Blink Funding Rules include a 30-day inactivity policy, requiring traders to place at least 1 trade per month.

Profit-sharing goes up to 90%, with challenges offering targets like 10% profit in 1-step or 5% profit across 3-step evaluations.

News trading is allowed, but trades must close by 3:45 PM EST Friday, unless the 10% cost Hold Over Weekend Add-on is purchased.

Blink Funding Rule Topics

Various rules are enforced by Blink Funding Prop Firm to ensure fair trading; Key topics for Blink Funding’s General and Trading Rules:

- Challenge Rules

- Hold & Trade Through Weekend

- Inactivity Rules

- News Trading

- Use of Expert Adviser

- Leverage Limits

- Payout Rules

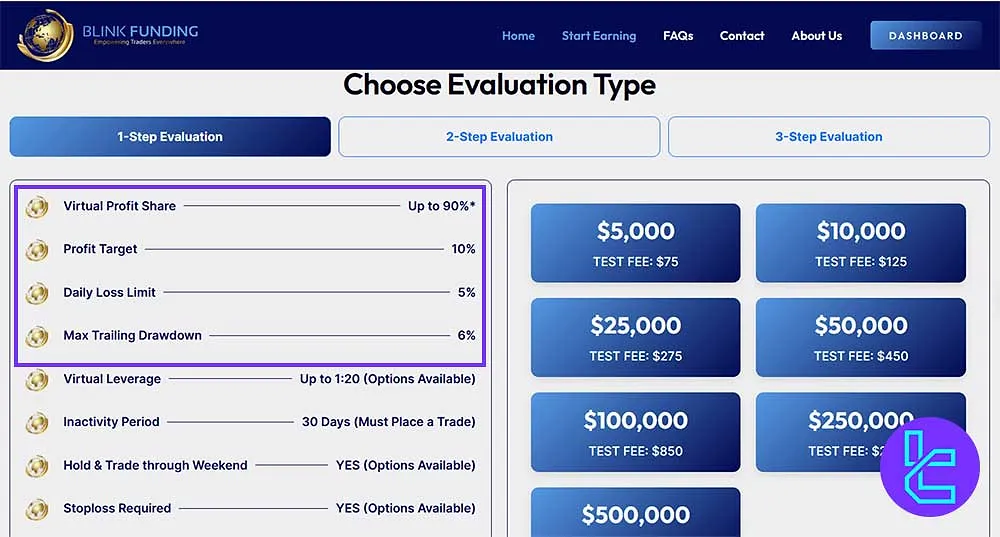

Blink Funding Challenge Rules

The firm offers different challenge types with specific profit targets and drawdown limits; Blink Funding Evaluation Rules:

Challenge Type | Virtual Profit Share | Profit Target | Daily Loss Limit | Max Drawdown |

1-Step | Up to 90% | 10% | 5% | Trailing: 6% |

2-Step | Up to 90% | Test 1: 10% Test 2: 5% | 4% | 8% |

3-Step | Up to 90% | Test 1: 5% Test 2: 5% Test 3: 5% | No | 5% |

As you see, 3-step challenges have no daily loss limits but have a tight max drawdown.

Blink Funding Hold & Trade Through Weekend

Blink Funding prop firm requires all trades to be closed by 3:45 PM EST on Friday. Open trades after this time will be automatically closed but will not result in an account breach.

To hold positions over the weekend, traders must purchase the Hold Over Weekend Add-on (10% cost), which disables the auto-close rule.

Blink Funding Inactivity Rules

Traders must remain active to keep their accounts in good standing; Blink Funding inactivity policy:

- Traders must place at least one trade every 30 days;

- Accounts without activity beyond 30 days may be subject to deactivation.

Blink Funding News Trading

News trading is permitted with some limitations; Blink Funding News Rules:

- Allowed: Trading during these events is permitted as long as pricing data from the broker is available;

- Restricted: Trading stocks before earnings announcements are not allowed.

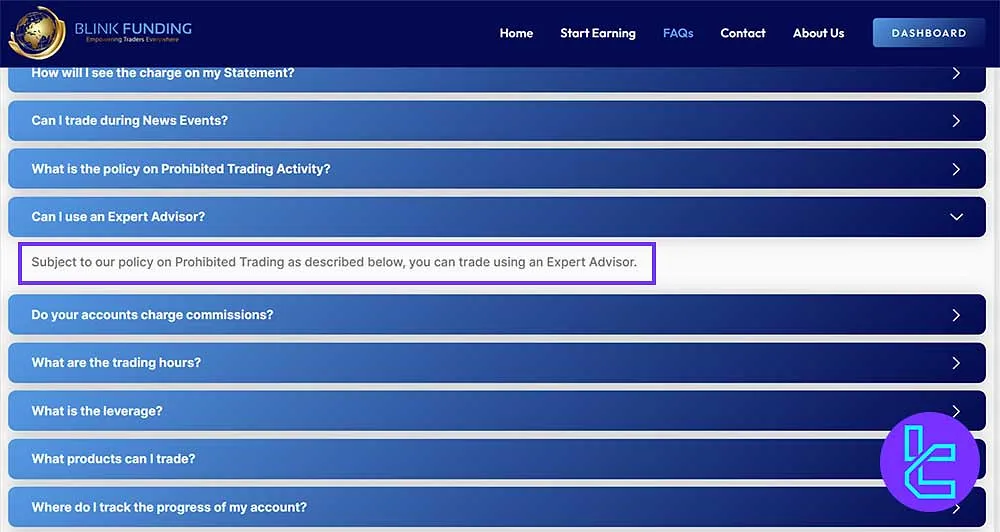

Blink Funding Expert Adviser

The firm allows traders to use Expert Advisers (EAs) but it comes with conditions; Blink Funding EAs Rules:

- EAs must comply with the platform’s general trading rules;

- High-frequency trading (HFT) and latency arbitrage strategies remain restricted.

Blink Funding Leverage Limits

Leverage options vary depending on the asset class, with the possibility of increasing limits through add-ons; Blink Funding Leverage Conditions:

Leverage Type | Forex & Metals | Indices | Equity Shares | Crypto |

Standard Leverage | 10:1 | 10:1 | 5:1 | 2:1 |

Double Leverage Add-on | 20:1 | 10:1 | 5:1 | 2:1 |

Blink Funding Payout Rules

The firm offers a structured withdrawal process for traders earning profits; Blink Funding Payout Policy:

- Traders can request a withdrawal once every 30 days via the trader dashboard;

- Payouts are processed through Deel, allowing access to various withdrawal methods.

Writer’s Opinion and Conclusion

Blink Funding Rules require, drawdown limits vary, with a 6% trailing for 1-step and 8% static for 2-step plans. Leverage is 10:1 for Forex, Metals, and Indices, but the Double Add-on boosts it to 20:1.

Withdrawals occur once per 30d via the trader dashboard and are processed via Deel. To begin trading with funded accounts on this platform, check the Blink Funding registration guide on the Blink Funding Tutorials page.