AudaCity Capital offers funded accounts, ranging from $7,500 to $240,000, with leverage options of up to 1:100. The prop firm provides access to 32 instruments across 3 asset classes, including Forex and Metals. First profit target, maximum daily loss, and maximum total drawdown are 10%, 7.5%, and 15%, respectively.

AudaCity Capital Company Introduction

Founded in 2012 in the heart of London's financial district, AudaCity prop firm has been on a mission to revolutionize the way traders access capital and scale their trading operations.

The company operates in 140+ countries worldwide and has seen a trading volume of $2.4B since inception. The firm funds traders with up to $2,000,000 through two main programs. Its monthly payout record is $2.82M. AudaCity Key features:

- Fast scaling options

- Economic calendar

- MT4 and MT5 trading platforms

- Integrated wallet

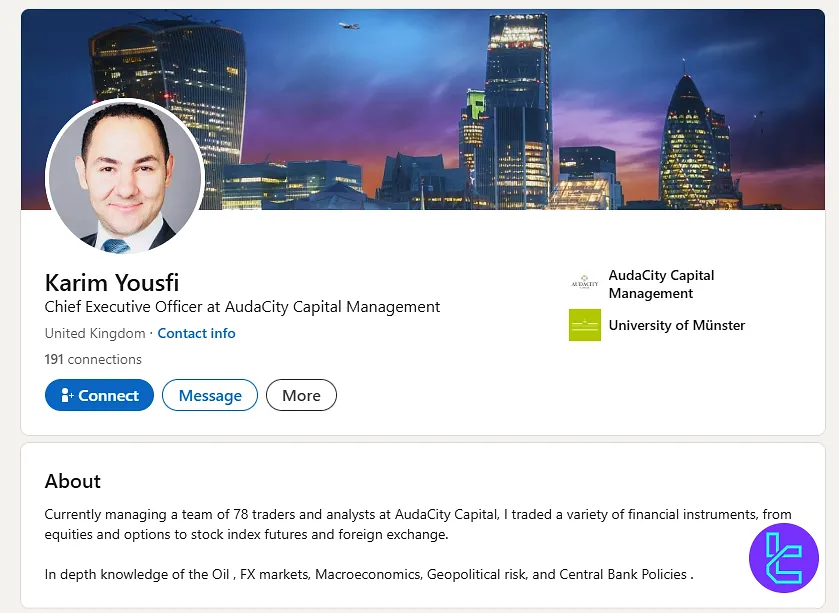

AudaCity Capital's CEO

The Chief Executive Officer of AudaCity Capital is Karim Yousfi (A. Karim Yousfi), who is also the founder of the firm. He created AudaCity Capital to provide funding solutions and support for talented traders seeking to scale their performance.

Yousfi has a professional background as a trader and market strategist, having worked with major banks and hedge funds. His expertise spans equities, options, stock index futures, foreign exchange, oil and FX markets, macroeconomics, and central bank policies.

As a public figure, he is frequently invited to speak at industry seminars and appears in articles and videos that explore prop trading strategies and trader development.

To connect with Yousfi, follow the link below:

AudaCity Capital Table of Specifications

The prop firm doesn’t work with brokers. Instead, it has partnered with an institutional liquidity provider. Thus, it offers some of the tightest spreads available in the market. AudaCity Capital specifics:

Account currency | USD |

Minimum price | $90 |

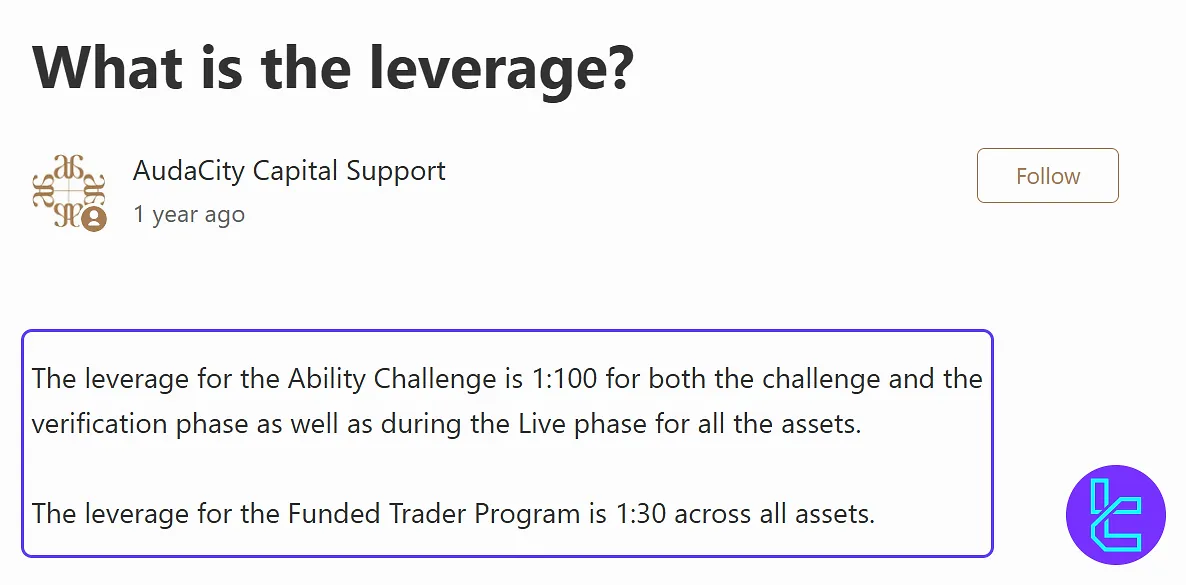

Maximum leverage | Up to 1:100 |

Maximum profit split | Up to 90% |

Instruments | Forex, Indices, Gold |

Assets | 32 |

Evaluation steps | 2-Phase |

Withdrawal methods | Paypal, Crypto, Direct Bank Transfer |

Maximum fund size | $2,000,000 |

First profit target | 10% |

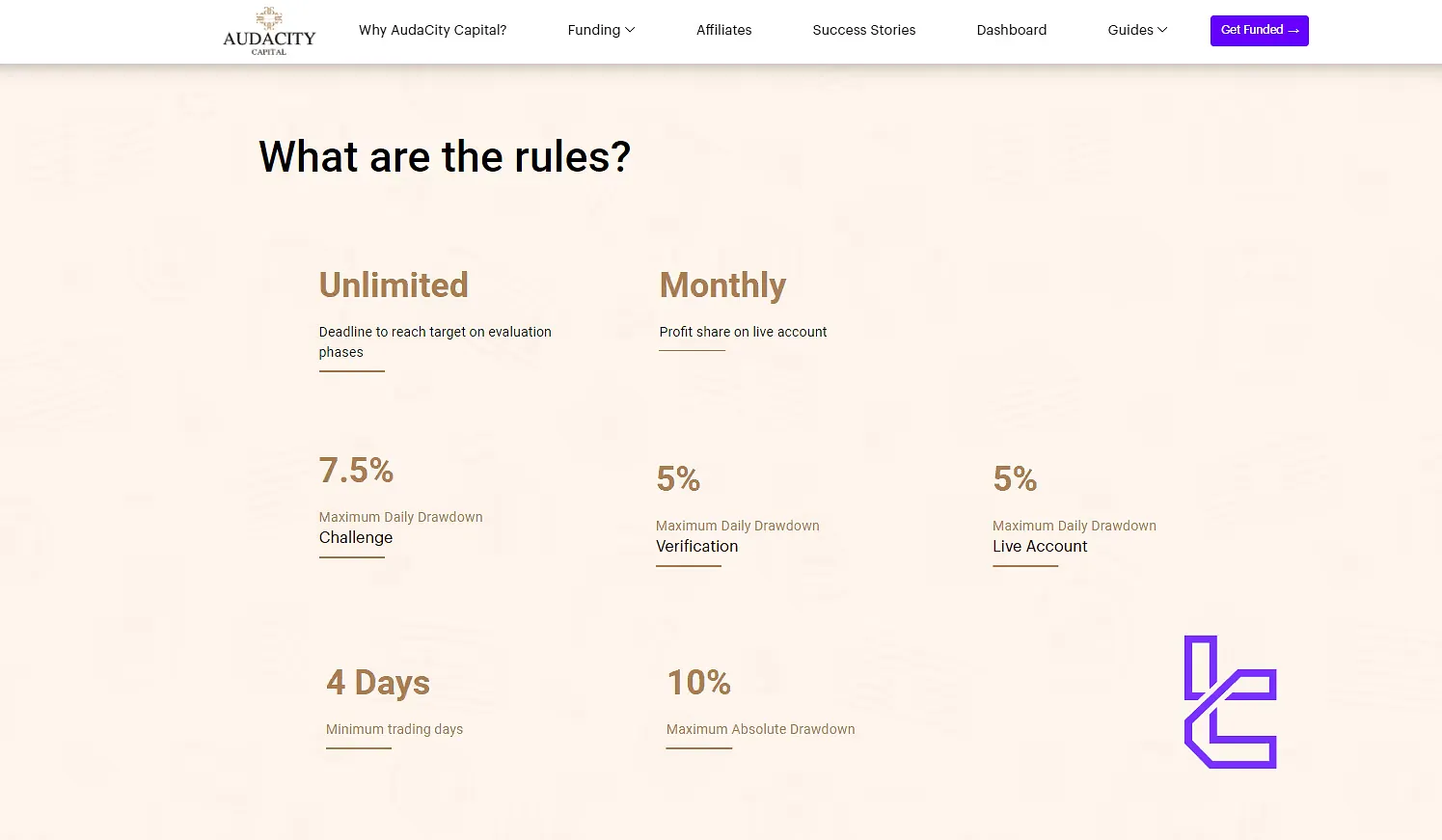

Max. daily loss | 7.5% |

Challenge time limit | Unlimited |

News trading | Unlimited |

Maximum total drawdown | 15% |

Trading platforms | MT5, MT4 |

Commission | $5 per lot in the Ability challenge |

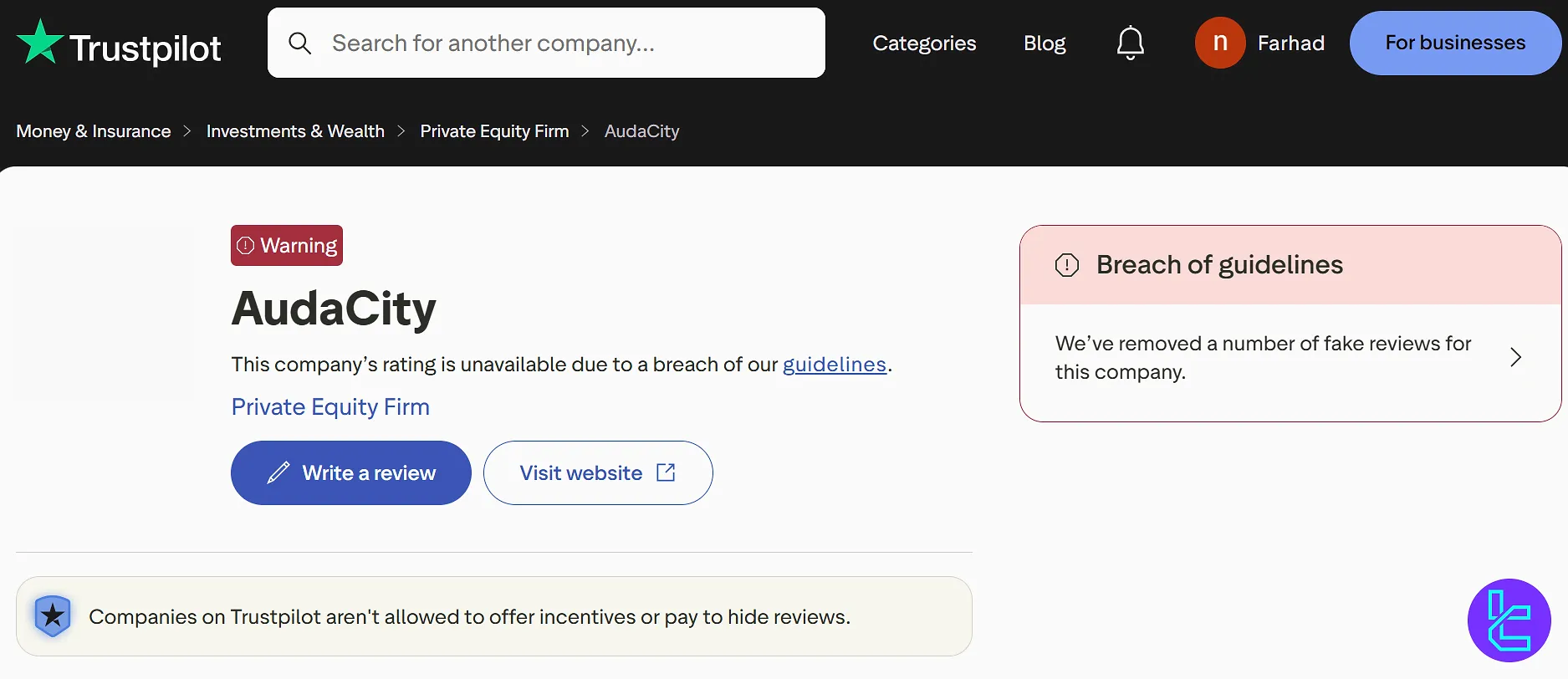

Trustpilot score | Unavailable |

Payout frequency | Bi-Weekly |

Established country | UK |

Established year | 2012 |

AudaCity Capital Pros & Cons

Every coin has two sides, and AudaCity Capital is no exception. While it offers some exceptional conditions, it also has downsides.

Pros | Cons |

Scaling plan up to $2M | Variable Profit Share (as low as 50%) |

Up to 90% profit split | Low leverage options |

Refundable fees | Limited trading assets |

No limitations on news trading | - |

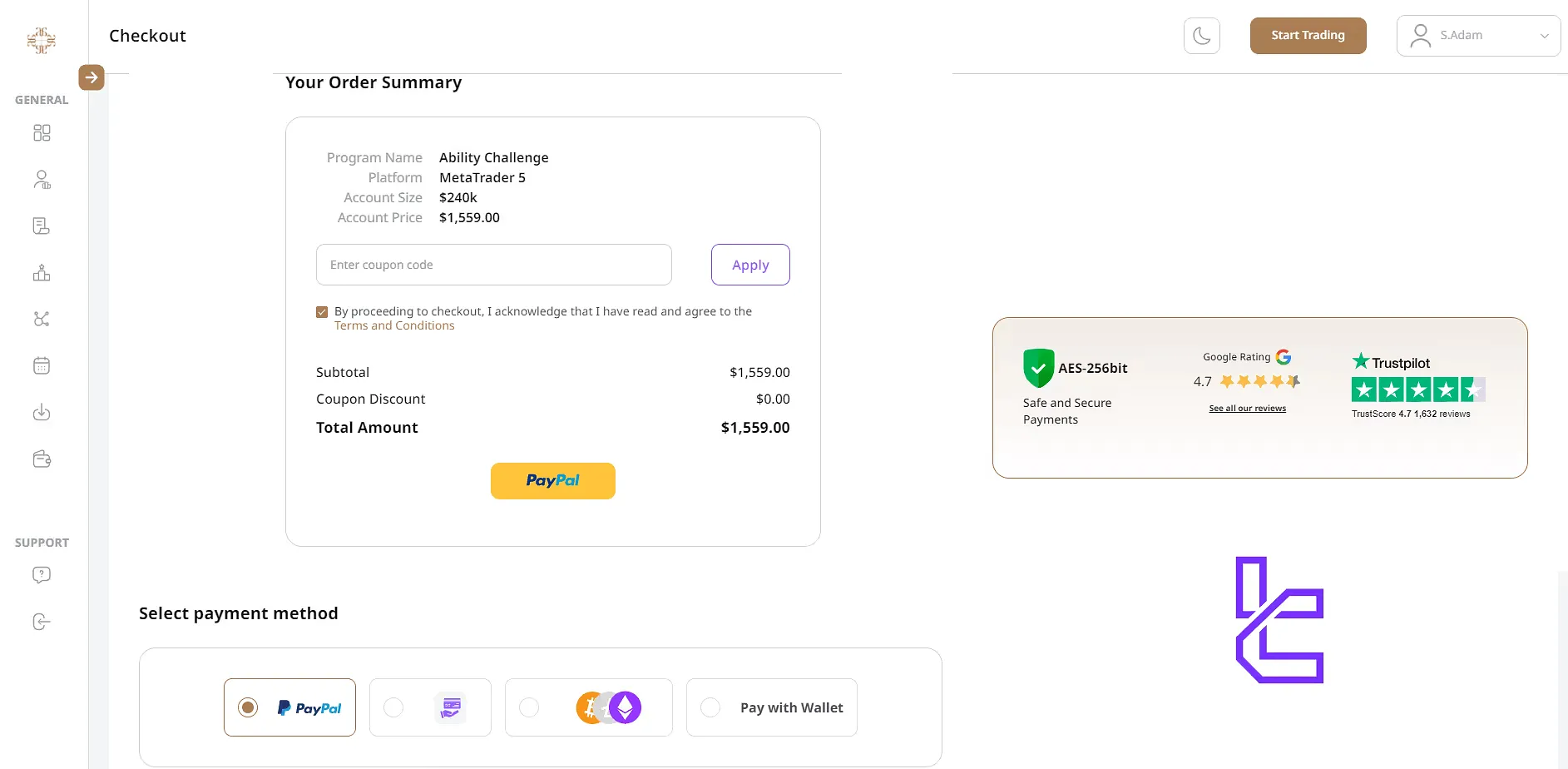

AudaCity Capital Funding Plans and Their Costs

There are two types of funding plans: Instant and Challenge. The first one suits professional traders, and the latter is designed for users who have a smaller budget. AudaCity Capital funding plans and related costs:

| Account Size | Funded Trader | Ability Challenge |

$7,500 | $329 | - |

$10,000 | - | $90 |

$15,000 | $649 | $130 |

$30,000 | - | $230 |

$60,000 | $2,399 | $320 |

$120,000 | - | $540 |

$240,000 | - | $1,090 |

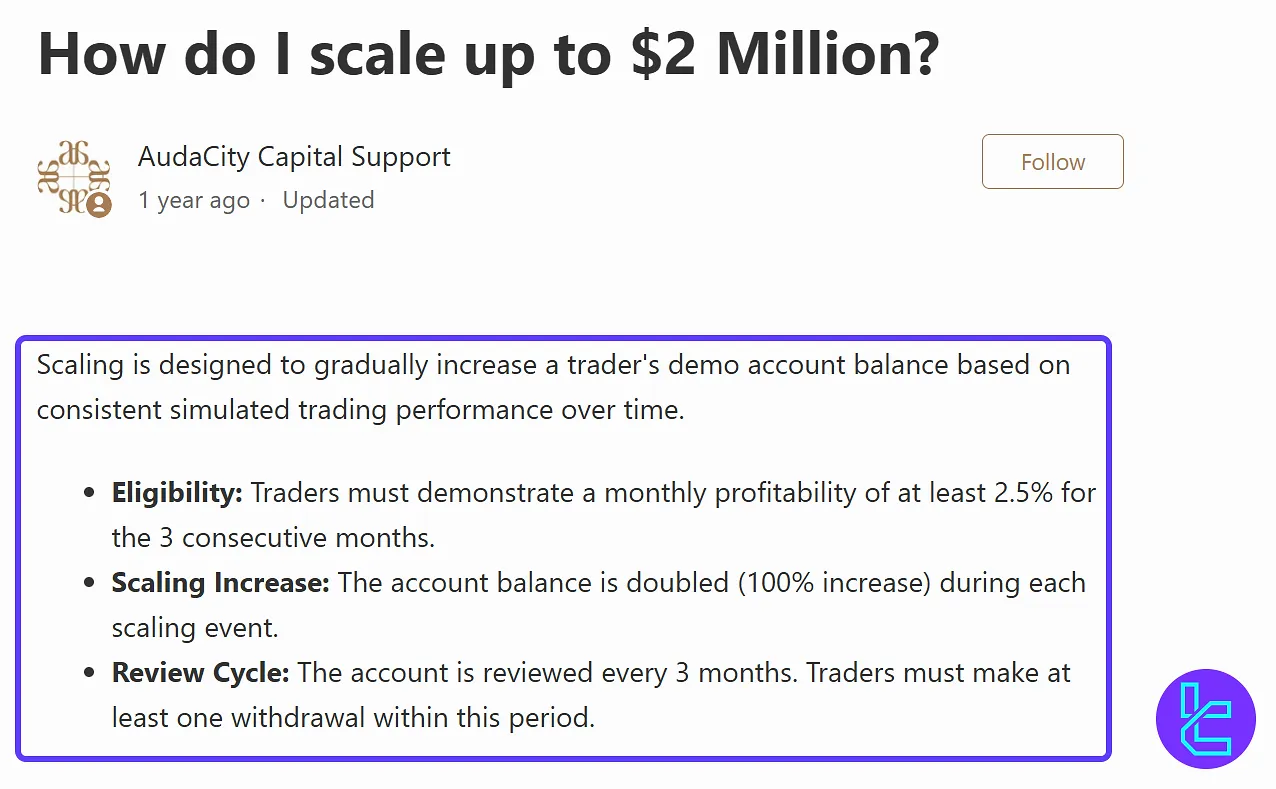

AudaCity provides performance-based scaling, up to $2M in funding. Once a trader achieves a 10% profit on their current balance, the account size doubles, advancing them to the next funding level. This system allows consistent traders to start with a modest account and scale rapidly over time.

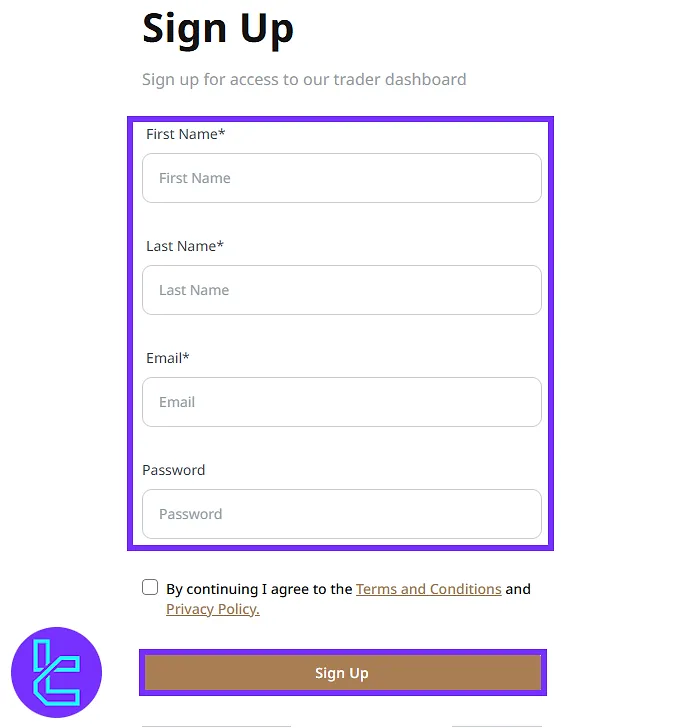

How to Create an Account and Verify It on Audacity Capital?

To join the prop firm’s community and trade Forex, Gold, and Indices without your money, follow the stages below to go through AudaCity Capital registration.

#1 Create Your Account

Start by opening the registration form via the “Open an Account” option. Input the following:

- Full Name

- Email Address (must be unique)

- Secure Password

Agree to the terms, then hit Sign Up to proceed.

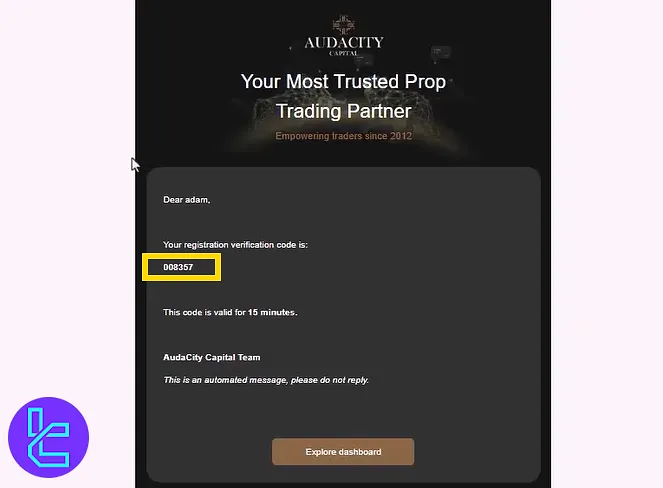

#2 Verify and Access the Dashboard

Once registered, you’ll receive a verification code via email. Enter this code to confirm your identity.

Upon success, you’ll immediately unlock the AudaCity Capital dashboard, where you can explore funded trader challenges and manage your trading profile.

#3 Identity Verification

To be able to withdraw profits from your account, you’ll need to complete the KYC process through the “Profile” menu in the client dashboard. Required documents for AudaCity Verification:

- ID card, Passport, or Driving license

- Selfie

Evaluation Phase on Audacity Capital

Audacity Capital's funding plans (Ability Challenge, Funded Trader Program) are designed to cater to a wide range of traders. They are different in areas like leverage offerings, profit split, and evaluation phases.

AudaCity Capital Ability Challenge Plan

AudaCity Capital’s Ability Challenge is designed to evaluate and prepare traders before granting them access to a fully funded live account.

The program consists of two evaluation phases, Challenge and Verification, followed by the Live Account stage.

Here are the parameters:

| Features | Challenge Phase | Verification Phase | Live Account |

Duration | Unlimited | Unlimited | Unlimited |

Min Trading Days | 4 | 4 | 4 |

Profit Share | - | - | Up to 90% |

Max Daily Drawdown | 7.5% | 5% | 5% |

Max Drawdown | 15% | 10% | 10% |

Target | 10% | 5% | - |

AudaCity Capital Funded Trader Account

For professional traders who are confident in their strategies and want to trade without having to pass evaluation steps, AudaCity offers the Funded Trader program.

The plan details are as follows:

Assets | Forex, Indices, Gold |

Min Trading Days | 5 (at least 3 profitable Days) |

Profit Share | Up to 80% |

Max Daily Drawdown | 5% |

Max Drawdown | 10% |

Target | 10% |

Leverage | 1:30 |

News Trading | No |

Audacity Capital Prop Firm Bonus and Promotions

The company offers two main promotional programs: Affiliate and Partnership. The Affiliate program features 2 levels with different commission rates. Participants are evaluated on a monthly basis. Here are Affiliate rankings:

Levels | Commission Rate |

Affiliate | 7% |

Ambassador | 10% |

Partnership program comes with 4 various levels with commission rates ranging from 10% to 20%. The more people you invite, the more your earnings.

Levels | Commission Rate |

Standard | 10% |

Premium | 12% |

Executive | 15% |

Elite | 20% |

AudaCity Capital Rules

Traders must trade by the rules set by the prop firm to be safe from account closures. AudaCity Capital Rules:

- Hedging is allowed for risk control, but not as a core trading strategy;

- EA (Expert Advisors) are permitted if they comply with risk and execution rules;

- High-risk methods like martingale, arbitrage, and grid trading are strictly prohibited;

- Trading during major economic news is restricted for Funded Traders;

- Traders receive notifications of restricted periods via email, with a mandatory 30-minute cooldown after events;

- Payouts are available after reaching a 10% profit, with profit shares ranging from 50% to 80% depending on account size and how quickly the target is achieved.

VPN Use

No specific guidance has been provided on the use of VPNs. Traders are advised to ensure their connection does not conflict with regional compliance policies or risk assessment protocols, as this may affect account verification or monitoring.

Hedging Policy

Audacity Capital permits hedging strategies solely for the purpose of managing risk exposure. However, traders must not rely on hedging as their dominant approach.

The firm views hedging as a supportive tool within a broader risk management plan rather than a standalone method for generating profits.

Expert Advisor (EA) Usage

Traders are allowed to utilize Expert Advisors (EAs) as part of their strategy, provided the automated systems comply with Audacity Capital’s risk parameters. Any EAs that employ these techniques are strictly prohibited:

- High-Frequency Trading (HFT)

- Martingale techniques

- Latency arbitrage or data manipulation

The firm encourages algorithmic solutions only if they are built upon sound risk management principles and align with long-term, sustainable trading practices.

Martingale & Arbitrage Restrictions

The use of martingale systems, which involve increasing lot sizes after each loss to recoup prior drawdowns, is explicitly forbidden. Despite its theoretical appeal, this strategy exposes accounts to exponential risk and is incompatible with risk-capped environments like proprietary trading firms.

Audacity Capital also prohibits any form of arbitrage or grid trading, particularly across multiple accounts (internal or across different firms). This includes group hedging tactics where traders attempt to offset risks by placing opposing trades in parallel accounts. Such practices distort real market risk and violate the integrity of the funded trading model.

News Event Trading Rules

Trading around high-impact economic announcements is subject to strict controls. Traders in the Funded Trader Program may not hold open positions during major events, including:

- Non-Farm Payrolls (NFP)

- Central Bank interest rate decisions

- Official monetary policy speeches

Prior to these events, the Risk Management Team will notify traders via email when such restrictions are in effect. Once the news event concludes, a mandatory 30-minute waiting period must be observed before initiating or modifying trades.

To help stay compliant, traders are encouraged to consult a real-time economic calendar to track upcoming restricted events.

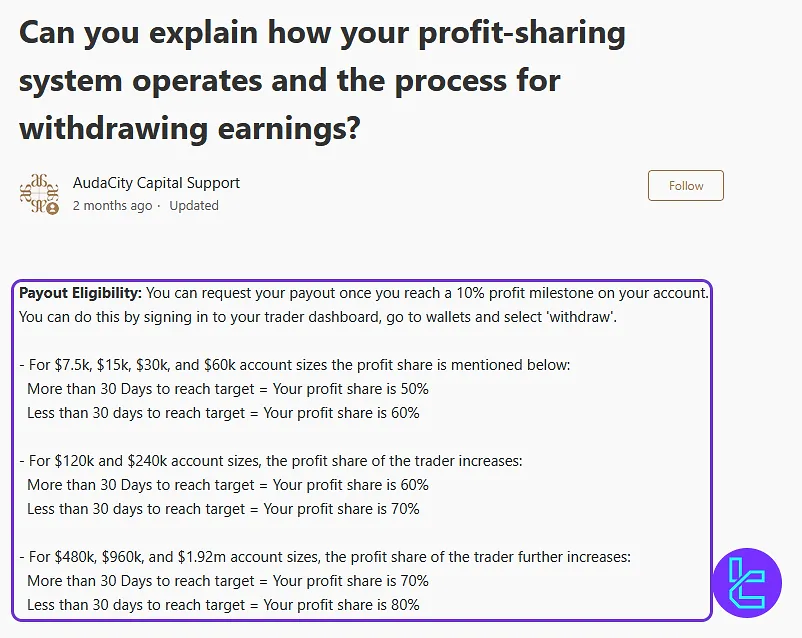

Payouts

AudaCity Capital allows traders to withdraw profits once they reach a 10% profit milestone on their account.

Payout requests can be made directly from the trader dashboard by selecting the wallet and choosing the “withdraw” option.

For $7.5k, $15k, $30k, and $60k account sizes, the profit share is:

- 50% if the profit target takes more than 30 days to achieve;

- 60% if the profit target is achieved in less than 30 days.

For $120k and $240k accounts, the profit share increases to:

- 60% for reaching the target in over 30 days;

- 70% for reaching it within 30 days.

For $480k, $960k, and $1.92M accounts, the highest payout tiers apply:

- 70% for more than 30 days;

- 80% for less than 30 days.

This structure rewards traders for reaching targets faster, offering higher profit splits for quicker performance.

AudaCity Capital Scaling Plan Details

AudaCity Capital provides a structured scaling plan designed to gradually grow a trader’s account balance based on consistent performance.

To qualify, traders must maintain a minimum monthly profitability of 2.5% over three consecutive months. Once eligible, their account balance is doubled at each scaling event, effectively increasing their capital by 100%.

Reviews are conducted every three months, and at least one withdrawal must be made within this period to remain eligible. This approach allows traders to systematically build their account size and potentially scale up to $2 million.

AudaCity Capital Trading Platforms

The firm offers two of the most advanced trading platforms out there; MetaTrader 4 and MetaTrader 5. Developed by MetaQuotes company, these two trading solutions provide robust trading features on Android, iOS, and Desktop. AudaCity Capital trading platforms links:

Traders can use these platforms with their funded accounts, whether from the Ability Challenge or the Funded Trader Program. Platform access is granted once registration, verification, and funding steps are completed.

Available Markets on Audacity Capital

The company offers the most popular financial instruments, allowing traders to spread their wings and explore various trading opportunities. However, the downside is that the list is limited to only 32 instruments. AudaCity Capital Asset List:

- Forex Market: AUDUSD, EURAUD, EURGBP, EURUSD, GBPCAD, GBPUSD, USDCAD, USDCHF, USDJPY, AUDCAD, AUDCHF, AUDJPY, AUDNZD

- Metals: XAUUSD

- Indices: GER30, SPX500, TECH100, WS30

Leverage Structure

AudaCity Capital provides a clear leverage model for its programs. In the Ability Challenge, traders have access to 1:100 leverage during both the challenge and verification phases, as well as in the live trading phase across all asset classes.

For those in the Funded Trader Program, leverage is set at 1:30 for all instruments, offering a more conservative trading environment while still allowing for effective risk management.

Which Payment Methods Does Audacity Capital Offer?

When it comes to getting your funds in and out of the AudaCity Capital account, they've got you covered with a smorgasbord of options.

The table below goes through the available choices.

Payment | Cryptocurrency, Credit card, PayPal, Bank Transfer |

Payout | Paypal, Crypto, Direct Bank Transfer |

Trading and Non-Trading Costs on Audacity Capital

The firm’s fee structure, while simple, is not very clear. There are only commissions on the Ability challenge. You have to pay $5 per lot on every instrument. And there are also swap fees on this program.

Audacity Capital Educational Contents

The company has partnered up with London School of Economics and Political Science (LSE). It also offers up to date financial guides and insights through blog posts.

Audacity Capital Prop Firm Trust Scores

When it comes to trust in the world of prop trading, Audacity Capital is not the best contender.

According to the AudaCity Capital Trustpilot page, the prop firm's score is unavailable due to "a breach of guidelines". The reputable review website states that they have removed a number of fake reviews for AudaCity.

How Can I Reach Audacity Capital Customer Support?

The prop firm offers 3 main contact channels for traders in need. Email, phone, and an address to visit in person. The table below provides more details:

Support Method | Availability |

Live Chat | No |

Yes (support@audacitycapital.co.uk) | |

Phone Call | Yes (+44 20 8050 1985) |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | Yes (with a Seach option) |

Help Center | No |

Yes (Message) | |

Messenger | No |

You can visit the company at One Canada Square, Level 8, Office 8.05, London E14 5AA, England, United Kingdom.

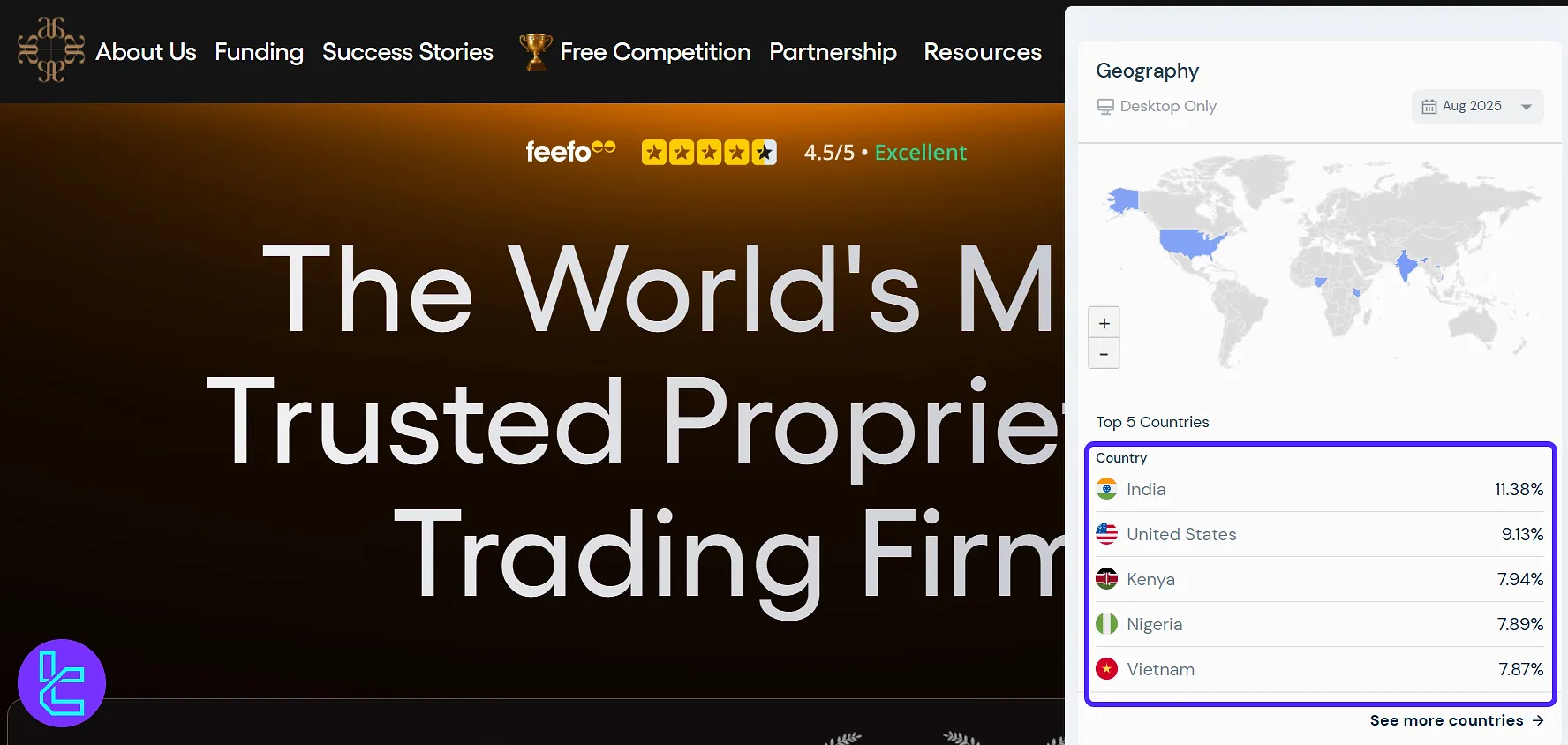

AudaCity Capital User Regions Investigation

AudaCity Capital attracts a diverse international audience, with a notable presence across Asia, Africa, and North America. This regional distribution reflects the firm’s global reach and its strong user base in emerging and developed markets.

- India: 11.38%, Largest user group, highlighting strong adoption in Asia

- United States: 9.13%, Significant share from North America

- Kenya: 7.94%, Growing presence in East Africa

- Nigeria: 7.89%, Stable engagement from West Africa

- Vietnam: 7.87%, Strong activity from Southeast Asia

Is Audacity Capital Active on Social Media?

The company maintains an active presence on social platforms and tries to know its customers on a human level.

AudaCity Capital social profiles:

Social Media | Members/Subscribers |

Over 10K | |

Over 32K | |

Over 22.6K | |

Over 34.2K | |

Over 1.2K | |

Over 5K |

Table of Comparison: AudaCity Capital vs. Top Prop Firms

To be able to compare the mentioned prop firm against its major peers, look at the table below:

Parameters | AudaCity Capital Prop Firm | |||

Minimum Challenge Price | $90 | $50 | €55 | $97 |

Maximum Fund Size | $2,000,000 | $2,000,000 | Infinite | $200,000 |

Evaluation steps | 2-Phase | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step |

Profit Share | Up to 90% | 90% | 100% | 80% |

Max Daily Drawdown | 7.5% | 4% | 5% | 5% |

Max Drawdown | 15% | 6% | 8% | 10% |

First Profit Target | 10% | 5% | 10% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:5 | 1:100 | 1:100 |

Payout Frequency | 14 Days | Bi-weekly | 14 Days | Bi-weekly |

Number of Trading Assets | 32 | 100+ | 150+ | 40 |

Trading Platforms | MT4, MT5 | Proprietary platform | Proprietary platform | MetaTrader 5, cTrader, Dxtrade |

Expert suggestions

AudaCity Capital offers prop trading with up to $2,000,000 capital on 27 Forex symbols, 4 Indices, and Gold. The firm offers instant funding accounts with a total drawdown of 10% and leverage options of up to 1:30 for a minimum fee of $329.

It supports some of the most popular payment methods like PayPal and Crypto. AudaCity Capital's prop firm had a Trustpilot score of 4.7 before it became unavailable on the mentioned website.