Apex Trader Funding rules include maintaining a 5:1 risk-to-reward ratio and adhering to a 30% initial drawdown limit, which can be adjusted to 50% as the account grows.

The prop firm allows news trading but bans high-risk, gambling-like trading strategies such as high-frequency trading. Traders can not share their account information or ask other users to pass their challenges.

Apex Trader Funding Rules

Various restrictions have been established by Apex Trader Funding Prop Firm for traders to follow; Some of the Apex Trader Funding trading condition topics:

- Challenge Conditions

- Market Manipulation

- Dollar-Cost Averaging (DCA)

- RR Rule

- Flipping

- Drawdown Limit

- Payout rules

ATF Challenge Conditions

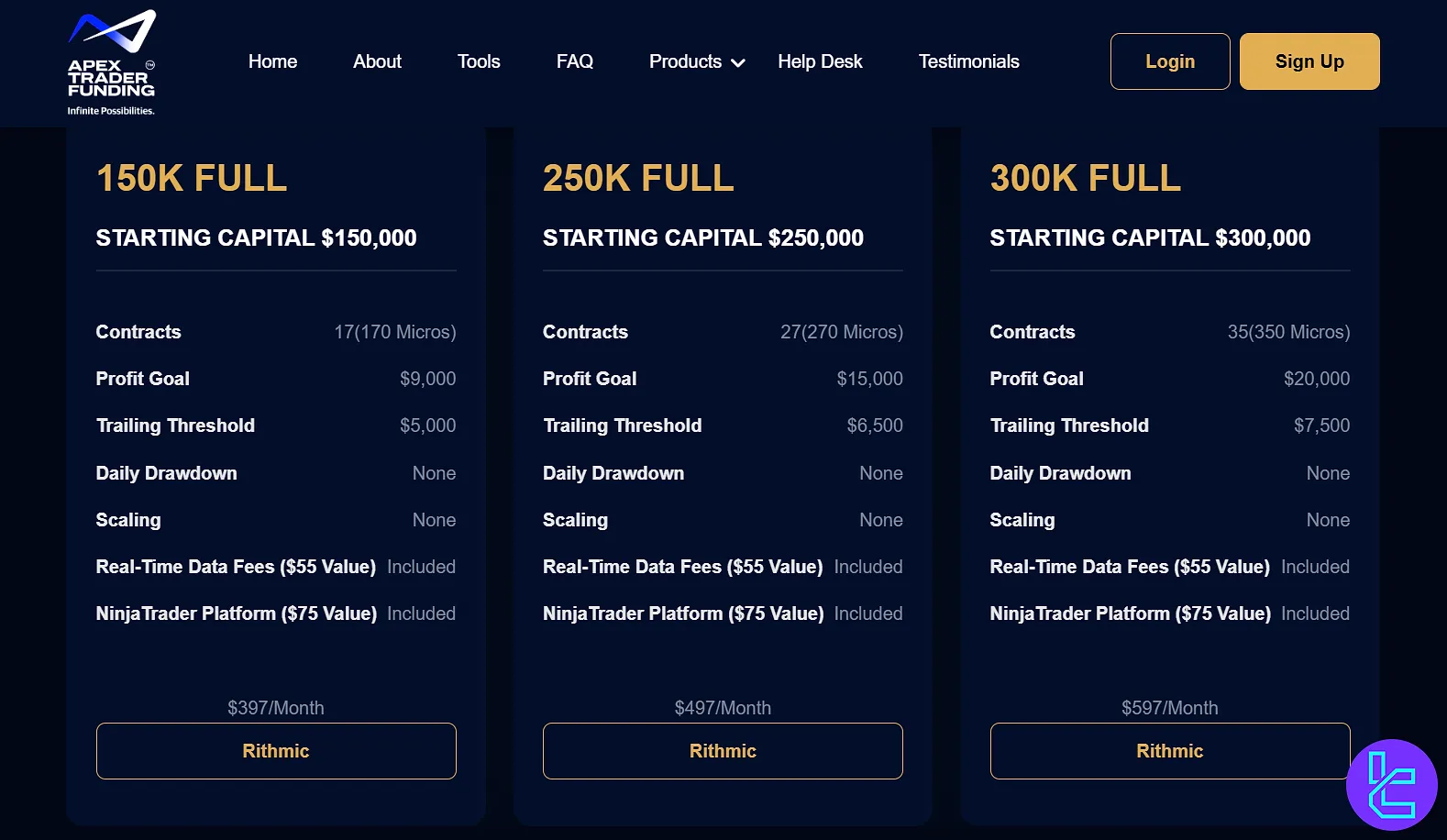

The ATF offers a diverse range of trading evaluations with varying risk management requirements and profit targets, enabling potential profitable traders to access substantial capital through this platform.

Trading Plan | WealthChart Plan | Rithmic Plan | Tradovate Plan |

Profit Target | 6% | 6% | 6% |

Maximum Daily Loss | No | No | No |

Maximum Overall Loss | 3% | 3% | 3% |

Number of Contracts | Based on the account size from 40 to 350 Micros | Based on the account size from 40 to 350 Micros | Based on the account size from 40 to 350 Micros |

It's essential to note that each challenge differs from the others based on the privileges they offer and their associated costs.

Market Manipulation Strategies

Apex Trader Funding strictly prohibits any form of market manipulation or exploitative behavior. Trading strategies such as high-frequency trading (HFT) or any method that attempts to exploit system inefficiencies are not permitted under any circumstances.

Each trader must operate only their own account, keeping full responsibility for its management. Sharing login credentials, allowing third parties to access, or trading on behalf of others is strictly prohibited and may result in account termination or payout denial.

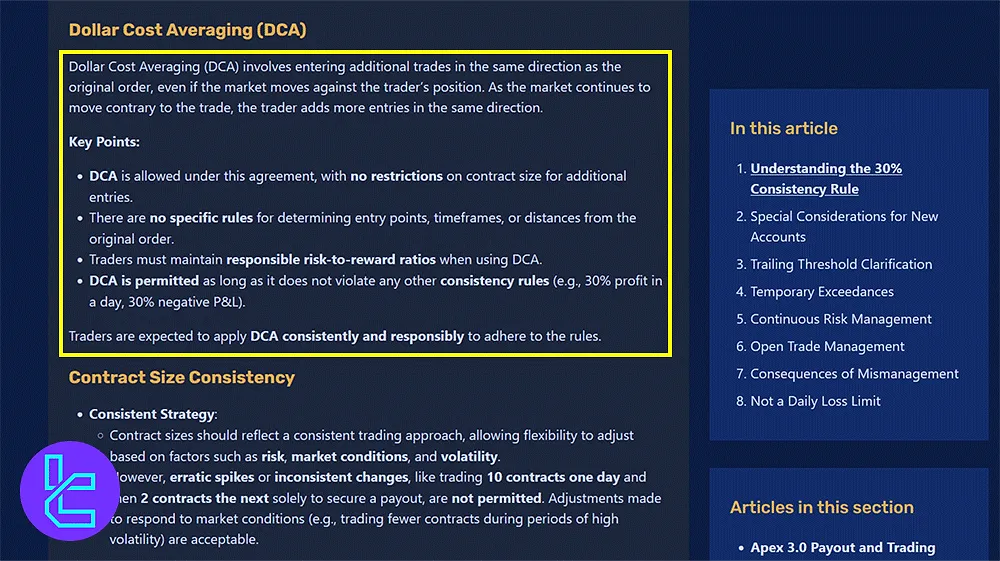

DCA Trading Conditions (Dollar-Cost Averaging)

Dollar-Cost Averaging (DCA) is allowed in Apex Trader Funding but must be applied consistently and responsibly; Apex Trader Funding DCA Rule:

- Consistent Application: Traders must apply DCA strategies regularly and in line with other rules;

- No Violations: The DCA cannot violate other consistency rules, such as profit/loss limits, to ensure the trading approach remains balanced.

Apex Trader Funding News Trading

Apex Trader Funding allows news trading, but traders must adhere to specific rules to ensure fair and consistent performance. Holding both long and short positions on the same news event is strictly prohibited.

All news-related trades must also comply with Apex’s consistency requirements, meaning traders must maintain the same discipline in profit targets and loss limits as in regular trading. Violations of these conditions may result in account review or disqualification from payouts.

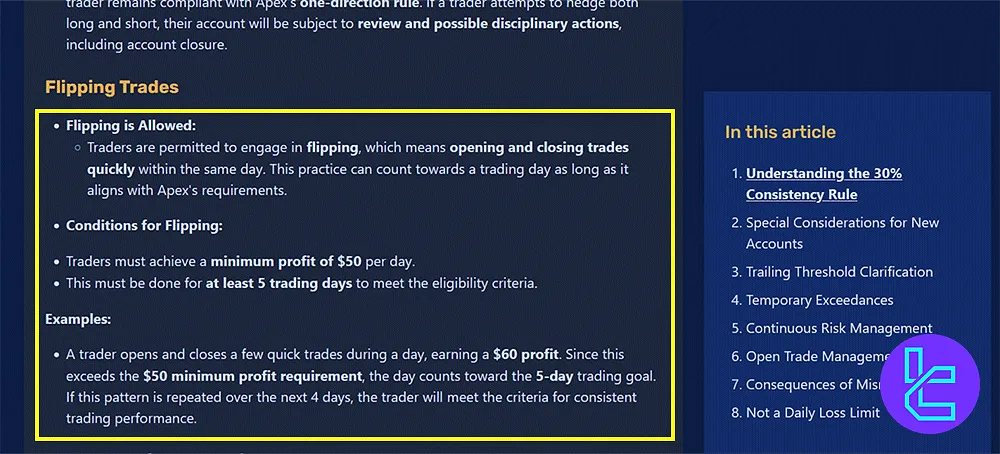

Apex Trader Funding Flipping

Flipping, or rapidly opening and closing trades, is allowed within Apex Trader Funding's framework; ATF Flipping Rules:

- Profit Requirement: Traders must meet the $50 minimum profit for 5 consecutive trading days;

- Rapid Trade Execution: Flipping must still adhere to the overall risk management requirements.

Trading Half Contracts

At Apex Trader Funding, traders are initially restricted to using only half of their available contracts until the trailing stop requirement is reached. Once the trailing stop threshold is successfully met, traders gain access to trade the full number of contracts allowed on their account.

This rule ensures that traders demonstrate consistency and proper risk management before scaling to their full trading capacity.

Risk-Reward Ratio Rules

Maintaining a 5:1 risk-to-reward ratio is a core requirement in Apex Trader Funding; Apex Trader Funding RR Rule:

- Risk Management: Traders must ensure that the risk on any trade is not more than 5 times the potential reward;

- Example: For a target profit of 10 ticks, the stop loss must not exceed 50 ticks.

Apex Trader Funding 30% Drawdown

Based on the data found for this Apex Trader Funding tutorial, this prop firm employs a strict drawdown policy that is adjusted based on each trader’s account performance. The initial drawdown limit is set at 30% of the account’s profit balance, ensuring controlled risk during the early stages of trading.

As the account grows and demonstrates consistent performance, the drawdown threshold can be increased up to 50%, allowing traders more flexibility while maintaining disciplined risk management.

Apex Trader Funding Payout Rules

Apex Trader Funding offers a transparent and efficient payout process for both U.S. and international traders.

- Payout Setup: US-based users receive payouts via ACH direct deposit to their local bank accounts, while international users receive payouts through Plane, Apex’s global payment partner. After the first payout is approved, international traders get an email invitation from Plane to link their local bank.

- Requesting a Payout: Traders can submit payout requests directly from their Apex Dashboard and continue trading immediately. However, if the account balance drops below the minimum payout threshold before approval, the request will be denied automatically.

- Processing and Timeline: Apex reviews payout requests within 2 business days. Once approved, funds are sent within 3–4 business days, and the bank or payment provider usually processes deposits within 3–7 business days. Most traders receive payouts within 5–11 business days in total.

- Payment Channels: US users receive payouts via ACH direct deposit, and international users via Plane. If funds are marked as “PAID” but not yet received, traders should allow up to 7 additional business days before contacting support.

Apex Trader Funding Policies vs Other Prop Firms

The table below provides a complete comparison of the trading policies in Apex Trader Funding and other famous prop firms.

Prop Firm | Apex Trader Funding Prop Firm | |||

VPN/VPS | Not Specified | Allowed | Allowed | Prohibited |

EA Usage | Not Specified | Allowed | Allowed | Allowed |

News Trading | Allowed | Allowed | Allowed | Prohibited |

Group Trading | Prohibited | Prohibited | Prohibited | Not Specified |

All-or-nothing Trading | Prohibited | Prohibited | Prohibited | Prohibited |

Writer’s Opinion and Conclusion

Apex Trader Funding rules require traders to complete 8 days of trading, with at least 5 days achieving a minimum $50 profit per day. The $100 safety net must be met, and traders can request payouts after 2 business days of approval.

While news trading is permitted in this prop firm, traders can't open both long and short trading positions simultaneously. The prop firm also offers Dollar Cost Averaging strategies across various plans.