Goat Funded Trader rules include a 10% profit target on 1-step accounts, 4 to 10% profit targets on 2-step accounts, and 6% on 3-phase evaluations.

The platform has also banned various trading strategies, including hedging, Grid Trading, Martingale, Arbitrage, and trade duplication between accounts.

Goat Funded Trader Rule Topics

Like many platforms, Goat Funded Trader Prop Firm has limitations on trading. Key Aspects of Goat Funded Trader Conditions:

- Challenge Rules

- Minimum Trading Days

- Weekend Trading

- News Trading

- All or Nothing Strategies

- Hedging Policy

- Use of EAs

- Payout Policies

- Restricted Strategies

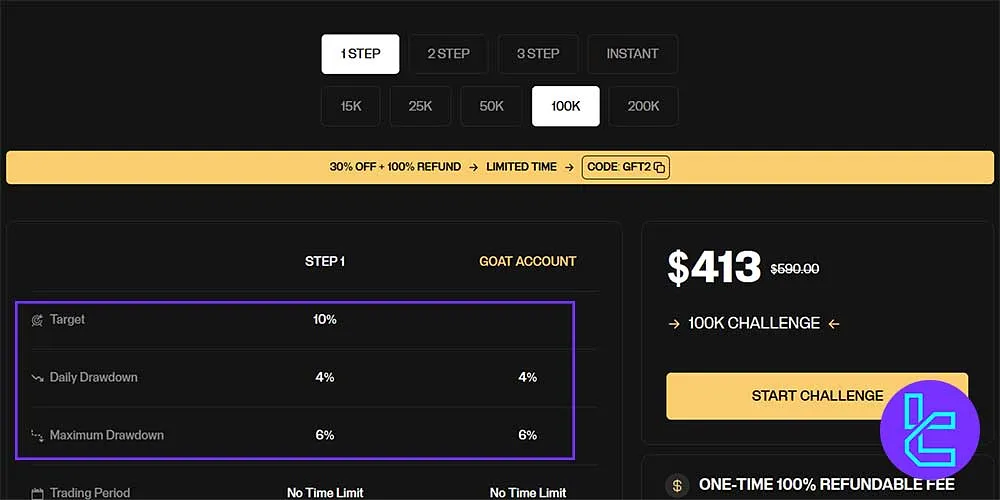

Goat Funded Trader Challenge Rules

Traders must meet specific targets while adhering to drawdown limits. Goat Funded Trader requirements for different accounts.

Challenge | 1-Step | 2-Step GOAT | 2-Step Standard | 2-Step Pro | 3-Step | Instant GOAT | Instant Pro | Instant Blitz |

Profit Target Step 1 | 10% | 8% | 10% | 8% | 6% | - | - | 3% |

Profit Target Step 2 | - | 6% | 5% | 4% | 6% | - | - | - |

Profit Target Step 3 | - | - | - | - | 6% | - | - | - |

Maximum Daily Drawdown | 4% | 4% | 5% | 4% | 4% | 3% | - | 3% |

Maximum Overall Drawdown | 6% | 10% | 10% | 8% | 8% | 6% | 4% | 5% |

As you see, the Instant model has no minimum for profit target. Traders can check the prop discount code page to acquire promo codes and access these challenges with reduced prices.

Minimum Days in Goat Funded Trader

At Goat Funded Trader, all participants must follow a 3-day minimum trading rule to qualify for both challenge completion and funded payouts. This rule applies to all account types except Instant Funding.

- Challenge Phase 1: Minimum of 3 active trading days required

- Challenge Phase 2: Minimum of 3 separate trading days required

- Funded Accounts: Traders must complete at least 3 trading days per payout cycle

- Profit Requirement: Each valid trading day must show at least 0.5% net profit based on the initial account balance

Goat Funded Holding Trades Over the Weekend

Goat Funded Trader prop firm allows traders to hold trades over the weekend without restrictions. This flexibility allows traders to maintain open positions through market closures, manage swing trades effectively, and adjust their strategies to accommodate long-term setups.

However, traders are encouraged to manage risk carefully around weekend volatility and potential gap movements when markets reopen.

Goat Funded Trader News Rules

News trading is permitted at Goat Funded Trader across both the Challenge and Funded phases, providing traders with full freedom to participate during economic announcements. However, profit restrictions apply around high-impact news events to ensure fairness and risk control.

- Permitted: Trading during news events is fully allowed and does not count as a rule breach;

- Time Restriction: Trades opened or closed within 2 minutes before or after high-impact news (as marked by red folders on ForexFactory) are subject to limits;

- Profit Cap: Maximum profit from these trades is limited to 1% of the initial account balance;

- Excess Adjustment: If profits exceed this limit, the extra amount will be removed automatically during account review without any penalties or breaches.

Goat Funded Trader All-or-Nothing Strategies

Goat Funded Trader strictly prohibits high-risk or “all or nothing” trading strategies. These approaches involve excessive risk exposure and go against the firm’s core principles of discipline and sustainable performance.

- Definition: Any single trade that uses more than 80% of available margin is considered gambling-style trading.

- Consequence: Violations may result in profit deductions, phase resets, or account termination, depending on the severity.

- Purpose: This policy encourages consistent risk management and supports traders who demonstrate control, patience, and long-term profitability.

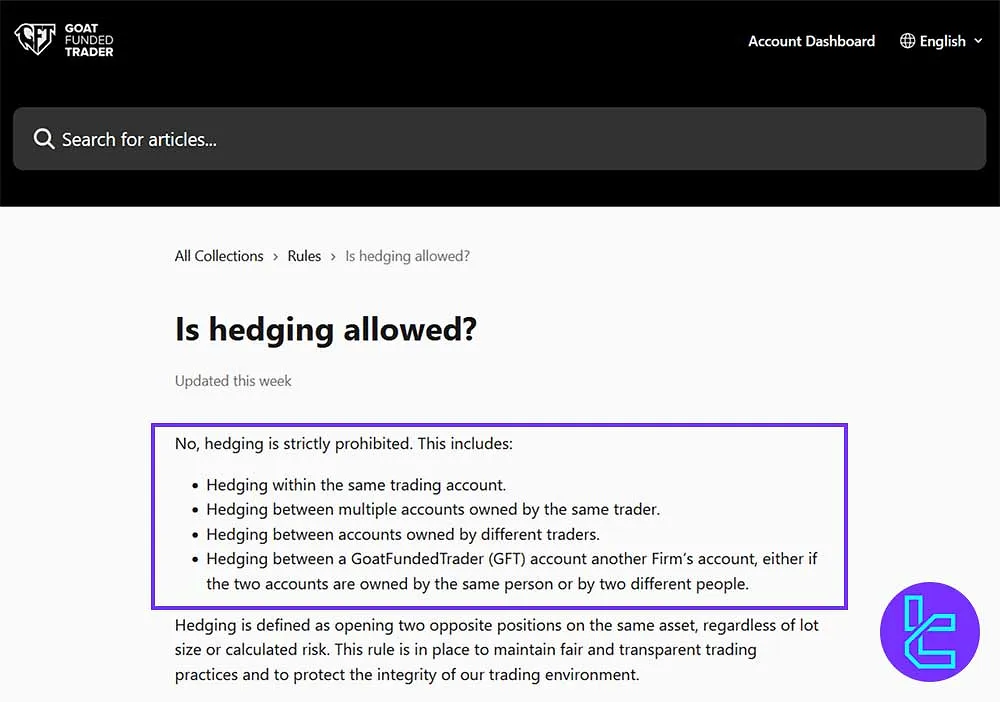

Hedging on Goat Funded Trader

Hedging is strictly prohibited across all Goat Funded Trader accounts to maintain fair trading conditions and platform integrity. This restriction applies to:

- Same-account hedging: Opening opposite positions within the same trading account.

- Multi-account hedging: Executing offsetting trades between multiple accounts owned by the same trader.

- Cross-account hedging: Coordinating trades between different traders’ accounts.

- Cross-firm hedging: Using a GFT account alongside another firm’s account to hedge, even if owned by the same person.

Any detected hedging activity results in an immediate account breach and permanent ban from the platform. For Simulated Funded Accounts, all associated rewards or payouts are forfeited.

Goat Funded Trader Expert Advisors (EAs) Policy

Traders are allowed to use Expert Advisors (EAs) at Goat Funded Trader, provided that their automated systems fully comply with the firm’s trading guidelines and do not engage in prohibited practices.

- Permitted Use: EAs can operate as long as they reflect normal trading behavior and follow the platform’s rules.

- Restricted Strategies: High-Frequency Trading (HFT) systems, latency arbitrage, and Gold Arbitrage EAs are strictly prohibited.

- Compliance Enforcement: Any EA detected using manipulative or exploitative methods may lead to account suspension, profit removal, or permanent disqualification.

Goat Funded Trader Payout Rules

The Goat Funded Trader payout policies vary based on the funding model traders choose for evaluations.

Funding Model | Payout Frequency | Withdrawal Limits for First Two Payouts | Withdrawal Limits After Two Payouts |

Instant Funding | Bi-weekly | No limits specified | No limits specified |

2-Step Models | Bi-weekly | Up to 6% of the initial balance | Full profit share |

3-Step Models | Bi-weekly | Up to 6% of the initial balance | Full profit share |

GFT Restricted Trading Strategies

Goat Funded Trader maintains strict rules regarding trading behaviors and strategies that compromise platform integrity or risk management principles. The firm prohibits all high-risk, exploitative, or manipulative methods to ensure fairness across all traders.

Violations of these policies may result in immediate account termination, forfeiture of profits, or disqualification from future programs. Traders are encouraged to employ disciplined, rule-compliant strategies that yield sustainable and consistent performance.

Strategy Type | Status / Limitation |

Hedging | Strictly prohibited across all accounts |

All-or-Nothing Trading | Not allowed; excessive margin use may lead to a breach |

Banned due to high-risk exposure | |

High-Frequency Trading (HFT) | Disallowed for both manual and EA trading |

Not permitted under any conditions | |

Insider / Latency Exploitation | Considered manipulation; results in account closure |

Third-Party or Pre-built EAs | Allowed only if code ownership is verifiable |

Duplicating Trades Between Accounts | Forbidden across the evaluation and funding stages |

Goat Funded Trader Rules in Comparison to Other Prop Firms

The table below helps traders understand the strictness of the Goat Funded Trader policies.

Prop Firm | Goat Funded Trader Prop Firm | |||

VPN/VPS | Not Disclosed | Allowed | Allowed | Prohibited |

EA Usage | Allowed | Allowed | Allowed | Allowed |

News Trading | Allowed | Allowed | Allowed | Prohibited |

Group Trading | Prohibited | Prohibited | Prohibited | Prohibited |

All-or-nothing Trading | Prohibited | Prohibited | Prohibited | Prohibited |

Writer’s Opinion and Conclusion

The Goat Funded Trader Rules establish distinct targets for a 2-Step Plan: 8% for Step 1 and 6% for Step 2, with a 4% daily drawdown and a maximum drawdown of 10%.

HFT strategies and Gold Arbitrage EAs are prohibited, with withdrawal limits set at 6% for the first two payouts, allowing for a full profit share thereafter.

Now that you are fully aware of the trading conditions in this prop firm, you can complete the Goat Funded Trader registration by checking out the guides on the Goat Funded Trader Tutorial page.