According to our regular checkup on the prop firm's website, apparently, DreamTicks has stopped offering services to its clients since the official website now shows a 1014 error "CNAME Cross-user Banned". Here's a screenshot of the website's current status:

DreamTicks provides funded accounts, ranging from $10K to $200K, through a 2-step evaluation program. The firm offers various features like refunds on challenge fees, a90% profit split add-on, and unlimited challenge time.

DreamTicks (Introduction to the Proprietary Trading Firm)

DreamTicks was founded in 2021 amidst the COVID-19 pandemic. The firm's core offering revolves around funded trading accounts, withcapital ranging from $10,000 to an impressive $200,000. Key features of DreamTicks:

- Up to 90% profit split for successful traders

- Two-stage evaluation process: Challenge, Verification, and Funded Account

- Instant profit payouts, ensuring quick access to earnings

- Flexible account scaling options up to $1,000,000

- Optional leverage enhancements and increased profit share

- Refundable registration fees, minimizing financial risk for participants

- 24/7 support

DreamTicks Table of Specifications

Understanding the key specifications of DreamTicks is crucial for traders considering this platform. Here's a comprehensive table outlining the essential features of the prop firm.

Account currency | USD |

Minimum price | $99 |

Maximum leverage | 1:60 (add-on) |

Maximum profit split | Up to 90% (add-on) |

Instruments | Forex, Indices, Metals, Crypto, US Shares |

Assets | 90+ |

Evaluation steps | 2-Step (Evaluation, Verification) |

Withdrawal methods | Crypto |

Maximum fund size | $1,000,000 |

First profit target | 8% |

Max. daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Conditioned |

Maximum total drawdown | 10% |

Trading platforms | N/A |

Commission | N/A |

TrustPilot score | Doesn’t have a profile |

Payout frequency | Bi-Weekly |

Established country | N/A |

Why DreamTicks? (Pros & Cons)

As with any trading platform, DreamTicks has its own advantages and disadvantages. To have a balanced look, let’s explore these factors.

Pros | Cons |

High capital on funded accounts up to $200,000 | Lack of transparency about the company and its founding team |

Generous profit split up to 90% | No live chat support |

Instant payouts of earned profits | Limited tradable assets |

Refundable registration fees | Limited payment options |

Funding Plans and Pricings on DreamTicks Prop Firm

When it comes to funded accounts, DreamTicks has only one offering. The two-stage evaluation program is designed to cater to traders at different levels of experience and capital requirements.

Funded Account | Price |

$10k | $99 |

$25K | $199 |

$50K | $299 |

$100K | $499 |

$200K | $979 |

DreamTicks Account Opening and KYC Verification

Opening an account with DreamTicks and completing the Know Your Customer (KYC) verification process is a straightforward yet crucial step in beginning your journey with the prop firm.

#1 Visit the DreamTicks Challnege Options

Begin by visiting the prop firm's official website. On the homepage, locate and select the “Buy Challenge” button. This will redirect you to the available challenge options.

#2 Select Your Account Size and Add-Ons

Choose your preferred account size based on your trading strategy and risk appetite. You can also select from various optional add-ons, such as:

- Stop Loss Removal

- 90% Profit Split

- Double Leverage

These add-ons enhance your flexibility and profit potential during the evaluation phase.

#3 Complete the Payment

Proceed to the checkout page and pay the challenge fee using the available payment methods. Ensure the transaction is confirmed before moving forward.

#4 Upload Verification Documents

To activate your account, you must complete KYC verification by submitting the following:

- Proof of Identity: Passport, national ID card, or driving license

- Proof of Address: Utility bill or recent bank statement

- A Selfie: A clear photo of yourself holding your ID for identity confirmation

DreamTicks Challenge Account (Rules and Conditions)

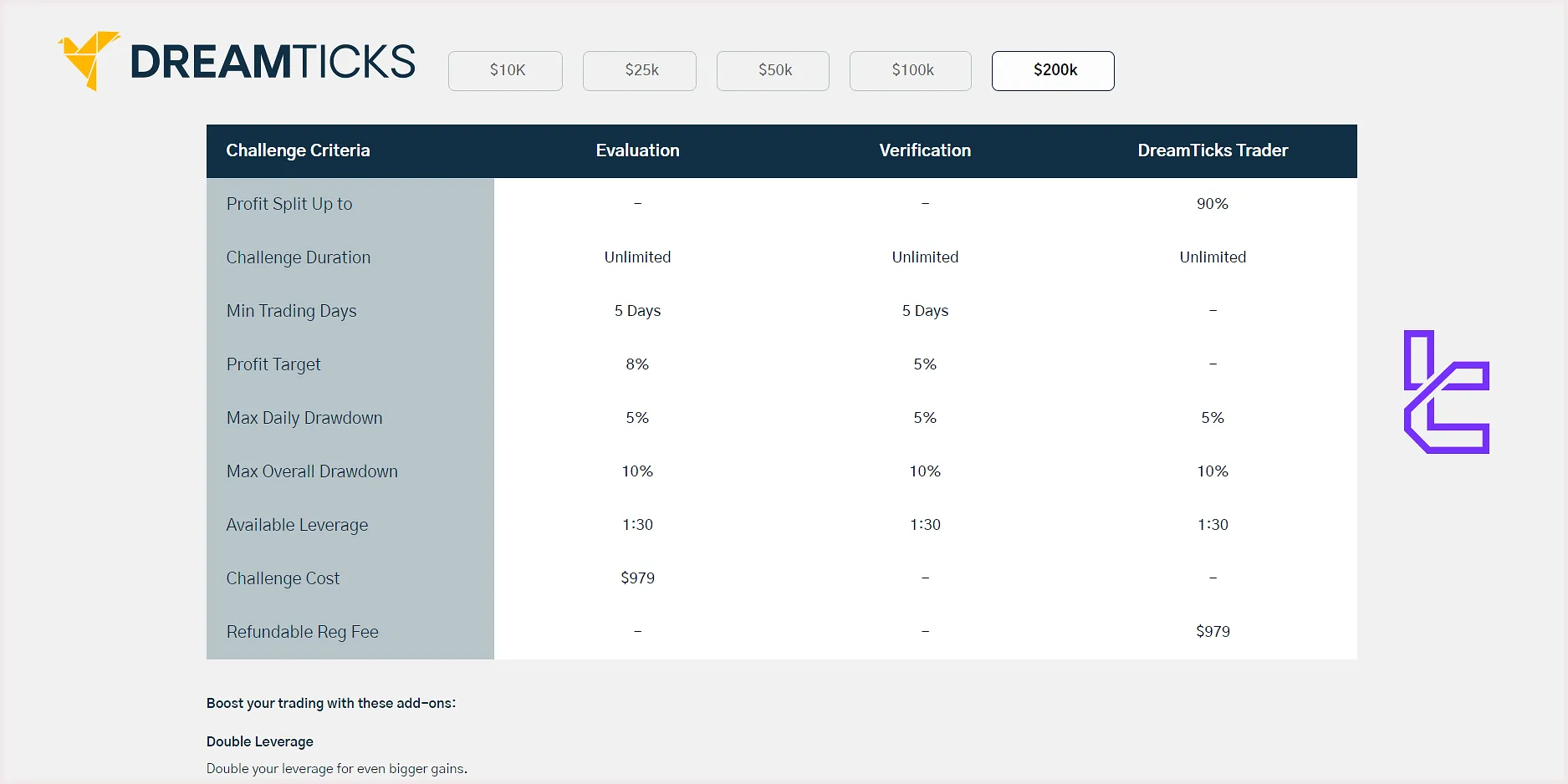

The 2-step evaluation plan has simple rules and requirements in regard to drawdown limitations, trading duration, etc.

Conditions | Evaluation (Phase 1) | Verification (Phase 2) | DreamTicks Trader (Funded Account) |

Profit Split | - | - | 90% |

Duration | Unlimited | Unlimited | Unlimited |

Min Trading Days | 5 | 5 | - |

Profit Target | 8% | 5% | - |

Max Daily Loss | 5% | 5% | 5% |

Max Total Drawdown | 10% | 10% | 10% |

Leverage | 1:30 | 1:30 | 1:30 |

DreamTicks provides a structured scaling plan for funded traders. After reaching 2 successful payout milestones and maintaining a 10% profit over a four-month period, traders become eligible for a 25% increase in their funded account balance.

This process can repeat until the maximum account size of $1,000,000 is achieved, enabling long-term growth for consistent performers.

DreamTicks Bonus and Promotional Programs

While the prop firm doesn’t offer traditional promotions, it compensates by offering various attractive add-ons that can boost your earning potential.

- Double Leverage: Double the initial leverage of 1:30 to 1:60;

- Increased Profit Split: Jump from 80/20 to 90/10 profit share;

- No Stop Loss: Remove the Stop Loss requirement from your trading.

DreamTicks also offers a dedicated referral program. However, the affiliate portal on the firm’s official website is not active at the time of writing this DreamTicks review.

DreamTicks Rules

As with many Prop Firms, DreamTicks allows some strategies while restricts others; Key Points:

- VPN Usage: Not addressed on the website;

- Hedging: Strictly prohibited to use fraudulent hedging strategies such as holding opposing positions across different accounts;

- Expert Advisors (EAs): Not mentioned on the website;

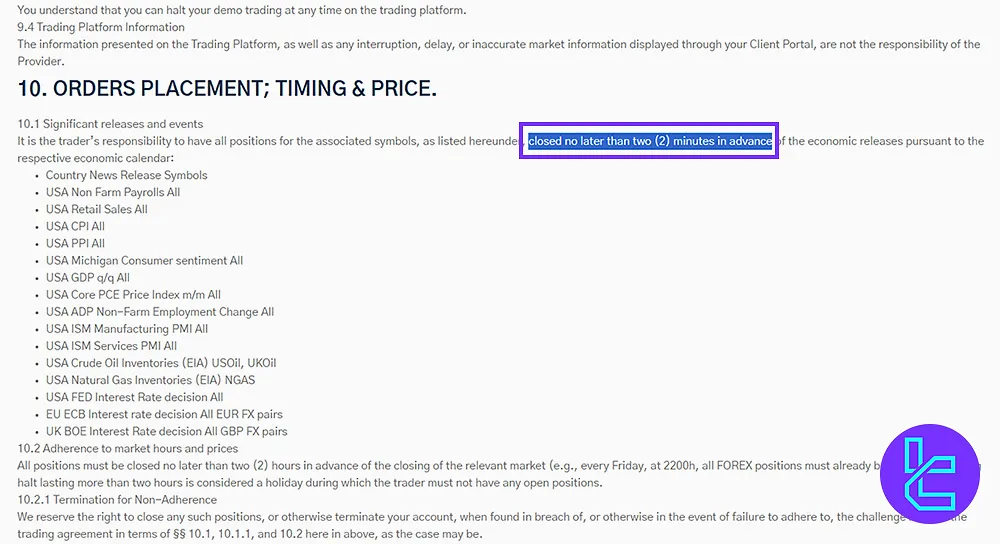

- News Trading: Traders must close positions for certain symbols at least 2 minutes before significant news releases to comply with trading rules.

DreamTicks VPN Usage

While VPN usage is not explicitly mentioned in the policy, maintaining consistent access methods for account security is implied. Users should avoid frequent IP address changes and should notify support in advance if accessing the account from a different country.

Hedging Practices at DreamTicks

The use of hedging strategies that involve opening contradictory positions across multiple accounts is strictly prohibited. This includes holding opposite positions in different accounts, whether individually or collectively with other traders. If such practices are detected, it will be considered a breach of the challenge rules or trading agreement, and any related positions will beimmediately closed.

Expert Advisors (EAs) on DreamTicks

The firm's website did not mention the use of Expert Advisors. However, it is understood that automated trading strategies, such as EAs, are subject to the platform’s rules and should be used in compliance with the provided guidelines.

DreamTicks News Trading Restrictions

Traders are required to close all positions related to specific financial instruments at least 2 minutes before the release of significant economic data. This includes news events from major global economies, such as:

- USA: Non-Farm Payrolls, Retail Sales, CPI, PPI, GDP, Core PCE Price Index, ADP Employment Change, and ISM Manufacturing/Services PMIs

- EU: European Central Bank(ECB) Interest Rate Decision

- UK: Bank of England (BOE) Interest Rate Decision

- Crude Oil: US Oil and UK Oil are affected by Crude Oil Inventories (EIA) announcements

- Natural Gas: NGAS is impacted by Natural Gas Inventories (EIA)

What Trading Platforms Are Available on DreamTicks?

There is no specific data available about the firm’s brokerage partner or its trading platforms. This lack of transparency on DreamTicks prop firm’s website could be an indicator that potential clients should tread cautiously.

DreamTicks Prop Firm Trading Assets

The firm offers diverse trading assets, catering to various trader preferences and market opportunities. The available asset classes on DreamTicks:

- Forex: Seven major currency pairs (EUR/USD, GBP/USD, USD/JPY, AUD/USD, NZD/USD, USD/CAD, USD/CHF) and 21 cross rates (e.g., AUD/CAD, CAD/CHF)

- Indices: Nine of the most popular global stock market indices (e.g., DAX, ESP35, EUSTX50, FRA40, JPN225, NAS100, SPX500, UK100, and US30)

- Crypto: CFDs on 23 major cryptocurrencies, including ADA, AVA, BAT, BCH, BTC, BNB, DASH, DOGE, DOT, EOS, and ETH

- US Shares: 27 of the American industry giants like AAPL, AMZN, BA, BAC, CSCO, CVX, FDX, GOOG, HP, and INTC

- Metals: CFDs on five precious metals, including Copper, Gold, Silver, Gold Pro, and Platinum

DreamTicks Payment Options

DreamTicks supports both crypto and fiat payment options for challenge purchases. Traders can pay via credit/debit card or through a wide range of cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Tether (USDT-ERC20)

- USD Coin (USDC -ERC20)

DreamTicks offers bi-weekly profit withdrawals for funded traders. The first payout can be requested 30 days after a trader’s first live trade. Minimum payout thresholds are $50 for funded traders and $100 for affiliate commissions. All payouts are processed instantly once verification is complete.

Does DreamTicks Charge Commission and Fees?

The firm’s lack of transparency goes on in regard to its fee structure.

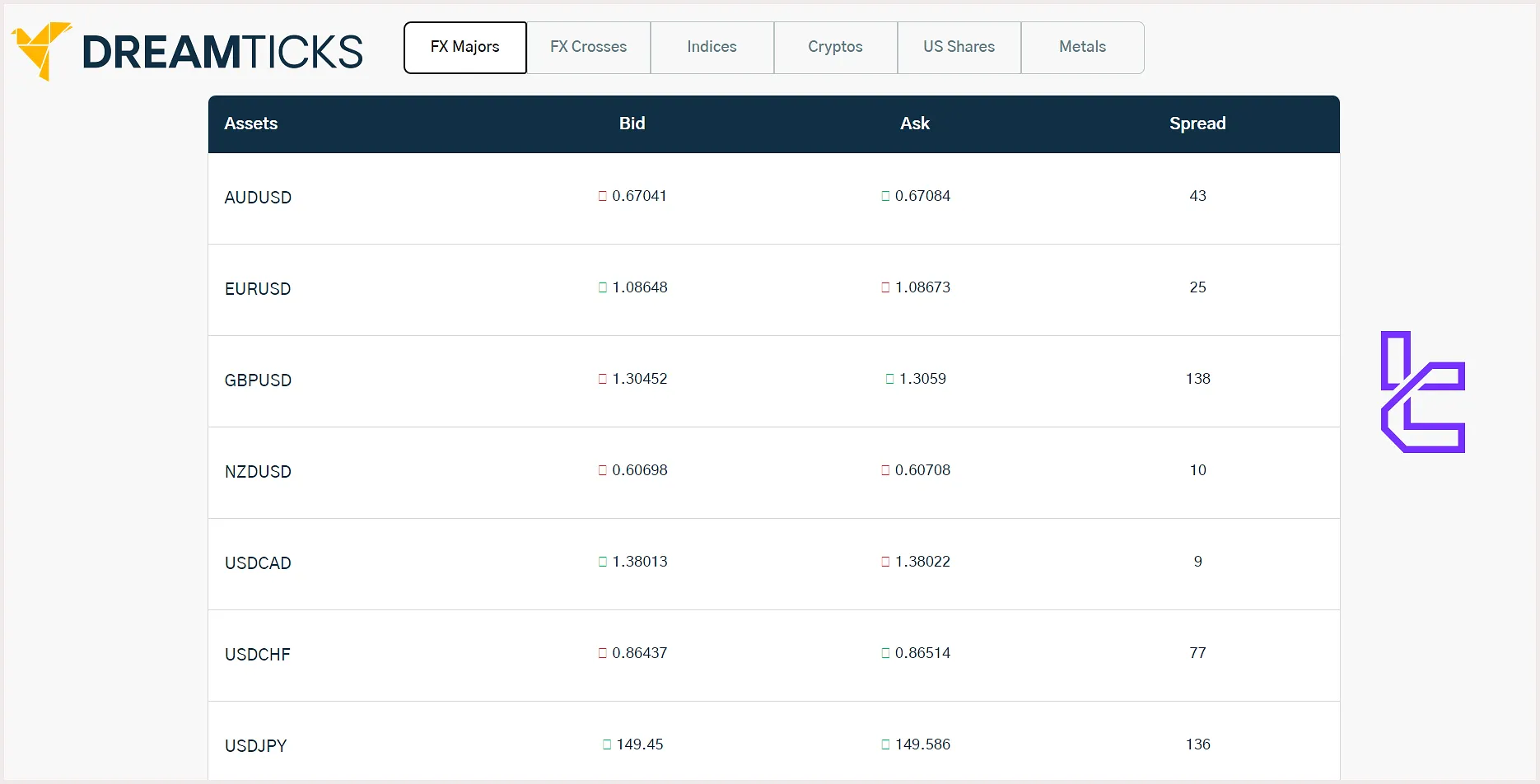

A list of Forex major currency pairs spreads on DreamTicks prop firm

A list of Forex major currency pairs spreads on DreamTicks prop firm

While there is no specific data about the trading commissions, we can explore the spreads for various instruments.

Financial Instrument | Spread (Pips) |

EUR/USD | 25 |

USD/CAD | 9 |

EUR/AUD | 118 |

SPX500 | 50 |

BTC/USD | 6801 |

AAPL | 25 |

XAU/USD | 87 |

It’s safe to say that DreamTicks’ spreads are pretty high compared to other competitors, and you should consider it before committing any funds.

DreamTicks Educational Materials

The firm doesn’t recognize the importance of continuous learning in the trading world since it only offers a blog as a resource for its clients. At the time of writing this DreamTicks review, there are only nine articles on the blog, covering topics like:

- Forex Trading

- How to trade the “Head and Shoulders” pattern

- Introduction to Indicators

- Technical Analysis

- Forex glossary

You can check TradingFinder's comprehensive Forex tutorials for additional educational resources.

DreamTicks Trust Scores

Trust is paramount in proprietary trading, and DreamTicks hasn’t earned it yet. While the firm has more experience than some of its competitors, it doesn’t have a solid standing among traders or on reputable review websites.

DreamTicks doesn’t have a profile on any reliable review sources like TrustPilot and Reviews.io. Before purchasing challenge accounts, you must consider these facts:

- Lack of transparency about the company’s history and its founding team;

- Poorly developed website and non-responsive customer support;

- No specific information about the trading costs;

- No profile on review websites.

We strongly advise you to do thorough research before purchasing any of the DreamTicks challenge accounts.

DreamTicks Prop Firm Support Channels

While the firm boasts 24/7 chat support, there is no button on the website to initiate this feature. This leaves us with only three contact channels, including:

support@dreamticks.com | |

Ticket | Available on the “Contact Us” page |

Discord Community |

DreamTicks Social Media Handles

Maintaining an active presence on social media platforms is an indicator of DreamTicks’ dedication to its clients and showcases if the trading community has accepted the prop firm.

- DreamTicks Facebook: No activity with only one follower;

- Instagram: 4 posts with only 17 followers;

- YouTube: The channel doesn’t exist anymore;

- Discord: Not active.

DreamTicks in Comparison with Other Prop Firms

Let's compare the DreamTicks features and services with those of other prop firms; DreamTicks Comparison:

Parameters | DreamTicks Prop Firm | ||||

Minimum Challenge Price | $99 | $39 | $15 | $33 | $97 |

Maximum Fund Size | $1,000,000 | $250,000 | $100,000 | $400,000 | $200,000 |

Evaluation steps | 2-Step (Evaluation, Verification) | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step |

Profit Share | Up to 90% (add-on) | 100% | 85% | 100% | 80% |

Max Daily Drawdown | 5% | 5% | 4% | 7% | 5% |

Max Drawdown | 10% | 10% | 8% | 14% | 10% |

First Profit Target | 8% | 5% | 8% | 6% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:60 (add-on) | 1:100 | 1:75 | 1:100 | 1:100 |

Payout Frequency | Bi-Weekly | Bi-weekly | 10 Days | Weekly | Bi-weekly |

Number of Trading Assets | 90+ | 3000+ | 400+ | 40+ | 40 |

Trading Platforms | N/A | Metatrader 5 | Match-Trader, cTrader | MetaTrader 5, Match Trader | MetaTrader 5, cTrader, Dxtrade |

Expert Suggestions

DreamTicks provides access to trading capital of up to $1,000,000 with an initial profit split of 80%. The firm only supports Crypto withdrawals, and processes them instantly in a bi-weekly frequency.

DreamTicks prop firm offers a wide range of trading instruments (90+) across 5 asset classes, including US Stocks, and Crypto. However, the lack of live chat support and proper data about the fee structure are the main weaknesses that impact this DreamTicks review.