Blue Guardian is a prop trading firm providing funded accounts ranging from $5,000 to $200,000. The company offers four main funding plans: 1 Step, 2 Step, 3 Step, and Instant, with profit splits of up to 90% and zero commissions on Cryptocurrencies.

Blue Guardian (what do we know about the company?)

Blue Guardian, founded in 2019 and headquartered in the United Arab Emirates, has quickly made a name for itself in the prop trading industry.

Led by CEO Sean Bainton, the firm has positioned itself as a gateway for talented traders to access significant capital and potentially lucrative profit-sharing arrangements. Key aspects of Blue Guardian:

- Financing traders with trading capital ranging from $5,000 to $200,000

- Access to popular trading platforms, including MatchTrader, Tradelocker, and MT5

- A diverse range of tradable instruments

- An ambitious scaling plan allowing growth up to $2 million

- A competitive 90% profit split for successful traders

- Bi-weekly payouts and refundable evaluation fees

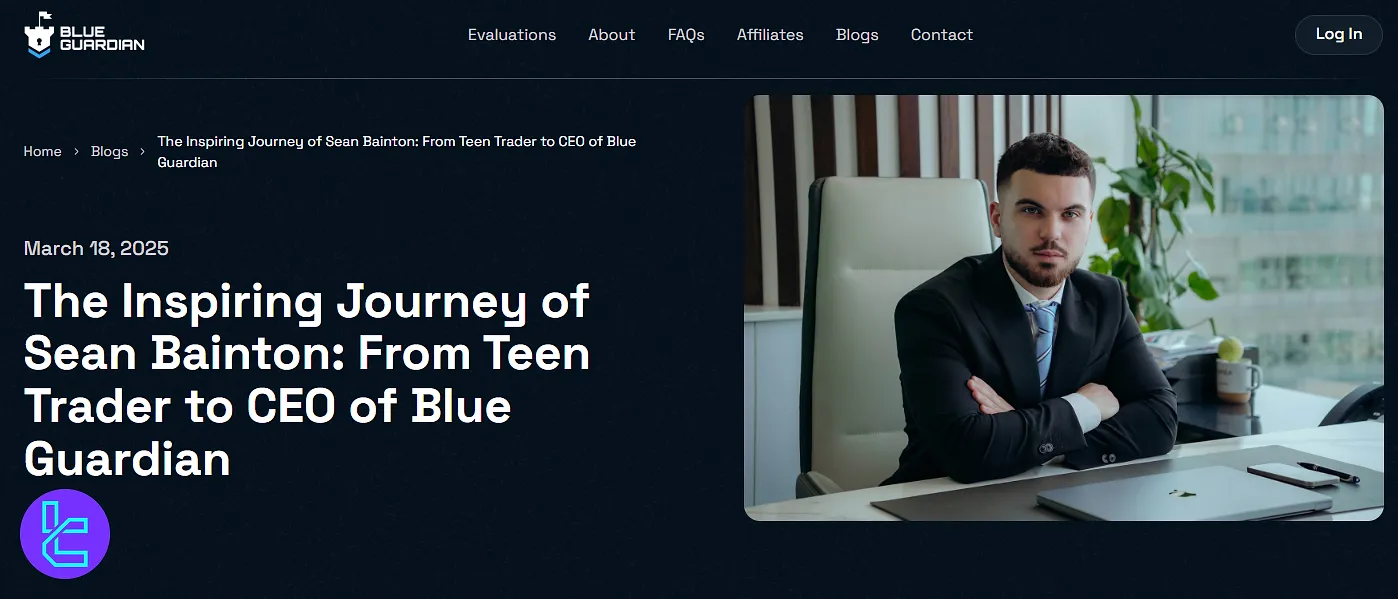

A Brief Introduction to the CEO

Sean Bainton entered the trading world as a teenager, developing an early interest in financial markets that later shaped his professional path. By his early twenties, he had already established Blue Guardian.

His career reflects a focus on transparency, accessibility, and building structures that support trader development.

Today, Bainton continues to lead the firm with an emphasis on adapting to the evolving needs of the trading community.

You can follow him through this link:

Blue Guardian Specifications

The firm’s offerings are designed to cater to a wide spectrum of traders, from novices to seasoned professionals. Blue Guardian Specifics:

Account currency | USD |

Minimum price | $27 |

Maximum leverage | Up to 1:100 |

Maximum profit split | Up to 90% |

Instruments | Forex, Indices, Commodities, Crypto |

Assets | N/A |

Evaluation steps | 1-Phase, 2-Phase, 3-Phase |

Withdrawal methods | Rise, Crypto |

Maximum fund size | $2,000,000 |

First profit target | 6% |

Max. daily loss | 4% |

Challenge time limit | Unlimited |

News trading | Unlimited |

Maximum total drawdown | 10% |

Trading platforms | MatchTrader, Tradelocker, MT5 |

Commission | $5 per lot on Forex and Commodities |

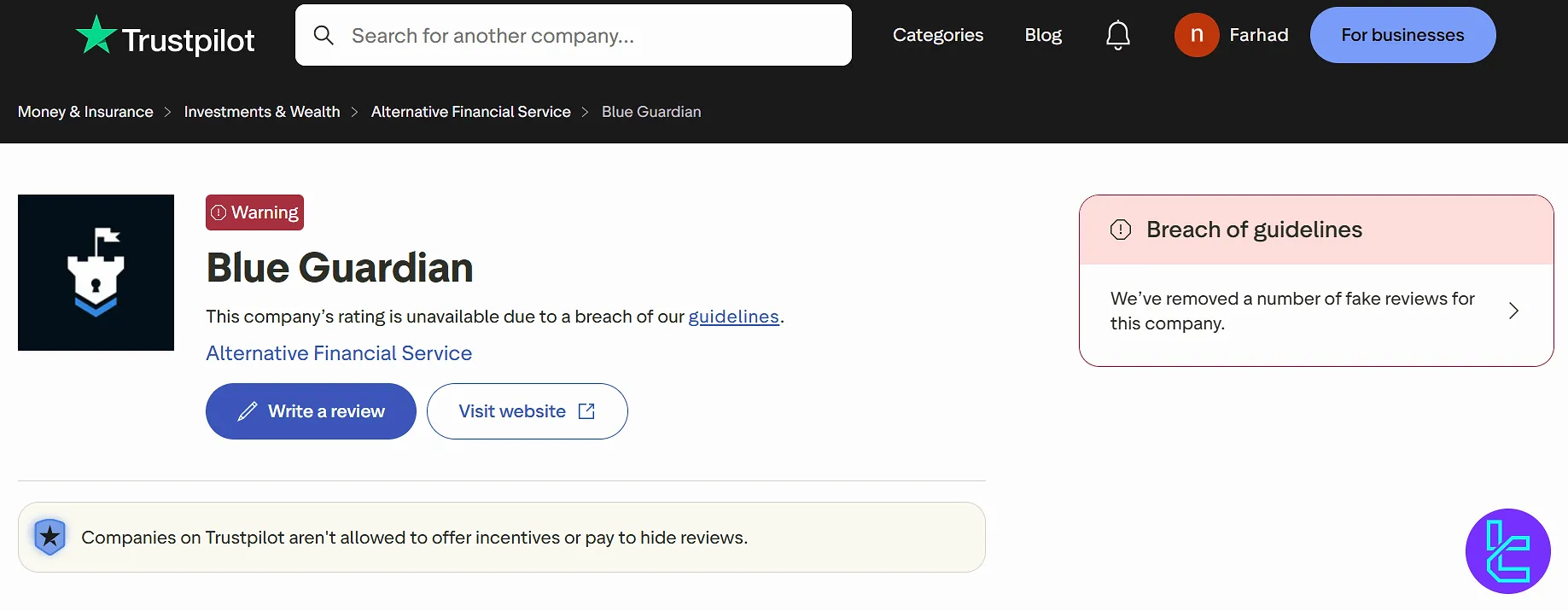

Trustpilot score | N/A |

Payout frequency | Bi-Weekly, Weekly, Instant |

Established country | UAE |

Established year | 2019 |

Why Blue Guardian? (Pros & Cons)

Choosing the right prop firm can be a game-changer for aspiring traders. Blue Guardian offers several compelling advantages, but it's essential to consider potential drawbacks as well.

Pros | Cons |

Generous 90% profit split | Lack of phone support |

Wide range of trading instruments | Restricted crypto leverage |

Diverse account types | Higher fees for the Elite Guardian account |

Bi-weekly payouts | - |

What Are the Funding Plans and Their Costs on Blue Guardian?

The company offers a range of funding options to suit different trader profiles and risk appetites. Blue Guardian funding plans and their costs:

| Funding | Instant Standard | Instant Starter | 1 Step Standard | 1 Step Pro | 2 Step Standard | 2 Step Classic | 2 Step Pro | 3 Step |

$5K | $109 | $27 | $70 | $87 | $42 | $79 | $36 | $30 |

$10K | $149 | N/A | $97 | $129 | $97 | $136 | $79 | $67 |

$25K | $309 | N/A | $197 | $244 | $197 | $264 | $141 | $147 |

$50K | $479 | N/A | $297 | $369 | $297 | $421 | $250 | $227 |

$100K | $779 | N/A | $497 | $707 | $497 | $707 | $464 | $367 |

$150K | N/A | N/A | $729 | N/A | $729 | N/A | $692 | $517 |

$200K | $1,045 | N/A | $997 | N/A | $997 | $1,500 | $921 | $667 |

Note that at the time of writing this article, the prop firm offers a 30% discount on its challenge fees.

Account Opening and KYC on Blue Guardian

Becoming a funded trader with the firm involves a straightforward process designed to assess your trading skills and ensure compliance with regulatory requirements. In this section, we will go through the Blue Guardian registration process.

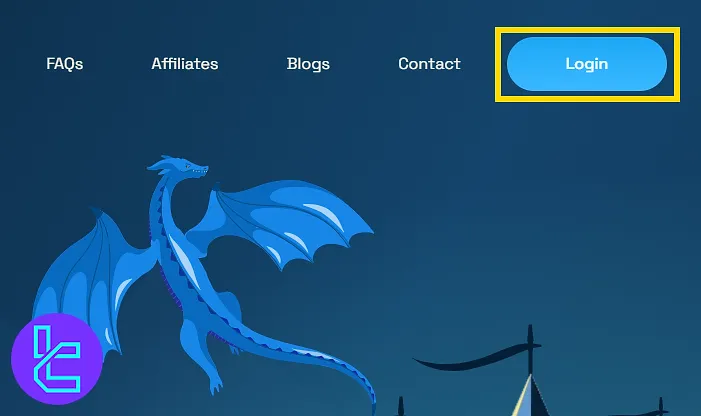

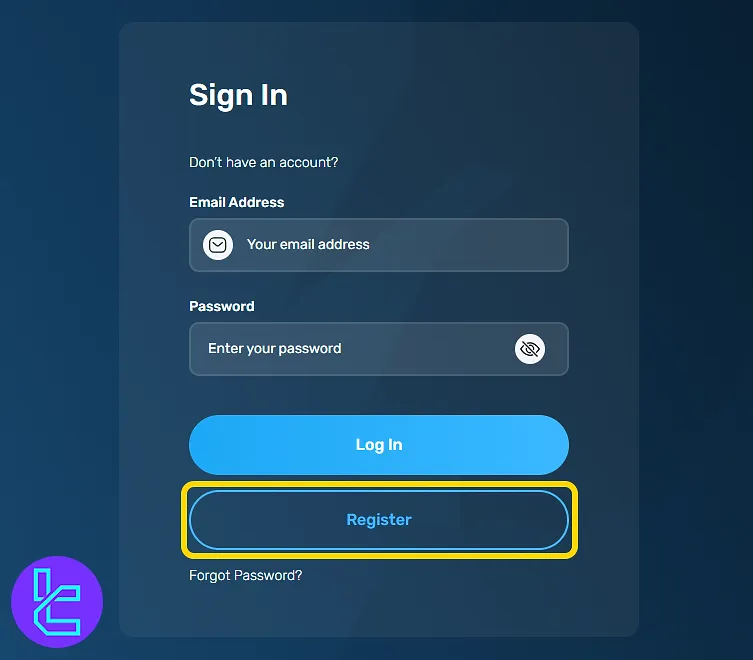

#1 Launch the Registration

Visit the Blue Guardian homepage and tap "Login".

From there, select “Register” to open the account creation page.

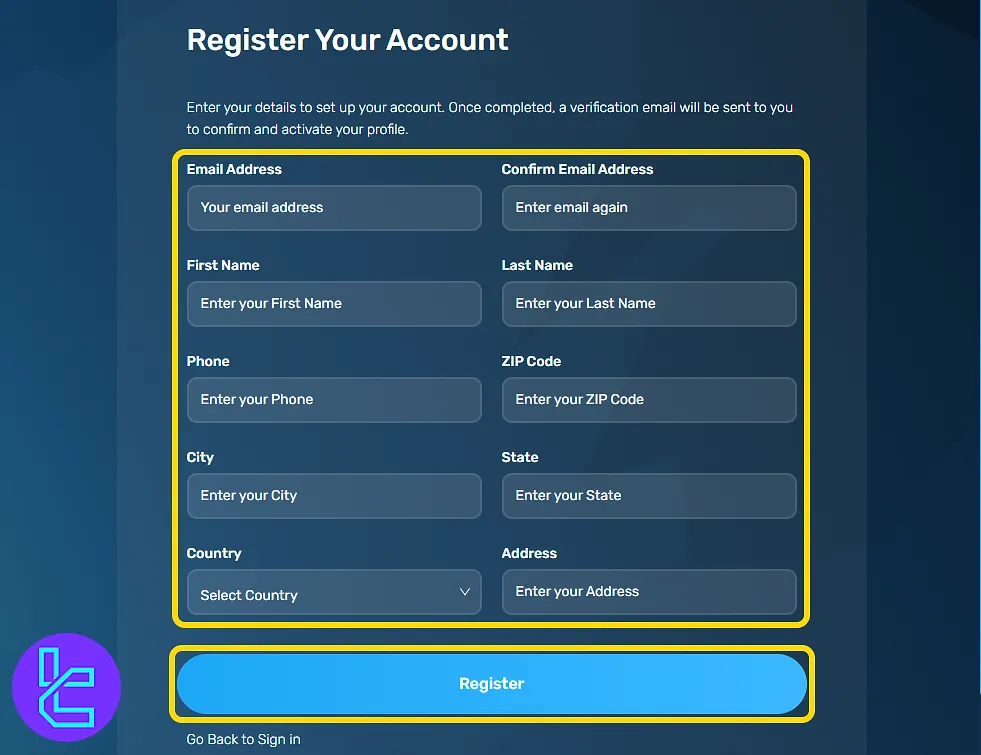

#2 Submit Your Details

Enter personal and residential details as listed below:

- Full name

- Email address

- Phone number

- Residential info

- Postal code

Afterwards, confirm registration.

#3 Email & Password Setup

Follow the email verification link sent to your inbox. A second email will guide you through creating your login password. Once set, return to the platform, log in, and explore your personal dashboard.

#4 KYC Verification

After succeeding in the evaluation phases, you can complete the KYC process and apply for a funded account through your dashboard. Required documents for Blue Guardian verification:

- Proof of ID: Passport or driving license

- Proof of Address: Bank statement or utility bill

Specifics of Blue Guardian Evaluation Phase

The evaluation phase at the prop firm is designed to identify skilled traders who can consistently generate profits while adhering to strict risk management principles. Blue Guardian evaluation rules:

| Features | Instant Standard | Instant Starter | 1 Step Standard | 1 Step Pro | 2 Step Standard | 2 Step Classic | 2 Step Pro | 3 Step |

Trading period | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited | unlimited |

Max Daily Drawdown | 3% | 3% | 4% | 3% | 4% | 4% | 4% | 4% |

Max Drawdown | 6% | 5% | 6% | 6% | 8% | 8% | 10% | 8% |

Target | N/A | N/A | 10% | 10% | 8-4% | 8-5% | 10-4% | 6% 6% 6% |

Leverage | 1:30 | 1:30 | 1:50 | 1:20 | 1:50 | 1:50 | 1:50 | 1:100 (Evaluation) 1:50 (Funded) |

Payout | Instant | Bi-Weekly | Weekly | Weekly | Weekly | First Payout on Demand | Weekly | Weekly |

Profit Split | 80% | 50% | Up to 90% | Up to 90% | 90% | 85% | 90% | 90% |

Refund | No | No | Yes | Yes | Yes | Yes | Yes | Yes |

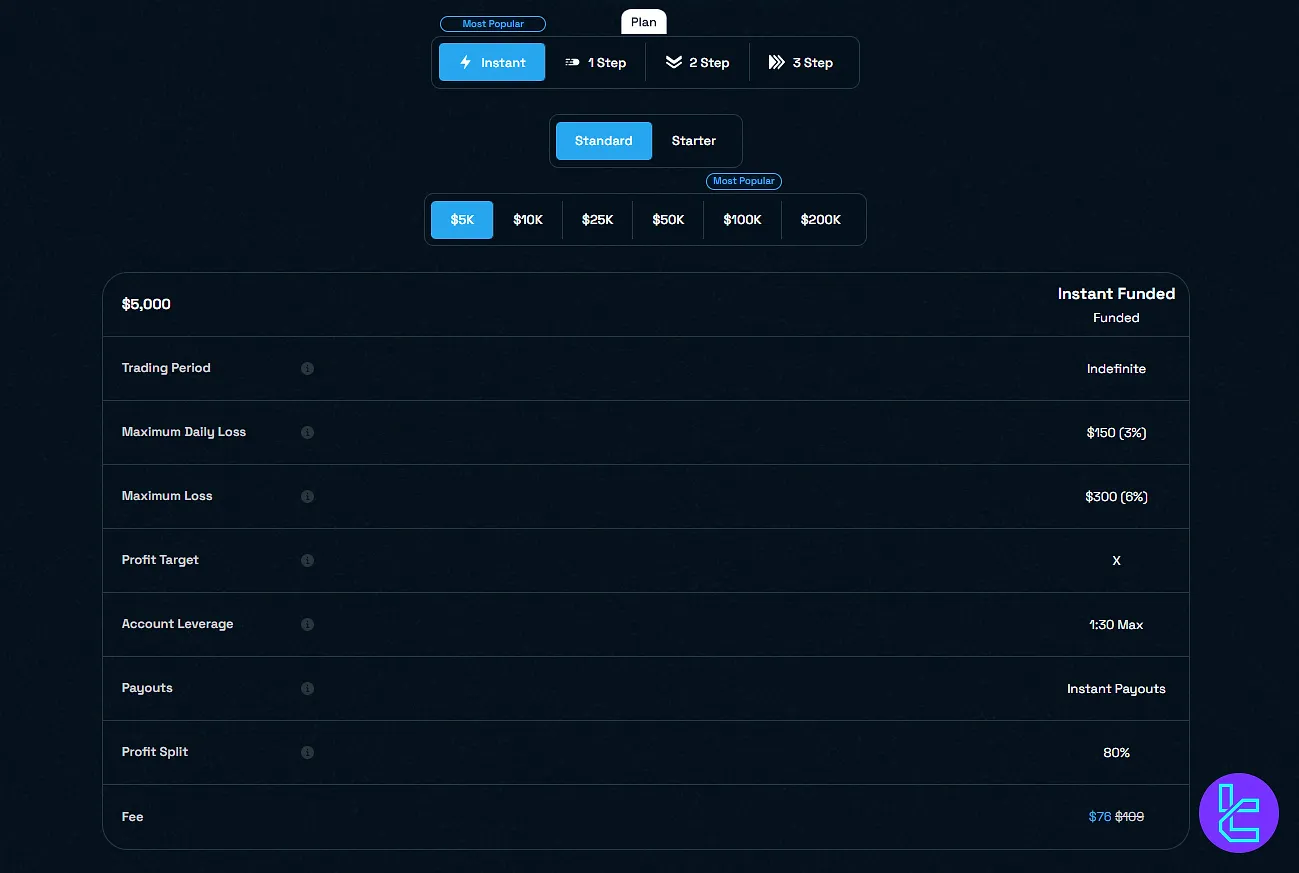

Instant Standard

Blue Guardian Instant Standard Account

Blue Guardian Instant Standard Account

The Instant Standard account by Blue Guardian is tailored for traders who seek immediate access to funded capital without undergoing a traditional evaluation process. Table of specifics:

| Account Title | Instant Standard |

Max Daily Drawdown | 3% |

Max Drawdown | 6% |

Target | N/A |

Leverage | 1:30 |

Payout | Instant |

Profit Split | 80% |

Refund | No |

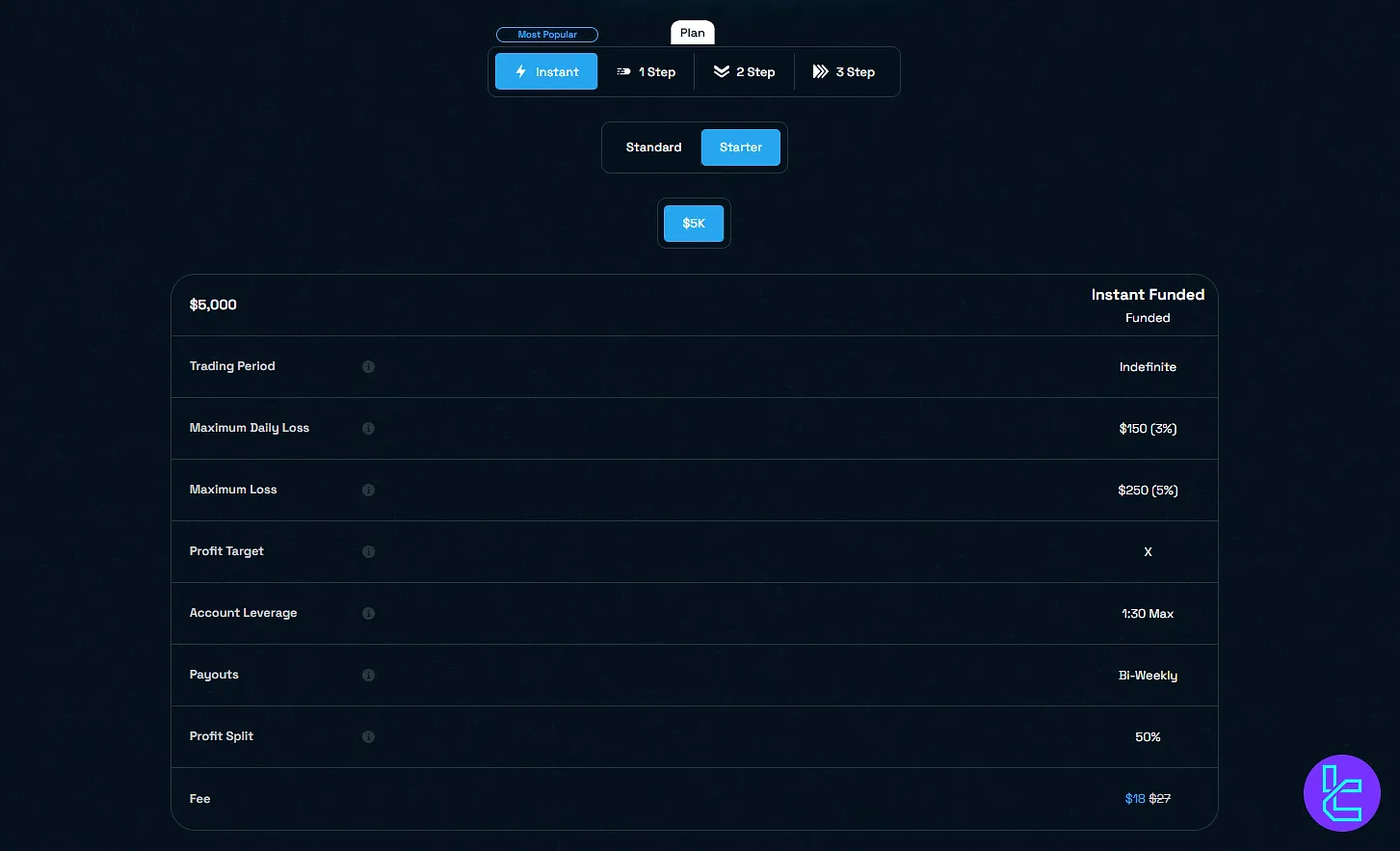

Instant Starter

The Instant Starter account by Blue Guardian provides an entry-level path to funded trading, designed for newcomers seeking minimal risk and steady progression. Account details:

| Account Title | Instant Starter |

Max Daily Drawdown | 3% |

Max Drawdown | 5% |

Target | N/A |

Leverage | 1:30 |

Payout | Bi-Weekly |

Profit Split | 50% |

Refund | No |

Note that this specific account will be shut down after receiving the first payout.

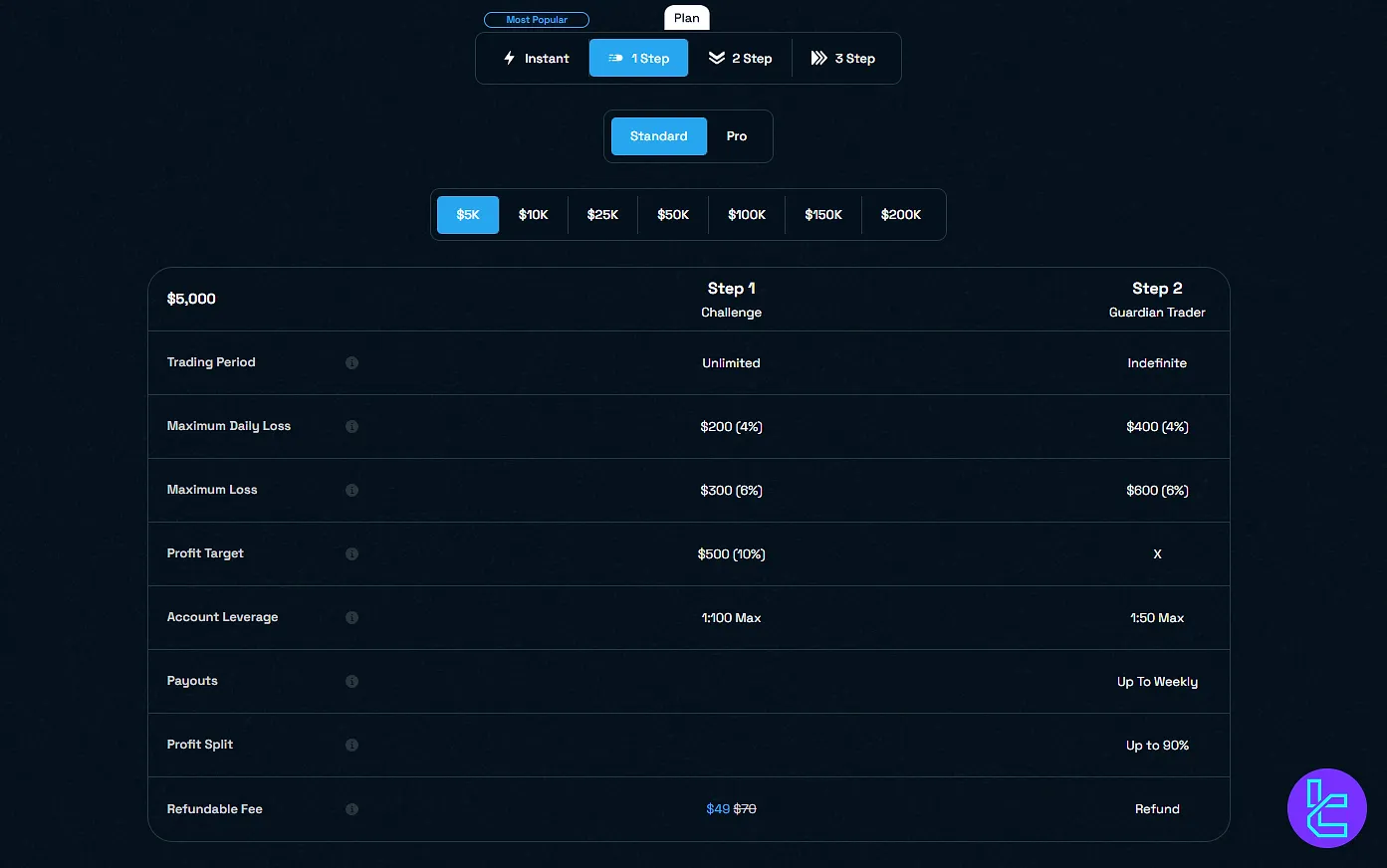

1 Step Standard

The 1 Step Standard account by Blue Guardian is crafted for traders ready to prove their skills through a single-phase evaluation. Details are in the table here:

| Account Title | 1 Step Standard |

Max Daily Drawdown | 4% |

Max Drawdown | 6% |

Target | 10% |

Leverage | 1:50 |

Payout | Weekly |

Profit Split | Up to 90% |

Refund | Yes |

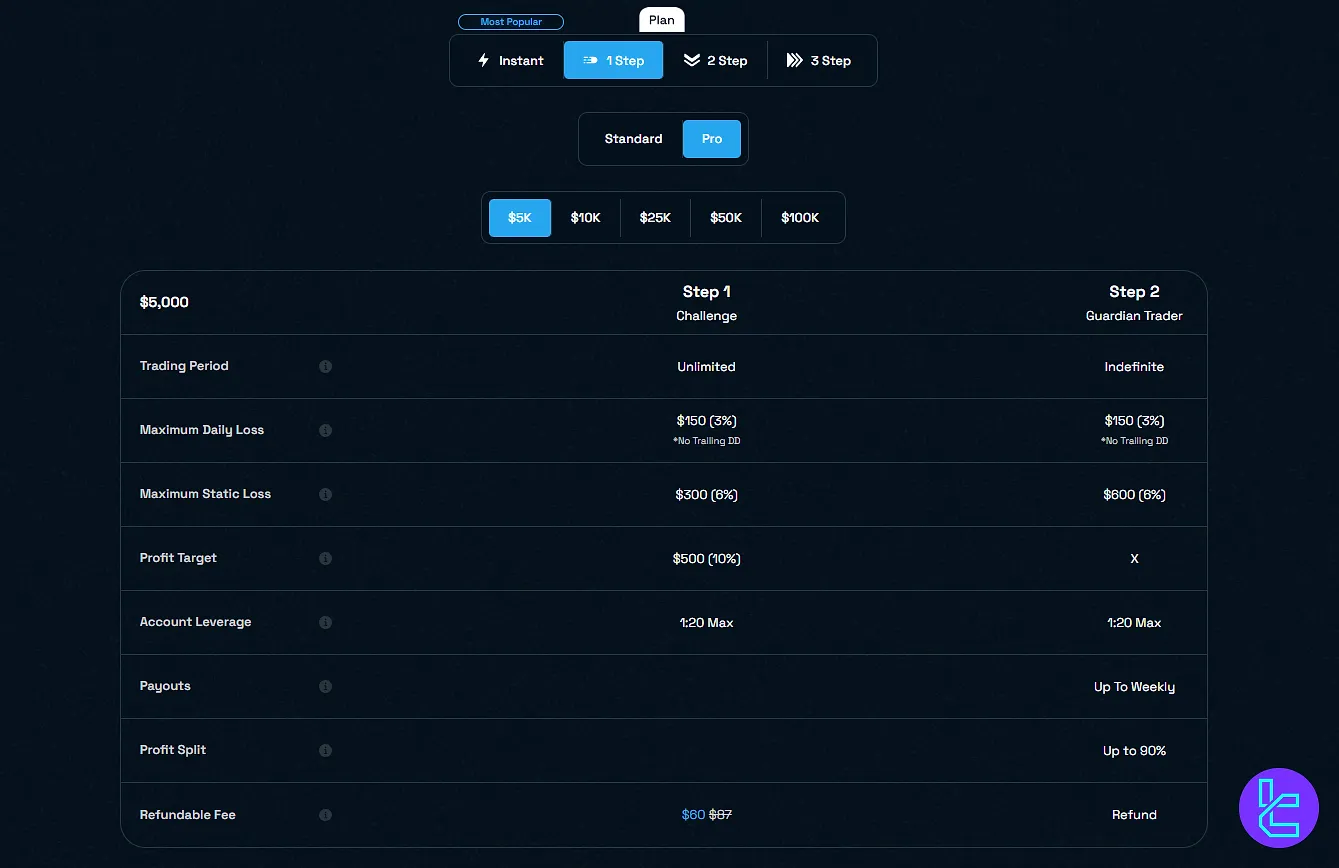

1 Step Pro

The 1 Step Pro account by Blue Guardian is tailored for professional traders who value tighter risk limits paired with premium rewards. Look at the table below for more information:

| Account Title | 1 Step Pro |

Max Daily Drawdown | 3% |

Max Drawdown | 6% |

Target | 10% |

Leverage | 1:20 |

Payout | Weekly |

Profit Split | Up to 90% |

Refund | Yes |

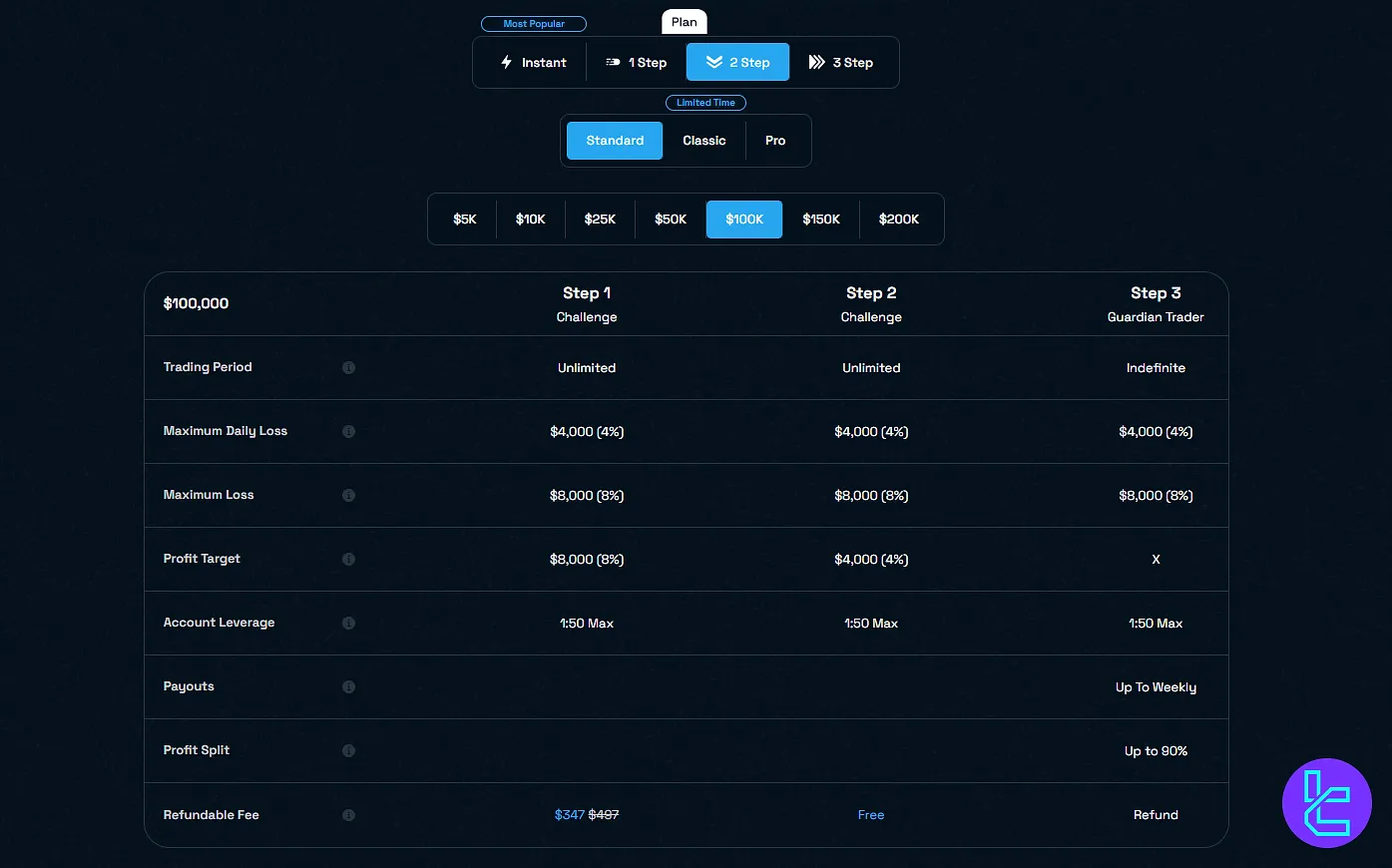

2 Step Standard

The 2 Step Standard account by Blue Guardian is a classic evaluation model for traders who prefer a gradual progression toward funded capital. Read the specifics below:

| Account Title | 2 Step Standard |

Max Daily Drawdown | 4% |

Max Drawdown | 8% |

Target | 8-4% |

Leverage | 1:50 |

Payout | Weekly |

Profit Split | 90% |

Refund | Yes |

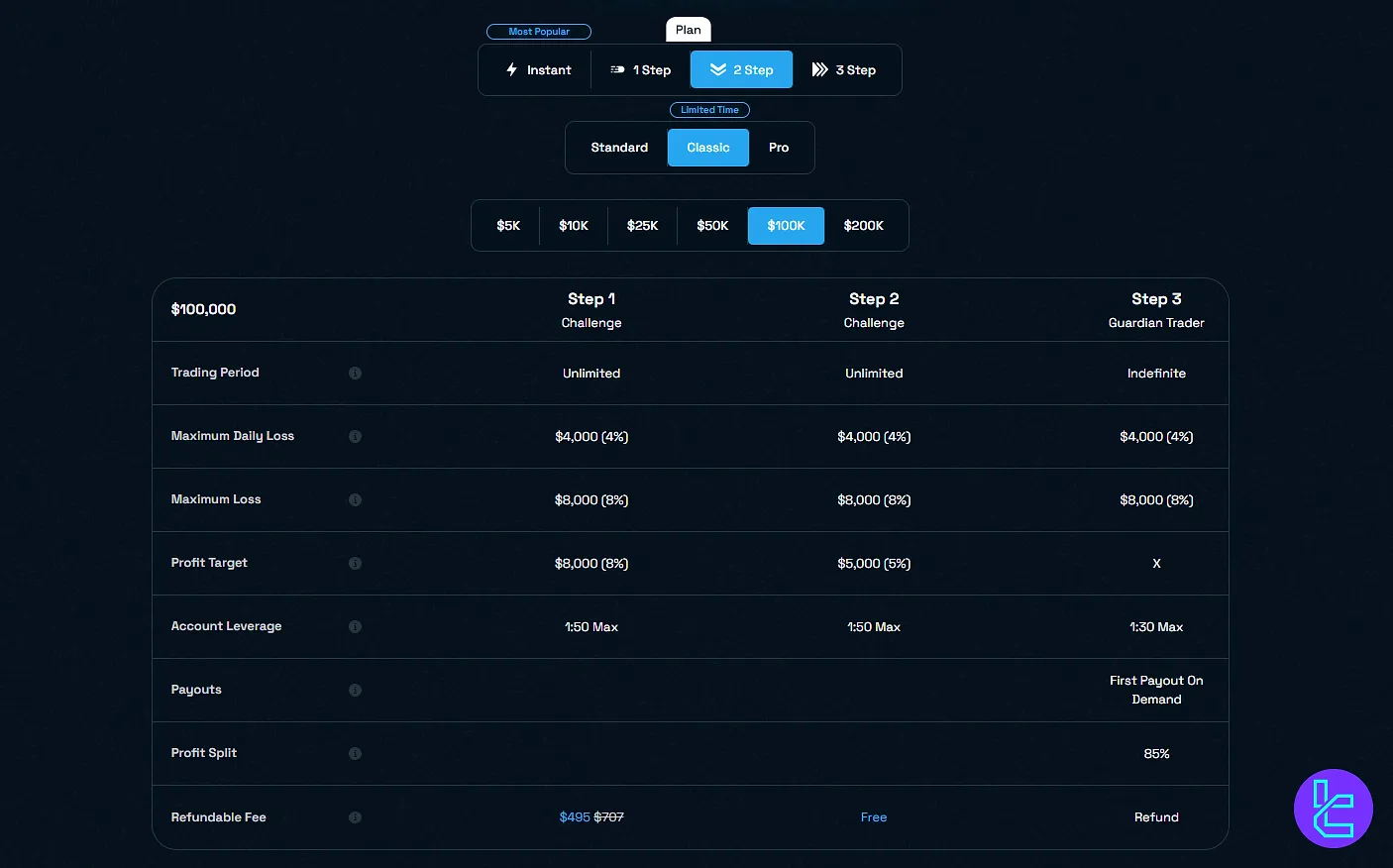

2 Step Classic

The 2 Step Classic account by Blue Guardian is designed for traders who prefer milestone-based evaluations with flexible payout timing. The table below is a summary of details:

| Account Title | 2 Step Classic |

Max Daily Drawdown | 4% |

Max Drawdown | 8% |

Target | 8-5% |

Leverage | 1:50 |

Payout | First Payout on Demand |

Profit Split | 85% |

Refund | Yes |

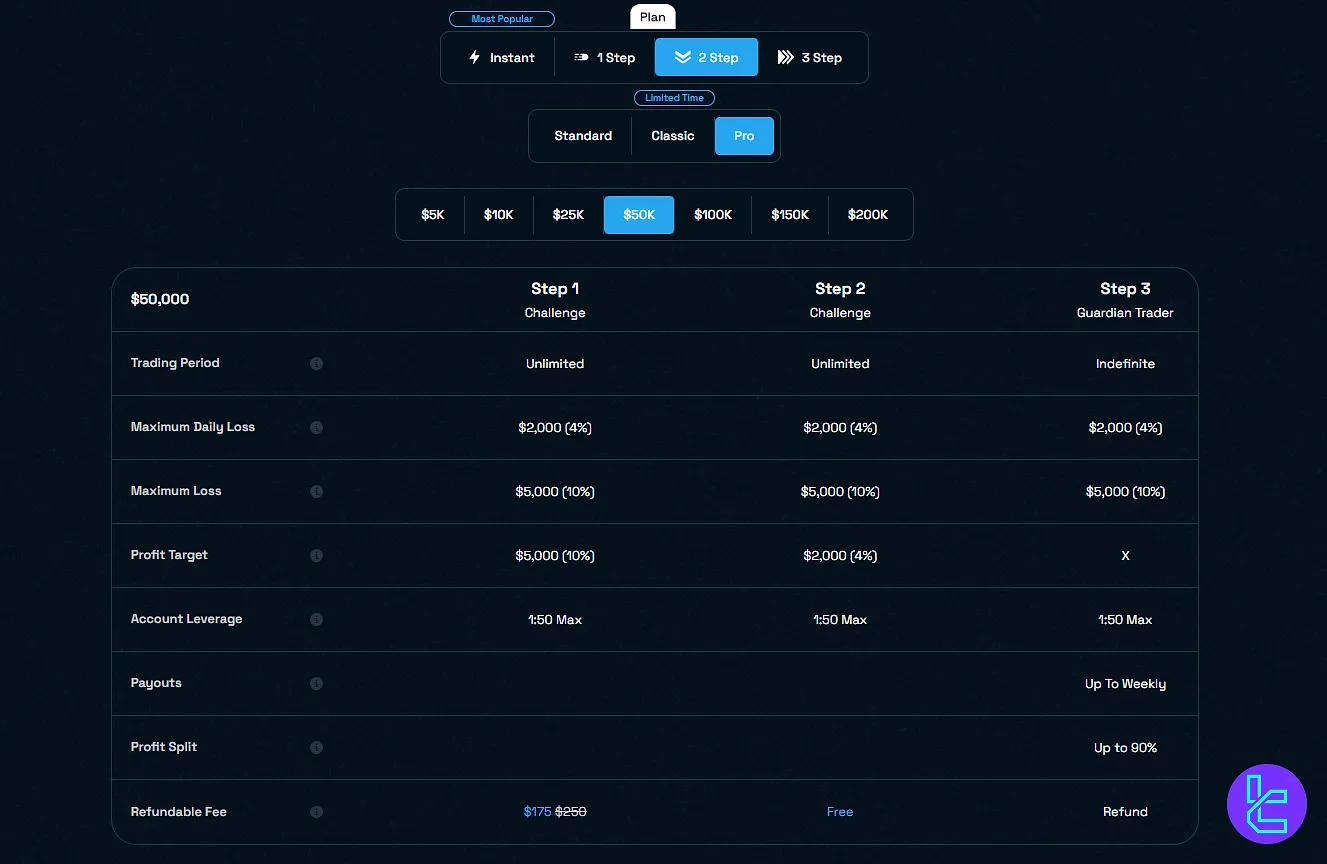

2 Step Pro

This model combines aggressive profit targets with weekly payouts and a full refund upon passing. The table below digs into the account:

| Account Title | 2 Step Pro |

Max Daily Drawdown | 4% |

Max Drawdown | 10% |

Target | 10-4% |

Leverage | 1:50 |

Payout | Weekly |

Profit Split | 90% |

Refund | Yes |

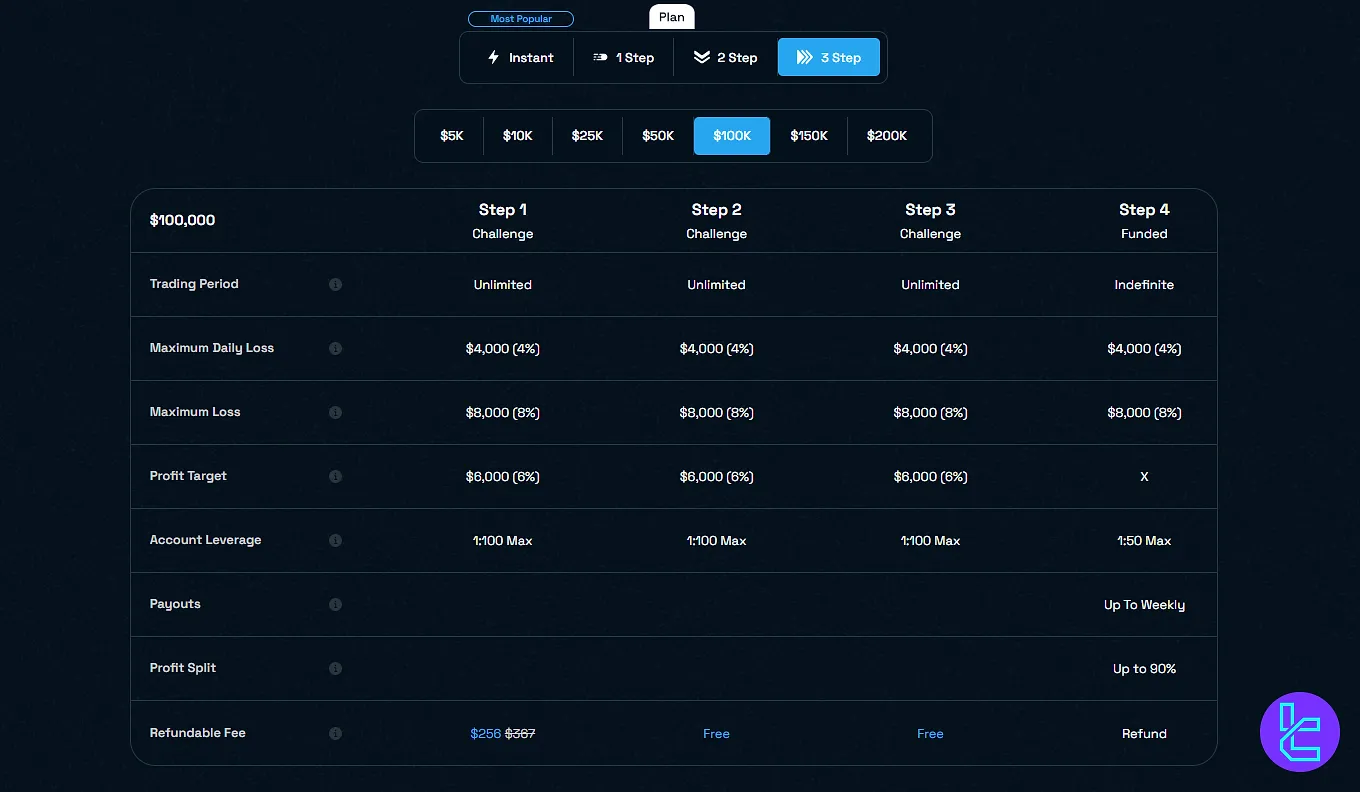

3 Step

With modest targets and flexible leverage settings, this model emphasizes consistency across all three phases. 3 Step model parameters and structure:

| Account Title | 3 Step |

Max Daily Drawdown | 4% |

Max Drawdown | 8% |

Target | 6% 6% 6% |

Leverage | 1:100 (Evaluation) 1:50 (Funded) |

Payout | Weekly |

Profit Split | 90% |

Refund | Yes |

Does Blue Guardian Prop Firm Offer Bonuses?

While Blue Guardian doesn't explicitly advertise traditional bonuses, it offers several attractive features that can be considered beneficial to traders.

- Refundable fees: The initial evaluation fees are 100% refundable upon the 4th payout, effectively allowing successful traders to recoup their investment;

- Affiliate: earn up to 15% commission from your referred traders in a tier system.

Affiliate | Referrals | Commissions |

Tier 1 | 1-100 | 10% |

Tier 2 | 100-250 | 12.5% |

Tier 3 | 250+ | 15% |

Blue Guardian Rules

This section mentions important trading rules that must be considered by the traders. Blue Guardian Rules:

- VPN Usage: VPNs and VPS are permitted; however, their use to bypass rules such as copy trading, group trading, or signal trading is strictly forbidden. Misuse will result in account termination;

- Hedging: Hedging is allowed during trading;

- Expert Advisors (EA): Traders are allowed to use EAs for their strategies or trading style. However, these should be setup by the trader to match their approach;

- Martingale & Arbitrage: The Martingale strategy is allowed, but various forms of arbitrage (such as data freezing, delayed data feed, and tick scalping) are prohibited;

- News Trading: News trading is permitted, but with restrictions on Funded accounts;

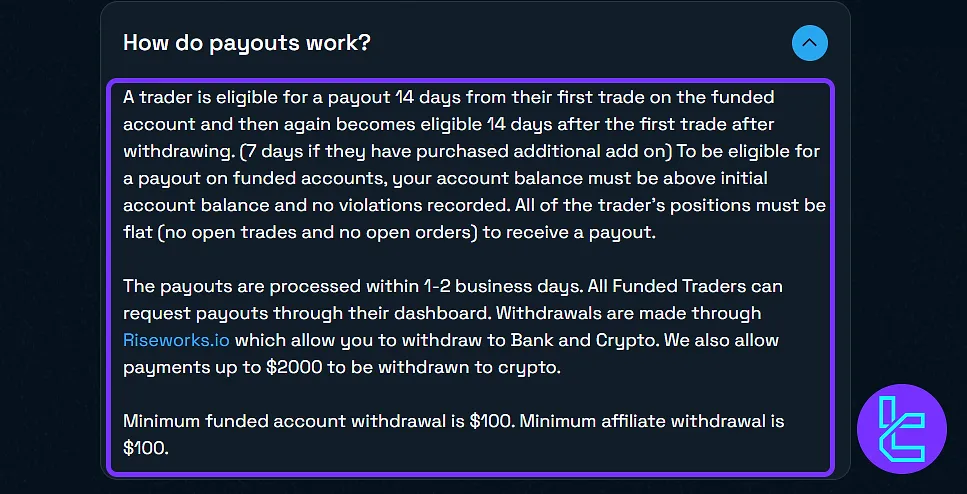

- Payouts: Available 14 days after the first trade (7 with add-ons), processed in 1–2 business days, with withdrawals via bank or crypto (min. $100, crypto up to $2000).

VPN Usage

While the use of VPNs and VPS is allowed, these services must not be utilized to bypass any rules related to copy trading, group trading, or signal trading. If any misuse of these services is detected, your account will be terminated in accordance with the contract and our Terms of Use.

Hedging

Hedging is allowed without restrictions during your trading activity.

Expert Advisors (EA)

Expert Advisors (EAs) are allowed. You can set up and use EAs that align with your trading strategy or style, providing more flexibility in your trading approach.

Martingale & Arbitrage

The Martingale strategy is allowed; however, certain forms of arbitrage and high-frequency trading are strictly prohibited. These include:

- Data freezing due to Demo Server errors

- Use of delayed data feeds

- Tick scalping

- High-frequency trading bots

- Reverse arbitrage

- Latency arbitrage

- Hedge arbitrage

- Use of any emulators

News Trading

News trading is allowed, but with restrictions on Funded accounts. For any trades on Funded accounts:

- Opening or closing trades 5 minutes before or after a high-impact (red folder) news event is prohibited;

- Any profits made during this period will be removed without violating the account's status.

Additionally, trades around FOMC speeches, statements, or news events should be avoided in the same time window. Any profits made from these events will also be removed.

Payouts

Blue Guardian ensures a structured payout process designed to support trader growth while maintaining compliance with trading rules.

Traders become eligible for payouts 14 days after their first trade on a funded account and subsequently every 14 days after each withdrawal. Those who purchase add-ons can shorten the cycle to 7 days.

To qualify, traders must keep their account balance above the initial funding, avoid violations, and close all trades and orders before requesting a withdrawal.

Summary of Details:

- Processing time: 1–2 business days

- Withdrawal methods: Bank transfer & crypto via Riseworks.io

- Crypto option: Up to $2000 per payout

- Minimum funded withdrawal: $100

- Minimum affiliate withdrawal: $100

Blue Guardian Trading Platforms

Exploring the firm’s trading solutions is an important part of this review. Blue Guardian’s platforms:

- MatchTrade

- Tradelocker

- MetaTrader 5

All funded accounts are connected through Blue Guardian’s liquidity partner, Purple Trading, ensuring deep liquidity and real-time pricing.

Financial Instruments

The firm offers a diverse range of financial instruments, allowing traders to implement various strategies across different markets. The available instruments on the prop firm:

- Forex

- Cryptocurrencies

- Forex Exotics

- Indices

- Gold and Commodities

Blue Guardian Leverage Specifics

Blue Guardian offers traders clear leverage conditions across evaluation and funded accounts, tailored to each asset class for balanced risk management. Leverage details:

- Evaluation Phase: Forex 1:50, Indices 1:20, Commodities 1:20, Crypto 1:2

- Funded Accounts: Forex 1:50, Indices 1:10, Commodities 1:10, Crypto 1:2

It's interesting to note that the prop firm's homepage website mentions a max. leverage of 1:100 for 3-step evaluation accounts, despite what's stated in the related FAQ.

Blue Guardian Payment Methods

We must discuss available payment methods in this Blue Guardian review. The firm offers a range of options to cater to traders' diverse needs.

| Deposit/Withdrawal | Methods | Min Amount |

| Payment | Credit/Debit Cards | $67 |

Crypto | $67 | |

| Payout | Rise | $500 |

Crypto | $100 |

Fee Structure on Blue Guardian

Blue Guardian prop firm's fee structure is designed to be transparent and aligned with traders' success. Their accounts have Raw spreads, and here’s a list of their commission:

Forex | $5 |

Indices | $0 |

Commodities | $5 |

Crypto | $0 |

Does Blue Guardian Provide Educational Materials?

The company doesn’t just fund traders, it also educates them by providing blog posts and articles on various subjects, including:

- How does the evaluation process work

- Required qualifications for prop trading

- Explanation of challenges

Blue Guardian in Review Websites (Trust Score)

Blue Guardian's presence on review websites has been somewhat controversial. Trustpilot has removed the company’s trust score due to guideline breaches.

A total of 1044 reviews have been submitted on Blue Guardian's Trustpilot profile. 78% of them are 5-star ratings and 12% are 1-star ratings.

Blue Guardian Prop Firm Customer Support

Next stage in Blue Guardian review is the firm’s customer support. The firm provides various channels for traders to seek assistance:

Support Method | Availability |

Live Chat | Yes (on the Website) |

Yes (via support@blueguardian.com) | |

Phone Call | No |

Discord | Yes (on the Official Server) |

Telegram | No |

Ticket | No |

FAQ | Yes (on the Website) |

Help Center | No |

No | |

Messenger | No |

Also, you can visit the company at its physical office located at Dubai Silicon Oasis, DDP, Building A2, Dubai, United Arab Emirates.

The firm’s Business hours are 9 am - 5 pm GMT, Monday to Friday, and the team tends to answer your questions within 24 hours.

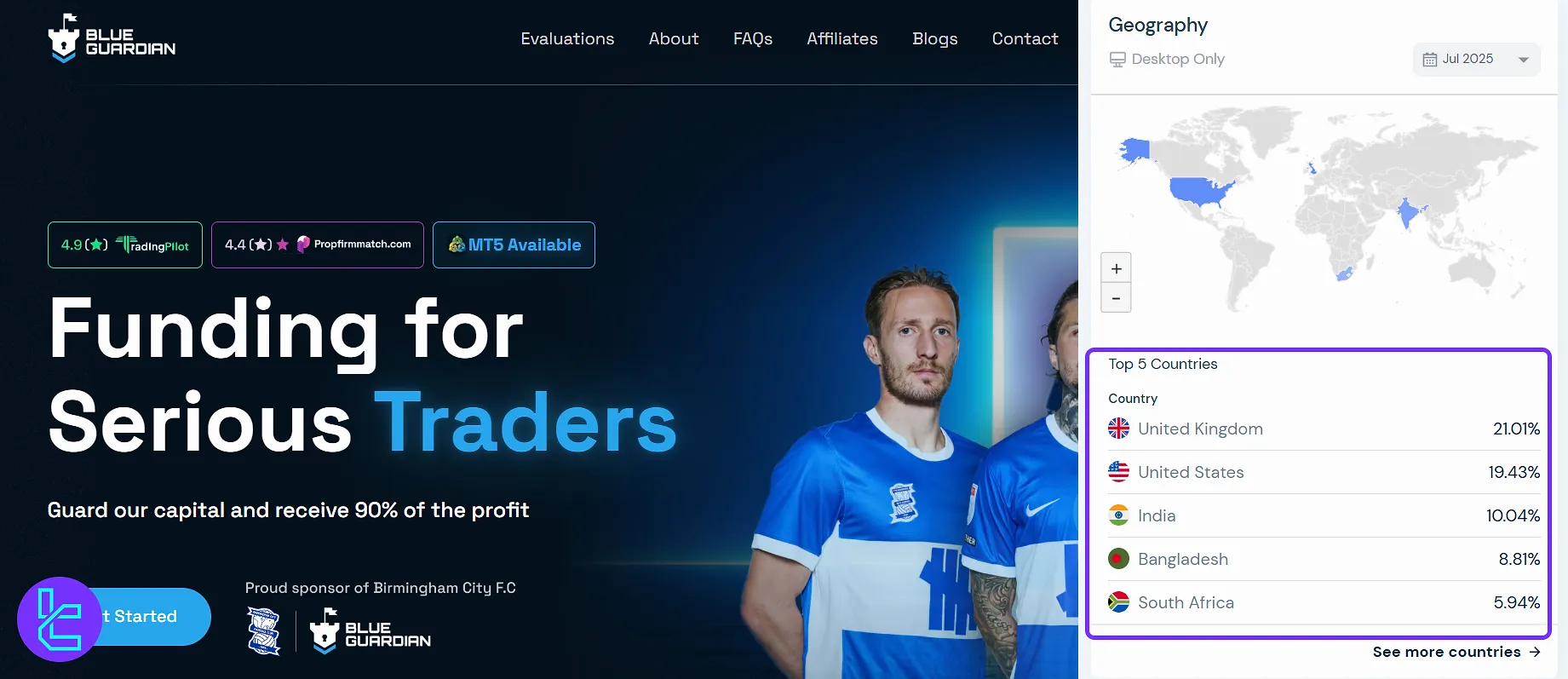

Blue Guardian Users Variety

Blue Guardian attracts a diverse global community of traders, with its strongest presence in established financial hubs and emerging markets alike. This wide user base highlights the firm’s credibility and international appeal.

Here are the details and numbers:

- United Kingdom (21.01%) – The largest share of Blue Guardian’s traders, reflecting strong ties with the firm’s Birmingham roots

- United States (19.43%) – A close second, showing growing interest among North American prop traders

- India (10.04%) – A rapidly expanding user base, driven by the country’s rising retail trading activity

- Bangladesh (8.81%) – Demonstrates strong adoption in South Asia’s fast-growing financial community

- South Africa (5.94%) – A significant market, highlighting the firm’s expansion across Africa

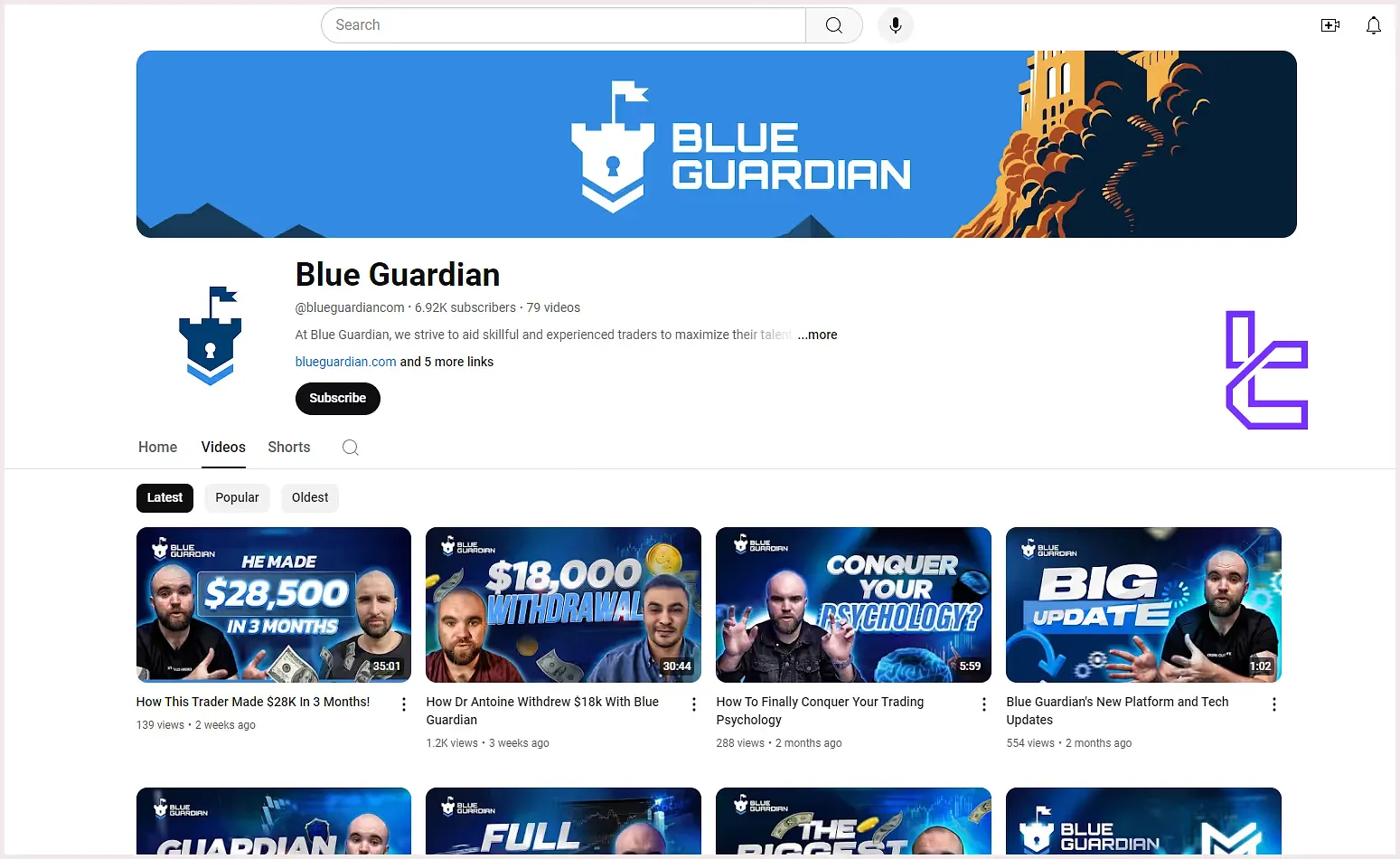

Blue Guardian on Social Media

The firm maintains an active presence on various social media platforms to engage with its community and share updates. The table below demonstrates the related channels:

Social Media Channel | Members/Followers/Subscribers |

~79,500 members | |

~57,200 followers | |

~362 followers | |

~26,800 followers | |

~7,560 subscribers | |

~4,380 members |

Through these channels, the firm aims to build a strong online community, foster dialogue around trading strategies, and keep traders informed about new opportunities and platform updates.

Social media serves as a crucial tool for the company to expand its reach and interact with both current and potential customers.

Blue Guardian vs. Top Competitors

Here's a comparison to see how the discussed prop firm fares against its competitors:

Parameters | Blue Guardian Prop Firm | |||

Minimum Challenge Price | $67 | $50 | $33 | $97 |

Maximum Fund Size | $2,000,000 | $2,000,000 | $400,000 | $200,000 |

Evaluation steps | 1-phase, 2-phase, 3-phase | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step |

Profit Share | Up to 90% | 90% | 100% | 80% |

Max Daily Drawdown | 4% | 4% | 7% | 5% |

Max Drawdown | 10% | 6% | 14% | 10% |

First Profit Target | 6% | 5% | 6% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:5 | 1:100 | 1:100 |

Payout Frequency | 14 Days | Bi-weekly | Weekly | Bi-weekly |

Number of Trading Assets | N/A | 100+ | 40+ | 40 |

Trading Platforms | MatchTrader, Tradelocker, MT5 | Proprietary platform | MetaTrader 5, Match Trader | MetaTrader 5, cTrader, Dxtrade |

Expert suggestions

Blue Guardian provides funded accounts at a price range of $27 to $1,500 with bi-weekly payouts and support for MT5 and MatchTrader.

The prop firm processes withdrawal requests in Fiat and Crypto through Rise. Affiliate commissions of up to 15% and refundable challenge fees are two of the main strength points in this Blue Guardian review.