The One-Phase Program offers traders funding from $10,000 up to $400,000 with clear and achievable rules. With a 10% profit target, 5% daily loss limit, and up to 90% profit split, it provides flexibility and growth potential.

FXIFY is a UK-based prop trading platform founded by Peter Brown and David Bhidey. This platform provides funded accounts ranging from $10,000 to $400,000 to professional Forex traders, with up to a 90% profit split.

FXIFY accounts have spreads from 0.0 pips and $6 commission on stock CFDs.

FXIFY Company Overview

FXIFY is a relatively new player in the proprietary trading arena, but it's already making waves with its innovative approach to trader evaluation and funding.

Founded by industry veterans Peter Brown and David Bhidey, the prop firm has set out to create a platform that caters to traders of all experience levels. Key features of FXIFY include:

- Founded in April 2023

- Based in London

- Partnership with reputable broker FXPIG

- Support for MetaTrader 4 and MT5 trading platforms

- Various funding programs

FXIFY CEO

FXIFY was co-founded by David Bhidey and Peter Brown, who combined their expertise in e-commerce, technology, and trading to launch the firm.

While they played a central role in building FXIFY into a leading prop trading company, it is not publicly clear who currently serves as the CEO.

- David Bhidey: Tech and e-commerce entrepreneur, transitioned into trading; co-founded FXIFY after experience at FXPIG;

- Peter Brown: Marketing and e-commerce expert, merged digital strategy with trading; drives FXIFY’s growth.

FXIFY Prop Firm Specifications Summary

FXIFY has unique features that make it stand out:

Account currency | N/A |

Minimum price | $39 |

Maximum leverage | 1:50 |

Maximum profit split | 90% |

Instruments | Forex, metals & oils, indices, stocks, crypto |

Assets | Gold, EUR/USD, S&P 500 |

Evaluation steps | 1 phase, 2 phase, 3 phase, Instant Funding, Lightning |

Trading platform | MT4, MT5, DXtrade |

Withdrawal methods | Rise |

Maximum fund size | $4,000,000 |

First profit target | 10% |

Maximum daily loss | 5% |

Challenge time limit | No |

News trading | Yes |

Maximum total drawdown | 10% |

Trading platforms | MT4, MT5 |

Commission Per Round lot | $6 per lot |

Trustpilot score | 4.3/5 |

Payout frequency | Bi-weekly |

Established country | United Kingdom |

Established year | 2023 |

FXIFY Pros and Cons

When considering FXIFY as your prop trading partner, it's essential to weigh both the advantages and potential drawbacks. Here's a balanced look at what FXIFY brings to the table:

Pros | Cons |

Up to $400,000 funding | Relatively new firm |

High profit split (up to 90%) | Higher profit targets compared to some competitors |

Allows EAs, copy trading, and news trading | No educational resources |

Allows trading over 300 instruments |

FXIFY Funding & Price

FXIFY provides 5 different types of challenges (including instant funding), to cater to all prop traders’ needs. FXIFY evaluation prices:

Funding Size | One-Phase | Two-Phase | Three-Phase | Instant Funding | Lightning |

$1,000 | - | - | - | $69 | - |

$2,500 | - | - | - | $119 | - |

$5,000 | $59 | $59 | $39 | $229 | $59 |

$10,000 | $89 | $89 | $59 | $449 | - |

$15,000 | $119 | $119 | $79 | - | - |

$25,000 | $199 | $199 | $149 | $899 | $119 |

$50,000 | $379 | $379 | $249 | $1749 | $209 |

$100,000 | $549 | $549 | $399 | - | $399 |

$200,000 | $1,049 | $1,049 | $799 | - | - |

$400,000 | $2,950 | $2,950 | $1,599 | - | - |

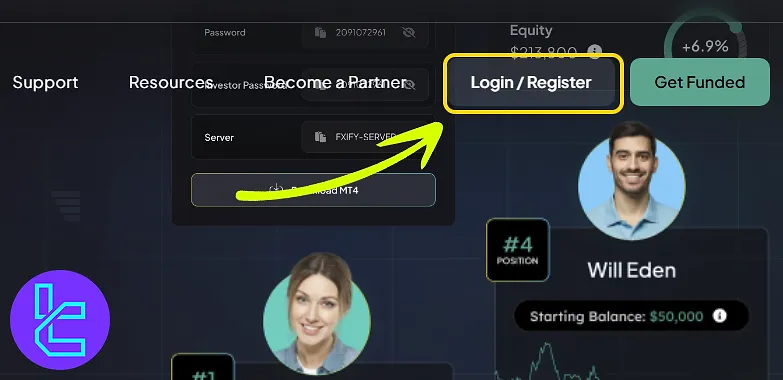

FXIFY Prop Sign-up and Verification

To begin trading on funded accounts, traders must first complete the FXIFY registration process.

#1 Visit the Official FXIFY Website

Navigate to the FXIFY homepage and click the “Log in” or “Open an Account” button to begin registering.

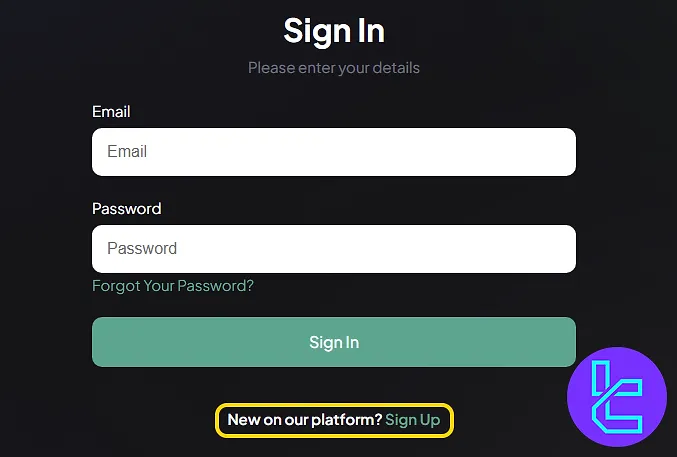

#2 Activate the Sign-Up Form

Select the “Sign Up” option to access the registration interface.

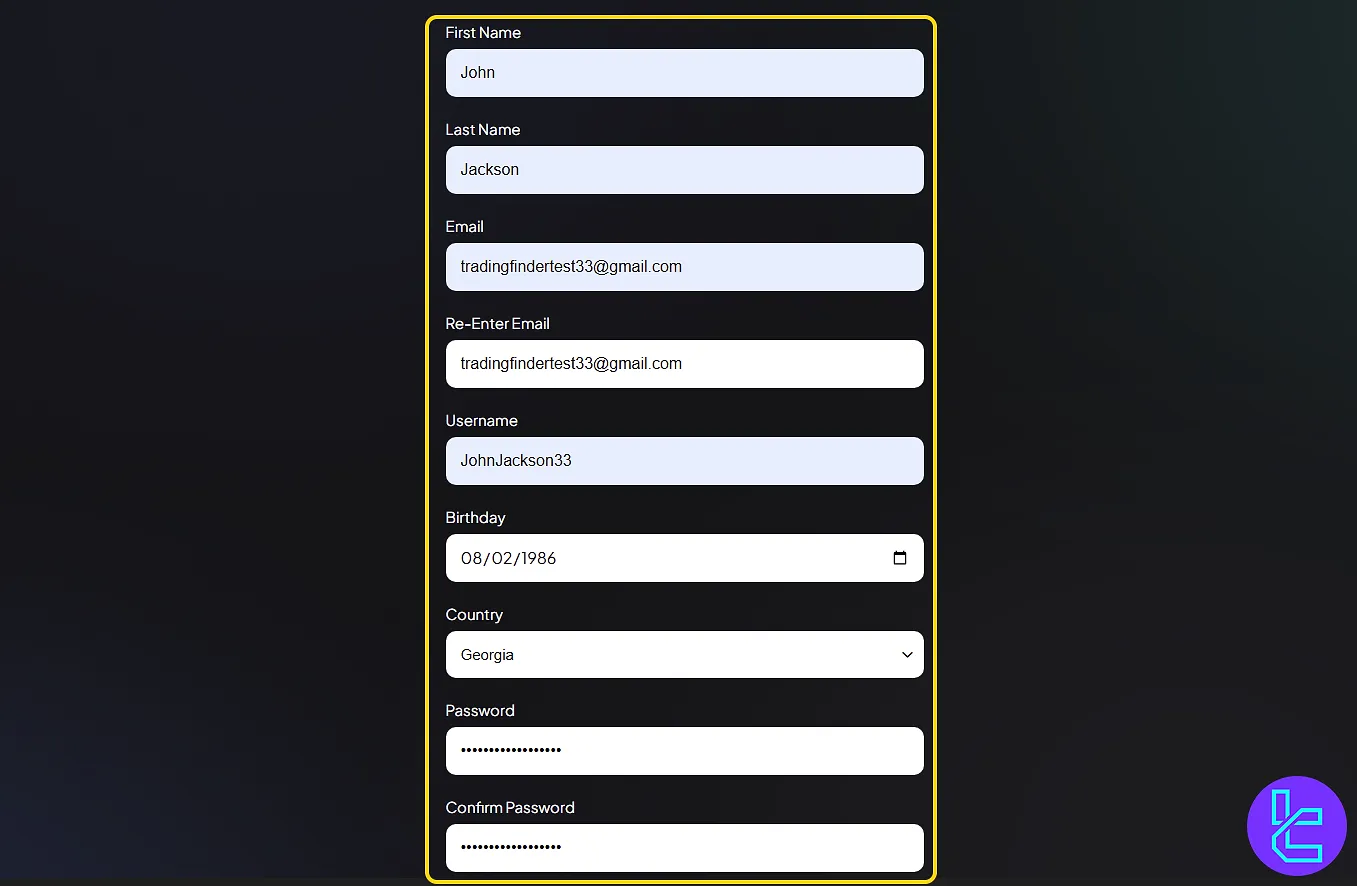

#3 Submit Your Details

Provide the following information:

- Full name

- Date of birth

- Country of residence

- Username and email

- Strong password (with uppercase, lowercase, numbers, and symbols)

Then, confirm your agreement with FXIFY's Terms and Conditions.

Traders must also note that verification is necessary to unlock withdrawals in the FXIFY prop firm. To do so, traders must provide a valid government-issued ID card and a utility bill or bank statement as proof of address.

FXIFY Prop Firm Evaluation Phases Complete Guide

It’s time to review 1-phase, 2-phase, 3-phase evaluation, Instant Funding, and Lighting challenges in our FXIFY Prop Firm review. Here's a breakdown of the evaluation rules:

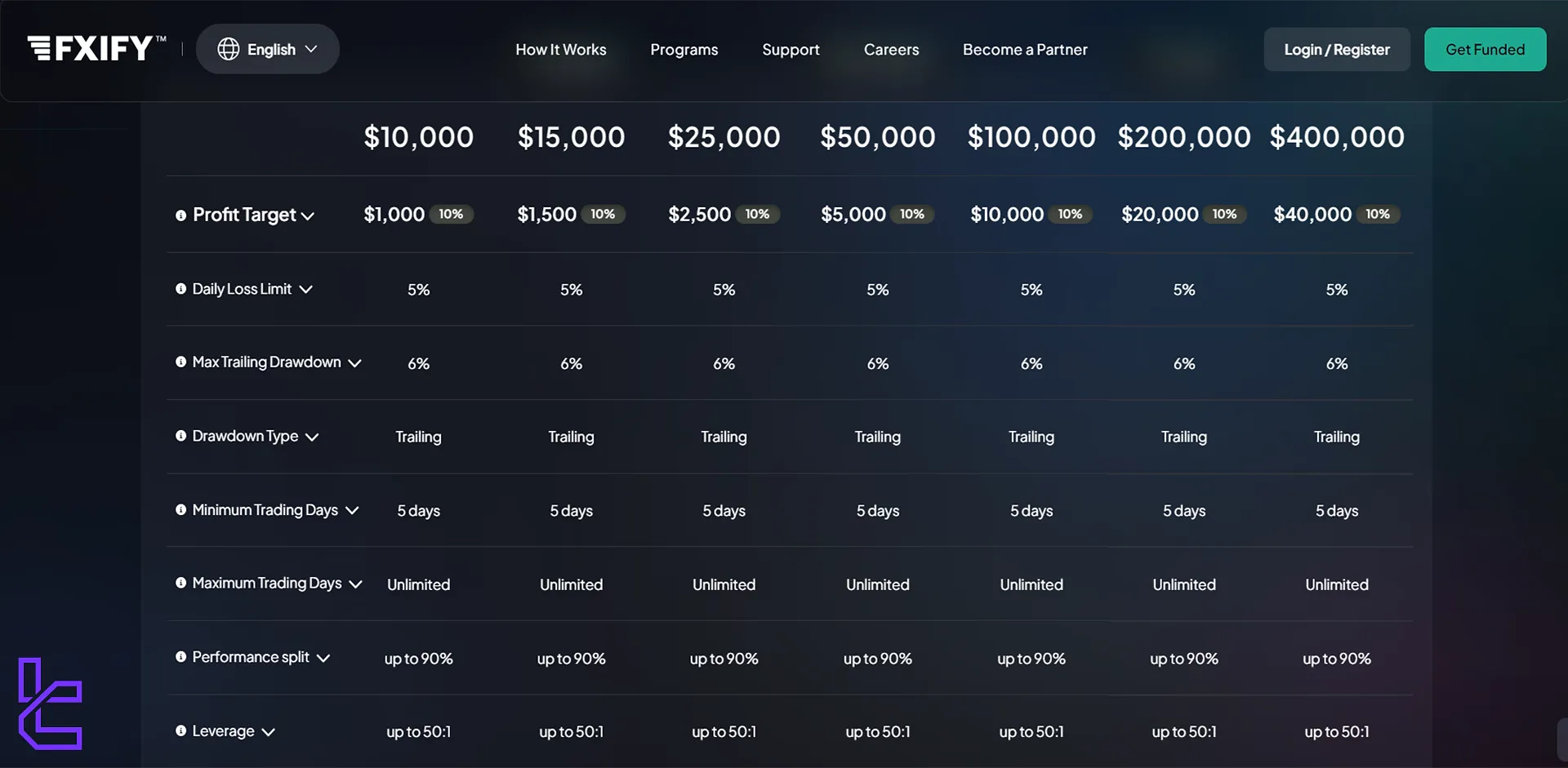

FXIFY One-Phase Evaluation

Funding amount | $10k | $15k | $25k | $50k | $100k | $200k | $400k |

Profit target | 10% | ||||||

Daily loss limit | 5% | ||||||

Max trailing drawdown | 6% | ||||||

Drawdown type | Trailing | ||||||

Minimum trading days | 5 | ||||||

Maximum trading days | Unlimited | ||||||

Performance split | Up to 90% | ||||||

Leverage | 1:50 | ||||||

Refundable Fee | $85 | $115 | $199 | $375 | $499 | $999 | $1999 |

This evaluation is designed for traders who want to get funded as quickly as possible.

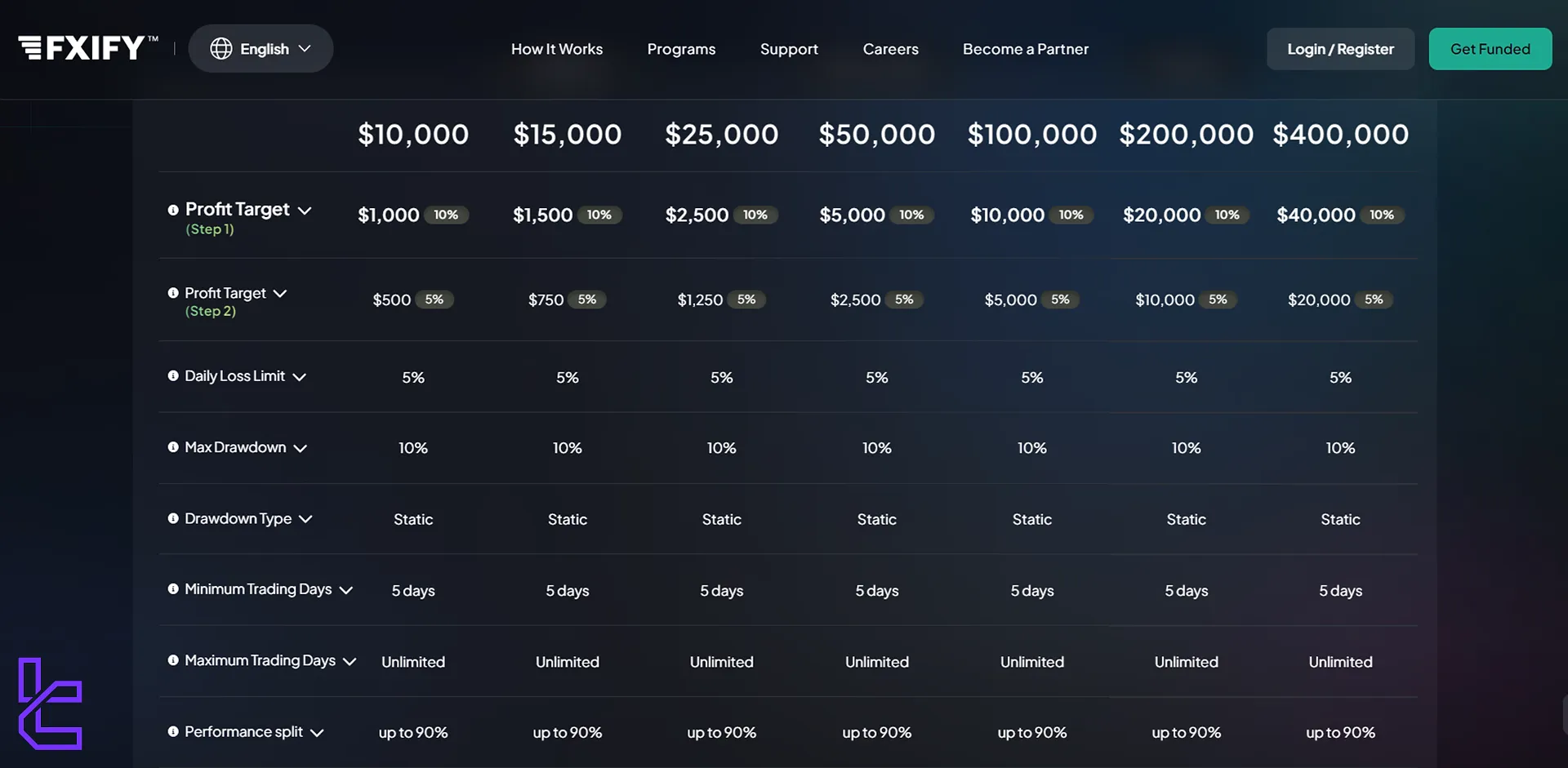

FXIFY Two-Phase Evaluation

The Two-Phase Program offers traders funding from $10,000 to $400,000, with a structured two-step challenge requiring a 10% profit target in phase one and 5% in phase two, combining flexibility, discipline, and profit splits up to 90%.

Funding amount | $10k | $15k | $25k | $50k | $100k | $200k | $400k |

Profit target step 1 | 10% | ||||||

Profit target step 2 | 5% | ||||||

Daily loss limit | 5% | ||||||

Max drawdown | 10% | ||||||

Drawdown type | Static | ||||||

Minimum trading days | 5 | ||||||

Maximum trading days | Unlimited | ||||||

Performance split | Up to 90% | ||||||

Leverage | 1:50 | ||||||

Refundable Fee | $85 | $115 | $199 | $375 | $499 | $999 | $1999 |

The 2-phase evaluation offers a standard approach for professional Forex to become a funded trader.

FXIFY Three-phase Evaluation

The Three-Phase Program provides traders with funding from $10,000 to $400,000, requiring profit targets of 10%, 5%, and 5% across three stages. With static drawdown, unlimited trading days, and up to 90% profit split, it promotes steady and consistent growth.

Funding amount | $10k | $15k | $25k | $50k | $100k | $200k | $400k |

Profit target step 1 | 10% | ||||||

Profit target step 2 | 5% | ||||||

Profit target step 3 | 5% | ||||||

Daily loss limit | 5% | ||||||

Max drawdown | 10% | ||||||

Drawdown type | Static | ||||||

Minimum trading days | 5 | ||||||

Maximum trading days | Unlimited | ||||||

Performance split | Up to 90% | ||||||

Leverage | 1:50 | ||||||

Refundable Fee | $85 | $115 | $199 | $375 | $499 | $999 | $1999 |

The 3-phase evaluation takes the longest to complete, but ensures a trader can have consistent trading results.

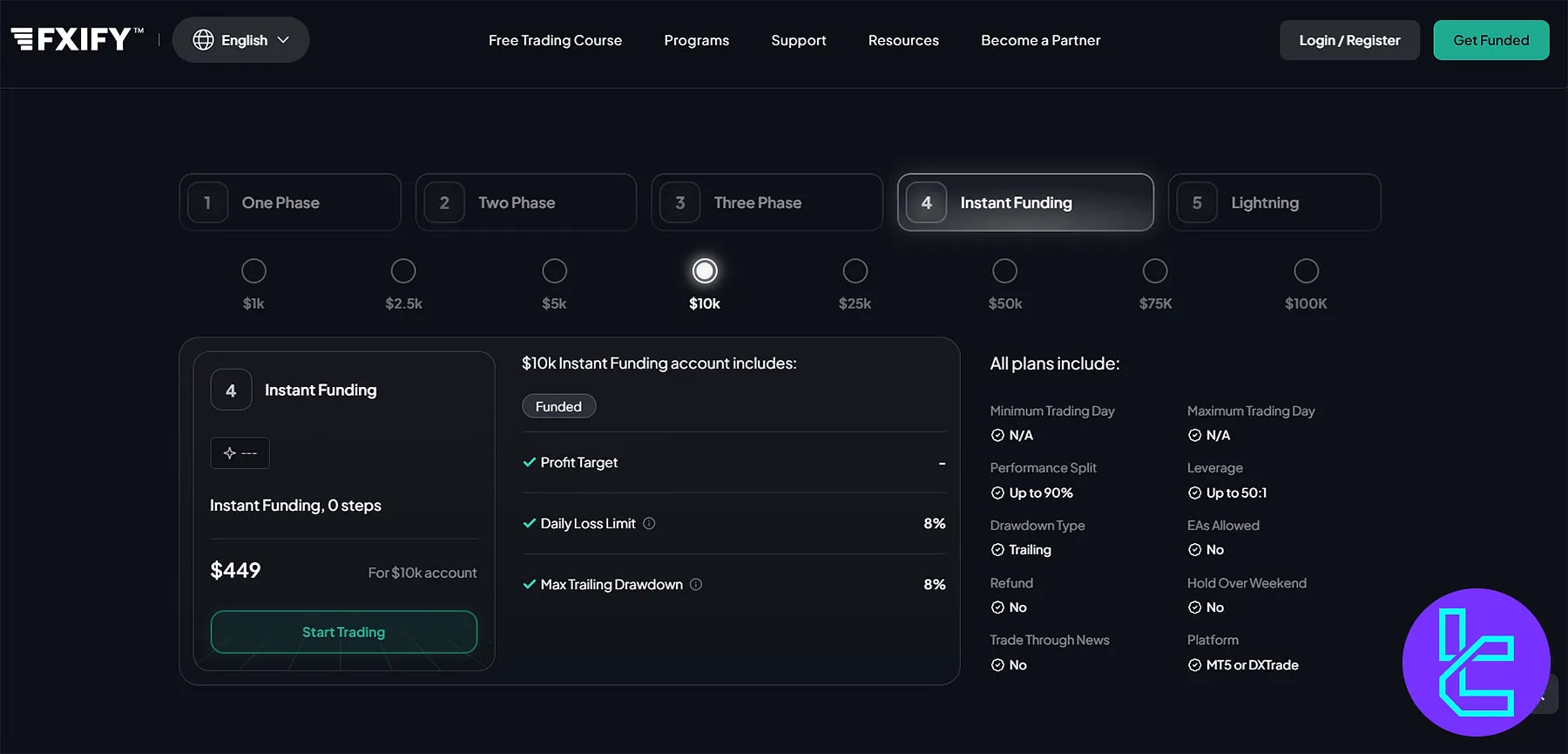

FXIFY Instant Funding

The Instant Funding program gives traders direct access to funded accounts with zero evaluation steps.

Offering up to 90% profit split, 1:50 leverage, and an 8% trailing drawdown, it’s designed for professionals seeking fast capital and seamless execution on MetaTrader 5 or DXtrade.

Parameter | Instant Funding |

Profit Target | - |

Daily Loss Limit | 8% |

Maximum Trailing Drawdown | 8% |

Profit Split | Up to 90% |

Maximum Leverage | 1:50 |

Trading Platform | MetaTrader 5 or DXTrade |

The instant funding model is perfect for traders who want to get funded as soon as possible, without passing evaluation challenges.

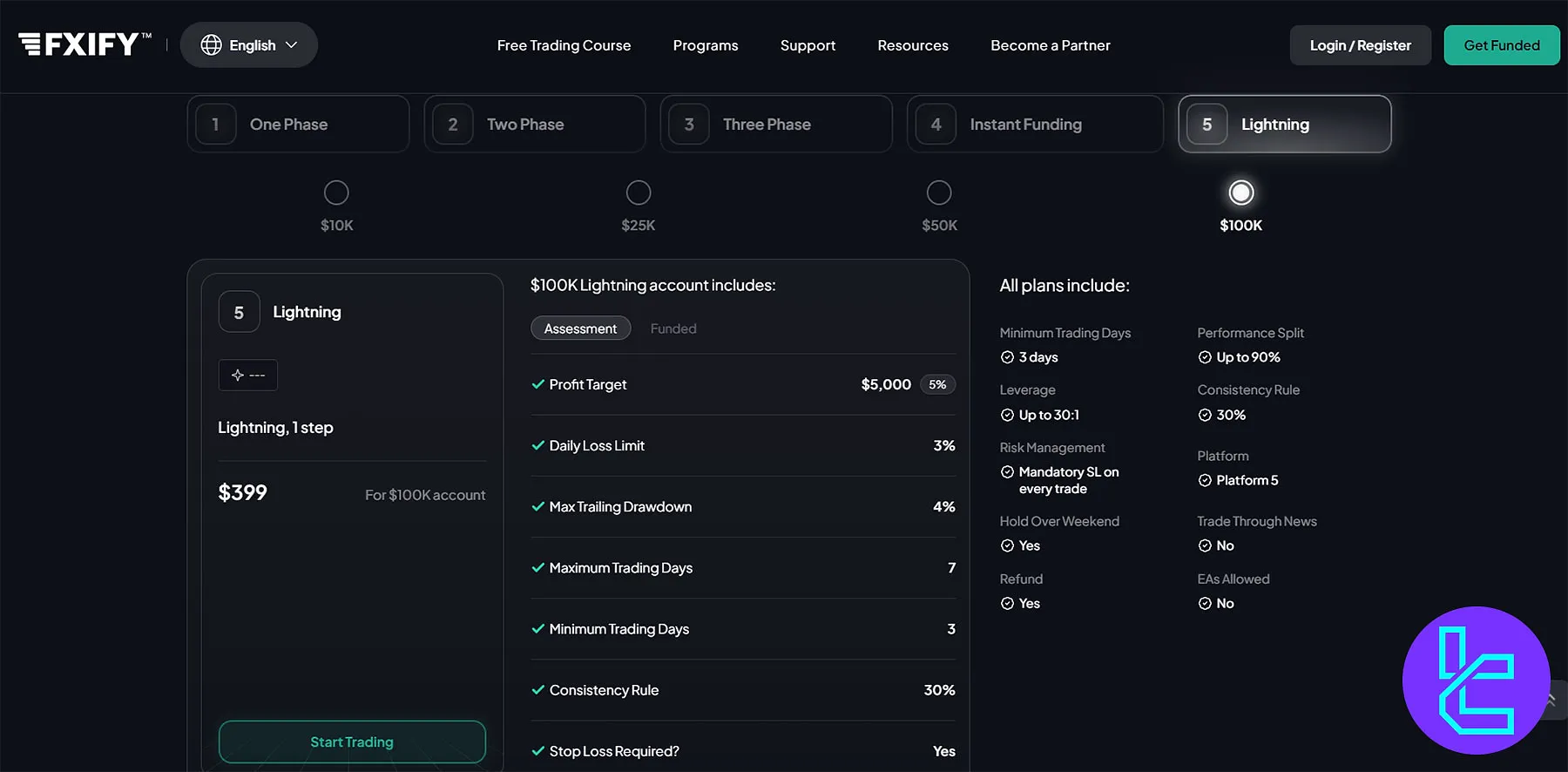

FXIFY Lightning Challenge

The Lightning program offers traders a fast-track funding option with just one evaluation step.

Featuring a $100K account, up to 90% profit split, 1:30 leverage, and mandatory stop-loss, it ensures disciplined risk management while enabling accelerated access to capital.

Parameter | Lightning Challenge |

Profit Target | 5% |

Daily Loss Limit | 3% |

Maximum Trailing Drawdown | 4% |

Profit Split | Up to 90% |

Maximum Leverage | 1:30 |

Minimum Trading Days | 3 Days |

Maximum Trading Days | 7 Days |

Consistency Rule | 30% |

The lighting challenge provides a fast-paced evaluation that allows traders to get funded as high as $100,000.

FXIFY Bonuses and Discounts

FXIFY offers an attractive affiliate program that offers various bonuses and discounts to partners. Here's a breakdown of the key features:

FXIFY Tiered Commission Structure

- Tier 1 (0-100 referrals): 10% commission per referral

- Tier 2 (100-500 referrals): 15% commission per referral

- Tier 3 (500+ referrals): 20% commission per referral

FXIFY Exclusive Rewards

- 50 paid referrals: Unlock a free $25K challenge account

- 250 paid referrals: Unlock a free $100K challenge account + bonus giveaway

- 500 paid referrals: Unlock a free $200K challenge account + bonus giveaway

FXIFY Discount Coupons

Tier 2 affiliates and above receive a unique 5% discount coupon to share with referrals. Traders can also use discount codes from their party websites.

FXIFY Rules and Trading Conditions

Understanding FXIFY policies and conditions helps traders avoid account termination due to violations. FXIFY Rules:

- VPN & Device Flexibility: You can use different devices and change IPs, as long as there are no multiple accounts on the same IP unless justified, and multiple users sharing the same Computer ID (CID) may raise concerns about account management or suspicious activity;

- Hedging Restrictions: Reverse and group hedging strategies, where offsetting positions are placed across accounts to minimize risk, are not allowed as they violate risk management rules;

- Expert Advisors (EAs) Usage: EAs, bots, and copy trading are prohibited in both theLightning Plan and Instant Funding accounts, as all trading must be manually managed by the trader;

- Gambling & Risk Strategies: High-Frequency Trading (HFT), latency arbitrage, and coordinated trading are not allowed, as these can manipulate the market and create unfair advantages;

- News Trading: Trading during news events is allowed, but traders must manage risks effectively due to potential slippage and increased volatility, or face penalties for improper risk management;

- Payout: FXIFY enables profit withdrawals with a $50 minimum, flexible frequency, and drawdown protection, via RISE or bank wire.

VPN and VPS Rules

FXIFY's policies offer flexibility when it comes to VPNs and devices. You are allowed to use different devices and change IPs, as long as no multiple accounts are using the same IP without proper justification.

However, the firm monitors CID (Computer ID), which is tied to specific devices, and if multiple users are associated with the same CID, it may raise concerns about account management or suspicious activity.

Hedging Terms and Conditions

In terms of hedging, FXIFY prohibits strategies like reverse or group hedging, where traders place offsetting positions across accounts to reduce market risk artificially.

Such strategies are seen as attempts to bypass risk management rules.

Are EAs Allowed in the FXIFY Prop Firm?

For Expert Advisors (EAs), FXIFY does not permit their use in the Lightning Plan or Instant Funding accounts. Traders in these plans are required to manage their trades to comply with program rules manually.

Any use of EAs, bots, or copy traders in these accounts can result in account termination.

Restricted Strategies

Regarding gambling and risk strategies, FXIFY does not allow high-frequency trading (HFT), which involves using algorithms to execute a large number of trades in fractions of a second, as it can lead to market manipulation and instability.

Additionally, exploiting price delays across platforms through latency arbitrage to gain an unfair advantage is strictly prohibited, as is coordinated trading, particularly when using the same EA across multiple accounts.

News Trading

While news trading is allowed, traders should be aware that higher volatility and lower liquidity during news events can affect trade execution, causing slippage or failure to fill at desired prices.

FXIFY advises traders to manage their risks properly during these periods, as improper risk management can lead to penalties or account bans.

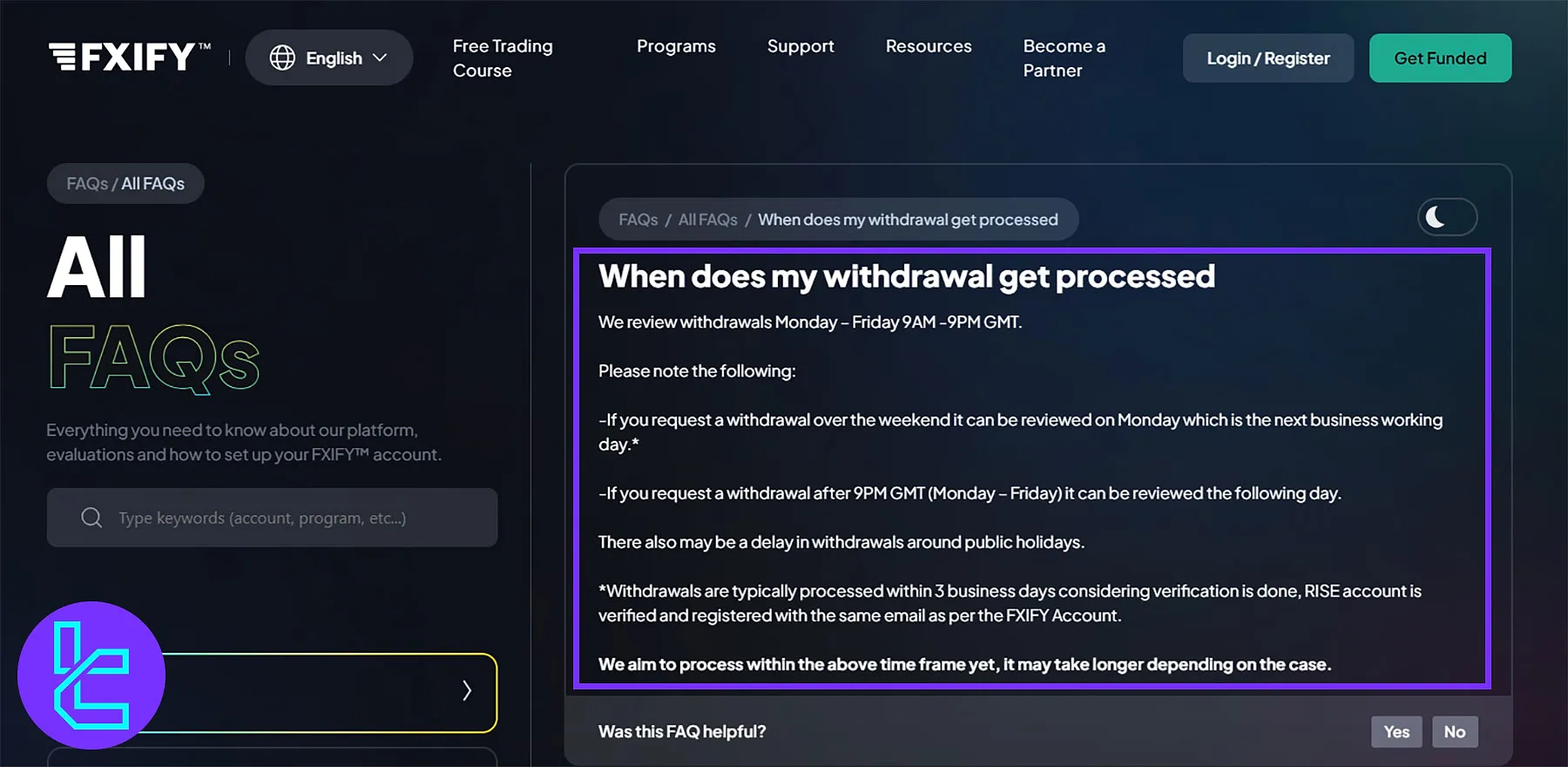

FXIFY Payout Policy

The FXIFY payout system is designed for flexibility and transparency, allowing traders to withdraw profits efficiently through RISE or bank wire (where applicable).

With a low minimum withdrawal and clear rules, FXIFY ensures fast processing while protecting account integrity.

- Minimum withdrawal: $50 across all accounts

- Processing time: Typically within 3 business days (Mon–Fri, 9AM–9PM GMT)

- Account types: 1, 2, and 3-Phase allow payouts after first profitable trade; Instant after 14 days; Lightning after 7 days

- Frequency: Monthly by default; bi-weekly with add-on

- Max Drawdown Rule: Locks at starting balance after payout, reducing profit buffer

- Availability: RISE not supported in IA, MN, SC, PR, GU, and U.S. Virgin Islands (bank wire is used instead)

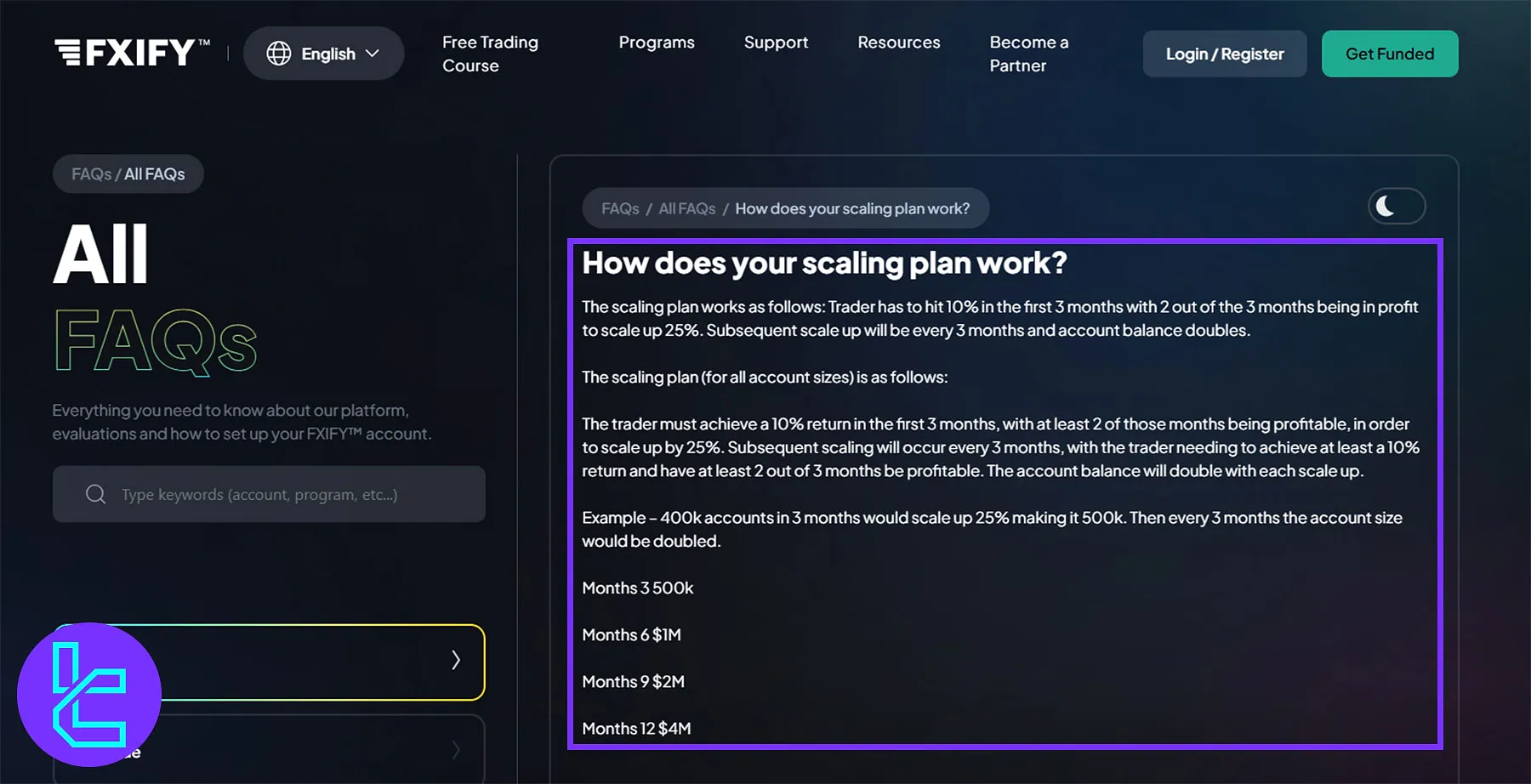

FXIFY Scaling Program

The Scaling Plan is designed to reward consistent traders by increasing funded capital every three months.

Traders who achieve a 10% return with at least two profitable months out of three can progressively grow their accounts, with balances doubling at each stage.

- Initial growth: 10% return in 3 months leads to +25% scale up;

- Ongoing scaling: Every 3 months with 10% profit, the balance doubles (except the first month with a 25% scaling);

- Long-term potential: $400k → $500k → $1M → $2M → $4M within a year;

- Eligibility: At least 2 of 3 months must close in profit.

FXIFY Trading Platforms

FXIFY provides traders access to industry-standard trading platforms, ensuring a familiar and reliable trading environment. The firm supports the following platforms:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- DXTrade

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Instruments & symbols Available for Trading on FXIFY

FXIFY offers a diverse range of trading instruments, providing traders with ample opportunities to diversify their portfolios and implement various trading strategies. Here's a breakdown of the available instruments:

- Forex

- Metal & Oils

- Indices

- Stocks

- Cryptocurrencies

FXIFY Leverage Offerings

The prop firm offers leverage options on CFDs, variable based on the funding program and the trading instrument:

Asset Class | 1-Phase | 2-Phase | 3-Phase | Instant Funding | Lightning |

Forex | 1:50 | 1:50 | 1:50 | 1:50 | 1:30 |

Metals | 1:30 | 1:30 | 1:30 | 1:20 | 1:10 |

Indices | 1:10 | 1:10 | 1:10 | 1:15 | 1:10 |

Oil | 1:5 | 1:5 | 1:5 | 1:5 | 1:10 |

Stocks | 1:2 | 1:2 | 1:2 | 1:2 | N/A |

Crypto | 1:2 | 1:2 | 1:2 | 1:2 | 1:1 |

Note: Leverage option for the following Forex pairs is fixed at 1:6.

- EURMXN

- EURTRY

- USDCNH

- USDCZK

- USDDKK

- USDHKD

- USDHUF

- USDILS

- USDMXN

- USDNOK

- USDPLN

- USDSEK

- USDSGD

- USDTRY

- USDZAR

FXIFY Payout Methods

FXIFY utilizes Rise as its primary payment processor for both affiliate and prop trader payouts. This streamlined approach ensures a consistent and efficient payment system for all users. FIXIFY has bi-weekly payouts, and challenge fees are withdrawable in the first payout.

FXIFY Commission & Costs

FXIFY offers a competitive fee structure designed to maximize trader profitability while maintaining high-quality services. Here's a breakdown of the commission and costs associated with trading on FXIFY:

Spreads:

- Raw spreads starting from 0.0 pips

- Option to choose between RAW or all-in pricing

Commissions:

- Commission-free trading on most instruments

- Small commission on stock CFDs (check current rates on the FXIFY website)

FXIFY Educational Resources

Unfortunately, FXIFYdoesn't offer educational resources. Novice traders who want to join this platform must consider this before buying a challenge in FXIFY prop Firm.

There are several other Prop Firms with comprehensive educational resources, including City Traders Imperium, FTMO, Goat Funded Trader, and My Funded FX.

You can check TradingFinder's Forex education section for comprehensive learning materials.

FXIFY Trust Scores

Trust is paramount when choosing a prop firm, and FXIFY's Trustpilot shows its commitment to trader satisfaction. This prop firm received a 4.3/5 score on the FXIFY Trustpilot website, and traders praised it for providing excellent services.

FXIFY Prop Customer Support

FXIFY understands the importance of robust customer support in the fast-paced world of trading. Their support structure includes:

Support Method | Availablity |

Live Chat | Yes (24/5) |

Yes (support@fxify.com) | |

Phone Call | No |

Discord | Yes |

Telegram | No |

Ticket | Yes |

FAQ | Yes |

Help Center | No |

No | |

Messenger | No |

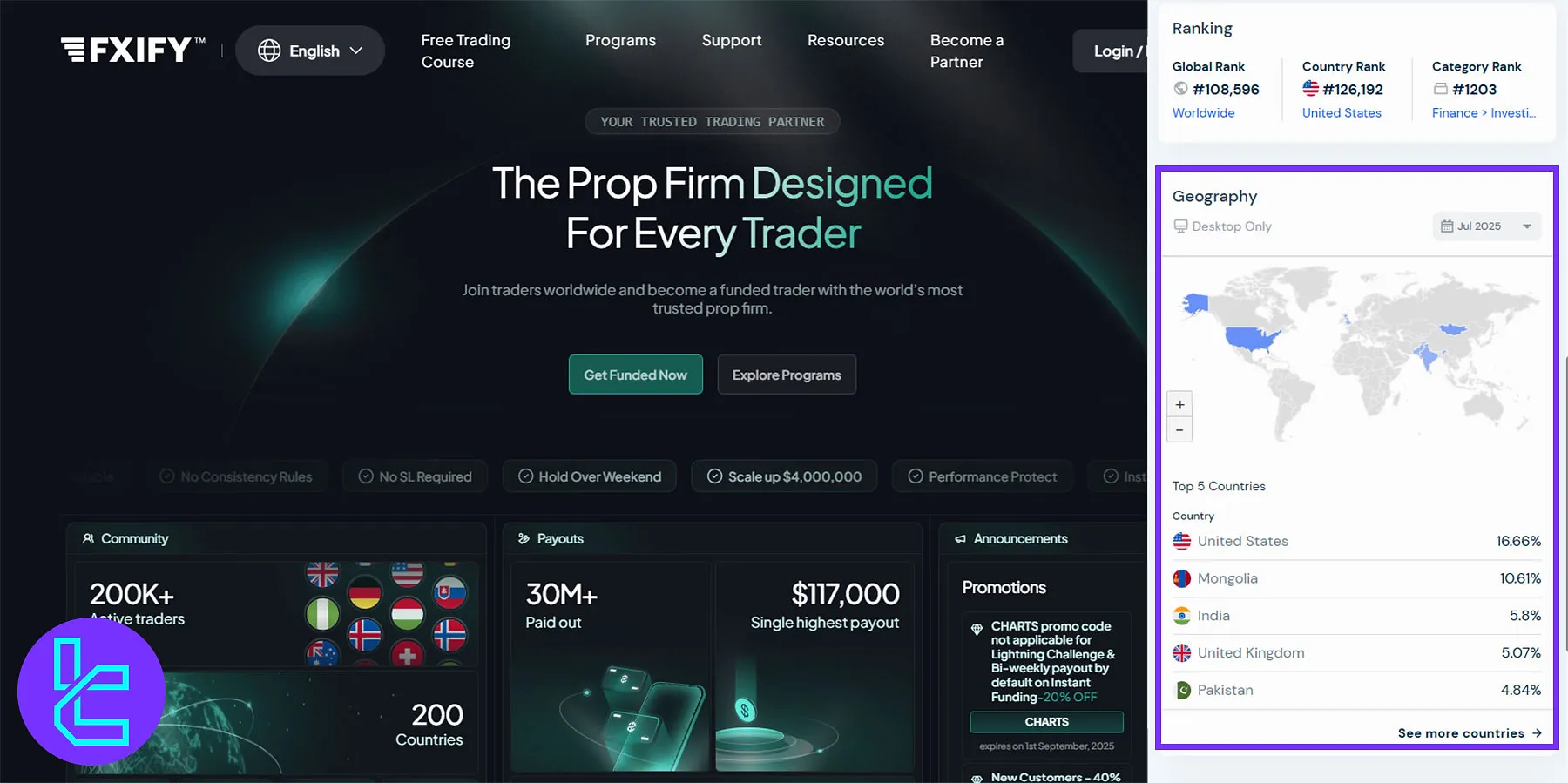

FXIFY User Base

The prop firm's user base spans more than 200 countries, with over 200,000 active traders worldwide.

Ranked globally at #108,596, FXIFY has built a strong presence, particularly in the United States, Asia, and Europe, reflecting its global trader appeal.

- United States: 16.66%

- Mongolia: 10.61%

- India: 5.8%

- United Kingdom: 5.07%

- Pakistan: 4.84%

FXIFY Social Media channels

FXIFY leverages social media to engage with its trading community.

Social Media | Members/Subscribers |

1.3K | |

30.3K | |

81.2K | |

6,727 | |

40,238 |

By maintaining an active social media presence, FXIFY keeps its trader community informed and engaged, fostering a sense of belonging among its users.

FXIFY Compared To Other Prop Firms

Traders can check the table below to understand the pros and cons of trading with FXIFY compared to other well-known prop firms.

Parameters | FXIFY Prop Firm | |||

Minimum Challenge Price | $39 | $49 | $55 | $50 |

Maximum Fund Size | $400,000 | $100,000 | $300,000 | $100,000 |

Evaluation steps | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 90% | 90% | 80% | 90% |

Max Daily Drawdown | 5% | 3% | 4% | 4% |

Max Drawdown | 10% | 6% | 6% | 6% |

First Profit Target | 10% | 9% | 8% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:50 | 1:125 | 1:100 | 1:5 |

Payout Frequency | Bi-weekly | Bi-weekly | Bi-weekly | Bi-weekly |

Number of Trading Assets | Not Specified | Not Specified | 200+ | 100+ |

Trading Platforms | MetaTrader 4, MetaTrader 5, DXTrade | DXTrade, TradeLocker, cTrader | Metatrader 5, CFT Platform and Crypto Futures | Proprietary |

TF Expert Suggestion

FXIFY's wide range of available instruments (over 300) and bi-weekly payouts have made this prop trading platform popular among traders.

However, traders must consider the maximum drawdown limits on 1-step (6%), 2-step (10%), and 3-step (10%) accounts and manage their risk accordingly.