The Finteria Verification process requires signing the client Agreement, uploading an ID card or Passport, and taking a selfie while holding the identity document beside your face.

Completing the Finteria KYC grants traders’ access to real trading on 50 instruments with a minimum trade size of just $1.

In addition, users can benefit from social trading features and leverage of up to 1:500 for a more flexible trading experience.

Typically, this process can be completed in 1 business day.

Key Steps to Finteria Verification

Verifying your account in Finteria Binary Broker is done in 4 steps; Finteria KYC Process:

- Deposit Funds

- Access the verification section in the Profile

- Sign the Client Agreement

- Submit the required ID documents and send a Selfie with the identity document

Before we go through the steps, you can check the table below to see the requirements needed to complete this process.

Verification Requirement | Yes/No |

Full Name | Yes |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | No |

ID Card (for POI) | Yes |

Driver’s License (for POI) | No |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | No |

Utility Bill (for POA) | No |

Bank Statement (for POA) | No |

2-Factor Authentication | No |

Biometric Face Scan | Yes |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

#1 Deposit Funds to Finteria

- Navigate to the deposit section of your profile

- Choose a payment method and deposit the required amount

For detailed steps, you can check out Finteria Deposit and Withdrawal.

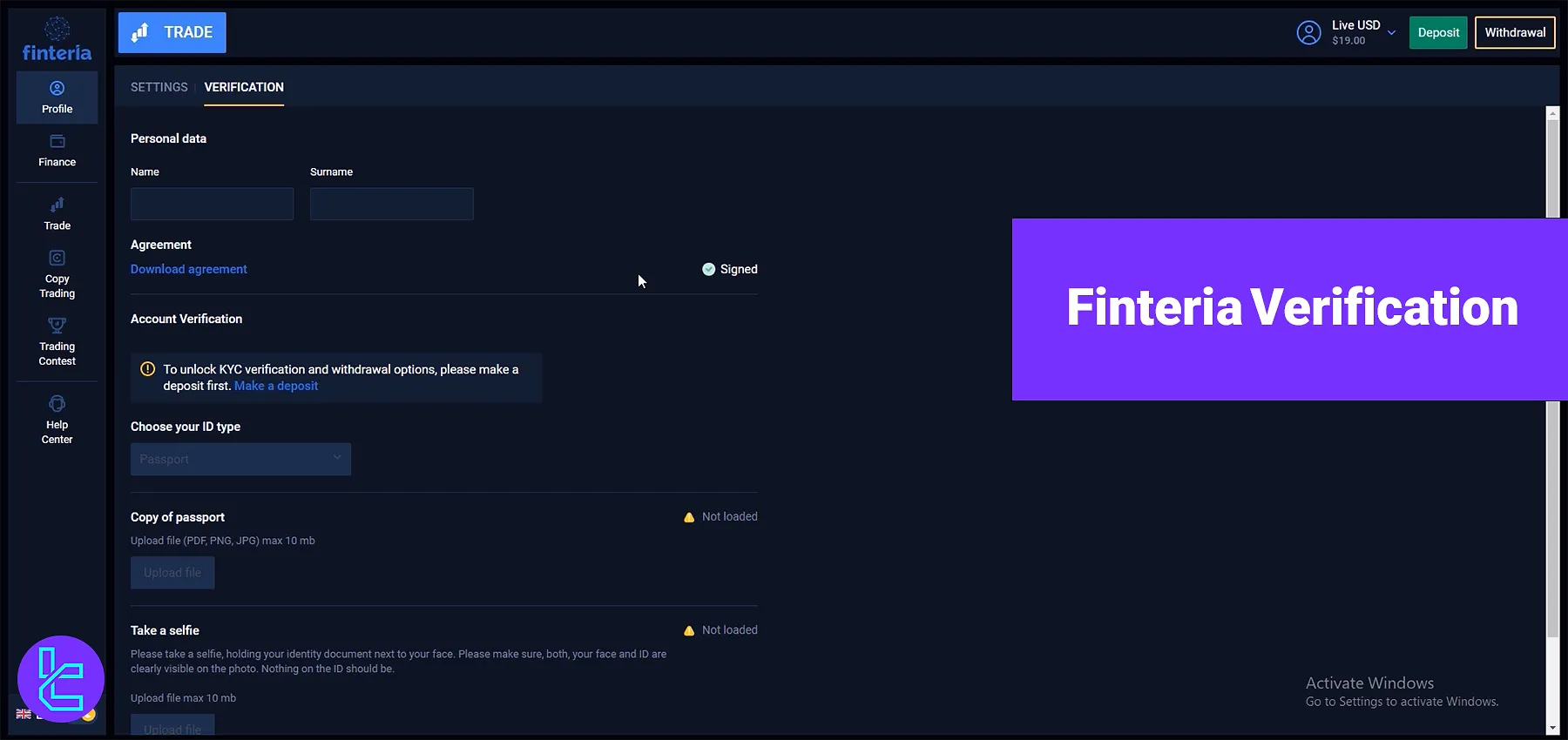

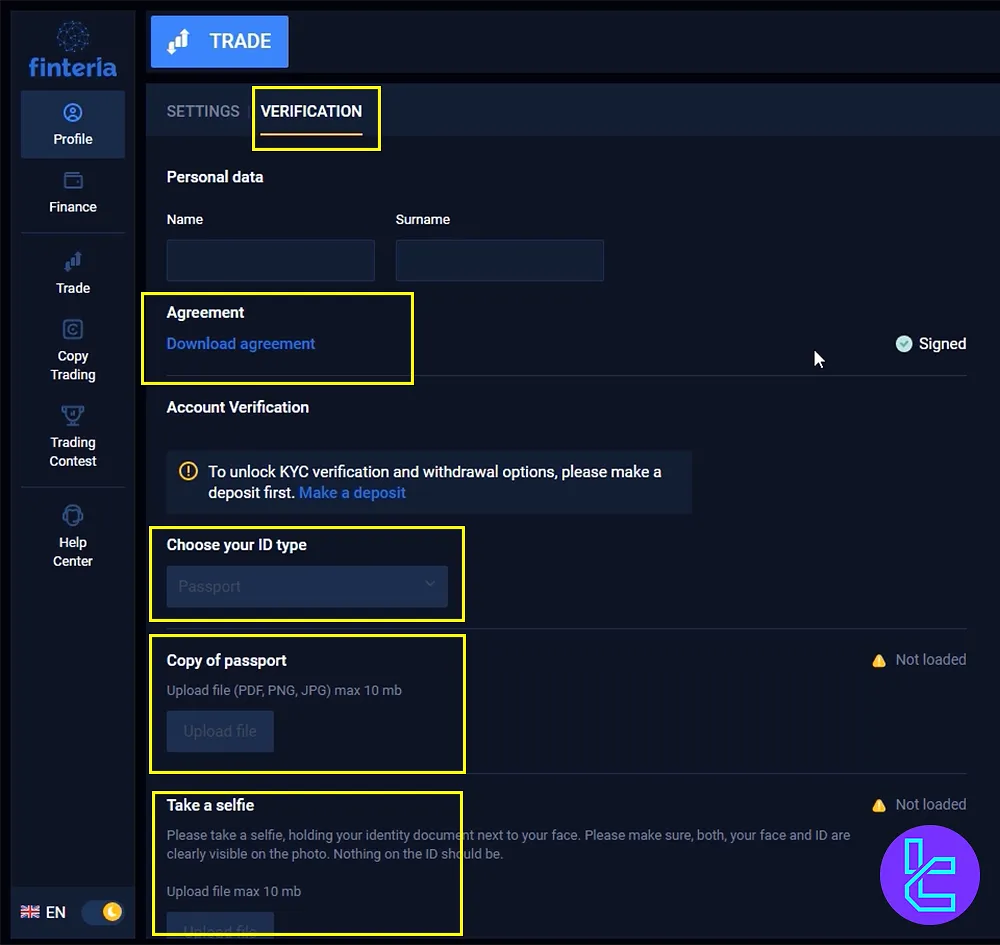

#2 Access the Finteria Verification Section

- Go to the Profile and locate the Verification part

- Ensure the deposit activates the verification option; if not, contact support

#3 Sign the Finteria Client Agreement

The Agreement is a disclaimer that warns users about the platform's risks. It emphasizes that trading carries a high risk, and users could lose all of their invested money.

It advises only investing money you can afford to lose and stresses the importance of reviewing the platform's terms and conditions before trading.

Additionally, it clarifies that Finteria is not responsible for any losses or damages users may experience while using the platform.

Finally, it states that Finteria and its affiliates are not registered to operate in the United States and do not offer services there.

#4 Upload ID Documents for Finteria KYC

- Provide images of your Passport or ID card (front, back, and a selfie holding the card)

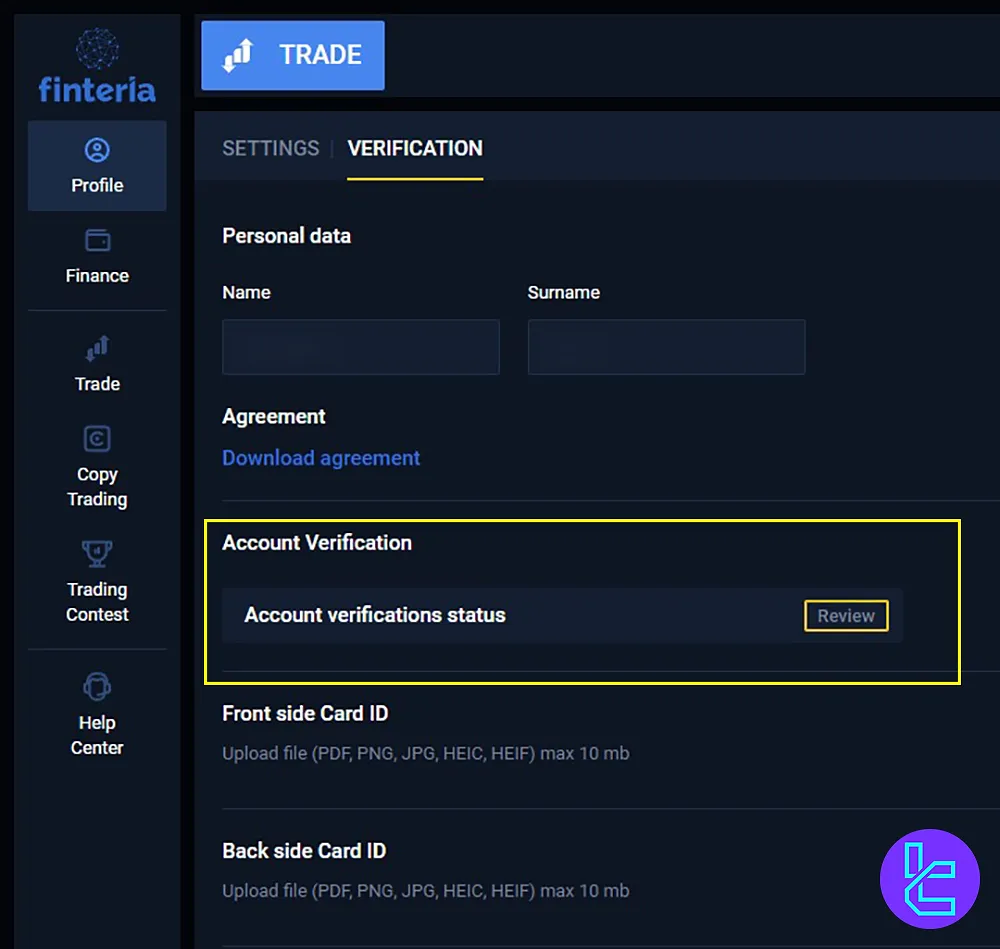

- Click on "Submit" to place the documents in verification mode

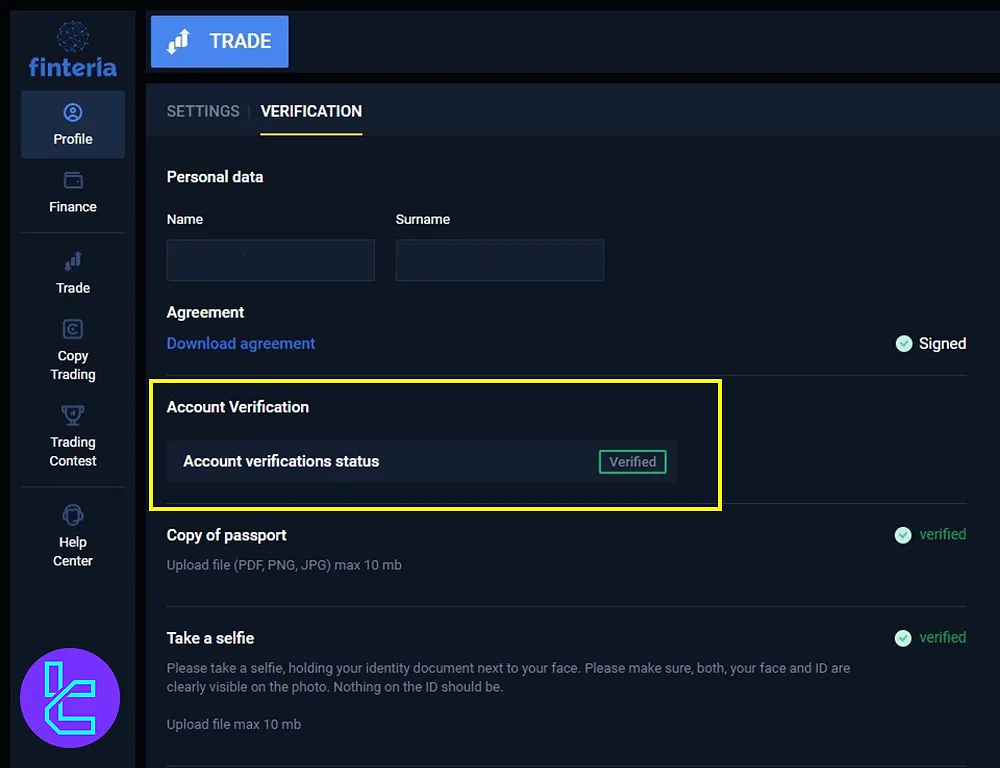

- Finteria’s team will review your documents

Approval typically takes 1 business day, enabling access to all site features, including the most used option, Finteria Tether TRC20 Withdrawal.

To avoid facing any issues during the process, we suggest checking out Finteria Verification Problems.

Comparison of Finteria KYC Requirements vs. Other Binary Options Brokers

The table below allows you to compare the requirements for Finteria KYC with those of other binary options brokers.

Verification Requirement | Finteria Broker | |||

Full Name | Yes | Yes | Yes | No |

Country of Residence | No | Yes | Yes | No |

Date of Birth Entry | No | Yes | Yes | No |

Phone Number Entry | No | Yes | No | No |

Residential Address Details | No | No | Yes | No |

Phone Number Verification | No | No | No | No |

Document Issuing Country | No | Yes | No | Yes |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | No | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | No | Yes | Yes | Yes |

Utility Bill (for POA) | No | No | No | No |

Bank Statement (for POA) | No | No | No | No |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | Yes | Yes | No | Yes |

Financial Status Questionnaire | No | No | No | No |

Trading Knowledge Questionnaire | No | No | No | No |

Restricted Countries | Yes | Yes | Yes | Yes |

Conclusion and Final Words

Finteria Verification is now done in 4 steps. To enable the verification, you should make a Finteria Deposit.

Submitting the KYC request takes less than 5 minutes. Don’t forget to upload both the front and back of the document.

To explore the platform, you can get help by reading our articles on the Finteria Tutorials page. For more visual content, visit TradingFinder's YouTube Channel.