Crypto Fund Trader prop firm has 2 challenges [1 Phase, 2 Phase, and Instant], and over 500,000 traders use them. This prop provides up to $200,000 of capital with 80% profit split. CFT completes payouts 2 times a month.

Crypto Fund Trader Company Information

Crypto Fund Trader is an evaluation services firm based in Spain that offers traders the opportunity to trade various financial instruments, including cryptocurrencies, Forex, indices, commodities, and stocks, using virtual funds.

Their primary focus is on assessing traders' abilities and providing them with support for their professional development. Key features of Crypto Fund Trader:

- Access to up to $200,000 in virtual funds

- Two-phase and one-phase evaluation programs

- 80/20 profit split in favor of the trader

- Leverage up to 1:100

- Spreads from 0 pips

- Multiple trading platforms, including MetaTrader 5 and their proprietary CFT Platform

Crypto Fund Trader CEO

Crypto Fund Trader is led by Alan Sánchez, who serves as the CEO. The company, legally registered as RLCRATES S.L., was founded on May 14, 2021, and is headquartered in Navarra, Spain.

Under his leadership, the firm has established its reputation as a proprietary trading platform specializing in the cryptocurrency market.

Specifications Summary

The goal of Crypto Fund Trader is to provide capital for traders. Here's a quick overview of what Crypto Fund Trader offers:

Account Currency | USD |

Minimum Price | $55 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 80% |

Instruments | Crypto, Commodities, Stocks, Forex, Indices |

Assets | +200 |

Evaluation Steps | 1 Phase, 2 Phase, Instant |

Withdrawal Methods | Credit Cards And Cryptocurrency |

Maximum Fund Size | $200k |

First Profit Target | 8% |

Max. Daily Loss | 4% |

Challenge Time Limit | 5 Days |

News Trading | Yes |

Maximum Total Drawdown | 6% |

Trading Platforms | Metatrader 5, CFT Platform and Crypto Futures |

Commission Per Round Lot | Varies By the Market |

Trust Pilot Score | 3.9/5 |

Payout Frequency | 2 Times a Month |

Established Country | Spain |

Established Year | 2021 |

Advantages & Disadvantages

Let's break down the pros and cons of trading with Crypto Fund Trader:

Pros | Cons |

High Funding Potential (Up To $200,000) | Low Profit Split Compared to Other Props |

Low Trading Costs with Spreads From 0 Pips | Evaluation Fees Required Upfront |

Multiple Trading Platforms Available | Limited Physical Presence (Headquartered in Switzerland) |

Diverse Range of Tradable Instruments | Some Traders Report Issues with Hidden Rules |

High Leverage (Up To 1:100) | Concerns About the Use of Virtual Funds Instead of Real Capital |

Educational Resources Provided | - |

Funding and Price in Crypto Fund Trader Prop Firm; Everything to Know About

Crypto Fund Trader offers 1-phase, 2-phase, and Instant accounts that have their own funding and price; Crypto Fund Trader Prop Funding and Price:

Evaluation Type | 1-Phase | 2-Phase | Instant |

$2500 | - | - | $125 |

$5000 | $63 | $58 | $240 |

$10000 | $120 | $110 | $475 |

$25000 | $262 | $240 | - |

$50000 | $399 | $360 | - |

$100000 | $656 | $598 | - |

$200000 | $1250 | $1150 | - |

In Crypto Fund Trader, Traders can get funded up to $200,000 and trade with significant capital to achieve their trading goals.

How to Sign Up in Crypto Fund Trader? Complete Guide!

To start trading with Crypto Fund Trader, you will need to purchase an account and sign up. We will explain the process in the following sections.

#1 Visit the Website

First, go to the official Crypto Fund Trader website. From there, you can start the registration process by clicking on “Start Challenge”.

#2 Choose A Plan

Select your preferred account size and evaluation type, and click on “Start Evaluation”. Afterwards, pay the evaluation fee.

#3 Sign Up with Your Information

Please complete the registration form with your personal details, including your name and address.

Then, verify your email address. Next, download and install the trading platform of your choice. Now, you can log in and start your evaluation phase.

#4 Verify Your Identity

For this stage, you will likely be required to submit proof of identity and proof of address.

What Are the Evaluation Stages of a Crypto Fund Trader Prop Firm?

As mentioned in the Crypto Fund Trader Review, three plans exist to attract capital in this form.

Specifics | 1 Phase | 2 Phase | Instant |

Max Daily Loss Limit | 4% | 5% | 4% |

Max Loss | 6% | 10% | 6% |

Phase 1 Target | 10% | 8% | - |

Phase 2 Target | - | 5% | - |

Min Days Traded | 5 | 5 | 0 |

Profit Split | 80% | 80% | Up to 90% |

As you can see, this prop firm offers a range of options to cater to traders with diverse trading strategies and preferences.

Crypto Fund Trader 1-Phase Evaluation

The 1-Phase Evaluation at Crypto Fund Trader is designed with a 10% profit target and straightforward rules. Traders must respect a maximum daily loss of 4% and a maximum trailing loss of 6%, with a minimum of 5 trading days required. There’s no maximum time limit, and leverage is offered up to 1:100.

Trading Conditions | 1-Phase Challenge |

Daily Loss Limit | 4% |

Maximum Loss Limit | 6% |

Profit Target Phase 1 | 10% |

Minimum Trading Days | 5 |

Once funded, traders move to the live stage with an 80% profit split, maintaining the same risk parameters.

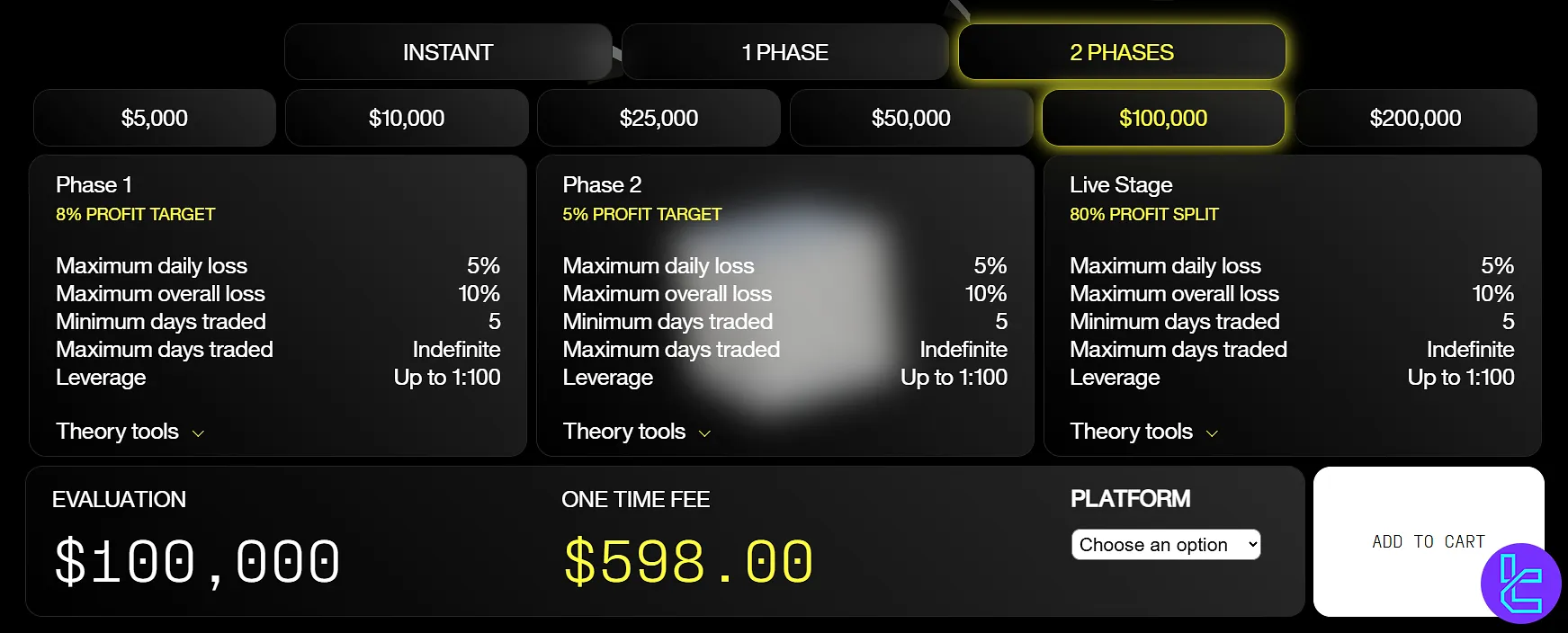

Crypto Fund Trader 2-Phase Evaluation

The 2-Phase Evaluation at Crypto Fund Trader provides traders with a structured path toward funding.

Trading Conditions | 2-Phase Challenge |

Daily Loss Limit | 5% |

Maximum Loss Limit | 10% |

Profit Target Phase 1 | 8% |

Profit Target Phase 2 | 5% |

Minimum Trading Days | 5 |

Key notes about this trading challenge

- Phase 1 requires an 8% profit target, with a 5% daily loss limit and a 10% maximum overall loss. At least 5 trading days must be completed, with no maximum duration;

- Phase 2 continues with a 5% profit target under the same risk rules, ensuring consistency in trading discipline;

- Upon reaching the Live Stage, traders receive an 80% profit split while maintaining identical limits and leverage of up to 1:100.

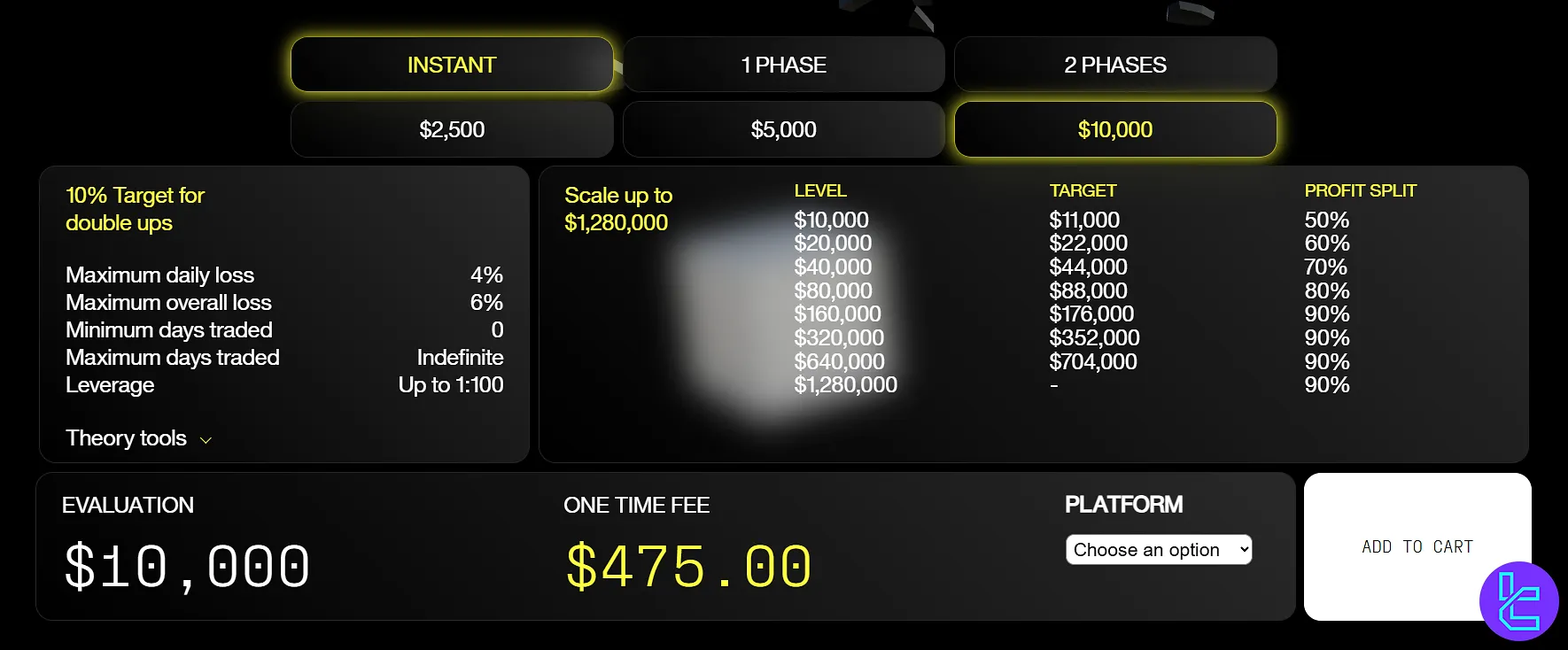

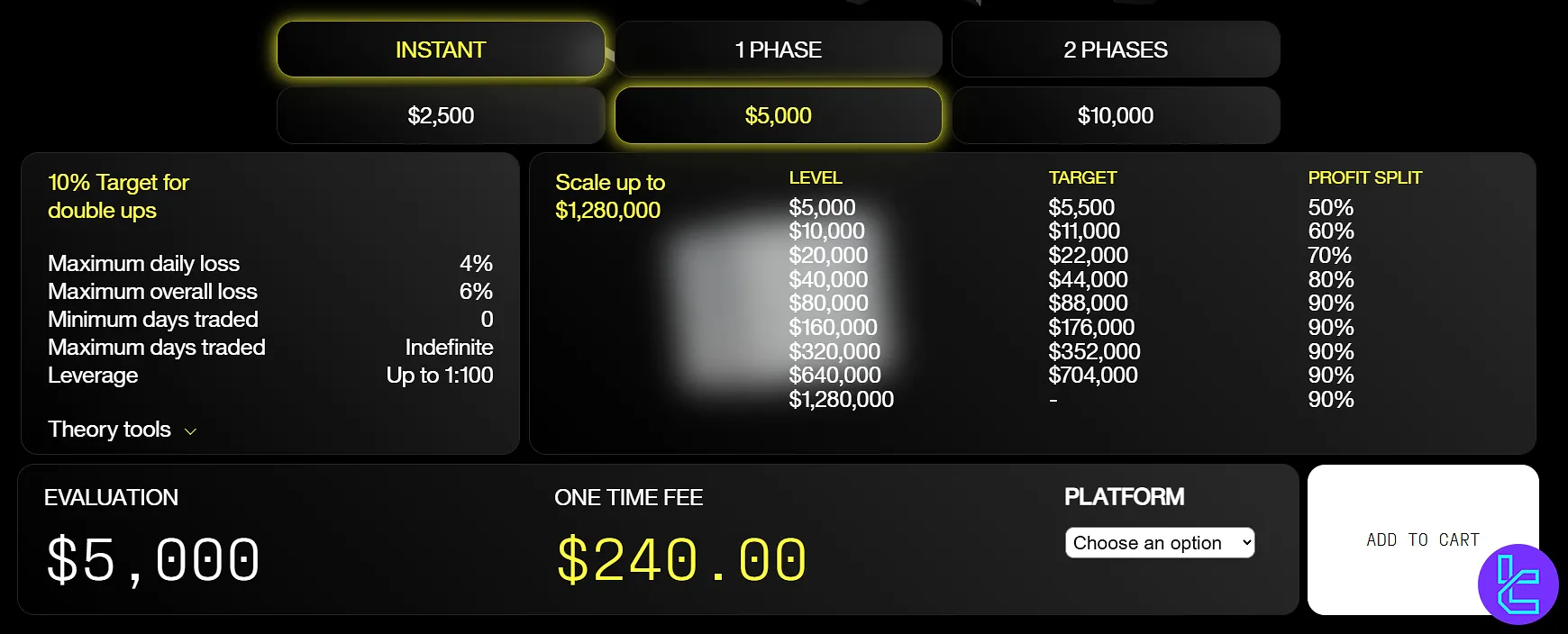

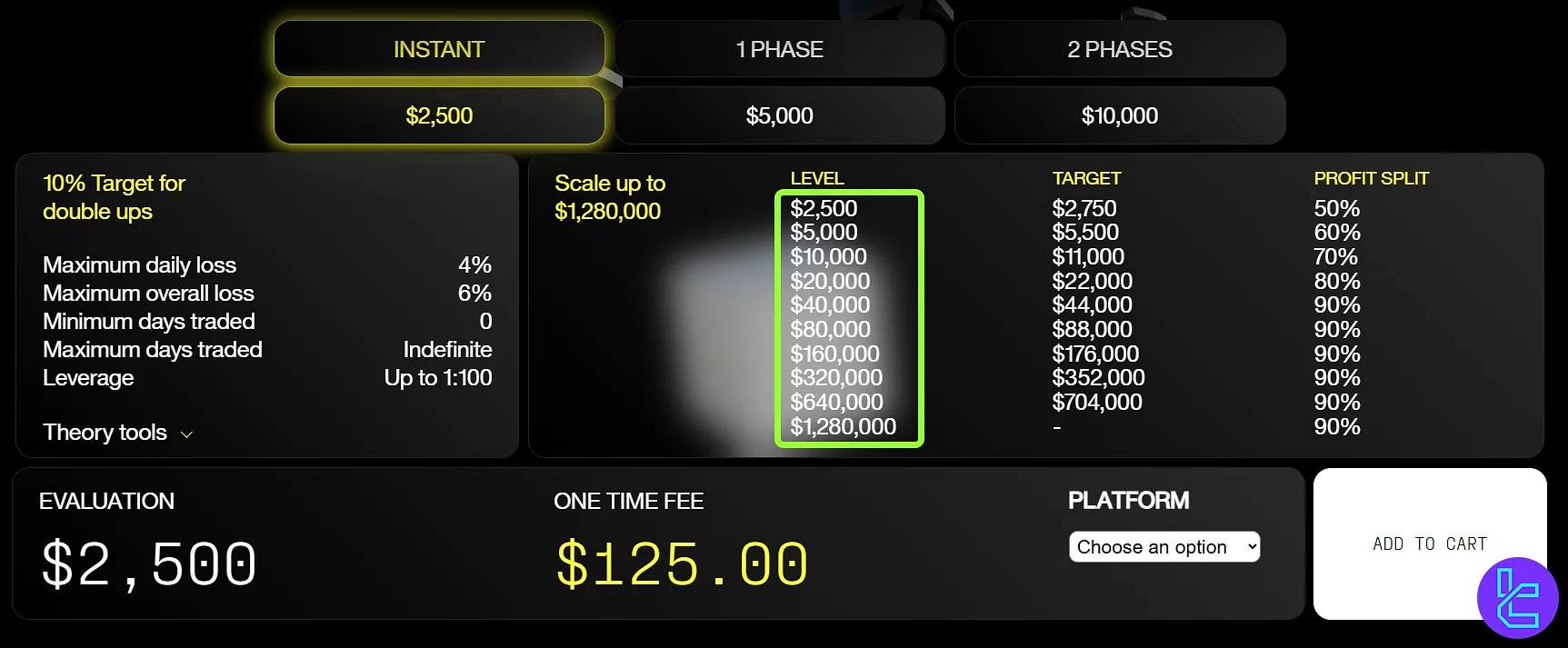

Crypto Fund Trader Instant Funding

The Instant Evaluation model at Crypto Fund Trader enables traders to access capital immediately, eliminating the need for a demo phase. With a 10% target for double-ups, participants can scale their accounts progressively up to $1,280,000.

The program sets clear limits, including a maximum daily loss of 4% and an overall loss of 6%, with no minimum trading days and an indefinite duration. Leverage is available up to 1:100, while profit splits start at 50% and can reach 90% at higher scaling levels.

Trading Conditions | Instant Funding |

Daily Loss Limit | 4% |

Maximum Loss Limit | 6% |

Profit Target | - |

Minimum Trading Days | 0 |

The picture below clears the path to success in the Instant Funding Accounts of Crypto Fund Trader.

What Bonuses and Discounts does Crypto Fund Trader Prop Offer?

While Crypto Fund Trader doesn't regularly offer bonuses or discounts, it occasionally runs promotional campaigns. These may include:

- Discounted evaluation fees

- Increased profit splits for a limited time

- Special challenges with additional rewards

Keep an eye on their official website and social media channels for any current promotions.

Crypto Fund Trader Rules

The prop firm has set specific trading rules that must be considered by traders:

- VPN Usage: Sharing accounts or using VPNs that cause IP address matches with other users is prohibited;

- Hedging: The company strictly prohibits gambling, which includes trading strategies that do not involve investment;

- Expert Advisor (EA) Restrictions:

- High-Frequency Trading: Using algorithms to make rapid trades is not allowed;

- Tick Scalping strategy: Opening and closing trades very quickly to make numerous trades in a short period is prohibited;

- Arbitrage Strategy: Arbitrage trading involving third-party accounts or other companies is strictly prohibited;

- News Trading: News trading is allowed, but users should be mindful of their strategies. The company encourages trading flexibility, even during high-impact news events;

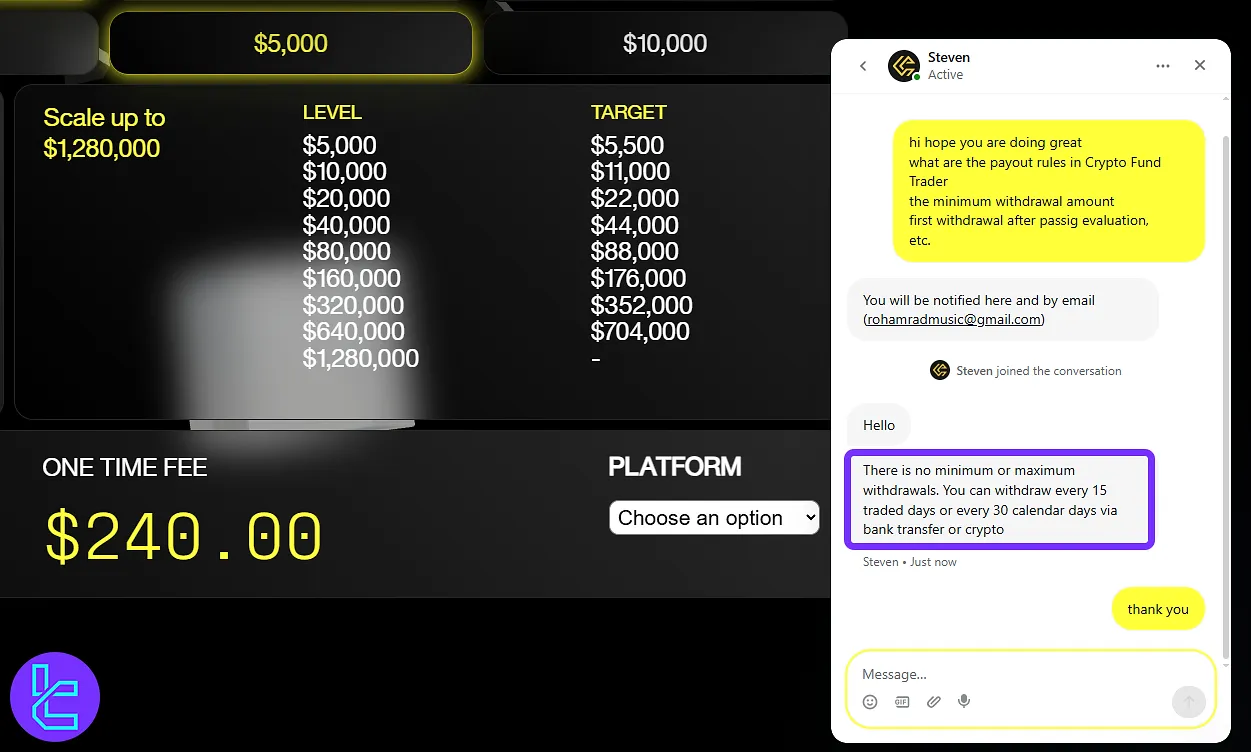

- Payout Rules: Withdrawals available every 15 traded days or 30 calendar days, with no limits, via bank transfer or crypto.

VPN Usage

When using VPNs, it is essential to ensure that your IP address does not match those of other users, as this could lead to potential account sharing violations.

The company holds the user responsible for any risks associated with using VPNs, as this may result in IP address overlaps with other traders.

Hedging

As a trading training company, Crypto Fund Trader maintains a strict policy against any form of gambling. The platform is designed for educational and investment purposes, so strategies that do not involve genuine investment decisions will be deemed inappropriate.

The firm reserves the right to evaluate and determine if a strategy aligns with the investment goals.

Expert Advisors (EA) Restrictions

- High-Frequency Trading: Automated programs or algorithms used to execute numerous trades in short intervals are prohibited on the platform;

- Tick Scalping: Making numerous quick trades (whether manually or with EAs) within brief timeframes is not permitted.

Martingale and Arbitrage Strategies

Crypto Fund Trader explicitly prohibits the use of Arbitrage strategies involving third-party accounts or other companies. While no specific information is given about martingale strategies, they are generally avoided due to their speculative nature and high risk.

News Trading

Traders are allowed to trade during news events. However, it is essential to be mindful of your approach and ensure it aligns with the firm's rules and guidelines.

Crypto Fund Trader Payout Rules

Crypto Fund Trader offers flexible withdrawals with no minimum or maximum limits. Traders can request payouts every 15 traded days or every 30 calendar days, using either bank transfer or crypto. This structure ensures steady access to profits while maintaining trading continuity. Key Points:

- Withdrawal Frequency: Every 15 traded days or 30 calendar days

- Limits: No minimum or maximum

- Methods: Bank transfer or crypto

Crypto Fund Trader Scaling Plan

The Scaling Program at Crypto Fund Trader enables traders to grow their funded accounts step by step, based on consistent performance. Starting from $5,000, accounts can expand through multiple stages,eventually reaching up to $1,280,000.

At each milestone, the profit target is set at 10%, while traders must adhere to the firm’s strict risk limits of 4% maximum daily loss and 6% overall loss.

Profit distribution improves as traders advance: beginning at 50%, the split gradually increases to as much as 90% at higher scaling levels. This structure is designed to reward disciplined trading and sustainable account growth.

What Platforms are Available in Crypto Fund Trader?

As of now, CFT supports 3 trading platforms, and traders can choose between these options; Crypto Fund Trader trading platforms:

- MetaTrader 5 (MT5): A popular, feature-rich platform suitable for various trading styles

- CFT Platform: Crypto Fund Trader's proprietary platform

- Crypto Futures: A dedicated platform for cryptocurrency futures trading

Each platform offers unique features, so choose the one that best fits your trading style and preferences.

Tradable Instruments and Symbols

Crypto Fund Trader offers a wide range of tradable instruments to its users. CFT Instruments:

- Cryptocurrencies: Over120 assets such as BTC, ETH, ADA, and many more

- Forex: 40 Symbols such as major and minor currency pairs

- Indices:15 Global stock market indices

- Commodities: 10 Assets including Gold, silver, oil, and more

- Stocks:25 stocks from major global markets

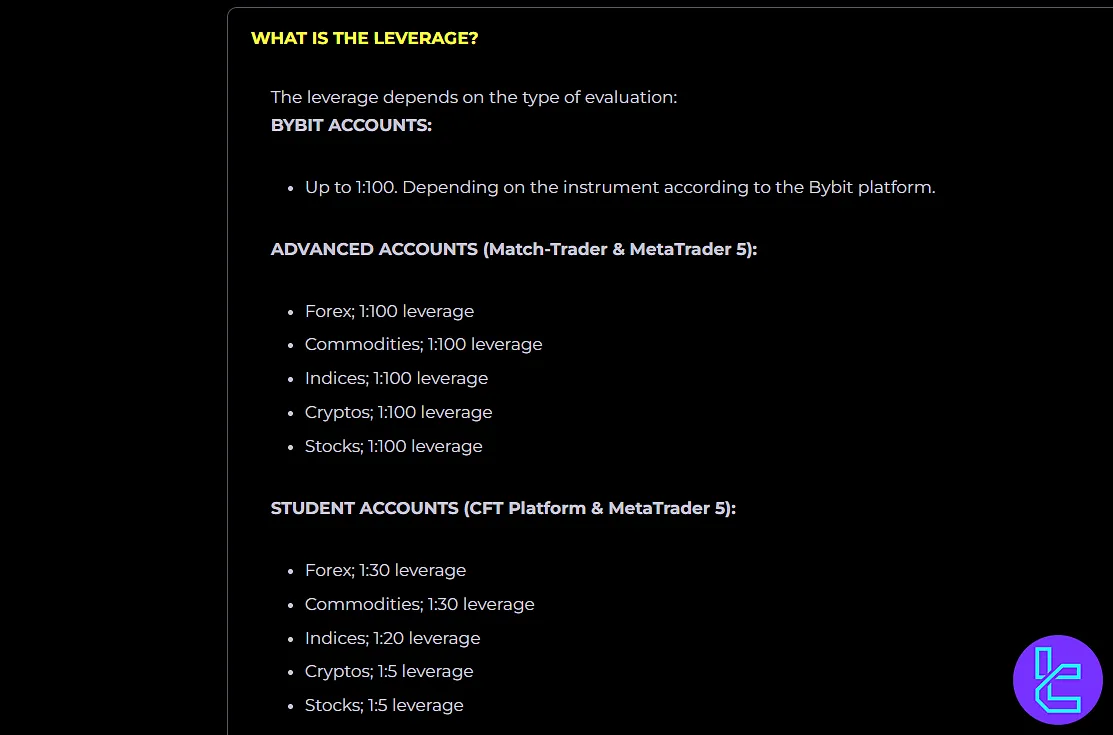

Crypto Fund Trader Leverage

Leverage at Crypto Fund Trader varies depending on the type of account and platform used.

- Bybit Accounts: Up to 1:100, depending on the instrument offered by Bybit

- Advanced Accounts (Match-Trader & MetaTrader 5): Forex, Commodities, Indices, Cryptos, and Stocks all come with 1:100 leverage

- Student Accounts (CFT Platform & MetaTrader 5): Lower risk limits apply, with 1:30 on Forex and Commodities, 1:20 on Indices, and 1:5 on Cryptos and Stocks

This tiered structure provides traders with flexibility, matching higher leverage to advanced accounts while maintaining a conservative risk profile in student programs.

Crypto Fund Trader Prop Payment Methods

For both deposits and withdrawals, Crypto Fund Trader offers just 2 payment methods:

- Credit Cards

- Cryptocurrency transfers via USDT (ERC20 and TRC20), Bitcoin (BTC), and Ethereum (ETH)

The prop firm accepts 11 various cryptocurrencies for payments in total. There's no minimum withdrawal amount, and the firm aims to process payments within 48 business hours.

What are the Fees & Costs on Crypto Fund Trader?

Crypto Fund Trader keeps a fee that is really low compared to other prop firms, and it's structured based on markets; CFT fees:

- Crypto: 0.0125% per position

- Commodities: 0.0005% per position

- Stocks: 0.002% per trade

- Forex: $1.5 per lot

- Indices: $0 in each position

There are no hidden fees, but always read the terms and conditions carefully.

Crypto Fund Trader Prop Educational Resources

Crypto Fund Trader provides various educational resources:

- Tutorial videos

- Virtual classes

- E-books

- Live streams

- Podcasts

- Personal mentoring (for certain account levels)

While these resources can be helpful, some traders report that they're not as comprehensive as those offered by other prop firms. It's always a good idea to supplement your learning with additional materials.

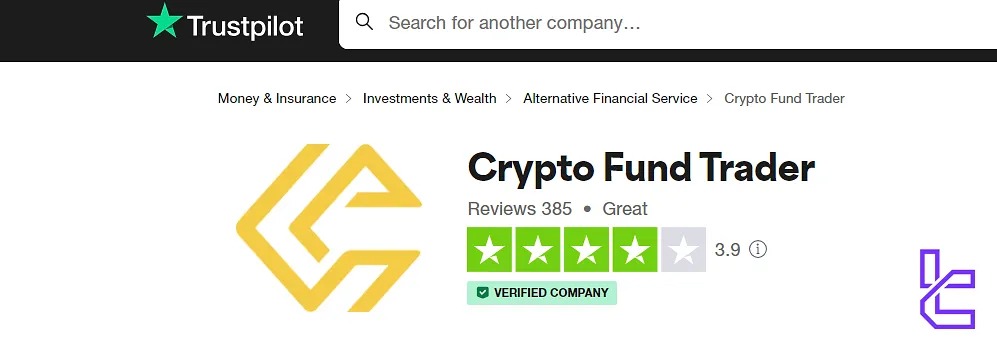

Crypto Fund Trader Prop Firm Trust Scores

Crypto Fund Trader Trustpilot earned 3.9/5 stars based on more than 300 reviews in Trustpilot; Users highlight the matters below:

- Transparent practices

- Competitive trading conditions

- Helpful support team

- Smooth payout process

- Account closure issues

- High spreads on some pairs

Always approach online reviews with a critical eye and consider multiple sources before making a decision.

Support: Channels & Opening Hours

In the Crypto Fund Trader Review, we found that one of its key strengths is the effective support function. The company has considered the following ways to support:

Support Method | Availability |

Live Chat | Yes (Available on the Website) |

Yes (support@cryptofundtrader.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | Yes (Accessible on the “Contact Us” page) |

FAQ | No |

Help Center | No |

No | |

Messenger | No |

While exact opening hours aren't specified, they aim to respond to queries as soon as possible.

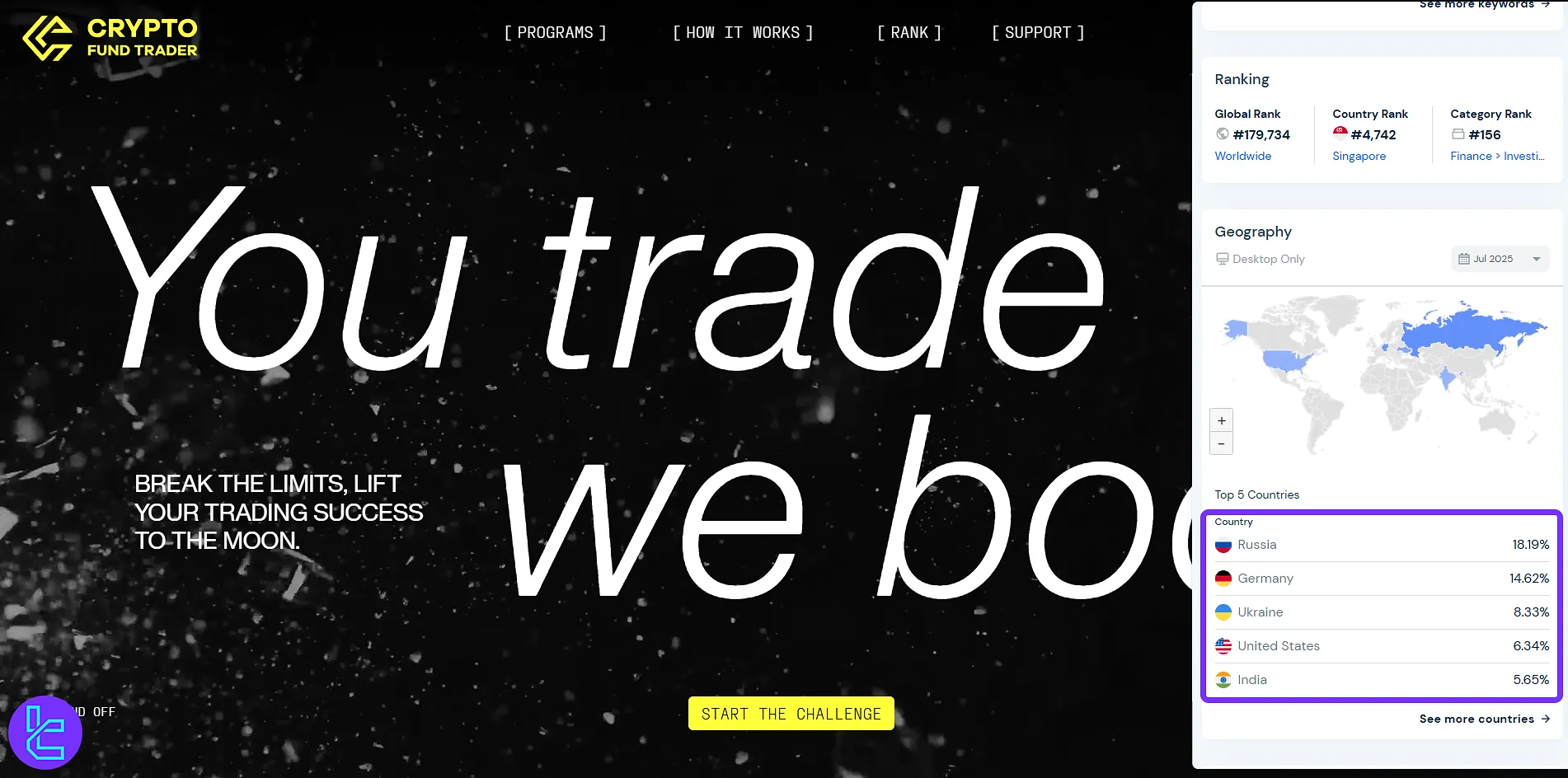

Crypto Fund Trader Userbase

Crypto Fund Trader has established a strong global presence, attracting traders from multiple regions. The platform’s userbase is particularly active in Russia (18.19%), Germany (14.62%), and Ukraine (8.33%), with notable participation from the United States (6.34%) and India (5.65%). This international distribution highlights the firm’s growing appeal across both European and global markets. Key Countries:

- Russia: 18.19%

- Germany: 14.62%

- Ukraine: 8.33%

- United States: 6.34%

- India: 5.65%

Crypto Fund Trader on Social Media

Crypto Fund Trader maintains a presence on major social media platforms:

Social Media | Followers/Subscribers |

Over 8000 | |

Over 5500 | |

Over 3200 | |

Over 9800 | |

Over 2100 |

These channels are used for announcements, educational content, and community engagement. Following them can help you stay updated on promotions and changes to their services.

Crypto Fund Trader Compared to the Other Prop Firms

The table below compares CFT with some of the major prop firms:

Parameters | Crypto Fund Trader Prop Firm | |||

Minimum Challenge Price | $55 | $50 | €55 | $97 |

Maximum Fund Size | $200,000 | $2,000,000 | Infinite | $200,000 |

Evaluation steps | 1-phase, 2-phase | 1-Step, 2-Step | 2-Step | 1-Step, 2-Step |

Profit Share | 80% | 90% | 100% | 80% |

Max Daily Drawdown | 4% | 4% | 5% | 5% |

Max Drawdown | 6% | 6% | 8% | 10% |

First Profit Target | 8% | 5% | 10% | 5% |

Challenge Time Limit | 5 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:5 | 1:100 | 1:100 |

Payout Frequency | 2 Times a Month | Bi-weekly | 14 Days | Bi-weekly |

Number of Trading Assets | 200+ | 100+ | 150+ | 40 |

Trading Platforms | Metatrader 5, CFT Platform and Crypto Futures | Proprietary platform | Proprietary platform | MetaTrader 5, cTrader, Dxtrade |

TradingFinder Expert Suggestions

6% maximum total drawdown, 4% maximum daily loss and 8% profit target are some of the features of Crypto Fund Trader; Under these conditions, you are able to trade200+ assets and use 1:100 maximum leverage.