FundingPips is a prop trading company offering up to 1:100 leverage and a maximum funding of $2,000,000. The initial fee paid for accounts is refunded after 4 successful payouts.

The company charges $2 per lot for trading Forex, metals, and energy sources; other markets have no fees.

FundingPips - Company Information

FundingPips prop firm burst onto the prop trading scene in 2022, quickly gaining attention for its trader-friendly policies and structured scaling plan. This UAE-based firm had partnered with BlackBull Markets to provide traders access to the popular MT5 platform.

However, this partnership has ended. Here are some key facts about FundingPips:

- Founded: 2022

- Headquarters Location: United Arab Emirates

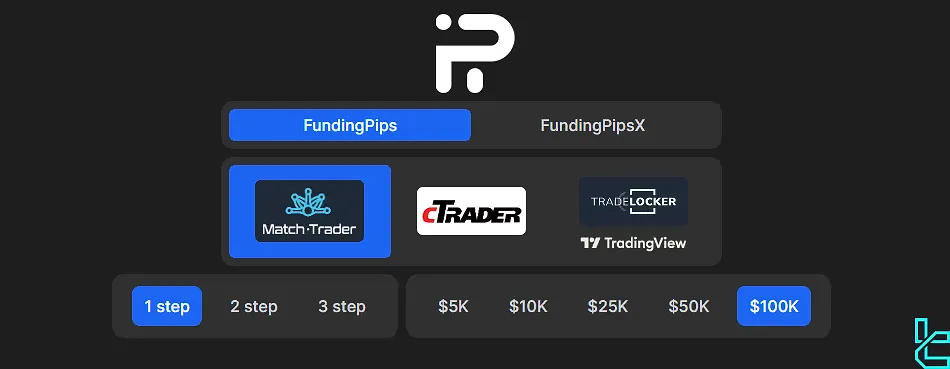

- Trading Platform: Match-Trader, cTrader, TradeLocker

- Account Sizes: $5,000 to $100,000 (with the potential to scale up to $2 million)

- Evaluation Process: one-phase, Two-phase, and instant funding

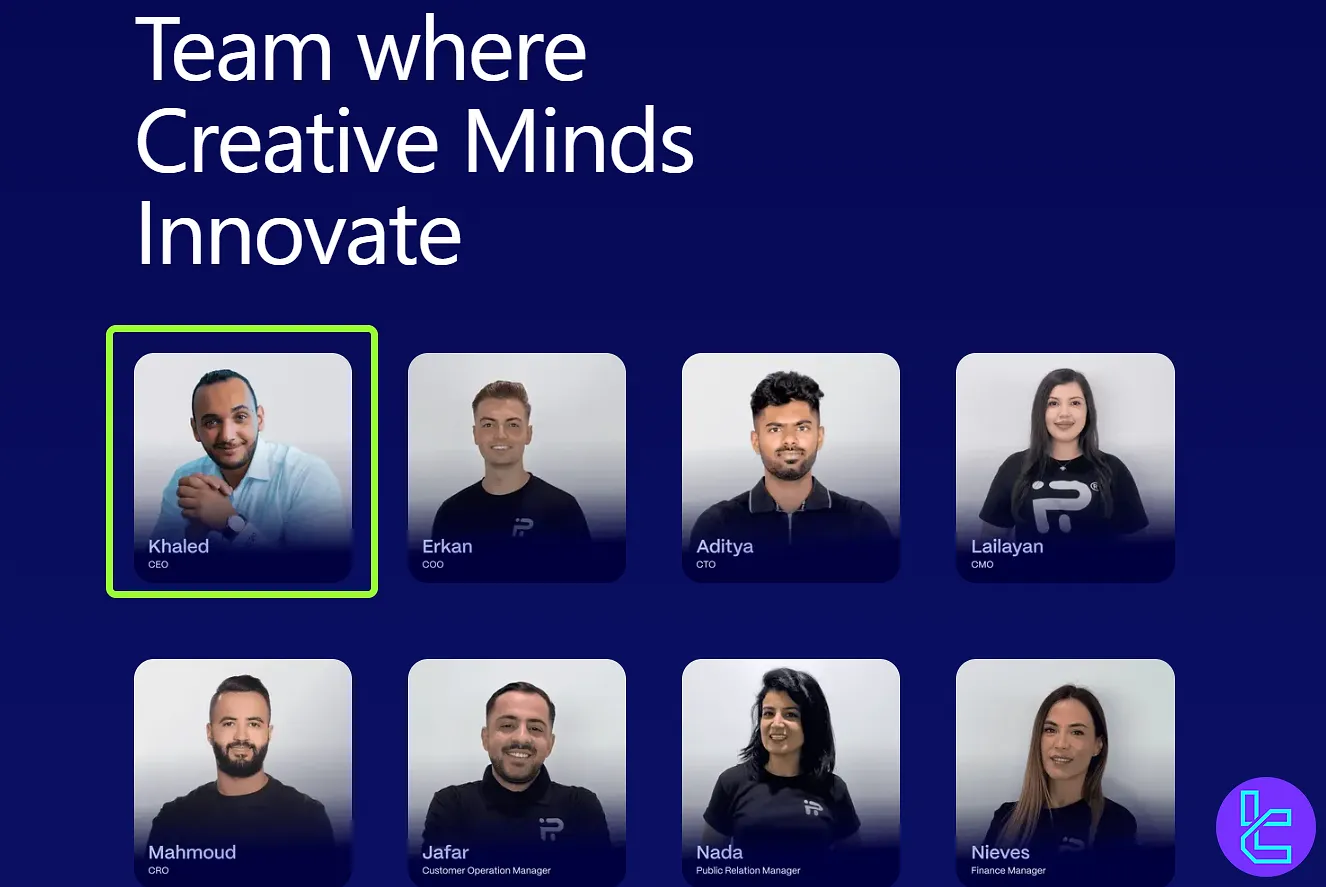

Funding Pips CEO

The CEO of the prop trading firm Funding Pips is Khaled Ayesh, a recognized professional gold trader, according to Yahoo Finance. He is widely acknowledged for revolutionizing the simulated trading environment industry, thanks to the innovative solutions offered by Funding Pips.

Khaled Ayesh's Instagram provides information for traders seeking funding capital in the FundingPips Prop Firm.

FundingPips Prop Firm Key Features

Here's a summary of the firm's features and specifications at a glance:

Account Currency | USD, EUR |

Minimum Price | $29 |

Maximum Leverage | Up to 1:100 |

Maximum Profit Split | 100% |

Instruments | Forex, Metals, Indices, Energy Sources, Cryptocurrencies |

Assets | Unknown |

Evaluation Steps | One-Step, Two-Step, Instant Funding |

Withdrawal Methods | E-Wallets, Bank Transfer, Cryptocurrencies |

Maximum Fund Size | $2,000,000 |

First Profit Target | 8% |

Max. Daily Loss | 5% |

Challenge Time Limit | None |

News Trading | Allowed, But On A Certain Condition |

Maximum Total Drawdown | 10% |

Trading Platforms | Match-Trader, ctrader, TradeLocker |

Commission Per Round Lot | $2 On Forex, Metals, Energy Sources Free On Other Instruments |

Trustpilot Score | 4.5 Out Of 5 |

Payout Frequency | Weekly |

Established Country | UAE |

Established Year | 2022 |

Advantages and Disadvantages

As with any prop firm, FundingPips has its strengths and potential drawbacks. Let's break them down:

Advantages | Disadvantages |

Structured scaling plan allows for consistent account growth | A relatively new firm with a limited track record |

High profit splits (up to 100%) at top levels | $2 per round lot commission on Forex, Metals, and Energies |

No time limits on challenges | Rules and pricing are subject to frequent changes |

Weekly payouts for funded traders | Some restrictions on specific account types for news trading |

Wide range of tradable instruments | - |

Low initial challenge fees | - |

Funding and Price Overview

FundingPips offers a range of account sizes to suit different trader preferences and experience levels. Here's a breakdown of their funding options:

Account Size | Zero | 1-Step | 2-Step FundingPips | 2-Step FundingPips Pro |

$5,000 | $69 | $59 | $36 | $29 |

$10,000 | $99 | $99 | $66 | $55 |

$25,000 | $199 | $199 | $156 | $109 |

$50,000 | $299 | $319 | $289 | $219 |

$100,000 | $499 | $555 | $529 | $399 |

Registration and Verification Guide

Getting started with FundingPips is a straightforward process. FundingPips registration:

#1 Visit the Official Signup Page

Go to the FundingPips website and click on “Sign Up” or “Open an Account” from the homepage to start the process.

#2 Fill in Your Details

Provide your full name, email address, and a secure password. You must confirm you’re over 18 and agree to the firm’s terms and conditions.

#3 Email Verification

Check your inbox for a message from FundingPips and click the verification link to activate your account and access the trader dashboard.

After successfully passing your challenge, you must verify your FundingPips account to unlock withdrawals. Required documents include proof of identity (such as an ID card, passport, or driver's license) and proof of address (e.g., a bank statement or utility bill).

FundingPips Prop Firm Evaluations

Three different types of FundingPips evaluations enable traders to select the one that best aligns with their trading objectives and risk tolerance. FundingPips evaluations:

Trading Conditions | Zero | 1-Step | 2-Step FundingPips | 2-Step FundingPips Pro |

Profit Target Step 1 | - | 10% | 8% | 6% |

Profit Target Step 2 | - | - | 5% | 6% |

Maximum Daily Loss | 3% | 3% | 5% | 3% |

Maximum Overall Drawdown | 5% | 6% | 10% | 6% |

Minimum Trading Days | 7 | 3 | 3 | 1 |

Note that the maximum leverage in Zero and 1-step accounts is 1:50, while in 2-step accounts, it increases to 1:100.

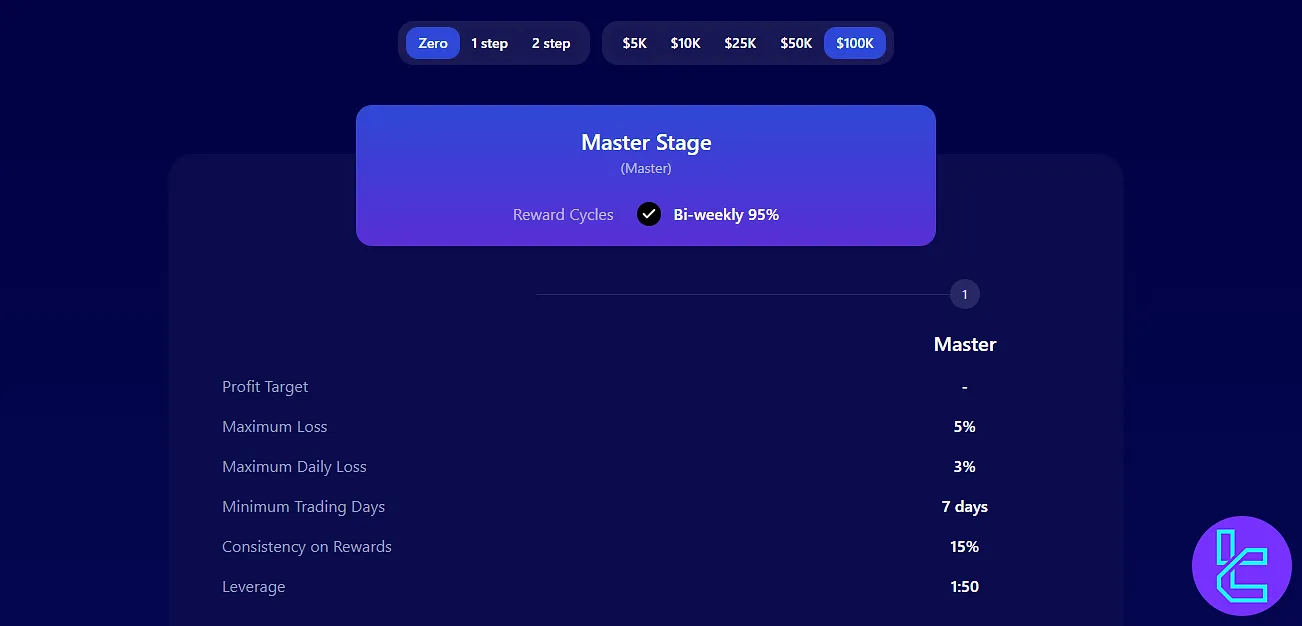

Funding Pips Zero Challenge

For the $100K account in the Zero challenge, the participation fee is $499. Traders are subject to a maximum loss limit of 5%, with a daily loss cap of 3%. A minimum of 7 trading days is required before qualifying for payouts.

Trading Conditions | Zero Challenge |

Profit Target | - |

Maximum Daily Loss | 3% |

Maximum Overall Drawdown | 5% |

Minimum Trading Days | 7 |

Leverage | 1:50 |

The payout structure is bi-weekly with a 95% profit split. Additionally, traders must meet a 15% consistency requirement to remain eligible for rewards. The account offers 1:50 leverage.

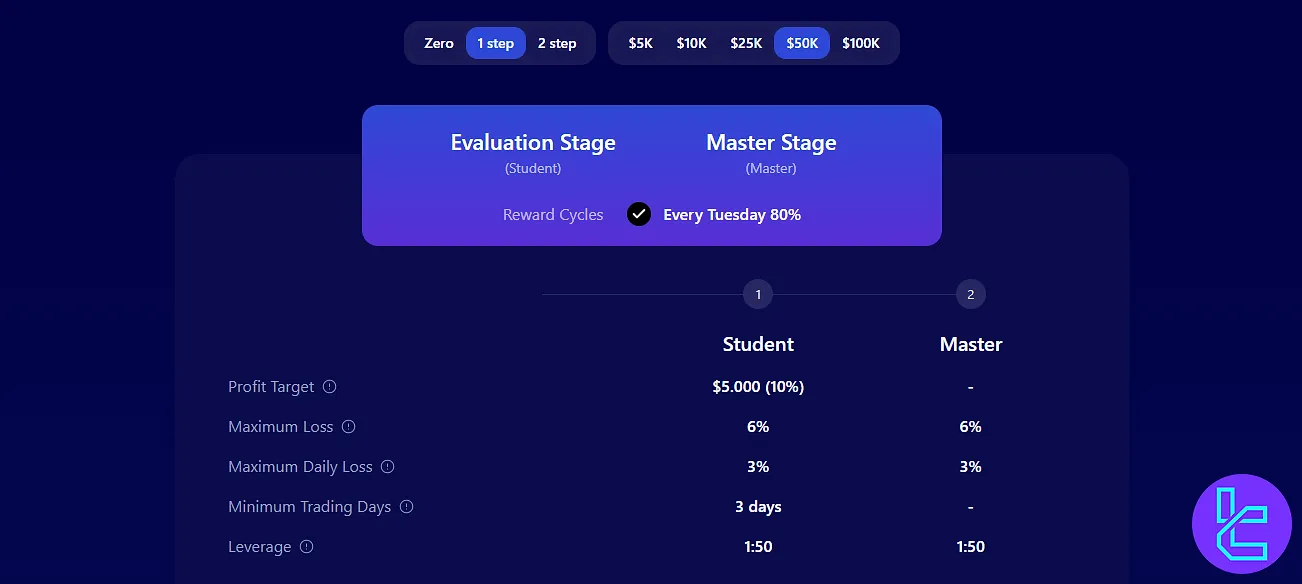

1-Step Evaluation

a fast-track program tailored for skilled traders seeking funding without multi-phase evaluations.

Trading Conditions | 1-Step Challenge |

Profit Target | 10% |

Maximum Daily Loss | 3% |

Maximum Overall Drawdown | 6% |

Minimum Trading Days | 3 |

Leverage | 1:50 |

This program tests your consistency over a single stage and promotes you to the Master account with an 80% payout every Tuesday.

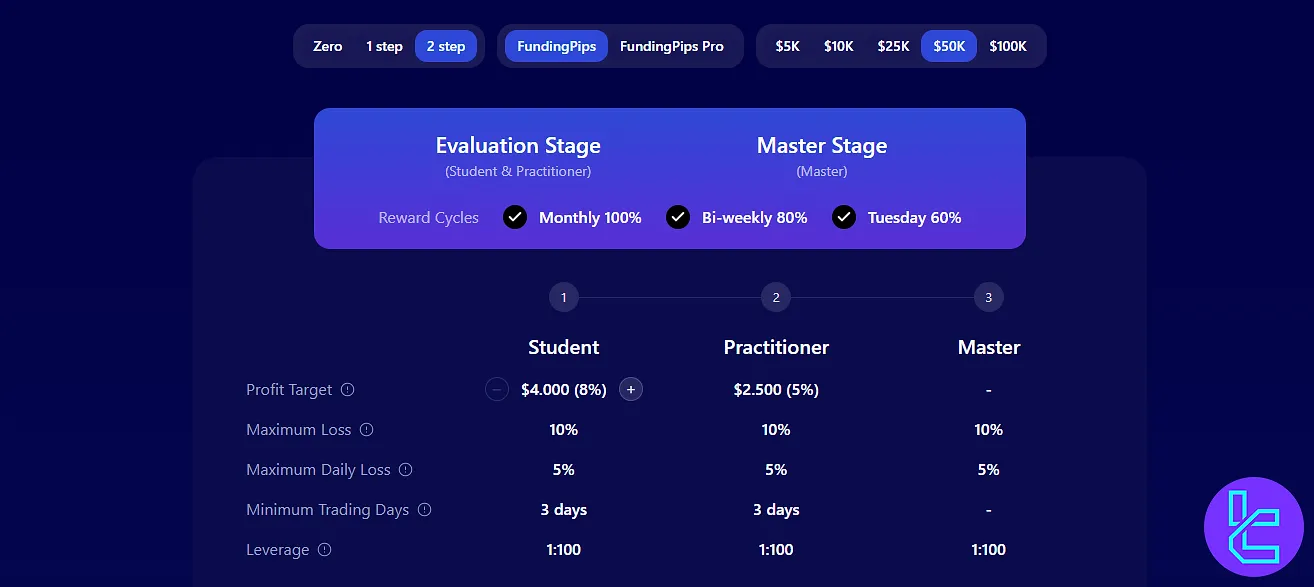

2-Step Evaluations

The 2-Step Evaluation model at FundingPips is structured to gradually assess trading consistency before moving traders to a funded account. This model includes two evaluation stages, Student and Practitioner, followed by the Master account.

Trading Conditions | 2-Step FundingPips | 2-Step FundingPips Pro |

Profit Target Stage 1 | 8% | 6% |

Profit Target Stage 2 | 5% | 6% |

Maximum Daily Loss | 5% | 3% |

Maximum Overall Drawdown | 10% | 6% |

Minimum Trading Days | 3 | 1 |

Leverage | 1:100 | 1:100 |

This structure is designed to encourage risk management discipline through moderate targets and standard drawdown constraints before reaching the funded stage.

Bonuses in FundingPips

This platform offers several attractive bonuses to incentivize and reward successful traders:

- Account Doubling: Traders who reach the Hotseat level see their account balance doubled.

- Increased Profit Split: Hotseat traders enjoy a 100% profit split.

- Capital Access: Up to $2 million in trading capital is available at the Hotseat level.

- Monthly Bonuses: Hotseat users receive monthly bonuses based on their initial account size.

FundingPips Rules

FundingPips encourages the use of safe trading strategies by implementing various rules and conditions. FundingPips rules:

- VPN and VPS Usage: You can use a VPS or VPN during both the Evaluation Phase and the Master Account, but the IP region must remain consistent.

- Hedging: Hedging is strictly forbidden.

- Expert Advisors (EAs): Only trade or risk management EAs are allowed; other third-party EAs will result in account termination.

- Gambling & Risk Strategies: Custom trading strategies are allowed, but prohibited strategies like high-frequency trading, arbitrage, and copy trading will result in account termination.

- News Trading (Evaluation Stage): No restrictions on holding trades during news events or weekends in the Evaluation Stage. Strict conditions in the funded accounts.

- Payout rules: FundingPips allows Tuesday withdrawals starting after 5 trading days, with profit splits of 60% (weekly), 80% (bi-weekly), and 100% (monthly).

VPN and VPS Usage

You are permitted to use a VPN or VPS during both the Evaluation Phase and on your Master Account.

However, the region of your IP address must remain consistent throughout. If any discrepancies are detected, the Responsible Trading Team may request proof, such as invoices to verify the ownership of your VPS/VPN or evidence demonstrating the consistency of your location.

Hedging

Hedging is strictly prohibited throughout both the Evaluation Phase and the Master Account. Hedging refers to opening positions that offset potential losses, and this strategy is not allowed.

Expert Advisors (EAs)

The use of third-party Expert Advisors is only allowed if the EA is a trade manager or risk manager. Any other type of third-party EA, particularly those unrelated to risk management or trade management, is prohibited.

Using such EAs will lead to the denial of the evaluation or closure of the account.

Gambling & Risk Strategies

FundingPips allows customization of your trading strategy within the provided limits (e.g., lot sizes, leverage). However, strategies such as high-frequency trading, arbitrage, server spamming, latency arbitrage, toxic trading flow, and copy trading are strictly prohibited.

Engaging in any of these strategies will result in the termination of the account.

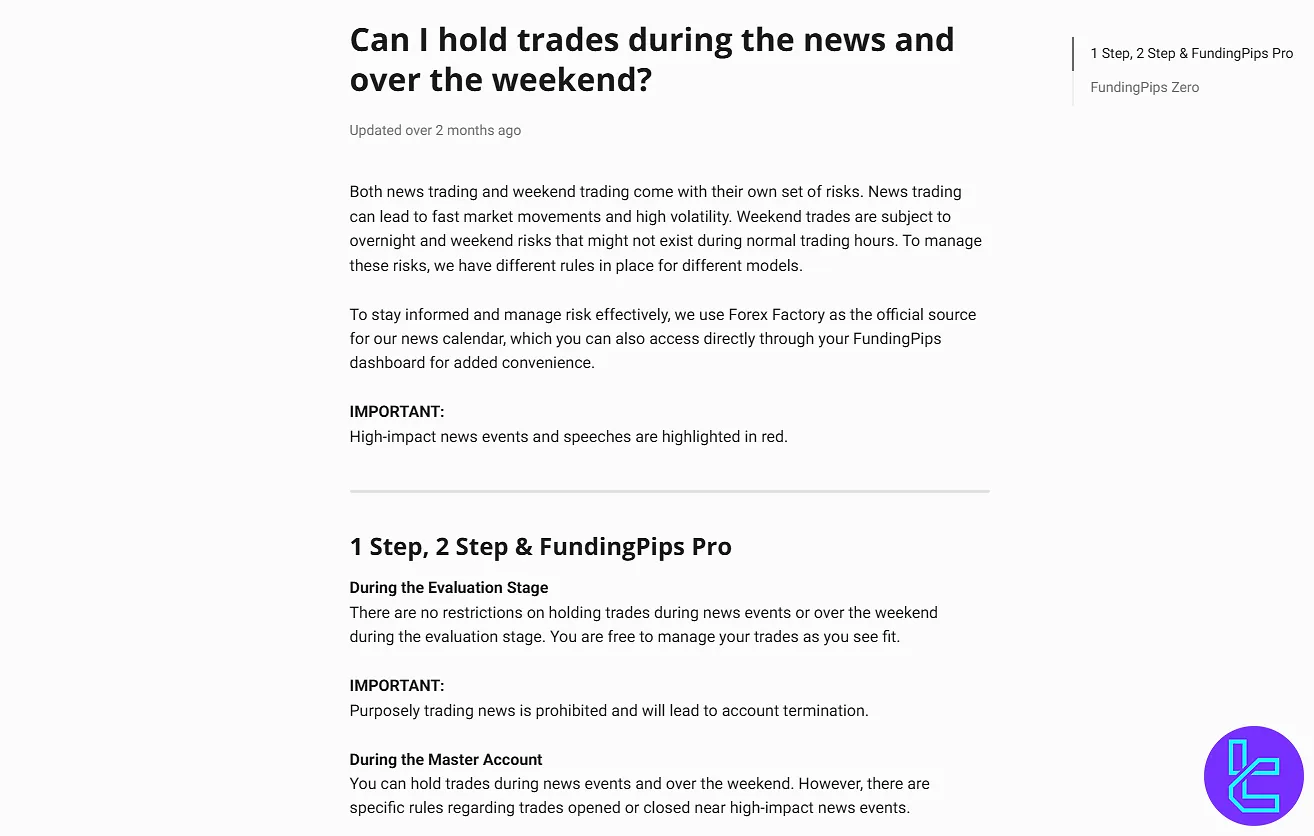

News Trading

FundingPips has different rules for each account type and during various stages.

News Trading (Evaluation Stage)

During the Evaluation Stage, there are no restrictions on holding trades during news events or over weekends. You are free to manage your trades as you see fit, and news releases do not limit you during this phase.

News Trading (Master Account)

In the Master Account, you are allowed to hold trades during news events and over the weekend, but there are important restrictions on high-impact news events:

- Profits from trades that are opened or closed within 5 minutes before or after a high-impact news event (red folder) will not count;

- To ensure compliance, trades must be executed at least 5 hours before the high-impact news event to be valid for counting.

News Trading in Zero Master Account

On the FundingPips Zero Master Account, holding trades during high-impact news or over the weekend is not allowed. Any violation of this restriction will lead to a breach of the account’s terms and will be subject to penalties.

Payout Rules

FundingPips implements a flexible payout system anchored around weekly Tuesday requests. Traders can submit their first withdrawal after completing five trading days, with subsequent payouts eligible every five trading days.

Payout processing depends on the amount: transfers under $500 are paid via USDT, while larger amounts are handled through Riseworks. The profit split is tiered based on payout frequency: 60% for weekly, 80% for bi-weekly, and 100% for monthly cycles.

To qualify, traders must request a minimum of 1% of their initial account balance.

FundingPips Scaling Plan

FundingPips employs a structured growth model designed to incrementally increase a trader’s capital based on consistent performance.

This tiered system encourages long-term development by linking capital allocation and drawdown flexibility to clearly defined milestones in profitability and reward history.

Launchpad (Novice Phase)

At the entry point, traders validate their basic trading capabilities, including risk control and steady returns.

Eligibility Criteria:

- Completion of 4 successful reward cycles

- Generation of 10% cumulative profit

Advantages:

- Capital raised by 20%

- Drawdown threshold increased by 1%

This phase is designed to serve as a foundation for scaling while reinforcing consistency.

Ascender (Intermediate Phase)

Progressing traders who demonstrate refined market interpretation and enhanced discipline qualify for this level.

Eligibility Criteria:

- Completion of 8 successful reward cycles

- Attainment of 20% overall profit

Advantages:

- Capital expanded by 30%

- Max drawdown extended by 1% (total 2%)

- Daily drawdown tolerance also raised by 1%

This stage empowers traders to operate with increased flexibility and confidence.

Trailblazer (Advanced Phase)

With a proven record of consistent execution, traders here are trusted with more substantial capital allocations.

Eligibility Criteria:

- Completion of 12 successful rewards

- Realization of 30% total profit

Advantages:

- Capital raised by 40%

- Max drawdown cap expanded to 13%

This tier supports advanced strategies and capital-efficient trading.

Hot Seat (Elite Status)

Reserved for top performers, this final level recognizes elite traders with exceptional control and profitability.

Eligibility Criteria:

- Completion of 16 successful rewards

- Achievement of 40% total profit

Premium Benefits:

- Initial balance doubled

- On-demand access to rewards

- 100% reward payout

- Capital access up to $2,000,000

- Monthly performance bonuses

Note: All scaling increments are calculated using the original account balance. In cases where accounts are merged, scaling remains anchored to the base account, not the merged total.

Available Trading Platforms

Currently, FundingPips offers three trading platforms for traders. We will introduce each one in the list below:

- Match-Trader: A web-based platform that offers a demo account;

- TradeLocker: Based on TradingView, it offers mostly the same options and tools;

- cTrader: Advanced platform with more tools, suitable for more experienced traders, with these features.

Trading Instruments and Symbols

FundingPips provides traders with a diverse range of tradable instruments, catering to various trading styles and preferences. Here's an overview of the available asset classes:

- Forex

- Metals

- Cryptocurrencies

- Indices

- Energies

FundingPips Leverage

AquaFunded offers a structured leverage model that adjusts across different programs and evaluation stages. While the leverage on most asset classes remains consistent in the initial phases, a noticeable increase is provided once traders reach Step 2 of the evaluation.

Zero & 1-Step Challenge Leverage

Both Zero Challenge and Step 1 phases share the same leverage limits:

- Forex: 1:50

- Metals: 1:20

- Indices: 1:20

- Energies: 1:10

- Crypto: 1:2

Note: To ensure platform stability during volatile conditions, there’s a 20-lot maximum per trade, based on margin availability. Traders cannot open positions larger than this in a single click.

2-Step Evaluation Leverage

Upon reaching Step 2, leverage improves for key asset classes:

- Forex: 1:100

- Metals: 1:30

- Indices: 1:20

- Energies: 1:10

- Crypto: 1:2

The same 20-lot cap per trade still applies, maintaining consistency in risk control regardless of account progression.

Payment Options: How Can I Withdraw My Profit?

FundingPips broker offers a straightforward process for withdrawing profits. Here's some tips regarding this section:

- Weekly Payouts: Traders who are funded can request withdrawals once a week.

- Minimum Withdrawal: The minimum amount is 1% of the initial balance, including the platform's split

- Payment Methods: Withdrawals are processed via bank transfer, e-wallets, or crypto wallets (specific options may vary).

- Processing Time: Most withdrawals are processed within 1-3 business days

- Profit Split: Traders receive their share of profits based on their current level

For Hotseat traders, on-demand payouts are available, allowing for even greater flexibility in managing their earnings.

Fees Overview

FundingPips aims to keep costs low for traders. Here's a breakdown of the main fees:

- Challenge Fees: Starting from $29 for a $5,000 account (one-time fee)

- Trading Commissions: $2 per round lot for Forex, Metals, and energy sources (other instruments commission-free)

- Spreads: RAW spreads provided, typically very competitive

- Withdrawal Fees: No fees charged by FundingPips (bank or e-wallet fees may apply)

- Account Maintenance: No monthly or inactivity fees

It's worth noting that the initial challenge fee is refunded after a trader has completed the evaluation step(s) and has achieved four successful payouts from their funded account.

Education Materials

While this platform primarily focuses on providing capital to skilled traders, they do offer some educational resources:

- Comprehensive FAQ section covering trading rules and platform usage

- A blog with some limited articles

- YouTube channel with webinars and educational videos

- The customer support team is available to answer trading-related questions

However, traders looking for extensive educational content may need to supplement with external resources.

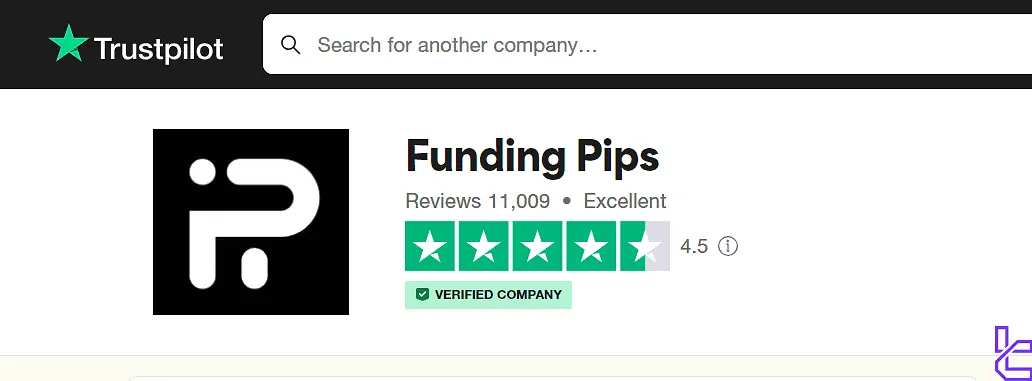

Trust Scores and Ratings

FundingPips broker has garnered generally positive reviews from the trading community. This platform has achieved a high score of 4.5 out of 5, based on over 11,000 reviews on the FundingPips Trustpilot page. A summary of users' feedbacks:

- Positive Feedback: User-friendly dashboard, responsive customer support, transparent rules

- Critical Feedback: Occasional rule changes, slippage on some hours, news trading restrictions

While 8% of Trustpilot reviews are 1-star, the overwhelming majority of traders report positive experiences with FundingPips.

Support Contact Options

FundingPips offers multiple channels for customer support:

Support Method | Availability |

Live Chat | Available on the website |

support@fundingpips.com | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | No |

FAQ | Yes |

Help Center | Yes |

No | |

Messenger | No |

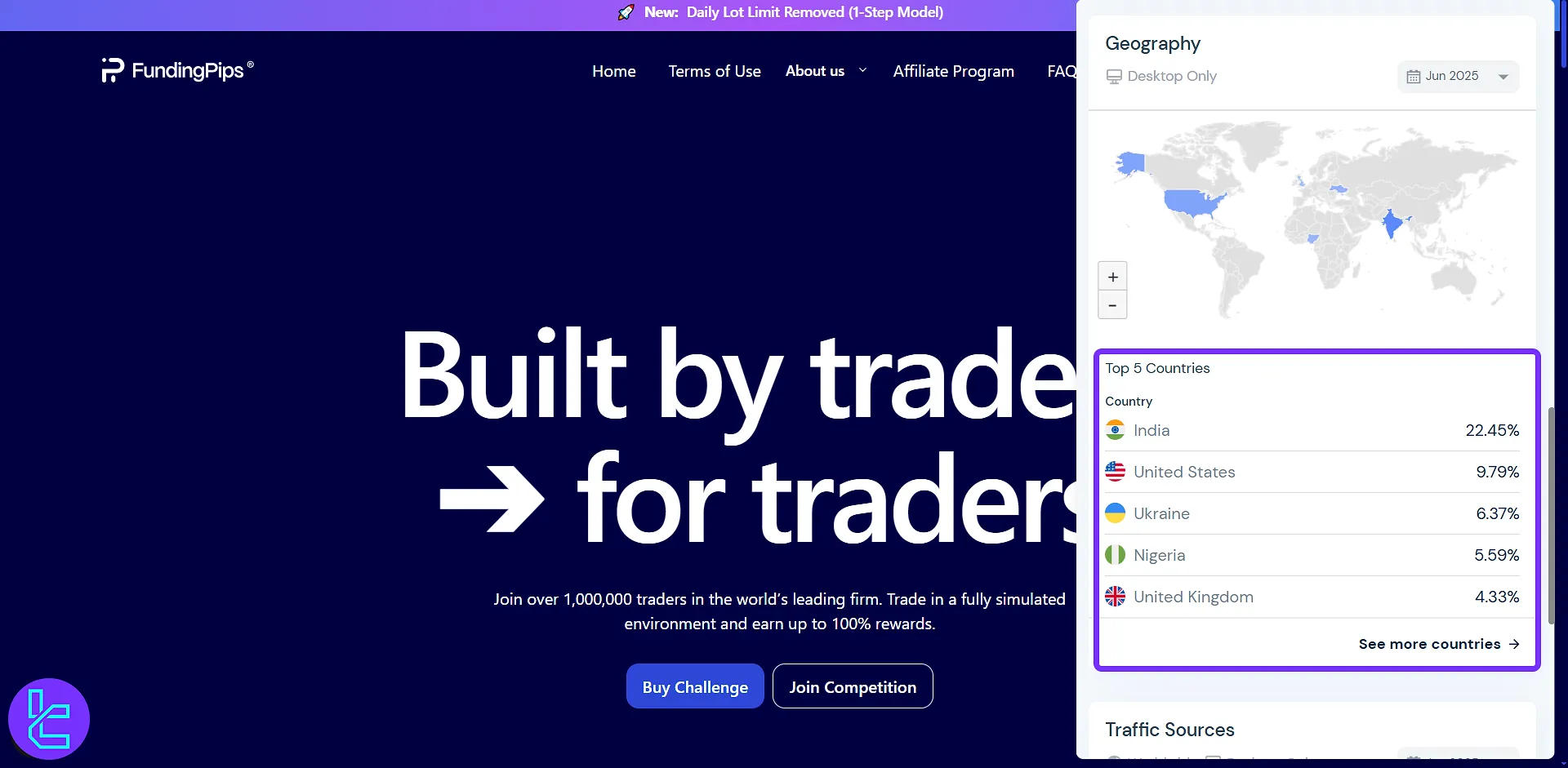

FundingPips User Base

Funding Pips currently serves over 1,000,000 traders worldwide. The platform has seen strong adoption in key trading regions, with India leading in desktop traffic share. According to the latest data:

- India: 22.45%

- United States: 9.79%

- Ukraine: 6.37%

- Nigeria: 5.59%

- United Kingdom: 4.33%

This distribution highlights the prop firm's growing influence across Asia, North America, and Europe.

Social Media Channels

Please stay connected with FundingPips through their social media presence. Updates and events regarding this platform will be posted on these channels:

Social Media | Members/Subscribers |

6500 | |

19000 | |

10300 | |

8100 | |

1100 | |

1400 |

Comparing FundingPips with Other Prop Firms

Let's compare FundingPips with other well-known prop firms:

Parameters | FundingPips Prop Firm | |||

Minimum Challenge Price | $29 | $33 | $50 | $32 |

Maximum Fund Size | $2,000,000 | $400,000 | $2,000,000 | $4,000,000 |

Evaluation steps | One-Step, Two-Step, Instant Funding | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 100% | 100% | 90% | 95% |

Max Daily Drawdown | 5% | 7% | 4% | 5% |

Max Drawdown | 10% | 14% | 6% | 10% |

First Profit Target | 8% | 6% | 5% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:5 | 1:100 |

Payout Frequency | Weekly | Weekly | Bi-weekly | From 5 Days |

Number of Trading Assets | N/A | 40+ | 100+ | 78 |

Trading Platforms | Match-Trader, ctrader, TradeLocker | MetaTrader 5, Match Trader | Proprietary platform | MT4, MT5, cTrader, MatchTarder |

Expert Suggestions

FundingPips, led by CEO Khaled Ayesh, has set a maximum total drawdown of 6% for 1-step and 3-step programs and 10% on 2-step models.

The minimum trading period required for passing the evaluation is 3 days in all accounts.