The platform supports3-stepevaluations, allowing traders to move from evaluation to funded accounts with a $1,500profit target.

The platform features a low entry challenge price of $49, a 90% profit split, and access to multiple instruments.

BluSky allows news trading, giving traders unparalleled freedom.

Commissions are $2 per side for mini contracts, while data fees for live brokerage are $140 per month per exchange.

BluSky uses trusted platforms like NinjaTrader, Tradovate, and TradingView. Bonuses add to its value, like the free NinjaTrader license and discounted trade analysis tools.

BluSky Prop Firm Company Overview

BluSky is gaining significant attention in the proprietary trading industry with its innovative approach to providing funded accounts. Owned by BluSky Trading Company, LLC, located at 7901 4th St N, Ste 300, St. Petersburg, FL 33702, United States, the firm stands out with its distinct methodology.

Their mission is straightforward: to equip traders with the necessary capital and resources to thrive in the competitive world of prop trading. BluSky is dedicated to empowering traders by offering them the tools and support they need to succeed in fast-moving markets.

CEO Introduction

Richard Amann Jr. is the Chief Executive Officer of BluSky Trading Company, a proprietary trading firm headquartered in Walden, New York. With over a decade of leadership experience across finance, operations, and technology, he now oversees BluSky’s expansion in the global prop-trading ecosystem.

Before founding BluSky, Richard built a strong track record in operations management and IT services, leading teams at organizations such as BioTouch, Sunrise Bus Transportation, and East Coast Worldwide Limousine. His background includes supervising large-scale teams, ensuring compliance standards, and delivering innovative technical solutions.

At BluSky, his focus is on providing traders with transparent funding opportunities, structured trading programs, and a strong support system. Leveraging his expertise in both technology and financial services, Richard drives BluSky’s mission of enabling traders to scale their skills while maintaining strict risk-management standards.

Under his leadership, BluSky has positioned itself as a forward-thinking prop firm, combining operational discipline with trader-centric strategies to create sustainable opportunities for both new and professional traders.

You can connect with him to learn more through the link below:

BluSky specifications summary

BluSky's unique selling point is its flexible trading conditions and robust support systems to foster long-term trader success. Let’s explore the specifications in the table below:

Account currency | USD |

Minimum price | $49 |

maximum leverage | N/A |

maximum profit split | 90% |

Instruments | FX, Energy, Financials, Grains, Indices, Meats, Metals |

Assets | Euro FX, E-Mini Heating Oil, US Treasury Bond, Soybean Oil, E-Mini S&P 500, Lean Hogs, Gold |

evaluation steps | 3-steps (instant funding available) |

Trading platform | NinjaTrader, Tradovate, TradingView, Jigsaw, Bookmap, Quantower, Sierra Chart, ATAS, R|Trader Pro, MotiveWave, Volumetrica, etc. |

Withdrawal methods | Bank account |

maximum fund size | $300,000 |

First profit target | $1,500 (6%) |

Max. daily loss | 2% |

Challenge time limit | No Limits |

news trading | Allowed |

Maximum total drawdown | $5,000 |

commission per side | $4 for Mini Contracts, $1 for Micro Contracts |

Trustpilot score | 4.5 out of 5 |

payout frequency | Daily |

established country | USA |

established year | 2022 |

BluSky Prop Firm Advantages & Disadvantages

BluSky's approach is trader-centric, providing a professional environment with minimal restrictions. The following table gives you a better perspective of what advantages and disadvantages BluSky has:

Pros | Cons |

High-profit split (up to 90%) | Limited educational resources |

fast payout process | The evaluation process may be challenging for beginners |

No minimum trading days | Limited track record |

Free NinjaTrader/Tradovate license | - |

1-on-1 coaching available | - |

Extensive range of platform options | - |

While they excel in flexibility and support, potential traders should weigh these benefits against the firm's relatively recent entry into the market.

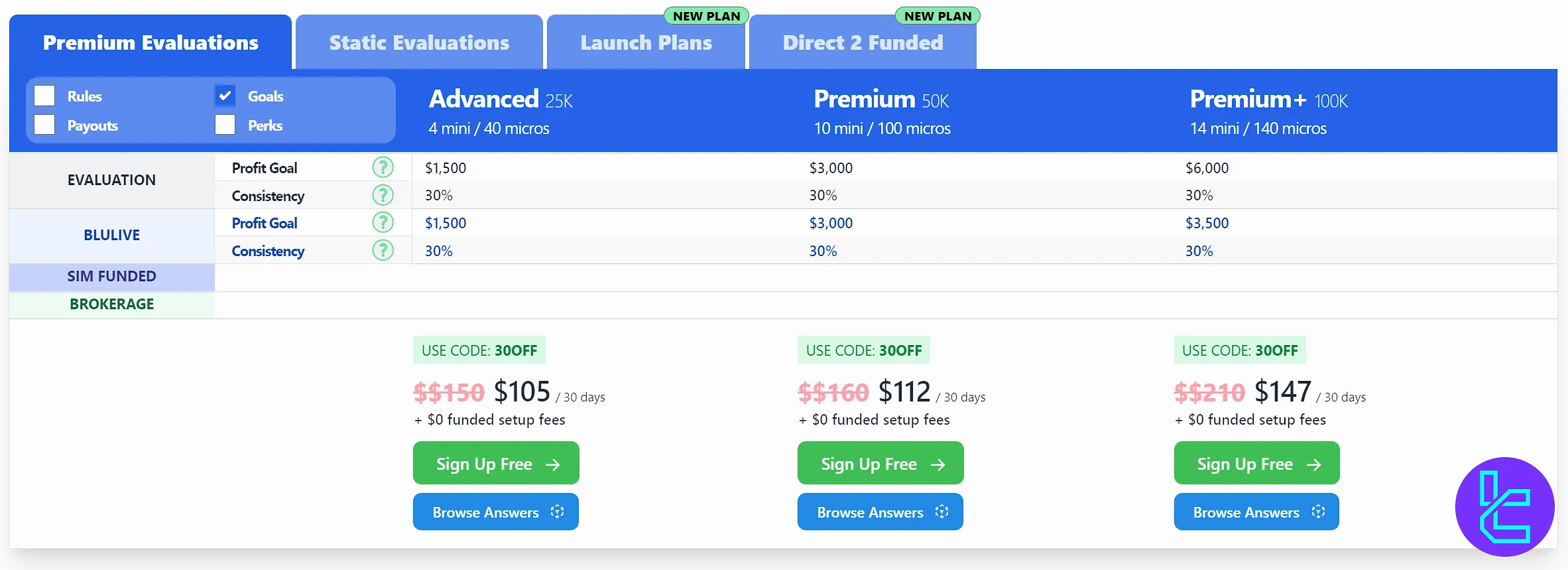

BluSky Funding & Price Structure

As with many Prop Firms, BluSky offers a range of funded account options to suit different trader needs and experience levels. This prop firm especially offers a really wide range of choices. Premium & Static plans:

Account type | Funding Size | Price |

Advanced | $25k | $150 |

Premium | $50k | $160 |

Premium+ | $100k | $210 |

Static Growth | $150k | $170 |

Static Growth+ | $200k | $220 |

Static Blu+ | $300k | $320 |

Launch Plans:

| Account Type | Funding Size | Price |

| Premium | $50k | $49 |

| Premium+ | $100k | $59 |

| Static Growth+ | $200k | $69 |

The fees mentioned above are paid every month. Also, an Instant Funding program is available at $749.

BluSky registration & verification process

This section guides you through the entire BluSky registration process, a three-stage, convenient procedure.

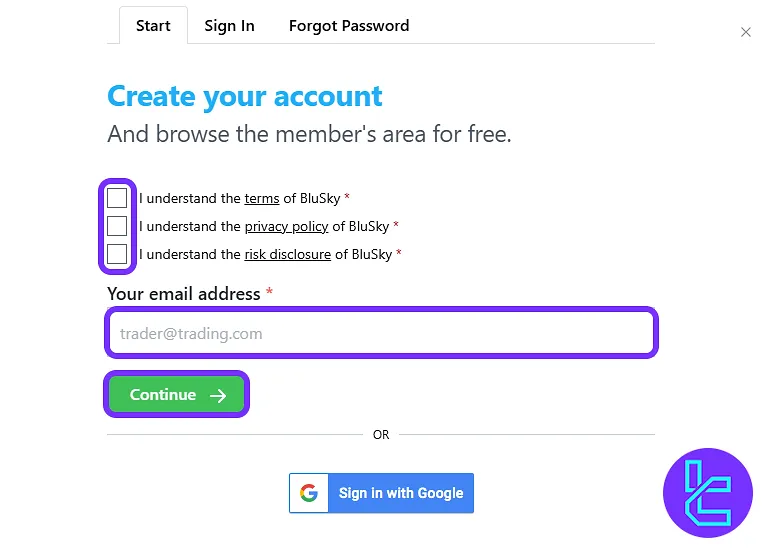

#1 Access the Official Sign-Up Page

Go to the BluSky homepage and click on “Sign Up Today!”. This directs you to the email-based registration form.

#2 Fill Out and Submit the Form

Enter your email address, agree to BluSky's Terms, Privacy Policy, and Risk Disclosure, then click “Continue”. Alternatively, use the “Sign in with Google” option for a faster experience.

#3 Verify Email and Log In

Check your inbox for a confirmation message. Click the verification link to activate your BluSky account and access the user dashboard.

#4 Go Through the KYC

For a complete account verification, go through the KYC process by providing the required documents and additional data.

BluSky Evaluation Steps

BluSky's property firm takes a somewhat different approach to evaluation models, with unnecessary complexity. There are 3-step evaluation programs in this firm.

Premium Evaluation Program

This plan is designed for traders who aim to demonstrate consistent profitability while managing defined risk parameters.

Under the Premium track, participants must achieve a $3,000 profit goal while maintaining strict discipline against a -$2,000 trailing drawdown and a $1,000 daily loss limit.

Here are the details:

Stages | Parameters | Advanced | Premium | Premium+ |

Evaluation | Profit Goal | $1,500 | $3,000 | $6,000 |

Trailing Drawdown | $-1,200 | $-2,000 | $-2,500 | |

Consistency | 30% | |||

BLULIVE | Profit Goal | $1,500 | $3,000 | $3,500 |

Trailing Drawdown | $1,200 | $2,000 | $2,500 | |

Payouts | At the profit goal | |||

Consistency | 30% | |||

SIM FUNDED | Profit Goal | None | ||

Min. Balance | $0 | |||

Starting Balance | $1,500 | $3,000 | $3,500 | |

Payout Eligibility | Limited to Profitable Trading Days | |||

BROKERAGE | Profit Goal | None | ||

Min. Balance | $300 | $1,000 | $1,000 | |

Payout Eligibility | Limited to Profitable Trading Days | |||

Static Evaluation Challenge

The BluSky Static Evaluation Program is tailored for traders who prefer fixed drawdown structures instead of trailing ones, providing more stability during market fluctuations.

At the Evaluation stage, traders face profit goals of $3,000, $6,000, and $20,000 depending on the track, with static drawdowns of $1,000, $2,000, and $5,000.

The table below outlines the parameters:

Stage | Parameters | Static Growth | Static Growth+ | Static Blu+ |

EVALUATION | Profit Goal | $3,000 | $6,000 | $20,000 |

Static Drawdown | $-1,000 | $-2,000 | $-5,000 | |

Daily Loss Limit | $0 | $0 | $2,500 | |

Consistency | 30% | 30% | 21% | |

BLULIVE | Profit Goal | $2,000 | $3,000 | $3,500 |

Static Drawdown | $-1,000 | $-2,000 | $-2,500 | |

Consistency | 30% | 30% | 21% | |

Payouts | At the Profit Goal | |||

SIM FUNDED | Profit Goal | None | ||

Min. Balance | $0 | |||

Payouts | Mon-Fri | |||

Starting Balance | $2,000 | $3,000 | $3,500 | |

Payout Eligibility | Limited to Profitable Trading Days | |||

BROKERAGE | Profit Goal | None | ||

Min. Balance | $500 | $1,000 | $1,000 | |

Payout Eligibility | Limited to Profitable Trading Days | |||

Starting Balance | $2,000 | $3,000 | $3,500 | |

Payouts | Mon-Fri | |||

Min. Payout | $250 | |||

BluSky Launch Plans

The Launch Plans accounts are designed to provide traders with an accessible entry point into the firm’s funded trading programs, while still maintaining professional-level evaluation standards.

With options across Premium, Premium+, and Static Growth+, traders can choose their preferred model based on profit targets, drawdown style, and risk appetite.

Launch Plans specifics:

Stages | Parameters | Premium | Premium+ | Static Growth+ |

EVALUATION | Profit Goal | $3,000 | $6,000 | $6,000 |

Trailing/Static Drawdown | $-2,000 | $-2,500 | $-2,000 | |

Consistency | 30% | |||

BLULIVE | Profit Goal | $3,000 | $3,500 | $3,000 |

Trailing/Static Drawdown | $-2,000 | $-2,500 | $-2,000 | |

Consistency | 30% | |||

Payouts | At the Profit Goal | |||

SIM FUNDED | Profit Goal | None | ||

At Launch | $99 | $149 | $149 | |

Min. Balance | $0 | |||

Payouts | Mon-Fri | |||

Starting Balance | $3,000 | $3,500 | $3,000 | |

Min. Payout | $250 | |||

Payout Eligibility | Limited to Profitable Trading Days | |||

BROKERAGE | Profit Goal | None | ||

Min. Balance | $1,000 | |||

Payout Eligibility | Limited to Profitable Trading Days | |||

Starting Balance | $3,000 | $3,500 | $3,000 | |

Payouts | Mon-Fri | |||

Min. Payout | $250 | |||

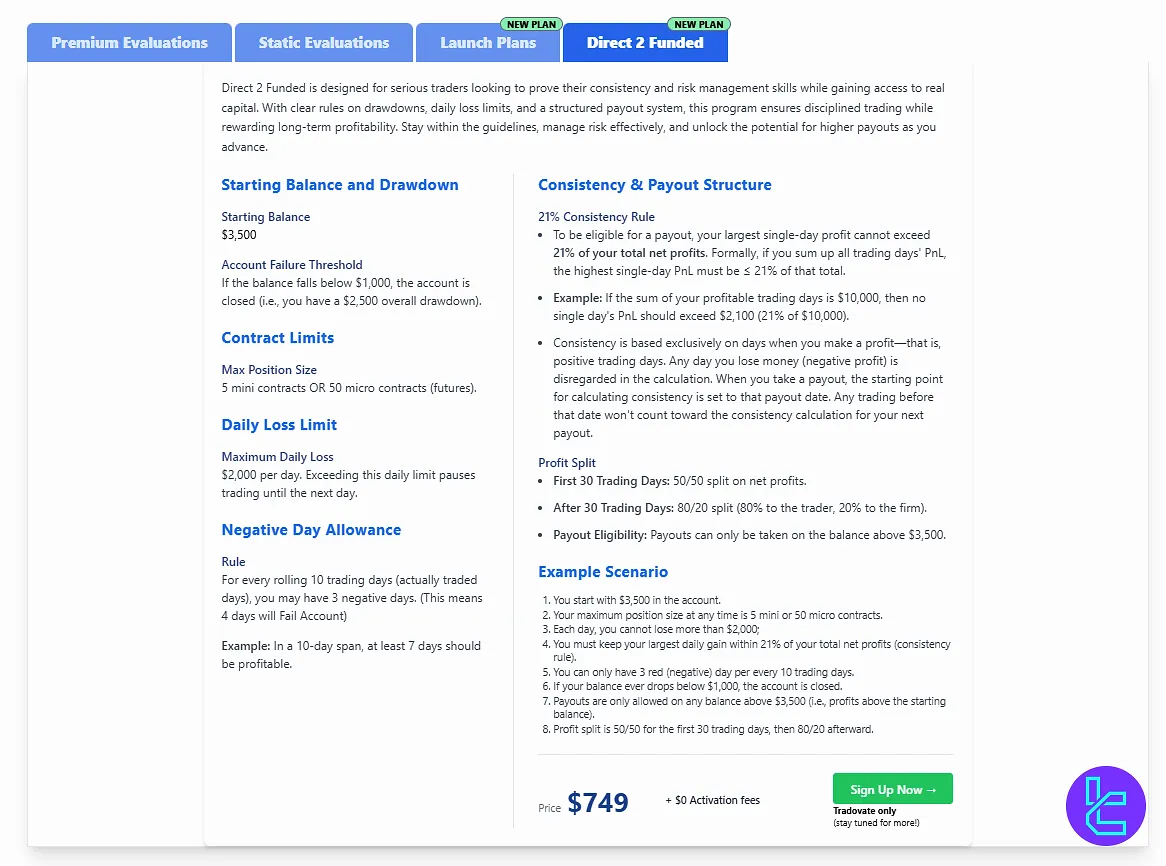

Direct 2 Funded

An instant funding program titled "Direct 2 Funded" is also available, with these parameters and values:

| Account | Direct 2 Funded |

| Starting Capital | $3,500 |

| Max. Overall Drawdown | $2,500 |

| Max. Daily Loss | $2,000 |

| Consistency Rule | 21% |

| Profit Split | 50% for the first 30 days, and 80% for the rest |

Note that payouts are exclusively available for balances above $3,500.

BluSky bonuses and discounts

At the time of writing this article, the prop firm provides a promo code that applies a discount on select plans. By entering "JULY30", you can buy Premium and Static accounts at a 30% lower fee.

BluSky Rules

The prop firm isn't the most talkative one when it comes to the trading rules for passing challenges, only detailing the news trading and payouts rule. Nevertheless, BluSky rules are reviewed in the following sections.

News Trading

BluSky prop firm merely states that the news trading is allowed, but traders themselves are responsible for the risks involved.

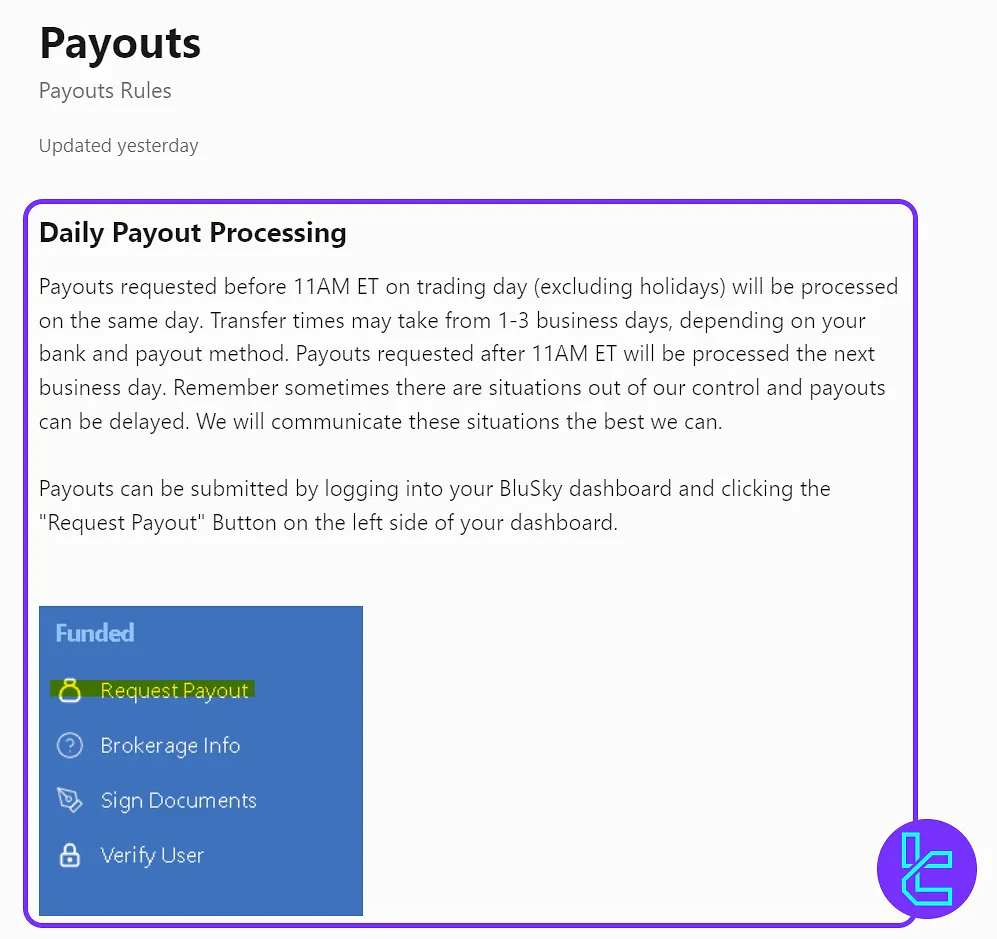

Payouts

BluSky ensures traders fast and transparent payout processing. Requests made before 11AM ET are processed the same day, with funds typically arriving within 1–3 business days depending on bank and method.

There are no minimum trading days required, and payouts become available once your account is above its initial balance.

The firm offers a generous 90/10 profit split in favor of the trader, with a minimum withdrawal of $250 from brokerage accounts. BluSky supports multiple payout solutions including Gusto, Rise, and BluSky Account Credit. For non-US traders, W-8BEN submission is required at the first withdrawal.

With daily processing, flexible rules, and one of the highest profit shares in the industry, BluSky makes sure successful traders keep more of what they earn.

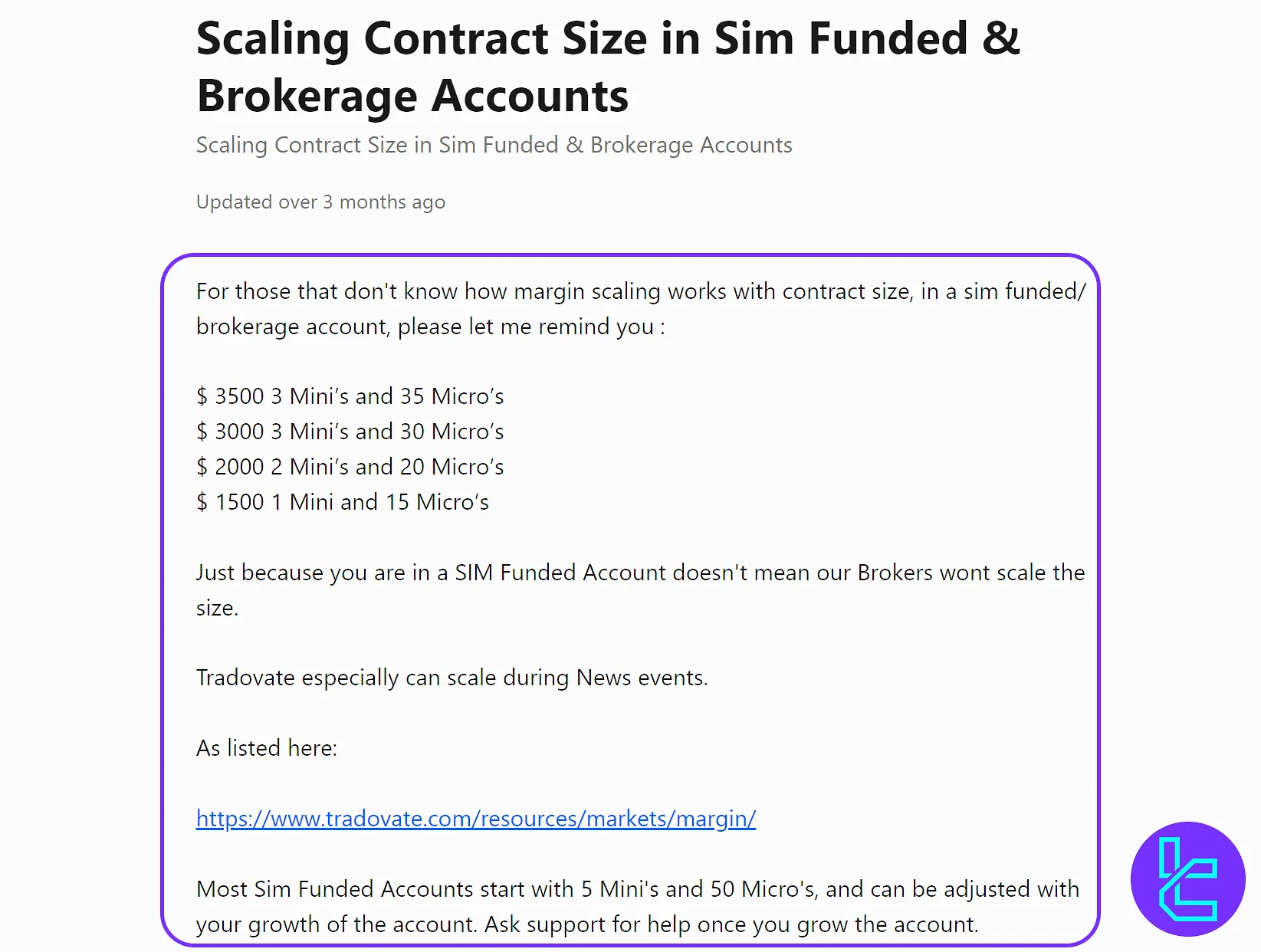

BluSky Scaling

The BluSky Prop Firm Scaling model is designed to align contract size with account balance, promoting disciplined risk management and sustainable growth. This framework applies to both Sim Funded and Brokerage accounts, with clear thresholds for Mini and Micro contracts.

- At balance of 3500 USD the limit is 3 Minis and 35 Micros;

- At balance of 3000 USD the limit is 3 Minis and 30 Micros;

- At balance of 2000 USD the limit is 2 Minis and 20 Micros;

- At balance of 1500 USD the limit is 1 Mini and 15 Micros.

This system prevents over-leverage while allowing traders to scale positions logically as their accounts grow. Tradovate may adjust contract allowances dynamically, especially during news events.

Most Sim Funded Accounts start with 5 Minis and 50 Micros, and scaling can be increased by request once the account balance expands.

It is also important to note that scaling can decrease if the account balance falls, reinforcing consistent trading discipline.

Different platforms handle scaling differently under BluSky partnerships:

- Project X scales up with account growth;

- Rithmic remains fixed and does not scale;

- Volumetrica remains fixed and does not scale;

- Plus500 (Project X) brokerage accounts scale margin by account size;

- Sweets Futures (Rithmic) brokerage accounts scale margin by account size.

This multi-layered approach ensures traders benefit from structured risk management while maintaining flexibility to expand contract size as their performance improves.

BluSky trading platforms

BluSky offers an impressive array of trading platforms to suit diverse trader preferences:

- NinjaTrader

- Tradovate

- TradingView

- Jigsaw

- Bookmap

- Quantower

- Sierra Chart

- ATAS

- R|Trader Pro

- and more

This wide selection ensures traders can choose the platform that best fits their trading style and technical requirements.

TradingFinder has developed a wide range of TradingView indicators that you can use for free.

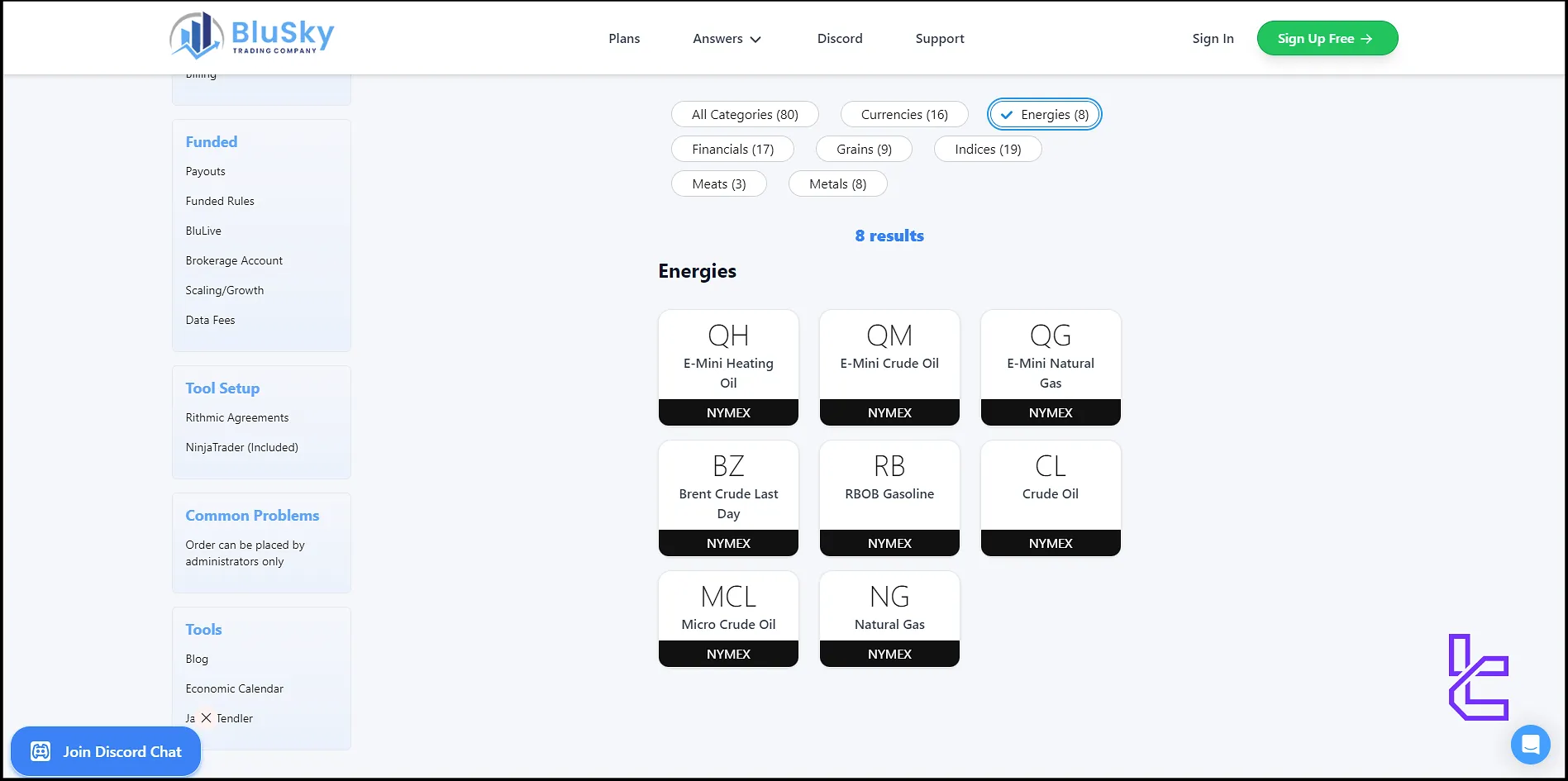

What instruments & symbols can I trade on BluSky?

BluSky offers a diverse range of tradable instruments:

- Forex Market Currencies: Major forex pairs (Canadian Dollar, Swiss Franc, Euro FX) and more

- Indices: E-Mini S&P 500, E-Mini NASDAQ, E-Mini Dow, etc.

- Grains: Mini Wheat, Corn, Soybean Oil, Oats

- Metals: Gold, Silver, Micro Copper, etc.

- Financials: US Treasury Bond, Eurodollar, Fed Funds 30 Day

- Energy: Natural Gas, Crude Oil, Brent Crude Last Day, etc.

- Meats: Live Cattle, Lean Hogs, Feeder Cattle

This broad selection allows traders to diversify their strategies and capitalize on various market opportunities.

BluSky payment methods

BluSky Trading currently offers limited payment options, with credit cards being the sole accepted method for transactions. This includes payments for evaluation fees and other related charges.

Note that the minimum payout amount required for withdrawing profits is $250.

While many proprietary trading firms offer a variety of payment methods, such as PayPal, bank transfers, or even cryptocurrency, BluSky’s decision to exclusively support credit card payments may present limitations for some traders.

BluSky commission & costs

BluSky maintains a transparent fee structure:

Commission Rates | |

Mini Contracts | $2 per side |

Micro Contracts | $0.50 per side |

EUREX | Currently unavailable |

Data Fees | |

Evaluation/BlueLive Phase | No data fees |

Live Brokerage | $140 per exchange/month |

Other Exchanges | Varies |

Rithmic Live Brokerage | First month covered, subsequent months deducted directly from brokerage account |

Note: While EUREX is unavailable, BluSky offers many other markets. Always check the latest fee schedule on their website, as we update this page to reflect any changes made by BluSky.

Does BluSky offer vast educational resources?

Compared to some competitors, BlueSky's educational offerings are relatively limited:

- Basic Trading Guides: Covers fundamental concepts, platform usage, and conditions

- 1-on-1 Coaching: Available, but not as comprehensive as some rivals

Additionally, a "US Futures Economic Calendar" tool is available to assist with navigating the markets.

You can also use TradingFinder's comprehensive Forex education section.

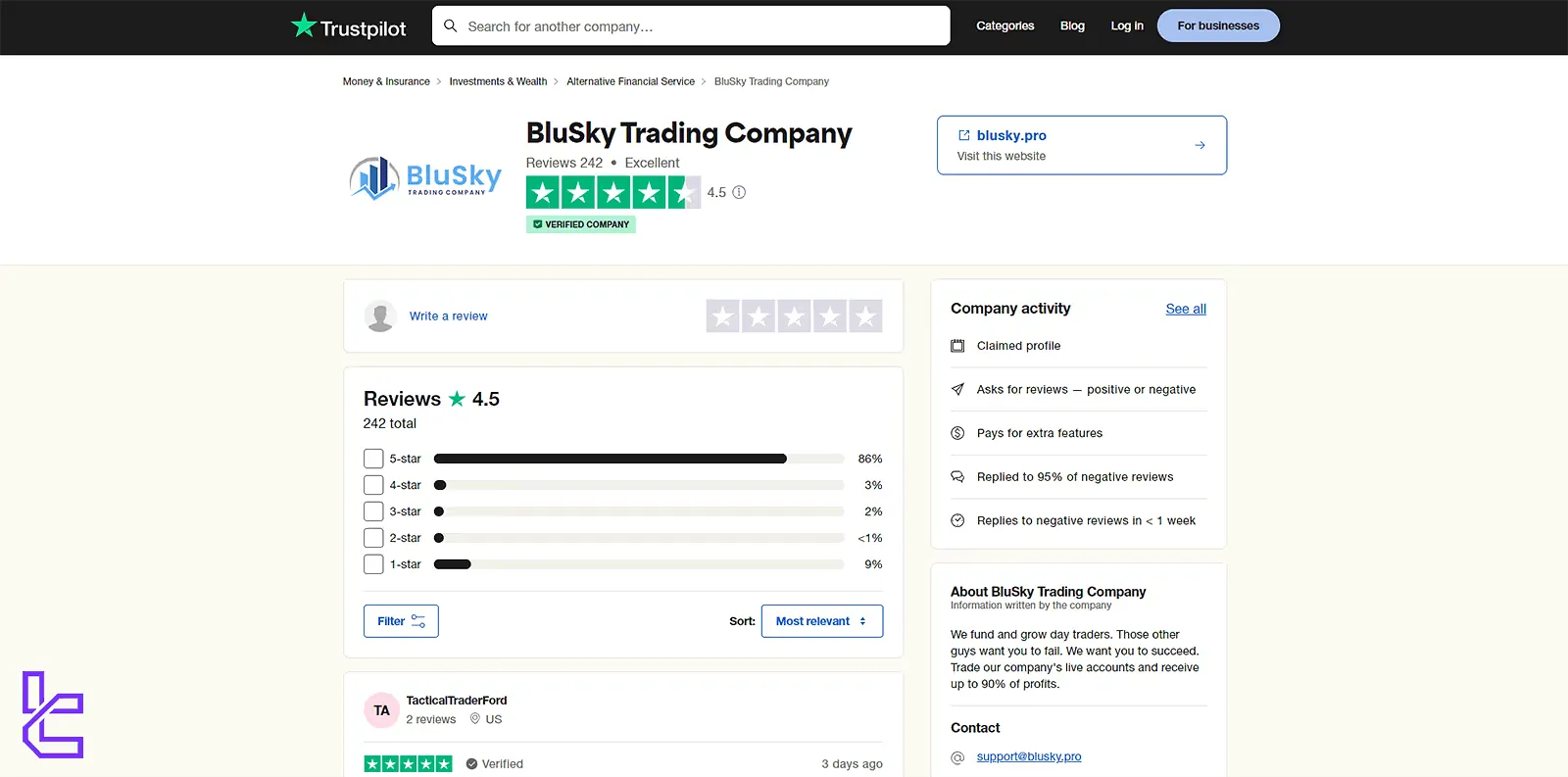

BluSky prop firm Trust scores on Trustpilot

The firm has garnered impressive trust scores on Trustpilot, boasting a 4.5 out of 5 rating. BluSky Trustpilot:

- Overall Sentiment: Overwhelmingly positive

- Number of Reviews: 100+ (as of 2024)

Key Praise Points | Common Critiques |

Transparent Rules | Limited Educational Resource offering |

Responsive Customer Support | Occasional glitches when using the platform |

Quick processing Payouts | - |

User-friendly Platforms | - |

This strong Trustpilot score reflects BluSky's commitment to trader satisfaction and ability to deliver on promises.

BluSky customer support team

BluSky prides itself on responsive and comprehensive customer support:

Support Method | Availability |

Live Chat | Yes (via the Official Website |

No | |

Phone Call | Yes (through 1-727-315-1406) |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | Yes (on the Website) |

Help Center | No |

No | |

Messenger | No |

BluSky's multi-channel support ensures traders can get help when needed, enhancing the overall trading experience.

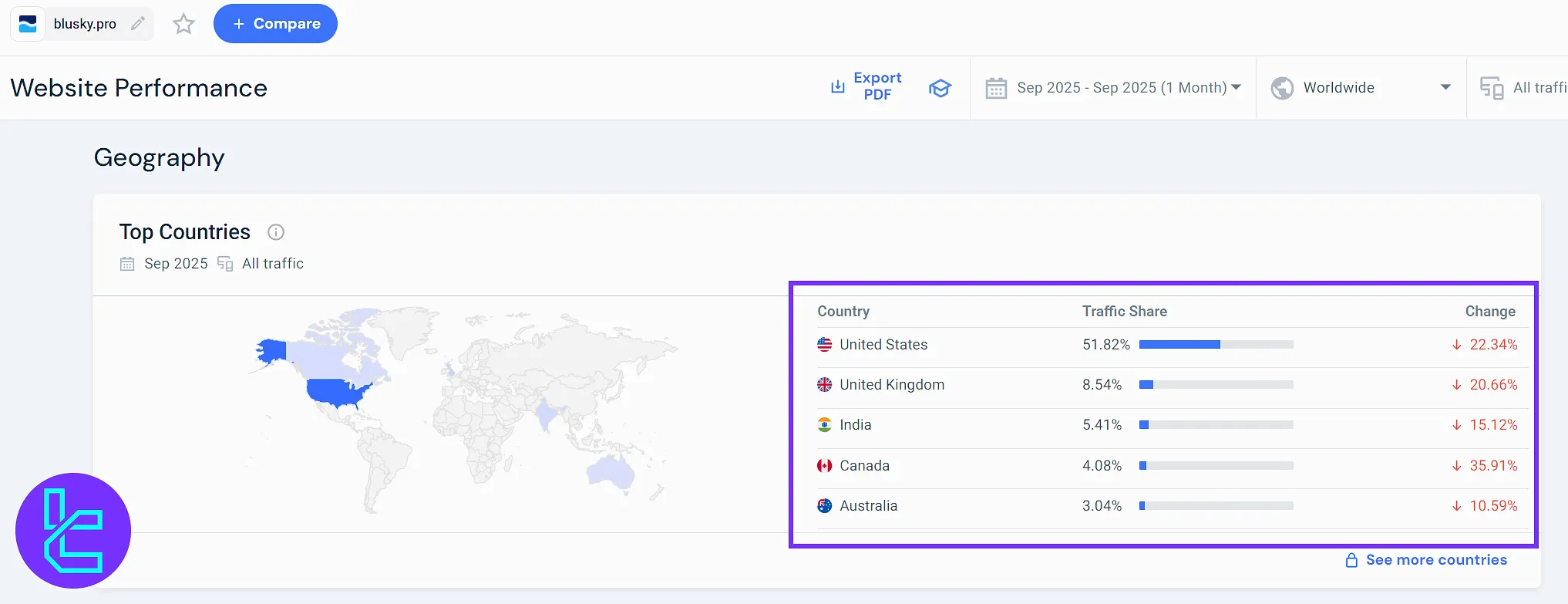

BluSky Prop Firm User Regions

According to Similarweb’s September 2025 data, BluSky Prop Firm maintains a predominantly U.S.–based client base, with 51.82 percent of total website traffic originating from the United States.

The United Kingdom follows with 8.54 percent, while India contributes 5.41 percent. Canada and Australia represent 4.08 percent and 3.04 percent respectively.

Although overall traffic experienced a moderate decline across all regions, the firm’s core audience remains concentrated in English-speaking and high-activity financial markets, indicating a stable trader community with strong engagement in North America and Europe.

BluSky’s presence on social media

BluSky leverages Discord as its primary social media channel:

- Active Community: 5000+ members

- Trading Discussions: Real-time market analysis and strategy sharing

- Admin Presence: Regular updates from BluSky staff

- Trader Networking: Connect with fellow funded traders

The Discord server is a hub for the BluSky trading community, fostering collaboration and knowledge sharing.

BluSky Compared to the Other Prop Firms

Here's a table for a detailed comparison between the reviewed prop firm and other rival companies:

Parameters | BluSky Prop Firm | The 5ers Prop Firm | E8 Markets Prop Firm | Maven Trading Prop Firm |

Minimum Challenge Price | $49 | $39 | $33 | $15 |

Maximum Fund Size | $300,000 | $4,000,000 | $400,000 | $100,000 |

Evaluation steps | 3-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step |

Profit Share | Up to 90% | 100% | 100% | 85% |

Max Daily Drawdown | 2% | 5% | 7% | 4% |

Max Drawdown | 2.5% | 10% | 14% | 8% |

First Profit Target | 6% | 5% | 6% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:1 | 1:100 | 1:100 | 1:75 |

Payout Frequency | Daily | Bi-weekly | Weekly | 10 Days |

Number of Trading Assets | N/A | 3000+ | 40+ | 400+ |

Trading Platforms | NinjaTrader, Tradovate, TradingView, Jigsaw, Bookmap, Quantower, Sierra Chart, ATAS, R|Trader Pro, MotiveWave, Volumetrica, etc. | Metatrader 5 | MetaTrader 5, Match Trader | Match-Trader, cTrader |

Expert suggestions

BluSky has a structured challenge pricing like the $100K Premium+ Account for $210 and the $50K Premium Account for $160.

Commissions of $2 per side for mini contracts and $0.50 for micro contracts ensure cost-effectiveness, while the 4.5/5 Trustpilot score reflects strong trader satisfaction.

Overall, the prop firm mainly targets experienced traders with its relatively difficult evaluation plans.