![CISD-CID + BPR Combined Indicator in ICT Style MT5 Download - Free - [TFlab]](https://cdn.tradingfinder.com/image/166584/13-29-en-cisd-cid-bpr-mt5-1.webp)

![CISD-CID + BPR Combined Indicator in ICT Style MT5 Download - Free - [TFlab] 0](https://cdn.tradingfinder.com/image/166584/13-29-en-cisd-cid-bpr-mt5-1.webp)

![CISD-CID + BPR Combined Indicator in ICT Style MT5 Download - Free - [TFlab] 1](https://cdn.tradingfinder.com/image/166574/13-29-en-cisd-cid-bpr-mt5-3.webp)

![CISD-CID + BPR Combined Indicator in ICT Style MT5 Download - Free - [TFlab] 2](https://cdn.tradingfinder.com/image/166586/13-29-en-cisd-cid-bpr-mt5-4.webp)

![CISD-CID + BPR Combined Indicator in ICT Style MT5 Download - Free - [TFlab] 3](https://cdn.tradingfinder.com/image/166585/13-29-en-cisd-cid-bpr-mt5-5.webp)

The CISD-CID + BPR Composite Indicator is an advanced tool based on the ICT trading style in MetaTrader 5. This MT5 Liquidity indicator utilizes the three concepts of "CID," "CISD," and "BPR" to identify specific zones on the chart and issue trading signals under appropriate conditions.

The "CISD" concept comprises four elements: consolidation, impulse, fluctuation, and divergence. Typically, the price exits these zones with a rapid movement (Impulse).

In such scenarios, the indicator detects the pattern, and whenever the large CISD line is touched, followed by the small CISD line breaking in the opposite direction, an arrow issues a trading signal.

The "CID" concept, as a complement to "CISD," signifies the transfer of order flow and a shift in price direction. It plays a significant role in predicting corrective moves or initiating new trends.

Indicator Specifications Table

Indicator Categories: | Smart Money MT5 Indicators Signal & Forecast MT5 Indicators ICT MT5 Indicators |

Platforms: | MetaTrader 5 Indicators |

Trading Skills: | Advanced |

Indicator Types: | Range MT5 Indicators Reversal MT5 Indicators |

Timeframe: | Multi-Timeframe MT5 Indicators |

Trading Style: | Day Trading MT5 Indicators |

Trading Instruments: | Forex MT5 Indicators Crypto MT5 Indicators Stock MT5 Indicators Commodity MT5 Indicators Indices MT5 Indicators Forward MT5 Indicators Share Stock MT5 Indicators |

Indicator at a Glance

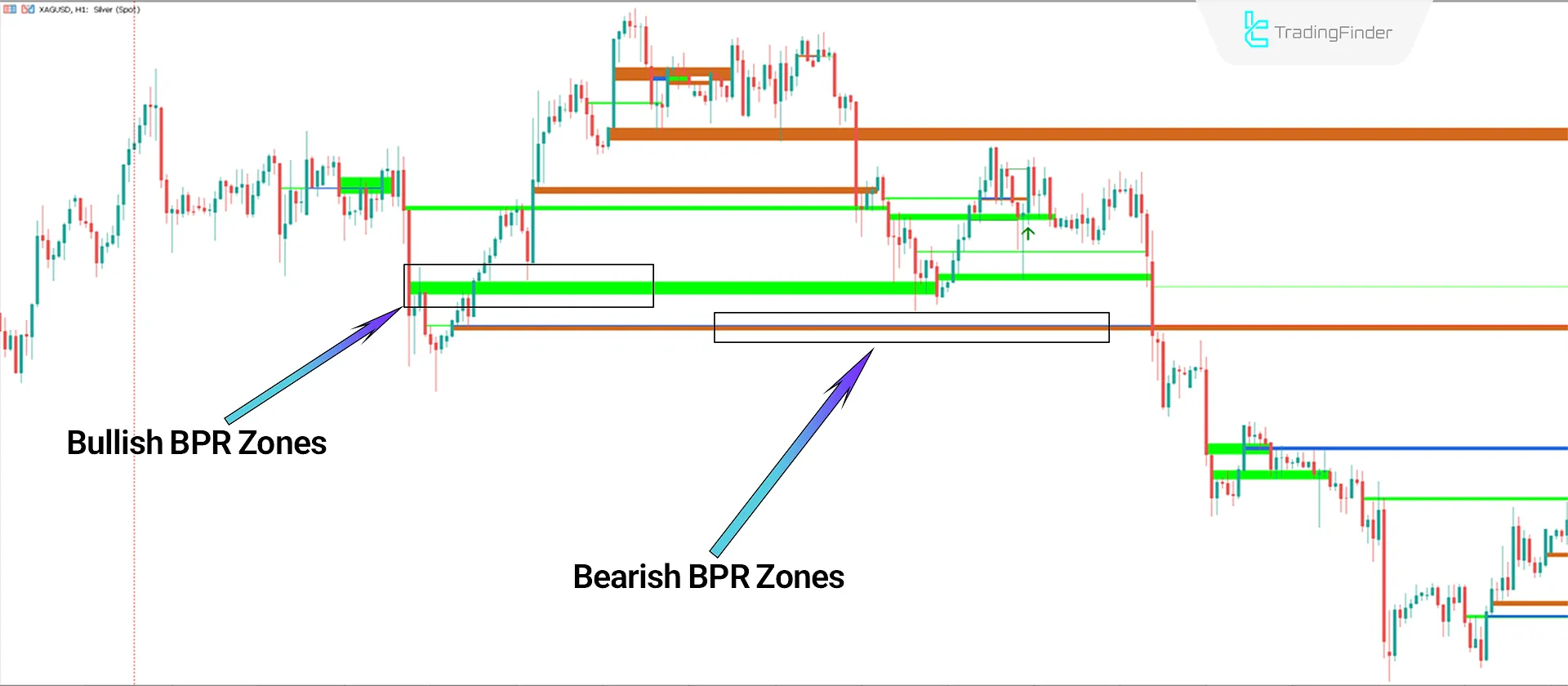

BPR zones refer to areas where the price fluctuates within a relatively fixed range, and there is a balance between buyers and sellers.

Exiting these zones is usually accompanied by a strong and powerful move, which is why ICT (Inner Circle Trader) traders use these zones as entry points for trades.

The image below shows green boxes representing Bullish BPR Zones, red boxes representing Bearish BPR Zones, and invalid zones are displayed in blue.

Buy Signal Issuance

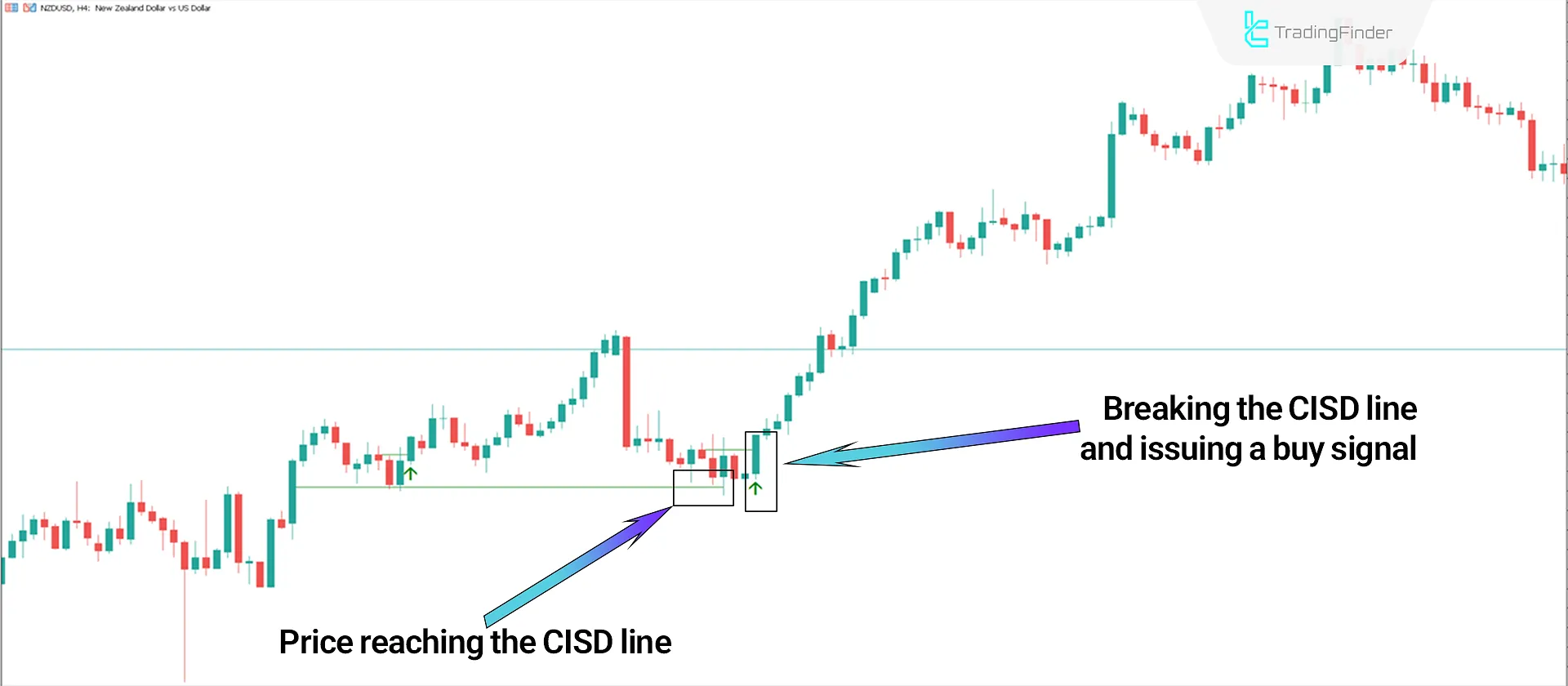

As seen in the NZD/USD currency pair chart in the 4-hour timeframe, the price starts an upward trend after a fake breakout of the larger CISD line.

Once the price breaks the smaller CISD line, the indicator issues a buy signal for entering a Long Position.

Sell Signal Issuance

As seen in the Chainlink cryptocurrency chart in the 1-hour timeframe, the price begins a downward trend after a fake breakout of the larger CISD line.

Once the price breaks the smaller CISD line, the indicator issues a sell signal to enter a Sell Position.

Indicator Settings

- Light theme: Chart theme settings;

- Show BPR: Show or hide BPR zones;

- show BPR CISD: Show or hide CISD lines;

- BPR CISD Limit: The number of BPR zones relative to CISD zones is set to 4.

Conclusion

The CISD-CID + BPR Indicators help traders identify trading opportunities using four elements: Consolidation, Impulse, Swing, and Divergence, along with the addition of Balanced Price Ranges (BPR).

Moreover, this MT5 ICT indicator issues entry signals using arrows based on these elements when the conditions are right.

CISD-CID BPR Combined ICT MT5 PDF

CISD-CID BPR Combined ICT MT5 PDF

Click to download CISD-CID BPR Combined ICT MT5 PDFWhich trading style is this indicator based on?

This indicator was developed based on the ICT (inner circle Trader) trading style and is especially suitable for ICT and smart money traders.

What is the purpose of BPR zones?

These zones indicate the balance between buyers and sellers; exiting these zones is usually accompanied by intensity. These zones can be suitable entry points for trade.

Can you help me to set the buffer and show in data board. Thank you so much

You can watch the video of this indicator on this page and get in touch with our support team.