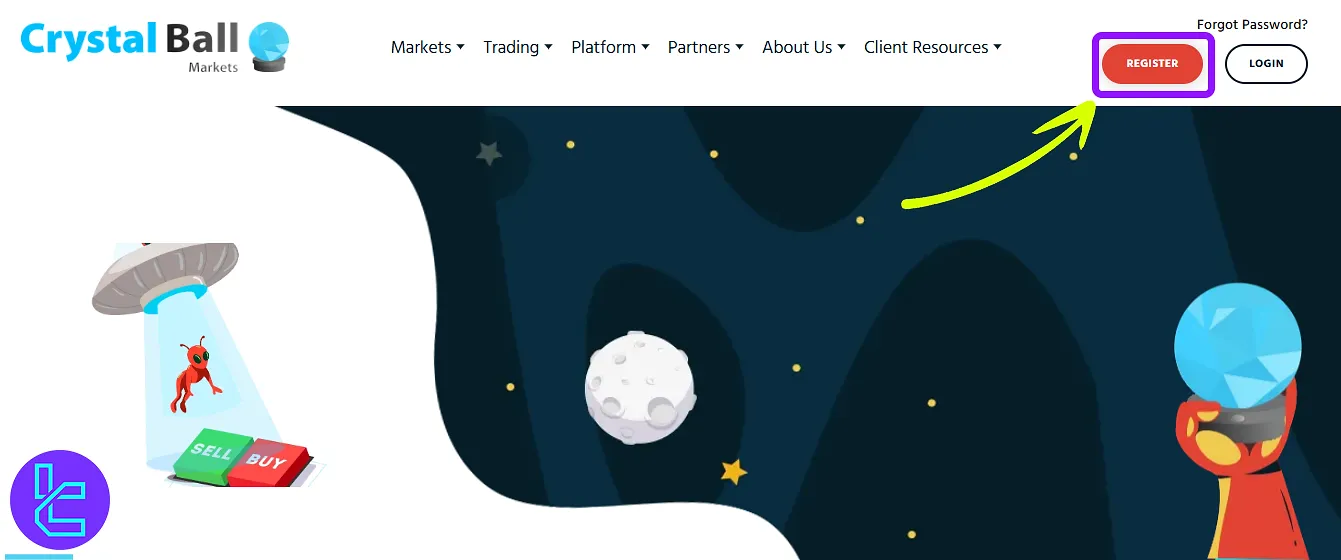

#1 Visit the Crystal Ball Markets Platform

Enter the official Crystal Ball Markets broker and hit the "Register" button to begin.

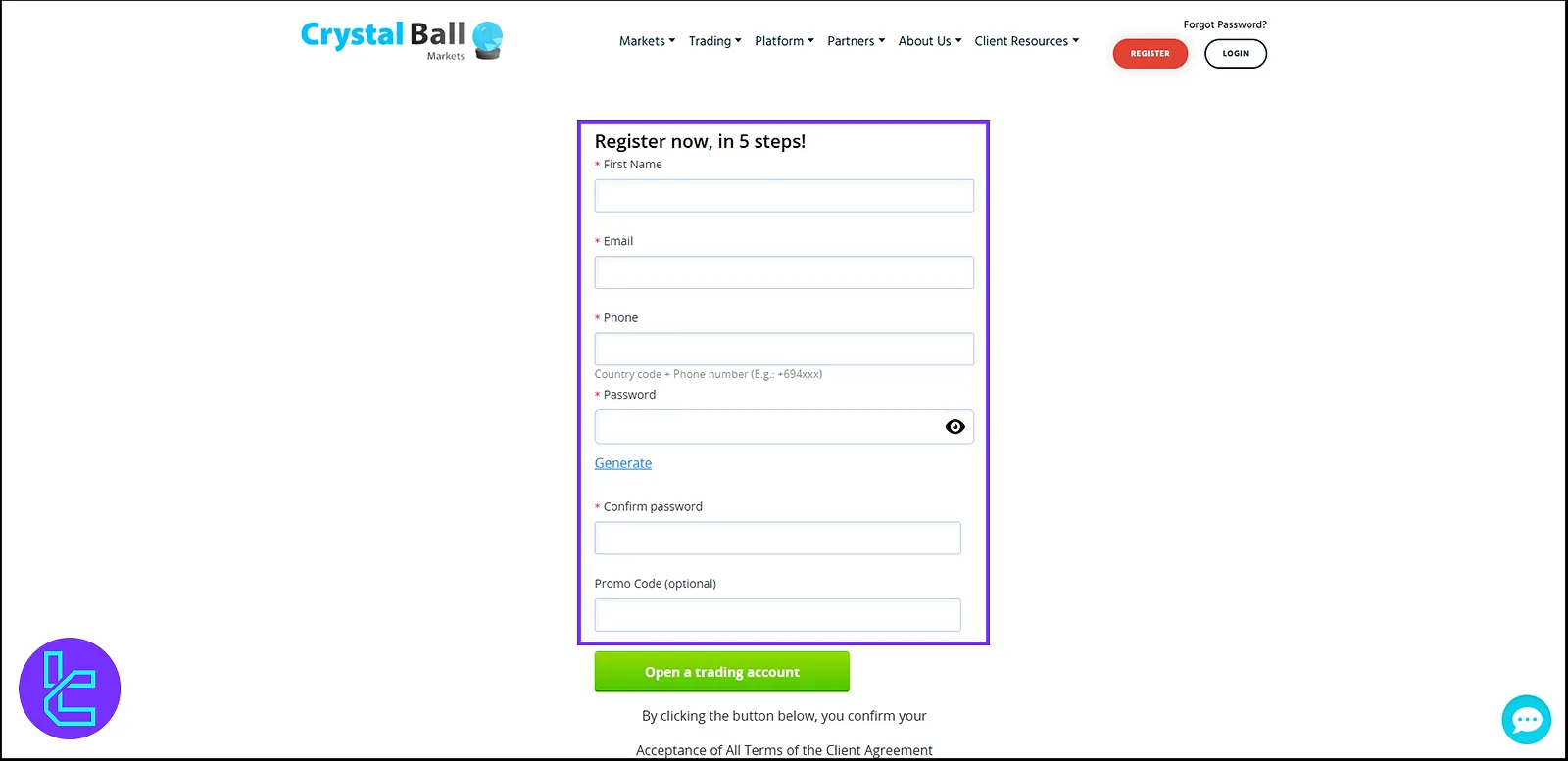

#2 Fill Out the Sign-Up Form

Enter your name, phone number, email address, and other requested details. Submit the form to proceed to the next step.

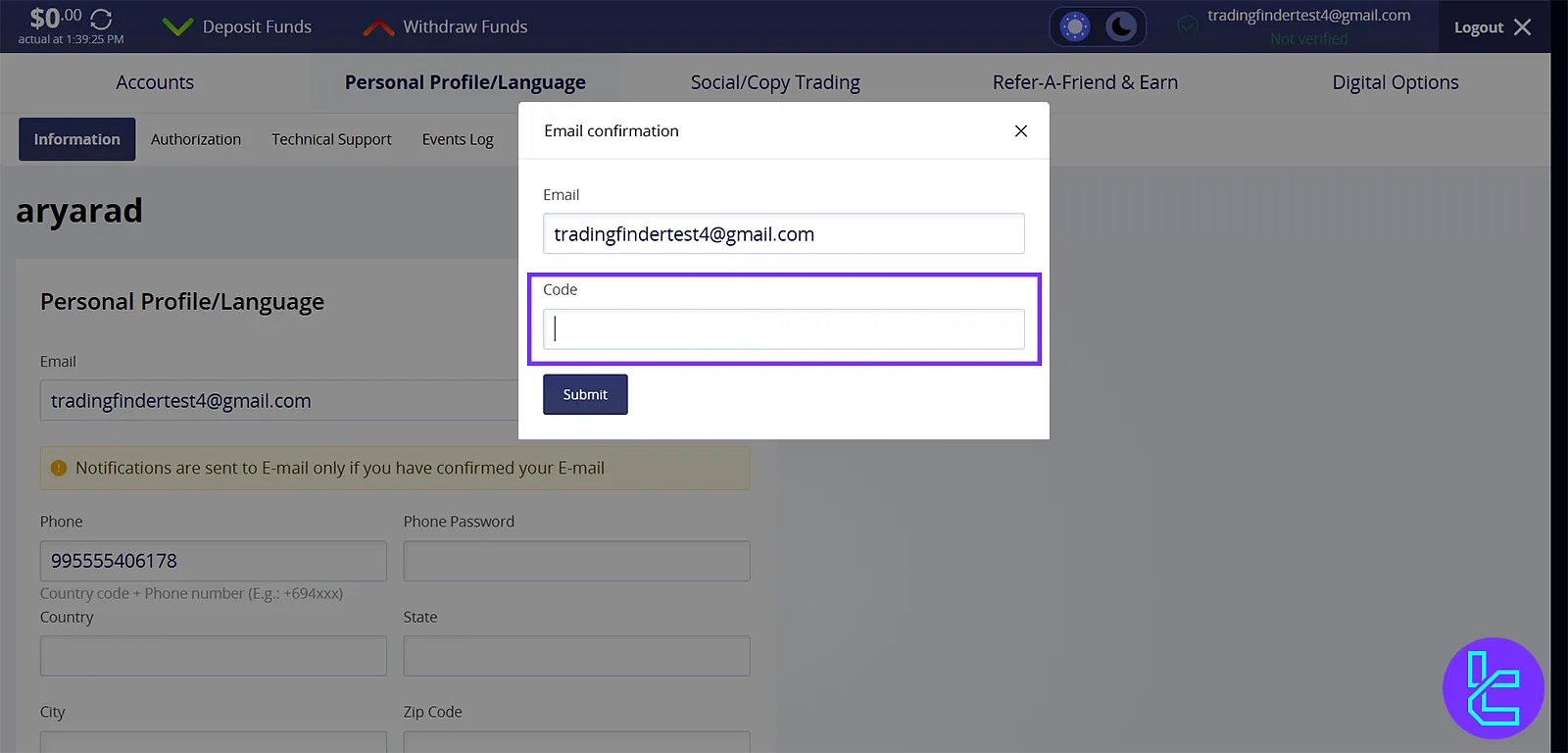

#3 Verify Your Email

Access your inbox and open the email from Crystal Ball Markets. Copy the verification code and paste it into the confirmation box within your profile settings. Submit to activate your account.

Next, you must verify your account. To help you complete this process using your ID card, driver's license, or passport, check the Crystal Ball Markets verification.

Crystal Ball Markets Bonus and Promotion

Currently, the broker offers three different types of bonuses to all its traders:

| Bonus Type/Title | Amount/Reward | Description |

| Trading Contest | Cash Prizes | 31-day Free and paid contests |

| Deposit Bonus | Up to 100% | Requires a minimum deposit of $50 |

| Free Rewards | Up to $50 | Community-based tasks |

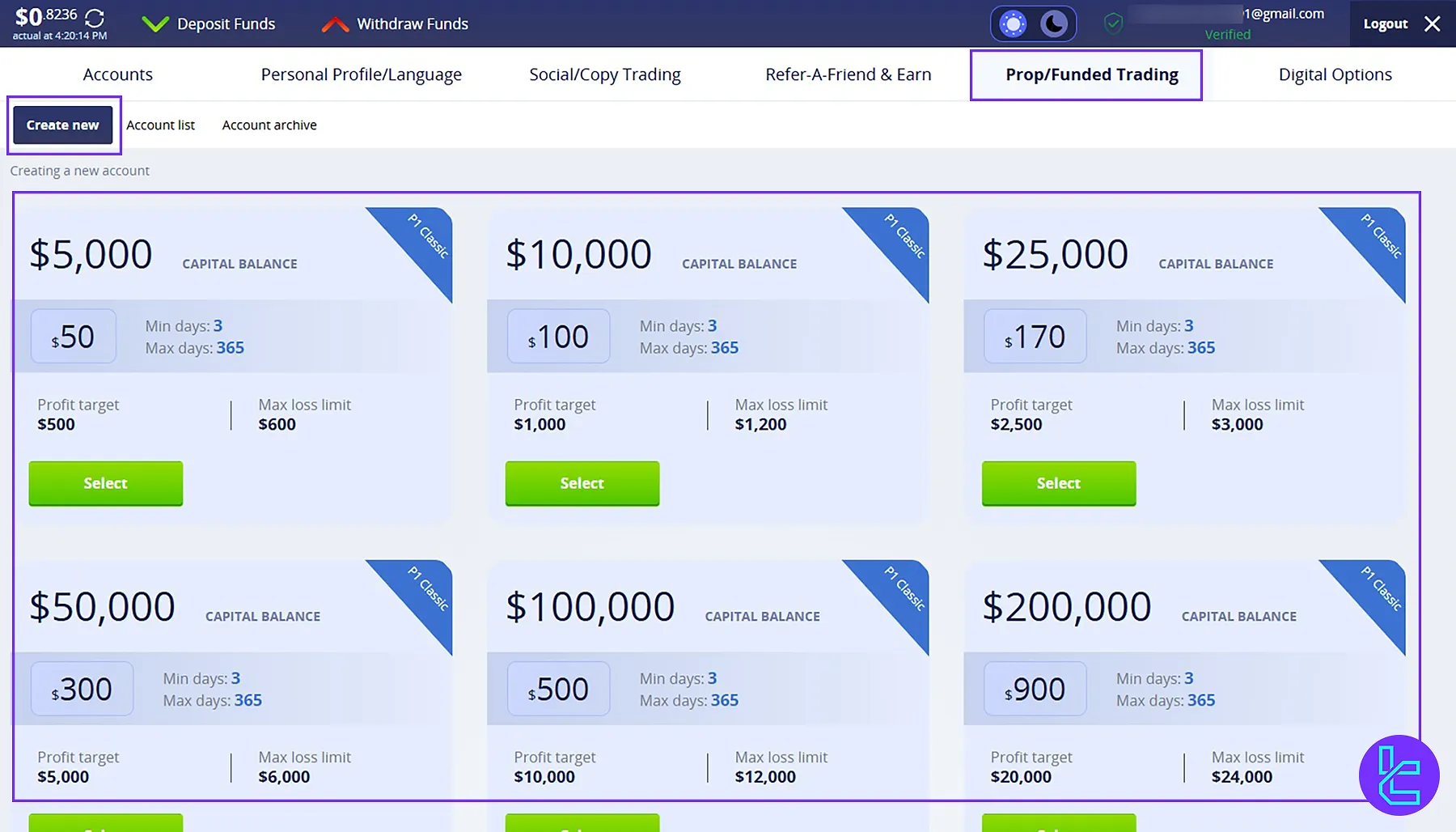

Trading Contest

The binary broker provides access to trading challenges similar to those found in prop trading firms. There are set rules and conditions with both types of free and paid access. The maximum duration is 31 days.

Deposit Bonus

CBM claims to offer up to 100% deposit bonus on every deposit made into the real account on the platform. The deposit must be $50 or more.

Free Rewards

Clients can earn rewards without making any deposits on the platform. Crystal Ball Markets makes it possible by engaging traders in community-based tasks.

The rewards are provided in the form of credits up to $50 in the trading account, and the porifts are withdrawable.

What are the trading costs on Crystal Ball Markets Binary Broker?

Understanding the cost structure helps you to maximize your profits. The broker charges no fees on deposit/withdrawal and there is no information available about commission; That only leaves spreads. Crystal Ball account types’ spreads:

Micro | From 1.9 pips |

PRO ECN | From 0 pip |

Standard | From 1.2 pips |

Crystal Ball Markets Trading Platform

Crystal Ball Markets offers a powerful web-based trading interface, giving traders instant access to over 160+ financial instruments. From advanced technical indicators and drawing tools to multi-asset charting and a real-time economic calendar, the platform combines ease of use with analytical depth.

Mobius Trader 7, the Crystal Ball Markets trading platform, will be investigated in the following sections.

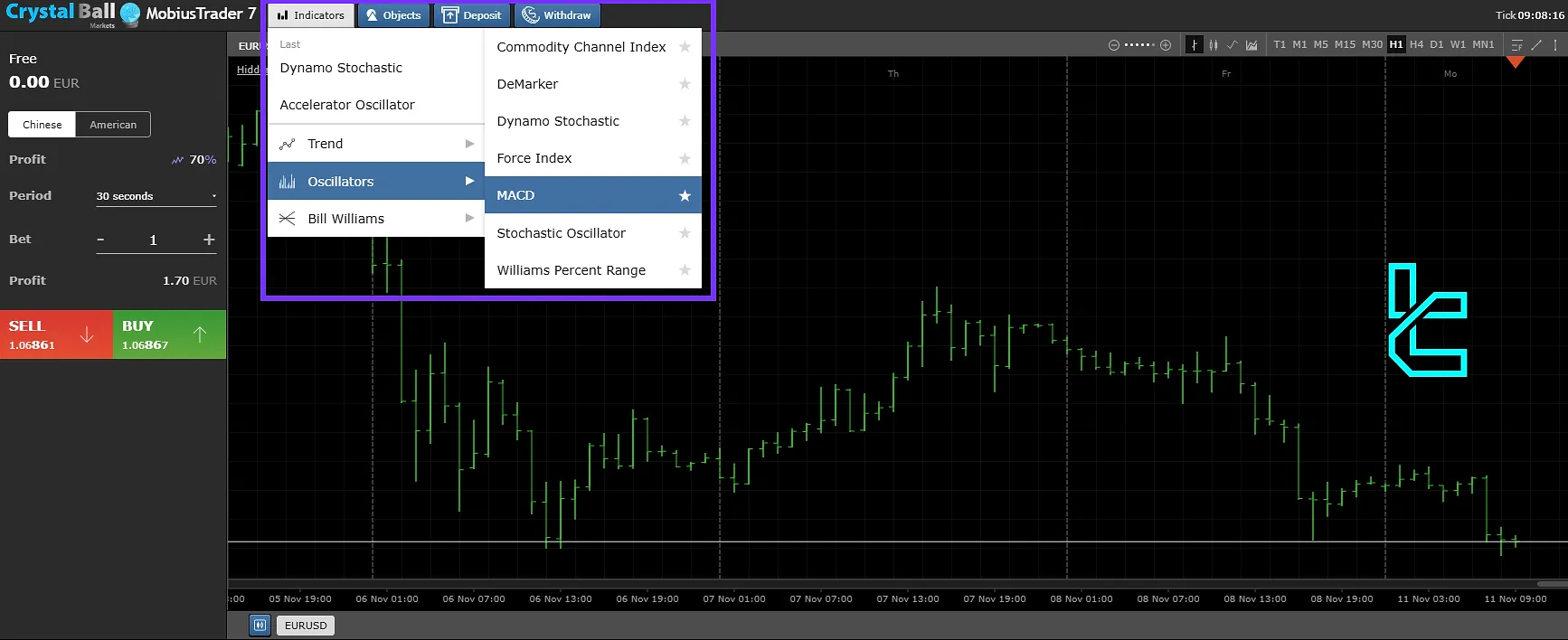

Interactive Charting Tools and Indicators

Access a wide range of indicators, including MACD, RSI, and Moving Averages, directly from the top menu. Also, the “Objects” section houses customizable drawing features for trendlines, bands, and overlays.

Asset Selection via Symbol Tab

Browse through all supported markets using the Symbols section. Traders can switch between currency pairs, commodities, and other instruments with one click.

Trading Execution and Bet Management

The Trading Panel, located on the left side, is your command center. Here, you can monitor your account balance, set investment amounts, define expiry times, and predict price movement—up or down—for binary options trades.

Trading History and Performance Logs

Completed trades are logged in the Options History tab. Each entry includes vital data like entry point, expiry time, and final outcome.

Chart Customization and Timeframe Control

Adjust timeframes from 1-minute to 1-month views and personalize chart layouts using the controls in the upper-right panel. This flexibility supports both scalping and long-term trading strategies.

Economic Calendar and Market Timing

Plan entries and exits around key financial events with the integrated economic calendar. This feature helps traders align with market sentiment and global macro trends.

Grid View for Multi-Asset Analysis

Use the Grids function to monitor multiple assets simultaneously. Ideal for comparative analysis or managing several positions across different markets.

Crystal Ball Markets Personal Cabinet Features

Crystal Ball Markets dashboard is a multi-functional client cabinet structured into six primary sections. This dashboard grants traders complete access to tools like fund transfers, copy trading, verification, account archiving, and prop-funded trading, all from one centralized workspace.

Trading Account Management

Handle all aspects of financial operations, from real-time balance updates to inter-account transfers, payment logs, and archived orders. The system ensures full transparency for your withdrawals, deposit history, and internal fund movements.

Personal Settings & Security Controls

Manage your profile, update personal info, and configure2FA authorization, notifications, and identity verification. This section also includes access to your event logs and direct technical support.

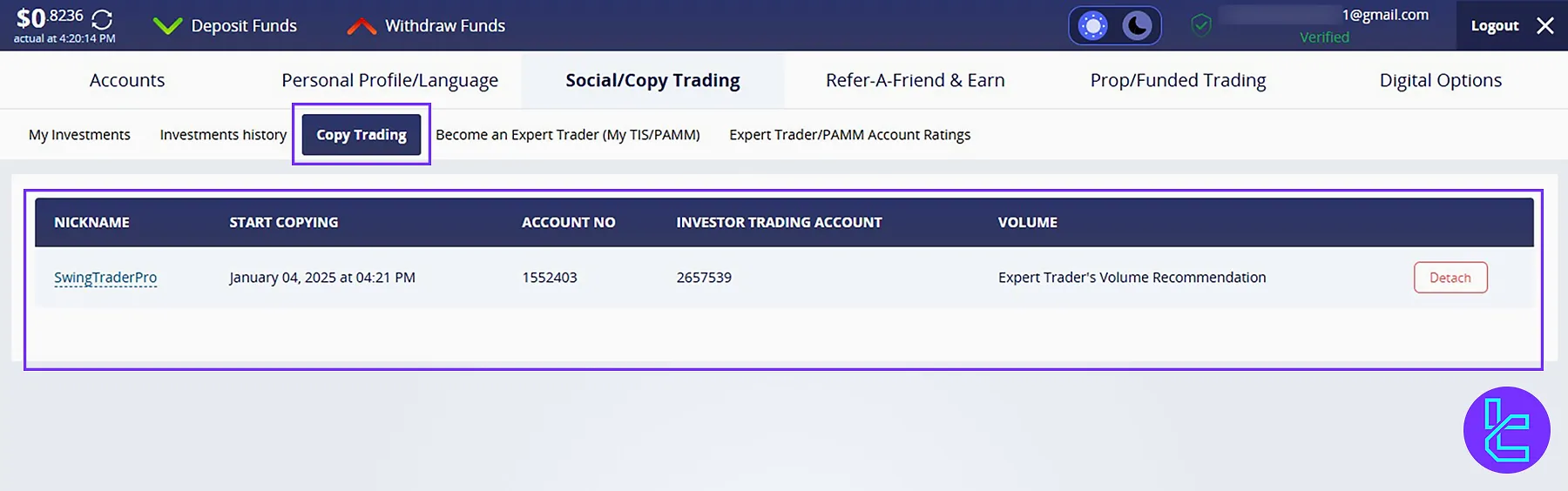

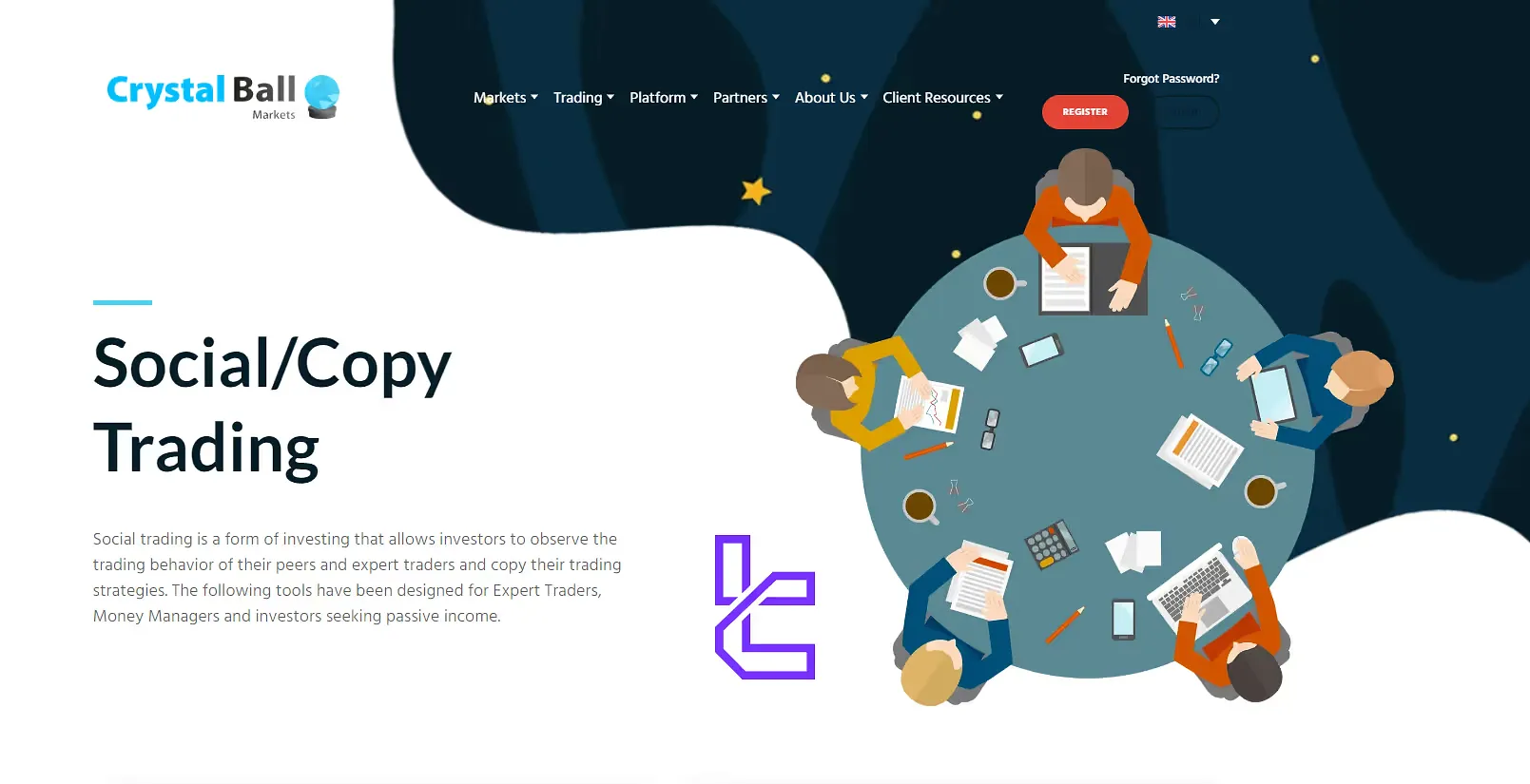

Copy & Social Trading Tools

Monitor your portfolio via My Investments, review your investment history, or replicate expert strategies through Copy Trading.

Qualified traders can activate a PAMM account, rank in the Expert Trader Leaderboard, and earn through follower activity.

Referral & Promo Program

Invite users and monetize your reach. Generate promo codes, manage your referrals, and track earnings from users who join via your affiliate link.

Proprietary Trading Accounts

Apply for funded trading challenges, view live prop accounts, and access historical performance via the account archive. This section is designed for traders aiming to trade capital without risking personal funds.

Digital Options Terminal

Engage in digital options trading with structured management for positions, contracts, and results tracking. This space serves as your hub for speculative trading using binary-style contracts.

Crystal Ball Markets Mobile App

The Mobius Trader 7 mobile platform blends speed, flexibility, and full-spectrum market access. Fromcurrencies to cryptocurrencies, it empowers users to execute diverse strategies with real-time insights, AI-powered automation, and institutional-grade features.

Intelligent Tools & Technical Analysis

Utilize built-in indicators, economic event overlays, and margin/tick price previews directly on charts. Advanced functions like order locking, reverse trades, and partial closures support active and precision-based strategies.

Integrated Web & Scripting Support

Access full desktop-level functionality via web and mobile. Deploy custom strategies using JavaScript-based AI algorithms, offering flexibility for coders and algo traders.

Transparency by Design

Experience pure-market execution with zero slippage, no dealing desk, and no manipulative interventions. This infrastructure ensures clean conditions for testing and scaling your trading systems.

Available Indicators and Oscillators on Crystal Ball Markets Trading Platform

Mobius Trader 7 is Crystal Ball Markets trading platform. While offering a new platform is attractive, we should check if it's up to the task to compete with top trading solutions, like MT4 and MT5.

One of the most important things to check in Crystal Ball Markets review is the availability of various Indicators and Oscillators, since each trader has different strategies. Make sure that your required tools are present. Crystal Ball Indicator offerings:

- Trend: Bollinger Bands, Ichimoku Kinko Hyo, Moving Average, Parabolic SAR

- Oscillators: Commodity Channel Index, DeMarker, Dynamo Stochastic, Force Index, MACD, Stochastic Oscillator, Williams Percent Range

- Bill Williams: Accelerator Oscillator, Alligator, Fractals, Awesome Oscillator

Crystal Ball Markets Trading Assets

The binary options broker provides a relatively long list of tradable fiancial instruments from six categories:

- Forex Market: EURUSD, USDCAD, CADCHF, and others

- Crypto: Popular digital assets

- Commodities: Agricultural products, etc.

- Metals: Gold and Silver

- Stocks: Boeing, Intel, Nike, and other companies

- Energies: Oil and gas

Supported Payment Methods on Crystal Ball Markets

Supporting a wide range of funding options is essential for a provider of trading services. Crystal Ball payment methods:

| - | Currency | Deposit Processing Time | Withdrawal Processing Time |

VISA | USD | Instant | 3-10 Business Days |

MasterCard | USD | Instant | 3-10 Business Days |

Perfect Money | USD | Instant | 24 hours |

Crypto | BTC, USDT, BCH, LTC, DASH, XRP, ETH | Instant | 24 hours |

Bank Transfer | USD | 3-10 Business Days | 3-10 Business Days |

Does Crystal Ball Markets Provide Copy Trading and Social Trading Services?

We should explore the possibility of earning passive income in the Crystal Ball markets review. Traders can use MAM and PAMM accounts through the Crystal Ball Markets Copy Trading feature.

- MAM (Multi Account Manager): The master can trade with his/her own funds and the followers’;

- PAMM (Percentage Allocation Master Module): The expert trader’s movements are replicated in your account.

Crystal Ball Markets Advantages and Disadvantages

While the broker offers attractive leverage options of up to 1:1000, its profit return rate is lower than the industry average.

Pros | Cons |

High leverage option (up to 1:1000) | High minimum deposit ($50) |

Wide range of tradable assets (160+) | Lower leverage options on PRO ECN and Standard accounts |

Various payment methods | An inactivity fee of $5 |

Competitive spreads from 0.0 pips | Lack of tier-1 licensing |

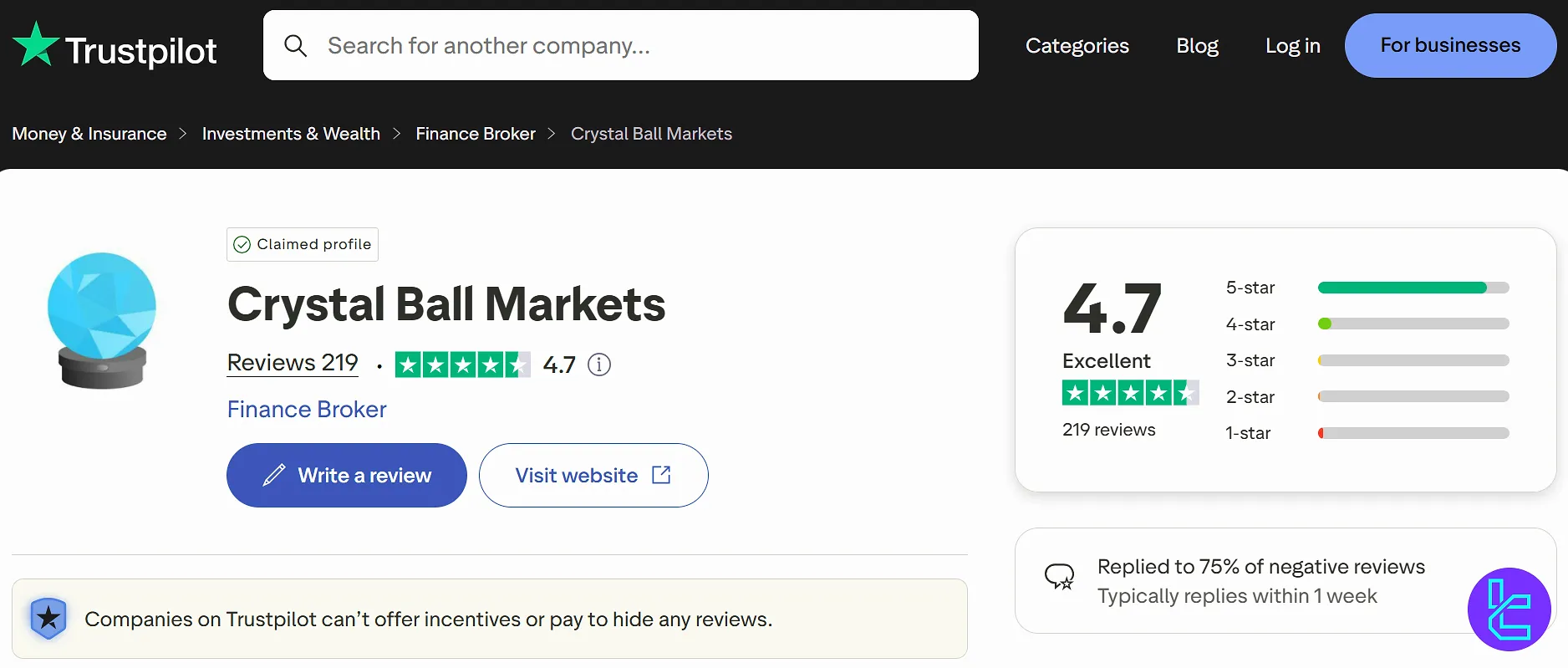

Crystal Ball Markets Binary Broker in Review Sources

Checking trust scores is an important part of Crystal Ball Markets review. The broker’s ratings paint rather a mixed picture. The firm’s trust scores:

4.7 out of 5 | |

Forex Peace Army | 2.1 out of 5 |

Many traders praise the platform's functionality, responsive customer support, and efficient withdrawal processing. While, some reviews note the broker's relatively new presence and limited regulatory oversight compared to more established firms.

Crystal Ball Markets Broker Customer Support

Customer support is a critical aspect of any trading platform, and Crystal Ball Markets emphasizes its commitment to assisting traders at every step of their journey 24/7.

support@Crystal Ball Markets.com | |

Phone | +44 1244 94 1257 |

Address | Suite 305, Griffith Corporate Centre, Beachmont, Kingstown. St. Vincent and the Grenadines |

Live Chat | Through the official website |

Crystal Ball Markets Restricted Regions

Check out the list in this section before registering with the binary broker to ensure you are eligible to open an account according to the restrictions policy. CBM Banned Countries:

- Afghanistan

- Canada

- Cuba

- Syria

- Iran

- Iraq

- And other regions

Comparison of Crystal Ball Markets with Other Binary Brokers

The table below helps you better understand how Crystal Ball Markets compares to other binary option brokers.

Parameters | Crystal Ball Markets | Tradonex Binary | |||

Establishment Year | 2020 | 2017 | 2019 | 2014 | 2020 |

Maximum Return | 70% | 90%+ | 98% | Up to 93% | 98% |

Minimum Deposit | $50 | $5 | $10 | $10 | $100 |

Minimum Trade amount | $1 | $1 | $1 | $1 | $0.01 |

Number of Trading Assets | over 160 | Over 100 | Over 400 | Over 100 | Not Specified |

Bonus | Affiliate Program | Welcome Bonus, First Deposit Bonus, No Deposit Bonus, YouTube Video Contest | Welcome Bonus, deposit bonus, risk-free trade, loyalty program, seasonal promotion | Deposit Bonus | 20%, 50%, and 100% Deposit Bonus |

Maximum Leverage | 1:1000 | 1:1000 | 1:1 | 1:500 | Not Specified |

Inactivity Fee | $5 Per Month | No | No | $10 Per Month | No |

Writer's Opinion and Conclusion

Crystal Ball Markets provides trading services through Mobius Trader 7 (MT7) with access to various Indicators, including Bollinger Bands, Ichimoku Kinko Hyo, Moving Average, and MACD. The binary broker has gained a great score of 4.7 on TrustPilot.