ATFunded is a prop firm offering funded accounts ranging from $5,000 to $200,000, with starting fees as low as $25.

Backed by its parent company, AT Global Markets LLC, and affiliated with the regulated ATFX broker, ATFunded has two distinct challenges, an 80% profit split, social trading via ATFunded+, and a free trial account with a $10K balance.

ATFunded Prop Firm Information & Key Features

Founded in January 2025, ATFunded operates under AT Global Markets LLC, a registered entity in Saint Vincent and the Grenadines (Registration Number: LLC 2020 333).

It is a sister brand of the ATFX brokerage and is led by CEO Josh Dentrinos.

The firm offers two main types of trading evaluations ATFunded Challenge and ATFunded Pro—with account sizes scaling up to $200,000 and profit splits of up to 80%.

Key Highlights of ATFunded:

- Parent Company: AT Global Markets LLC (Saint Vincent & Grenadines)

- Sister Brand: ATFX Broker

- CEO: Josh Dentrinos

- Founded: January 2025

- Challenge Types: ATFunded Challenge (2-phase), ATFunded Pro (1-phase)

- Account Sizes: Up to $200,000

- Starting Price: From $25

- Profit Split: Up to 80%

- Maximum Leverage: 1:30

- Social Trading: ATFunded+

- Free Trial: Demo account with $10,000 virtual balance

- Deposit Methods: Credit Card, Neteller, Skrill

- Withdrawal Methods: VISA, MasterCard, Diners Club, Bitcoin, Ethereum, USDT, USDC, Neteller, Skrill

ATFunded CEO

ATFX has appointed Joshua Dentrinos as the CEO of its proprietary trading arm, AT Funded, launched earlier this year. His leadership focuses on enhancing the evaluation process, boosting trader funding opportunities, and expanding the ATFunded+ social trading initiative.

- Former prop trading executive with a proven industry track record

- Recognized thought leader with expertise in trader development

- Committed to building innovative and supportive trading ecosystems

- Focused on aligning ATFunded with ATFX’s global vision and standards

ATFunded Specifications

The firm provides moderate leverage, a clean profit-sharing model, and access to major trading instruments, all integrated with social trading functionality via ATFunded+.

The following table outlines the core specifications of ATFunded:

Account Currency | USD |

Minimum Price | $25 |

Maximum Leverage | 1:30 |

Maximum Profit Split | Up to 80% |

Instruments | FX Majors, FX Minors, FX Exotics, Metals, Indices, Crypto, Energies |

Assets | Not Specified |

Evaluation Steps | 1 Step, 2 Step |

Withdrawal Methods | VISA, MasterCard, Diners club, Bitcoin, Netellet, Skrill, Ethereum, USDC, USDT |

Maximum Fund Size | $200,000 |

First Profit Target | 6% in Pro Program, 8% in 2-Phase Challenge |

Max. Daily Loss | 4% |

Challenge Time Limit | 3 Days |

News Trading | Banned |

Maximum Total Drawdown | 10% |

Trading Platforms | Platform 5 (MetaTrader 5) |

Commission Per Round Lot | $5 Per Every Lot |

Trustpilot Score | 4.2/5 |

Payout Frequency | Bi-weekly |

Established Country | Saint Vincent & Grenadines |

Established Year | 2025 |

ATFunded Pros & Cons

ATFunded offers a balanced suite of features, especially appealing to traders who prefer simplicity, transparent rules, and flexible funding options.

While its connection to a regulated broker (ATFX) adds credibility, the firm is still relatively new and lacks a large number of user reviews across third-party platforms.

ATFunded advantages and disadvantages:

Pros | Cons |

Backed by AT Global Markets LLC and affiliated with ATFX Broker | Maximum leverage limited to 1:30 |

Offers both 1-phase and 2-phase challenges | No current bonuses or discount campaigns |

Low entry cost (from $25) | Limited trading platform support (Platform 5 only) |

ATFunded+ social trading available | Still new in the industry, limited long-term data |

Free trial with $10K demo account | Only one-time activation fee structure |

While the firm offers unique pathways for getting funded, traders should consider its platform limitations and leverage cap when comparing it to more established firms.

How Much are the Fundings & Prices in ATFunded?

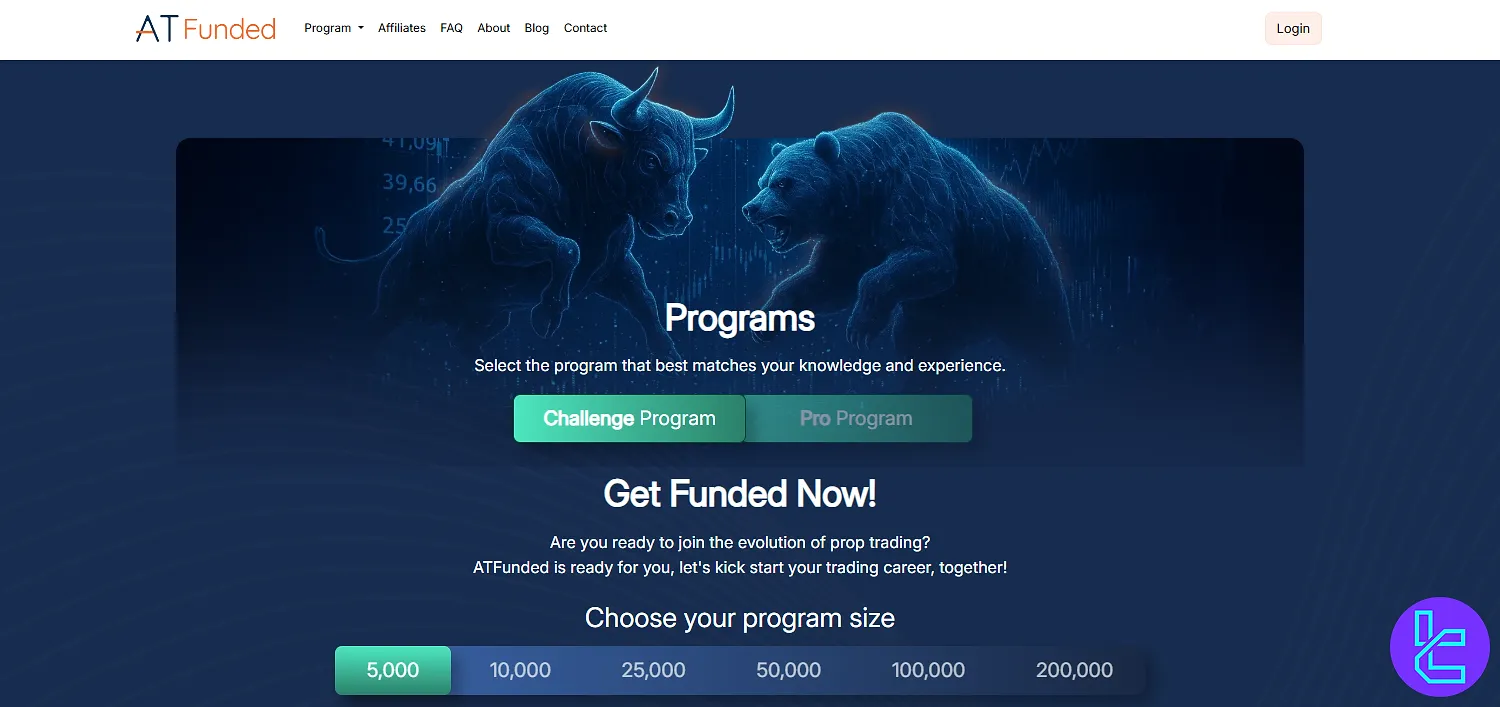

ATFunded provides two main evaluation programs: the Pro Program (a one-phase challenge) and the 2-Phase Challenge, each with multiple account sizes and corresponding pricing.

Prices are competitive, especially for the Pro Program, which starts at just $25. Funding programs and pricing table of ATFunded:

Program | Account Size | Price (USD) |

Pro Program | $10,000 | $25 |

$50,000 | $49 | |

$100,000 | $99 | |

$150,000 | $149 | |

2-Phase Challenge | $5,000 | $35 |

$10,000 | $69 | |

$25,000 | $135 | |

$50,000 | $250 | |

$100,000 | $460 | |

$200,000 | $920 |

How to Sign Up in ATFunded? 4Step Guide

Signing up with ATFunded allows traders to quickly select their preferred challenge and receive their funded account credentials. Registration in this prop firm can be completed in just a few minutes and 4 steps:

- Click on “Get Funded” from the homepage;

- Choose your challenge type and account size;

- Fill in your personal and address details;

- Select your payment method and complete the order.

#1 Click on “Get Funded”

To start your journey with ATFunded, visit the official website and click on the “Get Funded” button located in the top navigation menu. This will direct you to the challenge selection page where all available evaluation programs and account sizes are listed.

From here, you can begin the process of configuring your desired funded account and proceed to the payment stage.

#2 Choose Preferred Challenge

After clicking on “Get Funded,” you’ll be directed to a page where you can choose between the Pro Program (1-phase evaluation) or the 2-Phase Challenge.

Each option includes a range of account sizes and pricing. Once you've reviewed the trading objectives and selected the right match for your goals, proceed to the payment stage. Challenge Selection Steps:

- Choose Evaluation Model: Pro Program or 2-Phase Challenge

- Select Account Size: $5K, $10K, $25K, $50K, $100K, $150K, or $200K

- Review Challenge Objectives: Profit target, drawdown limits, and rules

After reviewing all of these, click on “Proceed to Payment” to continue the registration process.

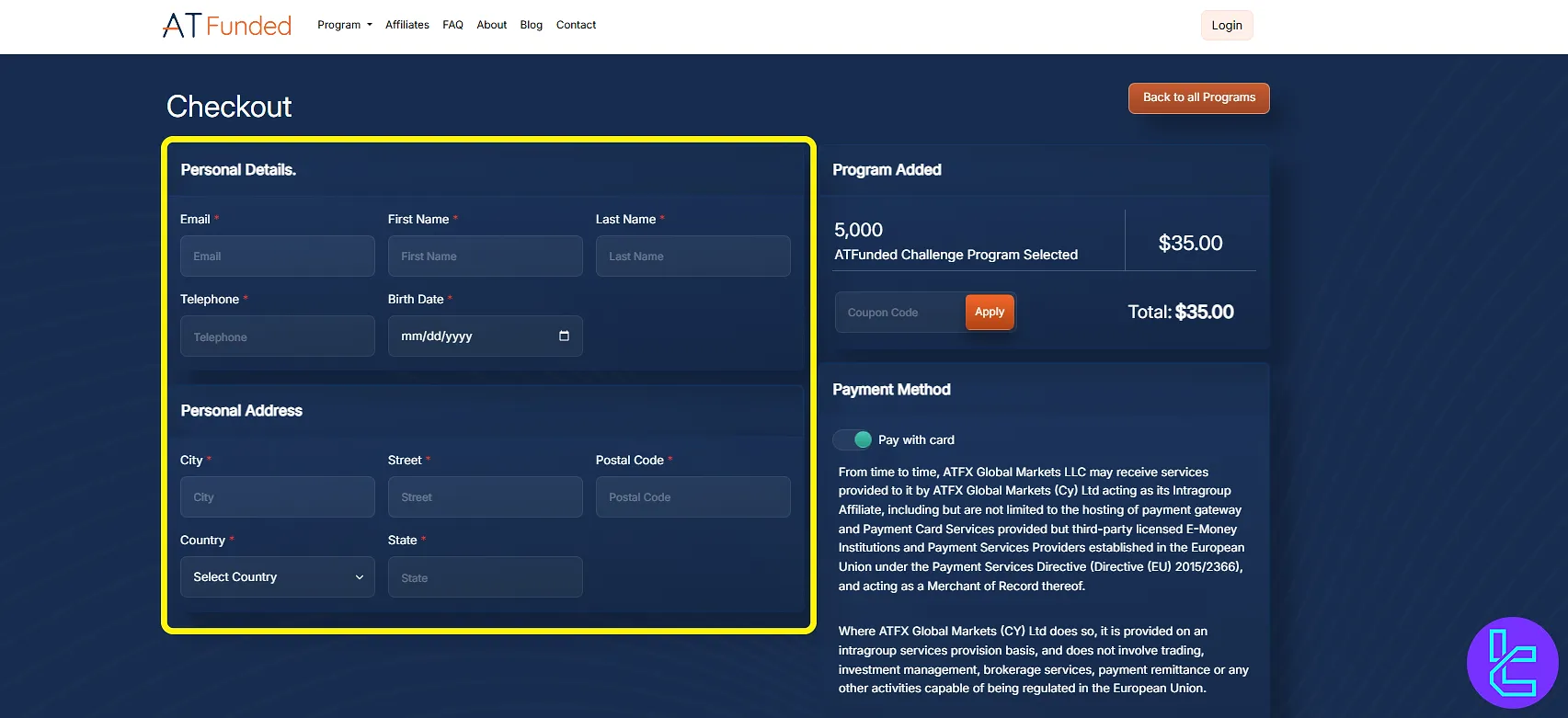

#3 Provide Personal Details & Address

Once you’ve selected your preferred challenge and account size, the next step is to enter your personal and contact information accurately.

These details are required to generate your account credentials and ensure compliance with the firm's internal verification procedures.

Personal Information

- Email address

- First name and last name

- Phone number

- Date of birth

Address Information

- Street name

- City

- Postal code

- Country

- State or province

Ensure all information is correct and up to date, as discrepancies may delay account access or future withdrawals.

#4 Pay the Challenge Price

After submitting your personal and address details, you’ll be directed to the payment page to finalize your purchase. ATFunded offers secure and commonly used payment methods, including Credit Card (Visa, MasterCard), Neteller, and Skrill.

Once the payment is confirmed, account credentials will be sent via email.

ATFunded Trading Challenge Conditions

ATFunded offers two evaluation types designed to test a trader’s consistency and discipline before granting access to funded capital. These include the Pro Challenge (1-phase evaluation) and the 2-Phase Challenge, each with its own risk parameters and objectives.

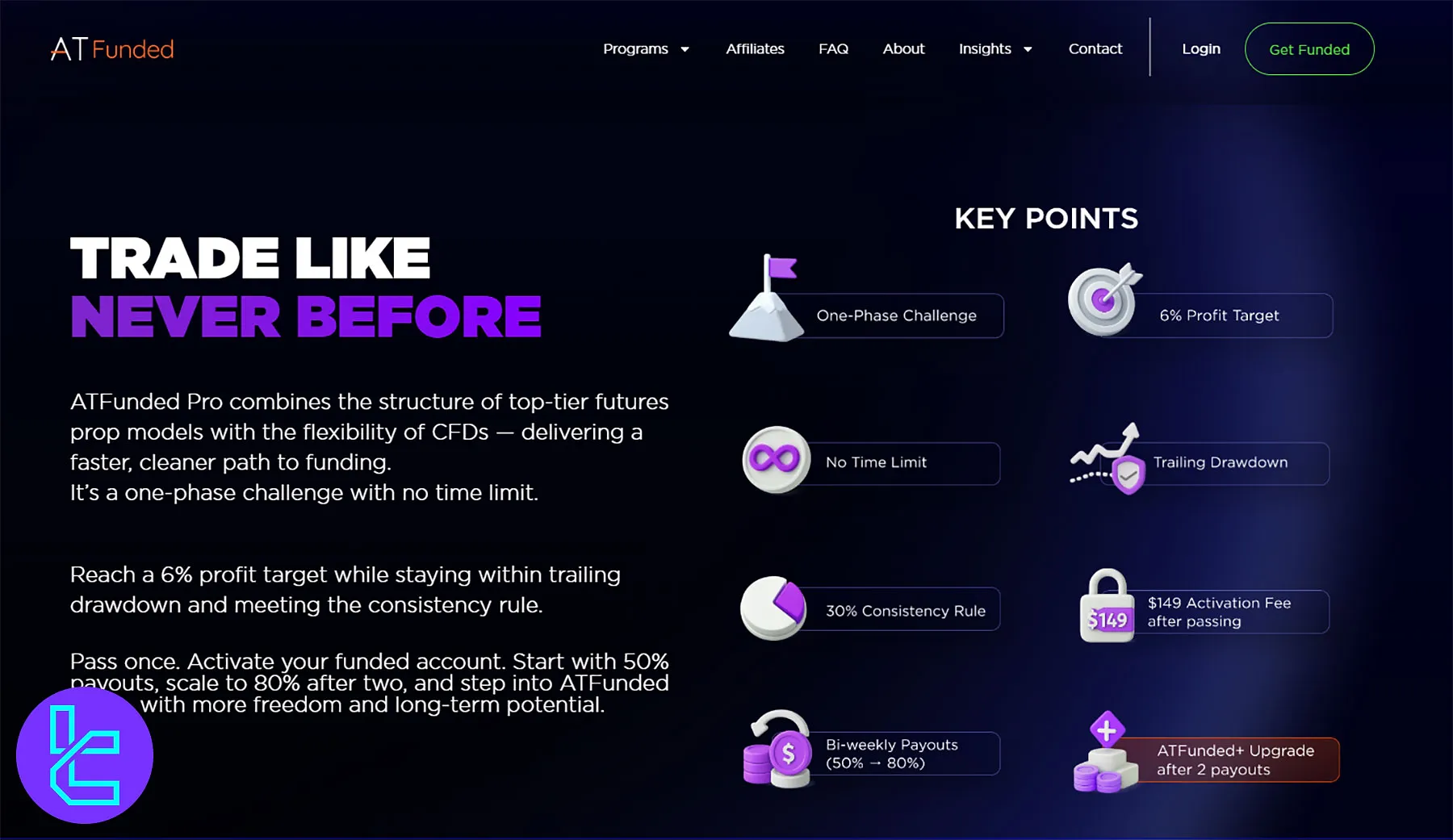

ATFunded Pro Program

The Pro Challenge is ideal for traders who want quicker access to funded accounts, as it involves meeting a single profit target under a defined drawdown limit.

ATFunded Pro Program specifics:

Parametrs | Pro Program |

Profit Target | 6% |

Daily Drawdown | None |

Maximum Drawdown | Trailing |

News Allowed | No |

EAs | Yes |

Consistency | 30% |

Payout Frequency | Bi-weekly |

Profit Split | 50-80% |

Maximum Leverage | 1:30 FX, 1:20 Indices & Metals, 1:10 Oil |

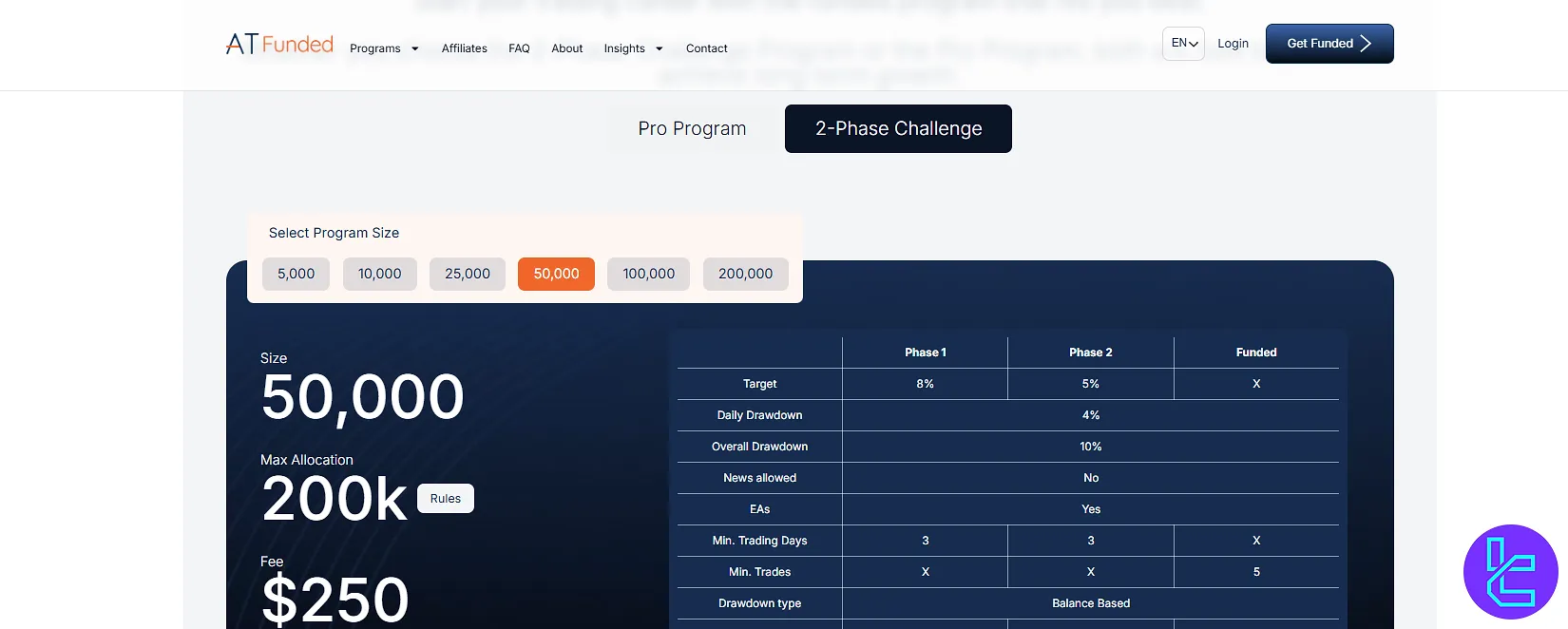

2-Phase Cbhallenge

2-Phase Challenge provides a more gradual approach, offering a two-step evaluation with lower initial profit targets and more lenient rules in Phase 1.

ATFunded 2-Phase Challenge features:

Parametrs | Phase 1 | Phase 2 |

Profit Target | 8% | 5% |

Daily Drawdown | 4% | 4% |

Maximum Drawdown | 10% | 10% |

News Allowed | No | No |

EAs | Yes | Yes |

Minimum Trading Days | 3 | 3 |

Payout Frequency | - | Bi-weekly |

Profit Split | - | 80% |

Maximum Leverage | 1:30 FX, 1:20 Indices & Metals, 1:10 Oil, 1:2 Crypto | 1:30 FX, 1:20 Indices & Metals, 1:10 Oil, 1:2 Crypto |

Does ATFunded Offer Bonus & Discounts?

ATFunded currently does not offer any promotional bonuses or discount campaigns. There are no temporary pricing reductions, deposit bonuses, or referral incentives in place at this time.

ATFunded Rules

ATFunded enforces clear and strict trading rules focused on protecting both trader and firm capital. Rules are designed to maintain a level playing field and ensure transparency throughout the evaluation process. Key trading rules include:

- VPNs are allowed, but U.S.-based IPs are restricted;

- Expert Advisors (EAs), trade copiers, and risk tools are permitted under strict conditions;

- News trading is banned within a 10-minute window around high-impact economic releases;

- Specific trading strategies including copy trading, reverse hedging, arbitrage, tick scalping, and HFT are strictly prohibited;

- ATFunded’s payout policy offers an 80% profit split, flexible withdrawals via bank or ATFX accounts.

VPN Policy

Traders are permitted to use VPN services; however, connections originating from United States-based IP addresses are automatically blocked by the system.

Participants should ensure their VPN endpoints are not located in the U.S. to maintain uninterrupted platform access.

Expert Advisor (EA) Usage

ATFunded allows the integration of automated trading tools such as Expert Advisors (EAs), trade copiers, and risk management software, provided they are not used to exploit system loopholes or mimic other users’ strategies. The following practices are explicitly banned:

- Copying signals or trades from external sources;

- Tick-based scalping techniques;

- Any form of arbitrage including latency, reverse, or hedge arbitrage;

- Usage of emulators or high-frequency trading (HFT) bots.

Use of third-party EAs poses risks to both the platform and its participants. If multiple accounts are detected executing identical trade patterns using the same EA, such accounts may be flagged for copy trading leading to disqualification.

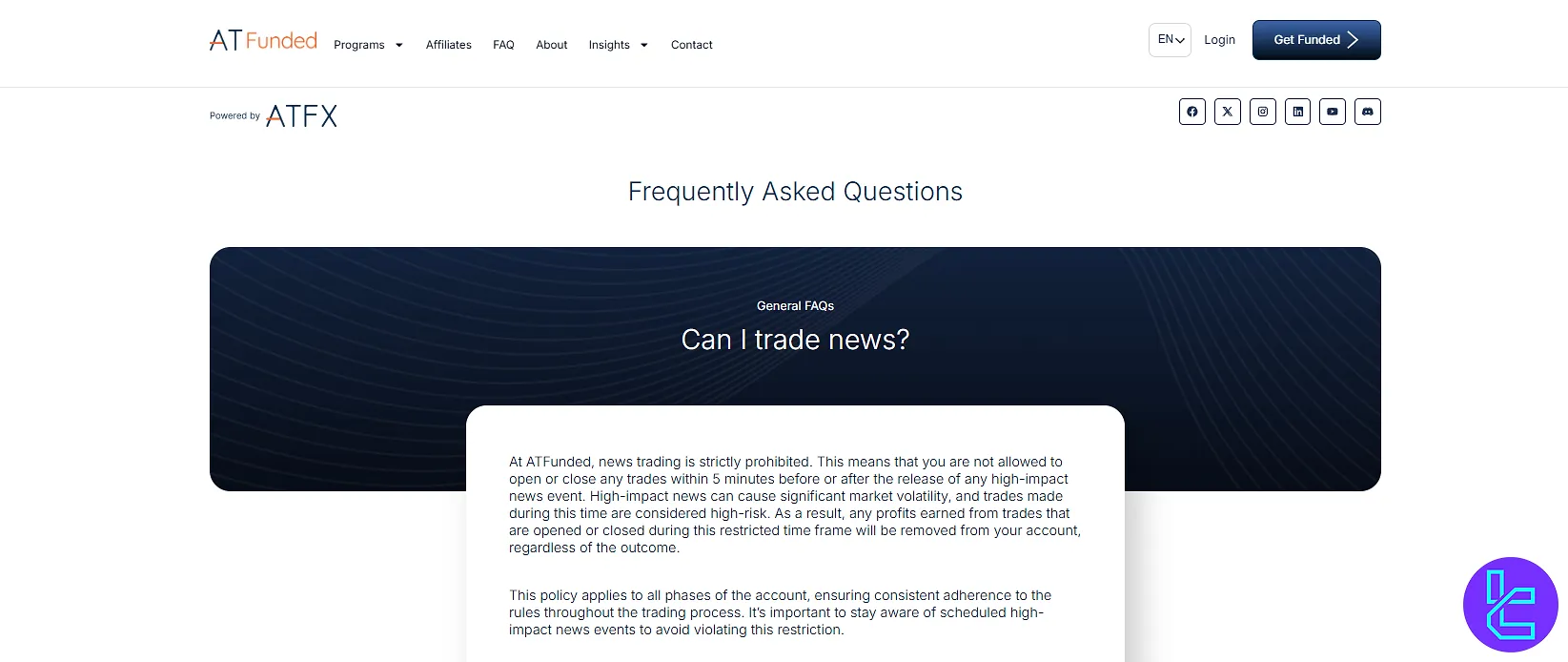

News Trading Restrictions

Engaging in news-based trading is not permitted under ATFunded's evaluation and funded programs.

Traders must refrain from initiating or closing any positions during a 5-minute window before and after any high-impact economic announcement.

Such events often introduce sharp volatility, and trades executed during these periods are considered non-representative of a trader's skill. Any profits generated from trades within this restricted window will be invalidated and removed from the account.

This rule remains consistent across all account phases, emphasizing the importance of monitoring economic calendars to remain compliant.

Prohibited Trading Tactics

To uphold integrity and ensure evaluations reflect genuine trading skill, the following strategies are banned:

- Reverse Trading Across Accounts: Opening opposing positions (buy/sell) on separate accounts whether under one trader or coordinated among multiple participants is disallowed. This includes hedging across prop firms as part of a group;

- Copy Trading: Replicating trades from others violates the core principle of individual performance evaluation in proprietary trading environments;

- Arbitrage-Based Models: Techniques that leverage price discrepancies across platforms or exchanges (e.g., latency or reverse arbitrage) are forbidden, as they exploit system inefficiencies rather than demonstrate strategic competency;

- High-Frequency Trading (HFT): The use of ultra-fast automated execution strategies that rely on milliseconds-level advantage is not supported;

- Tick Scalping: Methods focused on making profit from minute price ticks within extremely short holding periods are not allowed under the platform’s rules.

ATFunded Payout Policy

The prop firmoffers a transparent payout structure designed to reward traders fairly while encouraging account growth. With an 80% profit split and flexible withdrawal options, traders can either cash out earnings or reinvest through ATFX brokerage accounts.

- Profit Split: 80% from third payout onward, consistent for all traders

- Withdrawal Options: Bank transfer or ATFX brokerage account transfer

- Eligibility: Minimum $100 profit required to withdraw

- First Two Payouts: Up to 50% withdrawal, balance remains as buffer

ATFunded Scaling Program

The prop firm does not currently offer a traditional scaling program. Instead, traders receive fixed maximum allocations based on their chosen program, ensuring clear funding limits for both Challenge and Pro accounts.

- Challenge Program Max Allocation: $200,000

- Pro Program Max Allocation: $150,000

- No Scaling: Account size remains fixed after funding

- Focus: Encourages consistent performance within set capital limits

What Are the Trading Platforms of ATFunded?

ATFunded offers trading exclusively on Platform 5, which is the same as MetaTrader 5 (MT5). This modern trading platform supports advanced charting tools, custom indicators, algorithmic trading, and multi-asset execution.

Although it’s branded under a different name, Platform 5 mirrors the familiar layout and capabilities of MT5. Platform 5 Features:

- Full compatibility with EA trading and scripts

- Multi-timeframe technical analysis tools

- One-click trading and low latency order execution

- Built-in economic calendar and market depth data

- Access via desktop, web, and mobile applications

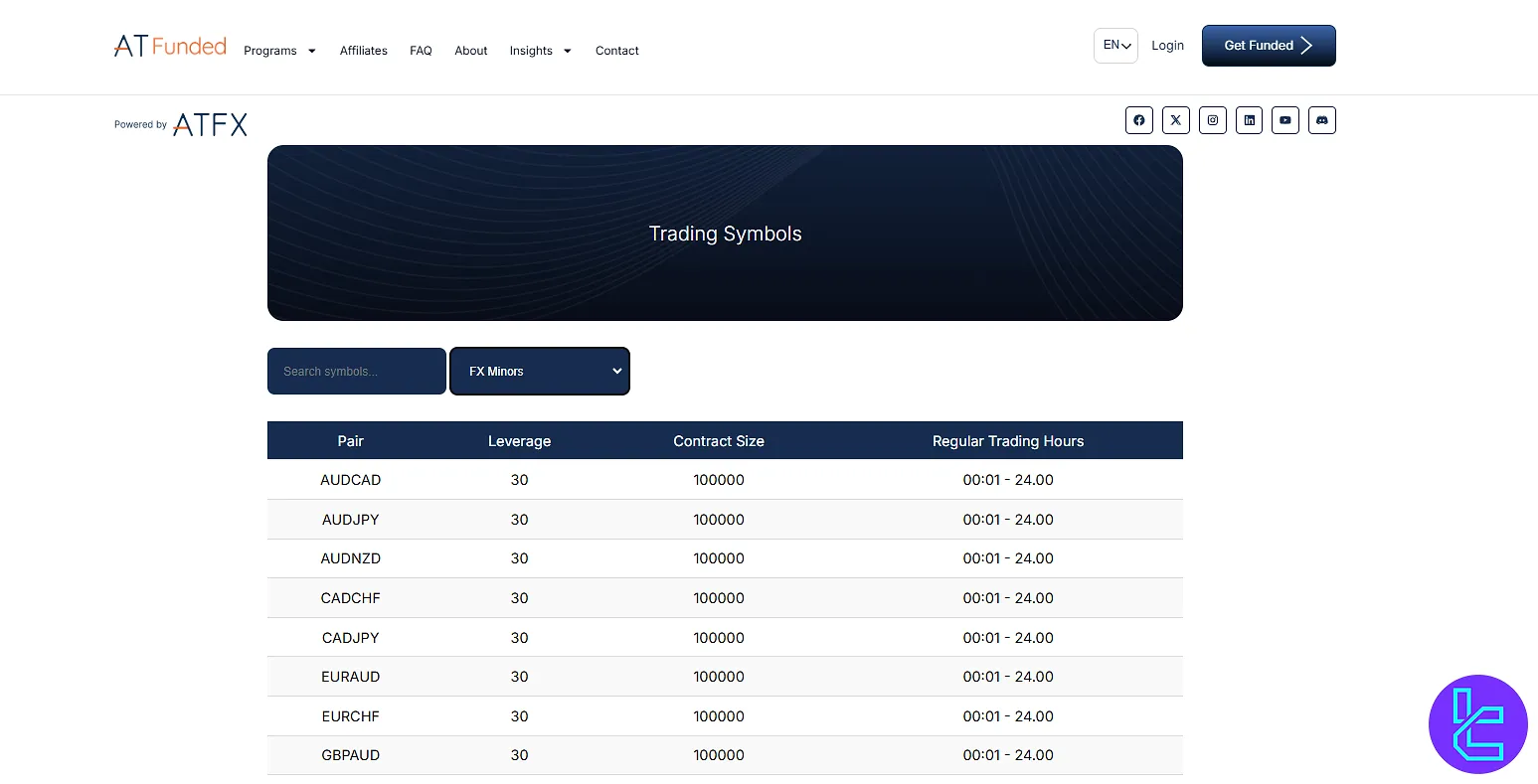

How Many Assets & Instruments Are Available on ATFunded?

ATFunded gives traders access to a broad range of tradable markets, covering major asset categories to suit diverse strategies.

Despite its recent launch, the firm offers instruments that span forex, commodities, indices, and digital assets. Available markets to trade in ATFunded:

- FX Majors (e.g. EUR/USD, GBP/USD)

- FX Minors (e.g. EUR/GBP, AUD/NZD)

- FX Exotics (e.g. USD/TRY, EUR/SGD)

- Metals (e.g. Gold, Silver)

- Indices (e.g. S&P 500, FTSE 100)

- Cryptocurrencies (e.g. Bitcoin, Ethereum, USDT pairs)

- Energies (e.g. WTI Crude, Brent Crude)

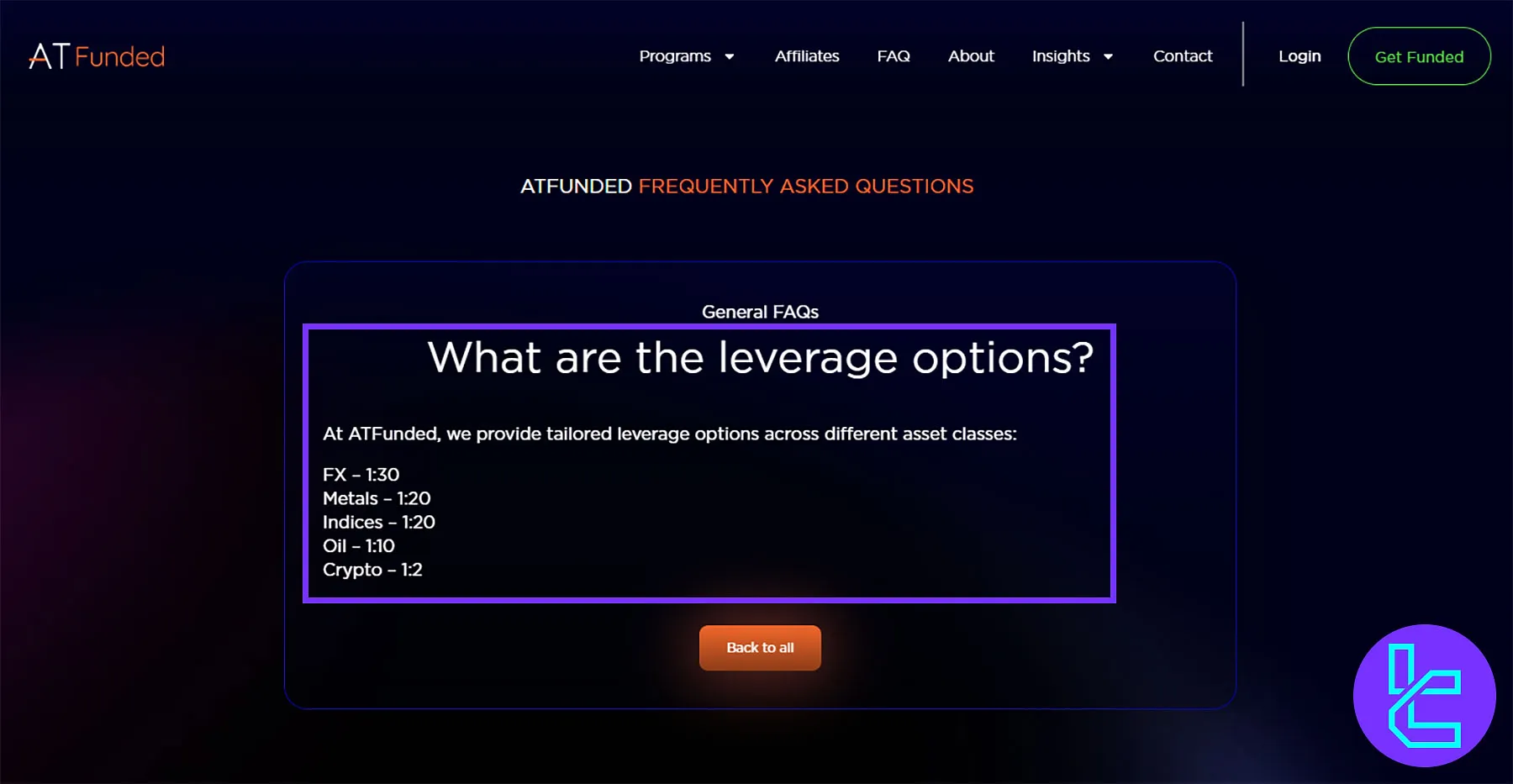

ATFunded Leverage Options

The prop firm offers carefully structured leverage across major asset classes, giving traders the ability to manage risk while maximizing market exposure in Forex, Metals, Indices, Oil, and Crypto within their funded accounts.

- Forex: 1:30

- Metals: 1:20

- Indices: 1:20

- Oil: 1:10

- Crypto: 1:2

ATFunded Fees

ATFunded focuses on funding activation and trade-based commissions.

Fee Breakdown:

- Commission: $5 per lot traded on all pairs

- Payment Deadline: Activation must be completed within 14 days after passing the assessment

These fees are transparent and predictable, but traders should consider the one-time activation cost in their overall capital management plans.

Does ATFunded Offer Educational Resources?

ATFunded currently provides basic educational tools designed to support trader knowledge and decision-making. While not a full-featured academy, the resources aim to help users stay informed about markets and firm-specific mechanics.

Educational Offerings:

- Financial insights via the ATFunded blog

- Economic calendar for upcoming macro events

- Glossary of trading terms and risk definitions

To access additional resources, check TradingFinder's Forex education section.

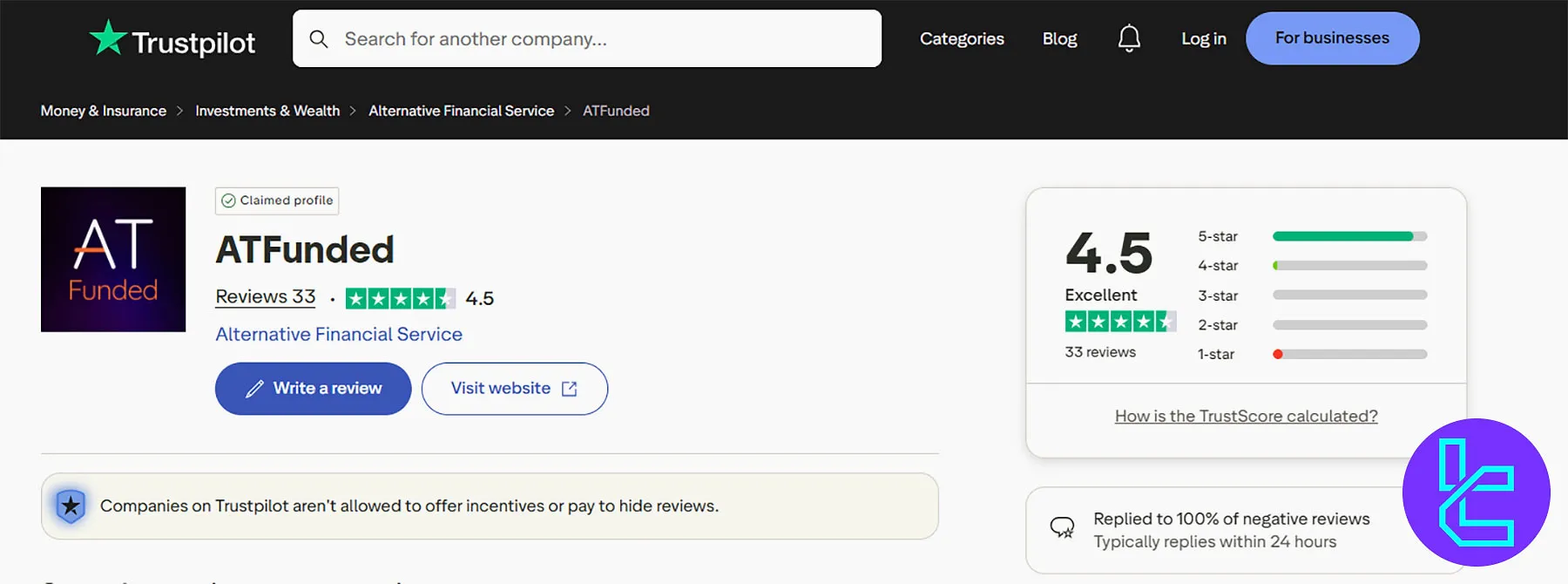

ATFunded Trust Scores

Despite being a new entrant in the prop firm landscape, ATFunded has begun collecting feedback from its user base. While review volume is still limited, early ratings indicate a strong approval pattern.

- ATFunded Trustpilot: 4.5 out of 5 with 33 reviews

- ATFunded PropFirmMatch: 5 out of 5, albeit from just 2 reviews

These trust scores reflect generally positive user experiences, supported by the firm’s transparent rules and clear structure. However, the relatively small number of reviews suggests that broader feedback is still evolving.

ATFunded Customer Services

ATFunded provides standard customer support through a ticket system and email. Their team is available during business hours, Monday to Friday, to assist with technical issues, account setup, and policy-related queries.

While there’s no 24/7 live chat yet, their responsiveness via email has been reported as professional and prompt.Support Channels:

Support Method | Availablity |

Live Chat | Yes (On the official website) |

Yes (support@atfunded.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | No |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

The ATFunded Office hours are Monday to Friday, 9:00 AM – 5:00 PM (GMT+3). The prop firm also offers In-person support for registered inquiries.

Although not as extensive as some larger prop firms, ATFunded’s current support coverage is sufficient for new and mid-level traders.

ATFunded contacts page with ticket section

ATFunded contacts page with ticket section

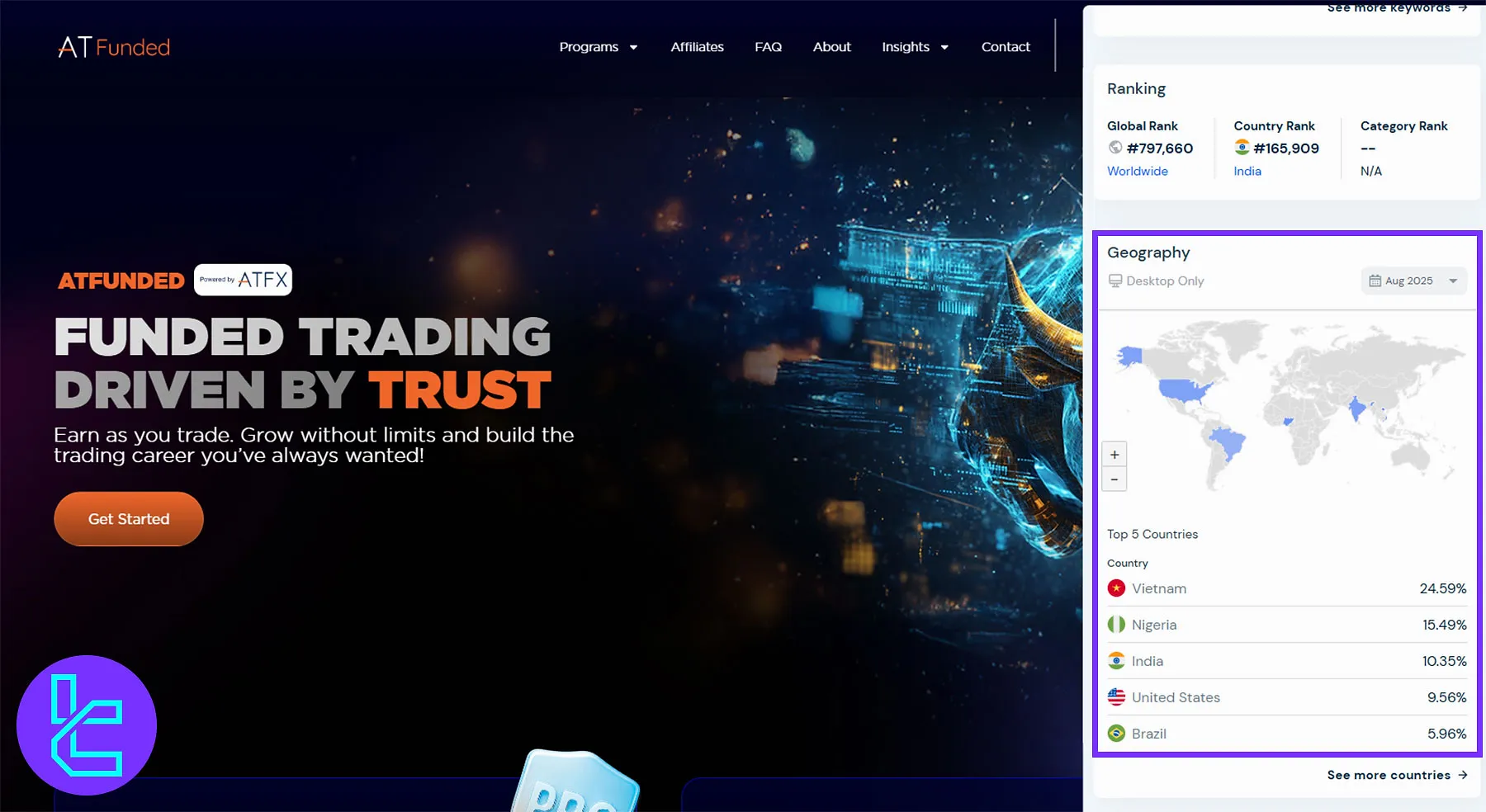

ATFunded User Base

The prop firm has established a diverse global audience, attracting traders from Asia, Africa, and the Americas. Its strong international presence highlights its credibility as a trusted proprietary trading firm powered by ATFX.

- Top Countries: Vietnam (24.59%), Nigeria (15.49%), India (10.35%)

- Other Key Markets: United States (9.56%), Brazil (5.96%)

- Reach: Expanding community across multiple continents

- Focus: Serving traders seeking funded accounts and consistent growth opportunities

ATFunded on Social Media

ATFunded maintains an active presence across several social platforms to engage with traders, announce updates, and share educational content.

These channels allow for both community interaction and firm announcements, though the depth of content varies by platform. Social Media Channels:

Social Media | Members/Subscribers |

1.2K | |

6,124 | |

2,239 | |

51 | |

3,517 | |

270 |

ATFunded Comparison with Other Prop Firms

While ATFunded is still new, it offers several standout features like low-cost entry, a free trial, and backing from a known brokerage group. Quick comparison with other prop firms:

Parameters | ATFunded Prop Firm | |||

Minimum Challenge Price | $25 | $39 | $67 | $55 |

Maximum Fund Size | $200,000 | $4,000,000 | $2,000,000 | $200,000 |

Evaluation steps | 1 Step, 2 Step | 1-Step, 2-Step, 3-Step | 1-phase, 2-phase, 3-phase | 1-phase, 2-phase |

Profit Share | Up to 80% | 100% | Up to 90% | 80% |

Max Daily Drawdown | 4% | 5% | 4% | 4% |

Max Drawdown | 10% | 10% | 10% | 6% |

First Profit Target | 6% in Pro Program, 8% in 2-Phase Challenge | 5% | 6% | 8% |

Challenge Time Limit | 3 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:30 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly | Bi-weekly | 14 Days | 2 Times a Month |

Number of Trading Assets | Not Specified | 3000+ | N/A | 200+ |

Trading Platforms | Platform 5 (MetaTrader 5) | Metatrader 5 | MatchTrader, Tradelocker, MT5 | Metatrader 5, CFT Platform and Crypto Futures |

TF Expert Conclusion

ATFunded is a prop firm backed by a regulated broker group, offering transparent evaluation programs [Pro and 2-Phase], moderate capital access [up to $200K], and affordable pricing [from $25].