FundedNext rules enforce a strict 2% price limit for futures contracts to maintain fair trading. The copy trading ban prohibits sharing strategies between different accounts to prevent unfair advantages.

Challenge plans include Stellar 2-Step and 1-Step with profit targets ranging from 8% to 10%, and daily loss limits between 3% and 5%.

FundedNext Rule Topics

This guide explains essential FundedNext prop firm’s rule topics that traders must know to avoid account termination in this prop firm:

- Challenge Rules

- Holding Over the Weekend

- Trading Strategies

- CFD Restricted Strategies

- Futures Prohibited Strategies

- VPN/VPS Policy

- Inactivity Policy

- 1% Risk Rule

- News Trading Rules

FundedNext Challenge Rules

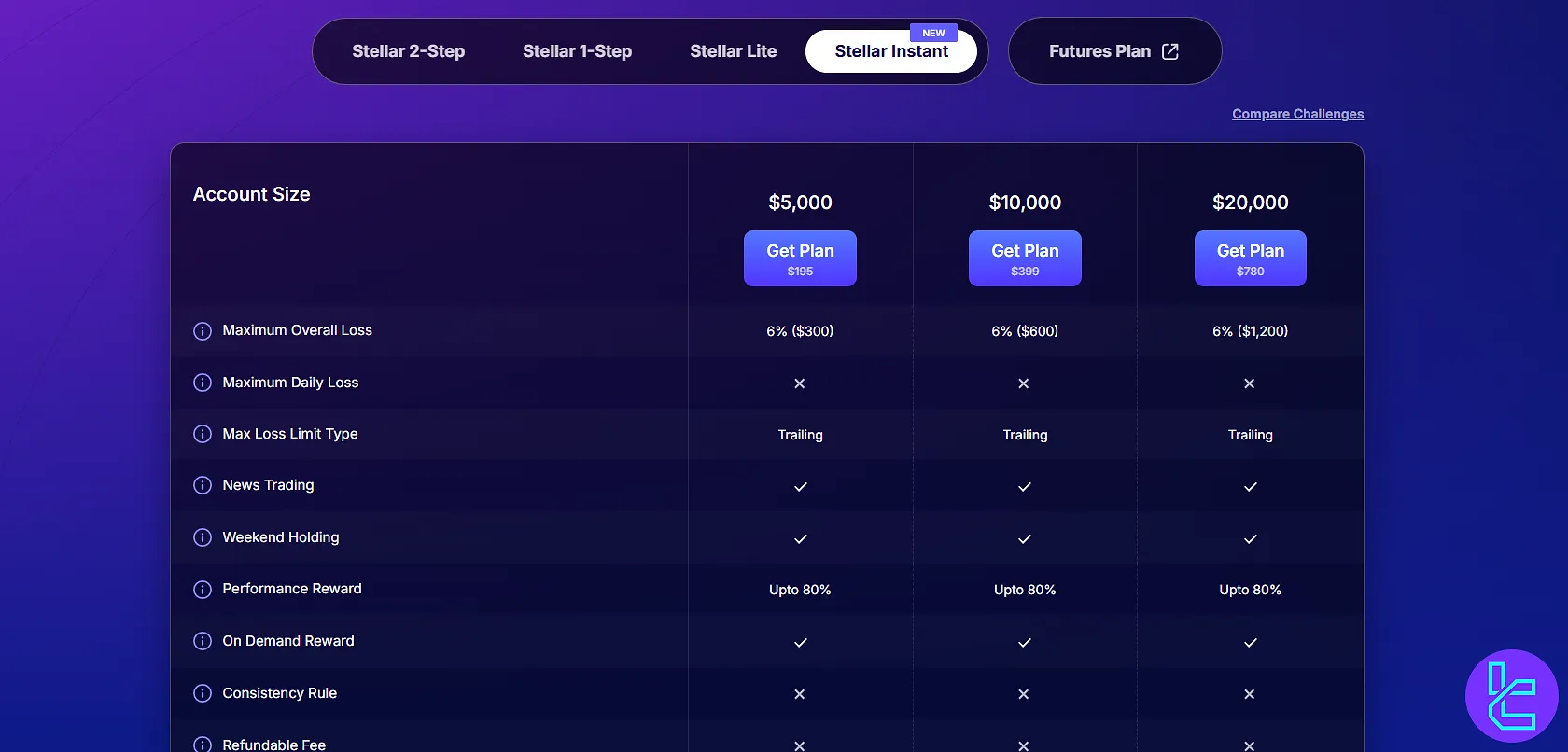

The firm offers several challenge plans with specific profit targets and loss limits. Below is an overview of major plans and their limits:

Plan | Phase 1 Profit Target | Phase 2 Profit Target | Max Overall Loss | Max Daily Loss |

Stellar 2-Step | 8% | 5% | 10% | 5% |

Stellar 1-Step | 10% | - | 6% | 3% |

Stellar Lite | 8% | 4% | 8% | 4% |

Stellar Instant | - | - | 6% | 6% |

Stellar Instant loss limits are trailing type, offering more flexible conditions.

FundedNext CFDs Holding Over the Weekend

Weekend and overnight holdings are generally allowed on most FundedNext accounts except for some exceptions:

- Evaluation Accounts: Allowed

- Stellar 1-Step & 2-Step: Allowed

- Stellar Lite: Allowed

- Express Non-Consistency: Allowed

- Express Consistency: Not Allowed (Weekend holding), Allowed (Overnight holding)

Overnight and weekend holdings are not permitted on FundedNext Futures.

FundedNext CFD Trading Strategies

FundedNext permits full freedom in trading strategies, including discretionary trading and martingale strategy Expert Advisors (EAs).

However, traders must maintain the same strategy consistently throughout the Challenges and FundedNext Accounts to show real skill and consistency.

Automated systems like EAs and trading bots are allowed but unsupported by FundedNext.

FundedNext CFD Restricted Strategies

FundedNext restricts certain CFD strategies to maintain fairness and reduce risks:

- Excessive margin use (70%+ risk) is prohibited;

- Quick Strike Method is restricted for market volatility;

- High-Frequency Trading (HFT) is banned;

- Copy trading between accounts not owned by the same person is prohibited;

- Hedging only allowed within one account. cross-account hedging banned;

- Arbitrage trading is strictly banned;

- Tick scalping limited;

- Grid trading is banned;

- Latency trading prohibited;

- Account rolling disallowed;

- One-sided betting restricted;

- Hyperactivity limits set at 200 trades or 2,000 messages/day;

- Platform/data freezing abuses forbidden;

- Guaranteed profit trades during low liquidity banned;

- Account and device sharing strictly banned.

FundedNext Futures Prohibited Strategies

The firm bans some practices to protect market integrity in Futures accounts; FundedNext Futures Forbidden Strategies:

- Exploiting platform errors

- Account sharing

- Account rolling

- Multi-order spam and coordinated exploits

- Abusing slow data feed

- Account flipping and inconsistent contract execution

- Copy and group trading

- Micro-scalping

- Spoofing strategies

- Order book shaping/layering

- Bracket strategies

- Grid trading

- Wash trading

- Latency arbitrage

- Reverse hedge

- Hedging with correlated instruments

- Gapped or illiquid market trading

- 2% price limit (maximum allowed price range for futures contracts)

FundedNext VPN/VPS

Traders may use VPNs and VPS with the specific guidelines; FundedNext IP Rules:

- Paid VPNs with consistent, country-specific IPs are recommended;

- VPNs from restricted countries are prohibited;

- VPS use allowed only with private, dedicated IPs;

- Sharing VPS connections is forbidden.

FundedNext Inactivity

FundedNext accounts are deactivated based on inactivity:

- Challenge Accounts: Deactivated after 7 consecutive days without trades

- FundedNext Accounts: Deactivated after 30 consecutive days without trades

Traders must log in and execute at least one trade within these periods to avoid deactivation.

FundedNext 1% Risk

Most traders lose money due to risky behaviors like over-risking and overleveraging. FundedNext encourages disciplined trading by limiting risk to no more than 1% per trade and margin use between 20%-30%.

FundedNext News Trading

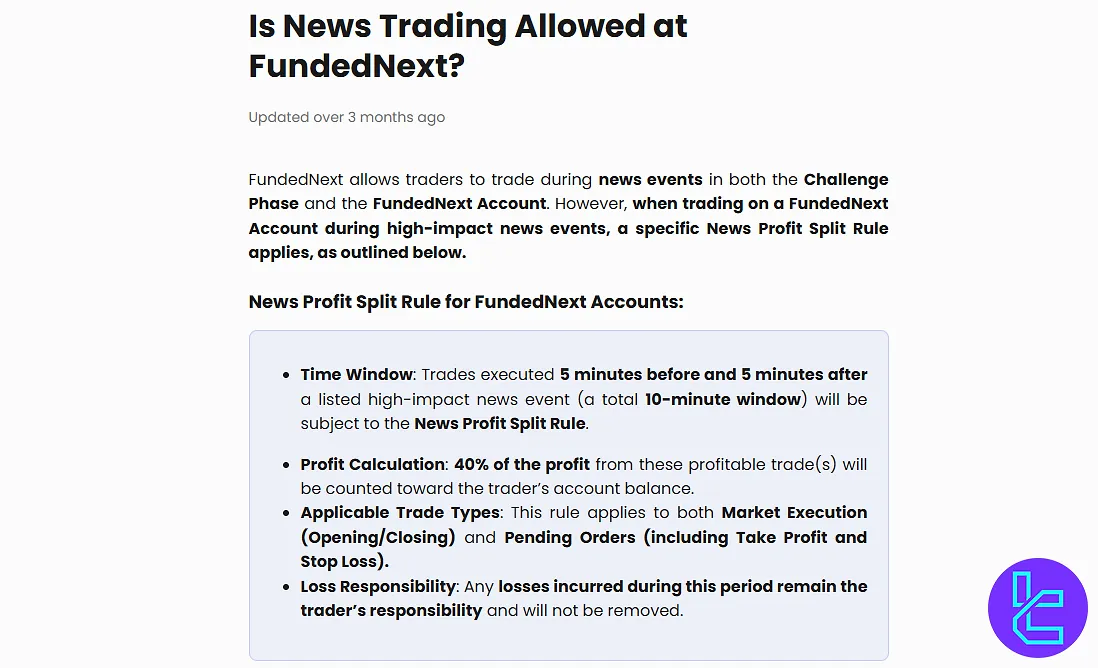

FundedNext allows trading during news events in Challenges and funded accounts.

However, trades executed within 5 minutes before and after high-impact news (10-minute window) on funded accounts in this prop firm are subject to the News Profit Split Rule, adjusting profit sharing during this period.

FundedNext Futures imposes no news trading restrictions.

Writer’s Opinion and Conclusion

FundedNext rules require traders to use consistent strategies, including martingale EAs, while avoiding restricted tactics like HFT, arbitrage, grid trading, and account rolling.

Use of paid VPNs with country-specific IPs and private VPS is mandatory, with sharing strictly forbidden. Accounts deactivate after 7-days inactivity in challenges or 30 days in funded accounts. For more articles about the firm, visit FundedNext tutorials.