Elite Trader Funding is a CFA Charteholder that offers 5 funding plans with 1-step evaluation programs to provide access to 76 Futures products. The prop firm has a profit split of up to 100% for the first $12,500 and 90% after that.

Founded in 2022 in the United States, Elite Trader Funding has rapidly grown by offering flexible conditions such as no daily loss limits, news and weekend trading, optional $75 evaluation resets, and the ability to manage multiple accounts under one login.

Elite Trader Funding (Company Information)

Elite Trader Funding is a prop firm based in the United Stated. The company was founded in February 2022 by a team of seasoned professionals with extensive experience in trading, banking, and web development. Key features of ETF prop firm:

- Multiple challenge options ranging from $50K to $300K

- 100% profit split for the first $12,500 and 90% further on

- Futures trading

- Holliday, Weekend, and News trading

- Transparent track record of successful traders and their payouts

- Automatic evaluation account reset

- TradingView support

- NYMEX, CME Group, CBOT, and COMEX available

- Challenges with no daily loss limits

Elite Trader Funding CEO

Elite Trader Funding processes funding requests quickly and securely under the leadership of CEO Kanwal Singh.

Kanwal Singh, CEO & Founder of Elite Trader Funding, brings nearly a decade of experience in network engineering, cybersecurity, and automation.

Based on the Kanwal Singh LinkedIn Profile, since January 2022, he has been managing operations at Elite Trader Funding LLC remotely from Washington, United States.

Under his guidance, the firm has streamlined operations and implemented robust technical frameworks to ensure efficiency, security, and reliability for all clients.

With expertise in Python, network design, and cybersecurity, Kanwal ensures Elite Trader Funding operates with precision and innovation, delivering a seamless and secure funding experience for traders.

Elite Trader Funding Table of Specifics

You can trade multiple accounts with one ETF login. The firm is also a CFA Charterholder. Let’s see what other specifics set Elite Trader Funding apart.

Account currency | USD |

Minimum price | $75 |

Maximum leverage | N/A |

Maximum profit split | Up to 100% |

Instruments | Interest Rate, Equity, Metals, Energy, Currencies, Crypto |

Assets | 76 |

Evaluation steps | 1-Phase |

Withdrawal methods | Rise |

Maximum fund size | $300,000 |

First profit target | 5% |

Max. daily loss | 2.2% |

Challenge time limit | 30 Days (Except the Fast Track Challenge) |

News trading | Allowed |

Maximum total drawdown | 10% |

Trading platforms | Tradovate, NinjaTrader, TradingView |

Commission | Variable based on the assets |

TrustPilot score | 3.8 |

Payout frequency | 10 Days |

Established country | USA |

Elite Trader Funding offers a two-tier profit-sharing model. Traders retain 100% of the profits earned up to the first $12,500. Once this threshold is reached, future profits are split 90/10, with 90% going to the trader and 10% to the firm.

Pros & Cons

Every prop trading platform has its strengths and weaknesses. Let's weigh the advantages and disadvantages of Elite Trader Funding prop firm.

Pros | Cons |

Multiple account sizes and evaluation types | No free Demo account |

High profit split (90% after the first $12,500) | $80/month subscription fee for live-funded accounts |

Optional $75 reset fee for failed evaluations | No overnight positions in most account types |

Elite Trader Funding partners with multiple major liquidity providers, including CME, COMEX, NYMEX, SMFE, and SWOT. This wide base of connections enhances execution quality and supports a broad range of futures markets.

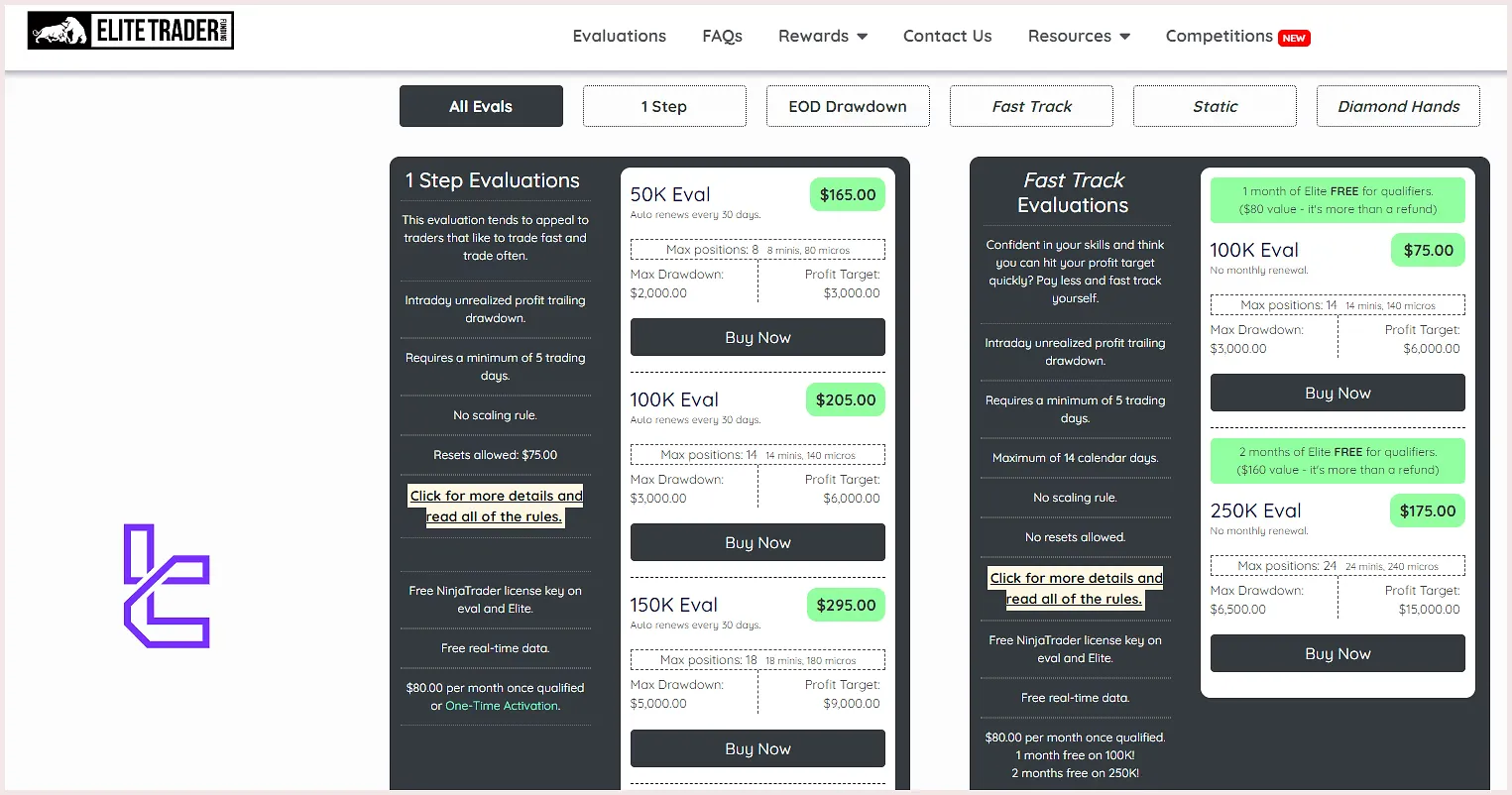

Funding Plans and Their Prices on Elite Trader Funding

The next subject on Elite Trader Funding review is the funding and pricing. The firm offers a range of evaluation programs to cater to different needs and risk appetites.

Capital | Direct To Funded (DTF) | 1 Step | Fast Track | Static |

$10K | - | - | - | $99 |

$25K | $599 | - | - | $229 |

$50K | $699 | $165 | - | $449 |

$100K | - | $205 | $75 | - |

$150K | - | $295 | - | - |

$250K | - | $515 | $175 | - |

$300K | - | $655 | - | - |

Note that upon successfully completing evaluation phase, you need to pay an $80 monthly fee to keep your real account activated. Also if you fail to complete the challenge within 30 days, you must pay the fee again.

When traders breach their account’s maximum drawdown, they have the option to reset the evaluation parameters by paying a flat $75 fee. This reset option is not applicable in accelerated accounts.

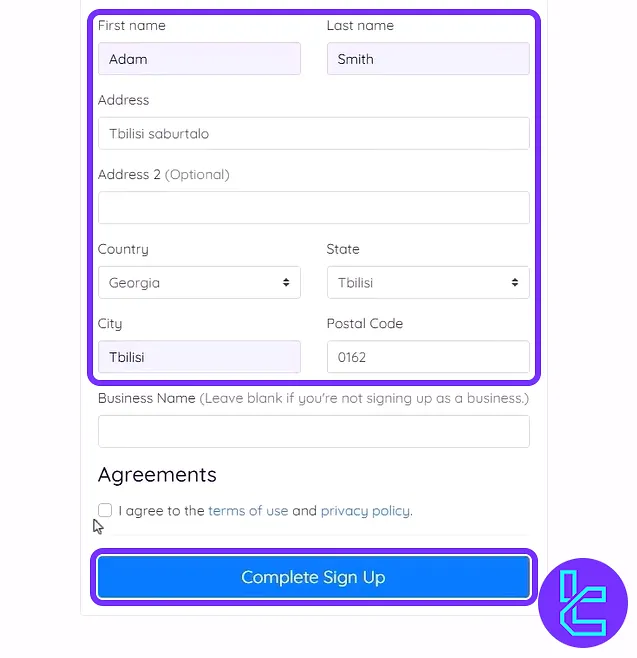

How to Open an Account and Verify It on Elite Trader Funding?

The Elite Trader Funding Registration is fast, flexible, and tailored to your trading style. Whether you're aiming for 1-Step, Fast-Track, EOD, Static, or Diamond Hands challenges, account setup takes only a few minutes.

#1 Pick Your ETF Challenge Type

Select your evaluation model:1-Step, Fast-Track, End-of-Day (EOD), Static, or Diamond Hands.

#2 Define ETF Account Size

Select the trading capital tier you want to work with, ranging from small starter accounts to larger funded options. Your chosen size determines profit targets, drawdown limits, and subscription fees.

#3 Fill Out the ETF Registration Form

Enter your personal information, contact details, and account preferences in the signup form. This step ensures your evaluation is linked correctly to your profile and funding plan.

#4 Choose a Platform on ETF

Pick your preferred trading platform: NinjaTrader, Tradovate, Rithmic, or TradingView. Your choice determines where you’ll execute trades and access charting tools.

#5 Complete Payment on ETF

Submit the evaluation fee using your preferred payment method to activate your account. Once processed, your trading credentials are emailed to you, ready to start trading immediately.

#6 Elite Trader Funding Verification

In order to get funded and start trading on live accounts, you must complete the KYC process and provide the following documents.

- Proof of Identity

- Proof of Address

Go to the profile section and look for the KYC/Verification option.

Elite Trader Funding Evaluation Conditions

Understanding the evaluation rules is crucial for success with Elite Trader Funding. Here are the key points, from daily drawdowns to profit targets.

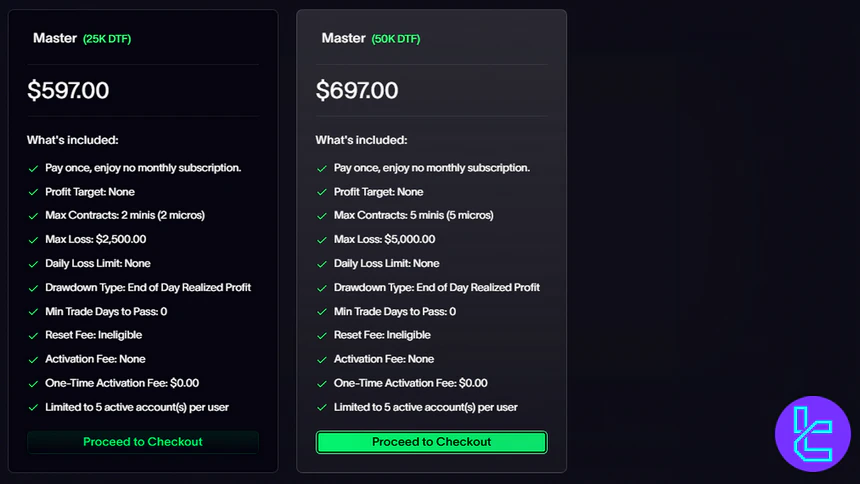

Direct to Funded (DTF)

This program is designed for experienced traders who want to skip the traditional evaluation phase and start trading a fully funded account immediately.

It’s ideal for traders who are confident in their strategies and want instant access to capital without going through multiple steps.

Here are the details of the Direct to Funded challenge:

Properties | $25K | $50K |

Total Drawdown | 10% | 10% |

Profit Target | N/A | N/A |

Max Positions | 2 minis, 2 micros | 2 minis, 2 micros |

Payout Frequency | 10 ATD | 15 ATD |

1 Step

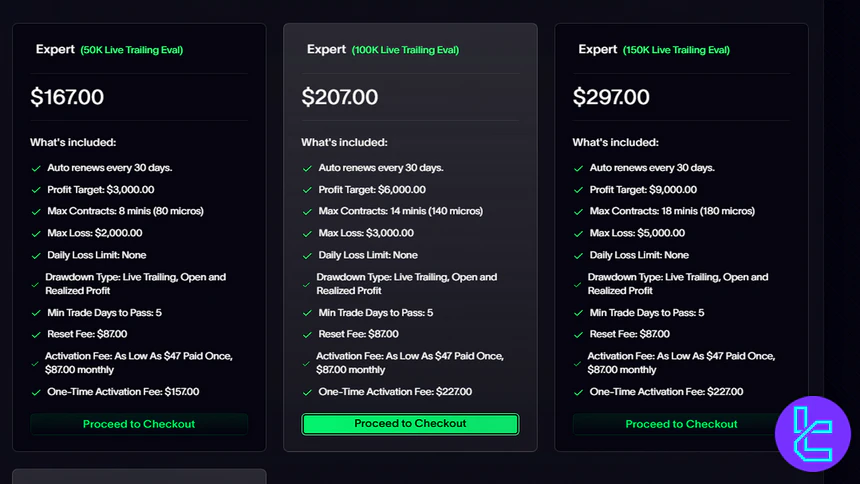

The 1 Step program is ideal for fast-paced traders who thrive on frequent trades. It allows participants to reach their profit targets efficiently while maintaining manageable risk.

The program is suitable for both new and intermediate traders who want to build confidence and scale their accounts.

Here are the details of the 1 step challenge:

Properties | $50K | $100K | $150K | $250K | $300K |

Total Drawdown | 4% | 3% | 3.33% | 2.6% | 2.5% |

Profit Target | 6% | 6% | 6% | 6% | 6.66% |

Max Positions | 8 minis, 80 micros | 14 minis, 140 micros | 18 minis, 180 micros | 24 minis, 240 micros | 30 minis, 300 micros |

Min Trading Days | 5 | 5 | 5 | 5 | 5 |

Payout Frequency | 15 Days for 1st to 2nd payout, then every 10 Days | ||||

Fast Track

The Fast Track program is tailored for confident traders who want to accelerate the funding process.

With a short 2-week challenge, you can qualify for a funded account faster and with a lower cost compared to standard programs.

Here are the details of the Fast Track challenge:

Properties | $100K | $250K |

Total Drawdown | 3% | 2.6% |

Profit Target | 6% | 6% |

Max Positions | 14 minis, 140 micros | 24 minis, 240 micros |

Min Trading Days | 5 | 5 |

Max Trading Days | 14 | 14 |

Payout Frequency | 15 Days for 1st to 2nd payout, then every 10 Days | |

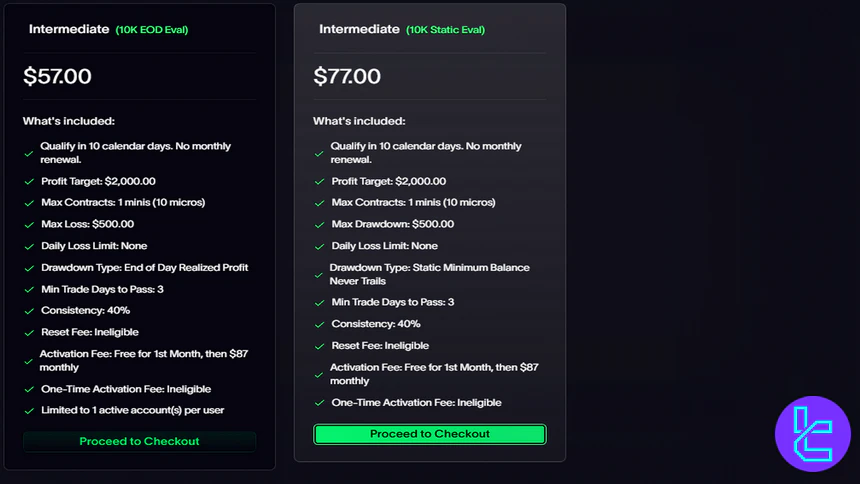

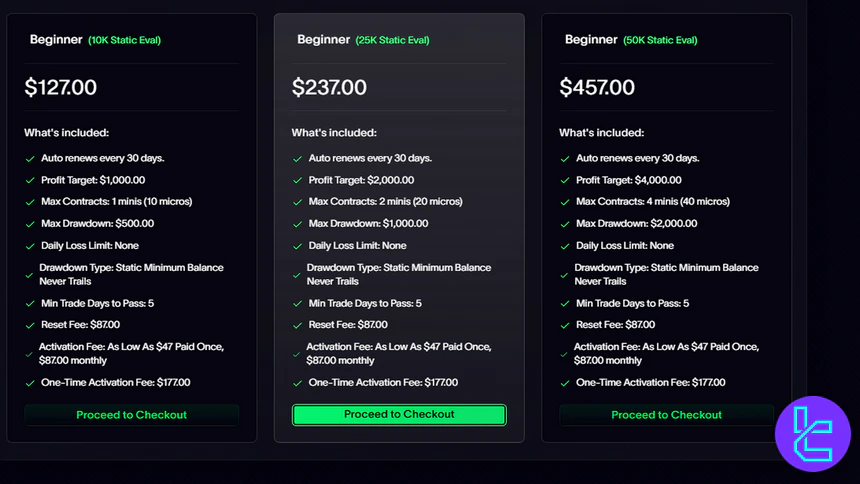

Static

The Static program is perfect for traders who prefer consistency and predictability. Unlike other programs, there is no trailing drawdown, and the starting balance remains fixed throughout the challenge.

This structure allows traders to focus purely on their strategy without adjusting for changing thresholds.

Here are the details of the Static challenge:

Properties | $10K | $25K | $50K |

Total Drawdown | 5% | 4% | 4% |

Profit Target | 10% | 8% | 8% |

Max Positions | 1 minis, 10 micros | 2 minis, 20 micros | 4 minis, 40 micros |

Payout Frequency | 15 Days for 1st to 2nd payout, then every 10 Days | ||

Elite Trader Funding Bonus and Promotion Programs

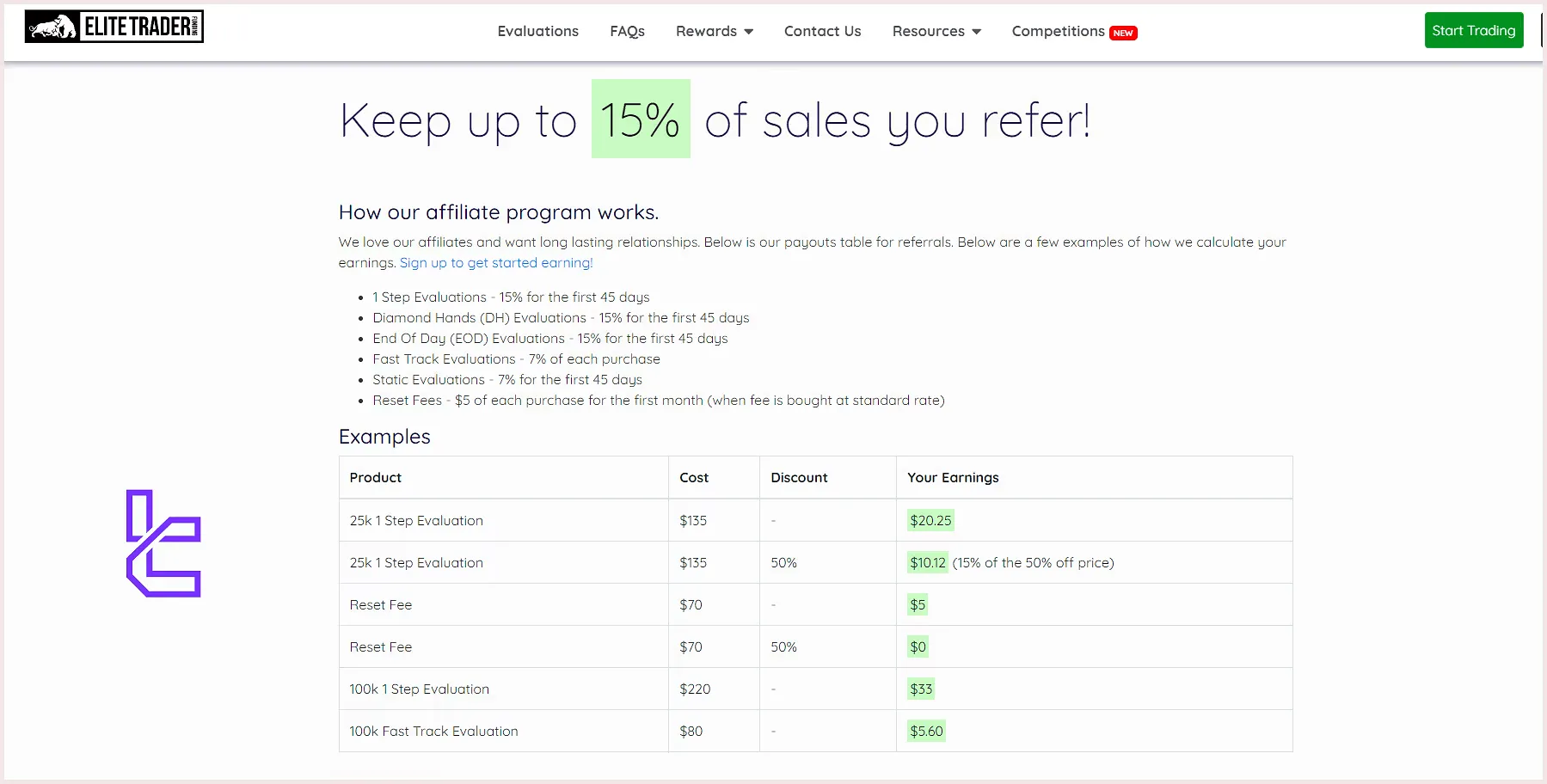

Elite Trader Funding offers several enticing bonus and promotion programs, including free data, account resets, and free NinjaTrader license key. But there are two main reward plans on ETF: Affiliate and Rewards.

- Affiliate: Commissions on evaluation accounts ranging from 7% to 15%, and a $5 commission on each Reset Fee for the first month;

- Rewards: Earn 1 point for every dollar you spent and use these points to buy various products, such as account reset (1250 points), 100K Fast Track (4200 points), and 250K Fast Track (8000 points).

As of our latest evaluations, we have noticed that ETF has decided to expand its services to Nigerian, Belgian, Indonesian, Kenyan, and Romanian users. To mark this expansion, they are offering a 90% discount and a promo code for new users. Additionally, users have the option to access up to 20 Elite-style funded accounts.

ETF Trading Rules

Setting trading rules are usual in Prop Firms; Elite Trader Funding is not an exception; Key Points of ETF Rules:

- VPN & VPS Usage: VPN and VPS usage is now allowed for trading ETF accounts, effective April 22nd;

- Hedging: Hedging against oneself using the same instrument across multiple accounts is strictly prohibited;

- Expert Advisors (EAs): No information provided on EA usage;

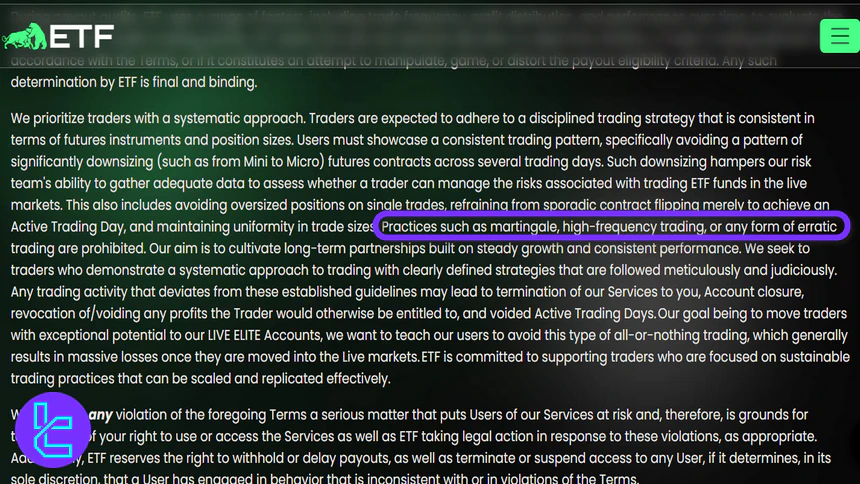

- Martingale & Arbitrage Strategies: Martingale strategy is prohibited due to high-risk nature. No details on Arbitrage;

- News Trading: No restrictions during major economic news events, allowing trading flexibility;

- Payout: Elite Trader Funding processes payouts quickly and securely, with eligibility after 15 trading days for the first two cycles and 10 days thereafter. Payouts start at $100, capped at $150,000 total, and unclaimed funds reset each cycle.

VPN & VPS Usage

EffectiveApril 22nd, ETF accounts will allow the use of VPNs and VPSs for trading purposes, addressing the needs of traders who require enhanced privacy or security.

Traders can utilize VPNs or VPS services, ensuring they comply with the platform's regulations and are not using restricted country IPs.

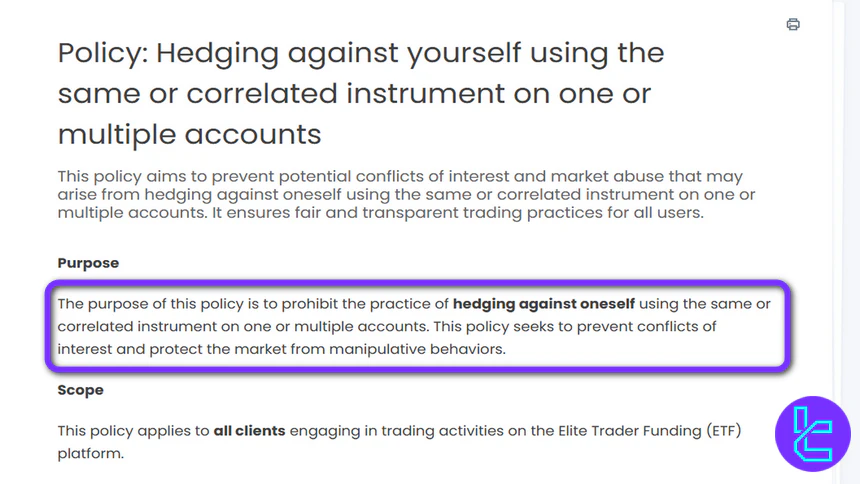

Hedging Policy

Hedging across multiple accounts using the same instrument is strictly prohibited.

Traders cannot open opposite positions on the same instrument across two or more accounts that are owned or associated with them, including accounts within the same household or address.

Expert Advisor (EA) Usage

No specific policy on Expert Advisors (EAs) is provided on the website, so it’s important to assume that any trading strategies involving EAs should be compliant with general trading rules unless further guidelines are announced.

Martingale & Arbitrage Strategies

Using the Martingale strategy, where traders increase the position size after a loss to recover, is prohibited.

This strategy poses a significant risk of substantial losses, especially in volatile markets. Arbitrage strategies are not mentioned on the website, and traders should proceed with caution when considering such methods.

News Trading Policy

ETF does not impose restrictions on trading during major economic news events.

Traders are free to trade during periods of high volatility, such as the release of key economic data, allowing them to take advantage of market movements without interruptions or imposed trading pauses.

Elite Trader Funding Payout

Elite Trader Funding provides fast and reliable payouts for all qualified traders. For the first and second payout cycles, traders become eligible once they complete fifteen individual trading days per cycle, and from the third cycle onward, ten individual trading days are required.

Payouts start from a minimum of $100, with the maximum determined by account size, though total payouts across all accounts for any trader are capped at $150,000.

Eligible traders can request payouts daily, and any unclaimed funds from a cycle are forfeited when the next cycle begins. Elite Trader Funding makes it simple to access your profits quickly and securely, so you can focus on trading with confidence.

Available Trading Platforms on Elite Trader Funding Prop Firm

Next stop on the Elite Trader Funding review is exploring the trading platforms. The firm supports a wide range of popular trading platforms and two main data feed. ETF data feed and their compatible trading platforms:

- Tradovate

- NinjaTrader

- TradingView

- Rithmic

While Elite Trader Funding provides access to these platforms, it's important to note that they don't directly operate or maintain them. Traders are responsible for ensuring compatibility and compliance with platform guidelines.

The firm does not offer MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for trading.

Elite Trader Funding Financial Instruments

Elite Trader Funding specializes in US Futures instruments, offering a diverse range of trading opportunities.

- Interest Rate (e.g., Treasury Bonds, Notes)

- Equity (e.g., E-mini S&P 500, E-mini Nasdaq 100)

- Agricultural (e.g., Corn, Soybeans, Wheat)

- Metal (e.g., Gold, Silver, Copper, Platinum)

- Energy (e.g., Natural Gas, Crude Oil, Gasoline Physical)

- Currency (e.g., Euro, Japanese Yen)

- Cryptocurrency (e.g., Bitcoin, Ethereum)

What Payment Methods Are Available on Elite Trader Funding Prop Firm?

We have to explore the payment/payout methods in this stage of Elite Trader Funding review. The firm offers only Fiat and Crypto withdrawals via Rise. Payments are made via Credit/Debit cards, such as Visa, MasterCard, American Express, Discover, and Union Pay.

Elite Trader Funding Fee Structure (Commission and Spread)

Understanding the trading and non-trading fees is crucial for managing your trading costs. Elite Trader Funding prop firm fee structure:

- One-time activation fee: $150-$300 (depending on account size and type);

- Monthly subscription: $80 for active Elite Sim-Funded accounts;

- Market Data: $128 for CME, COMEX, NYMEX, CBOT, and $80 for Eurex;

- Commissions: $2.00 for Minis, $0.62 for Micros, and $0.69 for Eurex.

ETF Educational Resources

While Elite Trader Funding's primary focus is on providing funded accounts, they do offer some educational resources through their rather new blog in regards of subjects like futures trading, financial news, and the firm’s announcements.

Topics such as fundamental and technical analysis, trading psychology, and money management are notably absent. Traders looking for structured learning materials will need to rely on third-party resources.

Elite Trader Funding Trust Scores

Elite Trader Funding currently holds a TrustPilot rating of 3.8 out of 5 stars. Reviews highlight rewarding points program, excellent customer support, and clear guidelines and transparency. Evaluation prices, consistency rules, and payout policies are the areas of concern.

How to Reach ETF Customer Support

It’s time to explore support channels in this Elite Trader Funding review. The firm offers several ways to get in touch:

Support Method | Availability |

Live Chat | Yes |

No | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

Note that standard customer service hours are 8 am-4 pm CST, Monday through Friday. Absence of an official email address and phone number is a total letdown for potential customers.

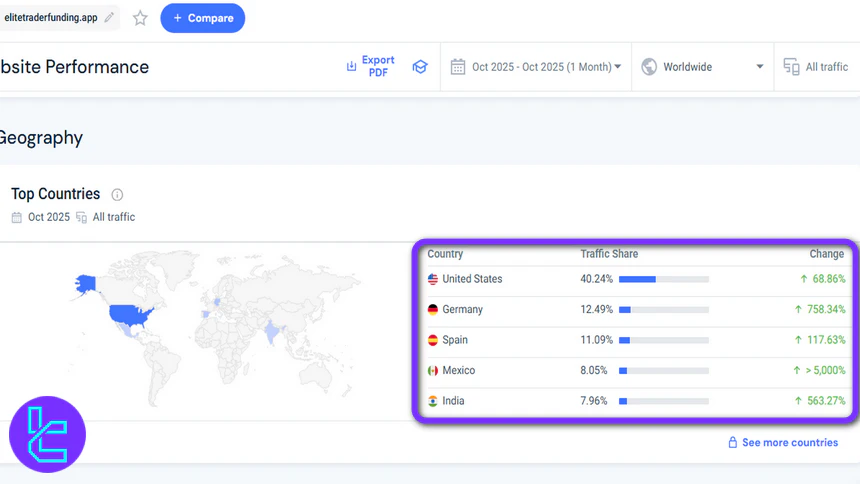

Elite Trader Funding User Base

Elite Trader Funding has a diverse and growing user base across the globe. The largest share of traders comes from the United States (40.24%), followed by Germany (12.49%), Spain (11.09%), Mexico (8.05%), and India (7.96%).

The platform continues to expand rapidly, reflecting strong engagement and adoption worldwide, with user activity and growth metrics showing impressive increases across all major regions.

Elite Trader Funding Social Media Handles

Elite Trader Funding maintains an active presence on social media, offering another way for traders to stay connected.

Social Media | Members/Subscribers |

Over 24K | |

Over 17.6K | |

Over 16.4K | |

Over 700 | |

Over 2K | |

Over 10.8K |

Elite Trader Funding Comparison Table

Let's see the differences between Elite Trader Funding features and those of other firms; ETF Comparison:

Parameters | Elite Trader Funding Prop Firm | |||

Minimum Challenge Price | $75 | $39 | $15 | $33 |

Maximum Fund Size | $300,000 | $250,000 | $100,000 | $400,000 |

Evaluation steps | 1-Phase | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding |

Profit Share | Up to 100% | 100% | 85% | 100% |

Max Daily Drawdown | 2.2% | 5% | 4% | 7% |

Max Drawdown | 10% | 10% | 8% | 14% |

First Profit Target | 5% | 5% | 8% | 6% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | N/A | 1:100 | 1:75 | 1:100 |

Payout Frequency | 10 Days | Bi-weekly | 10 Days | Weekly |

Number of Trading Assets | 76 | 3000+ | 400+ | 40+ |

Trading Platforms | Tradovate , NinjaTrader, TradingView, Rithmic | Metatrader 5 | Match-Trader, cTrader | MetaTrader 5, Match Trader |

Expert suggestions

Elite Trader Funding provides Futures trading across NYMEX, CME Group, CBOT, COMEX exchanges through its funded accounts with a balance, ranging from $50,000 to $300,000.

The prop firm supports TradingView, Tradovate, and NinjaTrader platforms, and processes Crypto and Fiat withdrawals through Rise.