FundingFutures stands out as a U.S.-based futures prop trading firm offering traders access to funded accounts from $50K to $150K with clear risk parameters and profit targets starting at 6%.

The prop firm offers a 1-step evaluation model, 100% profit share on the first $10,000 (then 90%), and no minimum trading day requirements. With over 140 instruments across CME, NYMEX, CBOT, and COMEX, traders can access currencies, metals, and crypto futures with competitive round-trip trading costs.

FundingFutures Prop Firm Information and Introduction

FundingFutures is a next-generation futures trading prop firm with over 30,000 active community members and a team of 50+ industry professionals. Built in response to high trader demand, it provides transparent rules, flexible funding programs, and world-class trading platforms.

The company’s roots go back to 2018 as an educational initiative. After launching FundingTraders in 2022 and paying out over $4M to 350,000+ traders by 2024, the team expanded into futures funding, creating FundingFutures to support serious traders seeking scalable capital.

- Access professional funding for futures trading without risking personal capital;

- Transparent rules and flexible scaling plans to grow trading accounts;

- Active Discord community for networking, mentorship, and support;

- Over $4,000,000 in trader payouts across the ecosystem.

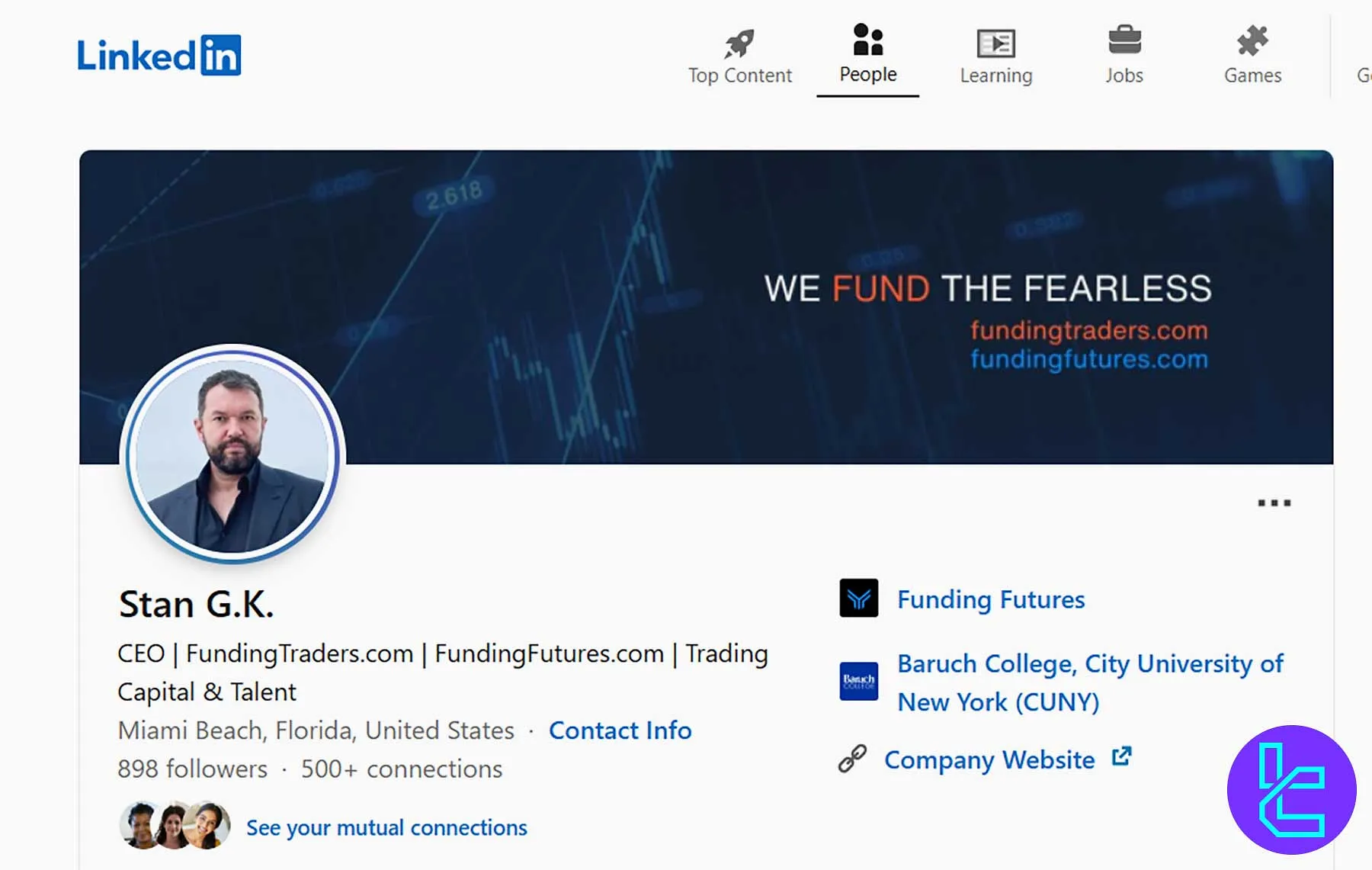

FundingFutures CEO

Stan G.K. is the CEO of FundingFutures.com and FundingTraders.com, leading two major proprietary trading platforms from Miami Beach, Florida. With 898 followers and 500+ professional connections on LinkedIn, he focuses on connecting trading talent with proprietary capital and scalable funding opportunities.

- Over a decade of experience building trading infrastructure and funding models

- Graduate of Baruch College, City University of New York (CUNY)

- Expertise in structured funding programs, performance-based models, and trader education

- Advocates transparency, scalability, and results-driven trader growth

- Committed to bridging institutional-grade capital with retail trading talent worldwide

FundingFutures Table of Specifications

Funding Futures offers up to $600K in trading capital. Let’s check the key offerings and products of the prop firm:

Account Currency | USD |

Minimum Price | $95 |

Maximum Leverage | 1:1 |

Maximum Profit Split | 90% |

Instruments | Currency, Equity, Agriculture, Energy, Metal, Micro, Cryptocurrencies |

Assets | 140 |

Evaluation Steps | 1-step |

Withdrawal Methods | Rise, Crypto |

Maximum Fund Size | $600,000 |

First Profit Target | 6% |

Max. Daily Loss | 2.4% |

Challenge Time Limit | 30 Days |

News Trading | No |

Maximum Total Drawdown | 5% |

Trading Platforms | Tradovate, ProjectX |

Commission | Variable based on the instrument |

Trustpilot Score | 4.1 / 5 |

Payout Frequency | Variable based on the challenge type |

Established Country | United States |

FundingFutures Pros & Cons

FundingFutures stands out in the futures prop trading industry with two funding models and no minimum trading day requirements. Its combination of Wall Street leadership and transparent funding rules attracts serious traders seeking capital access.

Pros | Cons |

100% profit split on the first $10K | Recurring fees (monthly) during the challenge phase |

Leadership with wall-street experience | News trading not allowed |

No activation fees | Maximum allocation capped at $600K |

No minimum trading days | High prices (starting from $95 for a $50K account) |

Despite some limitations like recurring fees and capped funding, FundingFutures offers one of the most trader-friendly profit splits and a streamlined path to funding, making it a top choice for futures market traders seeking scalable capital with transparent rules.

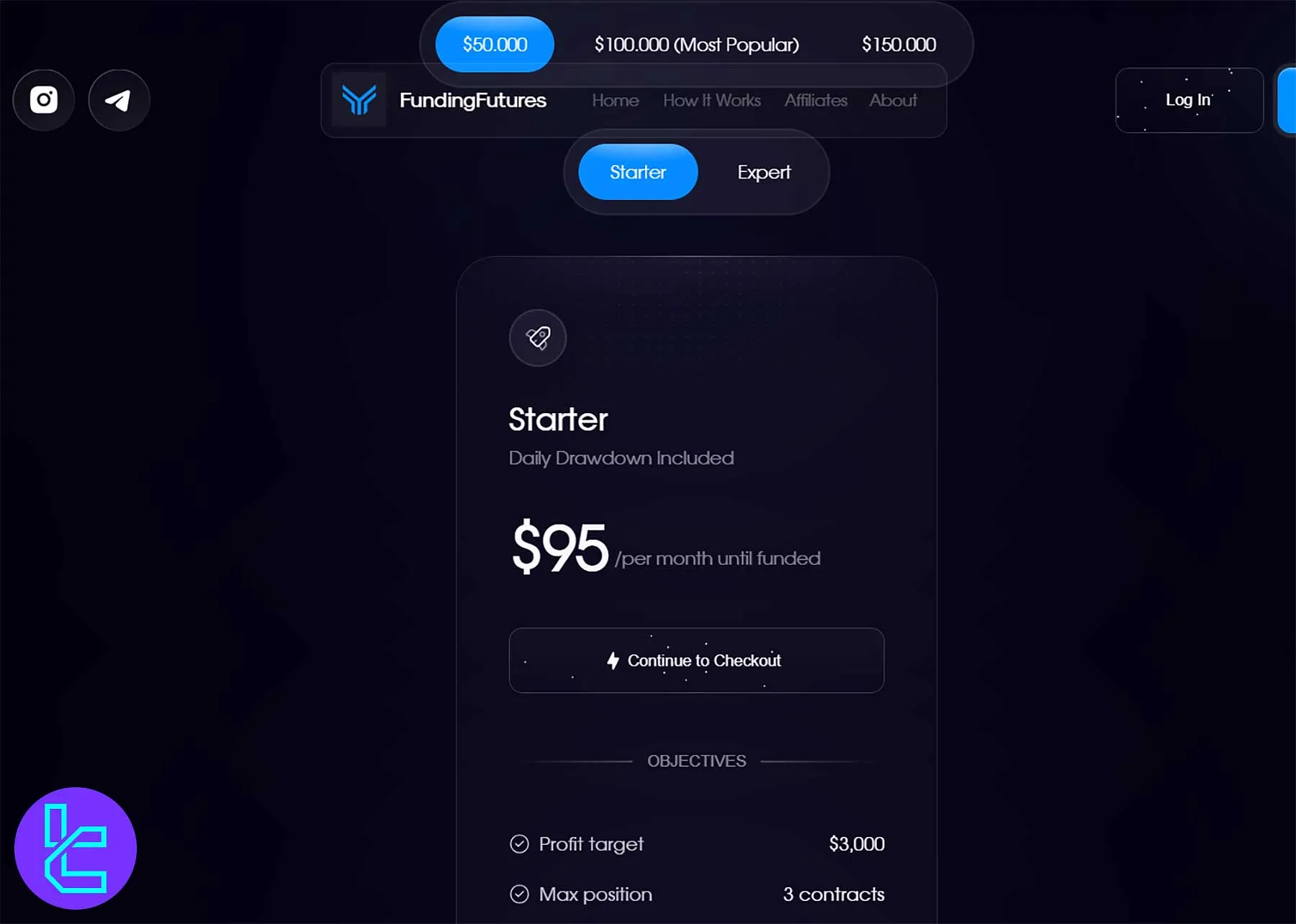

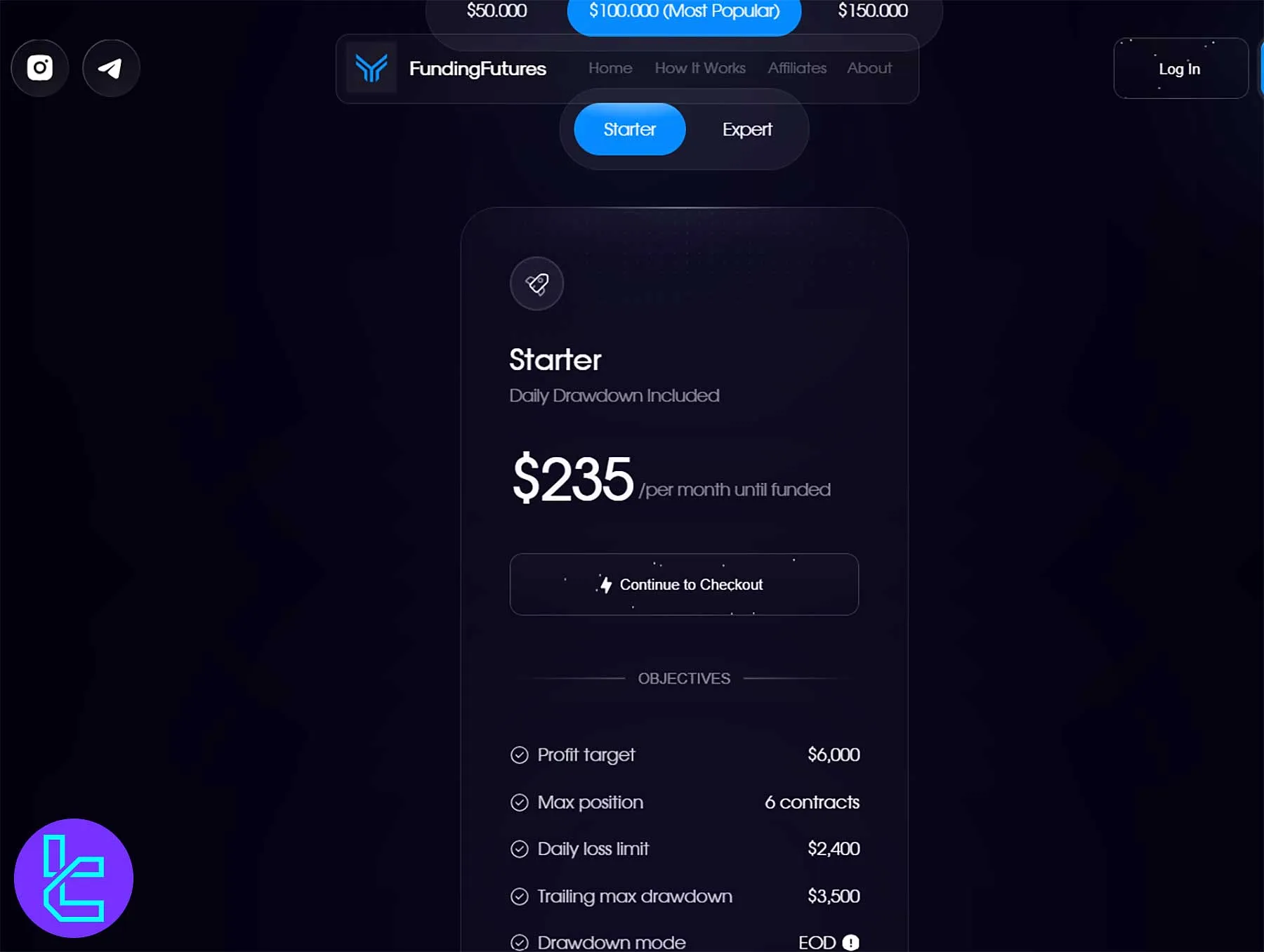

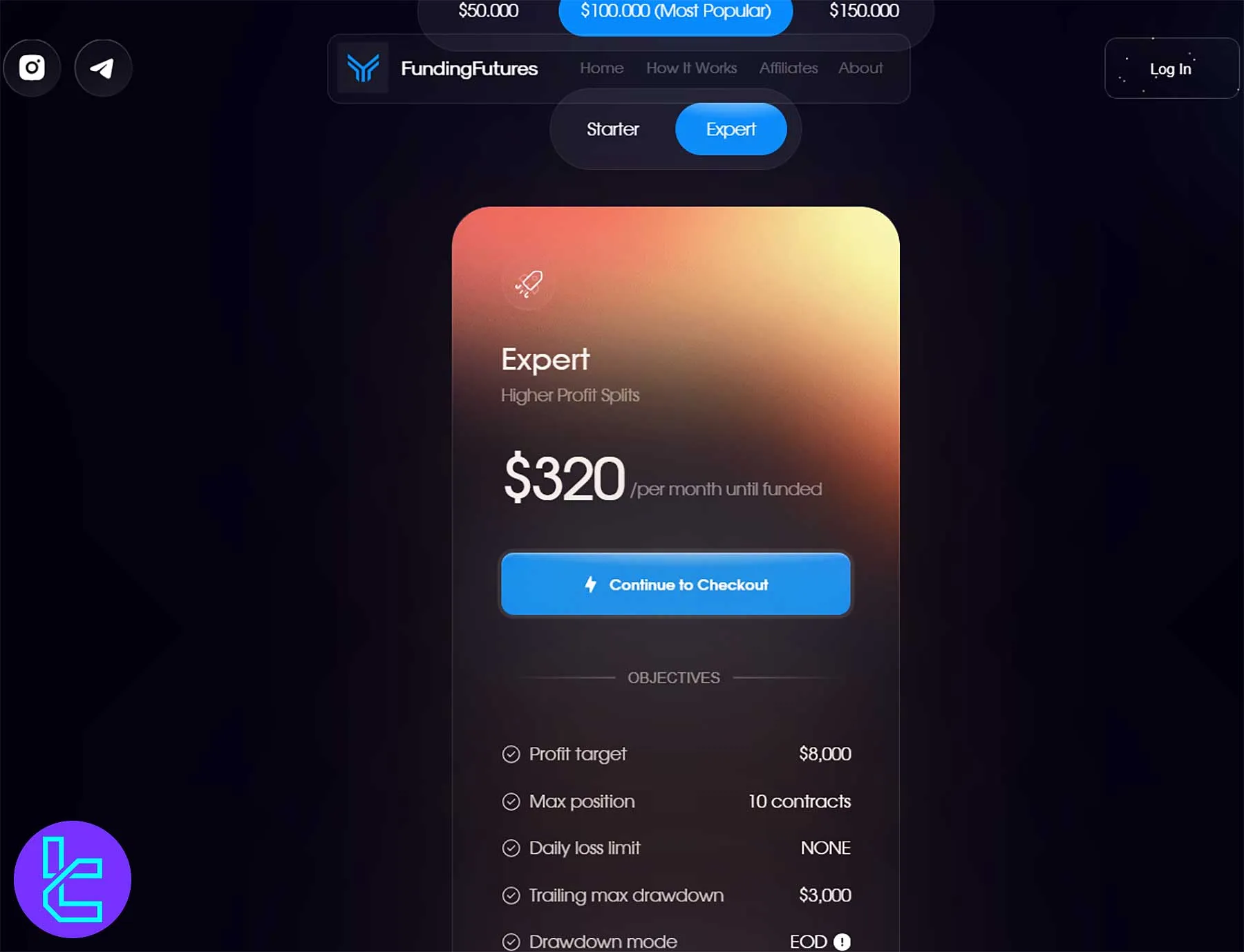

FundingFutures Challenge Prices

The prop firm provides funded accounts with initial balances of $50K, $100K, and $150K in a price range of $95 - $425. Note that the price is recurring, and traders are required to pay it monthly until funded.

Account Balance | Starter | Expert |

$50K | $95 | $150 |

$100K | $235 | $320 |

$150K | $325 | $425 |

FundingFutures Registration and KYC

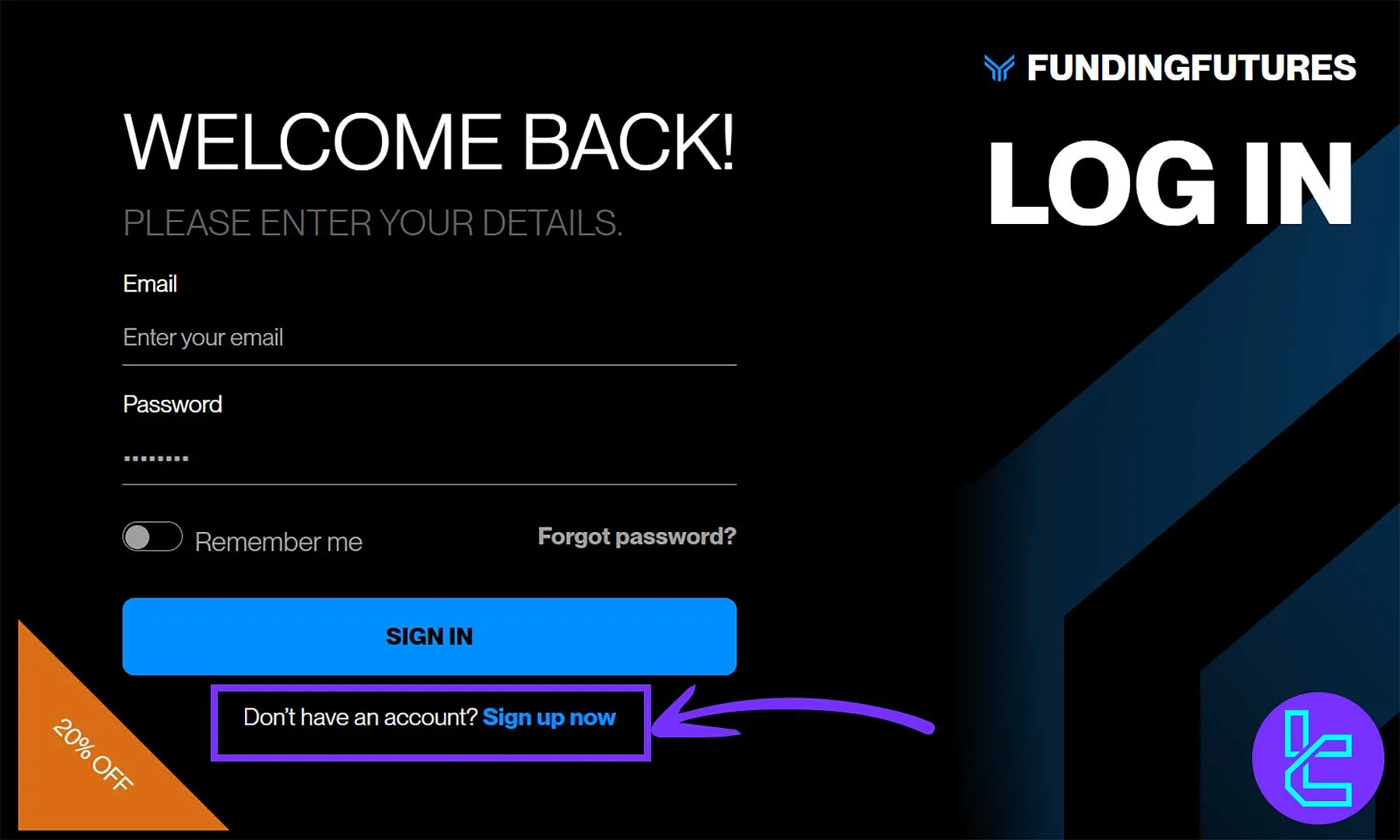

You can register with the prop firm using an email address. To initiate the FundingFutures sign up process, follow this instruction:

#1 Access the Sign Up Page

Click the “Get Funded Now” button on the Funding Futures homepage and then choose the “Don’t have an account? Sign up now” option to reach the registration form.

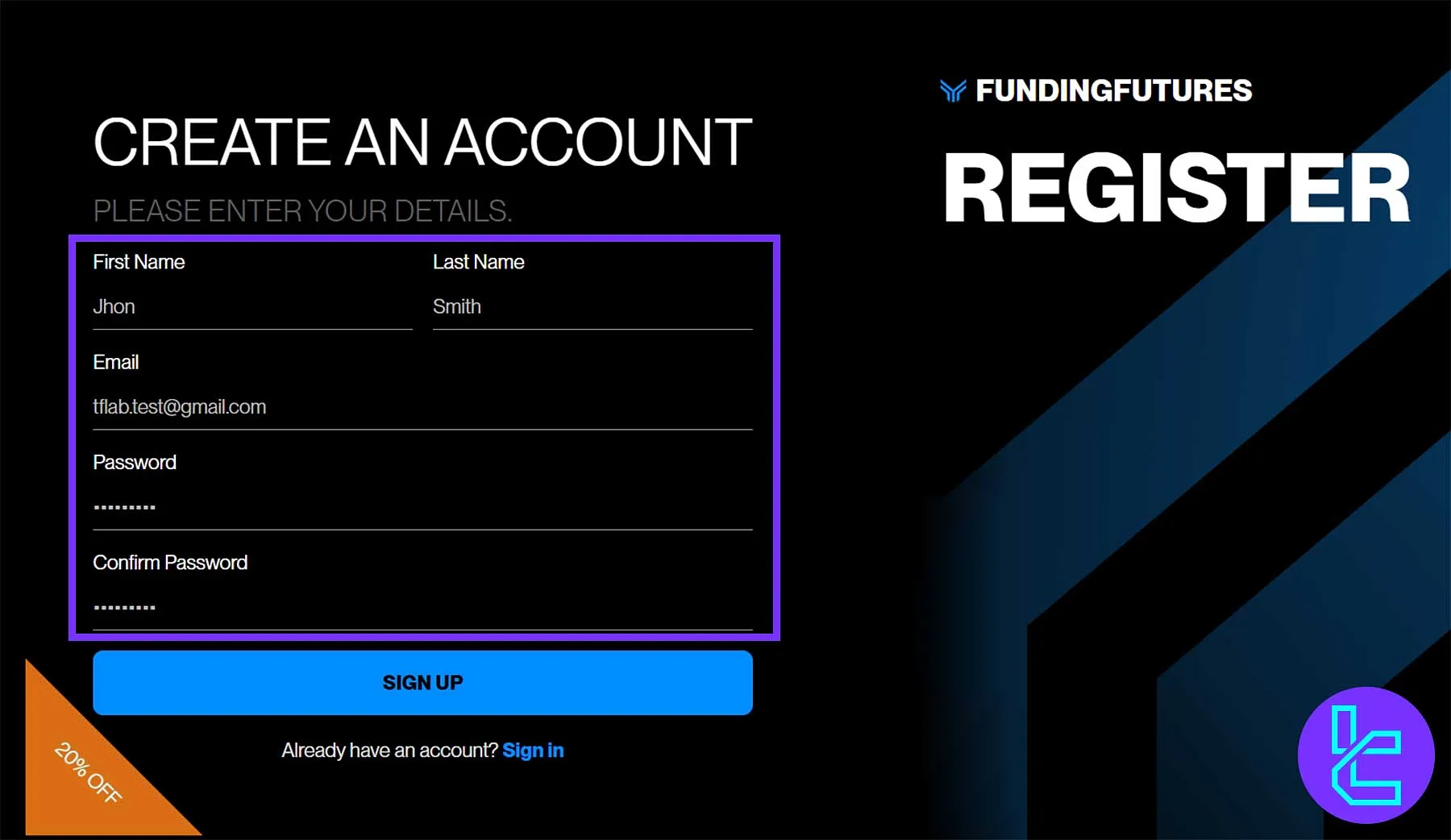

#2 FundingFutures Sign Up Form

On the new page, fill out the registration application with the following information:

- First name

- Last name

- Password

Your account is now created. Use the credentials to log in to the client dashboard.

#3 FundingFutures Prop Firm KYC

The firm prioritizes compliance and security by requiring traders to meet strict eligibility standards. Only users of legal trading age who successfully complete identity verification can access the platform, ensuring a transparent and law-abiding trading environment. Required documents for FundingFutures verification:

- Proof of ID: Passport or driving license

- Proof of Address: Utility bill or bank statement

FundingFutures Challenge Conditions

The prop firm gives traders the ability to choose between Starter and Expert funding models across $50K, $100K, and $150K accounts. Each plan has clear profit targets, trailing drawdown rules, and position sizing limits to match your trading style and risk profile.

Features | Starter | Expert | ||||

$50K | $100K | $150K | $50K | $100K | $150K | |

Profit Target | $3,000 (6%) | $6,000 (6%) | $9,000 (6%) | $4,000 (8%) | $8,000 (8%) | $12,000 (8%) |

Max Position Size | 3 Contracts | 6 Contracts | 9 Contracts | 5 Contracts | 10 Contracts | 15 Contracts |

Daily Loss Limit | $1,200 (2.4%) | $2,400 (2.4%) | $3,600 (2.4%) | None | None | None |

Trailing Max Drawdown | $2,500 (5%) | $3,500 (3.5%) | $5,250 (3.5%) | $2,000 (4%) | $3,000 (3%) | $4,500 (3%) |

Drawdown Mode | EOD | EOD | EOD | EOD | EOD | EOD |

Activation Fee | None | None | None | None | None | None |

Note: Trailing Drawdown is a dynamic equity limit that adjusts upward as profits grow. For example, on a $100,000 prop account with a 5% trailing limit, the maximum drawdown moves up with each new balance high.

Note: End-of-Day (EOD) Drawdown is calculated based on equity or balance at the daily close. A $100,000 account with a 5% EOD limit allows intraday fluctuations but must end the day above $95,000.

FundingFutures Starter Challenge

The Starter Model is designed for disciplined traders who benefit from daily loss limits and structured risk control. It’s available in $50K, $100K, and $150K accounts, making it ideal for consistent intraday and swing strategies.

Features | $50K | $100K | $150K |

Profit Target | $3,000 (6%) | $6,000 (6%) | $9,000 (6%) |

Max Position Size | 3 Contracts | 6 Contracts | 9 Contracts |

Daily Loss Limit | $1,200 (2.4%) | $2,400 (2.4%) | $3,600 (2.4%) |

Trailing Max Drawdown | $2,500 (5%) | $3,500 (3.5%) | $5,250 (3.5%) |

Drawdown Mode | EOD | EOD | EOD |

Activation Fee | None | None | None |

This model is perfect for traders who want structured risk rules, predictable funding objectives, and an affordable path to scaling their account.

FundingFutures Expert Challenge

The Expert Model removes the daily loss limit and increases the maximum contract size, giving experienced traders full control over their trading strategy. It is available in three account sizes with higher profit targets and faster scaling potential.

Features | $50K | $100K | $150K |

Profit Target | $4,000 (8%) | $8,000 (8%) | $12,000 (8%) |

Max Position Size | 5 Contracts | 10 Contracts | 15 Contracts |

Daily Loss Limit | None | None | None |

Trailing Max Drawdown | $2,000 (4%) | $3,000 (3%) | $4,500 (3%) |

Drawdown Mode | EOD | EOD | EOD |

Activation Fee | None | None | None |

The Expert Model is designed for traders seeking maximum freedom and larger position capacity to achieve funding goals without daily restrictions.

FundingFutures makes it easy to select the model that fits your trading style — Starter for risk-managed growth or Expert for unrestricted strategies — both with no hidden activation fees and just one day required to get funded.

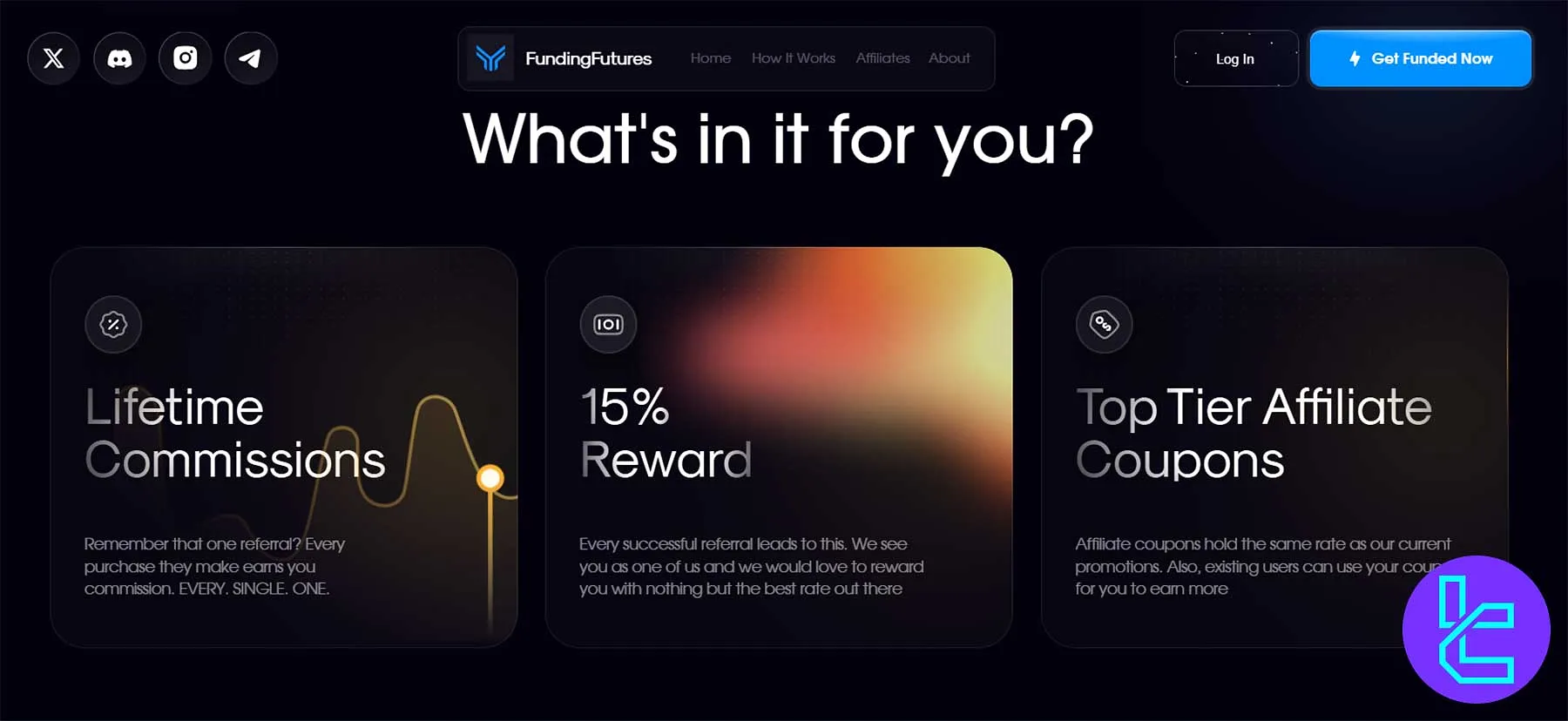

FundingFutures Prop Firm Discounts and Promotions

The company actively rewards its community with seasonal discounts and a top-tier affiliate program. At the time of writing this FundingFutures review (September 22, 2025), traders can claim a 20% discount on all challenge accounts, while affiliates earn recurring commissions through a fast, reliable payout system.

- 20% seasonal discount on all challenge account subscriptions

- Affiliate program with lifetime commissions, 15% reward per sale, and fast 24-hour payouts

FundingFutures Discount Code

As of September 2025, the prop firm is offering a 20% discount on all challenge accounts, allowing traders to access capital more affordably. This promotion applies to Starter and Expert models across $50K, $100K, and $150K accounts.

FundingFutures Affiliate Program

The prop firm offers a lifetime-commission affiliate program designed for influencers, trading educators, and partners who want to monetize their audience by promoting the platform. Affiliates receive marketing materials, unique links, and rapid payouts within 24 hours of approval.

- Lifetime commissions on every referred trader’s challenge purchases

- 15% reward per sale with monthly payout requests

- Access to affiliate dashboard, tracking, and promo banners

- Top-tier coupon codes for high-performing affiliates

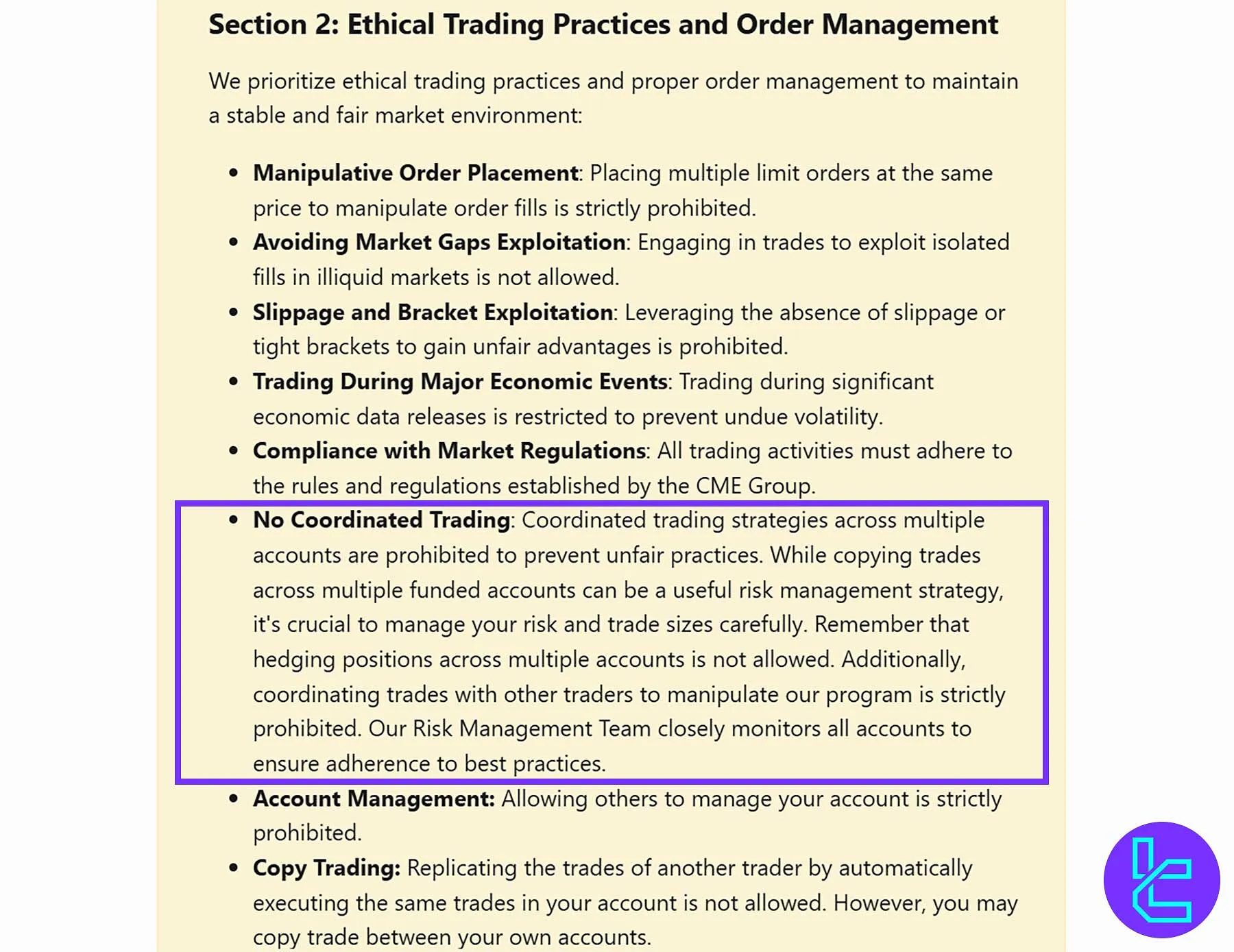

FundingFutures Rules

The prop firm enforces strict compliance and risk management rules to maintain fairness, transparency, and consistent trader performance. These rules cover VPN usage, hedging, arbitrage strategies, EA restrictions, news trading, and payout structures for both Starter and Expert accounts.

- VPN Usage: VPN use to bypass geo-restrictions is prohibited and may result in account suspension or permanent bans;

- Hedging Strategies: Hedging across multiple accounts or coordinating trades is forbidden;

- Policy on Expert Advisors (EAs): Automated trading via Expert Advisors is not authorized on the platform;

- Arbitrage & Martingale Strategies: No specific rules are disclosed for these strategies;

- News Trading: Positions must be closed 2 minutes before major news events and opened 2 minutes after to avoid volatility risks;

- Payout Rules: Traders receive 100% of the first $10K profits, then 90%, with specific payout conditions per account type.

VPN Usage

FundingFutures allows traders from most countries but maintains strict compliance with international regulations. Traders from 50+ restricted regions cannot participate, and VPN use to bypass geo-restrictions may result in account suspension or permanent bans.

- VPN usage to hide location is prohibited;

- IP address tracking is actively monitored;

- Traders from banned regions cannot bypass restrictions;

- Violations may lead to account termination and loss of progress.

Hedging Strategies

The prop firm enforces strict rules against hedging across multiple accounts to maintain fairness and program integrity. The Risk Management Team actively monitors trading activity to prevent coordinated manipulation or excessive risk-taking across accounts.

- Hedging positions across multiple accounts is strictly prohibited;

- Coordinated trading with other traders is not allowed;

- Copying trades is permitted only with proper risk sizing;

- Violations may lead to account termination and loss of funding eligibility.

FundingFutures Policy on Expert Advisors (EAs)

According to our conversation with the support team, the prop firm doesn’t authorize the use of Expert Advisors.

Arbitrage and Martingale Strategies

The prop firm’s website has disclosed no rules in regard of Arbitrage and Martingale strategies.

Is News Trading Allowed on FundingFutures?

FundingFutures prohibits news trading to protect accounts from extreme volatility. Traders must close open positions 2 minutes before major news events and may resume trading only 2 minutes after the news release to ensure fair and controlled risk exposure.

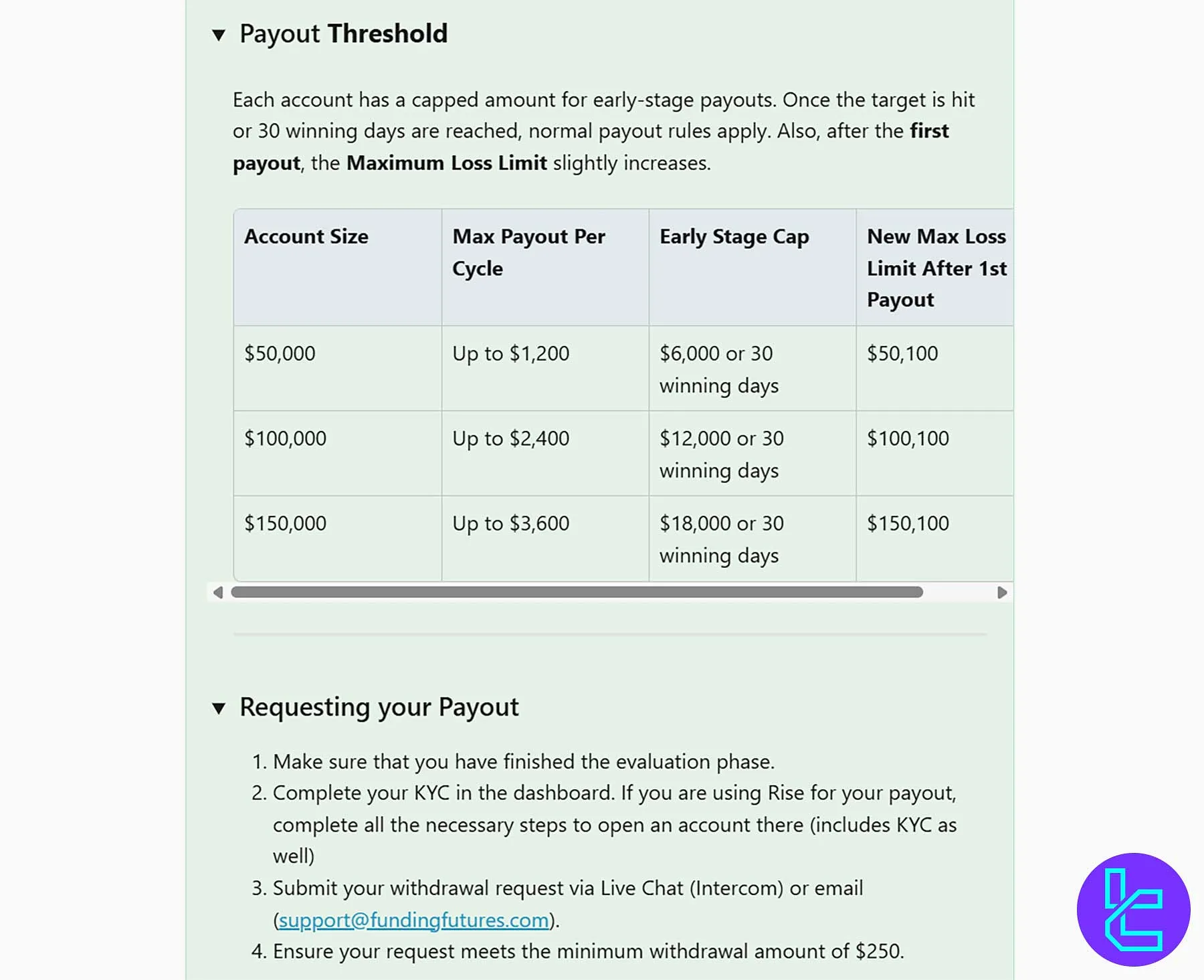

FundingFutures Payout Rules

The prop firm enforces clear and transparent payout rules for both Starter and Expert accounts. Traders can access up to 100% profit on their first $10,000, followed by a consistent 90% split, with payout eligibility tied to account-specific requirements and risk controls.

FundingFutures Starter Challenge Payout Policies

The Starter challenge is governed by the 40% Consistency Rule, ensuring that no single trading day accounts for more than 40% of total profits. This rule applies only at the funded stage and aims to encourage sustainable trading practices.

- Consistency Score: 40% cap per trading day

- Profit Split: 100% first $10K, then 90%

- Payout Frequency: After 5 winning days & $250 minimum payout

- Payout Thresholds: Early-stage caps per account size ($6K/$12K/$18K)

- Processing Time: 24–72 business hours after request

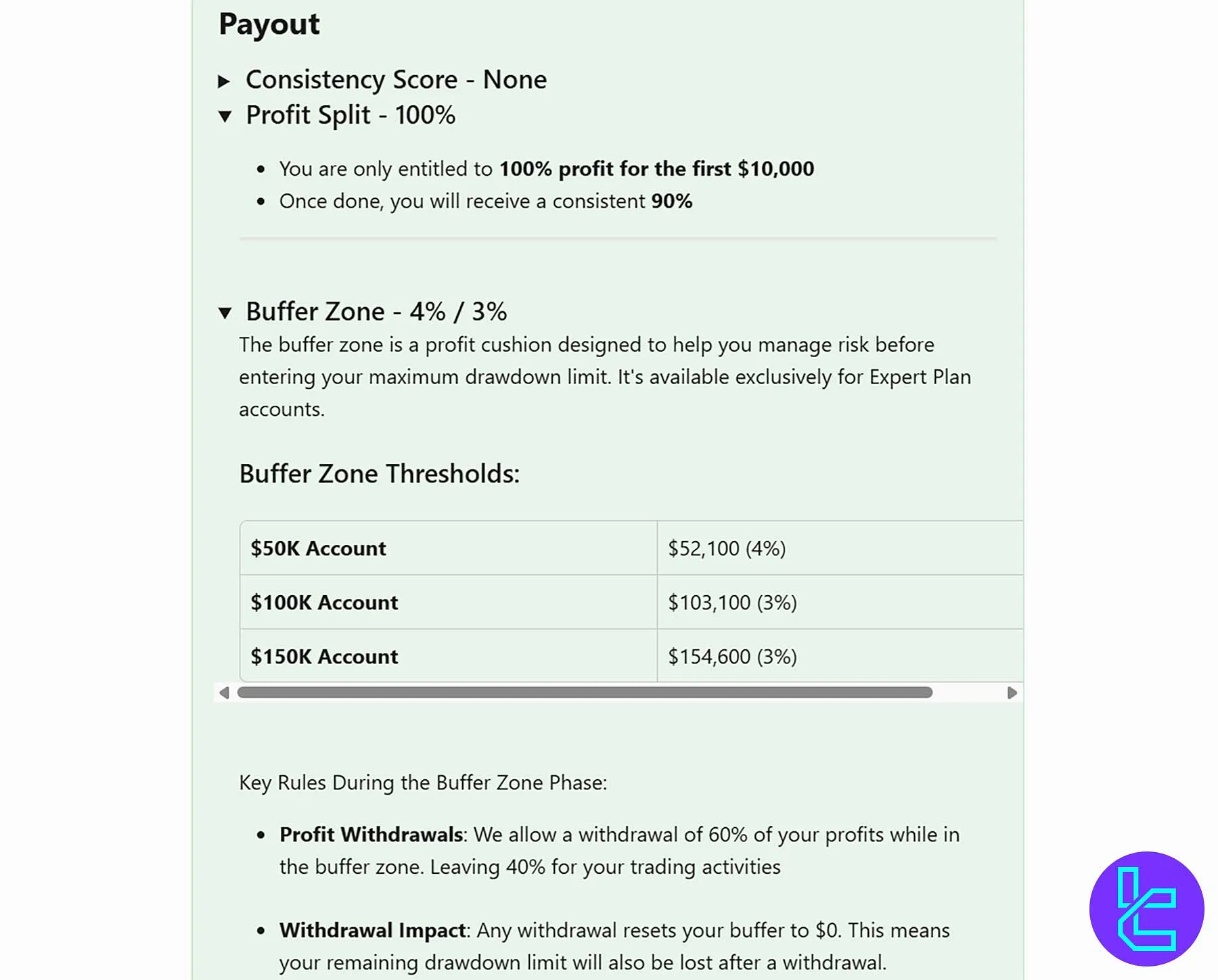

FundingFutures Expert Account Payout Rules

Expert accounts have no consistency score and benefit from a buffer zone that provides a profit cushion before hitting maximum drawdown. Traders can withdraw every 14 calendar days with a minimum $1,000 request.

- Consistency Score: None (applies only to Starter)

- Profit Split: 100% first $10K, then 90%

- Buffer Zone: 3–4% cushion (resets after withdrawal)

- Payout Frequency: Every 14 calendar days

- Minimum Withdrawal: $1,000 required per request

FundingFutures Trading Platform

FundingFutures equips traders with two powerful futures trading platforms, ProjectX and Tradovate, delivering real-time data, advanced charting, and risk controls. Both platforms are optimized for speed, flexibility, and seamless multi-device access, helping traders execute strategies with precision.

- ProjectX: Web-based, TradingView chart integration, unfiltered real-time data, advanced risk management, and mobile-friendly design

- Tradovate: Cloud-based platform with depth of market (DOM), one-click order entry, bracket orders, and cross-device trading

While ProjectX is mobile-friendly and accessible from various mobile web browsers, Tradovate offers exclusive applications for smartphones:

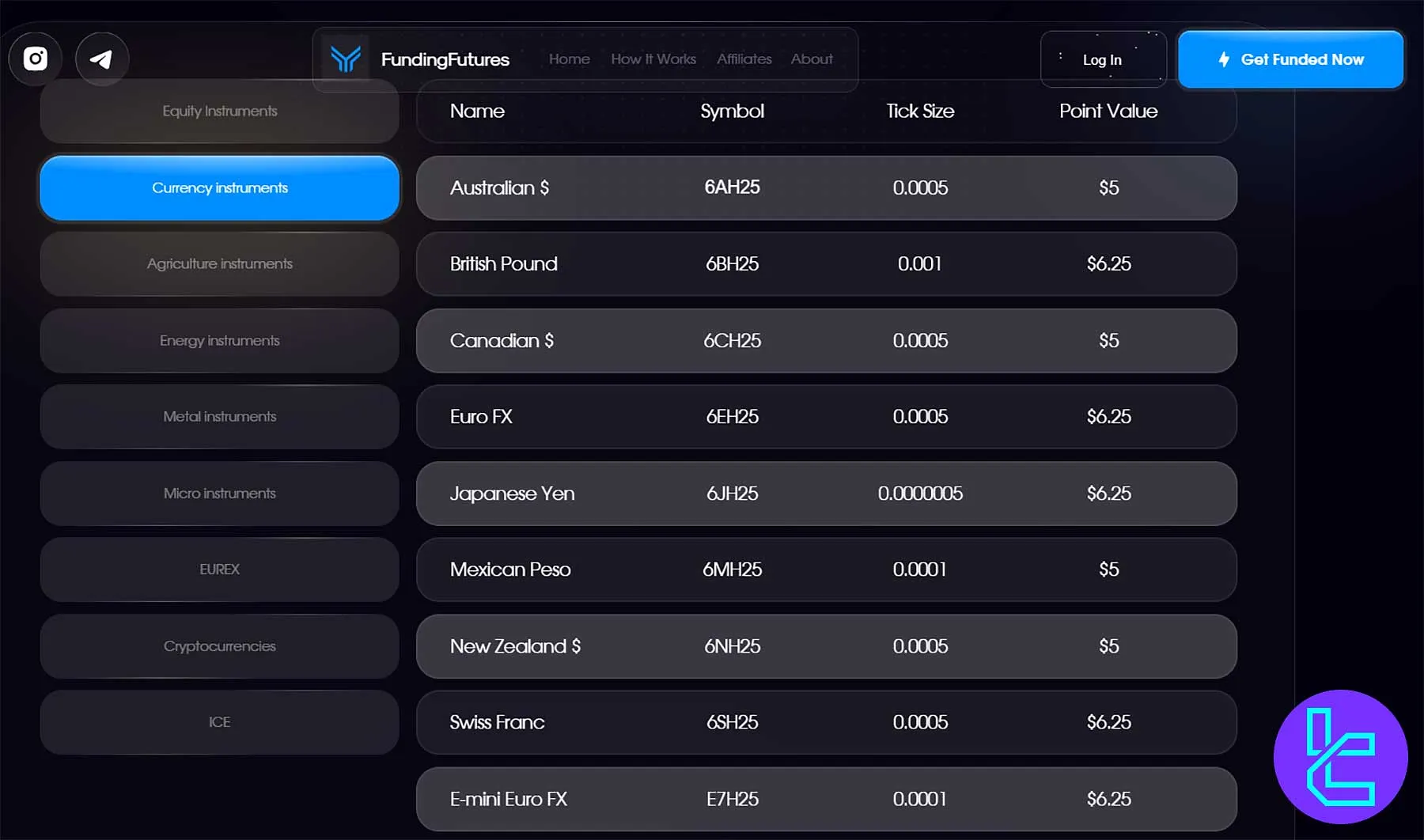

FundingFutures Trading Instruments

We must mention in this FundingFutures review that the prop firm’s market offerings differ based on the trading platform. It provides access to Cryptocurrencies, Equities, and many more across global exchanges, including CME, CBOT, NYMEX, and COMEX.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max Leverage |

Currency | Futures | 14 | 50–70 pairs | 1:1 |

Equity | Futures | 5 such as S&P 500, Nasdaq, DOW | 10-20 symbols | 1:1 |

Agriculture | Futures | 8 such as live cattle, soybeans, wheat | 15-30 symbols | 1:1 |

Energy | Futures | 5 such as Crude Oil, Natural Gas, RBOB Gasoline | 3-8 symbols | 1:1 |

Metal | Futures | 5, including Gold, Silver, Platinum, Copper, Palladium | 3-8 | 1:1 |

Micro | Futures | 12 instruments | N/A | 1:1 |

Cryptocurrencies | Futures | Bitcoin and Ethereum | 5-15 | 1:1 |

The comprehensive instrument list allows traders to diversify strategies across asset classes while benefiting from low-latency execution, institutional-grade liquidity, and competitive round-trip costs.

FundingFutures Payments and Payouts

FundingFutures accepts secure payments through major credit/debit cards, Amazon Pay, Link, and Cash App Pay. For compliance and fraud prevention, the cardholder’s name and billing address must match the trader’s registered profile in the dashboard.

- Cardholder name must match the registered account name;

- Billing address must match the registered address;

- Prepaid cards are not accepted;

- Using someone else’s card results in a permanent ban;

- KYC verification is required for refunds and payouts.

The available method for profit withdrawals on FundingFutures are:

- Rise: Bank wire and cryptocurrency

- Cryptocurrency

FundingFutures Trading Costs

The prop firm follows a Total Cost Round Trip price model, which includes commissions, exchange fees, bid/ask spreads, market impact costs, and occasionally taxes for its trading instruments. However, the costs vary based on the underlying asset.

In this FundingFutures review, we provide the Total Round Trip costs for 8 popular trading instruments:

Trading Instrument | Total Cost Round Trip |

Australian Dollar | $5.04 |

British Pound | $5.12 |

Canadian Dollar | $5.12 |

E-mini S&P 500 | $4.68 |

Euro FX | $5.12 |

Micro Bitcoin | $6.04 |

Micro EUR/USD | $1.36 |

Gold | $5.02 |

FundingFutures Educational Offerings

The prop firm doesn’t offer any educational materials, except for an economic calendar. This is a real letdown for traders new to the futures market. However, you can use TradingFinder’s Forex education and Crypto tutorial sections to access a rich educational resource.

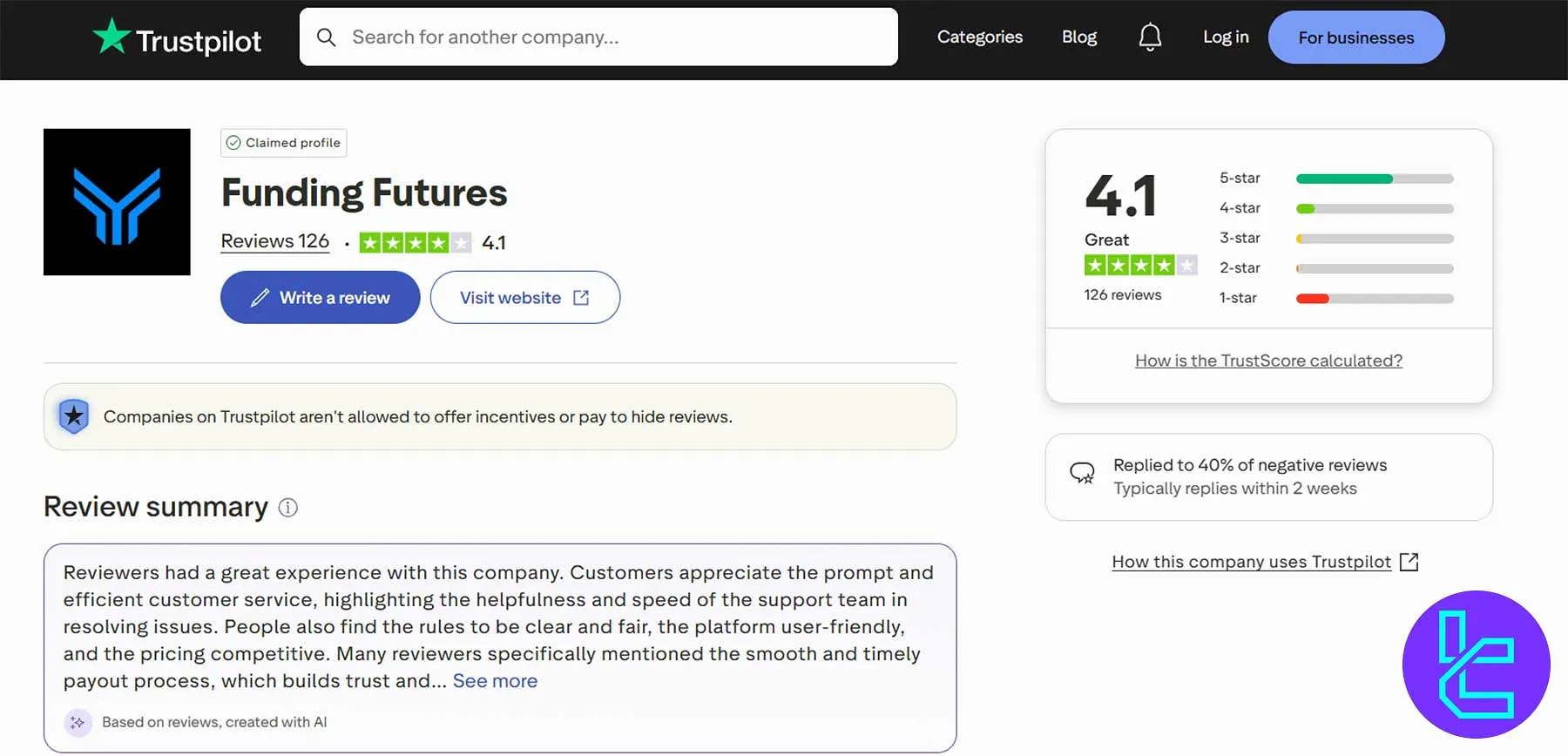

FundingFutures Trust Scores

The company is rather a new prop firm with a limited track record. However, the FundingFutures Trustpilot profile paints a good picture of it, scoring a great rating of 4.1 out of 5 based on 126 reviews.

FundingFutures Support

The prop firm provides multi-channel customer support to help traders resolve issues quickly and access guidance. Live chat, email, Discord, and a dedicated help center ensure 24/7 availability for inquiries, technical assistance, and account-related questions.

Support Method | Availability |

Live Chat | Yes |

Yes (support@fundingfutures.com) | |

Phone Call | No |

Discord | Yes (https://discord.com/invite/ZAUqSxaqdM) |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | Yes |

No | |

Messenger | No |

FundingFutures User Base

The company has built a global community of 30,000+ active traders, with its largest client concentration in the United States (69.47%), followed by India, Poland, Spain, and Vietnam, reflecting its international reach and growing popularity among futures traders worldwide.

- United States: 69.47% of total traffic

- India: 9.47%

- Poland: 6.76%

- Spain: 4.93%

- Vietnam: 3.24%

FundingFutures Prop Firm on Social Media

FundingFutures has an active community on Discord, allowing traders to make connections and find answers to their inquiries. It also uses X (Twitter), Instagram, and Telegram to share updates, engage traders, and provide educational content.

Social Media | Members/Subscribers |

2,689 | |

4,096 | |

70.1K | |

4,378 |

FundingFutures Comparison Table

Let’s compare Funding Futures’ key features and offerings with 3 other popular prop firms:

Parameters | FundingFutures Prop Firm | |||

Minimum Challenge Price | $95 | $13 | $39 | €55 |

Maximum Fund Size | $600,000 | $100,000 | $250,000 | Infinite |

Evaluation steps | 1-Step | Instant, 1-Step, 2-Step, 3-Step | 1-Step, 2-Step, 3-Step | 2-Step |

Profit Share | 90% | 80% | 100% | 100% |

Max Daily Drawdown | 2.4% | 4% | 5% | 5% |

Max Drawdown | 5% | 8% | 10% | 8% |

First Profit Target | 6% | 8% | 5% | 10% |

Challenge Time Limit | 30 Days | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:1 | 1:75 | 1:100 | 1:100 |

Payout Frequency | 5 Days and 14 Days | 10 Days | Bi-weekly | 14 Days |

Number of Trading Assets | 140 | 400+ | 3000+ | 150+ |

Trading Platforms | Tradovate, ProjectX | Match-Trader, cTrader, MetaTrader 5 | Metatrader 5 | cTrader, DXTrade |

Expert Suggestion

FundingFutures is praised for its no minimum trading day requirement, allowing traders to get funded after just one trading day. The platform also enforces EOD trailing drawdown rules and offers up to 15 contracts for $150K Expert accounts, giving experienced traders greater flexibility.

FundingFutures prop firm supports payouts via Rise or crypto wallets with a minimum withdrawal of $250 for Starter and $1,000 for Expert accounts. Its 4.1/5 Trustpilot score and compliance-focused KYC process ensure security and transparency for a growing community of committed futures traders.