Lark Funding rules restrict evaluations with distinct profit targets, such as 10%, and daily drawdowns ranging from 3% to 5%. Payouts start after 14 days in the 3-Phase program.

Expert Advisors (EAs) are allowed but only for HFT or arbitrage, and scalping is allowed under all programs.

Hedging is allowed internally, but cross-account hedging and Martingale or Grid strategies are prohibited.

Lark Funding Rule Topics

As with many platforms, Lark Funding Prop Firm has certain policy for trading; The Key Areas of Restriction and Permission in Lark Funding:

- Challenge Rules by Program Type

- Hedging Rules

- Country Restrictions

- Overnight and Weekend Positions

- EA Usage

- Copy Trading Limitations

- News Event Trading

- VPN Use

- Scalping Rules

- Prohibited Strategies

- Payout Rules

Lark Funding Challenge Rules

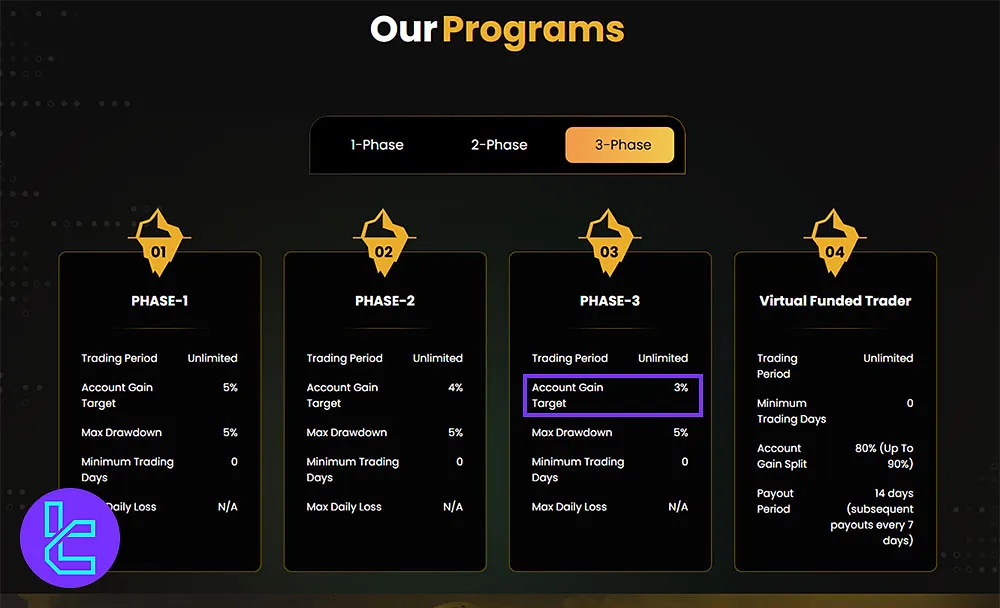

Below is a summary table comparing the drawdowns, profit targets, and profit share across different program types; Lark Funding Evaluation Conditions:

Program | Profit Target | Max Drawdown | Daily Drawdown | Profit Share |

1-Phase Challenge | 10% | 6% static | 5% | 80% (up to 90%) when funded |

2-Phase: Phase 1 | 8% | 10% | 5% | - |

2-Phase: Phase 2 | 5% | 10% | 5% | - |

2-Phase: Funded | 0% | 10% | 5% | 75% (up to 90%) |

3-Phase: Phase 1 | 5% | 5% | N/A | - |

3-Phase: Phase 2 | 4% | 5% | N/A | - |

3-Phase: Phase 3 | 3% | 5% | N/A | - |

3-Phase: Funded | 0% | 5% | N/A | 80% (up to 90%) |

2-Step Pro | 8% / 4% | 8% static | 3% | 80% (up to 90%) |

As mentioned above, 2-step Pro has the lowest daily drawdown.

Hedging at Lark Funding

Hedging is only permitted within the same trading account; Cross-account or external hedging is strictly prohibited. Violation may lead to account breach and a permanent ban.

Lark Funding Restricted Countries

Residents from the following countries cannot participate; Lark Funding Banned Regions:

- Afghanistan, Burundi, Central African Republic, Congo Republic

- Cuba, Crimea, DRC, Eritrea, Guinea, Guinea-Bissau

- Iran, Iraq, Liberia, Libya, Myanmar, North Korea

- Papua New Guinea, Somalia, Sudan, South Sudan

- Syria, Vanuatu, Yemen, Zimbabwe

Lark Funding Positions Overnight and Over the Weekends

Weekend trading is allowed only with a 10% upgrade fee; Without it, all positions must be closed by 3:45 pm EST on Friday. Failure to comply results in auto-close (minor violation).

Lark Funding Use of EAs

Expert Advisors are allowed, including those for HFT and arbitrage; Usage must comply with all performance and risk rules.

Copy Trading Rule in Lark Funding

As with many Prop Firms, trade copiers are allowed between Simulated Funded Accounts; Here are some notes:

- Copy Trading is not allowed for passing multiple Evaluations simultaneously;

- Each Evaluation must be passed individually.

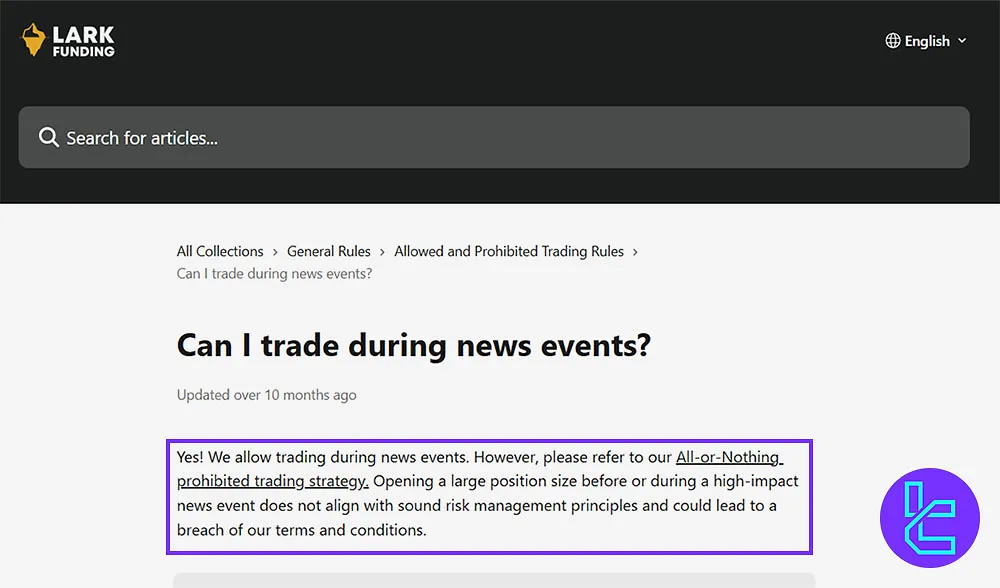

Lark Funding News Trading

Trading during news events is allowed. Using high-risk strategies (e.g., oversized positions) during news can lead to rule breach.

Use of VPN at Lark Funding

VPN/VPS use is allowed but discouraged. Usage during KYC/AML verification is prohibited. Suspicious activity linked to VPN use may result in account breach.

Lark Funding Scalping

Scalping is allowed on both simulated and funded accounts. Ensure risk and execution policies are still met.

Prohibited Strategies defined by Lark Funding

Despite the allowed practices, the firm disallows some of them; Lark Funding Forbidden Strategies:

- All-Or-Nothing: Risking entire drawdown on one trade; $10K daily gain limit; 3 strikes = breach;

- Martingale: Adding to losing trades is banned;

- Grid: Simultaneous buy/sell on the same pair is not allowed;

- HFT: Ultra-fast bot trading is forbidden;

- Hedging: No external or cross-account hedging is allowed;

- Earnings Hold: Equity CFDs must be closed pre-earnings release.

Lark Funding Payout Rules

Payouts can be requested within 7-30 days, based on the program; 3-Stage plan has the first payout after 14 days, then weekly.

Writer’s Opinion and Conclusion

Lark Funding rules include hedging allowed internally, but cross-account hedging and Martingale or Grid strategies are prohibited.

To keep positions open on weekends, a 10% upgrade fee must be paid; otherwise, close trades by 3:45 PM Friday.

News trading is allowed, but abusing volatility (e.g., $10K daily limit) or earning holds on CFDs will result in 3 strikes = breach.

For more articles, visit Lark Funding Tutorials.