Instant Funding Rules are used to avoid overleveraging and comply with restrictions on news trading and copy trading.

Inactivity for more than 60 days could result in account suspension. Additionally, certain trading strategies, such as Martingale, grid trading, and high-frequency trading (HFT), are prohibited.

Instant Funding Prohibited Strategies and Practices

To maintain a secure and fair trading environment, Instant Funding prop firm has prohibited several strategies and behaviors; Instant Funding Limits:

- Challenge Rules

- Overleveraging & Gambling

- News & Copy Trading Restrictions

- Restricted Strategies

- Expert Advisors (EAs)

- Account Misuse & Management Violations

- System Exploits & Trading Platform Manipulation

- Payout Conditions

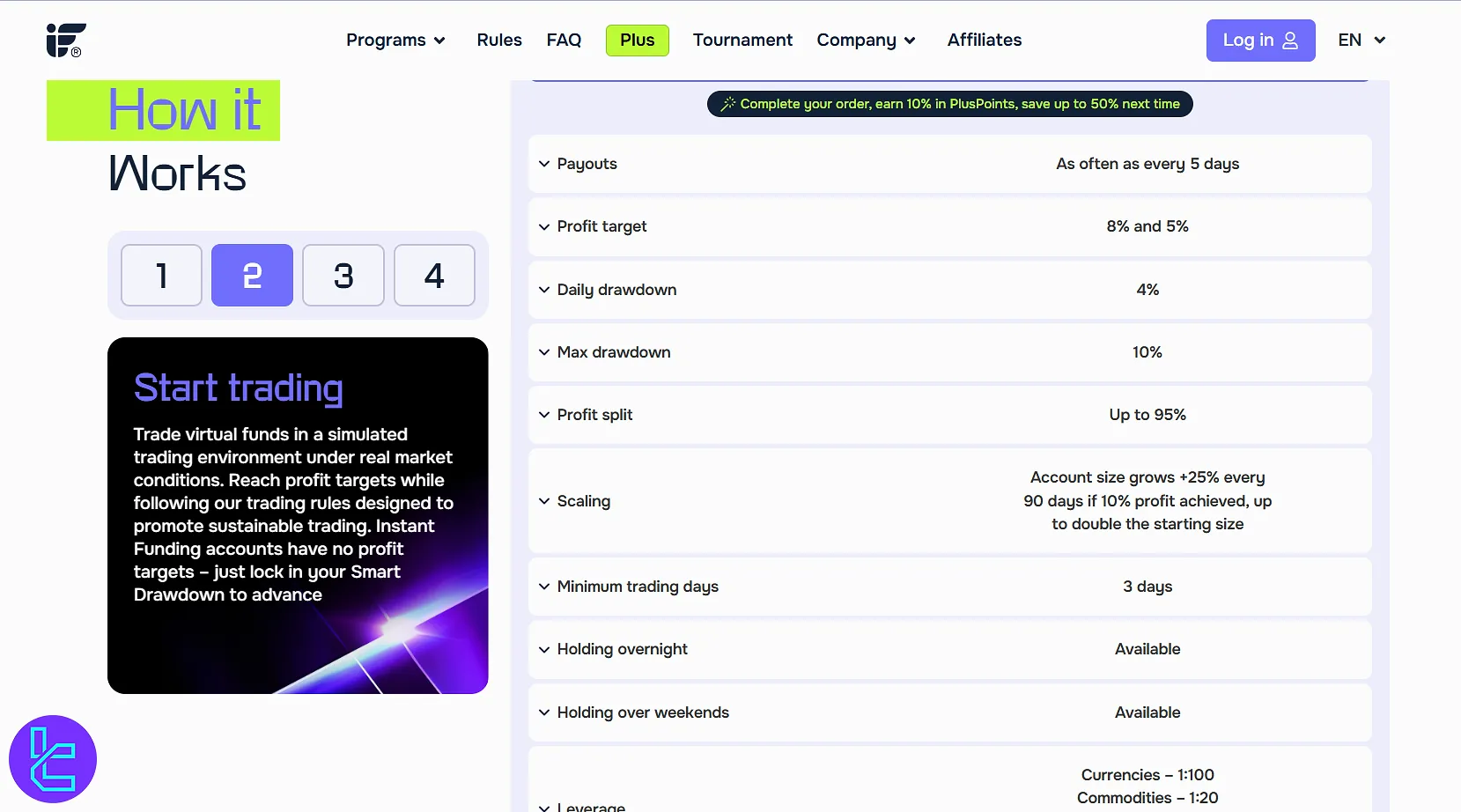

Instant Funding Challenge Conditions

To pass the evaluations, traders must adhere to various trading conditions. Here are the challenge rules in Instant Funding prop firm:

Challenge Type | Instant Funding | One-Phase | Two-Phase | IF Micro | One-Phase Micro | Two-Phase Max |

Profit Target Phase 1 | - | 10% | 8% | - | 10% | 8% |

Profit Target Phase 2 | - | - | 5% | - | - | 5% |

Maximum Daily Drawdown | - | 3% | 5% | 4% | 4% | 4% |

Maximum Overall Drawdown | 10% | 8% | 10% | 6% | 6% | 10% |

The Instant Funding plan provides excellent trading conditions, featuring a 10% maximum drawdown and no profit targets.

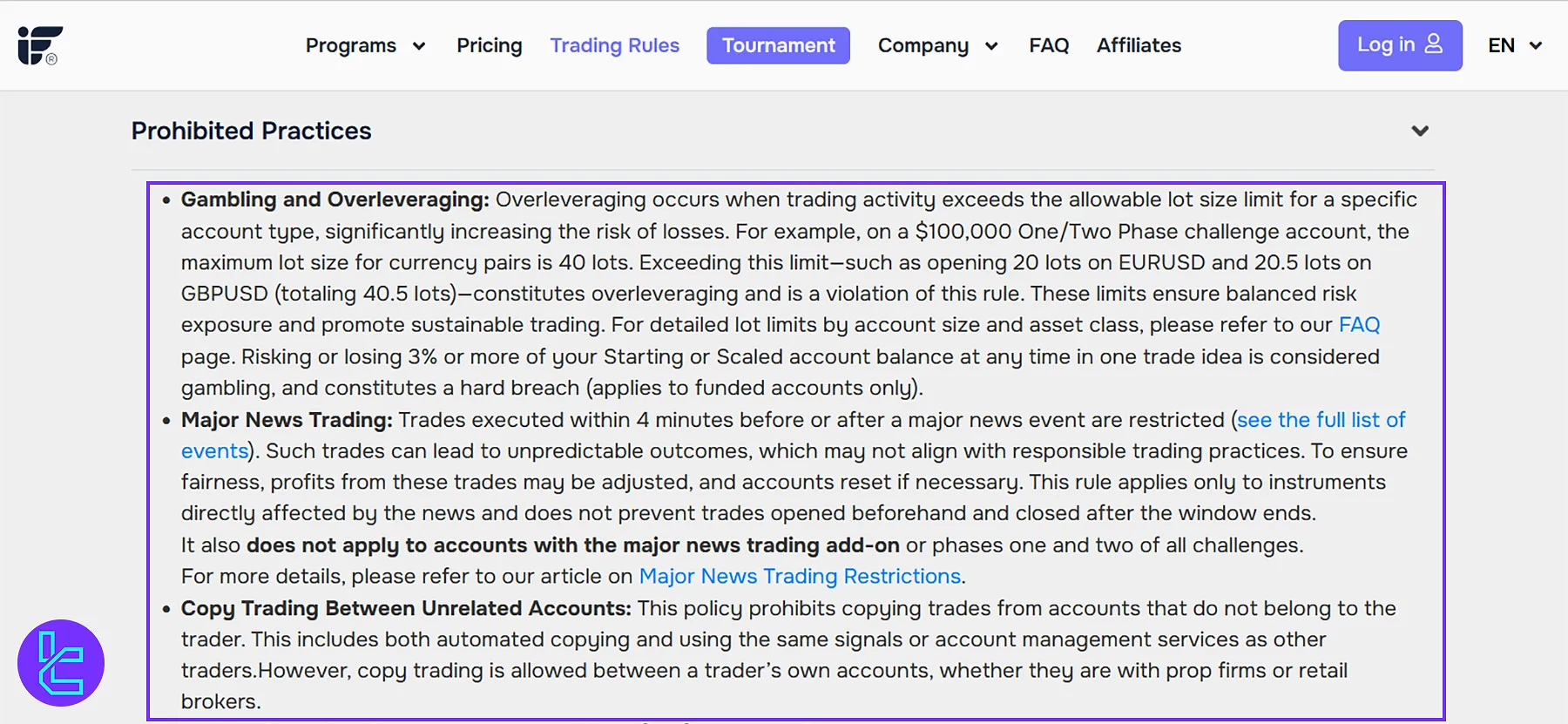

Instant Funding Overleveraging & Gambling

Instant Funding strictly prohibits gambling-style trading and excessive risk-taking. Any trader who risks or loses more than 50% of the daily drawdown in a single trade idea will be considered in violation of this rule, resulting in a hard breach. A trade idea encompasses all open positions on the same instrument, all taken in the same direction.

For Instant Funding accounts, the maximum risk allowed per trade idea is limited to 3% of the account balance. For IF Micro accounts, the limit is 1%. These limits are in place to ensure responsible risk management and prevent reckless trading behavior.

Instant Funding News & Copy Trading Restrictions

Instant Funding enables news trading under specific conditions, depending on the account type. During the challenge phase of One-Phase, Two-Phase, and Two-Phase Max accounts, traders are allowed to trade freely around news events.

News trading is also allowed by default on IF Micro and One-Phase Micro accounts. For Instant Funding, One-Phase, and Two-Phase funded accounts, it is only permitted with the Major News Trading add-on, while it is completely restricted on Two-Phase Max funded accounts.

A restriction window is applied around major economic releases to ensure fair execution. For funded accounts (except Two-Phase Max), this window lasts 4 minutes before and after the release; for funded Two-Phase Max accounts, it extends to 5 minutes. During this period, market orders, pending orders, and stop or limit triggers on affected instruments are blocked.

Traders can receive up to two warnings for trading within this window, each with profit deductions. A third violation results in an account breach. These rules apply only to high-impact (red) news events listed on FX Factory or FX Street. “All Day” events are excluded, and practices such as news straddling or bracketing are not allowed. The purpose of these measures is to maintain fairness and encourage disciplined, risk-aware trading.

Instant Funding allows copy trading only between a trader’s own accounts and those of prop firms or brokers. Copying trades, signals, or strategies from other traders or managed accounts is strictly prohibited.

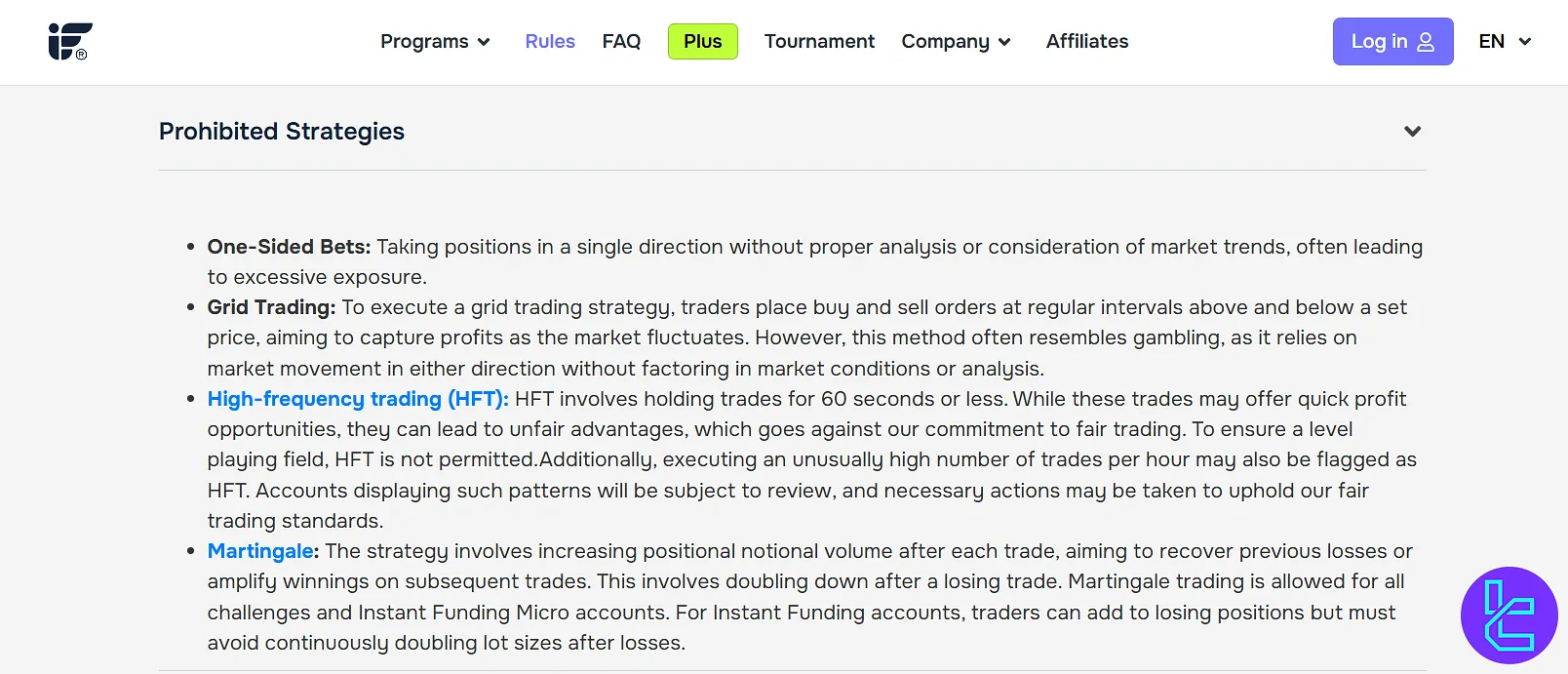

Instant Funding Restricted Trading Practices

Instant Funding discourages high-risk or unfair trading methods that compromise market integrity. One-sided betting without proper market analysis is prohibited due to excessive exposure. Grid trading is also restricted, as it relies on random price movement rather than analysis, resembling gambling behavior.

High-frequency trading (HFT), which involves trades held for less than 60 seconds or an abnormally high number of trades per hour, is not permitted and may result in an account review.

Martingale strategies are permitted for challenge accounts and Instant Funding Micro accounts. However, for regular Instant Funding accounts, traders may add to losing positions but must not continuously double their lot size after each loss.

Instant Funding Account Misuse & Management Violations

Account management breaches include any unauthorized trading practices.

- Group Copying: Using the same EA settings or identical trade setups in multiple accounts;

- Account Management: Only the account owner can trade; managing others' accounts is banned;

- Account Churning: Repeatedly opening and closing challenge accounts to bypass restrictions.

Inactivity Policies

Instant Funding requires traders to maintain active trading activity. If no trades are placed within 60 days of the account purchase or after the last executed trade, the account will be permanently closed.

Holding Positions Policies

Based on the data found for this Instant Funding tutorial, this prop firm enables traders to hold positions overnight, although caution is advised due to the changing market conditions. Weekend holding is permitted for Phase 1 and Phase 2 of all challenge accounts, as well as for Two-Phase Max, Instant Funding Micro, and One-Phase Micro accounts, and for any funded account with the Major News Trading add-on.

System Exploits & Trading Platform Manipulation

Exploiting inefficiencies in the trading environment is prohibited.

- Platform glitches

- Latency arbitrage

- Gap trading

- Toxic order flow

- Other system exploits to gain unfair advantages

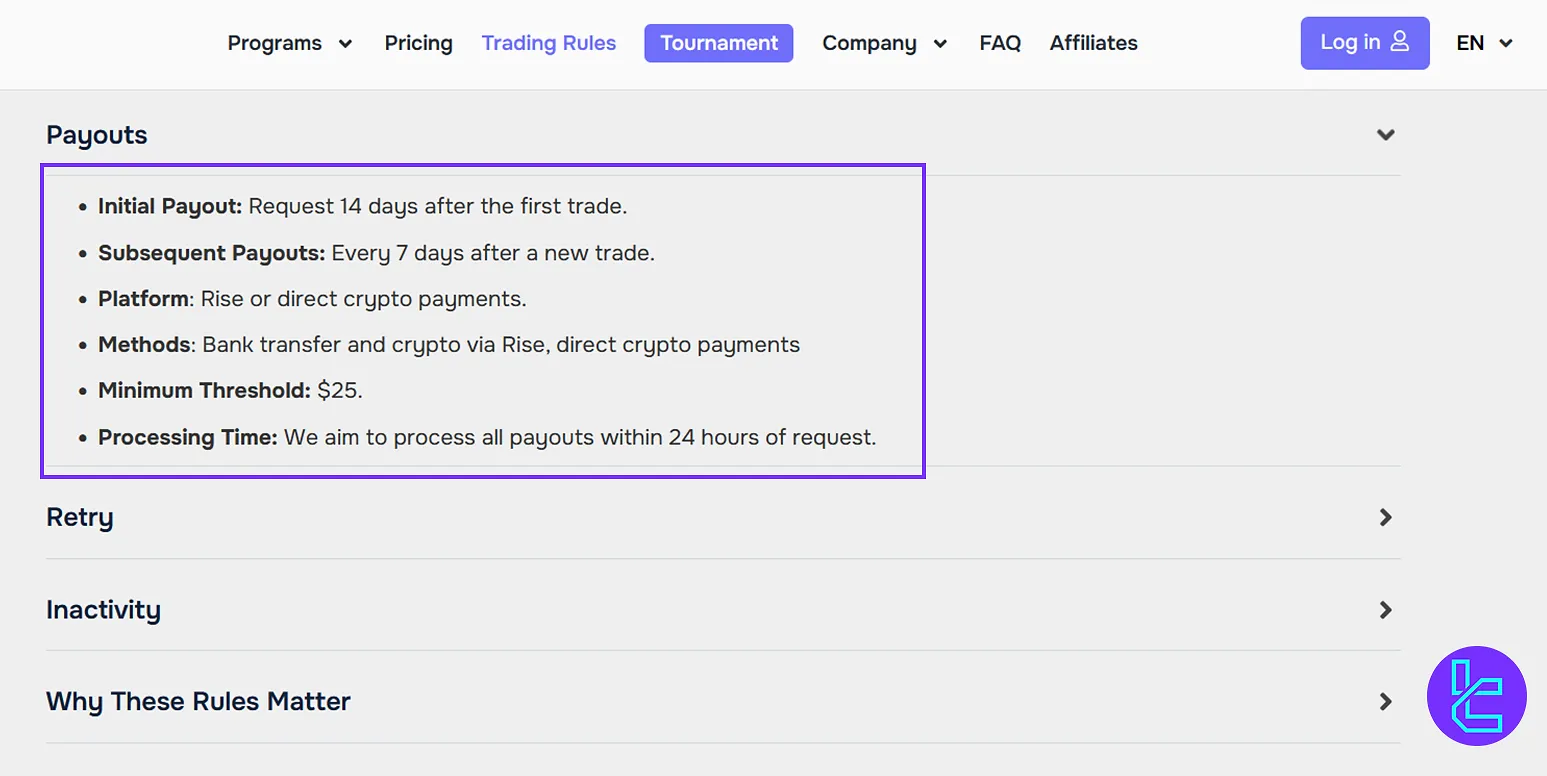

Instant Funding Payout Rules

Payouts follow a structured schedule to ensure traders receive earnings efficiently. Here are the Instant Funding Withdrawal Rules:

- Initial Payout: Available 14 days after the first trade

- Subsequent Payouts: Every 7 days after a new trade

- Payout Platform: Available through Rise or direct crypto payments

- Payment Methods: Bank transfer and crypto payments via Rise

- Minimum Threshold: At least $25 to request a payout

- Processing Time: Within 24 hours of request

Instant Funding Rules in Comparison to Other Prop Firms

The table below provides a deeper insight and comparison of the trading conditions between Instant Funding and other prop firms.

Prop Firm | Instant Funding Prop Firm | |||

VPN/VPS | Not Specifies | Allowed | Allowed | Prohibited |

EA Usage | Prohibited | Allowed | Allowed | Allowed |

News Trading | Allowed | Allowed | Allowed | Prohibited |

Group Trading | Prohibited | Prohibited | Prohibited | Prohibited |

All-or-nothing Trading | Prohibited | Prohibited | Prohibited | Prohibited |

Writer’s Opinion and Conclusion

Instant Funding Rules, such as the 14-day initial payout and 7-day subsequent payouts, are designed to provide transparency and efficiency. Traders should also manage their risk carefully, adhering to trade size limits (e.g., 40 lots for currency pairs), and be aware that holding positions over the weekend is permitted under specific conditions.

Now that you are fully familiar with the trading conditions in this prop firm, you can open an account using only an email by following the steps mentioned in the Instant Funding registration guide.