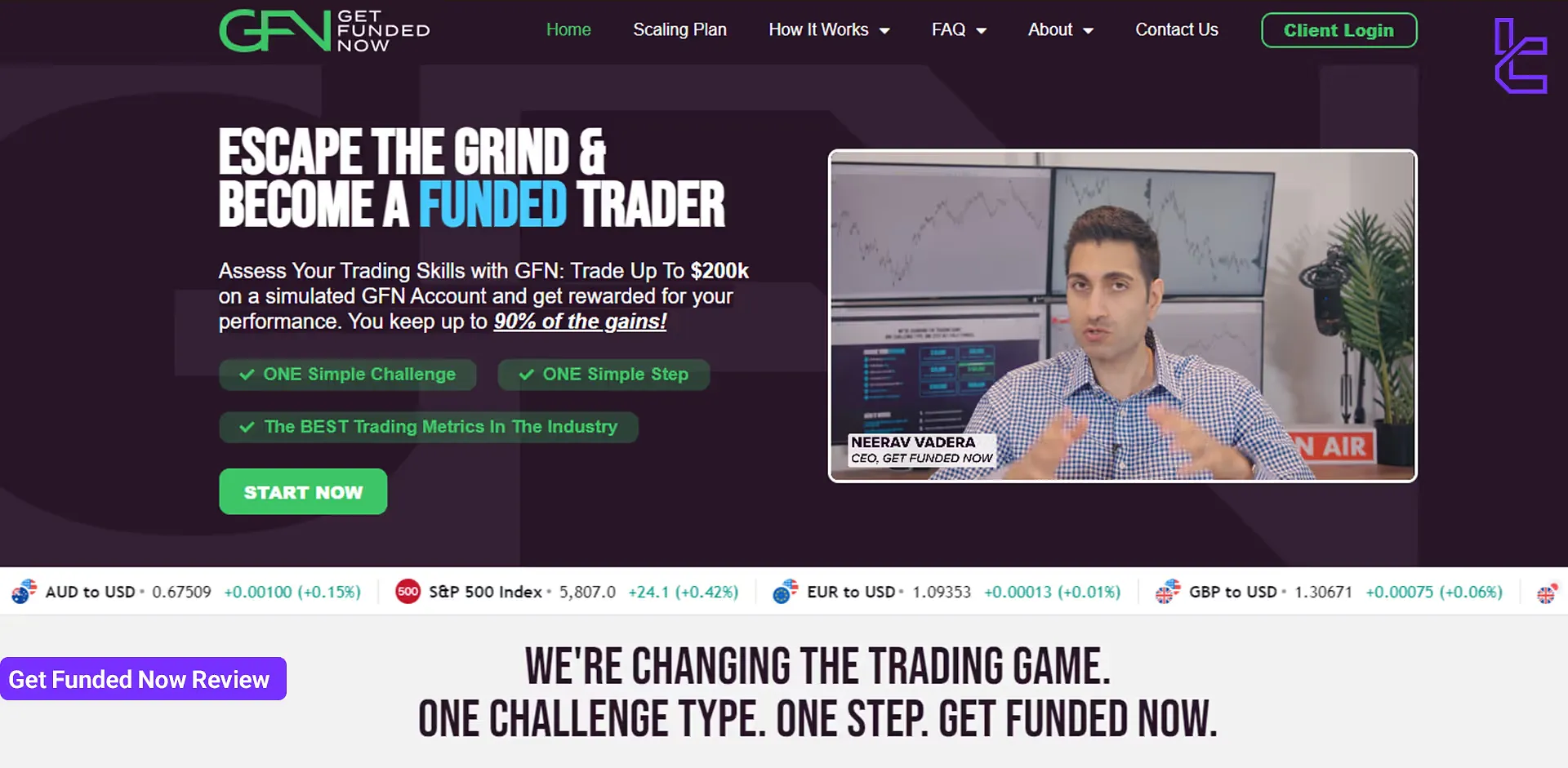

Get Funded Now offers one-step challenges at prices ranging from $149 to $1,143 to help traders get funded up to $200k and receive 90% of the profits they make on GFN-funded accounts.

This prop firm has a 4.4 score from over 120 reviews on the Trustpilotwebsite and is favored by many traders.

Get Funded Now Company Details Overview

Get Funded Now is a proprietary trading firm that has gained quite a reputation in the industry with its trader-friendly approach. Founded by an ex-institutional trader with experience managing a significant portion of global Forex volume, GFN aims to change how prop firms operate.

Here's an overview of the information you should know about Get Funded Now:

- Founder: Neerav Vadera

- Founding location: United Arab Emirates

- Account sizes: from $10,000 up to $200,000

- Parent company: TIGOGI – FZCO Group

Get Funded Now Prop Firm CEO Introduction

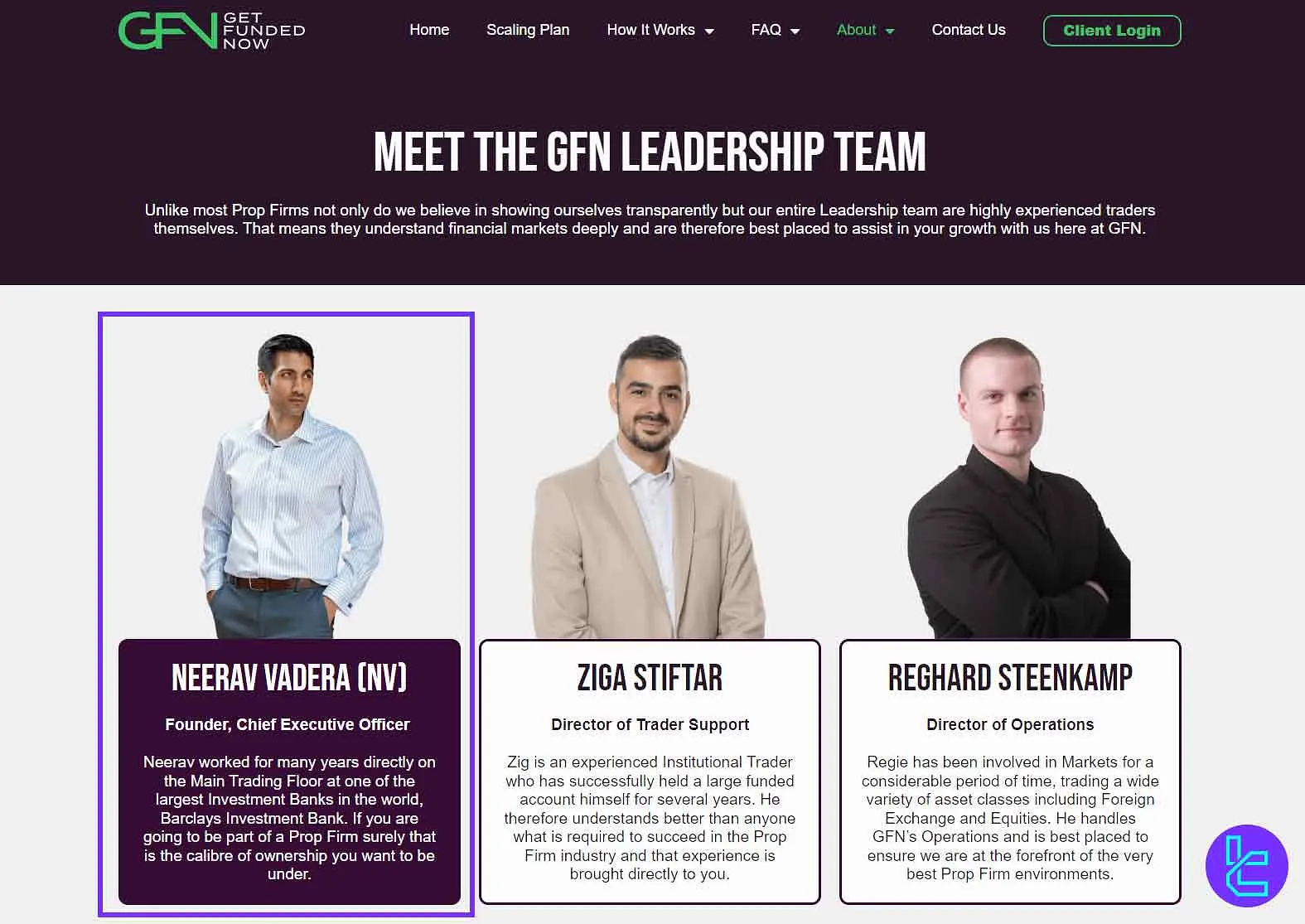

Neerav Vadera (NV) leads Get Funded Now with a background built on years of trading directly inside one of the world’s largest investment banks, Barclays Investment Bank.

His experience on the Main Trading Floor shapes the firm’s transparent structure, fast execution standards, and trader-first policies. Under his leadership, GFN operates with a clear focus on providing a reliable path for funded trading, supported by an experienced institutional-grade team.

You can connect with Neerav through the link here:

Get Funded Now (GFN) Specifications

Let's dive deeper into what makes Get Funded Now stand out in the crowded prop firm landscape:

Account currency | N/A |

Minimum price | $149 |

Maximum leverage | 1:20 |

Maximum profit split | 90% |

Instruments | Forex, crypto, indices, commodities |

Assets | EUR/USD, Bitcoin, S&P 500, Gold, Oil |

Evaluation steps | 1 |

Trading platform | Match-Trader |

Withdrawal methods | Rise, ACH, bank wired, crypto |

Maximum fund size | $200,000 |

First profit target | 10% |

Maximum daily loss | 5% |

Challenge time limit | Unlimited |

News trading | Yes |

Maximum total drawdown | 10% |

Commission per round lot | 5% |

Trust pilot score | 4.4/5 |

Payout frequency | N/A |

Established country | United Arab Emirates |

Established year | N/A |

Get Funded Now Prop Benefits & Drawback

Like any trading service, Get Funded Now has its strengths and potential drawbacks. Let's break them down:

Advantages | Disadvantages |

Simple, one-step evaluation process | High challenge fees |

No minimum trading days or time limits | $5 commission on metals and Forex |

High profit split (up to 90%) | Lack of access to major trading platforms |

No commission on crypto, indices, and oil | - |

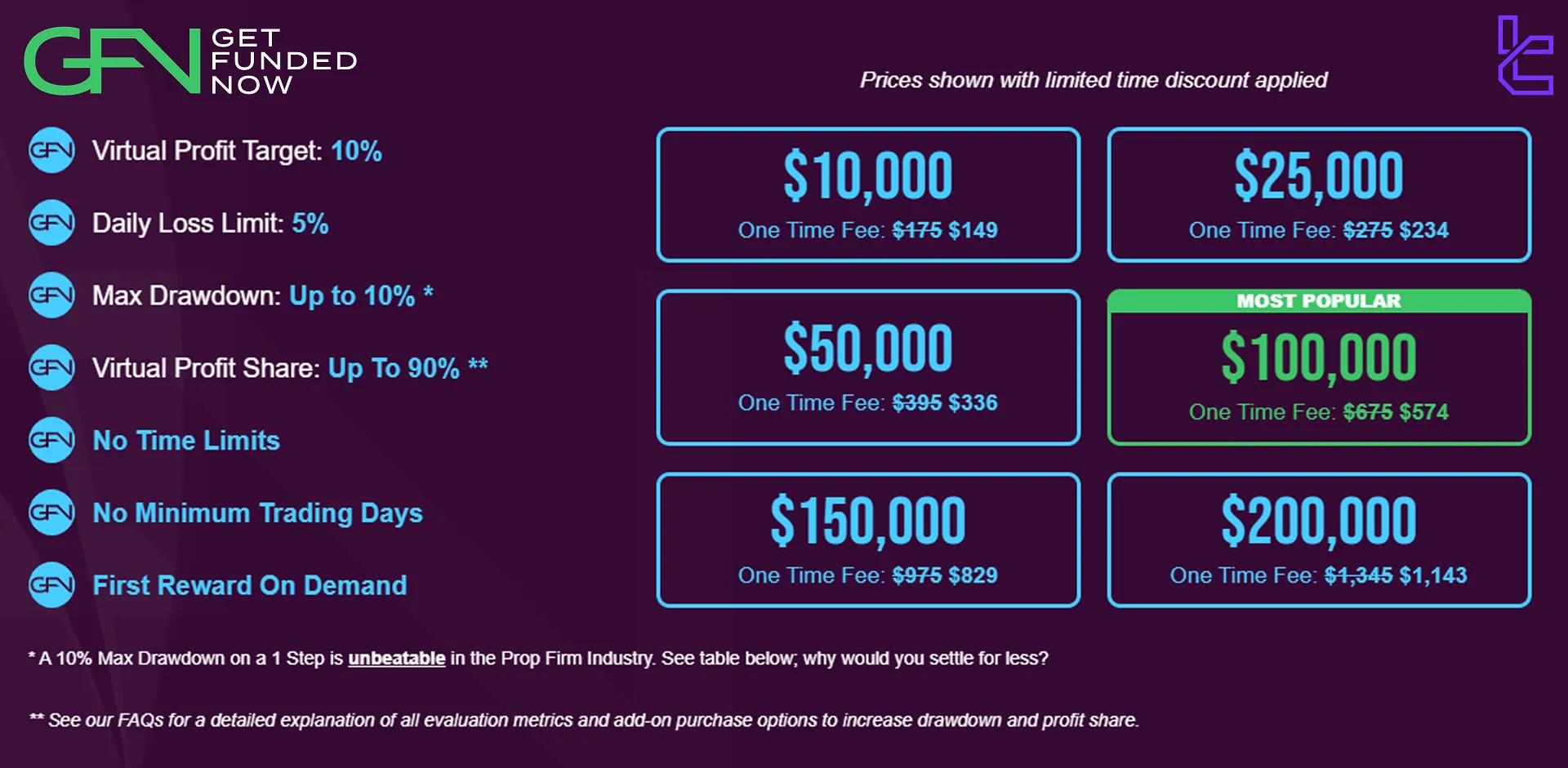

GFN Prop Account sizes and challenge fees

GFN offers a range of virtual account sizes to suit different trader needs and budgets. Here's a breakdown of their pricing structure:

Funding size | $10,000 | $25,000 | $50,000 | $100,000 | $150,000 | $200,000 |

Evaluation price | $149 | $234 | $336 | $574 | $829 | $1,143 |

The prices for lower account sizes are generally higher than industry average while for larger accounts the prices becomes more reasonable.

Get Funded Now Account Opening and Verification Full Guide

To open an account with the GFN prop firm, follow the steps below. Get Funded Now registration:

#1 Visit the Official Website

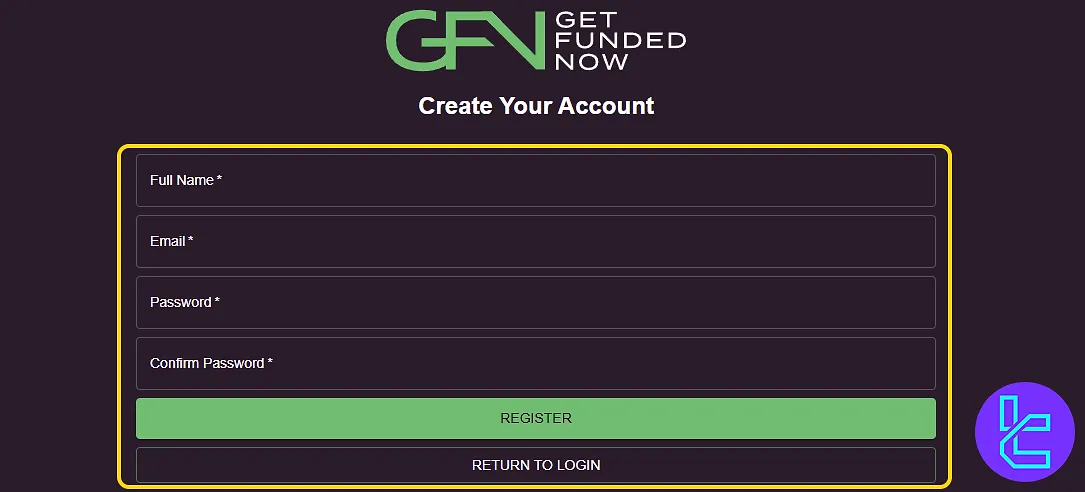

Start by heading to the official Get Funded Now website. Click on “Client Login”, then choose “Create an Account” to launch the onboarding form.

#2 Fill in Personal Information

Provide your first and last name, a valid email address, and create a strong password that meets standard security criteria (use of uppercase, lowercase, digits, and symbols).

#3 Enter Full Residential Address

Input your country, city, state, postal code, and any additional address lines. Accurate location data helps ensure proper account configuration and compliance.

After registration, traders must provide the necessary documents to verify their identity before submitting withdrawal requests.

Get Funded Now Evaluations Review

Unlike many prop firms that use multi-step challenges, GFN keeps things simple with a single-step evaluation.

Account Size | $10,000 | $25,000 | $50,000 | $100,000 | $150,000 | $200,000 |

Maximum daily drawdown | 5% | |||||

Maximum overall drawdown | 10% | |||||

Profit target | 10% | |||||

Profit split | 90% | |||||

Minimum and maximum trading days | No | |||||

Minimum challenge fee | $149 | $234 | $336 | $574 | $829 | $1,143 |

Get Funded Now offers a competitive profit split of up to 90% for funded traders, aligning well with top-tier prop firm standards. Payouts begin just 7 days after funding, with ongoing profits distributed every two weeks.

GFN also features a structured scaling plan, allowing traders to increase their account size up to$2,000,000. Scaling is not application-based, instead, the firm automatically upgrades accounts based on internal evaluations of:

- Consistency in returns

- Risk management discipline

- Profitability over time

This system rewards high-performing traders without requiring extra bureaucracy or paperwork.

GFN Bonuses and Discounts

Get Funded Now offers its challenges at a 15% discount for a limited time. This prop firm also offers a 20% discount code for traders who fail the first time but want to try again. This approach incentivizes traders to avoid getting discouraged by failure.

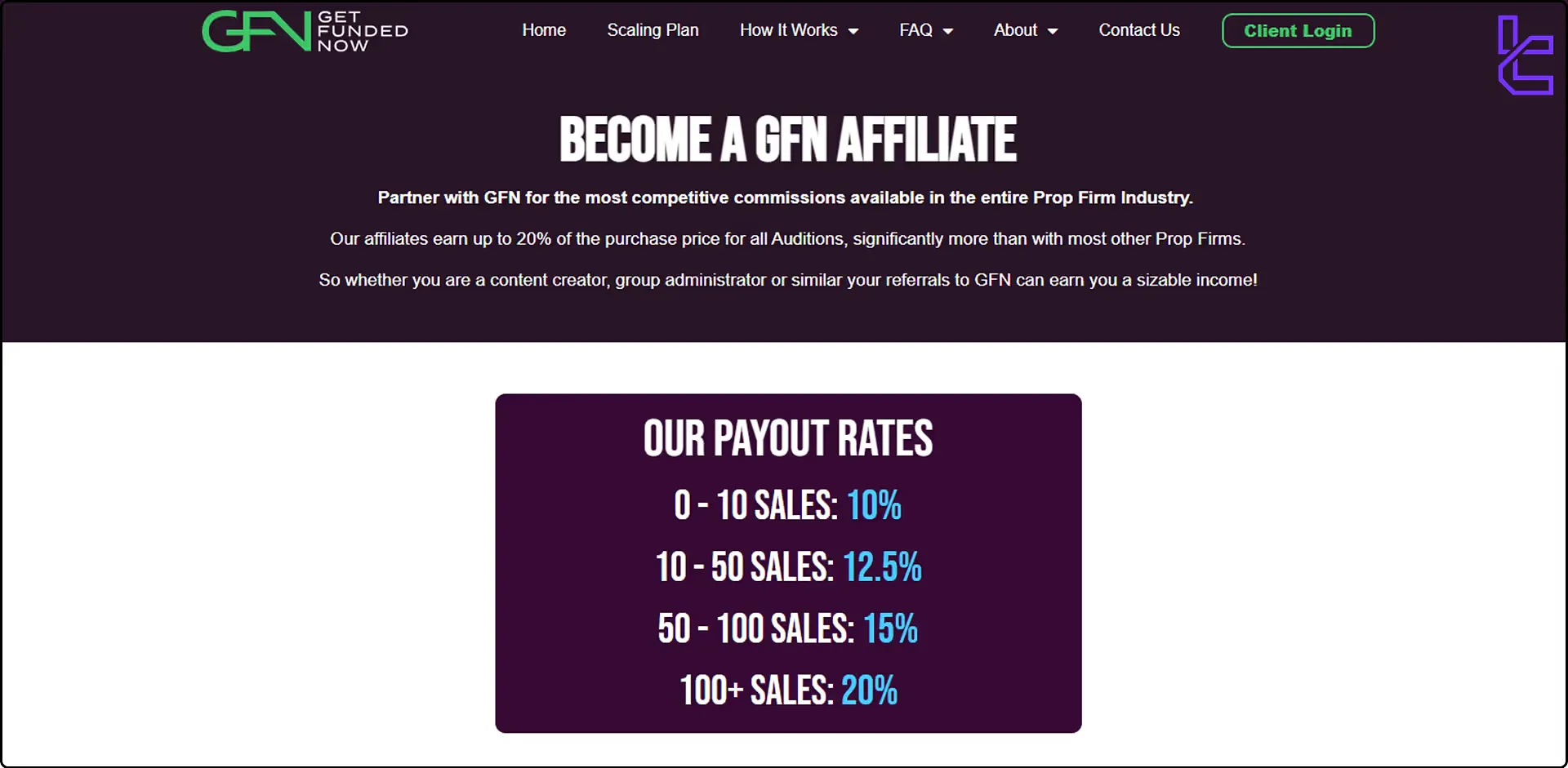

The GFN affiliate program is another way you can earn money from Get Funded Now. Traders with a following can share their affiliate links and earn up to 20% commission for signing new traders to the platform.

Get Funded Now Rules

Get Funded Now has set some ground rules and conditions to safeguard the funded accounts and encourage traders to manage their risks effectively. Get Funded Now rules:

- VPN and VPS: While using a VPN or VPS for trading isn't strictly prohibited, it may raise concerns if any suspicious activities are detected on your account. It’s important to note that such tools can complicate account monitoring, and their use may affect how violations of terms are assessed;

- Hedging: Hedging strategies, including arbitrage and grid trading, are not allowed due to their potential to create risk-free profits or violate market principles, even within simulated environments;

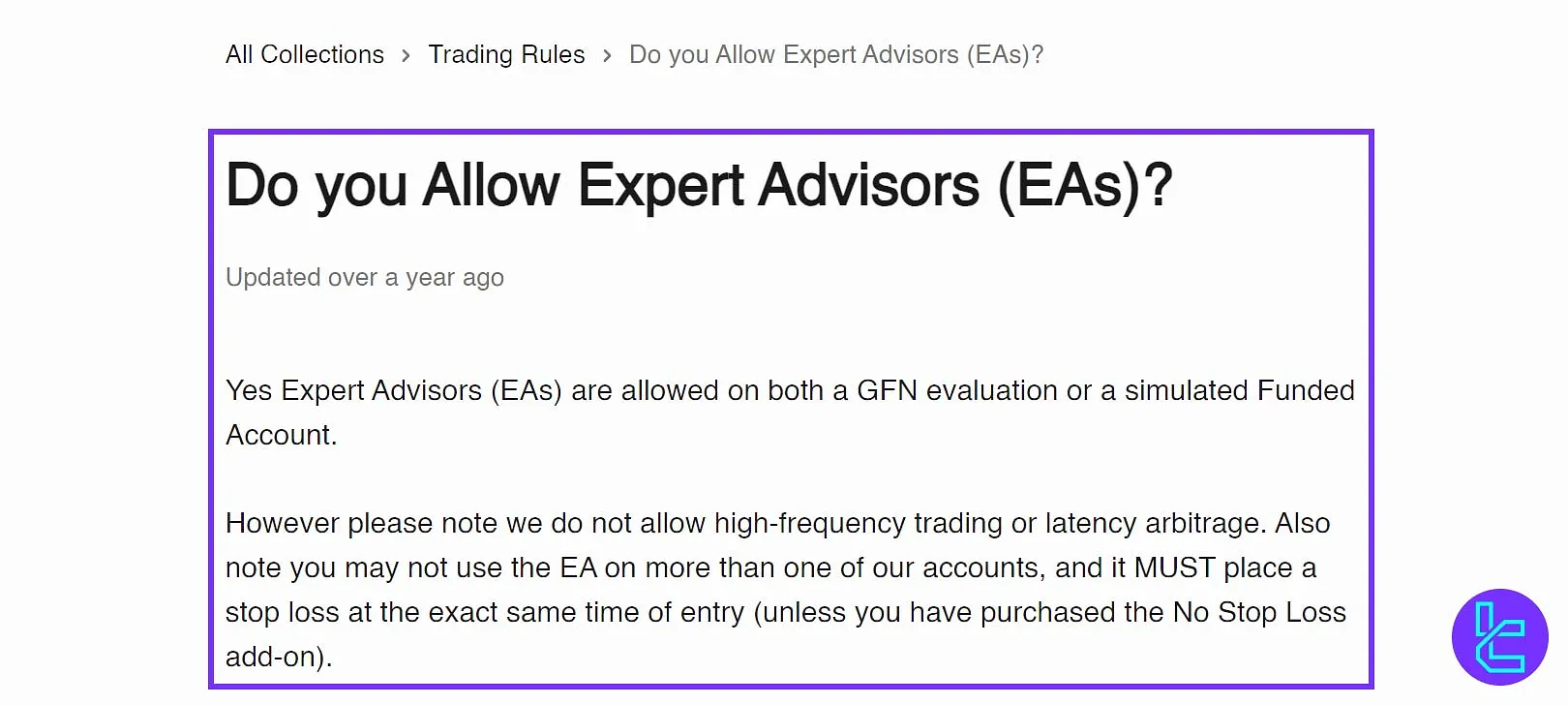

- Expert Advisors (EAs): EAs are permitted, but high-frequency trading (HFT) and latency arbitrage are not allowed. It’s essential to use them responsibly with proper risk management in place;

- Gambling and Risk Strategies: Strategies like high-frequency trading, grid trading, and Martingale are prohibited due to their potential for manipulation and high-risk outcomes;

- News Trading: There are no restrictions on news trading during the evaluation phase, but specific rules apply when trading around high-risk news events, like the Forex Factory Calendar’s “red label” news, which can affect trade validity;

- Payouts: Payouts at Get Funded Now are on-demand via Rise, processed in 48–72 hours, with a ten thousand dollar cap on the first two withdrawals and a Max Drawdown reset after the first payout.

VPN and VPS Usage in Trading

Although using a VPN or VPS isn’t outright banned, it can complicate account tracking and raise red flags if any suspicious activities are found.

All traders, particularly those involved in GFN evaluations, are expected to trade independently. For this reason, it’s discouraged to access accounts via VPN or VPS, as it hinders proper monitoring of data within internal systems.

That said, the use of VPNs and VPSs is not strictly prohibited; however, any questionable actions linked to these tools will heavily influence the evaluation of any potential violations.

Hedging

Hedging (placing opposite trades across multiple accounts with the aim of avoiding significant risk) is not allowed on GFN platforms.

These tactics violate market principles, and in the case of firms, it results in simulated profits on one account while incurring losses on the other, effectively creating risk-free profits.

Expert Advisors (EAs) Usage

Expert Advisors (EAs) are allowed on GFN platforms for bothevaluation and funded accounts. However, they must be used with caution. Additionally, EAs should not be used on multiple accounts, and they must include a stop-loss at the same time as entry, unless the “No Stop Loss” add-on has been purchased.

Prohibited Risk Strategies

Certain trading strategies are deemed too risky or manipulative under GFN’s terms and conditions:

- High-Frequency Trading (HFT): Prohibited due to its reliance on advanced algorithms to execute large numbers of trades in microseconds, which can lead to market manipulation and instability;

- Latency Arbitrage: Exploiting delays between trade execution and market data reception is prohibited, as it creates an unfair advantage;

- Grid Trading: This involves placing reverse buy and sell orders to potentially generate profits from market movements without taking real risk. It leads to over-leveraging and market instability, making it an illegal practice on GFN platforms;

- Martingale Strategy: A highly risky method where traders double their investments after each loss, hoping a win will recover previous losses. This method is considered gambling and can result in substantial losses due to its reliance on infinite capital.

News Trading Regulations

During the GFN evaluation phase, traders are free to trade around news events, including holding positions over weekends.

However, for simulated Funded Accounts, trades placed within a three-minute window before or after high-risk news releases (marked as “red label”on Forex Factory) will not count towards the trader’s balance.

Only the trade profits within this restricted timeframe will be removed, allowing the trader to continue as usual.

This rule is designed to encourage proper risk management and help traders build consistent strategies, ultimately increasing their chances of success and long-term payouts.

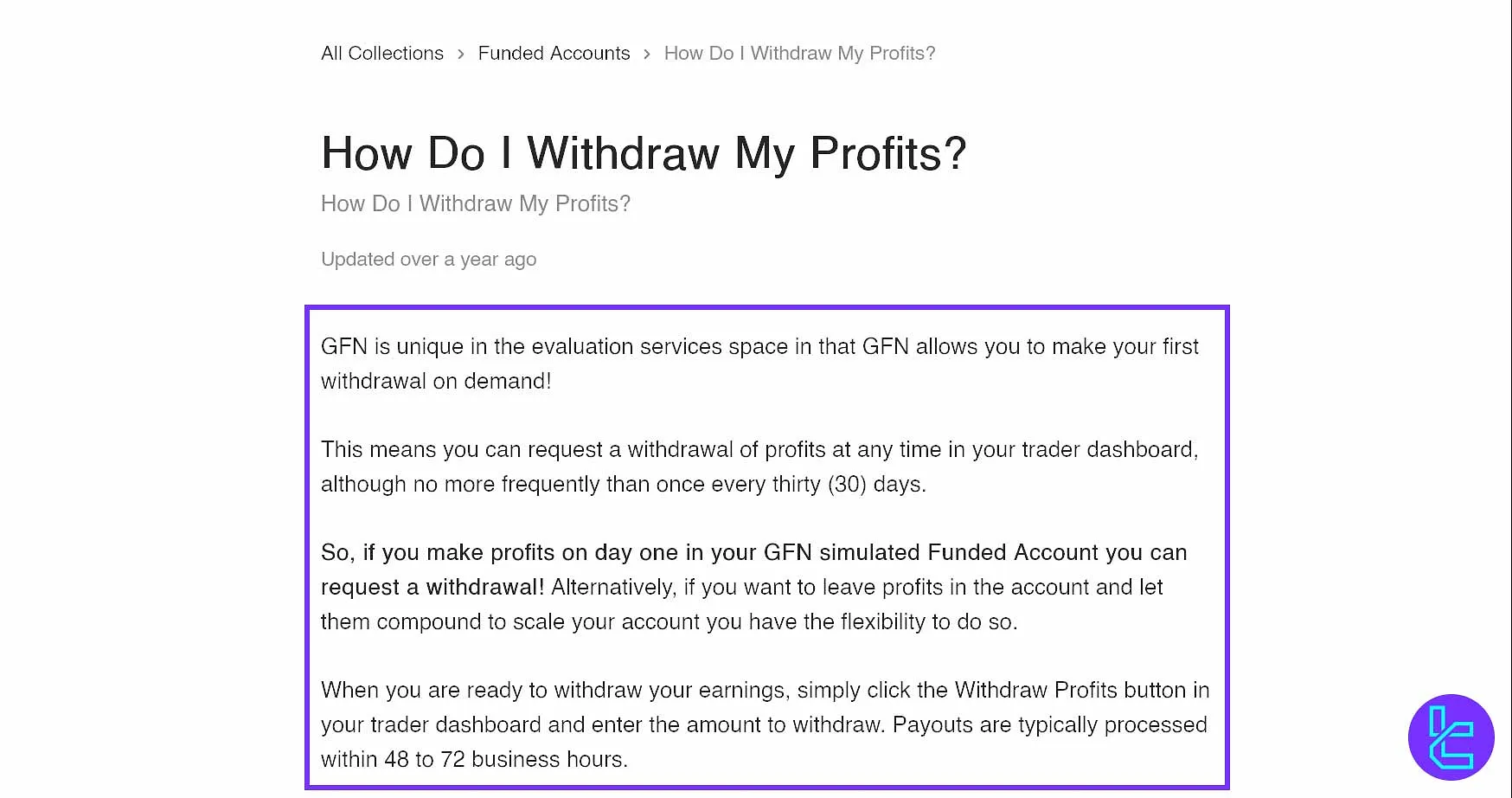

Payouts

Get Funded Now allows traders to request payouts on demand, with profit withdrawals available anytime through the trader dashboard, provided the request is not made more than once every 30 days.

The firm processes all payouts through Rise, giving traders flexibility to receive their profits via bank wire or crypto. Typical processing times range from 48 to 72 business hours.

For the first two payout requests, GFN applies a ten thousand dollar limit to ensure trader performance and risk behavior can be properly assessed at the start of the challenge. After these first two withdrawals, traders can withdraw any amount from their account, with only excess profits above the initial limit being deducted from the account balance.

Once a withdrawal is approved, GFN also deducts its share of the earnings based on the trader’s profit split. After the first payout, the Max Drawdown resets to the starting balance, enabling traders to compound growth and work toward larger future payouts while maintaining compliance with risk rules.

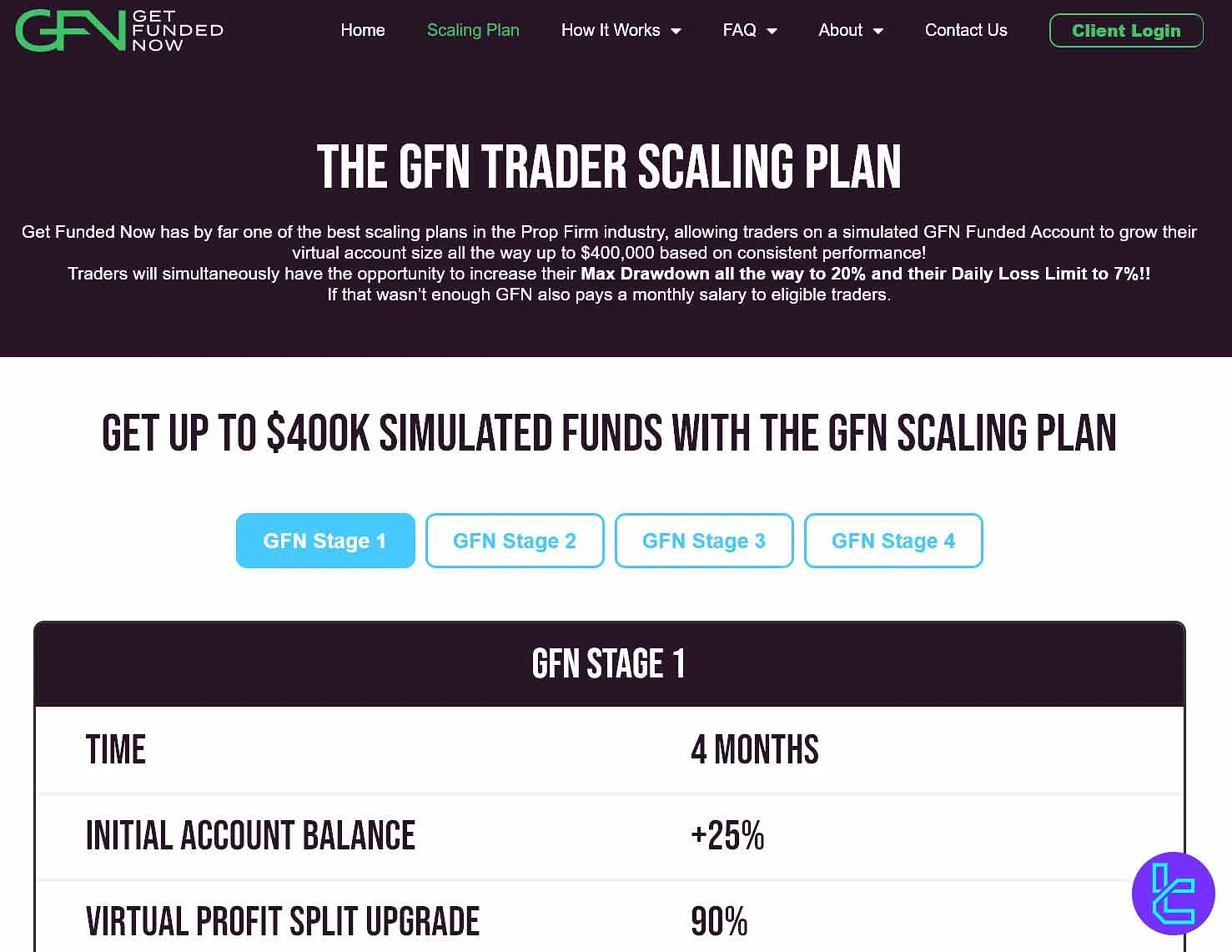

GFN Scaling Plan Details

The GFN Trader scaling plan outlines a multi-stage growth framework that allows participants to expand their simulated account size over time. Under this model, traders who meet the required performance metrics can gradually scale an initial GFN Funded Account toward higher virtual capital limits, potentially reaching up to $400,000.

The plan also integrates incremental adjustments to Max Drawdown and Daily Loss thresholds, which may extend to 20% and 7% when all scale conditions are met. Some stages additionally include eligibility for a monthly salary.

GFN Stage 1 covers a 4-month assessment window. During this period, the virtual account balance may increase by 25%, and the profit-split level is set at 90%. A free challenge option is not included at this point. The program may provide up to $500 in monthly compensation for qualifying traders.

Drawdown parameters begin with a 2% increase in Max Drawdown relative to the starting level and a 1% increase in Daily Drawdown, both of which are expandable in later stages.

To advance within the scaling model, the trader is expected to achieve an average monthly gain of 4% throughout the 4-month cycle, while maintaining a minimum performance of 2% in each individual month.

Additionally, at least 3 withdrawals must be completed during the same period. Once these requirements are met, traders can request an account review from Get Funded Now through official support channels.

Earnings above 5% per month are not fully applied to the scaling calculation; only 5% of any monthly return is counted toward the required average. Get Funded Now also retains the discretion to withhold a scale-up if necessary, based on internal evaluation of simulated Funded Accounts.

Get Funded Now Trading Platforms

Get Funded Now gives traders access to a range of popular platforms, including:

- MetaTrader 4 (MT4): legacy platform known for EA support and fast execution

- MetaTrader 5 (MT5): multi-asset successor to MT4 with advanced features

- TradeLocker: browser-based modern trading terminal with social features and sleek UI

Traders can select their preferred platform during challenge registration.

GFN Markets & Symbols

GFN offers a range of tradable instruments to suit various trading styles:

- Forex pairs

- Silver

- Gold

- Oil

- Indices

- Cryptocurrencies

GFN instruments arelimited compared to other famous prop firms.

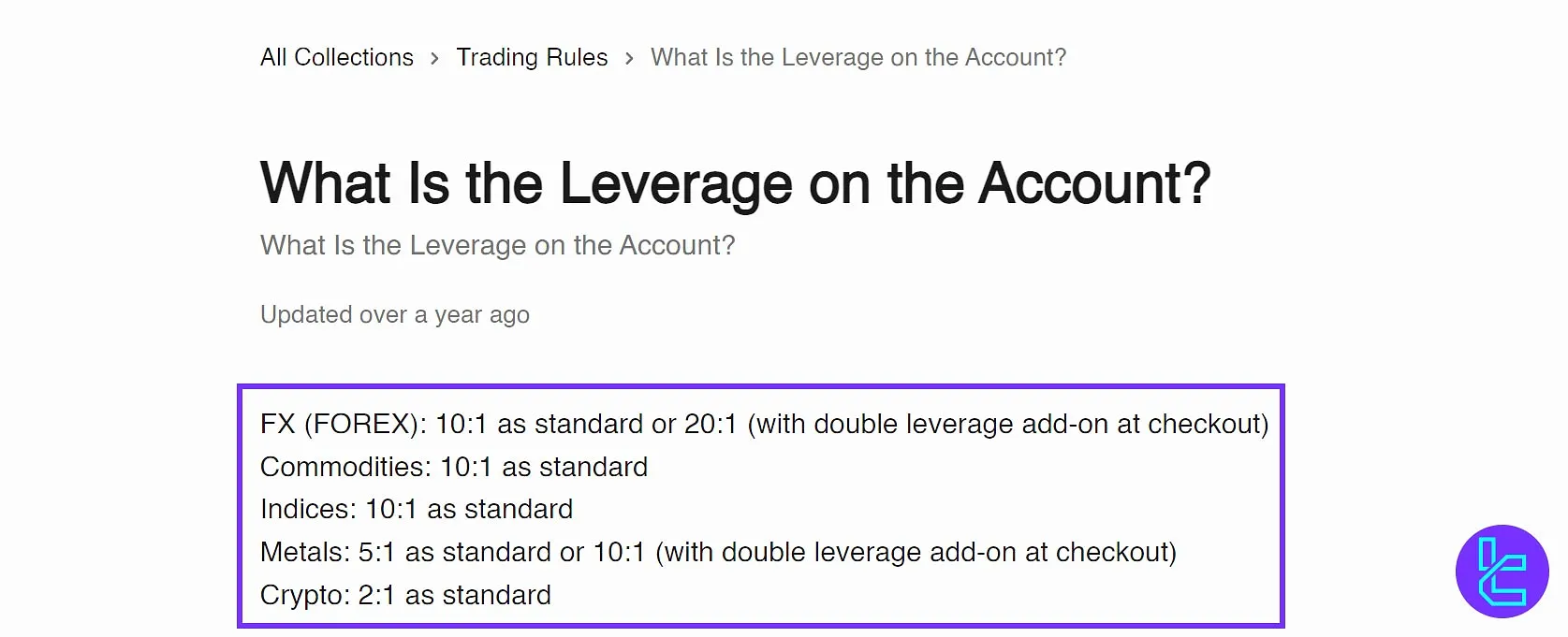

Get Funded Now Leverage Specifics

Get Funded Now offers asset-specific leverage tiers that keep risk controlled while still giving traders enough margin flexibility during challenges and funded phases.

The firm applies fixed ratios across FX, commodities, indices, metals, and crypto, with optional leverage upgrades available at checkout for certain assets.

- FX pairs come with 10:1 leverage by default, with the option to increase to 20:1 through the double-leverage add-on;

- Commodities and major indices trade at a standard 10:1 ratio;

- Metals operate at 5:1, or 10:1 when the leverage upgrade is selected;

- Crypto assets are capped at 2:1 for stability and volatility control.

Get Funded Now Prop Payment and Payout Methods

GFN understands the importance of convenient and secure payment options.

Payment methods:

- Credit/debit cards

- Cryptocurrencies

Withdrawal methods:

- Rise

- ACH

- Bank wired

- Crypto

Get Funded Now offers fast and consistent profit payouts for funded traders. The first withdrawal becomes available just 7 days after funding, while all subsequent payouts are scheduled on abi-weekly (14-day) cycle. No withdrawal fees are charged by the firm, ensuring traders receive their full share.

Additionally, the challenge fee is refundedalongside the first payout, further reinforcing GFN’s performance-based model.

Get Funded Now Prop Firm Commission & Costs

GFN's commission structure is designed to be trader-friendly:

- No ongoing fees after passing the evaluation

- Up to 90% profit split for traders

- Refund of challenge cost on first withdrawal (for successful traders)

- 5$ commission for trading metals and currency pairs

- Ultra-low spreads using Match-Prime Liquidity

You can use our live spread tool to check out currency pairs' spreads across various brokers and compare them with those on Get Funded Now.

Does Get Funded Now offer educational resources?

Many prop firms recognize the value of education in developing successful traders. Unfortunately, GFN is not one of those, and it doesn’t offer educational resources. This means that beginner traders can’t learn the ins and outs of learning this prop firm easily.

If you want to learn about prop trading and Forex fundamental and technical analysis, we suggest checking out FTMO and Funded Next's educational resources.

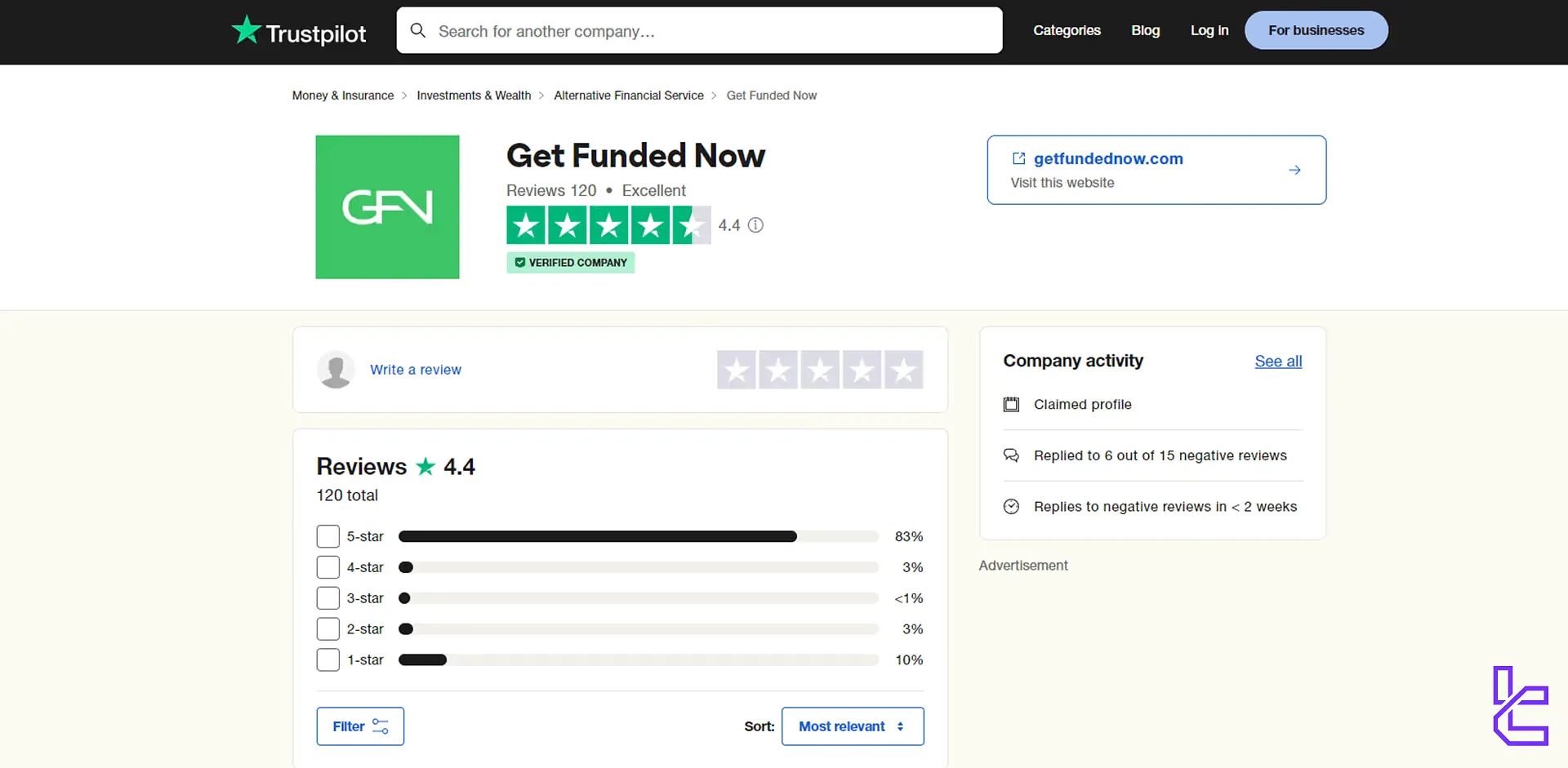

GFN Trust Scores and User Reviews

Get Funded Now has built a solid reputation, evidenced by its Get Funded Now Trustpilot score:

- 4.4 out of 5 stars overall rating

- Based on over 120 reviews

While some negative reviews mention high commissions or platform glitches, GFN appears responsive in addressing concerns and continuously improving its service.

Get Funded Now Customer Support Overview

Quality customer support is essential for any trading platform. GFN Support Channels:

Support Method | Availability |

Live Chat | Yes (Available on the website) |

Yes (Through support@getfundednow.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | No |

FAQ | No |

Help Center | No |

No | |

Messenger | No |

Lack of other customer support, including phone support, could be a major downside for many traders.

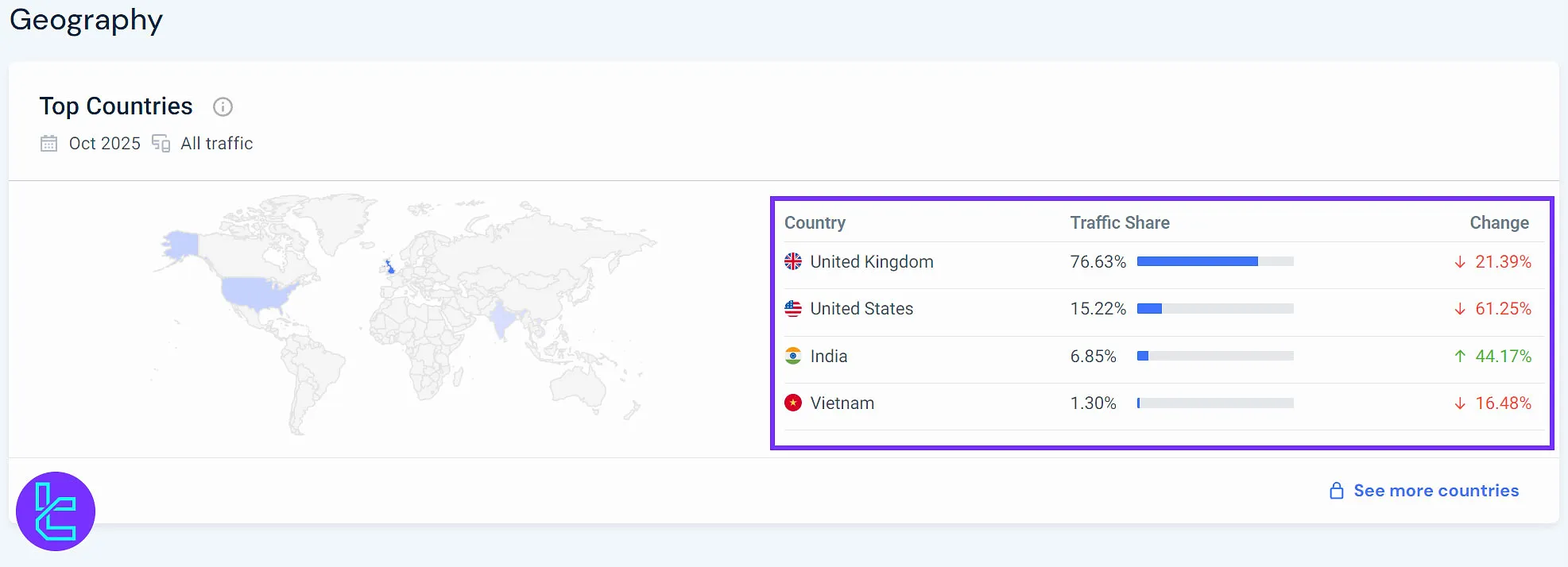

Get Funded Now User Regions Demography

Get Funded Now attracts a concentrated trader base, with the majority of its traffic originating from regions where proprietary trading programs are most active. The firm’s user distribution highlights strong engagement from English-speaking markets and fast-growing activity in emerging trading communities.

- United Kingdom leads with a dominant 76.63 percent share, making it the firm’s primary user hub;

- United States accounts for 15.22 percent of the audience, despite a recent decline in traffic;

- India contributes 6.85 percent, showing a sharp 44.17 percent month over month increase;

- Vietnam represents 1.30 percent of users, maintaining steady participation.

Get Funded Now Prop Social Media Accounts

GFN has a solid presence in various social media channels:

Social Media | Members/Subscribers |

30 | |

Over 7K | |

Over 3.2K | |

Over 3.5K | |

Over 90 | |

Over 340 |

Following a prop firm's social media can provide valuable insights into its culture and keep you updated on new opportunities.

GFN Comparison with Top Prop Firms

Comparing Get Funded Now features and trading conditions with other prop firms helps traders decide whether this is the right prop firm for them.

Parameters | Get Funded Now Prop Firm | |||

Minimum Challenge Price | $149 | $32 | $55 | $50 |

Maximum Fund Size | $200,000 | $200,000 | $300,000 | $100,000 |

Evaluation steps | 1-Step | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step |

Profit Share | 90% | 95% | 80% | 90% |

Max Daily Drawdown | 5% | 5% | 4% | 4% |

Max Drawdown | 10% | 10% | 6% | 6% |

First Profit Target | 10% | 8% | 8% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:20 | 1:100 | 1:100 | 1:5 |

Payout Frequency | Not Specified | 5 Days | Bi-weekly | Bi-weekly |

Number of Trading Assets | Not Specified | 78 | 200+ | 100+ |

Trading Platforms | Match-Trader | MetaTrader 4, MetaTrader 5, cTrader | Metatrader 5, CFT Platform and Crypto Futures | Proprietary |

TF Expert Suggestion

By reaching the 10% profit target and adhering to the 5% daily and 10% total drawdown limits, traders can receive their Get Funded Now funded accounts.

Remember, trading on funded accounts isn’t the only way to make money with GFN. You can earn up to 20% commission by becoming a Get Funded Now affiliate and referring over 100 clients to the platform.