IC Funded is a Hong Kong-based prop firm with a wide range of challenges, with prices ranging from $29.75 to $2,498.

Skilled traders can buy these accounts, trade over 150 instruments with up to 1:50 leverage, and receive 80% of the profits they make.

IC Funded Prop Firm Company Overview

IC Funded prop firm is a cutting-edge platform that provides comprehensive trading evaluations to help traders access funded trading accounts and enhance their trading abilities.Here are some key points about the IC Funded prop firm:

- IC Funded headquarters is in Hong Kong

- It has partnered with IC Markets broker

- IC Funded has 1-phase and 2-phase evaluation

IC Funded has an innovative approach and a supportive community to help traders scale up.

IC Funded Prop Summary

Let's break down the key specifications of IC Funded:

Account currency | USD |

Minimum price | $29.75 |

Maximum leverage | 1:50 |

Maximum profit split | 80% |

Instruments | Forex, indices, commodities, equities |

Assets | EUR/USD, gold, S&P500, silver |

Evaluation steps | 1-phase, 2-phase |

Trading platform | MT4, MT5 |

Withdrawal methods | Bank wired, Skrill, crypto |

Maximum fund size | $500,000 |

First profit target | 10% |

Maximum daily loss | 5% |

Challenge time limit | Unlimited |

News trading | N/A |

Maximum total drawdown | 10% |

Commission per round lot | NO |

Trust pilot score | 4.4/5 |

Payout frequency | 14 days |

Established country | Hong Kong |

Established year | 2024 |

IC Funded Prop Advantages & Disadvantages

Before diving deeper, let's weigh the pros and cons of IC Funded:

Pros | Cons |

Wide range of account sizes | Strict evaluation process |

Support for popular trading platforms | No copy trading allowed |

Comprehensive educational resources | Limited tradable instrument |

24/7 support | - |

IC Funded Challenges and Funding Price

IC Funded offers a tiered structure for its funded accounts so traders can choose the account that best suits their trading skills.

Account size | $5,000 | $10,000 | $25,000 | $50,000 | $100,000 | $250,000 | $500,000 |

1-Step Account Fee | $29.75 | $59.50 | $148.75 | $297.50 | $595 | $1487.50 | - |

2-Step Account Fee | $49 | $99 | $149 | $289 | $499 | $1,249 | $2,498 |

While challenge prices are average compared to other prop firms, strict trading conditions, such as 5% maximum daily drawdownand 10% overall drawdown, make passing challenges very hard.

IC Funded Sign-up & Verification

Traders who want to use the IC Funded services must first open an account with this prop firm. IC Funded registration:

#1 Visit the IC Funded Signup Page

Head over to the official website and click “Sign Up” or “Open an Account” on the homepage. You’ll be redirected to a secure registration form optimized for fast onboarding.

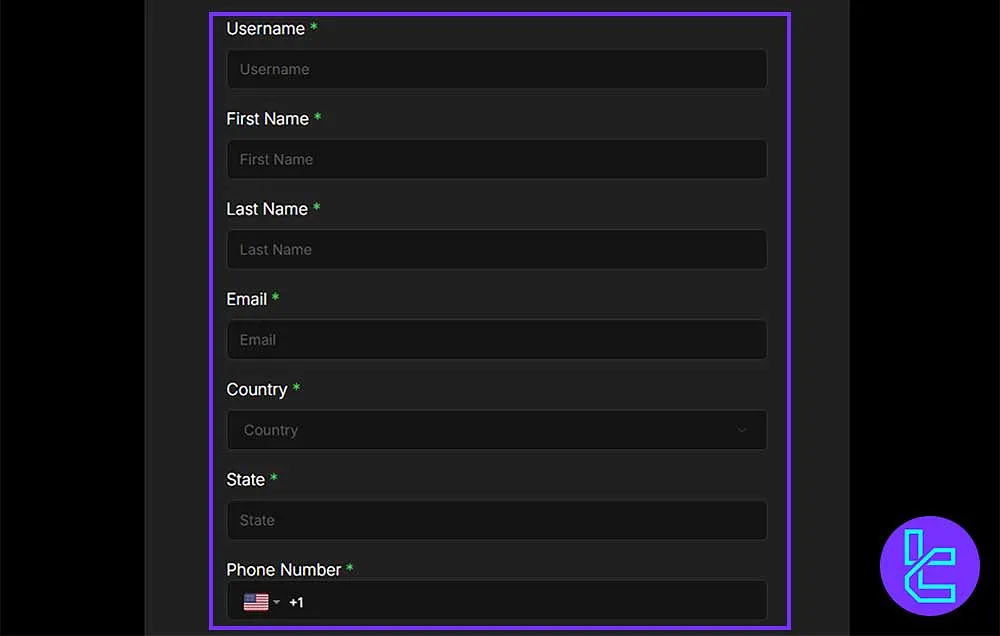

#2 Complete the Registration Form

Provide the following details:

- Username

- First & Last Name

- Email Address

- Mobile Number

- Country and State

- Password (confirm it)

- Accept the Terms of Service

Click "Sign Up" to complete your registration.

#3 Verify Your Account

At the final stage of your journey, you'll need to complete a simple Know Your Customer (KYC) process. This step is crucial for unlocking access to funded accounts and maintaining a secure, verified trading environment.

Completing KYC also enables a profit-sharing model, allowing you to earn a portion of the profits generated, offering the opportunity to accumulate substantial capital. The only required document is a valid ID (passport, driver's license, or national ID card).

IC Funded Prop Firm Evaluation

The evaluation process at IC Funded is designed to identify skilled traders who can manage risk effectively. Two evaluation paths are available to traders.

1-Step Evaluation

The IC Funded one-step evaluation model is designed for traders who prefer a short path to a funded account without passing multiple challenge phases. However, this short route is not necessarily easy to go through.

1-Step Parameters:

Evaluation | 1-Step |

Profit Target | 10% |

Minimum Trading Days | 5 days |

Maximum Trading Days | Unlimited |

Maximum Daily Drawdown | 5% |

Maximum Drawdown | 6% |

Leverage | 1:20 on Forex and Gold, 1:10 on Indices, and 1:5 on Equities |

Profit Split | 75/25 after a month, 80/20 |

2-Step Account

The IC Funded two-step evaluation program is structured for traders who prefer a more performance-driven qualification process with an emphasis on consistency and risk control. This challenge is also considered a difficult one, similar to the one step account.

2-Step Evaluation Details:

Evaluation | 2-Step |

Profit Target Phase 1 | 10% |

Profit Target Phase 2 | 5% |

Minimum Trading Days | 5 days |

Maximum Trading Days | Unlimited |

Maximum Daily Drawdown | 5% |

Maximum Drawdown | 10% |

Leverage | 1:50 for Forex and Gold, 1:10 for Indices and other Commodities, 1:5 on Equities |

Profit Split | 75/25 after a month, 80/20 |

This process ensures that IC Funded partners with traders who demonstrate consistency and solid risk management skills.

IC Funded Prop Discounts and Bonuses

IC Funded provides attractive offers to traders:

- Discounts on challenge accounts

- Enhanced profit-sharing arrangements after 1 month

- Exclusive promotional offers

- Excellent affiliate program to gain up to 15% commission for referring new traders to the platform

To join IC Funded affiliate program, you should follow these steps:

- Enter the IC Funded website and click on "Become an affiliate" button;

- Complete the affiliate registration form;

- Recieve your affiliate link and share it with your friends;

- Check your referral commission on the affiliate dashboard.

These incentives can provide significant value to traders, potentially offering additional funding or improved terms when signing up with IC Funded.

IC Funded Rules

Traders must adhere to the IC Funded rules and policies to avoid account termination due to breach of the guidelines. IC Funded rules:

- Expert Advisors (EAs) are permitted under specific conditions

- Prohibited strategies include copy trading, arbitrage, price manipulation, and strategy switching

- No public policy on news trading time restrictions

- IC Funded pays profits after 14 days from the first trade, processes withdrawals within 48 hours (or compensates $500 if delayed), and offers profit splits starting at 75/25, upgradeable to 80/20 with consistent performance

VPN & VPS Usage

IC Funded does not explicitly address the use of VPNs, VPSs, or changing IP addresses. No stated policy restricts or permits such tools, and traders are not provided guidelines regarding the geographical consistency of IP during assessments or funded phases.

Hedging

There is no available information on whether hedging is allowed or restricted. The absence of policy means traders should approach hedging cautiously and ideally seek direct confirmation before relying on such strategies.

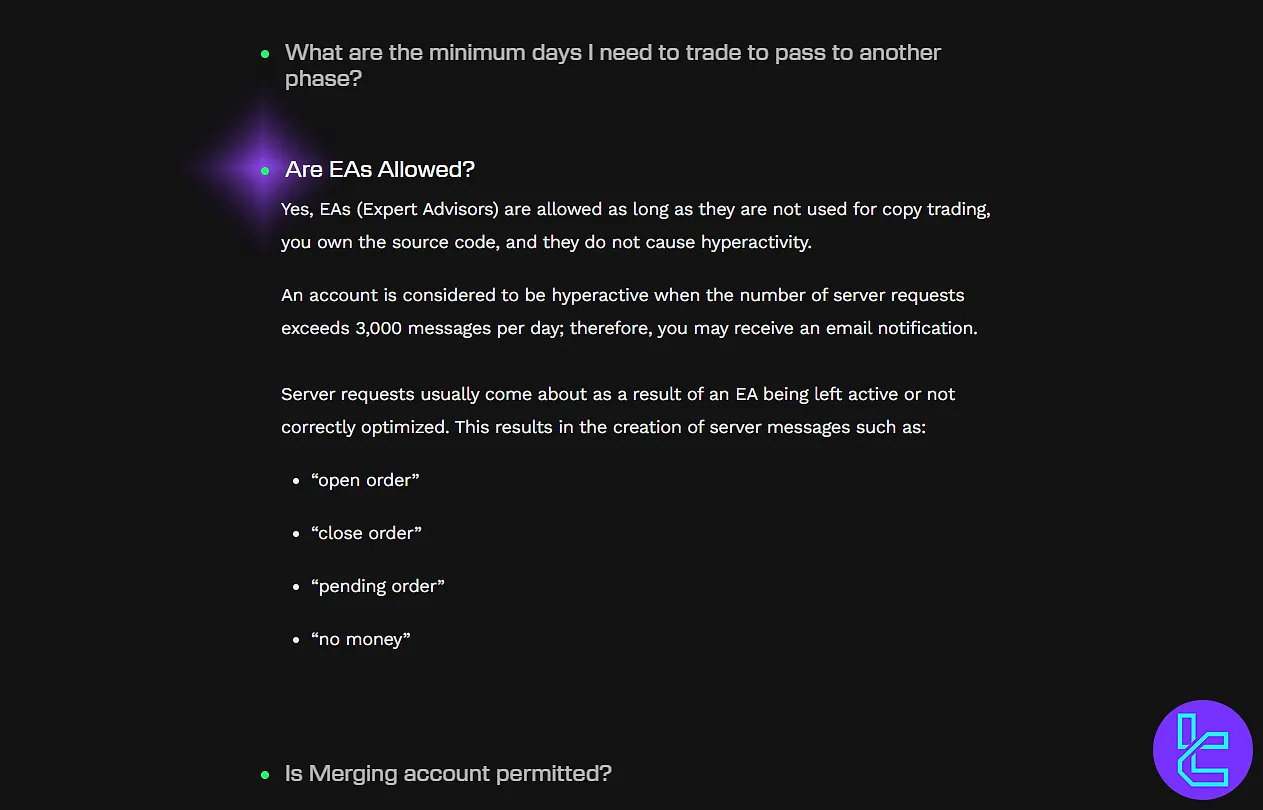

Expert Advisors (EAs)

IC Funded permits the use of Expert Advisors (EAs), but the following conditions must be met:

- The EA must not be used for copy trading across accounts;

- You mustown the source code of the EA;

- The EA must not cause severe hyperactivity.

An account is deemed hyperactive if it exceeds 3,000 server requests per day. This is often caused by an EA that is left running or not properly optimized. Common server requests that contribute to this include:

- “Open order”

- “Close order”

- “Pending order”

- “No money”

If your account triggers excessive requests, IC Funded may issue a warning via email.

Prohibited Strategies and Risk Behavior

The firm maintains a comprehensive list of banned practices designed to prevent exploitation and ensure integrity. These include:

- Copy trading across multiple accounts, including within IC Funded or other prop firms

- Exploiting pricing delays, data feed errors, or inefficiencies in broker platforms

- Using insider or confidential information for trading purposes

- Front-running or engaging in activities that may result in trade cancellations or broker complications

- Applying publicly available or third-party systems marketed for passing evaluations

- Shifting trading strategies between assessment and funded phases is deemed inappropriate

- Trading equity CFDs around earnings announcements without adhering to closing-time guidelines

- Attempting overnight gap arbitrage through late-session CFD trades

- Using any tactic that compromises broker compliance or execution transparency

The company reserves full discretion to deny funding, disable accounts, or withhold refunds if prohibited activity is detected. All trading accounts are reviewed before any funding is granted.

News Trading

IC Funded has not published any specific rules or restrictions related to news trading. There is no mention of blackout windows, event buffers, or restrictions around high-impact economic releases.

However, since the firm prohibits manipulative behavior and strategy abuse, traders should assume that using news volatility in an unreplicable or exploitative manner may still be penalized.

Payouts

IC Funded operates a fast and clearly defined payout system designed to minimize waiting time after passing the evaluation and starting live trading. Traders become eligible to request their first payout after 14 calendar days from the date of the first trade on the funded (Master) account. After that, payouts follow a regular cycle based on the firm’s internal schedule and account status.

One key feature of IC Funded’s payout policy is its 48-hour processing guarantee. Once a withdrawal request is submitted, the firm commits to processing it within two business days. If this deadline is not met, IC Funded compensates the trader with an additional $500, reinforcing transparency and accountability in payment handling.

Profit sharing begins with a 75/25 split in favor of the trader and can be upgraded to 80/20 after one month of consistent trading behavior and rule compliance. Profit split upgrades are tied strictly to risk management discipline and performance stability, not trading volume alone.

Scaling Plan in IC Funded

After you pass the Evaluation stage, IC Funded allows you to manage how your capital grows rather than locking you into a single path. You can either activate an IC Funded account with the same balance you used during the Evaluation, or continue with a higher-balance Evaluation account without paying an additional fee.

If you choose to repeat the Evaluation at the upgraded level and meet the required objectives again, the same flexibility remains available: you may step into a larger IC Funded account or scale your Evaluation balance once more.

This progression model is designed to provide structured capital growth while keeping account transitions optional at each stage. The overall funding limit across all upgrades and accounts is capped at $500,000.

IC Funded Prop Firm Trading Platforms

IC Funded supports popular trading platforms:

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a popular trading platform designed for Forex, futures market, and CFD trading. It offers advanced charting tools for technical analysis. MT4's user-friendly interface and customizable features make it a preferred choice for traders.

MetaTrader 5 (MT5)

MetaTrader 5 (MT5) is an advanced trading platform that supports Forex, stocks, and futures trading with enhanced features. It offers superior charting tools, in-depth technical analysis, and a powerful multi-asset capability, making it a versatile choice for professional traders.

cTrader

cTrader is a sophisticated trading platform designed for forex and CFD trading, offering advanced charting tools and intuitive order execution. With its user-friendly interface and focus on transparency, cTrader is favored by professional and retail traders.

Tradable Instruments on IC Funded

IC Funded offers over 150 tradable instruments, including:

- Forex: Major, minor, and exotic currency pairs

- Commodities: Gold, silver, oil, and more

- Indices: Major global stock indices

- Equities: Famous company shares

Unfortunately, IC Funded doesn't offer a diverse range of instruments, which is a major drawback for this platform compared to other prop firms.

Leverage Specifics

IC Funded applies a tiered leverage structure based on both the asset class and the evaluation model selected (1-Step or 2-Step), allowing traders to tailor risk exposure according to account type and market behavior.

2-Step Account Leverage

Under the 2-Step evaluation program, leverage is set at 1:50 for Forex pairs and Gold (XAUUSD), while indices and other commodities are capped at 1:10, and equities are limited to 1:5. This structure is designed to support active intraday strategies on FX while maintaining tighter risk control on more volatile or less liquid markets.

1-Step Model Leverage

In contrast, the 1-Step evaluation accounts operate with reduced exposure on currency markets, offering 1:20 leverage on Forex and Gold, while keeping 1:10 on indices and commodities and 1:5 on equities unchanged.

IC Funded Prop Payment Methods

IC Funded offers several options for deposits and withdrawals:

- Bank wire transfers

- Skrill

- Cryptocurrency transfers

It's worth noting that IC Funded doesn't charge fees for these payment methods.

IC Funded Prop Firm Commission & Costs

IC Funded's commission structure is designed to be competitive and transparent:

- Low spreads on major currency pairs

- Commission-free trading on certain account types

- No hidden fees or charges

Note that IC Funded doesn't pay back challenge fees upon withdrawal.

Does IC Funded Prop Firm Offer Vast Educational Resources?

Yes, IC Funded places a strong emphasis on trader education. Traders can use its learning hub to learn everything from beginner to advanced subjects. IC Funded Educational Matertials:

- Tutorial Videos

- Blog Posts

- Webinars

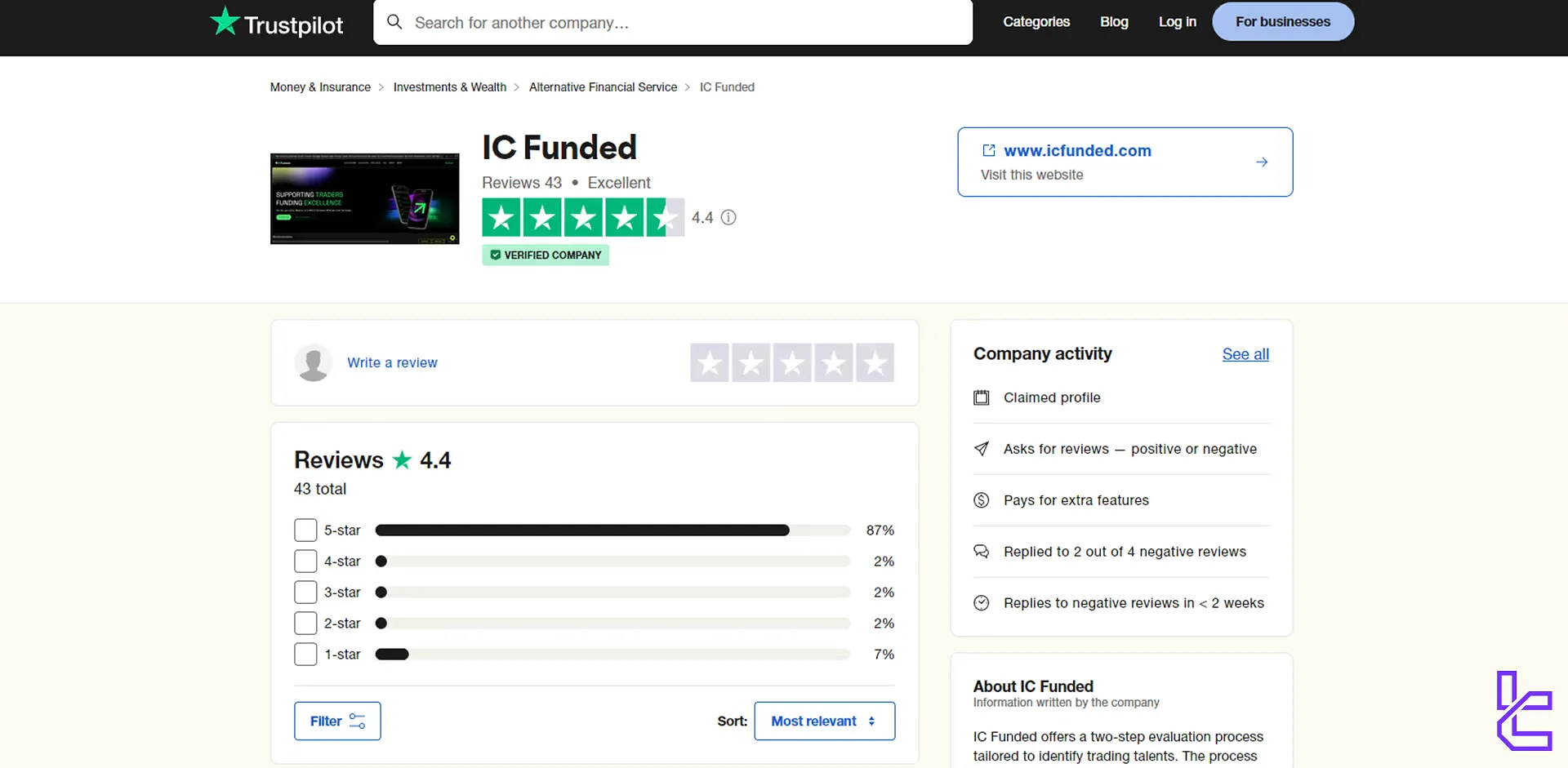

IC Funded Prop Firm Trust Scores

There is a lot of positive feedback on the IC Funded Trustpilot page. Key points from reviews include:

- Fair and transparent policies

- Efficient customer support

- User-friendly trading platform

- Quick resolution of technical challenges

IC Funded care for traders helped gain 4.4 out of 5 stars on this platform.

IC Funded Prop Customer Support

IC Funded provides excellent customer support through various channels:

Support Method | Availability |

Live Chat | Yes (AI) |

Yes (through support@icfunded.com) | |

Phone Call | No |

Discord | No |

Telegram | No |

Ticket | Yes (for various inquiries) |

FAQ | Yes (with Search bar) |

Help Center | Yes (comprehensive help section) |

No | |

Messenger | No |

The quality of customer support is often highlighted in user reviews as a strong point for IC Funded.

IC Funded User Regions

As of October 2025, IC Funded has seen a significant surge in user activity from emerging and diverse regions. Kenya leads with 27.64% of the total traffic, marking an explosive 617.79% increase in engagement. India follows closely at 22.52%, with a robust 224.87% growth.

The United States accounts for 7.60% of users, while South Africa and Vietnam represent 6.19% and 4.77% of the traffic, respectively. These statistics highlight IC Funded’s expanding global presence, particularly in high-growth regions across Africa and Asia.

IC Funded Social Media Channels

IC Funded maintains an active presence on various social media platforms:

Social Media Platform | Members/Subscribers |

2.8K+ | |

3.6K+ | |

2.7K+ | |

180+ | |

500+ |

Following IC Funded on these platforms can provide valuable insights and keep you updated on the latest news and offers.

Comparing IC Funded with Other Prop Firms

The table below helps you better understand the pros and cons of trading with IC Funded instead of other prop firms.

Parameters | IC Funded Prop Firm | |||

Minimum Challenge Price | $29.75 | $39 | $97 | $55 |

Maximum Fund Size | $500,000 | $250,000 | $200,000 | $200,000 |

Evaluation steps | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-phase, 2-phase |

Profit Share | 80% | 100% | 80% | 80% |

Max Daily Drawdown | 5% | 5% | 5% | 4% |

Max Drawdown | 10% | 10% | 10% | 6% |

First Profit Target | 10% | 5% | 5% | 8% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:50 | 1:100 | 1:100 | 1:100 |

Payout Frequency | Bi-weekly | Bi-weekly | Bi-weekly | 2 Times a Month |

Number of Trading Assets | 150+ | 3000+ | 40 | 200+ |

Trading Platforms | MetaTrader 4, MetaTrader 5 | Metatrader 5 | MetaTrader 5, cTrader, Dxtrade | Metatrader 5, CFT Platform and Crypto Futures |

TF Expert Suggestion

IC Funded’s standout features include a strong connection with the IC Markets broker and commission-free funded accounts.

Additionally, it has a 15% affiliate commission and an improved profit share after 1 monthto 80/20.