![Currency Pairs Correlation Indicator for MetaTrader 4 Download - Free - [Trading Finder]](https://cdn.tradingfinder.com/image/108524/11-33-en-currency-pairs-correlation-mt4-1.webp)

![Currency Pairs Correlation Indicator for MetaTrader 4 Download - Free - [Trading Finder] 0](https://cdn.tradingfinder.com/image/108524/11-33-en-currency-pairs-correlation-mt4-1.webp)

![Currency Pairs Correlation Indicator for MetaTrader 4 Download - Free - [Trading Finder] 1](https://cdn.tradingfinder.com/image/40882/11-33-en-currency-pairs-correlation-mt4-02.avif)

![Currency Pairs Correlation Indicator for MetaTrader 4 Download - Free - [Trading Finder] 2](https://cdn.tradingfinder.com/image/40884/11-33-en-currency-pairs-correlation-mt4-03.avif)

![Currency Pairs Correlation Indicator for MetaTrader 4 Download - Free - [Trading Finder] 3](https://cdn.tradingfinder.com/image/40883/11-33-en-currency-pairs-correlation-mt4-04.avif)

The Currency Pairs Correlation Indicator is one of the MetaTrader 4 indicators that automatically examines the correlation between various market currencies and presents it to traders. This Trading tool uses green and red histograms to show the positive and negative correlations between currency pairs in the market.

For instance, EURUSD and USDCHF have an inverse or negative correlation. The price chart displays correlated movements in the same direction using green histograms, while movements in opposite directions are shown using red histograms.

Currency Pairs Correlation Indicator Table

Indicator Categories: | Oscillators MT4 Indicators Signal & Forecast MT4 Indicators Trading Assist MT4 Indicators |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Lagging MT4 Indicators Reversal MT4 Indicators |

Timeframe: | Multi-Timeframe MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Scalper MT4 Indicators |

Trading Instruments: | Forward Market MT4 Indicators Indices Market MT4 Indicators Commodity Market MT4 Indicators Forex MT4 Indicators |

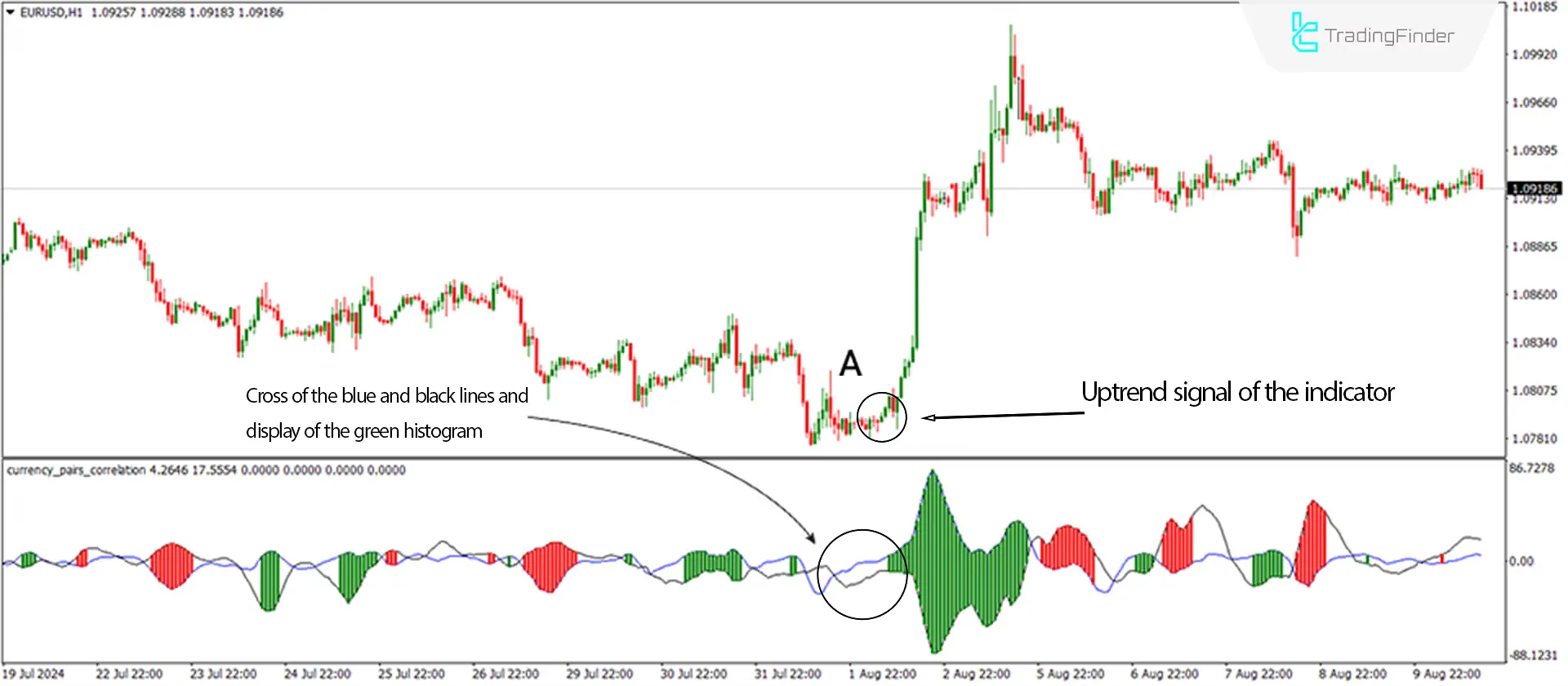

Bullish Trend Conditions of the Indicator (Buy Positions)

The EUR/USD currency pair is shown in the 1-hour timeframe in the image below. In this example, we compare EUR/USD with USD/CHF. Since these two symbols have a negative correlation, the oscillator’s two lines cross, and the green histogram indicates that EUR/USD is ready for an upward move, while USD/CHF is ready for a downward trend.

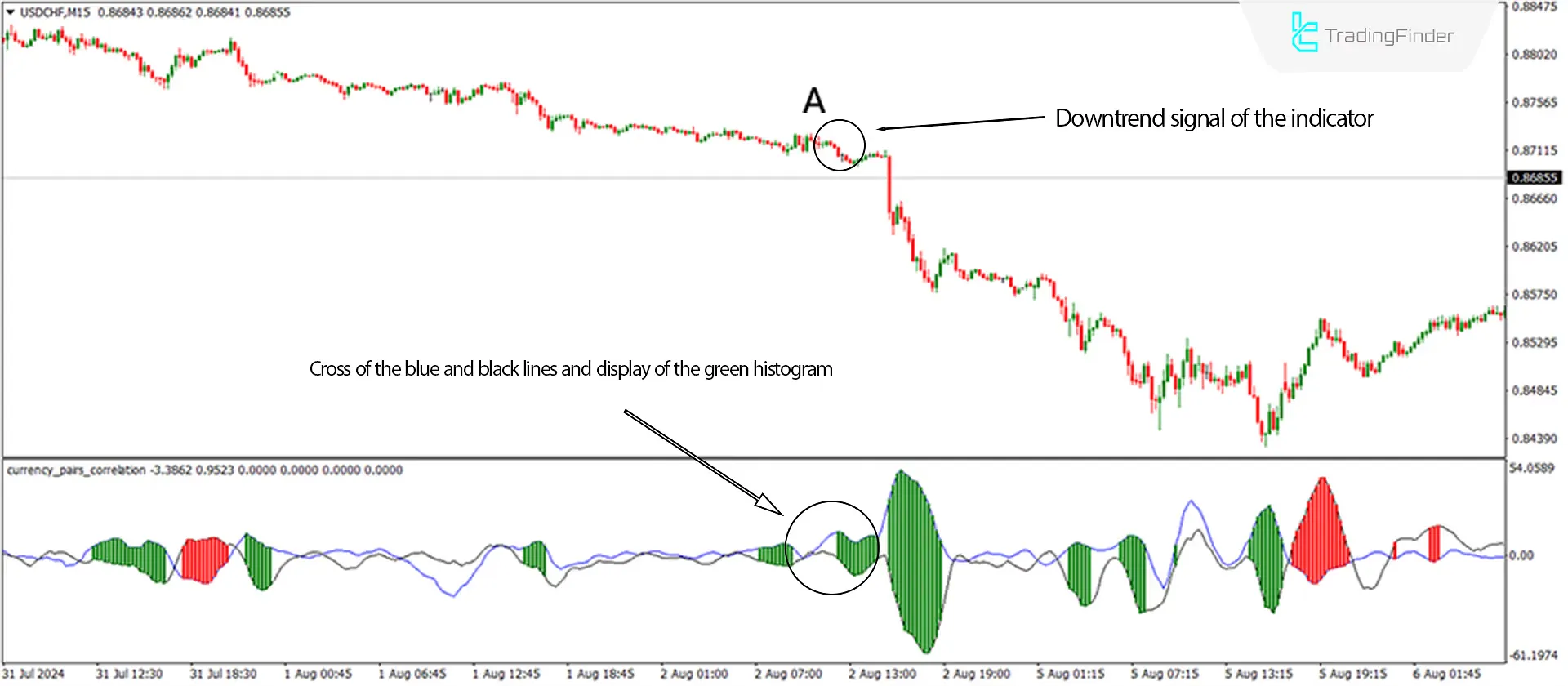

Bearish Trend Conditions of the Indicator (Sell Positions)

The USD/CHF currency pair is shown in the 15-minute timeframe in the image below. In this example, we compare USD/CHF with EUR/USD. Since these two symbols have a negative correlation, the oscillator’s two lines cross, and the green histogram indicates that USD/CHF is ready for a downward move, while EUR/USD is ready for an upward trend.

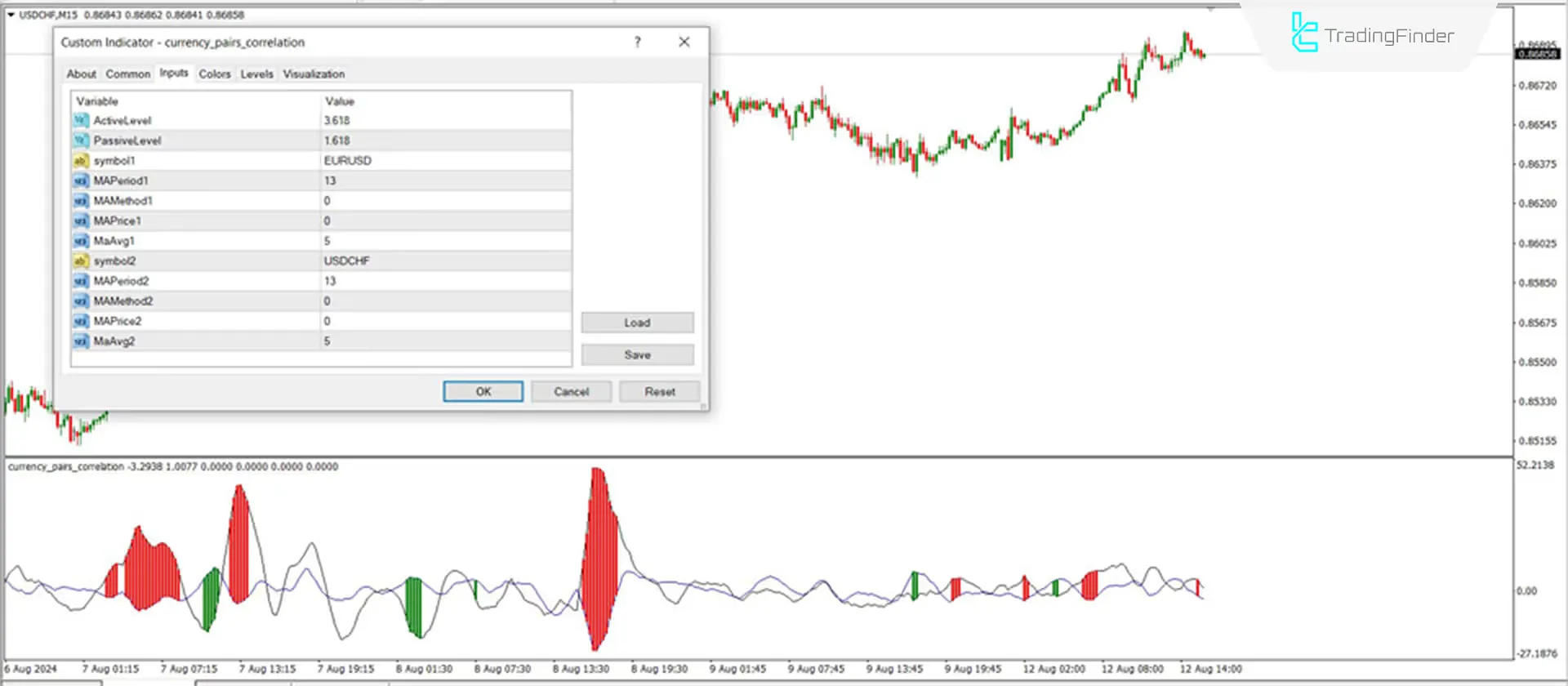

SettingDescription

- ActiveLevel: Settings for positive histograms

- PassiveLevel: Settings for negative histograms

- Symbol1: The first currency pair for calculation (e.g., EURUSD)

- MAPeriod1: Moving average period for the first pair, set to 13

- MAMethod1: Set to 0 for Exponential Moving Average

- MAPrice1: Set to 0 for calculation based on the Close price

- MaAvg1: Averaging based on the last five candles

- Symbol2: The second currency pair (e.g., USDCHF)

- MAPeriod2: Moving average period for the second pair, set to 13

- MAMethod2: Set to 0 for Exponential Moving Average

- MAPrice2: Set to 0 for calculation based on the Close price

- MaAvg2: Averaging based on the last five candles

Conclusion

The Currency Pairs Correlation MT4 Oscillator is a valuable tool for technical analysts. It helps to identify the relationship between different currency pairs. This indicator not only aids in finding effective trading opportunities but also enhances Risk Management.

Currency Pairs Correlation MT4 PDF

Currency Pairs Correlation MT4 PDF

Click to download Currency Pairs Correlation MT4 PDFWhat is the Currency Pairs Correlation Indicator?

The Currency Pairs Correlation Indicator is a tool that measures the correlation between two currency pairs. This correlation can be positive, negative, or neutral.

What is the difference between positive and negative correlation?

Positive correlation means that two currency pairs move in the same direction, while negative correlation means moving in opposite directions.