![RSI Heatmap Indicator for MetaTrader4 Download - Free - [Trading Finder]](https://cdn.tradingfinder.com/image/106447/10-14-en-rsi-heatmap-mt4.webp)

![RSI Heatmap Indicator for MetaTrader4 Download - Free - [Trading Finder] 0](https://cdn.tradingfinder.com/image/106447/10-14-en-rsi-heatmap-mt4.webp)

![RSI Heatmap Indicator for MetaTrader4 Download - Free - [Trading Finder] 1](https://cdn.tradingfinder.com/image/36195/10-14-en-rsi-heatmap-mt4-02.avif)

![RSI Heatmap Indicator for MetaTrader4 Download - Free - [Trading Finder] 2](https://cdn.tradingfinder.com/image/36194/10-14-en-rsi-heatmap-mt4-03.avif)

![RSI Heatmap Indicator for MetaTrader4 Download - Free - [Trading Finder] 3](https://cdn.tradingfinder.com/image/36196/10-14-en-rsi-heatmap-mt4-04.avif)

The RSI Heatmap Indicator is one of the technical analysis tools in MetaTrader 4 that helps traders visualize the relative strength status of various currency pairs in the form of a heatmap. This MetaTrader4 Currency Strength indicator combines the concept of the Relative Strength Index (RSI) with a heatmap to display trends and the strength of currencies relative to one another.

The RSI Heatmap Indicator generates a heatmap based on the RSI values for each asset. The different colors on the map indicate the overbought and oversold status of the assets: green indicates oversold conditions and buying opportunities, while red indicates overbought conditions and selling opportunities.

Indicator Table

Indicator Categories: | Signal & Forecast MT4 Indicators Currency Strength MT4 Indicators Trading Assist MT4 Indicators Heatmap Indicators for MetaTrader 4 |

Platforms: | MetaTrader 4 Indicators |

Trading Skills: | Elementary |

Indicator Types: | Reversal MT4 Indicators |

Timeframe: | M1-M5 Time MT4 Indicators M15-M30 Time MT4 Indicators H4-H1 Time MT4 Indicators |

Trading Style: | Day Trading MT4 Indicators Scalper MT4 Indicators Swing Trading MT4 Indicators |

Trading Instruments: | Forward Market MT4 Indicators Forex MT4 Indicators |

Overview

The RSI Heatmap Indicator can help determine trend direction and suitable entry-exit points across different timeframes, reducing trading risk. Using color changes in the heatmap, traders can identify solid trends and potential reversal points in MetaTrader4 indicator. It also allows for the assessment of the relative strength status of assets across multiple timeframes simultaneously.

Bullish Signal Conditions of the Indicator (Bullish Setup)

The chart of the USD/JPY currency pair in the 5-minute timeframe is shown in the image below. In the heatmap, the timeframes (M15-M30-H1) have changed from dark green to green, indicating oversold conditions and the beginning of a bullish trend in the short to medium term. Therefore, one can look for a trigger to enter buy trades in these timeframes.

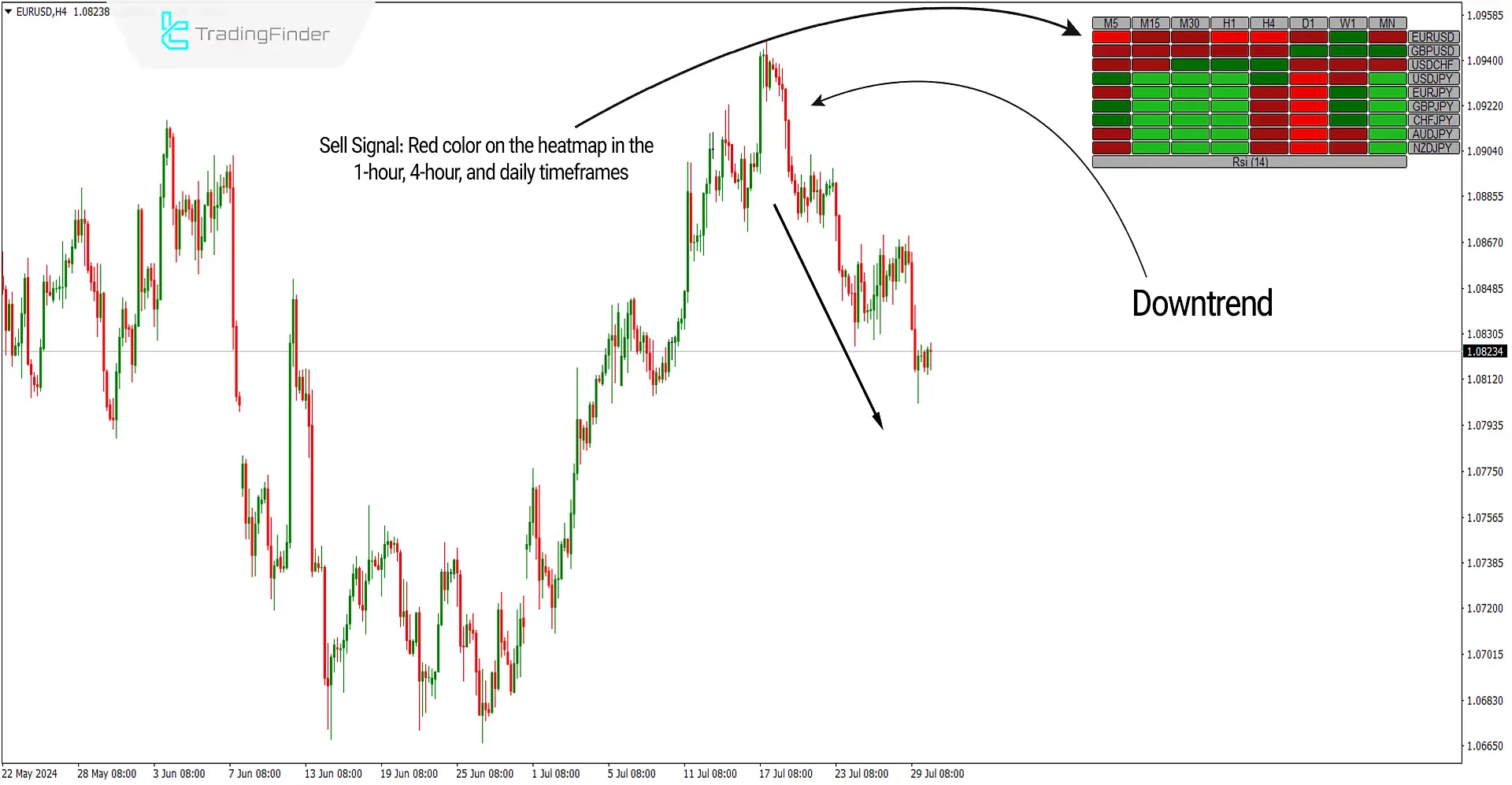

Bearish Signal Conditions of the Indicator (Bearish Setup)

The chart of the EUR/USD currency pair in the 4-hour timeframe is shown in the image below. In the heatmap, the timeframes (H1-H4-D1) have changed from red to dark red, indicating overbought conditions and the beginning of a bearish trend in the medium to long term. Therefore, one can look for a trigger to enter sell trades in these timeframes.

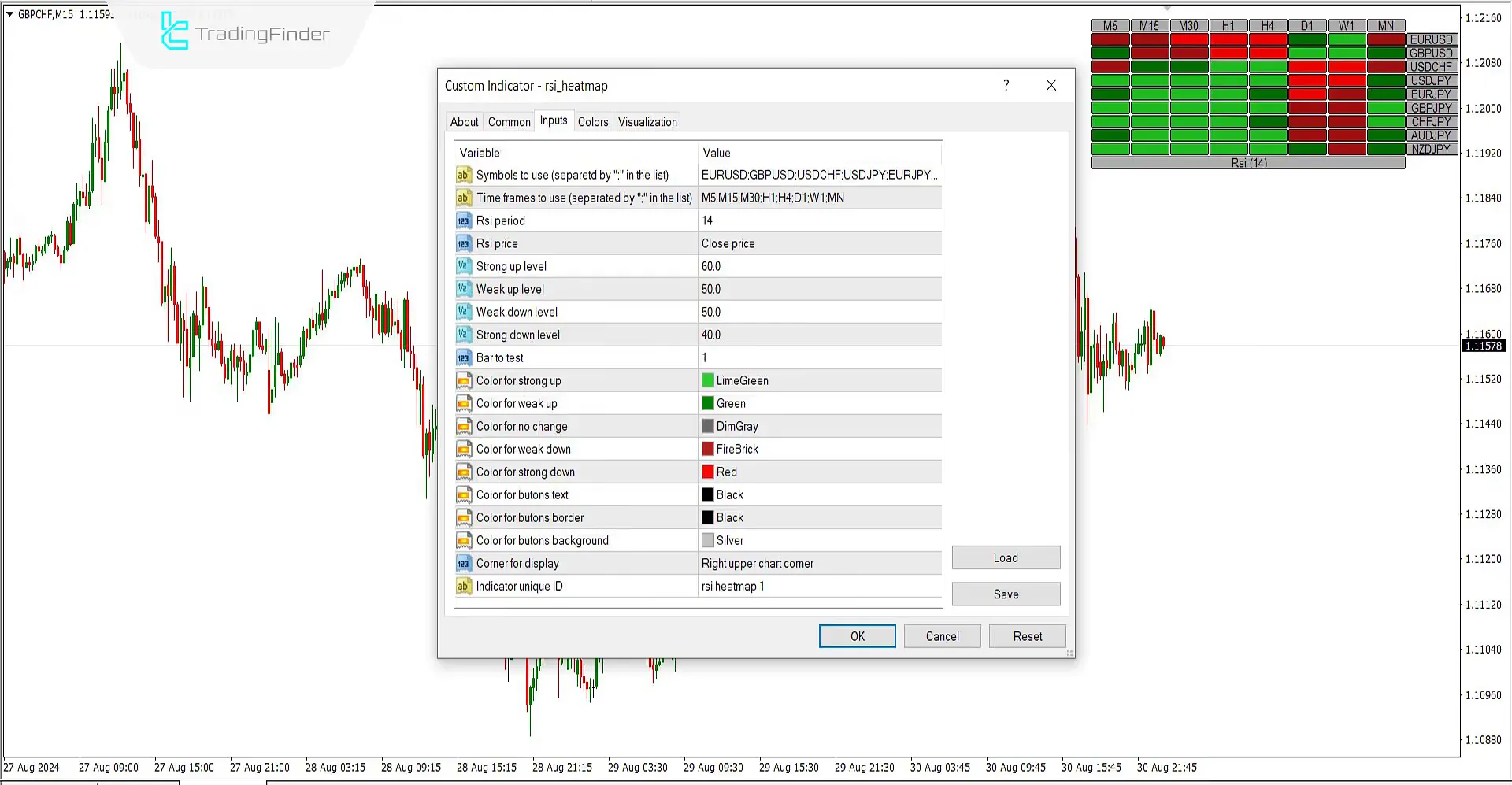

RSI Heatmap Indicator Settings

- Symbols to use: EURUSD, GBPUSD, USDCHF, USDJPY, EURJPY, GBPJPY, CHFJPY, AUDJPY, NZDJPY

- Time frames to use: M5, M15, M30, H1, H4, D1, W1, MN

- RSI period: 14

- RSI price: Based on Close Price

- Strong up level: 60 for a strong bullish trend

- Weak up level: 50 for a weak bullish trend

- Weak down level: 50 for a weak bearish trend

- Strong down level: 40 for a strong bearish trend

- Bar to test: RSI calculation based on the second to last candle

- Color for strong up: Light green for a strong bullish trend

- Color for weak up: Green for a weak bullish trend

- Color for no change: Gray for a neutral trend

- Color for weak down: Dark red for a weak bearish trend

- Color for strong down: Red for a strong bearish trend

- Color for buttons text: Black

- Color for buttons border: Black

- Color for buttons background: Gray

- Corner for display: Right upper chart corner

- Indicator unique ID: RSI Heatmap 1

Summary

The RSI Heatmap Indicator is a valuable tool for identifying the strength of currency trends and can be applied alongside various trading strategies. Traders can use it to evaluate signals and gain additional confirmations for more confident trade entry.

In addition to the RSI Heatmap indicator, the TradingFinder Forex heat map tool is available for free for traders to use to identify the currency pairs with the most growth and decline.

RSI Heatmap MT4 PDF

RSI Heatmap MT4 PDF

Click to download RSI Heatmap MT4 PDFHow can the RSI Heatmap be used for trading?

Color changes in the heatmap help traders identify buy and sell signals. For example, a color change from green to light green may indicate a buy signal and a change from dark red to red may indicate a sell signal.

Is the RSI Heatmap suitable for all timeframes?

This indicator can be used for different timeframes, but it may show high sensitivity to short-term fluctuations and generate false signals in shorter timeframes.