House of Leverage prop firm started its work with transparent rules, multiple challenge types, and scalable funding up to $300K. Since launching in mid-2024, this UK-based firm has attracted attention for its no-hidden-rules approach and fast bi-weekly payouts. House of Leverage supports only MetaTrader 5 and offers access to key markets such as forex market and metals.

House of Leverage Prop Company Information

House of Leverage is a London-based prop firm launched on June 14, 2024, under the leadership of CEO Rhys Thomas. The firm promises transparency, no hidden rules, and flexible funding options from $5,000 to $300,000.

Traders can choose from three challenge types, including 1-step and 2-step models, all designed to accommodate different trading styles. With bi-weekly payouts, an 80% profit split, and pricing from $65 to $1,489, it caters to both newcomers and experienced prop traders aiming to scale.

Key Highlights:

- Based in London, UK

- Launched: June 14, 2024

- CEO: Rhys Thomas

- Up to $300K in scaled capital

- 3 types of challenges (1-step, 2-step, HFT)

- Prices from $65 to $1,489

- Bi-weekly payouts

- 80% profit share

House of Leverage Prop Summary of Specification

House of Leverage presents a flexible yet structured model for traders looking to grow with digital capital funding. With no hidden rules and multiple evaluation options, the firm enables quick entry and clear performance metrics. HoL specifications:

Account Currency | USD |

Minimum Price | $65 |

Maximum Leverage | 1:100 |

Maximum Profit Split | Up to 80% |

Instruments | Forex, Metals |

Assets | N/A |

Evaluation Steps | 1 Setp ,2 Step |

Withdrawal Methods | N/A |

Maximum Fund Size | $300000 |

First Profit Target | 4% |

Max. Daily Loss | 5% |

Challenge Time Limit | Unlimited |

News Trading | Not Specified |

Maximum Total Drawdown | 10% |

Trading Platforms | MetaTrader 5 |

Commission Per Round Lot | Not Specified |

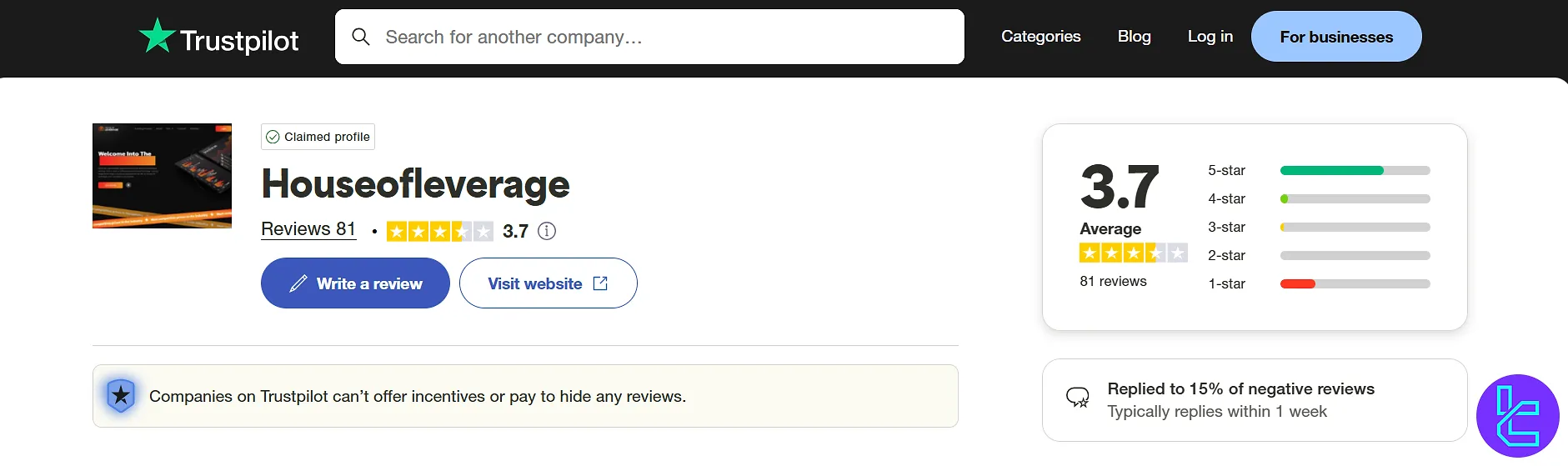

Trustpilot Score | 3.7 Out of 5 |

Payout Frequency | Bi-Weekly |

Established Country | UK |

Established Year | 2024 |

What are the House of Leverage Pros and Cons?

The firm scores well on capital flexibility, profit split, and transparency.

However, the absence of cryptocurrency assets and external tools may affect those seeking broader exposure. House of Leverage advantages and disadvantages:

Pros | Cons |

No hidden rules | No access to crypto assets |

80% profit split | Limited platform choice (MT5 only) |

Bi-weekly payouts | No trading journal or calculator tools |

Competitive pricing structure | Education blog not yet active |

Multiple challenge types | No bonus or discount program currently |

House of Leverage Prop Fundings and Price

In general, House of Leverage offers a range of digital capital funding options [from $5,000 and go up to $300,000], designed to support traders at different stages. But, each challenge has its own funding and pricing structure:

Funding | Price in “1 Step” | Price in “2 Step” | Price in “The HFT Challenge” |

$5K | - | $75 | $65 |

$10K | $169 | $79 | $145 |

$25K | $289 | $149 | $295 |

$50K | $409 | $239 | $415 |

$100K | $599 | $389 | $615 |

$200K | $989 | $649 | $1059 |

$300K | $1489 | - | - |

These scalable plans make it easier to choose a challenge that aligns with your budget and trading objectives.

How to Open an Account in House of Leverage Prop Firm? Complete Guide

Getting started with House of Leverage can be completed in just a few minutes. The platform offers an intuitive interface, making account creation and challenge selection seamless.

Step-by-step process:

- Click on the “Login/Register” Button on the Main Page

- Provide Information

- Buy Challenge in the Dashboard

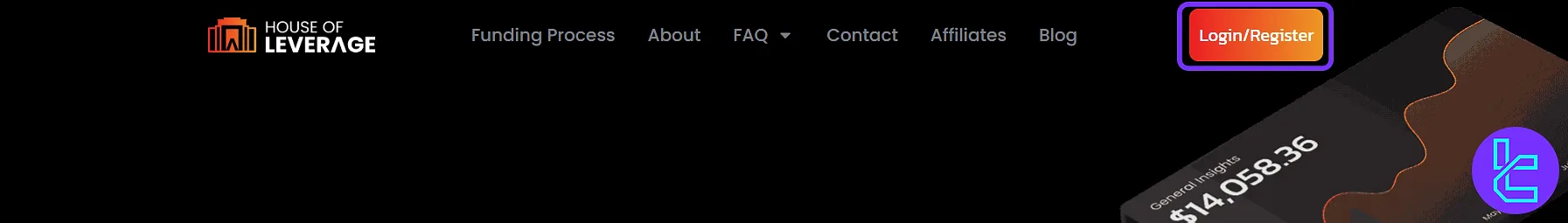

#1 Click on the “Login/Register” Button on the Main Page

To start your journey with House of Leverage, head to the homepage and locate the “Login/Register” button in the top-right corner.

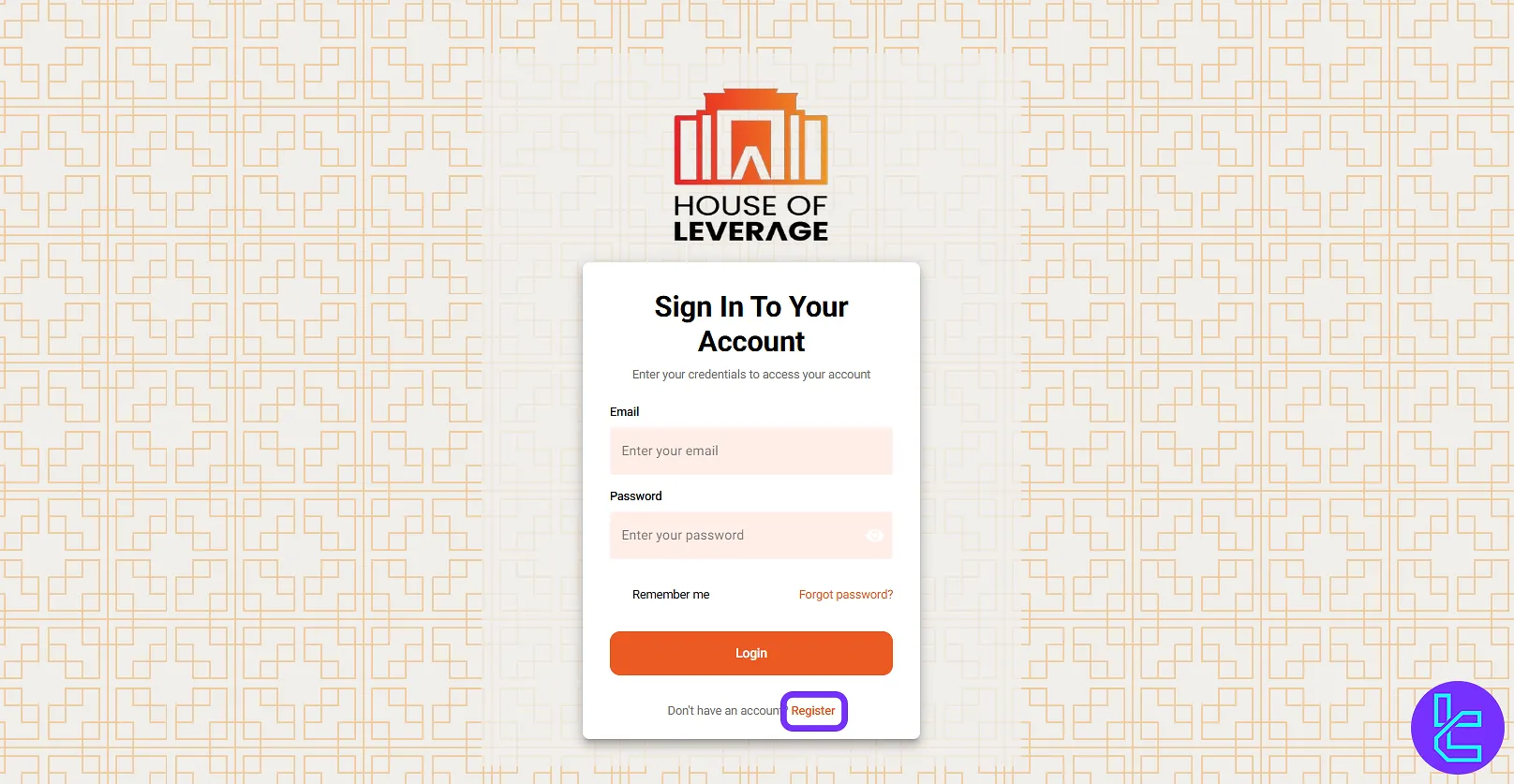

If you're new to the platform, select the “Register” tab to begin the onboarding process. The website is responsive across devices and optimized for quick access.

#2 Provide Information

After clicking “Register,” you’ll be directed to a simple form where you need to provide the following:

- Full name

- Email address

- Password

- Country of residence

Make sure your email is valid, as you’ll need to confirm it before accessing the dashboard. The sign-up process is fast and requires no initial identity verification.

#3 Buy Challenge in the Dashboard

Once registered and logged in, you'll be redirected to dashboard. Here, you can manage your account and join challenges. To begin, click on the “+New Challenge” button and select your preferred model (1-Step, 2-Step, or HFT).

After choosing your challenge type and account size, complete the payment using the available gateways. Your challenge credentials will be generated immediately.

House of Leverage Prop Firm Challenges

House of Leverage offers three distinct challenge types. These include a 1-Step Evaluation, a 2-Step Challenge, and the HFT Challenge—each tailored for different trader profiles and has their own specifications. House of Leverage challenges:

Parameters | 1 Step Challenge | 2 Step Challenges | The HTF Challenge | |

Steps | Step 1 | Step 1 | Step 2 | Step 1 (Challenge) |

Trading Period | Unlimited | Unlimited | Unlimited | Unlimited |

Profit Target | 8% | 10% | 5% | 6% |

Maximum Daily Loss | 4% | 5% | 5% | 4% |

Maximum Loss | 8% | 10% | 10% | 8% |

Account Leverage | 1:100 | 1:100 | 1:100 | 1:50 |

Payouts | 30 days 1st payout then Bi-Weekly | - | Bi-Weekly | No Information Available |

Profit Split | 80% | - | 80% | 80% |

Bonus & Discounts

Currently, House of Leverage does not offer any bonuses or discount programs. There are no coupon codes, affiliate discounts, or seasonal deals at the moment. However, the firm may introduce promotional offers or trader competitions in the future.

House of Leverage Prop Rules

House of Leverage follows a clear and simplified rulebook. There are no hidden rules, which makes the firm appealing to many traders frustrated by fine-print restrictions. HoL Rules key points:

- Expert Advisors (EA): Allowed, but Martingale systems, HFT, tick scalping, arbitrage, and exploitative software are prohibited and may lead to account termination

- Prohibited Strategies: Arbitrage, Grid Trading and Martingale/DCA/Layering

Expert Advisors (EA)

Expert Advisors (EAs) are allowed within House of Leverage, but there are clear restrictions on the types of software that can be used. Specifically, the following are prohibited:

- Martingale Systems: A strategy that can amplify losses and is not permitted;

- High-Frequency Trading (HFT): This technique, which involves executing a large number of trades in a very short period, is disallowed;

- Tick Scalping: A fast-paced trading strategy targeting minute price movements is not allowed;

- Arbitrage: This strategy, which involves exploiting price differences across markets, is strictly forbidden;

- Malicious Software: Any software that is designed to manipulate or exploit the funding process is prohibited.

If any unauthorized or exploitative software is detected, the account will be terminated immediately.

Trading Strategies

House of Leverage acknowledges the diverse range of trading strategies employed by traders, and strives to remain as flexible as possible. However, some strategies are restricted to ensure effective risk management. The following strategies are not allowed:

- Arbitrage: This trading strategy is banned due to its potential to disrupt market conditions;

- Grid Trading: A strategy that creates multiple positions based on predefined intervals is not permitted due to its high-risk nature;

- Martingale/DCA/Layering:

- These strategies involve adding more positions to a losing trade, regardless of whether the lot size remains unchanged or adjusted;

- It is strictly prohibited to have multiple positions in drawdown, as this behavior resembles gambling and increases risk unnecessarily;

- Traders are allowed to add one position while in drawdown, but any additional trades will result in the forfeiture of the challenge;

- Entering additional trades while in profit is permissible and within the rules.

Trading Platforms

House of Leverage currently supports only MetaTrader 5, a leading platform among retail traders for its speed, charting tools, and expert advisor compatibility. No additional platforms like cTrader, MetaTrader 4, or web-based dashboards are available.

How Many Assets are Tradable in House of Leverage?

House of Leverage gives traders access to forex and precious metals. This ensures deep liquidity and clear pricing for evaluation and live accounts. However, cryptocurrencies, indices, stocks, and commodities are currently not available on this platform. HoL Tradable Markets:

- Major Forex pairs (e.g., EUR/USD, GBP/USD)

- Minor and some exotic pairs

- Gold (XAU/USD) and Silver (XAG/USD)

House of Leverage Prop Fees

As of now, no official information has been disclosed regarding spread markups, commissions, swap policies, or hidden costs. However, based on user feedback and early reviews, the firm appears to maintain standard MetaTrader 5 trading costs.

Since House of Leverage promotes a “no hidden rules” philosophy, it's expected that fee structures (when published) will remain transparent and fixed.

House of Leverage Prop Education

House of Leverage provides basic needed information support through an FAQ section that accompanies each challenge type. Additionally, a blog section has been launched, but as of now, no articles have been published.

While the educational infrastructure is still under development, the platform offers challenge-specific FAQs to address the most common concerns regarding rules, scaling, and payouts.

House of Leverage Prop Firm Trust Scores

The prop firm holds a Trustpilot rating of 3.7 out of 5, based on 80+ user reviews. Most positive comments in House of Leverage Trustpilot highlight the fast payouts, transparent conditions, and supportive onboarding process.

However, some users have expressed concerns about asset limitations and the lack of advanced trading tools. As a new entrant in the market, the trust score is likely to evolve as more traders complete funded stages.

House of Leverage Prop Customer Support

The customer support system at this prop is structured to offer direct and tiered assistance. Users can reach out via phone, live chat, email, or the internal ticket system. While response times vary, the support team is known for providing clear answers, especially on issues related to platform access and evaluation rules.

Available support channels offered by House of Leverage:

- Phone Support

- Email Assistance

- Ticket Submission

- Live Chat

House of Leverage Prop on Social Media

House of Leverage maintains an active presence on 2 community platforms. While their social content is still ramping up, the firm uses these channels for updates, trader announcements, and feature rollouts.

House of Leverage Social Media Platforms:

- Discord: Primary communication channel for traders, support, and updates

- X (Twitter): Announcements, product updates, and user feedback highlights

House of Leverage Vs Other Prop Firms

House of Leverage offers a competitive model, especially for traders looking for flexible challenge formats and quick bi-weekly payouts. However, its asset limitations and lack of advanced tools place it slightly behind more established firms in terms of overall versatility.

Parameters | House of Leverage Prop Firm | |||

Minimum Challenge Price | $65 | $97 | $33 | $55 |

Maximum Fund Size | $300,000 | $200,000 | $400,000 | $200,000 |

Evaluation steps | 1-Step, 2-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-phase, 2-phase |

Profit Share | 80% | 80% | 100% | 80% |

Max Daily Drawdown | 5% | 5% | 7% | 4% |

Max Drawdown | 10% | 10% | 14% | 6% |

First Profit Target | 4% | 5% | 6% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly | Bi-weekly | Weekly | 2 Times a Month |

Number of Trading Assets | N/A | 40 | 40+ | 200+ |

Trading Platforms | MetaTrader 5 | MetaTrader 5, cTrader, Dxtrade | MetaTrader 5, Match Trader | Metatrader 5, CFT Platform and Crypto Futures |

TradingFinder Expert Conclusion

House of Leverage Prop enters the industry with transparent rules, multiple challenge options [1 step, 2 Step, The HFT Challenge] and fast payouts [Bi-weekly].

However, it has limitations in platform [only MetaTrader 5] and asset options, since only forex and metals are available to trade.